Global Millimeter Wave Mmwave Sensors And Modules Market

Market Size in USD Million

CAGR :

%

USD

537.72 Million

USD

5,296.43 Million

2025

2033

USD

537.72 Million

USD

5,296.43 Million

2025

2033

| 2026 –2033 | |

| USD 537.72 Million | |

| USD 5,296.43 Million | |

|

|

|

|

Millimeter Wave (mmWave) Sensors and Modules Market Size

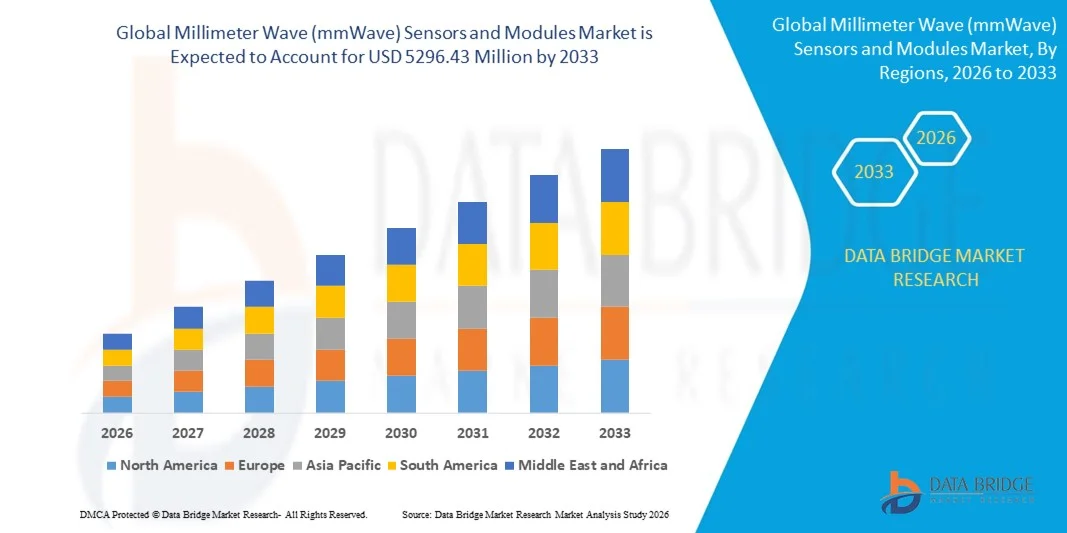

- The global millimeter wave (mmWave) sensors and modules market size was valued at USD 537.72 million in 2025 and is expected to reach USD 5296.43 million by 2033, at a CAGR of 33.10% during the forecast period

- The market growth is largely fueled by the increasing deployment of 5G networks, advanced automotive radar systems, and industrial automation, which are driving demand for high-frequency, high-resolution sensing solutions across multiple sectors

- Furthermore, rising adoption of mmWave technology in smart cities, healthcare monitoring, autonomous vehicles, and IoT-enabled devices is creating new application avenues for sensors and modules. These converging factors are accelerating the uptake of mmWave solutions, thereby significantly boosting the market's growth

Millimeter Wave (mmWave) Sensors and Modules Market Analysis

- Millimeter Wave sensors and modules, offering high-frequency radar and communication capabilities, are increasingly vital components in automotive, telecommunication, industrial, and consumer applications due to their precise detection, high data rates, and reliability under diverse environmental conditions

- The escalating demand for mmWave solutions is primarily fueled by the need for next-generation wireless connectivity, enhanced vehicular safety systems, and advanced monitoring and automation in industrial and healthcare settings, driving consistent expansion of the market

- North America dominated the millimeter wave (mmWave) sensors and modules market in 2025, due to high adoption of advanced automotive radar systems, 5G infrastructure expansion, and industrial automation

- Asia-Pacific is expected to be the fastest growing region in the millimeter wave (mmWave) sensors and modules market during the forecast period due to rapid urbanization, expansion of 5G networks, and growing adoption of autonomous vehicles in countries such as China, Japan, and India

- E-band segment dominated the market with a market share of 63.9% in 2025, due to its high data transmission rates and long-range capability suitable for backhaul and point-to-point communication applications. Telecom and IT companies increasingly deploy E-Band mmWave modules for 5G infrastructure, enabling faster connectivity and efficient spectrum utilization. The band’s robustness against interference and environmental obstacles further strengthens its adoption across critical communication networks. Its role in facilitating high-capacity links for urban and industrial applications continues to reinforce its market leadership

Report Scope and Millimeter Wave (mmWave) Sensors and Modules Market Segmentation

|

Attributes |

Millimeter Wave (mmWave) Sensors and Modules Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Millimeter Wave (mmWave) Sensors and Modules Market Trends

Growing Use of mmWave Sensors in Automotive and Industry

- The millimeter wave (mmWave) sensors and modules market is expanding rapidly thanks to increasing adoption in automotive safety systems and industrial automation. These sensors provide high-resolution detection and accurate distance measurement, making them ideal for applications such as advanced driver-assistance systems (ADAS), collision avoidance, and smart manufacturing

- For instance, companies such as Texas Instruments and Bosch are integrating mmWave sensors into automotive radar systems that enable adaptive cruise control and blind-spot detection. Such deployments enhance vehicle safety and support the development of autonomous driving technologies

- The industrial sector is leveraging mmWave sensors for non-contact object detection, level measurement, and material characterization in harsh or complex environments. Their ability to operate reliably through dust, fog, and smoke extends usability in manufacturing, logistics, and process control applications

- In addition, continuous advancements in semiconductor technologies and integration techniques are improving the performance and miniaturization of mmWave modules. This trend is driving new use cases in robotics, security screening, and wireless communication systems, further broadening market scope

- Regulatory support for automotive safety mandates and growing industrial digitization initiatives contribute to market momentum. The combination of enhanced sensor capabilities and evolving industry standards is accelerating the adoption of mmWave technology across sectors

- Overall, the growing use of mmWave sensors in automotive and industrial domains reflects a strong trend toward safer, smarter, and more connected systems. This evolution underscores the critical role of mmWave sensing in enabling next-generation applications

Millimeter Wave (mmWave) Sensors and Modules Market Dynamics

Driver

5G Network Expansion and High-Frequency Connectivity

- The rapid expansion of 5G networks and the push for high-frequency wireless connectivity are key drivers propelling the mmWave sensors and modules market growth. mmWave technology supports the bandwidth and low-latency requirements of 5G, enabling faster and more reliable data transmission for connected devices

- For instance, Qualcomm has developed mmWave transceiver modules that facilitate 5G-enabled smartphones and IoT devices. These innovations underpin enhanced mobile broadband and ultra-reliable low-latency communications, crucial for smart city and automotive use cases

- The increasing deployment of 5G infrastructure is motivating industries to adopt mmWave sensors for improved wireless communication and sensing applications. This synergy supports the development of autonomous vehicles, real-time industrial monitoring, and enhanced security systems

- In addition, governments and telecom operators worldwide are investing heavily in expanding mmWave spectrum availability, creating favorable market conditions for sensor manufacturers. This investment boost accelerates innovation and commercial deployment across end-user segments

- The alignment of mmWave sensor capabilities with the technical demands of fifth-generation connectivity highlights this driver’s critical influence. As 5G networks mature, the reliance on mmWave technology is expected to grow significantly across digital ecosystems

Restraint/Challenge

High Costs and Complex Deployment

- The relatively high costs and technical complexities involved in deploying mmWave sensors and modules pose significant challenges to broad market adoption. Components require sophisticated manufacturing processes and precise calibration, which contribute to overall system expense

- For instance, smaller manufacturers and startups often find it difficult to compete due to expensive development infrastructure and the need for specialized expertise in mmWave frequency design. This market barrier limits diversity and slows innovation speed

- Integration with existing systems also presents deployment challenges, especially in automotive and industrial environments with diverse hardware and software platforms. Ensuring signal integrity and mitigating interference require comprehensive design and testing efforts

- In addition, environmental factors such as signal attenuation due to obstacles and atmospheric conditions necessitate robust installation strategies that can increase complexity and cost. Overcoming these challenges demands extensive planning and investment in advanced hardware and software solutions

- Addressing these financial and technical difficulties through standardization, modular design approaches, and scalable production techniques will be vital to unlock the full potential of the mmWave sensor market. Cost reduction and simplified deployment can drive broader adoption across industries

Millimeter Wave (mmWave) Sensors and Modules Market Scope

The market is segmented on the basis of frequency band, application, and band type.

- By Frequency Band

On the basis of frequency band, the mmWave sensors and modules market is segmented into the band between 30 GHz and 57 GHz, the band between 57 GHz and 96 GHz, and the band between 96 GHz and 300 GHz. The band between 57 GHz and 96 GHz dominated the market with the largest revenue share in 2025, driven by its balance between high-resolution sensing and manageable signal attenuation. This frequency range is widely adopted across automotive and industrial applications for precise detection and imaging, making it highly preferred by manufacturers and system integrators. The band offers compatibility with multiple sensor types and is suitable for both short- and medium-range applications, contributing to its established presence in the market. Its adoption is further accelerated by regulatory approvals and its ability to support next-generation 5G communication use cases.

The band between 96 GHz and 300 GHz is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising demand for ultra-high-resolution imaging and emerging applications in aerospace, healthcare, and advanced industrial automation. This band enables superior object detection and material characterization at higher precision levels, attracting investments from leading technology providers. In addition, its growing integration with autonomous systems and security applications further drives market expansion, establishing it as a preferred choice for innovative mmWave deployments.

- By Application

On the basis of application, the mmWave sensors and modules market is segmented into IT and telecommunication, automotive and aerospace, healthcare, consumer and commercial, government and defence, and transportation. The automotive and aerospace segment dominated the market in 2025 with the largest revenue share, driven by increasing integration of mmWave sensors in advanced driver-assistance systems (ADAS) and collision avoidance technologies. For instance, companies such as Continental AG and Bosch leverage mmWave modules for adaptive cruise control, blind-spot detection, and autonomous navigation, boosting adoption across passenger and commercial vehicles. The segment benefits from rising investments in electric vehicles, drones, and aerospace applications requiring high-frequency sensing solutions. In addition, the ability of mmWave sensors to provide accurate detection in adverse weather and complex environments further enhances their utility in automotive and aerospace sectors.

The healthcare segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising adoption of mmWave-based imaging and monitoring solutions for patient care and diagnostic applications. These sensors offer non-invasive, high-resolution monitoring capabilities, attracting healthcare providers and device manufacturers. Growing integration of mmWave technology in telemedicine, wearable health devices, and hospital automation further accelerates market expansion in this segment.

- By Band Type

On the basis of band type, the mmWave sensors and modules market is segmented into V-Band, E-Band, and other frequency bands. The E-Band dominated the market with the largest revenue share of 63.9% in 2025, driven by its high data transmission rates and long-range capability suitable for backhaul and point-to-point communication applications. Telecom and IT companies increasingly deploy E-Band mmWave modules for 5G infrastructure, enabling faster connectivity and efficient spectrum utilization. The band’s robustness against interference and environmental obstacles further strengthens its adoption across critical communication networks. Its role in facilitating high-capacity links for urban and industrial applications continues to reinforce its market leadership.

The V-Band segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising demand for compact, high-frequency solutions in automotive radar, short-range communication, and emerging industrial automation use cases. V-Band mmWave sensors provide high-resolution detection at lower deployment costs and are preferred for localized sensing applications. Increasing investments in smart manufacturing, autonomous systems, and consumer electronics further accelerate growth in this segment, positioning it as a key area of innovation for mmWave technology providers.

Millimeter Wave (mmWave) Sensors and Modules Market Regional Analysis

- North America dominated the millimeter wave (mmWave) sensors and modules market with the largest revenue share in 2025, driven by high adoption of advanced automotive radar systems, 5G infrastructure expansion, and industrial automation

- Businesses and government organizations in the region increasingly value the precision, high-speed data transmission, and reliability offered by mmWave sensors and modules for applications such as autonomous vehicles, telecommunications, and defence

- This widespread adoption is further supported by strong R&D investment, well-established infrastructure, and a technology-savvy population, establishing North America as a key market for mmWave innovations

U.S. Millimeter Wave (mmWave) Sensors and Modules Market Insight

The U.S. mmWave sensors and modules market captured the largest revenue share in 2025 within North America, fueled by rapid deployment of 5G networks, automotive radar adoption, and increasing industrial automation. Companies are prioritizing high-frequency sensing solutions for autonomous vehicles, smart factories, and telecommunications infrastructure. The growing emphasis on next-generation radar, IoT integration, and secure communication networks is further accelerating market growth. In addition, the presence of leading semiconductor and sensor manufacturers is significantly supporting technology adoption.

Europe Millimeter Wave (mmWave) Sensors and Modules Market Insight

The Europe mmWave sensors and modules market is projected to grow steadily at a substantial CAGR during the forecast period, driven by automotive radar deployment, 5G network rollouts, and government initiatives promoting smart manufacturing. The demand for precision sensing in aerospace, industrial automation, and public safety applications is boosting adoption. European organizations are increasingly incorporating mmWave modules in new mobility solutions and smart infrastructure projects, further contributing to market expansion.

U.K. Millimeter Wave (mmWave) Sensors and Modules Market Insight

The U.K. mmWave sensors and modules market is expected to grow at a noteworthy CAGR, driven by advancements in telecommunications, autonomous vehicle trials, and industrial automation projects. Increased government support for 5G deployment, along with rising interest from automotive OEMs and tech startups, is fueling market demand. The U.K.’s strong digital ecosystem and focus on smart city initiatives further accelerate adoption.

Germany Millimeter Wave (mmWave) Sensors and Modules Market Insight

The Germany mmWave sensors and modules market is expected to expand at a considerable CAGR, fueled by high adoption of automotive radar, industrial automation, and aerospace applications. Germany’s focus on innovation, sustainable technology solutions, and precision engineering supports the deployment of high-frequency sensors. In addition, integration of mmWave modules with Industry 4.0 initiatives enhances operational efficiency and boosts demand across industrial and commercial sectors.

Asia-Pacific Millimeter Wave (mmWave) Sensors and Modules Market Insight

The Asia-Pacific mmWave sensors and modules market is poised to grow at the fastest CAGR from 2026 to 2033, driven by rapid urbanization, expansion of 5G networks, and growing adoption of autonomous vehicles in countries such as China, Japan, and India. The region’s rising manufacturing capabilities, coupled with government initiatives promoting smart cities and IoT deployment, are accelerating market growth. Increased affordability and accessibility of mmWave solutions are expanding adoption across automotive, industrial, and consumer applications.

Japan Millimeter Wave (mmWave) Sensors and Modules Market Insight

The Japan mmWave sensors and modules market is gaining momentum due to the country’s technological advancements, focus on autonomous mobility, and adoption of smart infrastructure. Japanese industries are integrating mmWave sensors into automotive radar, robotics, and industrial automation systems. In addition, demand for precise sensing solutions in healthcare, smart buildings, and connected devices is contributing to market growth.

China Millimeter Wave (mmWave) Sensors and Modules Market Insight

The China mmWave sensors and modules market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid 5G deployment, automotive radar adoption, and industrial automation. The country’s expanding middle class, urbanization, and government-backed smart city initiatives are promoting the adoption of mmWave solutions. Strong domestic manufacturers and competitive pricing further strengthen market penetration across residential, commercial, and industrial applications.

Millimeter Wave (mmWave) Sensors and Modules Market Share

The millimeter wave (mmWave) sensors and modules industry is primarily led by well-established companies, including:

- Aviat Networks, Inc. (U.S.)

- Siklu Inc. (U.S.)

- E-Band Communications, LLC. (U.S.)

- Eravant (U.S.)

- REMEC Broadband Wireless Networks LLC (U.S.)

- Farran Technology (Ireland)

- Keysight Technologies (U.S.)

- LIGHTPOINTE COMMUNICATIONS, INC (U.S.)

- Smiths Interconnect (U.K.)

- NEC Corporation (Japan)

- QuinStar Technology, Inc. (U.S.)

- Trex Enterprises Corporation (U.S.)

- Texas Instruments Incorporated (U.S.)

- Mistral Solutions Pvt. Ltd. (India)

- Qualcomm Technologies, Inc. (U.S.)

- Radio Gigabit Inc. (U.S.)

- Virginia Diodes (U.S.)

- MediaTek Inc. (Taiwan)

- NOVELIC (U.S.)

- Pulsar Measurement (U.K.)

Latest Developments in Global Millimeter Wave (mmWave) Sensors and Modules Market

- In September 2025, Asahi Kasei Microdevices Corporation (AKM) launched its AK581xAIM antenna‑in‑module mmWave radar modules, designed for presence, breathing, and posture sensing in smart home and IoT healthcare applications. These ready-to-use modules reduce engineering efforts and shorten time-to-market for device manufacturers, enabling faster deployment of health monitoring solutions. The development broadens mmWave adoption beyond traditional telecom and automotive sectors, expanding market opportunities in healthcare and consumer safety solutions

- In August 2025, Sumitomo Electric Industries, Ltd. announced the deployment of its “NEXUSEYE™” pedestrian-detection mmWave sensor in U.S. urban locations, capable of high-precision detection at night and in adverse weather conditions. This real-world implementation highlights mmWave sensors’ applicability in smart city infrastructure, traffic safety, and public monitoring systems. The deployment is expected to stimulate demand for robust, high-accuracy mmWave modules for government and commercial infrastructure projects, driving growth in the modules segment

- In February 2025, Samsung Electronics Co., Ltd. and UScellular announced the deployment of Samsung’s 5G mmWave and vRAN solution in the Mid‑Atlantic region of the U.S., covering the 28 GHz and 39 GHz bands. This deployment enables multi-gigabit speeds for both fixed-wireless access and mobile broadband applications, demonstrating strong commercial adoption of mmWave infrastructure. The move is expected to accelerate demand for mmWave modules, driving network equipment manufacturers to scale production while promoting innovation in next-generation wireless communication systems

- In January 2025, Texas Instruments Incorporated (TI) introduced the AWRL6844 60 GHz mmWave radar sensor with integrated edge-AI capabilities, targeting in-cabin automotive sensing such as occupancy detection, child presence monitoring, and intrusion alerts. This innovation underscores automotive OEMs’ commitment to incorporating mmWave technology for advanced safety, security, and comfort features. It also encourages cost-optimization across the supply chain and promotes broader integration of mmWave modules in next-generation vehicles

- In July 2024, Sumitomo Electric released its first “NEXUSEYE™” mmWave sensors for pedestrian detection, offering high accuracy in low-light and adverse weather conditions, with commercial launch scheduled for October 2024. This early deployment laid the foundation for wide-scale infrastructure sensing using mmWave technology, demonstrating its reliability for all-weather applications. The introduction of these sensors set a precedent for public safety and smart city applications, supporting sustained market growth in the mmWave modules segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Millimeter Wave Mmwave Sensors And Modules Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Millimeter Wave Mmwave Sensors And Modules Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Millimeter Wave Mmwave Sensors And Modules Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.