Global Mining Equipment Market

Market Size in USD Billion

CAGR :

%

USD

95.97 Billion

USD

150.11 Billion

2024

2032

USD

95.97 Billion

USD

150.11 Billion

2024

2032

| 2025 –2032 | |

| USD 95.97 Billion | |

| USD 150.11 Billion | |

|

|

|

|

Mining Equipment Market Size

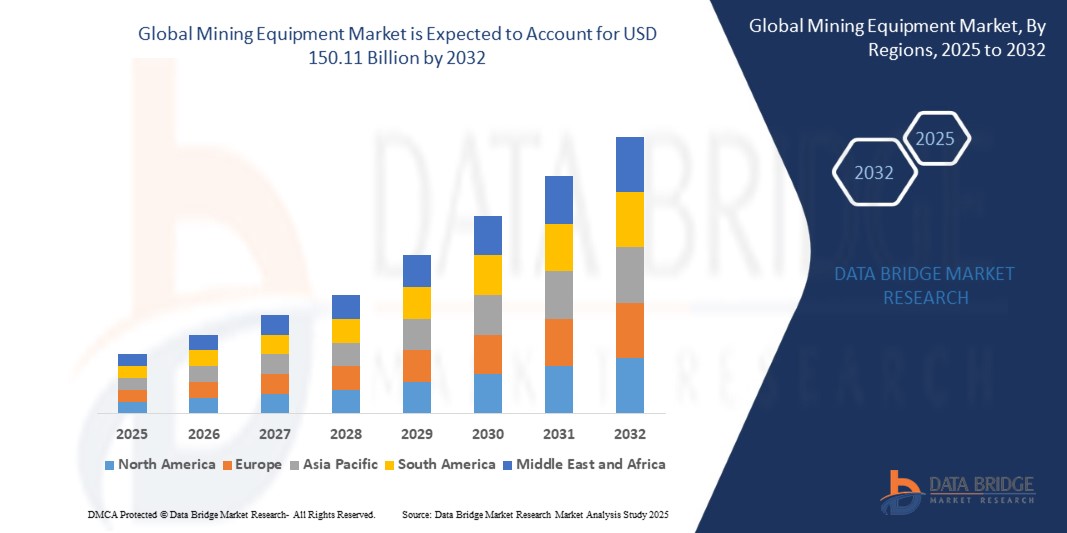

- The global mining equipment market size was valued at USD 95.97 billion in 2024 and is expected to reach USD 150.11 billion by 2032, at a CAGR of 5.75% during the forecast period

- This growth is driven by rising demand of metals and minerals worldwide

Mining Equipment Market Analysis

- Mining equipment are essential tools used in the extraction, transportation, and processing of minerals, playing a pivotal role in both surface and underground mining operations

- The demand for mining equipment is significantly driven by the increasing global need for metals and minerals such as iron ore, coal, copper, and lithium, which are critical for industrial development, energy production, and the growing electric vehicle sector

- Asia-Pacific is expected to dominate the mining equipment market due to rapid industrialization, infrastructure development, and extensive mining activities in countries such as China, India, and Australia

- North America is projected to be the fastest-growing region in the mining equipment market during the forecast period, supported by the adoption of advanced technologies, stringent safety regulations, and the integration of autonomous and electric mining machinery to enhance operational efficiency and sustainability

- The surface mining equipment segment is expected to dominate the market with the market share of 40.41% owing to its increasing demand for iron ore, coal, diamonds, and chromium in emerging economies is expected to create significant opportunities for surface mining equipment. The growing adoption of this equipment has facilitated specialized mining operations, including the extraction of high-quality resources and the development of stable embankments and surfaces

Report Scope and Mining Equipment Market Segmentation

|

Attributes |

Mining Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Mining Equipment Market Trends

“Electrification and Sustainability in Mining Operations”

- A major trend reshaping the mining equipment market is the shift towards electrification and eco-friendly machinery to reduce emissions and operational costs

- Manufacturers are increasingly focusing on developing electric mining trucks, drills, and loaders that run on lithium-ion batteries or hydrogen fuel cells

- This trend is driven by stricter environmental regulations, carbon neutrality goals, and demand from mining companies to meet ESG (Environmental, Social, Governance) standards

- For instance, in July 2023, Komatsu Ltd. unveiled the PC210LCE-11 electric excavator, aimed at enhancing zero-emission construction and mining solutions

- As sustainability becomes a core operational strategy, this transition is expected to significantly increase the adoption of electric and hybrid mining equipment worldwide

Mining Equipment Market Dynamics

Driver

“Expansion of Mining Activities for Energy Transition Minerals”

- The global push for clean energy technologies such as wind, solar, and electric vehicles has created high demand for transition minerals such as lithium, copper, and cobalt

- Countries are ramping up mining operations to secure critical raw materials needed for batteries, grid storage, and renewable power infrastructure

- Mining Equipment plays a pivotal role in enabling efficient extraction and processing of these minerals

- For instance, in April 2024, the International Energy Agency (IEA) highlighted a 30% surge in lithium and copper mining projects to meet net-zero goals

- This demand is fueling investments in modern, high-capacity mining equipment and expanding the market at a rapid pace

Opportunity

“Automation and Remote Operation Technologies”

- The incorporation of automation and teleoperation systems into mining equipment presents a significant growth opportunity

- These technologies improve safety by reducing human presence in hazardous zones, while also enhancing productivity and precision

- AI-enabled fleet management, predictive maintenance, and autonomous drilling systems are revolutionizing mining operations

- For instance, in 2023, Caterpillar expanded its autonomous haulage solutions across various mines in Australia and North America, leading to higher output and cost savings

- As digital transformation accelerates, the demand for smart and autonomous mining equipment is poised to rise substantially

Restraint/Challenge

“Volatility in Raw Material Prices and Equipment Costs”

- A major challenge in the mining equipment market is the price fluctuation of raw materials such as steel, copper, and aluminum, which significantly impacts equipment manufacturing costs

- Combined with high initial capital investments, these cost variations can deter small and mid-sized mining companies from upgrading to advanced machinery

- Moreover, shipping delays and geopolitical tensions can disrupt supply chains, further increasing equipment procurement challenges

- For instance, in late 2023, price hikes in steel and semiconductor shortages delayed deliveries of heavy-duty mining machinery across several global markets

- These economic and supply constraints can limit market expansion, especially in cost-sensitive regions

Mining Equipment Market Scope

The market is segmented on the basis of equipment category, industry, propulsion, electric equipment type, autonomous equipment category.

|

Segmentation |

Sub-Segmentation |

|

By Equipment Category |

|

|

By Industry |

|

|

By Propulsion |

|

|

By Electric Equipment Type

|

|

|

By Autonomous Equipment Category |

|

In 2025, the surface mining equipment is projected to dominate the market with a largest share in equipment category segment

The surface mining equipment segment is expected to dominate the mining equipment market with the largest share of 40.42% in 2025 due to increasing demand for iron ore, coal, diamonds, and chromium in emerging economies is expected to create significant opportunities for surface mining equipment. The growing adoption of this equipment has facilitated specialized mining operations, including the extraction of high-quality resources and the development of stable embankments and surfaces.

The coal is expected to account for the largest share during the forecast period in industry market

In 2025, the coal segment is expected to dominate the market with the largest market share of 39% due to rising need for electricity generation has driven increased demand for coal, leading to a surge in coal mining activities. As a result, coal mining equipment has seen expanded usage and broader adoption across the industry.

Mining Equipment Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Mining Equipment Market”

- Asia-Pacific dominates the global mining equipment market with market share of 36.71%, driven by substantial mining activity, rapid industrialization, and large-scale infrastructure development projects across key countries such as China, India, and Australia

- China holds a dominant share in the region, supported by extensive mineral reserves, heavy investments in mining automation, and government-backed initiatives promoting energy and metal security

- Favorable policies, lower labor costs, and the presence of leading manufacturers such as Komatsu, Hitachi Construction Machinery, and SANY Group contribute to the region’s dominance in equipment production and deployment

- The growing demand for minerals and metals, coupled with increasing adoption of advanced technologies such as autonomous trucks and electric mining equipment, continues to fuel the expansion of the mining equipment market across Asia-Pacific

“North America is Projected to Register the Highest CAGR in the Mining Equipment Market”

- North America is expected to witness the highest growth rate in the mining equipment market, fueled by the rising demand for metals and minerals, increasing investments in mine expansion, and the adoption of automation and electric mining technologies

- The U.S. and Canada are emerging as key markets, supported by favorable mining regulations, significant coal and metal reserves, and government initiatives promoting sustainable mining practices

- The U.S. market continues to grow due to its focus on upgrading aging infrastructure, integrating digital technologies in mining operations, and encouraging private investments in mineral exploration and development

- With a strong focus on productivity, safety, and environmental performance, North America is attracting global mining equipment manufacturers and investors, positioning the region for robust growth during the forecast period

Mining Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Caterpillar (U.S.)

- AB Volvo (Sweden)

- Komatsu (Japan)

- Sandvik AB (Sweden)

- Liebherr-International Deutschland GmbH (Germany)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Terex Corporation (U.S.)

- JSC "Mining Machines" (Russia)

- Atlas Copco Group (Sweden)

- SANY Group (China)

- Doosan Corporation (South Korea)

- Equipment North Inc. (Canada)

- RTM Supply Inc. (U.S.)

- DAKOTA EQUIPMENT MANUFACTURING INC. (U.S.)

- ASTEC INDUSTRIES, INC. (U.S.)

- minemaster (Canada)

- Konecranes (Finland)

- XCMG GROUP (China)

- BEML Limited (India)

- Hyundai Heavy Industries Co. Ltd. (South Korea)

- AARD Mining Equipment (South Africa)

Latest Developments in Global Mining Equipment Market

- In July 2023, Komatsu Ltd. announced the upcoming launch of its PC210LCE-11 and 200LCE-11 electric excavators, both 20-ton models powered by lithium-ion batteries, targeting the Japanese and European markets. This launch reflects Komatsu’s strategic focus on penetrating the electric construction equipment segment and reinforces its commitment to achieving carbon neutrality by 2050. This move strengthens Komatsu’s presence in the sustainable machinery market and positions it as a frontrunner in eco-friendly innovation

- In July 2023, Liebherr formed a strategic partnership with Leica Geosystems to deliver a comprehensive suite of machine control systems for hydraulic excavators. These advanced systems function as driver assistance tools, aiming to enhance safety, accuracy, and productivity on construction sites. This collaboration supports Liebherr’s goal of integrating intelligent solutions for improved construction efficiency

- In July 2023, Metso Corporation entered into an acquisition agreement with Brouwer Engineering, an Australia-based company known for its expertise in electrical and control systems. This acquisition enables Metso to expand its capabilities in bulk material handling by offering a more comprehensive solution portfolio to its customers. The merger aims to deliver enhanced value through combined technological strengths and a broader service offering

- In June 2023, Epiroc launched a mobile hydraulic powerpack tailored for blast hole drilling applications, specifically designed to optimize the performance of electric drills. The wagon-mounted unit facilitates off-grid operations by eliminating the dependency on established electrical infrastructure. This innovation improves drill mobility and energy efficiency, advancing Epiroc’s mission of supporting off-grid and sustainable mining practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.