Global Mobile Advertising Market

Market Size in USD Million

CAGR :

%

USD

418.08 Million

USD

2,204.57 Million

2024

2032

USD

418.08 Million

USD

2,204.57 Million

2024

2032

| 2025 –2032 | |

| USD 418.08 Million | |

| USD 2,204.57 Million | |

|

|

|

|

Mobile Advertising Market Size

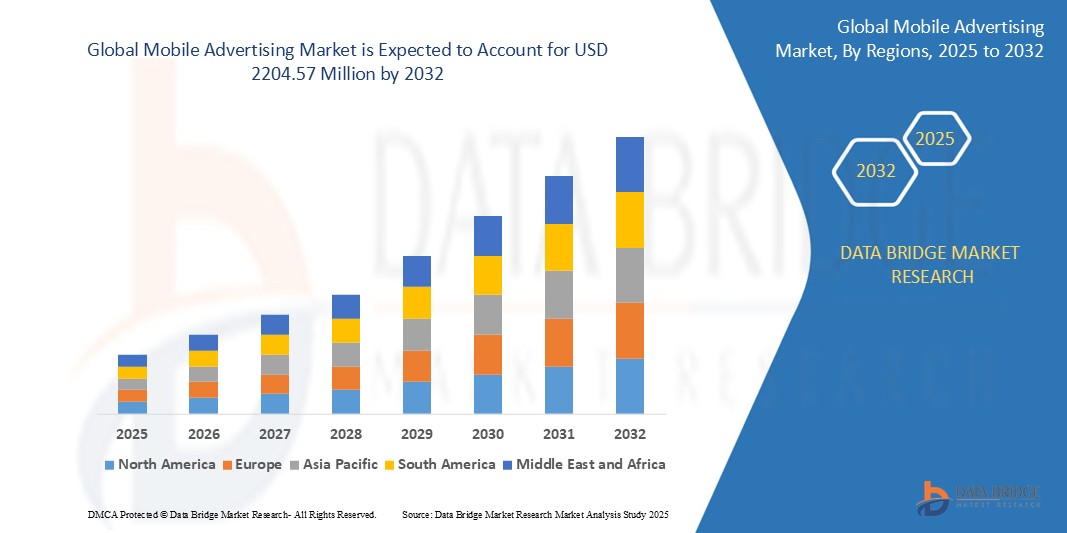

- The global mobile advertising market size was valued at USD 418.08 million in 2024 and is expected to reach USD 2204.57 million by 2032, at a CAGR of 23.10% during the forecast period

- The market growth is largely fueled by the increasing global adoption and usage of smartphones across all demographics, making mobile devices a primary platform for communication, entertainment, information access, and commerce. This widespread reliance on mobile creates a significant and readily accessible audience for advertisers

- Technological advancements in mobile advertising platforms, data analytics, and various ad formats are enhancing the precision, effectiveness, and engagement of mobile advertising campaigns. The growing preference among advertisers for reaching consumers directly on their personal devices with tailored and relevant messages, as opposed to broader, less targeted traditional advertising methods, is also a significant driver

Mobile Advertising Market Analysis

- Mobile advertising involves utilizing mobile devices such as smartphones and tablets to deliver promotional and marketing messages to consumers. This has become increasingly crucial in modern marketing due to its capacity to reach a vast and engaged audience with personalized and highly measurable campaigns

- The growing adoption of this advertising method is primarily due to the widespread use of mobile devices by consumers for various daily activities, an increasing understanding of the limitations and declining effectiveness of traditional advertising channels, and a growing demand from businesses for more direct, targeted, and impactful ways to connect with their target audience

- North America is expected to dominate the mobile advertising market with a share of 37.0% due to substantial investments in digital advertising technologies and a mature technological landscape

- Asia-Pacific is expected to be the fastest growing region in the mobile advertising market with a share of during the forecast period due to rising internet penetration and smartphone adoption. Key factors contributing to this growth include increasing digital engagement and supportive government initiatives

- Mobile advertising platform segment is expected to dominate the market with a market share of 68.3% due to the growing demand for centralized ad management, real-time bidding (RTB), and data-driven targeting solutions offered by platforms

Report Scope and Mobile Advertising Market Segmentation

|

Attributes |

Mobile Advertising Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Mobile Advertising Market Trends

“Increasing Use of Smartphones and Mobile Apps”

- A significant and accelerating trend in the global mobile advertising Market is the increasing reliance on smartphones and the growing popularity of mobile applications, making them central platforms for reaching consumers

- For instance, major players in the technology and advertising industries, such as Google (with its mobile advertising platform and Android ecosystem) and Meta (with its advertising on Facebook, Instagram, and within mobile apps), are heavily invested in optimizing advertising for smartphones and within mobile apps

- This heightened reliance enables the development of advertising strategies capable of targeting users based on their smartphone usage, app interactions, and data collected through these platforms, ensuring that promotional messages are delivered to relevant audiences. This approach significantly enhances the likelihood of user engagement and conversion compared to less targeted advertising methods

- The growing preference among consumers for accessing information, entertainment, and services through mobile apps, along with the increasing functionality and capabilities of smartphones, further fuels the importance of mobile advertising

- Businesses are increasingly recognizing the potential of these platforms to effectively connect with their target demographics and achieve their marketing objectives. This trend towards greater mobile engagement, coupled with advancements in mobile advertising technologies, is driving significant growth in the market

- The demand for mobile advertising is growing rapidly as the increasing use of smartphones and mobile apps encourages businesses to develop and adopt innovative advertising strategies tailored for these platforms. This direct and personalized approach to reaching consumers is vital for effective marketing and significantly boosts the mobile advertising market

Mobile Advertising Market Dynamics

Driver

“Increasing Preference for Video and Interactive Ad Formats”

- The increasing recognition of the effectiveness of engaging content among consumers is a significant driver for the heightened demand for Video and Interactive Ad Formats in the mobile advertising market

- For instance, major platforms in the mobile advertising space, such as Google (with YouTube video ads and interactive rich media formats on AdMob) and Meta (with Instagram Reels video ads and interactive polls/quizzes in ads), consistently showcase the higher engagement rates achieved through these formats in their case studies and advertising guidelines

- As the understanding of the engaging nature of video and interactive content expands, these ad formats offer a potentially superior approach compared to static banner ads by promising increased user attention and higher click-through rates

- Furthermore, the growing recognition of the limitations of traditional static mobile ads and the potential of video and interactive formats to overcome banner blindness and capture user interest is prompting more investment and innovation in this area

- The increasing availability of tools and platforms for creating and delivering compelling video and interactive mobile advertisements, coupled with the growing appetite from advertisers for formats that yield better results, makes it an attractive area for innovation and investment. The trend towards more immersive and engaging digital experiences and the desire for advertising that resonates with users are also key factors propelling the adoption and development of Video and Interactive Ad Formats in mobile advertising

Restraint/Challenge

“Inadequate Measurement Tools”

- Inadequate measurement tools presents a significant challenge to effectively understanding the true impact and return on investment of mobile advertising campaigns in the mobile advertising market. While the potential for precise targeting and reach is high, the complexity of the digital ecosystem poses hurdles for accurate measurement

- For instance, accurately attributing conversions and tracking user journeys across different devices and platforms remains a complex task, as seen with the challenges in utilizing tools such as Google Analytics and Meta Ads Manager

- Addressing these measurement challenges requires the development of sophisticated attribution models, privacy-preserving measurement techniques, and robust analytics solutions

- While the potential long-term benefits of overcoming these limitations, such as more effective campaign optimization, better budget allocation, and a clearer understanding of consumer behavior, are substantial, the current inadequacies in reliably measuring the impact of mobile advertising hinder optimal marketing strategies and accurate ROI calculations

- Overcoming these challenges through innovations in ad tech, data science, and analytics by companies such as Google, Meta, Nielsen, and various mobile measurement partners will be vital for realizing the full potential and demonstrating the true value of the mobile advertising sector

Mobile Advertising Market Scope

The market is segmented on the basis of format, category, solution, industry vertical, and mobile devices.

- By Format

On the basis of format, the market is segmented into search, native social, display, in-app, websites, video, and short message service (SMS). The short message service (SMS) segment dominates the largest market revenue share of 63.9% in 2025, driven by its widespread reach, cost-effectiveness, and ability to deliver targeted promotional content directly to consumers, especially in emerging markets with limited internet access.

The search segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing mobile search usage, growing smartphone penetration, and the rising effectiveness of intent-based advertising through search engines.

- By Category

On the basis of category, the market is segmented into art and entertainment, hobbies and interests, and others. The entertainment segment dominates the largest market revenue share in 2025, driven by the high consumption of mobile content such as music, gaming, and video streaming, making it a prime avenue for advertisers.

The hobbies and interests segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising adoption of personalized advertising and AI-based ad targeting that caters to user-specific preferences and activities.

- By Solution

On the basis of solution, the market is segmented into mobile advertising network, mobile advertising platform, mobile advertising server, and others. The mobile advertising platform segment dominates the largest market revenue share of 68.3% in 2025, driven by the growing demand for centralized ad management, real-time bidding (RTB), and data-driven targeting solutions offered by platforms.

The mobile advertising server segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising need for ad delivery optimization, performance tracking, and programmatic capabilities.

- By Industry Vertical

On the basis of industry vertical, the market is segmented into media and entertainment, banking, financial services and insurance (BFSI), education, government, fast moving consumable goods (FMCG), healthcare, and others. The fast moving consumable goods (FMCG) segment dominates the largest market revenue share in 2025, driven by high-frequency product purchases and the sector's reliance on mass reach, brand recall, and impulse-driven consumer engagement.

The media and entertainment segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing digital content consumption and the integration of immersive ad formats such as video and in-app ads to drive viewer interaction.

- By Mobile Devices

On the basis of mobile devices, the market is segmented into smartphones, tablets, laptops and notebooks, and other devices. The smartphones segment dominates the largest market revenue share in 2025, driven by their ubiquity, high screen time, and preference as the primary device for accessing social media, apps, and e-commerce platforms.

The laptops segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing hybrid work culture, increased usage for web browsing and video streaming, and more integrated ad experiences across web-based platforms.

Mobile Advertising Market Regional Analysis

- North America dominates the mobile advertising market with the largest revenue share of 37.0% in 2024, driven by substantial investments in digital advertising technologies and a mature technological landscape

- The region is witnessing a shift where digital channel spending is projected to surpass television expenditures, indicating the increasing importance of mobile as an advertising platform. Furthermore, the greater implementation and acceptance of advanced technologies such as augmented reality and virtual reality within mobile advertising contribute to the region's global market leadership

- Businesses in the region increasingly prioritize sophisticated digital advertising solutions to enhance customer engagement and marketing effectiveness, supported by favorable investment climates and a proactive approach to leveraging digital platforms for consumer outreach

U.S. Mobile Advertising Market Insight

U.S. mobile advertising market is anticipated to capture the largest revenue share 0f 78.7% within North America in 2025. This growth is fueled by a substantial consumer base increasingly engaging with mobile content and seeking more relevant and personalized advertising experiences. The increasing emphasis on data-driven advertising strategies and the active research and development of sophisticated mobile advertising systems for targeted ad delivery are key drivers. Moreover, the growing awareness among businesses of the benefits of reaching consumers directly through their mobile devices is contributing to greater adoption of mobile advertising solutions.

Europe Mobile Advertising Market Insight

European mobile advertising market is projected to expand at a substantial CAGR throughout the forecast period. This regional market growth is largely due to increasing investments in digital infrastructure and the growing preference among businesses for advanced and targeted advertising approaches to reach the diverse European consumer base. Consequently, advertising agencies and technology firms across Europe are increasingly focusing on developing and implementing innovative mobile advertising campaigns. Furthermore, rising government initiatives and funding aimed at promoting digital transformation and supporting business growth through effective advertising channels are fueling the need for comprehensive and user-friendly mobile advertising solutions.

U.K. Mobile Advertising Market Insight

U.K. mobile advertising market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing smartphone penetration and a growing demand for innovative and targeted advertising alternatives to conventional methods. In addition, the rising recognition of the potential of mobile platforms in revolutionizing marketing and the presence of strong advertising and technology companies are encouraging greater adoption. U.K.'s well-established digital infrastructure and increasing focus on personalized marketing experiences are expected to continue to stimulate market growth, with mobile advertising playing a crucial role in reaching consumers effectively.

Germany Mobile Advertising Market Insight

Germany's mobile advertising market is experiencing significant growth, fueled by increasing mobile device usage. Advertisers are increasingly prioritizing mobile and video formats to effectively reach consumers. Key trends include the importance of mobile-friendly strategies, search optimization, and personalized content delivery. As German consumers spend more time on their mobile devices, brands that adapt their marketing to these digital channels are well-positioned for success. The market is projected for continued substantial expansion in the coming years.

Asia-Pacific Mobile Advertising Market Insight

The Asia-Pacific region represents the fastest-growing mobile advertising market globally, driven by rising internet penetration and smartphone adoption. Key factors contributing to this growth include increasing digital engagement and supportive government initiatives. Smartphone advertising currently dominates the market. China holds the largest market share, while India is recognized as the fastest-growing individual market within the region. This dynamic landscape offers substantial opportunities for advertisers looking to engage a vast and rapidly expanding mobile-first consumer base.

Japan Mobile Advertising Market Insight

Japan's mobile advertising market is gaining momentum due to the country’s advanced digital ecosystem, increasing awareness of the effectiveness of mobile advertising, and demand for highly effective and minimally intrusive advertising solutions to reach its tech-savvy population. The Japanese market places a significant emphasis on precision and consumer engagement, and the adoption of sophisticated mobile advertising systems is driven by the increasing need for personalized marketing. The strong collaboration between advertising agencies, technology providers, and various industries is fueling growth in mobile advertising market.

China Mobile Advertising Market Insight

China's mobile advertising market is expected to account for the largest market revenue share of 50.8% in Asia Pacific in 2025. This is attributed to the country's massive mobile-first internet population, increasing prevalence of online consumption requiring effective advertising, and growing digital access, coupled with significant government investment in digital technologies and online business. China represents a significant market for digital advertising and innovative marketing strategies, and mobile advertising is becoming increasingly recognized as a crucial approach for reaching consumers. The increasing investment in digital infrastructure and the rising awareness of the potential of mobile advertising among businesses are key factors propelling the market in China.

Mobile Advertising Market Share

The mobile advertising industry is primarily led by well-established companies, including:

- AppLovin (U.S.)

- Avazu Inc. (Germany)

- Chartboost Inc. (U.S.)

- Meta (U.S.)

- Yahoo (U.S.)

- Google LLC (U.S.)

- InMobi (India)

- Matomy Media Group Ltd. (Israel)

- millennial media (U.S.)

- Smaato, Inc. (U.S.)

- Blockthrough, Inc. (Canada)

- Adobe (U.S.)

- TUNE Inc. (U.S.)

- Amobee, Inc. (U.S.)

- Twitter (U.S.)

- Pandora Media (U.S.)

Latest Developments in Global Mobile Advertising Market

- In November 2023, Amazon and Meta formed a partnership to enhance shopping advertising across Instagram and Facebook. This collaboration aims to make Meta more attractive to advertisers while providing Amazon with an opportunity to drive more potential customers to its external web store. By leveraging both platforms, the partnership is designed to increase visibility and boost engagement for brands looking to expand their reach

- In July 2023, Digital Turbine partnered with Connect Ads to deliver cutting-edge mobile advertising solutions to leading brands and agencies in the Middle East and North Africa. Through this collaboration, Aleph's Connect Ads will help regional clients leverage the growing potential of video marketing within mobile games, an area where Digital Turbine is a prominent global player. The partnership aims to enhance advertising opportunities, allowing brands to effectively engage with mobile users in this dynamic market

- In July 2023, AppLovin Corporation enhanced its mobile user acquisition platform, AppDiscovery, by integrating advanced AI capabilities. The upgraded AXON engine now features more robust models, enabling partners to achieve their campaign goals on a larger global scale with improved accuracy, better performance, and faster execution. This advancement aims to streamline user acquisition efforts, providing a more efficient and effective advertising experience for brands worldwide

- In June 2023, Google introduced two AI-powered features aimed at enhancing advertising for brands. One of the new tools, Demand Gen, utilizes AI to automatically place video and photo ads across Google’s services, including YouTube feed, Gmail, and Shorts. This innovation enables advertisers to reach a wider audience by optimizing ad placements across multiple platforms, streamlining the process and improving campaign effectiveness

- In February 2023, InMobi Commerce teamed up with Point Pickup to offer product discovery and monetization solutions. This partnership enabled Point Pickup’s grocery retail partners to enhance media-driven revenue opportunities. By leveraging InMobi’s expertise, the collaboration aimed to optimize advertising strategies and boost profitability for retail clients in the grocery sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MOBILE ADVERTISING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MOBILE ADVERTISING MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MOBILE ADVERTISING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES ANALYSIS

5.2 REGULATORY STANDARDS

5.3 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.4 PENETRATION AND GROWTH POSPECT MAPPING

5.5 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

5.6 CONSUMER BEHAVIOR

5.6.1 CLICK-BASED ADVERTISING

5.6.2 IMPRESSION-BASED ADVERTISING

5.7 TECHNOLOGY ANALYSIS

5.7.1 KEY TECHNOLOGIES

5.7.2 COMPLEMENTARY TECHNOLOGIES

5.7.3 ADJACENT TECHNOLOGIES

5.8 TECHNOLOGY MATRIX

Company Product/Service offered

5.9 CHALLENGES

5.1 INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.10.1 CUSTOMER BASE

5.10.2 SERVICE POSITIONING

5.10.3 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

5.10.4 APPLICATION REACH

5.10.5 SERVICE PLATFORM MATRIX

5.11 COMPANY COMPARATIVE ANALYSIS

Parameters Company A

Market Share

Growth (%)

Target Audience

Price Structure

Market Strategies

Customer Feedback

Service Positioning

Customer Feedback/Rating

Strategic Development

Application Reach

5.12 COMPANY SERVICE PLATFORM MATRIX

5.13 USED CASES & ITS ANALYSIS

FIGURE 1 USED CASE ANALYSIS

Company Product/Service offered

5.14 PRICING ANALYSIS BASED ON SALES, MARKETING & CUSTOMER SERVICE

6 GLOBAL MOBILE ADVERTISING MARKET, BY CHANNEL

6.1 OVERVIEW

6.2 WEBSITES

6.3 MOBILE MESSAGING

6.3.1 SMS

6.3.2 MMS

6.4 APPLICATIONS

6.5 VIDEO AND TV

6.5.1 PRE-ROLL, MID-ROLL OR POST ROLL.

6.5.2 ANIMATION

6.5.3 OTHER

6.6 OTHERS

7 GLOBAL MOBILE ADVERTISING MARKET, BY TYPE

7.1 OVERVIEW

7.2 PUSH NOTIFICATIONS

7.3 BANNER ADS

7.3.1 LOCATION

7.3.1.1. AT THE TOP OF THE PAGE

7.3.1.2. AT THE BOTTOM OF THE PAGE

7.3.1.3. IN THE MIDDLE OF THE PAGE’S CONTENT

7.3.2 BY SIZES

7.3.2.1. 300 X 50 PIXELS

7.3.2.2. 320 X 50 PIXELS

7.3.2.3. 320 X 90 PIXELS

7.3.2.4. OTHER PIXELS

7.4 INTERSTITIAL ADS

7.5 VIDEO ADS

7.6 NATIVE ADS

7.7 LOCATION-BASED ADS

7.8 SEARCH ADS

7.9 OTHERS

8 GLOBAL MOBILE ADVERTISING MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 ART AND ENTERTAINMENT

8.3 HOBBIES AND INTERESTS

8.4 OTHERS

9 GLOBAL MOBILE ADVERTISING MARKET, BY SOLUTION

9.1 OVERVIEW

9.2 MOBILE ADVERTISING NETWORK

9.3 MOBILE ADVERTISING PLATFORM

9.4 MOBILE ADVERTISING SERVER

9.5 OTHERS

10 GLOBAL MOBILE ADVERTISING MARKET, BY MOBILE DEVICES

10.1 OVERVIEW

10.2 SMARTPHONES

10.3 TABLETS

10.4 LAPTOPS

10.5 OTHERS

11 GLOBAL MOBILE ADVERTISING MARKET, BY ORGANIZATION SIZE

11.1 OVERVIEW

11.2 SMES

11.3 LARGE ENTERPRISES

12 GLOBAL MOBILE ADVERTISING MARKET, BY INDUSTRY VERTICAL

12.1 OVERVIEW

12.2 MEDIA AND ENTERTAINMENT

12.2.1 BY TYPE

12.2.1.1. PUSH NOTIFICATIONS

12.2.1.2. BANNER ADS

12.2.1.3. INTERSTITIAL ADS

12.2.1.4. VIDEO ADS

12.2.1.5. NATIVE ADS

12.2.1.6. LOCATION-BASED ADS

12.2.1.7. SEARCH ADS

12.2.1.8. OTHERS

12.3 BANKING FINANCIAL SERVICES AND INSURANCE (BFSI)

12.3.1 BY TYPE

12.3.1.1. PUSH NOTIFICATIONS

12.3.1.2. BANNER ADS

12.3.1.3. INTERSTITIAL ADS

12.3.1.4. VIDEO ADS

12.3.1.5. NATIVE ADS

12.3.1.6. LOCATION-BASED ADS

12.3.1.7. SEARCH ADS

12.3.1.8. OTHERS

12.4 EDUCATION

12.4.1 BY TYPE

12.4.1.1. PUSH NOTIFICATIONS

12.4.1.2. BANNER ADS

12.4.1.3. INTERSTITIAL ADS

12.4.1.4. VIDEO ADS

12.4.1.5. NATIVE ADS

12.4.1.6. LOCATION-BASED ADS

12.4.1.7. SEARCH ADS

12.4.1.8. OTHERS

12.5 GOVERNMENT

12.5.1 BY TYPE

12.5.1.1. PUSH NOTIFICATIONS

12.5.1.2. BANNER ADS

12.5.1.3. INTERSTITIAL ADS

12.5.1.4. VIDEO ADS

12.5.1.5. NATIVE ADS

12.5.1.6. LOCATION-BASED ADS

12.5.1.7. SEARCH ADS

12.5.1.8. OTHERS

12.6 FAST MOVING CONSUMABLE GOODS (FMCG)

12.6.1 BY TYPE

12.6.1.1. PUSH NOTIFICATIONS

12.6.1.2. BANNER ADS

12.6.1.3. INTERSTITIAL ADS

12.6.1.4. VIDEO ADS

12.6.1.5. NATIVE ADS

12.6.1.6. LOCATION-BASED ADS

12.6.1.7. SEARCH ADS

12.6.1.8. OTHERS

12.7 HEALTHCARE

12.7.1 BY TYPE

12.7.1.1. PUSH NOTIFICATIONS

12.7.1.2. BANNER ADS

12.7.1.3. INTERSTITIAL ADS

12.7.1.4. VIDEO ADS

12.7.1.5. NATIVE ADS

12.7.1.6. LOCATION-BASED ADS

12.7.1.7. SEARCH ADS

12.7.1.8. OTHERS

12.8 OTHERS

13 GLOBAL MOBILE ADVERTISING MARKET, BY GEOGRAPHY

GLOBAL MOBILE ADVERTISING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 FRANCE

13.2.3 U.K.

13.2.4 ITALY

13.2.5 SPAIN

13.2.6 RUSSIA

13.2.7 TURKEY

13.2.8 BELGIUM

13.2.9 NETHERLANDS

13.2.10 NORWAY

13.2.11 FINLAND

13.2.12 SWITZERLAND

13.2.13 DENMARK

13.2.14 SWEDEN

13.2.15 POLAND

13.2.16 REST OF EUROPE

13.3 ASIA PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 AUSTRALIA

13.3.6 NEW ZEALAND

13.3.7 SINGAPORE

13.3.8 THAILAND

13.3.9 MALAYSIA

13.3.10 INDONESIA

13.3.11 PHILIPPINES

13.3.12 TAIWAN

13.3.13 VIETNAM

13.3.14 REST OF ASIA PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 U.A.E

13.5.5 OMAN

13.5.6 BAHRAIN

13.5.7 ISRAEL

13.5.8 KUWAIT

13.5.9 QATAR

13.5.10 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL MOBILE ADVERTISING MARKET,COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL MOBILE ADVERTISING MARKET, SWOT & DBMR ANALYSIS

16 GLOBAL MOBILE ADVERTISING MARKET, COMPANY PROFILE

16.1 GOOGLE LLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 META

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 HUBSPOT, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 APPLOVIN

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 CRITEO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 DIGI117

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 DIGITAL TURBINE INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 EPOM

16.9 COMPANY SNAPSHOT

16.9.1 REVENUE ANALYSIS

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 GUMGUM INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 LEADBOLT

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 MATOMY MEDIA GROUP LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 MEDIA AND GAMES INVEST SE (MGI)

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 MOLOCO, INC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 UNITY TECHNOLOGIES

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 VERIZON

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 ZYNGA INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 CHARTBOOST, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 FLURRY

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 INMOBI

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 MATOMY MEDIA GROUP LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 SMAATO, INC.

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 ADOBE

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 TWITTER(X)

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PRODUCT PORTFOLIO

16.24.4 RECENT DEVELOPMENT

16.25 PANDORA MEDIA, LLC,

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENT

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.