Global Milk Protein Hydrolysate Market

Market Size in USD Billion

CAGR :

%

USD

2.96 Billion

USD

4.27 Billion

2024

2032

USD

2.96 Billion

USD

4.27 Billion

2024

2032

| 2025 –2032 | |

| USD 2.96 Billion | |

| USD 4.27 Billion | |

|

|

|

|

Milk Protein Hydro lysate Market Size

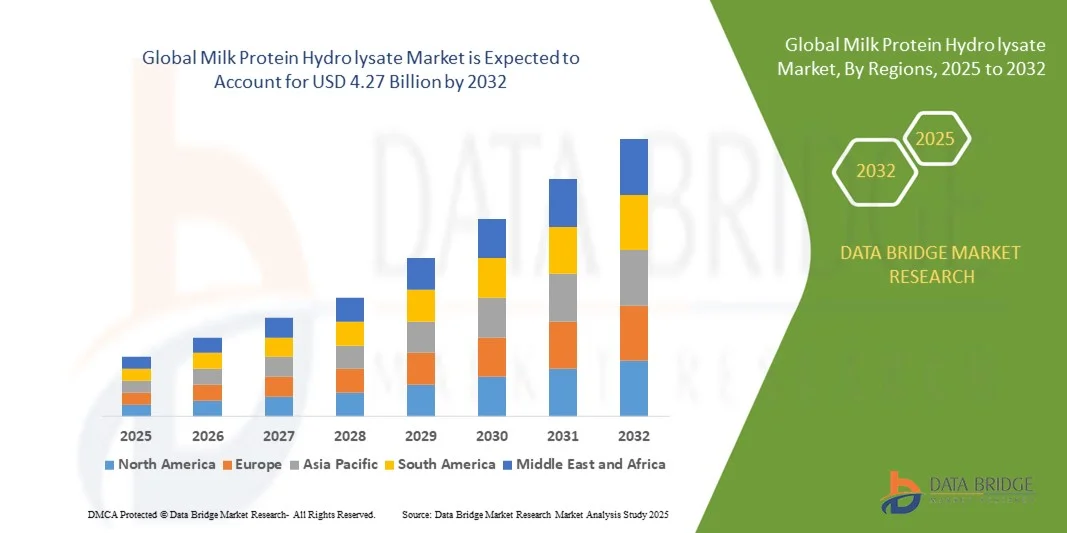

- The global milk protein hydro iysate market size was valued at USD 2.96 billion in 2024 and is expected to reach USD 4.27 billion by 2032, at a CAGR of 4.70% during the forecast period

- The market growth is largely fueled by the increasing awareness of health and nutrition, leading to higher adoption of protein-rich products in infant nutrition, clinical nutrition, and sports supplements

- Furthermore, rising consumer demand for easily digestible, hypoallergenic, and high-quality protein hydrolysates is driving the development of innovative products. These converging factors are accelerating the uptake of milk protein hydrolysates, thereby significantly boosting the industry's growth

Milk Protein Hydro lysate Market Analysis

- Milk protein hydrolysates are proteins that have been broken down into smaller peptides through enzymatic or acid hydrolysis, improving digestibility and reducing allergenicity. These products are widely used in infant formula, medical nutrition, clinical nutrition, and sports supplements to provide high-quality protein with enhanced functional properties

- The escalating demand for milk protein hydrolysates is primarily fueled by growing health awareness, increasing prevalence of protein allergies among infants, rising adoption of sports and functional nutrition products, and the expanding need for clinical nutrition solutions for patients with digestive challenges

- North America dominated the milk protein hydro iysate market with a share of 46.7% in 2024, due to growing awareness of health and nutrition, increasing demand for sports and clinical nutrition products, and rising adoption of infant formula fortified with hydrolysates

- Asia-Pacific is expected to be the fastest growing region in the milk protein hydro iysate market during the forecast period due to rising disposable incomes, urbanization, and growing health awareness in countries such as China, Japan, and India

- Powder segment dominated the market with a market share of 65.5% in 2024, due to its convenience, longer shelf life, and wide applicability in infant formulas, sports supplements, and clinical nutrition products. Powdered hydrolysates are easier to transport, store, and incorporate into various formulations, making them the preferred choice for manufacturers and end-users alike. The segment also benefits from strong adoption in ready-to-mix beverages and fortified foods, enhancing its market presence

Report Scope and Milk Protein Hydro lysate Market Segmentation

|

Attributes |

Milk Protein Hydro lysate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Milk Protein Hydro lysate Market Trends

Growth of Protein-Fortified Foods and Beverages

- The milk protein hydrolysate market is witnessing strong growth due to the expanding consumption of protein-fortified foods and beverages. Consumers are increasingly seeking nutritional products enriched with bioavailable proteins that support muscle recovery, immunity, and overall wellness, leading manufacturers to incorporate hydrolyzed milk proteins into diverse food and drink applications

- For instance, Arla Foods Ingredients offers Lacprodan® Hydro.365, a milk protein hydrolysate designed for sports nutrition beverages that enable rapid absorption and post-exercise recovery. Similarly, Kerry Group has diversified its dairy-based ingredient portfolio with hydrolysates formulated for functional beverages and nutritional bars catering to active consumers

- The inclusion of milk protein hydrolysates in ready-to-drink shakes, yogurts, infant formulas, and clinical nutrition products is driven by rising health awareness and the growing preference for high-protein diets. These products appeal to both fitness enthusiasts and aging populations seeking efficient protein uptake for muscle maintenance and metabolic health

- In addition, advances in enzymatic hydrolysis processes are allowing manufacturers to enhance the solubility, taste, and amino acid profile of hydrolyzed proteins. This technological progress is expanding the scope of application across food and beverage formulations that require high nutritional value and improved digestibility

- The trend toward functional and fortified foods aligns with global lifestyle shifts emphasizing convenience and performance nutrition. Manufacturers are responding by integrating milk protein hydrolysates that deliver targeted benefits such as rapid energy recovery, reduced allergenicity, and improved digestive tolerance

- As consumer demand for nutrient-dense and high-protein options continues to rise, the market for milk protein hydrolysates is expected to expand. The ongoing growth of protein-fortified functional foods and beverages is setting the foundation for sustained innovation in dairy-derived nutritional ingredients

Milk Protein Hydro lysate Market Dynamics

Driver

Rising Demand for Hypoallergenic, Easily Digestible Proteins

- The increasing prevalence of food sensitivities, lactose intolerance, and digestive disorders is driving demand for hypoallergenic and easily digestible protein sources. Milk protein hydrolysates, produced through enzymatic breakdown of casein or whey, offer superior digestibility and reduced allergenic potential compared to non-hydrolyzed proteins

- For instance, FrieslandCampina Ingredients and Hilmar Ingredients have developed specialized hydrolyzed whey proteins for infant nutrition and medical dietary products that ensure minimized allergic reactions and fast absorption. These innovations are widely adopted in formulas designed for sensitive or pediatric populations requiring gentle dietary support

- Rising consumer awareness of gut health and nutrient absorption efficiency has strengthened the role of hydrolyzed proteins in health-centered food formulations. Their rapid amino acid release contributes to faster muscle recovery and better tolerance in individuals with compromised digestion or food allergies

- In addition, milk protein hydrolysates are increasingly used in medical and clinical nutrition to support patients recovering from surgery or illness. Their ease of digestion and nutrient assimilation makes them ideal for specialized therapeutic applications in healthcare settings

- As health-focused consumers continue to seek gentle, effective, and functional protein solutions, the demand for hypoallergenic milk protein hydrolysates will expand. This enduring need for digestible, safe, and nutritionally effective proteins remains a core growth driver for the global market

Restraint/Challenge

High Production Costs and Strict Regulations

- The production of milk protein hydrolysates involves complex enzymatic processes, driving up manufacturing costs and posing challenges for scalability. The precise control required during hydrolysis to optimize peptide composition, flavor, and digestibility necessitates advanced equipment and quality management, increasing overall production expenses

- For instance, companies such as Glanbia Nutritionals and Arla Foods Ingredients face high operational costs due to the need for specialized enzymes, filtration technologies, and downstream purification systems. These costs make hydrolyzed protein formulations more expensive than standard milk protein concentrates or isolates, limiting adoption in cost-sensitive markets

- In addition, strict regulatory requirements surrounding infant and medical nutrition products increase compliance costs and delay market entry for new formulations. Authorities across regions such as the European Food Safety Authority (EFSA) and U.S. FDA enforce rigid standards for product safety, allergen labeling, and efficacy testing, adding complexity to global commercialization

- Flavor challenges also contribute to higher costs, as the bitter taste commonly associated with hydrolysates requires flavor masking and formulation refinement. This further elevates R&D expenditure for food and beverage manufacturers developing consumer-friendly products

- Although innovation in enzyme efficiency and processing automation is gradually improving cost structures, regulatory scrutiny and production intensity continue to restrict rapid expansion. Achieving an optimal balance between cost-effectiveness, compliance, and product performance will be crucial for sustaining growth in the milk protein hydrolysate market

Milk Protein Hydro lysate Market Scope

The market is segmented on the basis of technology, product, form, and application.

- By Technology

On the basis of technology, the milk protein hydrolysate market is segmented into acid hydrolysis and alkali/enzymatic hydrolysis. The alkali/enzymatic hydrolysis segment dominated the largest market revenue share in 2024, driven by its superior efficiency in breaking down proteins into bioactive peptides while preserving nutritional quality. This method is widely preferred by manufacturers for its ability to produce hydrolysates with controlled peptide profiles, making them suitable for infant formulas and clinical nutrition products. Furthermore, alkali/enzymatic hydrolysis is favored for its compatibility with large-scale production processes, ensuring consistency and scalability. The segment’s prominence is also reinforced by growing consumer demand for high-quality protein products that are easily digestible and hypoallergenic.

The acid hydrolysis segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption in specialty nutrition applications and animal feed. Acid hydrolysis provides cost-effective production of protein hydrolysates, particularly for functional food and sports nutrition formulations. Its ability to enhance bioavailability of amino acids and improve protein solubility contributes to its expanding use across various applications, especially in markets focusing on rapid nutrition delivery and affordable solutions

- By Product

On the basis of product, the market is segmented into casein and whey. The whey segment held the largest market revenue share in 2024, owing to its high digestibility, rich amino acid profile, and strong functional properties. Whey protein hydrolysates are widely incorporated in infant nutrition, clinical nutrition, and sports supplements due to their ability to support muscle recovery and promote overall health. The segment’s dominance is further reinforced by its extensive use in ready-to-drink beverages, nutritional powders, and fortified food products, making it a preferred choice for both manufacturers and consumers.

The casein segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increasing applications in sports nutrition and medical nutrition products. Casein hydrolysates offer slow-release properties, providing sustained amino acid supply, which is ideal for post-workout recovery and clinical nutrition formulations. The rising awareness of functional foods with prolonged nutritional benefits is expected to boost demand for casein-based hydrolysates globally.

- By Form

On the basis of form, the milk protein hydrolysate market is segmented into paste and powder. The powder segment dominated the largest market revenue share of 65.5% in 2024, driven by its convenience, longer shelf life, and wide applicability in infant formulas, sports supplements, and clinical nutrition products. Powdered hydrolysates are easier to transport, store, and incorporate into various formulations, making them the preferred choice for manufacturers and end-users alike. The segment also benefits from strong adoption in ready-to-mix beverages and fortified foods, enhancing its market presence.

The paste segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing demand for customized nutrition solutions and ready-to-use liquid formulations. Paste hydrolysates are particularly suited for infant nutrition and clinical settings where precise dosing and rapid absorption are critical. The growing trend of convenience-focused functional foods and beverages is projected to support the expansion of paste-form hydrolysates in emerging markets.

- By Application

On the basis of application, the market is segmented into sport nutrition, clinical nutrition, infant nutrition, and animal feed. The infant nutrition segment held the largest market revenue share in 2024, owing to the rising prevalence of digestive sensitivities among infants and the need for hypoallergenic, easily digestible protein formulations. Milk protein hydrolysates are extensively used in hypoallergenic infant formulas due to their reduced allergenicity, high nutritional value, and enhanced digestibility. Growing awareness among parents and healthcare providers about infant health and nutrition further drives the dominance of this segment.

The sports nutrition segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing fitness awareness and rising demand for protein-rich supplements among athletes and health-conscious consumers. Hydrolyzed milk proteins support faster muscle recovery and improved protein absorption, making them ideal for post-workout beverages and performance supplements. The proliferation of gyms, fitness centers, and lifestyle-focused nutrition products globally is anticipated to accelerate the adoption of milk protein hydrolysates in sports nutrition applications.

Milk Protein Hydro lysate Market Regional Analysis

- North America dominated the milk protein hydro iysate market with the largest revenue share of 46.7% in 2024, driven by growing awareness of health and nutrition, increasing demand for sports and clinical nutrition products, and rising adoption of infant formula fortified with hydrolysates

- Consumers in the region prioritize high-quality, easily digestible protein products, fueling demand for whey and casein hydrolysates in infant nutrition, clinical applications, and sports supplements

- This widespread adoption is further supported by strong healthcare infrastructure, high disposable incomes, and the rising trend of personalized nutrition, establishing milk protein hydrolysates as a preferred solution across multiple applications

U.S. Milk Protein Hydrolysate Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by increasing consumption of protein supplements and infant formula containing hydrolyzed proteins. Rising health awareness, coupled with the popularity of sports nutrition and functional foods, is driving demand. Furthermore, advancements in protein hydrolysis technology and the strong presence of major nutrition product manufacturers contribute significantly to market growth. The adoption of whey and casein hydrolysates in clinical nutrition for elderly and hospitalized patients further strengthens market expansion.

Europe Milk Protein Hydrolysate Market Insight

The Europe market is projected to grow at a notable CAGR, primarily driven by increasing demand for infant formula, clinical nutrition, and functional foods. Stringent regulatory standards on infant and clinical nutrition products are encouraging manufacturers to adopt high-quality hydrolysates. In addition, the growth in urban population and rising health-conscious consumer base are accelerating demand. Countries such as Germany, France, and Italy are witnessing widespread adoption across infant nutrition and sports supplement applications.

U.K. Milk Protein Hydrolysate Market Insight

The U.K. market is anticipated to expand at a significant CAGR during the forecast period, driven by the rising trend of health and wellness products, sports nutrition, and fortified infant formulas. Growing concerns about protein allergies and digestive health among infants are encouraging the adoption of hydrolyzed proteins. Moreover, strong retail and e-commerce infrastructure in the U.K. supports increased availability and consumption of milk protein hydrolysate-based products.

Germany Milk Protein Hydrolysate Market Insight

Germany’s market is expected to grow at a considerable CAGR, fueled by high consumer awareness regarding protein quality, digestive health, and clinical nutrition requirements. The country’s well-established healthcare system and increasing focus on sports nutrition and elderly care are driving hydrolysate adoption. In addition, manufacturers are emphasizing sustainable production practices, which aligns with Germany’s consumer preference for eco-conscious and safe nutritional solutions.

Asia-Pacific Milk Protein Hydrolysate Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising disposable incomes, urbanization, and growing health awareness in countries such as China, Japan, and India. Increasing demand for infant nutrition, clinical nutrition, and sports supplements is fueling market growth. Government initiatives supporting maternal and child health, coupled with the region’s role as a major manufacturing hub for protein ingredients, are enhancing availability and affordability of milk protein hydrolysates.

Japan Milk Protein Hydrolysate Market Insight

The Japan market is gaining momentum due to the country’s health-conscious population, aging demographics, and high demand for specialized nutrition products. Infant and clinical nutrition segments are witnessing strong adoption, with whey and casein hydrolysates being used for improved digestibility and hypoallergenic properties. The integration of functional protein products into daily diets and growing popularity of sports nutrition supplements are key growth drivers.

China Milk Protein Hydrolysate Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding middle-class population, and increasing demand for infant formula and functional foods. The country’s robust manufacturing capabilities and the availability of competitively priced hydrolysate products support widespread adoption. Rising awareness of infant health, sports nutrition, and clinical nutrition, alongside government initiatives promoting maternal and child health, are major factors propelling the market.

Milk Protein Hydro lysate Market Share

The milk protein hydro iysate industry is primarily led by well-established companies, including:

- AMCO Proteins (U.S.)

- Arla Foods Ingredients Group P/S (Denmark)

- Innova Flavors (U.S.)

- Kerry Group (Ireland)

- Tate & Lyle (U.K.)

- Lactalis American Group, Inc. (U.S.)

- MILEI GmbH (Germany)

- Morinaga Milk Industry Co., Ltd. (Japan)

- Tatua (New Zealand)

- Fonterra Co-operative Group Limited (New Zealand)

- Royal FrieslandCampina (Netherlands)

- Glanbia PLC (Ireland)

- Chaitanya Agro Bio-tech Pvt. Ltd. (India)

- A. Costantino & C. S.p.A. (Italy)

- Ba’emek Advanced Technologies Ltd. (Israel)

- Hilmar Ingredients (U.S.)

- Hoogwegt (Netherlands)

- Milk Specialties (U.S.)

- Armor Proteines SAS (France)

Latest Developments in Global Milk Protein Hydro lysate Market

- In September 2025, FrieslandCampina Ingredients launched a new whey protein hydrolysate tailored for sports nutrition applications. The ingredient is designed to provide rapid protein absorption, improved muscle recovery, and a clean taste profile for athletes and active consumers. This launch strengthens FrieslandCampina’s position in the performance nutrition segment and addresses the rising demand for functional protein ingredients in Asia-Pacific and European markets

- In May 2025, Arla Foods Ingredients appointed Alchemy Agencies to oversee the distribution of its premium performance nutrition ingredients throughout Australia, New Zealand, and the Pacific Islands. This strategic partnership aims to enhance the availability of key products such as Lacprodan whey protein isolate and MicelPure micellar casein isolate in the region. By leveraging Alchemy's expertise in the specialty food and beverage markets, Arla seeks to strengthen its presence in the Asia-Pacific region and meet the growing demand for high-quality protein ingredients in performance nutrition

- In November 2024, Arla Foods Ingredients introduced Lacprodan DI-3092, a new whey protein hydrolysate designed for peptide-based medical nutrition. This innovative ingredient delivers 10g of high-quality protein per 100ml, surpassing the market standard and offering a significantly improved taste with minimal bitterness. The launch of Lacprodan DI-3092 addresses key challenges in medical nutrition by providing a highly digestible protein source that enhances patient compliance, particularly for those with nutrient absorption issues and potential gastrointestinal complications

- In March 2023, Arla Foods Ingredients' Peptigen IF-3080, a milk protein hydrolysate designed for infant formula, received official approval from the European Union. This approval followed the EU's introduction of new regulations mandating safety and suitability assessments for all protein hydrolysates used in formula products. The European Food Safety Agency (EFSA) confirmed that Peptigen IF-3080 is safe and suitable for use in EU infant formulas and follow-on formulas, marking a significant milestone in expanding the availability of hypoallergenic protein options for infants with cow's milk protein allergies

- In December 2022, Kerry unveiled KerryNutri Guide, a novel tool capable of evaluating a broad spectrum of food and beverage items in accordance with various front-of-pack nutrition labeling systems. This tool guides users toward achieving a more favorable nutrition score by measuring products across multiple global nutrient profiling models, including NutriScore, the UK multiple traffic light system, and Australia's Health Star Ratings. KerryNutri Guide empowers manufacturers to enhance the nutritional profile of their products, aligning with evolving consumer preferences and regulatory requirements in the nutrition and health sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Milk Protein Hydrolysate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Milk Protein Hydrolysate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Milk Protein Hydrolysate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.