Global Minerals For Infant Formula Market

Market Size in USD Million

CAGR :

%

USD

296.80 Million

USD

750.77 Million

2025

2033

USD

296.80 Million

USD

750.77 Million

2025

2033

| 2026 –2033 | |

| USD 296.80 Million | |

| USD 750.77 Million | |

|

|

|

|

What is the Global Minerals for Infant Formula Market Size and Growth Rate?

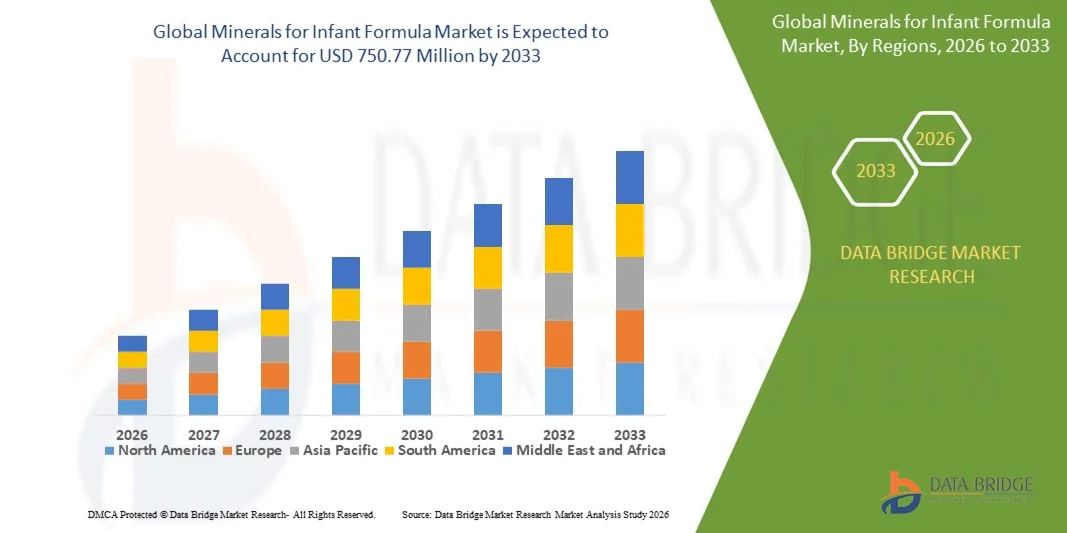

- The global minerals for infant formula market size was valued at USD 296.80 million in 2025 and is expected to reach USD 750.77 million by 2033, at a CAGR of8.4%% during the forecast period

- The rise in the infant population across the globe acts as one of the major factors driving the growth of minerals for infant formula market. The increase in women working population outside home seeking for nutritious baby food formula for their babies, and continuous extensive research and development by companies operating in the infant formula ingredients accelerate the market growth

What are the Major Takeaways of Minerals for Infant Formula Market?

- The emergence of infant formula as an appealing alternative for working mothers for their babies as per the need and convenience, and consumer perception of high nutritional content in the infant formula also supplements further influence the market

- In addition, rise in population globally, surge in the disposable income, change in consumer lifestyle, growth in the awareness, and increase in consumers’ health consciousness positively affect the minerals for infant formula market.

- North America dominated the minerals for infant formula market with the largest revenue share of 32.21% in 2025, supported by high infant formula consumption, strong regulatory standards, and widespread awareness of infant nutrition

- Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by rising birth rates, rapid urbanization, growing middle-class populations, and increasing awareness of infant nutrition across China, India, Southeast Asia, and parts of Oceania

- The Minerals segment dominated the market with an estimated 34.6% share in 2025, driven by the critical role of calcium, iron, zinc, magnesium, and phosphorus in infant bone development, cognitive growth, and immune function

Report Scope and Minerals for Infant Formula Market Segmentation

|

Attributes |

Minerals for Infant Formula Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Minerals for Infant Formula Market?

Increasing Shift Toward High-Purity, Bioavailable, and Scientifically Fortified Minerals for Infant Formulas

- The minerals for infant formula market is witnessing rising adoption of high-purity and highly bioavailable mineral ingredients such as calcium, iron, zinc, magnesium, and phosphorus to better support infant growth and development

- Manufacturers are increasingly focusing on precision mineral fortification, optimizing particle size, solubility, and absorption to closely mimic the nutritional profile of human milk

- Growing demand for clean-label, safe, and clinically validated infant nutrition products is encouraging the use of pharmaceutical-grade and traceable mineral sources

- For instance, companies such as DSM, Nestlé, Danone, Abbott, and BASF SE are investing in advanced mineral formulations and research-backed fortification technologies

- Rising emphasis on regulatory compliance, quality assurance, and infant safety standards is accelerating innovation in mineral sourcing and formulation

- As infant nutrition becomes more science-driven, Minerals for Infant Formulas will remain essential for delivering balanced nutrition and long-term health benefits

What are the Key Drivers of Minerals for Infant Formula Market?

- Rising awareness regarding infant micronutrient deficiencies and the importance of balanced mineral intake during early-life development is a key growth driver

- For instance, during 2024–2025, leading nutrition companies such as Nestlé, Danone, and Abbott expanded their fortified infant formula portfolios with enhanced mineral blends

- Growing demand for premium and specialized infant formulas, including hypoallergenic, lactose-free, and organic variants, is boosting mineral ingredient consumption

- Advancements in encapsulation technologies, chelation techniques, and mineral stabilization have improved bioavailability, taste masking, and shelf life

- Increasing birth rates in emerging economies and rising adoption of infant formula as a nutritional supplement are expanding global demand

- Supported by continuous investments in pediatric nutrition research and stringent quality regulations, the Minerals for Infant Formula market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Minerals for Infant Formula Market?

- High costs associated with pharmaceutical-grade and highly bioavailable mineral ingredients can limit adoption, particularly among cost-sensitive manufacturers

- For instance, during 2024–2025, raw material price volatility, supply chain disruptions, and stricter regulatory scrutiny increased production costs for mineral suppliers

- Complexity in meeting stringent infant nutrition regulations, labeling requirements, and safety standards increases compliance burden for manufacturers

- Limited awareness in developing regions regarding micronutrient formulation standards and mineral bioavailability can slow market penetration

- Competition from breastfeeding promotion programs and alternative nutrition solutions creates demand-side challenges in certain markets

- To address these issues, companies are focusing on cost optimization, sustainable sourcing, regulatory harmonization, and science-backed product development to expand global adoption of minerals for infant formulas

How is the Minerals for Infant Formula Market Segmented?

The market is segmented on the basis of type, source, and application.

- By Type

On the basis of type, the minerals for infant formula market is segmented into Carbohydrates, Fats & Oils, Proteins, Vitamins, Minerals, Prebiotics, and Others. The Minerals segment dominated the market with an estimated 34.6% share in 2025, driven by the critical role of calcium, iron, zinc, magnesium, and phosphorus in infant bone development, cognitive growth, and immune function. Increasing focus on addressing micronutrient deficiencies and meeting regulatory nutritional requirements has strengthened demand for mineral fortification in infant formulas.

The Prebiotics segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising awareness of gut health, improved mineral absorption, and immune system development. Growing demand for premium and science-backed infant nutrition products is accelerating adoption of prebiotic-enriched formulations globally.

- By Source

On the basis of source, the minerals for infant formula market is segmented into Powder and Liquid & Semi-Liquid forms. The Powder segment dominated the market with a 68.9% share in 2025, owing to its longer shelf life, ease of transportation, cost-effectiveness, and widespread use in large-scale infant formula manufacturing. Powdered mineral ingredients offer better stability, precise dosing, and compatibility with dry blending processes, making them the preferred choice among manufacturers.

The Liquid & Semi-Liquid segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for ready-to-feed and liquid infant formula products. Advancements in liquid mineral stabilization and aseptic packaging technologies are further supporting growth, particularly in developed markets.

- By Application

On the basis of application, the minerals for infant formula market is segmented into Growing-Up Milk, Standard Infant Formula, Follow-On Formula, and Specialty Formula. The Standard Infant Formula segment dominated the market with a 41.2% share in 2025, supported by its widespread use as a primary nutrition source for infants aged 0–6 months. Strong regulatory compliance, high consumption volumes, and consistent demand across developed and emerging economies drive this segment.

The Specialty Formula segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising incidence of allergies, lactose intolerance, premature births, and metabolic disorders. Increasing medical recommendations and parental awareness are accelerating demand for mineral-enriched specialty infant formulas.

Which Region Holds the Largest Share of the Minerals for Infant Formula Market?

- North America dominated the minerals for infant formula market with the largest revenue share of 32.21% in 2025, supported by high infant formula consumption, strong regulatory standards, and widespread awareness of infant nutrition. The region benefits from advanced food processing infrastructure, strong purchasing power, and high demand for fortified infant products across the U.S. and Canada. Rising focus on micronutrient-enriched formulas and premium nutrition products continues to support market growth

- Leading manufacturers in North America are investing in advanced mineral fortification technologies, clean-label formulations, and clinically validated nutritional blends, strengthening regional leadership. Continuous innovation in calcium, iron, zinc, and magnesium enrichment supports long-term demand

- Well-established healthcare systems, strong pediatric nutrition awareness, and regulatory support further reinforce North America’s dominant market position

U.S. Minerals for Infant Formula Market Insight

The U.S. is the largest contributor in North America, driven by high birth rates in certain demographics, strong consumer trust in branded infant nutrition, and strict nutritional guidelines set by regulatory bodies. Increasing demand for iron-fortified and mineral-balanced formulas to support infant growth, immunity, and cognitive development drives market expansion. Presence of major infant nutrition brands, strong clinical research, and high spending on premium baby food products further support sustained growth.

Canada Minerals for Infant Formula Market Insight

Canada contributes steadily to regional growth due to rising awareness of infant micronutrient deficiencies and increasing preference for fortified and organic infant formulas. Government-supported nutrition programs, strong healthcare access, and growing demand for specialty and hypoallergenic formulas enhance mineral ingredient adoption. Increasing immigrant population and focus on early-life nutrition further strengthen market penetration across the country.

Asia-Pacific Minerals for Infant Formula Market

Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by rising birth rates, rapid urbanization, growing middle-class populations, and increasing awareness of infant nutrition across China, India, Southeast Asia, and parts of Oceania. Expanding demand for fortified infant formulas, improving healthcare access, and growing female workforce participation accelerate market growth. Rising focus on addressing micronutrient deficiencies significantly boosts mineral ingredient demand.

China Minerals for Infant Formula Market Insight

China is the largest contributor in Asia-Pacific, supported by strong domestic infant formula production, rising disposable income, and increasing consumer trust in fortified nutrition products. Government emphasis on improving infant health outcomes and reducing mineral deficiencies drives demand for iron-, calcium-, and zinc-enriched formulas. Expansion of local manufacturing and premium formula brands further accelerates market growth.

Japan Minerals for Infant Formula Market Insight

Japan shows steady growth due to advanced food technology, high-quality nutrition standards, and strong focus on scientifically formulated infant products. Aging parental demographics and preference for premium, mineral-balanced formulas support sustained demand. Continuous innovation in bioavailable mineral ingredients strengthens long-term market development.

India Minerals for Infant Formula Market Insight

India is emerging as a high-growth market, driven by increasing awareness of infant malnutrition, rising urban birth rates, and government nutrition initiatives. Growing demand for affordable, mineral-fortified formulas to address iron and calcium deficiencies fuels adoption. Expanding healthcare infrastructure and rising pediatric nutrition awareness further boost market growth.

South Korea Minerals for Infant Formula Market Insight

South Korea contributes significantly due to high adoption of premium infant nutrition products and strong emphasis on early childhood development. Rising demand for scientifically validated mineral blends, coupled with advanced food manufacturing capabilities, supports steady market expansion. Innovation-driven product launches further strengthen regional growth.

Which are the Top Companies in Minerals for Infant Formula Market?

The minerals for infant formula industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Arla Foods amba (Denmark)

- CSC Brand LP. (U.S.)

- Danone India (India)

- Blédina (France)

- Nutricia (Netherlands)

- Milupa Nutricia GmbH (Germany)

- Heilongjiang Feihe Dairy Co., Ltd (China)

- Fonterra Co-operative Group Limited (New Zealand)

- HiPP (Germany)

- Mead Johnson & Company, LLC. (U.S.)

- Nestlé (Switzerland)

- Hain Celestial (U.S.)

- AAK AB (Sweden)

- Sachsenmilch Leppersdorf (Germany)

- BASF SE (Germany)

- DSM (Netherlands)

- Chr. Hansen Holding A/S (Denmark)

- Glanbia plc (Ireland)

What are the Recent Developments in Global Minerals for Infant Formula Market?

- In October 2023, Arla Foods Ingredients upgraded its Porteña manufacturing facility in Argentina to address rising global demand for high-quality whey ingredients, particularly across Latin America. The enhancement included the modernization of a new drying tower, enabling higher whey permeate powder output and increased production of infant-formula-grade proteins, thereby strengthening the company’s supply capabilities and global market presence

- In February 2023, Koninklijke DSM N.V., a Netherlands-based multinational company, received approval from the U.S. Food and Drug Administration for its newly developed infant nutrition ingredient. The approval of its human milk oligosaccharide (HMO) ingredient allowed DSM to formulate infant nutrition products that replicate the immune and gut-health benefits of naturally occurring HMOs in breast milk, reinforcing its innovation leadership in infant nutrition

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Minerals For Infant Formula Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Minerals For Infant Formula Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Minerals For Infant Formula Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.