Global Minimally Invasive Surgical Instruments Market

Market Size in USD Billion

CAGR :

%

USD

24.49 Billion

USD

42.71 Billion

2024

2032

USD

24.49 Billion

USD

42.71 Billion

2024

2032

| 2025 –2032 | |

| USD 24.49 Billion | |

| USD 42.71 Billion | |

|

|

|

|

Minimally Invasive Surgical Instruments Market Size

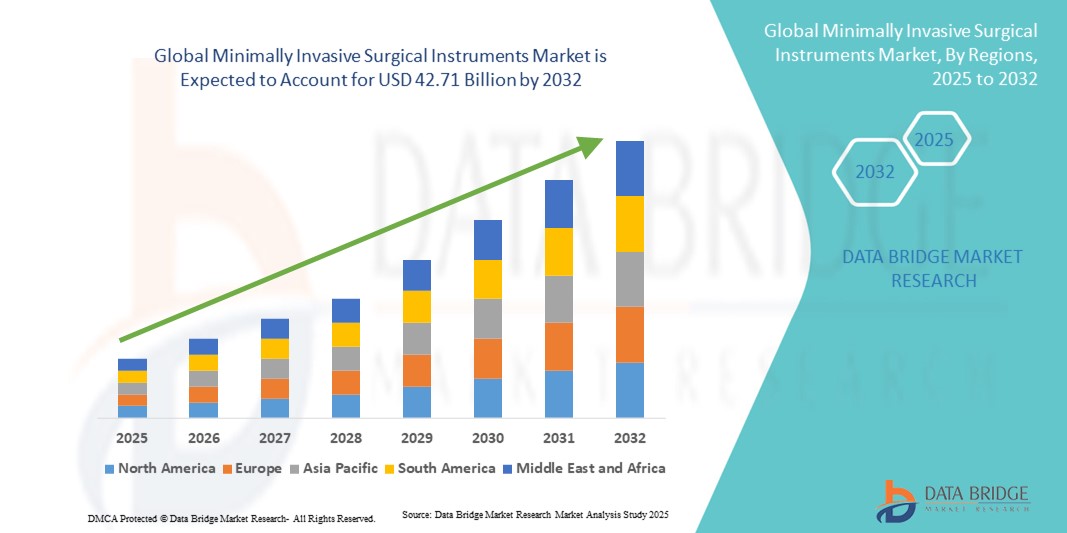

- The global minimally invasive surgical instruments market size was valued at USD 24.49 billion in 2024 and is expected to reach USD 42.71 billion by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is primarily driven by the increasing adoption of minimally invasive procedures across hospitals and ambulatory surgical centers, as patients and providers alike prefer techniques that reduce recovery times, hospital stays, and overall healthcare costs

- Continuous technological advancements in surgical instruments, including the integration of robotics, enhanced imaging, and precision tools, are further accelerating digitalization and innovation in surgical practices

Minimally Invasive Surgical Instruments Market Analysis

- Minimally invasive surgical (MIS) instruments are increasingly vital in modern healthcare settings due to their role in reducing patient recovery time, lowering complication risks, and enabling cost-effective outpatient and same-day procedures

- The global demand for MIS instruments is primarily fueled by the rising prevalence of chronic diseases, an aging population, continuous technological advancements (robotic assistance, advanced imaging, ergonomic handheld tools), and favorable reimbursement frameworks in developed markets

- North America dominated the minimally invasive surgical instruments market with the largest revenue share of 30.4% in 2024, supported by advanced healthcare infrastructure, early technology adoption, and high surgical volumes, with the U.S. leading in adoption of robotic and image-guided systems

- Asia-Pacific is projected to be the fastest-growing region in the minimally invasive surgical instruments market during the forecast period, with a CAGR of 11.3% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, increasing surgical capacity, and growing investments in healthcare modernization

- The Handheld Instruments segment dominated the minimally invasive surgical instruments market with the largest revenue share of 25.1% in 2024. This leadership is attributed to their essential role in nearly every minimally invasive procedure, spanning orthopedic, gynecological, gastrointestinal, and urological surgeries

Report Scope and Minimally Invasive Surgical Instruments Market Segmentation

|

Attributes |

Minimally Invasive Surgical Instruments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Minimally Invasive Surgical Instruments Market Trends

Enhanced Convenience Through Robotics and Digital Integration

- A significant and accelerating trend in the global minimally invasive surgical instruments market is the deepening integration with advanced robotics, computer-assisted navigation, and digital imaging platforms. This fusion of technologies is significantly enhancing surgeon precision, reducing operating times, and improving patient outcomes

- For instance, robotic-assisted MIS platforms seamlessly integrate with high-definition imaging and navigation systems, allowing surgeons to perform highly complex procedures with enhanced dexterity and control. Similarly, next-generation laparoscopic systems are being designed with digital interfaces that offer surgeons real-time guidance during critical interventions

- Integration of machine learning and data analytics into MIS platforms enables features such as surgical workflow optimization, predictive maintenance of instruments, and intelligent feedback on instrument usage. For instance, some robotic MIS systems are capable of learning from procedural data to enhance accuracy and improve decision support for surgeons

- The seamless integration of MIS instruments with hospital information systems (HIS) and digital operating rooms facilitates centralized control over various aspects of surgical workflows. Through a single interface, surgical teams can manage instruments, imaging, and patient data simultaneously, creating a unified and more efficient surgical environment

- This trend towards more intelligent, intuitive, and interconnected MIS solutions is fundamentally reshaping expectations for operating room efficiency and patient safety. Consequently, companies such as Intuitive Surgical, Medtronic, and Johnson & Johnson are developing advanced MIS systems with enhanced robotic capabilities, improved ergonomics, and greater digital connectivity

- The demand for minimally invasive instruments that offer seamless integration with robotics, digital platforms, and data-driven support is growing rapidly across hospitals and ambulatory surgery centers, as healthcare providers increasingly prioritize precision, efficiency, and improved clinical outcomes

Minimally Invasive Surgical Instruments Market Dynamics

Driver

Growing Need Due to Rising Preference for Minimally Invasive Procedures

- The increasing prevalence of chronic diseases and rising demand for surgical interventions with reduced trauma, faster recovery times, and shorter hospital stays are major drivers fueling the growth of the minimally invasive surgical instruments market

- For instance, in April 2024, Medtronic plc announced the expansion of its minimally invasive surgical product portfolio with advanced laparoscopic instruments designed to enhance precision and improve patient safety. Such initiatives by leading companies are expected to accelerate market growth during the forecast period

- As patients and healthcare providers become more aware of the benefits of minimally invasive techniques, including reduced post-operative pain, lower infection risks, and quicker return to daily activities, the adoption of advanced surgical instruments continues to rise

- Furthermore, the integration of robotics, enhanced imaging systems, and energy-based devices is reshaping surgical practices, making minimally invasive instruments an integral part of modern operating rooms

- The convenience of reduced surgical complications, higher efficiency for surgeons, and improved patient satisfaction are key factors propelling the uptake of minimally invasive surgical instruments across hospitals, ambulatory surgery centers, and specialty clinics. The growing availability of user-friendly and cost-effective minimally invasive surgical devices further contributes to market expansion

Restraint/Challenge

High Costs of Instruments and Limited Accessibility in Emerging Regions

- The relatively high cost of advanced minimally invasive surgical instruments, particularly robotic-assisted and energy-based systems, poses a significant challenge to broader adoption. Hospitals and clinics in developing regions often struggle with budget constraints, limiting the penetration of such technologies

- For instance, many healthcare facilities in low- and middle-income countries continue to rely on traditional open surgical approaches due to the prohibitive upfront investment required for advanced MIS systems

- Addressing these challenges through cost-effective product innovations, favorable reimbursement policies, and training programs for surgeons is essential to ensure widespread adoption. Companies such as Stryker and Johnson & Johnson are focusing on developing affordable instrument portfolios and expanding training initiatives to improve accessibility

- In addition, the lack of skilled professionals trained in minimally invasive techniques remains a barrier, as these procedures require specialized expertise and equipment handling

- While the costs of instruments are gradually decreasing with technological advancements, affordability and accessibility remain pressing concerns for healthcare providers in resource-constrained settings. Overcoming these barriers through government support, public–private partnerships, and scalable training programs will be crucial for sustaining long-term market growth

Minimally Invasive Surgical Instruments Market Scope

The market is segmented on the basis of Product, Surgery Type, and End User.

- By Product

On the basis of product, the minimally invasive surgical instruments market is segmented into handheld instruments, inflation devices, surgical scopes, cutting instruments, guiding devices, electrosurgical & electrocautery instruments, and others. The handheld instruments segment dominated the market with the largest revenue share of 25.1% in 2024. This leadership is attributed to their essential role in nearly every minimally invasive procedure, spanning orthopedic, gynecological, gastrointestinal, and urological surgeries. Their popularity stems from high versatility, ergonomic designs, and ability to deliver precise control during critical surgical interventions. Handheld instruments are also cost-effective compared to robotic systems, making them accessible for both developed and developing healthcare settings. Their proven reliability and ease of sterilization further support large-scale adoption in hospitals and ambulatory centers. Surgeons prefer handheld instruments for their tactile feedback and compatibility with advanced surgical systems, which makes them indispensable in complex operations. Additionally, continuous product innovations, such as lightweight materials and improved grip designs, further drive their use. Rising patient volumes globally and growing demand for outpatient surgeries ensure that handheld instruments will maintain their dominant position.

The electrosurgical & electrocautery instruments segment is projected to witness the fastest CAGR of 10.3% from 2025 to 2032. Growth in this segment is driven by their ability to perform both cutting and coagulation with high precision, reducing blood loss and minimizing surgical complications. Electrosurgical tools are increasingly adopted in complex procedures across cardiology, orthopedics, and gastroenterology, where enhanced control of tissue dissection and hemostasis is critical. Their integration with energy-based technologies provides surgeons with better accuracy, improving patient safety and recovery rates. The trend toward minimally invasive procedures that demand efficient energy delivery is fueling greater reliance on electrosurgical systems. Furthermore, continuous advancements such as bipolar devices, improved insulation, and integration with robotic platforms are enhancing the effectiveness of these instruments. Hospitals and ASCs are increasingly investing in electrosurgical systems as part of digital operating room upgrades. With rising procedure volumes globally and demand for reduced operative trauma, this segment is expected to expand rapidly in the coming years.

- By Surgery Type

On the basis of surgery type, the minimally invasive surgical instruments market is segmented into cardiothoracic surgery, gastrointestinal surgery, orthopedic surgery, gynecological surgery, cosmetic & bariatric surgery, urological surgery, and others. The orthopedic surgery segment dominated the market with a share of 24.1% in 2024. This dominance is largely driven by the increasing prevalence of musculoskeletal disorders, rising geriatric population, and greater incidence of sports-related injuries. Minimally invasive orthopedic procedures, such as arthroscopy, knee and hip replacements, and spinal surgeries, are widely adopted due to their ability to reduce patient recovery times, lower infection risks, and minimize scarring. The demand for joint replacement procedures is rising significantly in both developed and emerging economies, contributing to strong segmental growth. Hospitals and specialized orthopedic centers increasingly prefer MIS instruments to enhance surgical precision while reducing hospital stay durations. Moreover, growing technological advancements in orthopedic MIS tools, including power-assisted handheld devices and navigation systems, further strengthen adoption. Favorable reimbursement policies and rising patient preference for less invasive orthopedic procedures also boost this segment. Together, these factors ensure orthopedic surgery remains the leading contributor to overall MIS instrument demand.

The cardiothoracic surgery segment is expected to record the fastest CAGR of 9.1% from 2025 to 2032. Growth in this segment is being fueled by the rising global burden of cardiovascular diseases, which remain the leading cause of mortality worldwide. The shift from traditional open-heart procedures to minimally invasive cardiothoracic interventions is accelerating due to the benefits of reduced trauma, shorter recovery times, and lower hospital costs. Surgeons are increasingly adopting MIS techniques for valve replacements, bypass surgeries, and atrial fibrillation treatments. The integration of MIS instruments with robotic and image-guided navigation systems enhances procedural safety and accuracy. Rising patient awareness of less invasive treatment options further contributes to this trend, especially in regions with expanding healthcare access. Major medical device companies are investing heavily in developing advanced cardiothoracic MIS tools to cater to this growing demand. With governments and healthcare systems prioritizing early interventions for cardiac patients, this segment is expected to see strong expansion globally.

- By End User

On the basis of end user, the minimally invasive surgical instruments market is segmented into hospitals, and ambulatory surgery centers & clinics. The hospitals segment accounted for the largest revenue share of 69.5% in 2024. Hospitals dominate as they are the primary centers for high-complexity surgeries requiring advanced minimally invasive tools. Their infrastructure allows the integration of robotic systems, high-definition imaging, and digital operating suites, creating favorable conditions for large-scale adoption of MIS instruments. Hospitals also have access to specialized surgeons trained in performing advanced minimally invasive procedures, which strengthens their role as the leading end users. Furthermore, hospitals benefit from strong funding mechanisms, reimbursement support, and higher patient inflows for chronic and emergency conditions requiring surgery. Their ability to perform multi-specialty procedures—orthopedic, cardiac, gynecological, and bariatric—adds to their strong market share. Additionally, partnerships with medical device companies for clinical trials and innovation further strengthen hospital adoption of MIS systems. These factors collectively secure the hospital segment’s dominant position in the global market.

The ambulatory surgical centers (ASCs) & clinics segment is anticipated to grow at the fastest CAGR of 8.7% from 2025 to 2032. ASCs are gaining prominence due to their ability to offer cost-effective outpatient surgeries, making minimally invasive procedures more accessible to patients. The increasing demand for same-day surgeries, shorter recovery times, and lower hospitalization costs is driving the shift toward ASCs. Technological advancements now allow a wide range of MIS procedures, including gastrointestinal, orthopedic, and gynecological surgeries, to be performed safely outside hospital settings. Favorable insurance coverage and government support in many regions further encourage this transition. Patients also increasingly prefer ASCs for their convenience, reduced waiting times, and patient-centered care environments. The growing trend of decentralizing healthcare delivery and expanding ASC networks worldwide contributes significantly to segmental growth. With rising surgical procedure volumes and healthcare cost optimization efforts, ASCs are expected to be the fastest-growing end-user group in the MIS instruments market.

Minimally Invasive Surgical Instruments Market Regional Analysis

- North America dominated the minimally invasive surgical instruments market with the largest revenue share of 30.4% in 2024, supported by advanced healthcare infrastructure, early adoption of cutting-edge technologies, and high surgical volumes.

- The U.S. accounted for the majority share within the region, driven by the strong uptake of robotic-assisted surgeries, image-guided systems, and innovative laparoscopic instruments.

- Favorable reimbursement policies, a high prevalence of chronic diseases, and continuous R&D investment by leading companies further reinforce North America’s market leadership.

U.S. Minimally Invasive Surgical Instruments Market Insight

The U.S. minimally invasive surgical instruments market captured 81.05% of the North American revenue share in 2024, underpinned by strong demand for robotic-assisted surgery, minimally invasive orthopedic procedures, and advanced imaging-guided interventions. The growing emphasis on reducing hospital stays, lowering healthcare costs, and improving patient outcomes continues to drive adoption of advanced MIS instruments in hospitals and ambulatory surgery centers. Strategic partnerships between medical device manufacturers and healthcare providers are further accelerating technology integration in operating rooms.

Europe Minimally Invasive Surgical Instruments Market Insight

The Europe minimally invasive surgical instruments market is projected to expand at a steady CAGR over the forecast period, primarily supported by rising demand for minimally invasive procedures in cardiology, orthopedics, and gynecology. Countries such as Germany, France, and the U.K. are at the forefront due to well-established healthcare systems, significant investments in surgical robotics, and growing emphasis on reducing post-operative recovery times. The region’s strong regulatory framework ensures product safety and efficacy, encouraging adoption of advanced instruments across hospitals and specialty clinics.

U.K. Minimally Invasive Surgical Instruments Market Insight

The U.K. minimally invasive surgical instruments market is anticipated to grow at a noteworthy CAGR, supported by the country’s robust healthcare infrastructure and an increasing focus on reducing surgical complications and patient recovery times. A surge in day-care surgeries and the adoption of laparoscopic and robotic systems are contributing to the expansion of MIS procedures. Government initiatives to modernize operating rooms and strengthen NHS surgical capacity are further fueling demand.

Germany Minimally Invasive Surgical Instruments Market Insight

Germany minimally invasive surgical instruments market is expected to witness significant growth during the forecast period, driven by its strong medical device manufacturing base and emphasis on technological innovation. The country’s advanced hospital infrastructure and high adoption of precision surgical tools are supporting the uptake of minimally invasive techniques in orthopedic, cardiac, and bariatric surgeries. Sustainability and patient safety standards also encourage hospitals to invest in modern MIS instruments.

Asia-Pacific Minimally Invasive Surgical Instruments Market Insight

The Asia-Pacific minimally invasive surgical instruments market is projected to grow at the fastest CAGR of 11.3% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and increasing surgical capacity in countries such as China, Japan, and India. Growing investments in healthcare modernization, expanding medical tourism, and government initiatives to upgrade hospital infrastructure are key drivers of market expansion. The region is also emerging as a global hub for cost-effective device manufacturing, further enhancing accessibility to advanced MIS instruments.

Japan Minimally Invasive Surgical Instruments Market Insight

The Japan minimally invasive surgical instruments market is gaining momentum in the adoption of MIS instruments due to its high-tech healthcare culture, growing elderly population, and demand for less invasive treatments. Advanced imaging and robotic-assisted surgical systems are increasingly being used in hospitals to improve surgical accuracy and patient recovery outcomes. The country’s continuous focus on integrating cutting-edge medical technologies positions it as a key contributor to the regional market.

China Minimally Invasive Surgical Instruments Market Insight

The China minimally invasive surgical instruments market accounted for the largest revenue share within Asia-Pacific in 2024, supported by rapid urbanization, a large patient pool, and significant investment in healthcare infrastructure. The country is witnessing a strong rise in laparoscopic, orthopedic, and gynecological procedures, driven by both public and private healthcare providers. A thriving domestic medical device manufacturing sector and government-backed initiatives to promote advanced surgical care are further accelerating market growth.

Minimally Invasive Surgical Instruments Market Share

The minimally invasive surgical instruments industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Johnson & Johnson and its affiliates (U.S.)

- Stryker (U.S.)

- Smith+Nephew (U.K.)

- Abbott (U.S.)

- B. Braun SE (Germany)

- CONMED Corporation (U.S.)

- Boston Scientific Corporation (U.S.)

- Zimmer Biomet (U.S.)

- HOYA Corporation (Japan)

- KARL STORZ SE & Co. KG (Germany)

- Applied Medical Resources Corporation (U.S.)

Latest Developments in Global Minimally Invasive Surgical Instruments Market

- In April 2023, Orthofix Medical Inc. announced the full commercial launch of two access retractor systems designed for minimally invasive spine (MIS) procedures, enhancing surgical access and precision in spinal operations

- In August 2023, Orthofix unveiled the 7D FLASH Navigation System Percutaneous Module 2.0 for minimally invasive surgery—successfully completing its first U.S. cases and expanding MIS spine navigation capabilities with integrated implant planning and navigated tools

- In February 2024, Virtual Incision Corporation received FDA authorization for the MIRA Surgical System, the world’s first miniaturized robotic-assisted surgery (miniRAS) device, cleared for adult colectomy procedures—a breakthrough in compact robotic platforms for MIS

- In June 2023, Rob Surgical and Hospital Clínic completed the first series of patient operations using the Bitrack robotic platform, marking a key milestone in the adoption of new robotic systems within urologic minimally invasive surgery

- In July 2025, SurGenTec launched the INSITE Sterile Surgery-Ready Kit, designed for minimally invasive SI joint fusion procedures. The system aims to reduce infection risk while providing a streamlined, cost-effective solution for surgeons

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.