Global Mineral Wool Ceiling Tiles Market

Market Size in USD Billion

CAGR :

%

USD

2.52 Billion

USD

3.73 Billion

2025

2033

USD

2.52 Billion

USD

3.73 Billion

2025

2033

| 2026 –2033 | |

| USD 2.52 Billion | |

| USD 3.73 Billion | |

|

|

|

|

Mineral Wool Ceiling Tiles Market Size

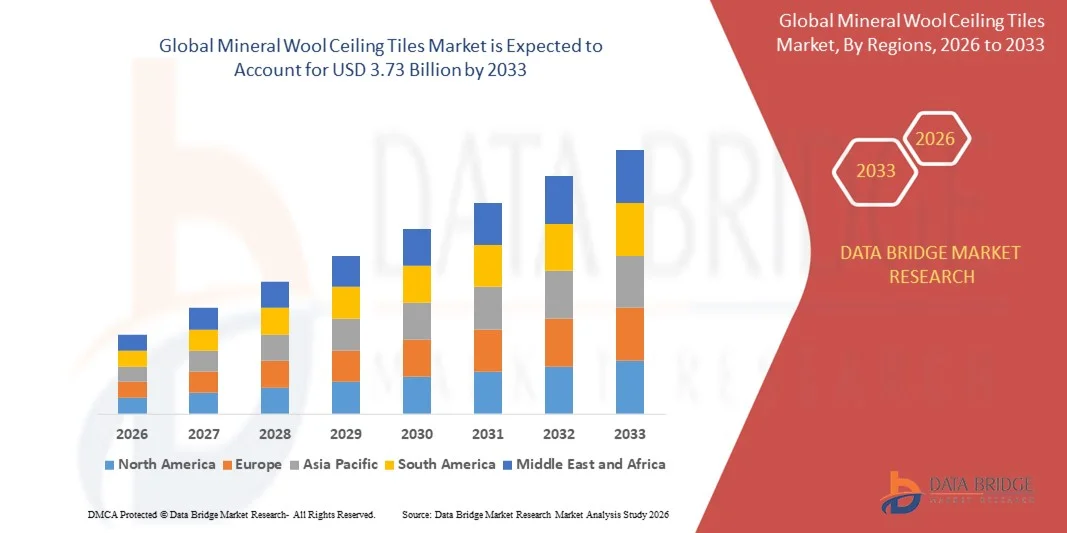

- The global mineral wool ceiling tiles market size was valued at USD 2.52 billion in 2025 and is expected to reach USD 3.73 billion by 2033, at a CAGR of 5.05% during the forecast period

- The market growth is largely fueled by the increasing demand for acoustic comfort, fire safety, and thermal insulation across commercial, institutional, and residential construction, driven by rapid urbanization and rising investments in modern building infrastructure

- Furthermore, growing emphasis on sustainable construction materials, compliance with stringent building regulations, and rising awareness of indoor environmental quality are positioning mineral wool ceiling tiles as a preferred ceiling solution, thereby accelerating market adoption and supporting consistent industry growth

Mineral Wool Ceiling Tiles Market Analysis

- Mineral wool ceiling tiles, offering effective sound absorption, fire resistance, and energy efficiency, are becoming essential components of modern interior construction across offices, healthcare facilities, educational institutions, and residential spaces due to their functional and aesthetic benefits

- The escalating demand for mineral wool ceiling tiles is primarily driven by expanding commercial construction, increasing renovation activities, and a strong preference for durable, low-maintenance, and environmentally compliant building materials in both developed and emerging markets

- North America dominated the mineral wool ceiling tiles market with a share of over 40% in 2025, due to strong demand from commercial construction, institutional buildings, and renovation activities across offices, healthcare facilities, and educational institutions

- Asia-Pacific is expected to be the fastest growing region in the mineral wool ceiling tiles market during the forecast period due to rapid urbanization, infrastructure development, and rising commercial construction across emerging economies

- Acoustic segment dominated the market with a market share of 65.9% in 2025, due to rising demand for effective sound absorption in commercial buildings, offices, educational institutions, and healthcare facilities. Acoustic mineral wool ceiling tiles are widely preferred due to their superior noise reduction, fire resistance, and thermal insulation properties, which support occupant comfort and regulatory compliance. Growing focus on indoor environmental quality and workplace productivity further strengthens adoption. These tiles also support aesthetic ceiling designs while maintaining functional performance, making them a standard choice in modern construction and renovation projects. Continuous innovation in high-performance acoustic solutions reinforces the strong position of this segment

Report Scope and Mineral Wool Ceiling Tiles Market Segmentation

|

Attributes |

Mineral Wool Ceiling Tiles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mineral Wool Ceiling Tiles Market Trends

Rising Adoption of Acoustic and Fire-Resistant Ceiling Solutions

- A major trend in the mineral wool ceiling tiles market is the increasing adoption of acoustic and fire-resistant ceiling systems across commercial, institutional, and public infrastructure projects, driven by stricter building safety norms and rising awareness of indoor environmental quality. These ceiling tiles are becoming integral to modern interior construction as they support sound control, thermal efficiency, and fire protection in high-occupancy buildings

- For instance, ROCKWOOL International A/S supplies stone wool ceiling solutions that are widely used in commercial offices, educational institutions, and healthcare facilities to meet acoustic performance and fire safety requirements. Such solutions strengthen compliance with international building standards while enhancing occupant comfort and safety

- The demand for acoustic ceiling tiles is growing significantly in offices and corporate workspaces where noise management is critical for productivity and employee well-being. This trend is influencing architects and designers to increasingly specify mineral wool ceiling tiles in workspace planning

- Healthcare facilities are adopting mineral wool ceiling tiles due to their sound absorption properties and resistance to fire and moisture, which support patient comfort and regulatory compliance. Hospitals and clinics continue to integrate these ceilings as part of modern healthcare infrastructure upgrades

- Educational institutions are also driving adoption as classrooms and auditoriums require effective noise control to improve learning environments. This sustained preference is reinforcing the role of mineral wool ceiling tiles as a standard solution in institutional construction

- Overall, the rising emphasis on acoustic performance, fire resistance, and sustainable interior materials is shaping long-term demand for mineral wool ceiling tiles and supporting consistent market expansion

Mineral Wool Ceiling Tiles Market Dynamics

Driver

Growing Commercial Construction and Infrastructure Development

- The rapid growth of commercial construction and large-scale infrastructure development is a primary driver of the mineral wool ceiling tiles market, as new offices, hospitals, educational buildings, and transportation hubs increasingly require high-performance ceiling systems. These projects prioritize materials that meet safety regulations while offering durability and acoustic control

- For instance, USG Corporation supplies mineral fiber ceiling tiles for commercial buildings across North America, supporting office complexes, healthcare facilities, and institutional projects. Such widespread use reflects the strong linkage between commercial construction growth and ceiling tile demand

- Urbanization and expansion of business districts are increasing the construction of modern office spaces that rely on acoustic ceiling solutions to manage noise levels and enhance workspace efficiency. Mineral wool ceiling tiles are widely specified for these environments due to their proven performance

- Government investments in public infrastructure such as schools, hospitals, and transit facilities are further supporting market growth. These projects often mandate fire-resistant and acoustically efficient materials, strengthening demand for mineral wool ceiling tiles

- Renovation and retrofitting of aging commercial buildings also contribute to this driver, as property owners upgrade interiors to meet modern safety and comfort standards. This sustained construction activity continues to reinforce market momentum

Restraint/Challenge

High Raw Material and Energy Costs

- The mineral wool ceiling tiles market faces challenges from high raw material and energy costs, as the production of mineral wool involves energy-intensive processes and reliance on raw materials such as basalt, slag, and other mineral inputs. These factors increase manufacturing expenses and impact pricing stability

- For instance, manufacturers such as Knauf Gips KG operate mineral wool production facilities that require significant energy input for melting and fiberizing raw materials. Fluctuations in energy prices directly affect production costs and profitability

- Rising fuel and electricity costs place pressure on manufacturers to balance cost efficiency with product quality and regulatory compliance. This challenge is particularly significant in regions experiencing volatile energy markets

- Transportation costs associated with heavy and bulky ceiling tile products further add to overall expenses, affecting supply chain efficiency and market competitiveness

- The need to invest in energy-efficient production technologies and sustainable manufacturing practices increases capital requirements for producers. These combined cost pressures create challenges for market players as they seek to maintain margins while meeting growing demand for high-performance ceiling solutions

Mineral Wool Ceiling Tiles Market Scope

The market is segmented on the basis of property type and end-user.

- By Property Type

On the basis of property type, the Mineral Wool Ceiling Tiles market is segmented into acoustic and non-acoustic tiles. The acoustic segment dominated the market with the largest revenue share of 65.9% in 2025, driven by rising demand for effective sound absorption in commercial buildings, offices, educational institutions, and healthcare facilities. Acoustic mineral wool ceiling tiles are widely preferred due to their superior noise reduction, fire resistance, and thermal insulation properties, which support occupant comfort and regulatory compliance. Growing focus on indoor environmental quality and workplace productivity further strengthens adoption. These tiles also support aesthetic ceiling designs while maintaining functional performance, making them a standard choice in modern construction and renovation projects. Continuous innovation in high-performance acoustic solutions reinforces the strong position of this segment.

The non-acoustic segment is expected to witness the fastest growth from 2026 to 2033, supported by increasing use in cost-sensitive residential and light commercial applications. Non-acoustic mineral wool ceiling tiles are gaining traction due to their durability, fire safety benefits, and moisture resistance, particularly in utility areas, corridors, and storage spaces. Expansion of affordable housing projects and infrastructure development in emerging economies accelerates demand. The availability of simple designs and easy installation further supports market penetration. Growing renovation activities also contribute to the rising adoption of non-acoustic ceiling solutions.

- By End-User

On the basis of end-user, the Mineral Wool Ceiling Tiles market is segmented into residential and non-residential users. The non-residential segment dominated the market in 2025, driven by extensive usage across commercial offices, healthcare facilities, educational institutions, retail spaces, and hospitality buildings. High demand for fire-resistant, acoustically efficient, and thermally insulating ceiling solutions supports adoption in this segment. Regulatory building standards related to safety, energy efficiency, and noise control encourage the use of mineral wool ceiling tiles. Large-scale construction of commercial and institutional buildings further strengthens segment dominance. The need for durable and low-maintenance ceiling systems sustains long-term demand.

The residential segment is projected to register the fastest growth rate from 2026 to 2033, fueled by increasing urbanization and rising investment in modern housing infrastructure. Homeowners are increasingly adopting mineral wool ceiling tiles for improved thermal comfort, fire protection, and enhanced interior aesthetics. Growth in apartment construction and home renovation activities supports segment expansion. Increasing awareness of energy-efficient building materials further boosts adoption. The availability of visually appealing and easy-to-install ceiling tile solutions accelerates demand across residential applications.

Mineral Wool Ceiling Tiles Market Regional Analysis

- North America dominated the mineral wool ceiling tiles market with the largest revenue share of over 40% in 2025, driven by strong demand from commercial construction, institutional buildings, and renovation activities across offices, healthcare facilities, and educational institutions

- The region places high importance on acoustic comfort, fire safety, and energy efficiency, leading to widespread adoption of mineral wool ceiling tiles in compliance with stringent building codes and standards

- This dominance is further supported by high spending on interior upgrades, mature construction practices, and a strong preference for sustainable and high-performance building materials, positioning mineral wool ceiling tiles as a preferred ceiling solution across non-residential and premium residential projects

U.S. Mineral Wool Ceiling Tiles Market Insight

The U.S. mineral wool ceiling tiles market captured the largest revenue share within North America in 2025, fueled by extensive commercial construction and large-scale renovation of aging infrastructure. Strong demand from corporate offices, hospitals, schools, and retail spaces continues to support market growth. The emphasis on fire-resistant and sound-absorbing materials, along with green building certifications, accelerates adoption. Increasing investments in modern workplace design and healthcare infrastructure further strengthen the U.S. market outlook.

Europe Mineral Wool Ceiling Tiles Market Insight

The Europe mineral wool ceiling tiles market is projected to expand at a steady CAGR during the forecast period, primarily driven by strict fire safety regulations and sustainability mandates across the construction sector. Rising urbanization and refurbishment of old buildings support demand for acoustic and thermally efficient ceiling solutions. European construction trends emphasize energy efficiency and indoor environmental quality, encouraging the use of mineral wool ceiling tiles. Growth is evident across commercial, institutional, and residential renovation projects.

U.K. Mineral Wool Ceiling Tiles Market Insight

The U.K. mineral wool ceiling tiles market is anticipated to grow at a notable CAGR, driven by increased spending on commercial refurbishments and public infrastructure projects. Demand for acoustic ceiling solutions in offices, schools, and healthcare facilities remains strong. Fire safety regulations and the focus on sustainable construction materials further encourage adoption. The rise in mixed-use developments and renovation of older buildings continues to support market growth.

Germany Mineral Wool Ceiling Tiles Market Insight

The Germany mineral wool ceiling tiles market is expected to expand at a considerable CAGR, supported by the country’s emphasis on high-quality construction, energy efficiency, and fire safety. Strong industrial and commercial building activity drives demand for durable and acoustically efficient ceiling systems. Germany’s focus on sustainable materials and green building standards aligns well with mineral wool ceiling tile properties. Increasing renovation of commercial and institutional spaces further fuels adoption.

Asia-Pacific Mineral Wool Ceiling Tiles Market Insight

The Asia-Pacific mineral wool ceiling tiles market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, infrastructure development, and rising commercial construction across emerging economies. Expanding office spaces, healthcare facilities, and educational institutions significantly contribute to demand. Government-led infrastructure investments and growing awareness of fire safety and acoustic comfort further accelerate adoption. The region’s growing construction activity positions Asia-Pacific as a key growth engine for the market.

Japan Mineral Wool Ceiling Tiles Market Insight

The Japan mineral wool ceiling tiles market is witnessing steady growth due to strong demand for high-quality interior building materials and strict fire safety standards. Commercial buildings, transportation hubs, and institutional facilities increasingly adopt mineral wool ceiling tiles for acoustic control and durability. Japan’s focus on precision construction and long-term building performance supports market expansion. Renovation of existing structures also plays a key role in sustaining demand.

China Mineral Wool Ceiling Tiles Market Insight

The China mineral wool ceiling tiles market accounted for the largest revenue share in Asia Pacific in 2025, supported by massive urban development and large-scale commercial and public infrastructure projects. Rapid construction of offices, hospitals, educational institutions, and transportation facilities drives significant demand. Increasing enforcement of fire safety and building performance regulations boosts adoption. The presence of strong domestic manufacturers and cost-effective production further enhances market growth in China.

Mineral Wool Ceiling Tiles Market Share

The mineral wool ceiling tiles industry is primarily led by well-established companies, including:

- USG Corporation (U.S.)

- CertainTeed (U.S.)

- Saint-Gobain Gyproc India Ltd (India)

- ROCKWOOL International A/S (Denmark)

- Odenwald Faserplattenwerk GmbH (Germany)

- Knauf Gips KG (Germany)

- Georgia-Pacific LLC (U.S.)

- Acoustigreen (U.S.)

- Mada Gypsum (Saudi Arabia)

- BYUCKSAN Corporation (South Korea)

- CK Birla Group (India)

- Techno Ceiling Products (India)

- Renhurst Ceilings Pty Ltd (Australia)

- Acoustic Ceiling Products LLC (U.S.)

- VANS Gypsum (Vietnam)

Latest Developments in Global Mineral Wool Ceiling Tiles Market

- In October 2024, Knauf Group strengthened its position in the mineral wool ecosystem through the acquisition of a low-carbon rock mineral wool insulation manufacturing facility in Uzbekistan, expanding its production footprint and supporting the supply of sustainable mineral wool materials used across ceiling and insulation applications. This development enhances Knauf’s ability to serve fast-growing construction markets while aligning with global demand for low-emission and energy-efficient building materials, indirectly reinforcing competitiveness within the mineral wool ceiling tiles market

- In August 2024, Armstrong World Industries expanded its sustainable product portfolio with the introduction of Ultima Low Embodied Carbon mineral wool ceiling panels in North America, addressing rising demand for environmentally responsible construction solutions. This launch supports green building certifications and positions Armstrong to capture higher demand from commercial and institutional projects prioritizing reduced carbon footprints and recycled content materials

- In June 2024, OWA UK introduced OWAlifetime mineral wool ceiling tiles featuring near-zero VOC emissions and high recycled content, responding to increasing regulatory and customer focus on indoor air quality and occupant health. This product development strengthens OWA’s presence in health-sensitive environments such as offices, schools, and healthcare facilities, supporting broader adoption of premium mineral wool ceiling solutions

- In April 2024, Rockfon North America advanced circular economy practices through the expansion of its Rockcycle take-back and recycling program for end-of-life stone wool ceiling tiles. This initiative improves material recovery and sustainability credentials, increasing the attractiveness of mineral wool ceiling tiles for environmentally conscious construction projects and long-term refurbishment cycles

- In February 2024, Armstrong World Industries launched School Zone Fine Fissured Templok mineral fiber ceiling panels incorporating phase change material technology to enhance thermal regulation and acoustic performance. This innovation supports energy efficiency and comfort in educational and institutional buildings, strengthening the role of advanced mineral wool ceiling tiles in high-occupancy and performance-driven environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mineral Wool Ceiling Tiles Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mineral Wool Ceiling Tiles Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mineral Wool Ceiling Tiles Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.