Global Military Man Portable Radar System Market

Market Size in USD Billion

CAGR :

%

USD

1.74 Billion

USD

3.74 Billion

2024

2032

USD

1.74 Billion

USD

3.74 Billion

2024

2032

| 2025 –2032 | |

| USD 1.74 Billion | |

| USD 3.74 Billion | |

|

|

|

|

Military Man Portable Radar System Market Size

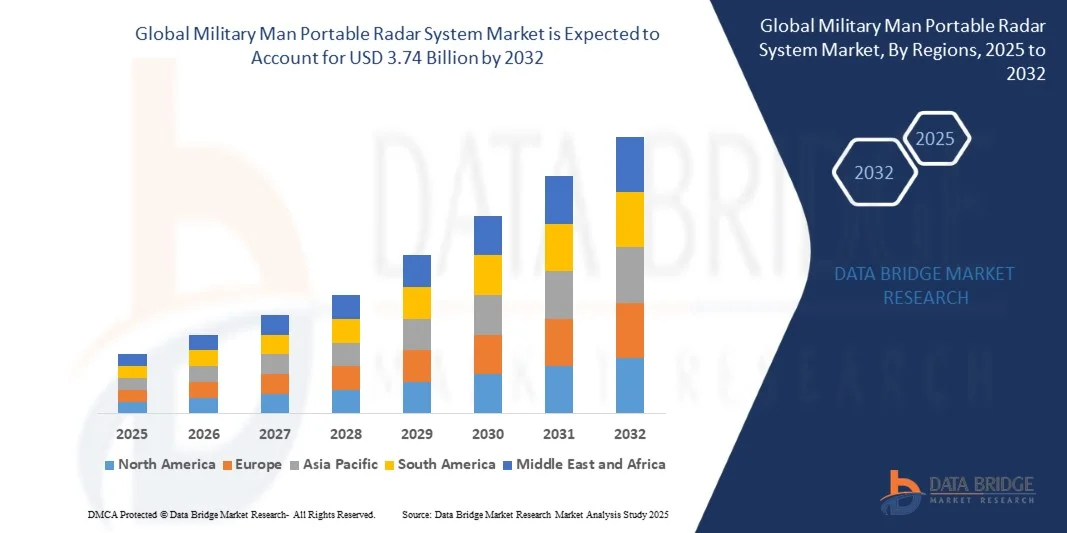

- The global military man portable radar system market size was valued at USD 1.74 billion in 2024 and is expected to reach USD 3.74 billion by 2032, at a CAGR of 10.0% during the forecast period

- The market growth is largely fueled by the increasing demand for advanced battlefield surveillance and the rapid technological progress in lightweight, portable radar systems, enabling real-time detection of aerial and ground threats in diverse terrains

- Furthermore, rising defense budgets, the growing need for counter-drone capabilities, and the emphasis on mobility and rapid deployment are establishing man portable radars as a critical component of modern military operations. These converging factors are accelerating adoption, thereby significantly boosting the market’s expansion

Military Man Portable Radar System Market Analysis

- Military man portable radar systems are compact, mobile units designed for easy deployment by individual soldiers or small teams to detect, track, and identify aerial, ground, or maritime threats. These systems provide high-resolution situational awareness and play a vital role in surveillance, target acquisition, and air defense across dynamic combat scenarios

- The escalating demand for these radar systems is primarily fueled by growing cross-border tensions, advancements in UAV and stealth technologies, and the increasing requirement for flexible, rapid-response defense solutions that combine portability with cutting-edge detection capabilities

- Europe dominated the military man portable radar system market with a share of 39.9% in 2024, due to heightened defense modernization programs, cross-border security initiatives, and the rising need for rapid-deployment surveillance solutions

- Asia-Pacific is expected to be the fastest growing region in the military man portable radar system market during the forecast period due to rising territorial disputes, increasing defense budgets, and rapid modernization of military forces in China, India, and Japan

- Less than 50 Km segment dominated the market with a market share of 51.3% in 2024, due to its extensive deployment in short-range battlefield surveillance and border security operations. These radar systems are widely favored for their portability, compact size, and capability to detect low-flying objects such as UAVs, helicopters, and ground vehicles. Military forces rely on them for rapid deployment in tactical missions where close-range detection accuracy and mobility are crucial

Report Scope and Military Man Portable Radar System Market Segmentation

|

Attributes |

Military Man Portable Radar System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Military Man Portable Radar System Market Trends

Integration of AI and Machine Learning for Enhanced Target Recognition

- The military man-portable radar system market is undergoing a transformational shift driven by the integration of artificial intelligence (AI) and machine learning (ML) technologies, which significantly enhance target recognition and tracking capabilities. These advancements enable quicker, more accurate identification of threats, improving battlefield situational awareness and decision-making efficiency

- For instance, SRC Inc. developed next-generation AI-powered man-portable radar systems featuring autonomous tracking for drone and low-flying target detection. Defense Research and Development Organization (DRDO) introduced VSHORADS, incorporating AI to support multi-domain situational awareness in Indian armed forces operations

- AI and ML integration facilitates advanced signal processing and reduces false alarms, allowing systems to adapt dynamically to evolving threat environments. These technologies also enhance multi-sensor fusion, combining data from diverse inputs to deliver comprehensive and actionable intelligence to operators on the ground

- Collaborations between government agencies and private sector innovators have accelerated the deployment of AI-enhanced portable radar systems. Enhanced algorithms are being embedded into lightweight, ruggedized devices tailored for infantry, special operations, and border security missions

- The adoption of AI-capable portable radar aligns with broader military modernization trends emphasizing network-centric warfare, electronic countermeasures, and unmanned system defense. This integrated approach ensures ongoing improvements in target acquisition, threat discrimination, and battlefield survivability

- The trend toward embedding AI and ML in man-portable radar systems is expected to remain a key market driver, fostering greater operational flexibility and resilience against emerging asymmetric threats

Military Man Portable Radar System Market Dynamics

Driver

Rising Defense Modernization

- Global defense forces are increasing investments in modernizing their military assets, driving demand for advanced man-portable radar solutions that improve tactical surveillance and combat effectiveness. Modernization programs prioritize lightweight, multi-mission capable systems with enhanced detection precision and interoperability capabilities

- For instance, the U.S. Department of Defense approved a foreign military sale of 18 AN/TPQ-50 man-portable radar systems to the UAE, reflecting ongoing demand for cutting-edge portable radar technologies. The French government announced an additional USD 7.6 billion in military spending in 2025, allocating resources toward battlefield surveillance capabilities

- Growing geopolitical tensions and asymmetric warfare challenges have compelled armed forces to enhance situational awareness with rapidly deployable radar systems. Man-portable radars support infantry and special forces with real-time intelligence, critical for urban combat, border security, and reconnaissance

- Military modernization also involves replacing legacy systems with AI-driven, networked radars that enable integrated command and control operations. Enhanced electronic warfare capabilities embedded in portable radar systems further reinforce defense posture

- Sustained defense budget increases worldwide, particularly in North America, Europe, and the Asia-Pacific region, underpin steady growth forecasts for portable radar system adoption. This trend highlights the indispensable role of advanced portable radars in next-generation military modernization initiatives

Restraint/Challenge

High Development Costs

- The high research, development, and production costs associated with advanced military man-portable radar systems pose a significant challenge to market expansion. These costs are driven by the need for state-of-the-art components, ruggedized designs, and integration of complex AI and electronic warfare technologies

- For instance, the development of DRDO’s indigenous VSHORADS system involved substantial investment in overcoming technical hurdles related to miniaturization, power efficiency, and multi-domain operational capability. Such high entry costs can restrict procurement volumes and delay deployment timelines, particularly for smaller defense budgets

- The complexity of testing and certification processes for military radar systems further adds to cost burdens. Prolonged development cycles and mandatory compliance with stringent military standards increase financial risks faced by manufacturers and procuring agencies

- In addition, sustaining highly specialized engineering talent and continuous upgrades to maintain technological superiority incur ongoing expenses, creating barriers especially for emerging market players. Technology transfer and production scale-up also raise capital requirements

- In conclusion, the high development and production costs remain a key restraint on rapid market growth. Overcoming this challenge will require innovative funding approaches, collaborative ventures, and incremental technology adoption to ensure broader access to next-generation man-portable radar systems across global defense forces

Military Man Portable Radar System Market Scope

The market is segmented on the basis of component, range, frequency band, and application.

• By Component

On the basis of component, the military man portable radar system market is segmented into antenna, transmitter, receivers, and others. The antenna segment dominated the largest market revenue share in 2024, as it plays a critical role in signal transmission and reception, directly influencing detection accuracy and range. Antennas are the most frequently upgraded component due to rapid advancements in phased-array and electronically scanned technologies that enhance radar coverage and precision. Their durability and adaptability to different terrains make them a preferred choice in combat environments, ensuring operational superiority in search, surveillance, and threat detection missions.

The transmitter segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increasing demand for power-efficient, lightweight, and high-frequency transmitters in modern warfare systems. Transmitters are undergoing significant innovation to handle advanced signal processing and high bandwidth, enabling better target identification and minimal signal loss. Rising adoption of solid-state transmitters, which offer high reliability and low maintenance, is accelerating their integration into next-generation radar systems. This makes transmitters a key area of investment for defense agencies modernizing their radar infrastructure.

• By Range

On the basis of range, the market is segmented into less than 50 km and more than 50 km. The less than 50 km segment held the largest market revenue share of 51.3% in 2024, attributed to its extensive deployment in short-range battlefield surveillance and border security operations. These radar systems are widely favored for their portability, compact size, and capability to detect low-flying objects such as UAVs, helicopters, and ground vehicles. Military forces rely on them for rapid deployment in tactical missions where close-range detection accuracy and mobility are crucial.

The more than 50 km segment is projected to witness the fastest growth during 2025–2032, driven by the rising need for long-range surveillance and target acquisition in modern defense strategies. With increasing threats from high-speed aerial targets and missile systems, the demand for extended detection capability is expanding rapidly. Advancements in radar technology, such as higher frequency bands and improved power transmission, are making long-range portable radar systems more viable. This segment’s growth is further supported by strategic investments in integrated air defense systems.

• By Frequency Band

On the basis of frequency band, the market is segmented into Ka-Band, Ku-Band, and others. The Ku-Band segment accounted for the largest market revenue share in 2024 due to its effectiveness in providing high-resolution imaging and target detection in all-weather conditions. Ku-band radars are widely deployed for ground surveillance, border security, and tactical military operations as they balance detection range and resolution effectively. Their broad adoption is further supported by their ability to counter low observable threats, including stealth aircraft and drones.

The Ka-Band segment is expected to grow at the fastest pace from 2025 to 2032, driven by its superior accuracy and capability to detect small and fast-moving objects. Ka-band radars are becoming increasingly vital for applications requiring high precision, such as missile tracking and advanced battlefield monitoring. The rapid rise in UAV threats and the need for compact systems with enhanced resolution are fueling the integration of Ka-band radars. As modern warfare shifts toward precision and real-time data, Ka-band systems are witnessing growing adoption by defense forces globally.

• By Application

On the basis of application, the market is segmented into search & detection, target acquisition, air defense, and others. The search & detection segment dominated the largest market revenue share in 2024, driven by its critical role in battlefield surveillance, border patrol, and reconnaissance missions. Military forces prioritize portable radar systems with strong detection capabilities to track a wide range of threats, including aerial drones, vehicles, and personnel. Their flexibility, combined with high mobility, makes search & detection radars indispensable in both defensive and offensive operations.

The air defense segment is projected to witness the fastest growth from 2025 to 2032, fueled by increasing global investments in advanced defense infrastructure to counter evolving aerial threats. With the rising use of stealth aircraft and missile systems, man portable radar systems are gaining importance in integrated air defense networks. These radars enable quick deployment and reliable monitoring, providing critical data to intercept potential threats in real time. The increasing emphasis on national security and aerial threat mitigation is accelerating demand for air defense applications.

Military Man Portable Radar System Market Regional Analysis

- Europe dominated the military man portable radar system market with the largest revenue share of 39.9% in 2024, driven by heightened defense modernization programs, cross-border security initiatives, and the rising need for rapid-deployment surveillance solutions

- The region’s emphasis on countering emerging threats such as UAV incursions, stealth aircraft, and asymmetric warfare has accelerated the adoption of advanced portable radar systems

- Moreover, Europe’s strong defense budgets, joint military collaborations, and focus on equipping forces with lightweight, high-precision systems strengthen its leadership in the global market

Germany Military Man Portable Radar System Market Insight

The Germany market captured the largest revenue share within Europe in 2024, supported by significant defense spending and strong investments in next-generation radar technologies. Germany’s strategic emphasis on integrated air defense and border security has driven demand for portable radar systems that combine mobility with advanced detection capabilities. In addition, Germany’s defense industry, known for engineering excellence, is investing in indigenous development of radar components, creating a favorable ecosystem for long-term market growth.

U.K. Military Man Portable Radar System Market Insight

The U.K. military man portable radar system market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by defense modernization plans and an increasing focus on counter-drone solutions. The U.K. armed forces are rapidly adopting man portable radar systems to improve situational awareness, particularly in urban warfare and coastal monitoring. Strong collaborations with global radar manufacturers and ongoing R&D projects aimed at miniaturization and enhanced mobility are also boosting the market outlook in the country.

North America Military Man Portable Radar System Market Insight

The North America market is projected to expand at a considerable pace, underpinned by high military expenditure and strong adoption of advanced surveillance systems by the U.S. Department of Defense. Growing deployment of radar systems for tactical operations, air defense, and border monitoring has strengthened regional growth. The U.S., with its continuous investments in AI-enabled radar technologies and integrated defense platforms, plays a key role in advancing man portable radar solutions across both domestic and allied military operations.

Asia-Pacific Military Man Portable Radar System Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR 2025–2032, driven by rising territorial disputes, increasing defense budgets, and rapid modernization of military forces in China, India, and Japan. The growing demand for portable, lightweight radar systems capable of detecting UAVs and missile threats is fueling adoption. Government-backed defense initiatives, coupled with domestic production capabilities, are expanding affordability and accessibility of radar technologies across the region.

China Military Man Portable Radar System Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, supported by its massive defense budget, focus on strengthening border security, and investments in indigenous radar manufacturing. China’s growing reliance on AI and IoT technologies to enhance radar efficiency is accelerating adoption. Moreover, the country’s push for defense self-reliance and development of cost-effective systems ensures wider deployment across ground forces and strategic military bases.

Japan Military Man Portable Radar System Market Insight

The Japan market is gaining momentum due to increasing investments in air defense capabilities and the rising need for mobile radar systems to counter regional threats. Japan’s advanced technological infrastructure supports the integration of cutting-edge features, such as electronic scanning and high-frequency band usage, in portable radars. Furthermore, the demand is reinforced by Japan’s strategic focus on strengthening maritime security and ensuring preparedness against advanced aerial threats.

Military Man Portable Radar System Market Share

The military man portable radar system industry is primarily led by well-established companies, including:

- Thales Group (France)

- Leonardo S.p.A (Italy)

- Saab AB (Sweden)

- Telefunken Racoms (Germany)

- FLIR Systems Inc. (U.S.)

- Elbit Systems Ltd. (Israel)

- ASELSAN A.S (Turkey)

- BAE Systems PLC (U.K.)

- Harris Corporation (U.S.)

- Blighter Surveillance Systems Ltd. (U.K.)

- SpotterRF (U.S.)

Latest Developments in Military Man Portable Radar System Market

- In September 2025, HENSOLDT expanded the application of its SPEXER radar family to naval platforms, signing an initial contract with a NATO country. This development strengthens the radar market by widening use cases of portable and modular radar systems, as SPEXER technology is known for drone detection and low-signature threat monitoring. Its transition to naval deployment indicates growing demand for flexible radar solutions across multiple defense environments, reinforcing trust in lightweight, adaptable systems

- In April 2025, Israel Aerospace Industries (IAI) and India’s DCX Systems Ltd formed a joint venture named ELTX to deliver airborne and ground radar capabilities in India. This partnership marks a significant step for the man portable radar system market, as it supports technology transfer, local production, and long-term self-reliance. By leveraging IAI’s expertise and DCX’s integration capabilities, India can accelerate the deployment of portable and high-precision radars, strengthening its defense supply chain and reducing import dependence

- In February 2025, at Aero India 2025, German defense major HENSOLDT signed MoUs with Samtel Avionics and Raphe mPhibr to co-produce radar and sensor technologies in India. This collaboration fosters indigenous manufacturing and ensures wider accessibility of advanced radar solutions for portable defense applications. By localizing production, the market benefits from cost efficiency, faster delivery, and stronger support for India’s defense modernization goals, ultimately boosting adoption in field operations

- In March 2024, Indra Sistemas (Spain) and the UAE’s EDGE Group established a joint venture named PULSE in Abu Dhabi to design and manufacture next-generation radars for land, air, and sea applications. With over 300 systems planned, this JV significantly enhances regional radar production capabilities, offering scalable solutions that can also extend to portable military applications. The agreement positions the Middle East as a rising hub for radar innovation, strengthening competition and accelerating technology availability in global defense markets

- In May 2024, Czech radar manufacturer Eldis Pardubice secured a contract to install 20 new radar systems in India by 2026, including advanced surveillance radars for airports and coastal defense. Although focused on mixed applications, the deployment highlights India’s increasing demand for compact, modernized radar systems. This project strengthens the ecosystem for portable radars by ensuring interoperability across civilian and military use cases, reflecting the rising importance of rapid deployment and versatile solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.