Global Millimeter Wave Radar Vision System Market

Market Size in USD Billion

CAGR :

%

USD

32.69 Billion

USD

543.52 Billion

2025

2033

USD

32.69 Billion

USD

543.52 Billion

2025

2033

| 2026 –2033 | |

| USD 32.69 Billion | |

| USD 543.52 Billion | |

|

|

|

|

Millimeter Wave Radar Vision System Market Size

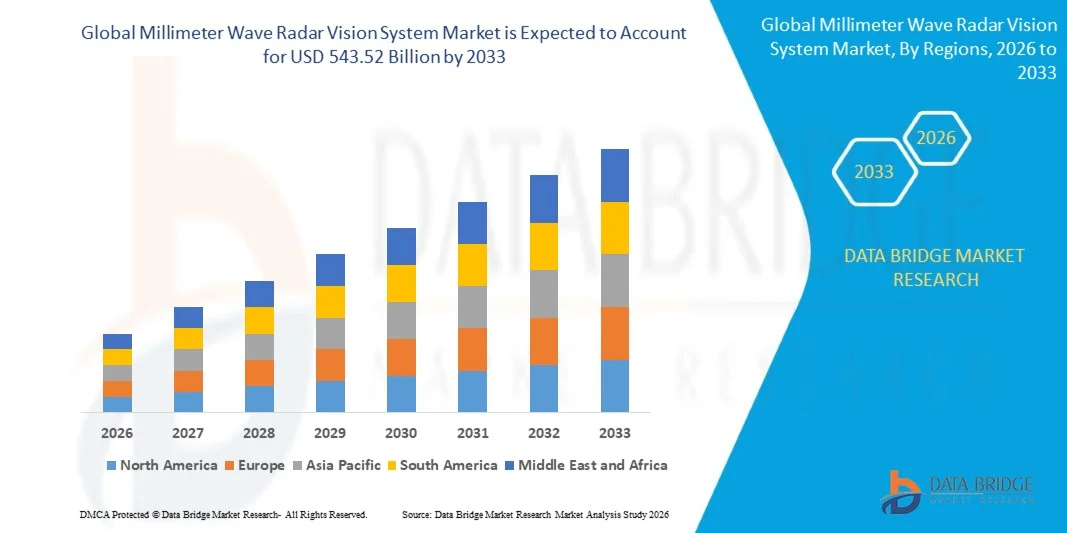

- The global millimeter wave radar vision system market size was valued at USD 32.69 billion in 2025 and is expected to reach USD 543.52 billion by 2033, at a CAGR of 42.10% during the forecast period

- The market growth is largely fuelled by the rising adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles, increasing demand for enhanced safety features, and growing investments in automotive radar technologies

- Increasing application of millimeter wave radar systems in industrial automation, robotics, and smart infrastructure is further driving market expansion

Millimeter Wave Radar Vision System Market Analysis

- The market is witnessing rapid growth due to increasing emphasis on vehicle safety, collision avoidance systems, and self-driving technology innovations

- Adoption is further supported by government regulations and standards promoting autonomous vehicles and smart mobility solutions, which require reliable radar sensing technologies

- North America dominated the millimeter wave radar vision system market with the largest revenue share of 38.50% in 2025, driven by the strong adoption of advanced automotive safety technologies and defense applications, as well as increased investments in autonomous vehicles and unmanned aerial systems

- Asia-Pacific region is expected to witness the highest growth rate in the global millimeter wave radar vision system market, driven by rapid technological adoption in automotive and aerospace sectors, government initiatives promoting smart transportation, and expanding defense budgets in countries such as China, Japan, and India

- The sensors segment held the largest market revenue share in 2025, driven by the critical role of high-resolution radar and LiDAR sensors in accurate object detection and environmental mapping. Sensor technologies enable real-time situational awareness for autonomous vehicles, industrial automation, and defense applications, making them a preferred choice for advanced radar vision systems

Report Scope and Millimeter Wave Radar Vision System Market Segmentation

|

Attributes |

Millimeter Wave Radar Vision System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Millimeter Wave Radar Vision System Market Trends

“Rise of Advanced Radar Vision Systems in Automotive and Industrial Applications”

• The growing integration of millimeter wave (mmWave) radar vision systems is transforming automotive safety and industrial automation by enabling high-resolution object detection and real-time environmental monitoring. These systems enhance collision avoidance, adaptive cruise control, and autonomous navigation, leading to improved safety and operational efficiency

• Increasing demand for smart transportation and autonomous vehicles is accelerating the adoption of mmWave radar systems. These systems are particularly effective in adverse weather conditions and low-visibility scenarios, providing accurate detection of vehicles, pedestrians, and obstacles, thereby supporting safer mobility solutions

• The advancement in sensor fusion and AI-enabled radar analytics is making mmWave systems more reliable and versatile. Automotive OEMs and industrial operators benefit from predictive maintenance, precise monitoring, and enhanced situational awareness, reducing operational risks and improving efficiency

• For instance, in 2023, several automotive manufacturers in Germany integrated next-generation mmWave radar systems into luxury and commercial vehicles, resulting in a 30% improvement in collision avoidance response and increased driver confidence

• While mmWave radar systems are driving innovation in autonomous mobility and industrial automation, their adoption depends on continued technological development, cost optimization, and regulatory approvals. Stakeholders must focus on scalable, high-accuracy, and interoperable solutions to capitalize on market growth

Millimeter Wave Radar Vision System Market Dynamics

Driver

“Rising Adoption of Autonomous Vehicles and Advanced Driver-Assistance Systems”

• The increasing deployment of autonomous vehicles (AVs) and advanced driver-assistance systems (ADAS) is pushing automotive manufacturers to integrate mmWave radar vision systems as a core safety and navigation technology. These systems support adaptive cruise control, lane-keeping assistance, and collision avoidance, improving overall road safety

• Automotive OEMs are increasingly aware of the competitive advantage offered by radar-based safety systems, including enhanced perception in adverse weather, night vision capabilities, and precise object detection. This awareness is driving investments and adoption across luxury, commercial, and passenger vehicles

• Government regulations and safety mandates, such as Euro NCAP and U.S. NHTSA guidelines, are encouraging manufacturers to deploy mmWave radar systems for compliance and enhanced safety ratings. Public sector initiatives promoting intelligent transportation systems are further supporting market growth

• For instance, in 2022, major U.S. automakers incorporated mmWave radar technology into all new vehicle models to meet stricter safety regulations and consumer safety expectations, significantly boosting adoption rates

• While autonomous and semi-autonomous vehicle deployment is accelerating market growth, challenges such as high costs, sensor calibration requirements, and system interoperability must be addressed to ensure widespread adoption

Restraint/Challenge

“High Cost of Advanced Radar Systems and Complexity of Integration”

• The high price of mmWave radar vision systems, particularly those integrated with AI and sensor fusion technologies, limits adoption among mid-range and budget vehicle segments. Cost remains a key barrier for widespread automotive and industrial deployment

• Complex integration with existing vehicle electronics and industrial automation systems requires skilled engineers and precise calibration, increasing implementation time and costs. Lack of standardized integration frameworks can hinder adoption across diverse platforms

• Supply chain constraints for high-precision radar components, including semiconductors and antennas, further restrict market penetration. Delays in component availability can impact production schedules and slow adoption in emerging markets

• For instance, in 2023, several automotive and industrial manufacturers in Asia-Pacific reported delayed deployments due to limited availability of advanced radar sensors and integration challenges, highlighting the need for robust supply chain management

• While technological advancements continue to enhance mmWave radar systems, addressing cost, complexity, and supply challenges is critical. Market stakeholders must focus on modular, scalable, and interoperable solutions to enable widespread adoption and long-term growth

Millimeter Wave Radar Vision System Market Scope

The millimeter wave radar vision system market is segmented into notable segments based on component, platform, and system.

• By Component

On the basis of component, the market is segmented into displays, cameras, processing units, sensors, and control electronics. The sensors segment held the largest market revenue share in 2025, driven by the critical role of high-resolution radar and LiDAR sensors in accurate object detection and environmental mapping. Sensor technologies enable real-time situational awareness for autonomous vehicles, industrial automation, and defense applications, making them a preferred choice for advanced radar vision systems.

The processing unit segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of AI- and ML-enabled processors for real-time data analysis, predictive maintenance, and enhanced system performance. High-speed processors are particularly important for integrating multiple sensor inputs and ensuring rapid decision-making in dynamic environments, supporting safer and more efficient operations.

• By Platform

On the basis of platform, the market is segmented into fixed wing and rotary wing. The rotary wing segment held the largest market revenue share in 2025, driven by extensive use in drones and UAVs for surveillance, logistics, and inspection tasks. Rotary wing platforms benefit from Wave radar systems’ ability to detect obstacles and navigate in confined or complex spaces.

The fixed wing segment is expected to witness the fastest growth rate from 2026 to 2033, attributed to increasing deployment in long-range surveillance, mapping, and autonomous aircraft applications. Fixed wing platforms rely on radar vision systems for high-accuracy detection over large areas, improving operational efficiency and safety.

• By System

On the basis of system, the market is segmented into cockpit voice recorder, flight data recorder, quick access recorder, and data logger. The flight data recorder segment held the largest market revenue share in 2025, driven by regulatory mandates and the critical need for safety monitoring and incident analysis. Flight data recorders integrated with radar vision systems provide accurate recording of operational parameters, enhancing flight safety and post-flight analysis.

The quick access recorder segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing requirement for rapid access to recorded data for maintenance, accident investigation, and real-time operational monitoring. These systems enable quicker decision-making and reduce downtime in aerospace and defense operations.

Millimeter Wave Radar Vision System Market Regional Analysis

• North America dominated the millimeter wave radar vision system market with the largest revenue share of 38.50% in 2025, driven by the strong adoption of advanced automotive safety technologies and defense applications, as well as increased investments in autonomous vehicles and unmanned aerial systems

• Consumers and enterprises in the region highly value the reliability, precision, and real-time detection capabilities offered by millimeter wave radar systems, which are increasingly integrated into vehicles, drones, and surveillance platforms

• This widespread adoption is further supported by government regulations promoting vehicle safety, high R&D investment in radar technologies, and the growing trend toward autonomous and semi-autonomous platforms, establishing millimeter wave radar systems as a preferred solution across automotive and aerospace applications

U.S. Millimeter Wave Radar Vision System Market Insight

The U.S. millimeter wave radar vision system market captured the largest revenue share in 2025 within North America, fueled by rapid advancements in ADAS (Advanced Driver Assistance Systems) and autonomous vehicles. Key automotive manufacturers and defense agencies are increasingly deploying high-resolution radar systems for collision avoidance, navigation, and surveillance. In addition, strong government support and funding for next-generation radar technologies, combined with a well-established automotive ecosystem, is significantly driving market expansion.

Europe Millimeter Wave Radar Vision System Market Insight

The Europe millimeter wave radar vision system market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent vehicle safety regulations, the rising adoption of autonomous vehicles, and investments in smart mobility solutions. Urbanization and the growing focus on reducing traffic accidents are fostering radar system integration in both automotive and industrial applications. The region is also seeing increased deployment in aerospace and defense platforms, promoting overall market growth.

U.K. Millimeter Wave Radar Vision System Market Insight

The U.K. millimeter wave radar vision system market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing investment in smart transportation systems and autonomous vehicle trials. The government’s support for connected mobility projects, combined with the demand for improved road safety and collision prevention, is encouraging the adoption of radar-based sensing technologies in automotive and commercial vehicle applications.

Germany Millimeter Wave Radar Vision System Market Insight

The Germany millimeter wave radar vision system market is expected to witness the fastest growth rate from 2026 to 2033, fueled by strong automotive manufacturing infrastructure, R&D in ADAS technologies, and the country’s emphasis on sustainable and safe mobility solutions. The integration of radar sensors in passenger vehicles and commercial fleets is becoming increasingly prevalent, with a preference for high-resolution, reliable, and long-range detection systems aligning with local automotive safety standards.

Asia-Pacific Millimeter Wave Radar Vision System Market Insight

The Asia-Pacific millimeter wave radar vision system market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, technological advancements, and the increasing adoption of autonomous vehicles in countries such as China, Japan, and South Korea. The region’s growing automotive and aerospace sectors, supported by government incentives and innovation hubs, are accelerating radar system deployment. In addition, increasing investments in drones, UAVs, and smart transportation infrastructure are further propelling market growth.

Japan Millimeter Wave Radar Vision System Market Insight

The Japan millimeter wave radar vision system market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s focus on autonomous vehicle development, intelligent transportation systems, and advanced robotics. Japanese OEMs and technology firms are actively integrating high-frequency radar systems for ADAS, traffic monitoring, and UAV applications. Moreover, Japan’s aging population and emphasis on road safety are likely to spur demand for more advanced and reliable radar vision solutions.

China Millimeter Wave Radar Vision System Market Insight

The China millimeter wave radar vision system market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s booming automotive and aerospace sectors, rapid urbanization, and strong government support for intelligent transportation and smart city projects. China is emerging as a key hub for manufacturing radar sensors and systems, and the growing push toward electric vehicles, autonomous vehicles, and UAV deployment is driving substantial market demand.

Millimeter Wave Radar Vision System Market Share

The Millimeter Wave Radar Vision System industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Thales Group (U.K.)

- Elbit Systems Ltd. (Israel)

- Collins Aerospace (U.S.)

- Transdigm Group, Inc. (U.S.)

- Astronics Corporation (U.S.)

- MBDA (U.K.)

- Opgal Optronic Industries Ltd. (Israel)

- FLIR Systems, Inc. (U.S.)

- Safran (France)

- Dassault Falcon Jet Corp. (France)

- Gulfstream Aerospace Corporation (U.S.)

- BAE Systems (U.K.)

- Bombardier (Canada)

- Embraer (Brazil)

- Cirrus Design Corporation (U.S.)

- Sierra Nevada Corporation (U.S.)

- Lexavia Integrated Systems (U.K.)

- Textron Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Millimeter Wave Radar Vision System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Millimeter Wave Radar Vision System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Millimeter Wave Radar Vision System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.