Global Mint And Menthol Market

Market Size in USD Billion

CAGR :

%

USD

39.13 Billion

USD

59.15 Billion

2021

2029

USD

39.13 Billion

USD

59.15 Billion

2021

2029

| 2022 –2029 | |

| USD 39.13 Billion | |

| USD 59.15 Billion | |

|

|

|

|

Mint and Menthol Market Analysis and Size

Mint and menthol is a recreational food that is chewed solely for the desire to masticate. Consumers are looking for functional benefits from gum as they become more health conscious. Some Mint and Menthols on the market promote the product's functional benefits of keeping teeth clean. There are also nicotine gum mint and menthols that are used by consumers who want to quit smoking. Teeth whitening Mint and Menthol is the most popular functional gum, accounting for more than half of all sales, followed by nicotine gum.

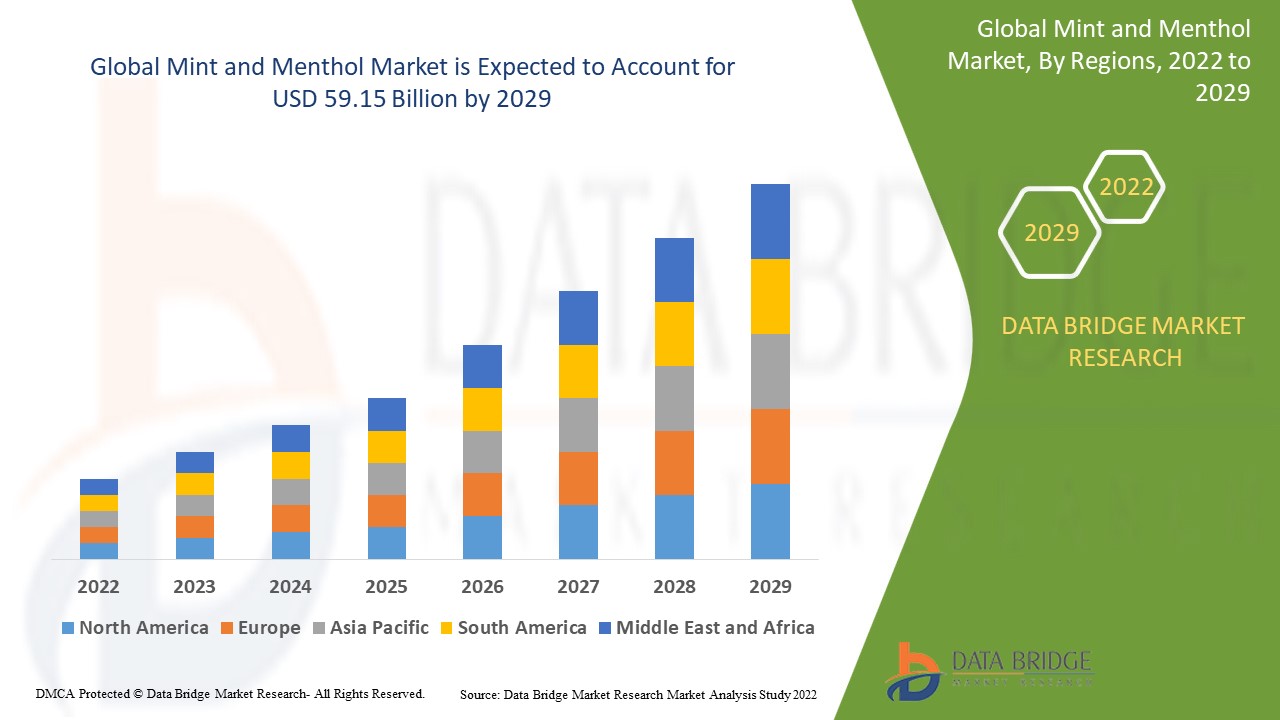

Data Bridge Market Research analyses that the mint and menthol market was valued at USD 39.13 billion in 2021 and is expected to reach the value of USD 59.15 billion by 2029, at a CAGR of 5.30% during the forecast period. With the passage of time, there has been a significant shift from simple product groups to sugar-free products, allowing manufacturers to meet the changing needs of consumers and creating a plethora of opportunities in the market. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Mint and Menthol Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Hard Type, Chewing Type, Scotland Type), Product (Synthetic, Natural Menthol), Application (Drinks, Dairy Products, Dried Processed Food, Tobacco, Confectionary, Ice-creams, Others), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Pharmacies, Specialist Retailers, Other) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Global (APAC) in the Global (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

The Hershey Company (U.S.), Perfetti Van Melle Group B.V. (Italy), Mondelez International, Inc (U.S.), Lotte Corporation (Japan), The PUR Company Inc. (Canada), Mars Incorporated (U.S.), Health Made Easy Group (U.K.), Ferndale Confectionery Pty Ltd (Australia), Ferrero SpA (Italy), Verve, Inc. (U.S.), Kraft Foods Inc (U.S.), Haribo GmbH & Co. Kg (Germany), The Wm. Wrigley Jr. Company (U.S.), Topps Company Inc. (U.S.), Simply Gum Inc. (U.S.) |

|

Opportunities |

|

Market Definition

Mint is a herb plant whose leaves, seeds, and flowers are used to flavour foods, whereas menthol is an aromatic organic compound that gives mint its sweet and spicy flavour. Mint is a herb plant in the Mentha genus. It belongs to the Lamiaceae family. Menthol is an aromatic compound that is mostly found in mint. In general, essential oil from mint is extracted using cyclic monoterpene alcohol. It is a waxy, crystalline substance that can be clear or white.

Mint and Menthol Market Dynamics

Drivers

- Growing use of menthol in the tobacco and cigarette manufacturing industry

Tobacco companies are increasingly using menthol, as manufacturers continue to market menthol cigarettes as a cool and refreshing product. Furthermore, tobacco companies produce menthol cigarettes to attract new customers because menthol cigarettes are more appealing than traditional non-flavoured cigarettes. Furthermore, as tobacco companies continue to invest in engaging ads and branding for menthol cigarettes that feature water, nature, and other refreshing elements, the global preference for menthol cigarettes has grown.

- Improved marketing strategies to attract the youth

Research and development activities are expected to play a significant role in the overall development of the global mint and menthol market during the forecast period. Menthol has emerged as one of the most effective pain control solutions in the medical sector as a result of several research and development activities. Furthermore, because menthol is relatively safe and effective in the treatment of a wide range of painful conditions such as sports injuries, migraine, neuropathic pain, and musculoskeletal pain, there is a growing demand for menthol in topical analgesic products.

Manufacturers are employing a variety of marketing strategies to pique the interest of the younger generation and increase demand for Mint and Menthol with new flavours, shapes, and appealing packaging.

Opportunity

The rapid consumption of this mint and menthol is one of the major trends observed in the global market, owing to the growing population of young people in developing countries. Another factor that could drive target market growth in the coming years is the incorporation of additional health aids and ingredients into functional mint and menthols rather than a refreshing-breathing function. Manufacturers are employing a variety of marketing strategies to pique the interest of the younger generation and increase demand for mint and menthol with new flavours and appealing packaging.

Restraints

Methanol use in tobacco is a major cause of several deaths worldwide. As a result, the Food and Drug Administration (FDA) intends to impose a ban on the use of methanol as a flavouring agent. The move is likely to impede the aforementioned market's steady growth. Other alternatives are stealing market share from mint and methanol. Furthermore, the worsening environmental situation, declining soil fertility, soil erosion, and changing season lengths are likely to pose significant challenges to the mint and methanol markets in the coming years.

This mint and menthol market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the mint and menthol market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Mint and Menthol Market

During the COVID-19 pandemic, demand for nicotine gums, an important component of the mint and menthol market, increased dramatically among global consumers. This was due to consumers' growing awareness of the severity of COVID-19 disease, which is more prevalent among smokers. Tobacco use reduces lung function, making it more difficult for the body to fight off coronaviruses and other diseases. As a result, it insisted that global consumers stop smoking, fuelling demand for nicotine gums.

Recent Development

- On April 18, 2022, the San Francisco, California-based biotechnology firm "Lygos Inc" announced that it had successfully completed a merger agreement with the Victoria, Canada-based chemical manufacturing firm "Flexible Solutions International Inc." The merger is expected to be completed by the third quarter of 2022, with the goal of forming a company that deals with high-value food ingredients.

- On September 6, 2021, the Zurich, Switzerland-based chocolate manufacturer and cocoa processing company "Barry Callebaut" announced the successful acquisition of Europe Chocolate Company of Malle, Belgium (ECC). The company did not disclose the acquisition's financials; however, the transaction is likely to strengthen Barry's customised chocolate portfolio.

- On May 18, 2021, Singapore-based food and agri-business firm "Olam International" announced the successful acquisition of renowned spice manufacturing firm "Olde Thompson" in California, United States. Olam International made a $950 million payment to complete the acquisition.

Global Mint and Menthol Market Scope

The mint and menthol market is segmented on the basis of type, product, application and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Hard Type

- Chewing Type

- Scotland Type

Product

- Synthetic

- Natural Menthol

Application

- Drinks

- Dairy Products

- Dried Processed Food

- Tobacco

- Confectionary

- Ice-creams

- Others

Distribution channel

- supermarket

- hypermarket

- convenience stores

- pharmaceuticals

- departmental stores

- online

Mint and Menthol Market Regional Analysis/Insights

The mint and menthol market is analysed and market size insights and trends are provided by country, type, product, application and distribution channel as referenced above.

The countries covered in the mint and menthol market report are U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Global (APAC) in the Global (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America held the largest share of the market. This segment's growth is due to factors such as mint production dominance. The United States produces between 65 and 70 percent of the world's mints. Confectionery items such as candy canes have also drawn the attention of a variety of consumers. Furthermore, the United States is the world's largest methanol consumer. However, Asia-Pacific is expected to be the fastest-growing segment. This increase is due to the rising popularity of flavoured cigarettes, rising confectionery consumption, an expanding middle-class, increasing pressure on governments of large carbon-emitting countries like India and China to reduce emissions, and an increase in the prevalence of health complications as the population ages.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Mint and Menthol Market Share Analysis

The mint and menthol market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to mint and menthol market.

Some of the major players operating in the mint and menthol market are:

- The Hershey Company (U.S.)

- Perfetti Van Melle Group B.V. (Italy)

- Mondelez International, Inc (U.S.)

- Lotte Corporation (Japan)

- The PUR Company Inc. (Canada)

- Mars Incorporated (U.S.)

- Health Made Easy Group (U.K.)

- Ferndale Confectionery Pty Ltd (Australia)

- Ferrero SpA (Italy)

- Verve, Inc. (U.S.)

- Kraft Foods Inc (U.S.)

- Haribo GmbH & Co. Kg (Germany)

- The Wm. Wrigley Jr. Company (U.S.)

- Topps Company Inc. (U.S.)

- Simply Gum Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MINT AND MENTHOL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MINT AND MENTHOL MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MINT AND MENTHOL MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.6 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL MINT AND MENTHOL MARKET, BY TYPE

11.1 OVERVIEW

11.2 MINT PRODUCT

11.2.1 MINT PRODUCT, BY PRODUCT TYPE

11.2.1.1. MINT CANDIES

11.2.1.2. MINT GUMMIES

11.2.1.3. MINT CHEWING GUMS

11.2.1.4. COUGH DROP

11.2.1.5. OTHERS

11.3 MENTHOL PRODUCT

11.3.1 MENTHOL PRODUCT, BY PRODUCT TYPE

11.3.1.1. MENTHOL CANDIES

11.3.1.2. MENTHOL GUMMIES

11.3.1.3. MENTHOL CHEWING GUMS

11.3.1.4. COUGH DROP

11.3.1.5. OTHERS

11.3.1.6.

12 GLOBAL MINT AND MENTHOL MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 CANDIES

12.2.1 CANDIES, BY TYPE

12.2.1.1. SOFT CANDIES

12.2.1.2. HARD CANDIES

12.3 GUMMIES

12.4 CHEWING GUMS

12.5 COUGH DROP

12.6 OTHERS (IF ANY)

13 GLOBAL MINT AND MENTHOL MARKET, BY FLAVOUR

13.1 OVERVIEW

13.2 PEPPERMINT

13.3 SPEARMINT

13.4 PINEAPPLE

13.5 APPLE

13.6 GINGER

13.7 HORSEMINT

13.8 HONEY

13.9 RED RARIPILA

13.1 CATMINT

13.11 CHOCOLATE

13.12 ORANGE

13.13 VANILA

13.14 GRAPEFRUIT

13.15 CALAMINT

13.16 LICORICE

13.17 BASIL

13.18 OTHERS (IF ANY)

14 GLOBAL MINT AND MENTHOL MARKET, BY SUGAR CONTENT

14.1 OVERVIEW

14.2 REGULAR/ WITH SUGAR

14.3 LOW SUGAR

14.4 NO SUGAR

15 GLOBAL MINT AND MENTHOL MARKET, BY CONSUMER CATEGORY

15.1 OVERVIEW

15.2 ADULTS

15.3 KIDS

16 GLOBAL MINT AND MENTHOL MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 STORE BASED RETAILERS

16.2.1 STORE BASED RETAILERS, BY TYPE

16.2.1.1. SUPERMARKETS/HYPERMARKETS

16.2.1.2. CONVENIENCE STORES

16.2.1.3. SPECIALTY STORES

16.2.1.4. GROCERY STORES

16.2.1.5. CANDIES STORES

16.2.1.6. OTHERS

16.3 NON-STORE RETAILERS

16.3.1 NON-STORE RETAILERS, BY TYPE

16.3.1.1. ONLINE RETAILERS

16.3.1.2. COMPANY WEBSITE

17 GLOBAL MINT AND MENTHOL MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS & PARTNERSHIP

17.8 REGULATORY CHANGES

18 GLOBAL MINT AND MENTHOL MARKET, BY GEOGRAPHY

18.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

18.2 NORTH AMERICA

18.2.1 U.S.

18.2.2 CANADA

18.2.3 MEXICO

18.3 EUROPE

18.3.1 GERMANY

18.3.2 U.K.

18.3.3 ITALY

18.3.4 FRANCE

18.3.5 SPAIN

18.3.6 SWITZERLAND

18.3.7 NETHERLANDS

18.3.8 BELGIUM

18.3.9 RUSSIA

18.3.10 TURKEY

18.3.11 REST OF EUROPE

18.4 ASIA-PACIFIC

18.4.1 JAPAN

18.4.2 CHINA

18.4.3 SOUTH KOREA

18.4.4 INDIA

18.4.5 AUSTRALIA

18.4.6 SINGAPORE

18.4.7 THAILAND

18.4.8 INDONESIA

18.4.9 MALAYSIA

18.4.10 PHILIPPINES

18.4.11 REST OF ASIA-PACIFIC

18.5 SOUTH AMERICA

18.5.1 BRAZIL

18.5.2 ARGENTINA

18.5.3 REST OF SOUTH AMERICA

18.6 MIDDLE EAST AND AFRICA

18.6.1 SOUTH AFRICA

18.6.2 UAE

18.6.3 SAUDI ARABIA

18.6.4 KUWAIT

18.6.5 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL MINT AND MENTHOL MARKET, SWOT & DBMR ANALYSIS

20 GLOBAL MINT AND MENTHOL MARKET, COMPANY PROFILE

20.1 A.L.SIMPKIN & CO. LTD

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 GEOGRAPHICAL PRESENCE

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 QUALITY CANDY COMPANY

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 GEOGRAPHICAL PRESENCE

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 NESTLÉ SA

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 GEOGRAPHICAL PRESENCE

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENTS

20.4 HALF NUTS

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 GEOGRAPHICAL PRESENCE

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 WEAVER NUT SWEETS & SNACKS.

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHICAL PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 THE KROGER COMPANY

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHICAL PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT DEVELOPMENTS

20.7 TOOTSIE ROLL INC.

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 GEOGRAPHICAL PRESENCE

20.7.4 PRODUCT PORTFOLIO

20.7.5 RECENT DEVELOPMENTS

20.8 LIFE SAVERS

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 GEOGRAPHICAL PRESENCE

20.8.4 PRODUCT PORTFOLIO

20.8.5 RECENT DEVELOPMENTS

20.9 ARCOR CANDY

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 GEOGRAPHICAL PRESENCE

20.9.4 PRODUCT PORTFOLIO

20.9.5 RECENT DEVELOPMENTS

20.1 PERFETTI VAN MELLE

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 GEOGRAPHICAL PRESENCE

20.10.4 PRODUCT PORTFOLIO

20.10.5 RECENT DEVELOPMENTS

20.11 HOUSE OF CANDY

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 GEOGRAPHICAL PRESENCE

20.11.4 PRODUCT PORTFOLIO

20.11.5 RECENT DEVELOPMENTS

20.12 WRINGLEYS

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 GEOGRAPHICAL PRESENCE

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPMENTS

20.13 BRACHS

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 GEOGRAPHICAL PRESENCE

20.13.4 PRODUCT PORTFOLIO

20.13.5 RECENT DEVELOPMENTS

20.14 ALLTOIDS

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 GEOGRAPHICAL PRESENCE

20.14.4 PRODUCT PORTFOLIO

20.14.5 RECENT DEVELOPMENTS

20.15 PIEDMONT CANDY

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 GEOGRAPHICAL PRESENCE

20.15.4 PRODUCT PORTFOLIO

20.15.5 RECENT DEVELOPMENTS

20.16 KERRS CANDY

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 GEOGRAPHICAL PRESENCE

20.16.4 PRODUCT PORTFOLIO

20.16.5 RECENT DEVELOPMENTS

20.17 KAYCO.

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 GEOGRAPHICAL PRESENCE

20.17.4 PRODUCT PORTFOLIO

20.17.5 RECENT DEVELOPMENTS

20.18 FRUIDLES

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 GEOGRAPHICAL PRESENCE

20.18.4 PRODUCT PORTFOLIO

20.18.5 RECENT DEVELOPMENTS

20.19 NAVAFRESH

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 GEOGRAPHICAL PRESENCE

20.19.4 PRODUCT PORTFOLIO

20.19.5 RECENT DEVELOPMENTS

20.2 BRACHS

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 GEOGRAPHICAL PRESENCE

20.20.4 PRODUCT PORTFOLIO

20.20.5 RECENT DEVELOPMENTS

Note: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 QUESTIONNAIRE

23 ABOUT DATA BRIDGE MARKET RESEARCH

Global Mint And Menthol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mint And Menthol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mint And Menthol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.