Global Mobile Gamma Cameras Market

Market Size in USD Million

CAGR :

%

USD

56.83 Million

USD

82.06 Million

2024

2032

USD

56.83 Million

USD

82.06 Million

2024

2032

| 2025 –2032 | |

| USD 56.83 Million | |

| USD 82.06 Million | |

|

|

|

|

Mobile Gamma Cameras Market Size

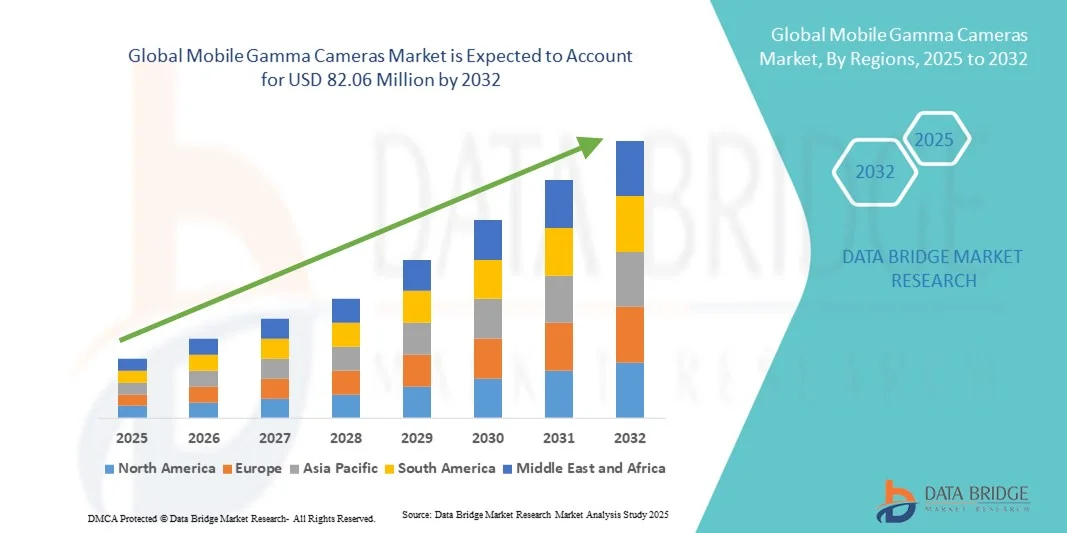

- The global mobile gamma cameras market size was valued at USD 56.83 million in 2024 and is expected to reach USD 82.06 Million by 2032, at a CAGR of 4.70% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced imaging technologies and continuous technological innovations in nuclear medicine, enabling more accurate and efficient detection of radiotracers in clinical settings. The development of portable and compact gamma camera systems is enhancing accessibility and convenience in hospitals, diagnostic centers, and research facilities

- Furthermore, rising demand for precise, real-time imaging solutions and minimally invasive diagnostic procedures is driving the adoption of Mobile Gamma Cameras. These converging factors are accelerating the uptake of Mobile Gamma Cameras solutions, thereby significantly boosting the industry's growth

Mobile Gamma Cameras Market Analysis

- The Mobile Gamma Cameras market comprises advanced portable nuclear imaging systems designed to provide functional imaging for cardiology, oncology, and surgical procedures at the point of care. These systems offer high-resolution imaging in compact, mobile formats, enabling rapid diagnostics and improved patient management

- Furthermore, rising demand for portable and flexible gamma imaging solutions that can be easily deployed in operating rooms, emergency care, and remote healthcare facilities is significantly boosting the Mobile Gamma Cameras market

- North America dominated the mobile gamma cameras market with the largest revenue share of 41.3% in 2024, supported by a strong presence of key manufacturers, high adoption of advanced medical imaging systems, and substantial healthcare expenditure. The U.S. experienced notable growth due to the increasing use of mobile gamma cameras in nuclear medicine, cardiology, and oncology applications, along with innovations in compact and high-resolution imaging systems

- Asia-Pacific is expected to be the fastest growing region in the mobile gamma cameras market during the forecast period, attributed to rising healthcare infrastructure investments, growing awareness of nuclear imaging, and increasing urbanization in countries such as China, India, and Japan

- The Single Head Mobile Gamma Camera segment dominated the mobile gamma cameras market with the largest market revenue share of 42.8% in 2024, owing to its affordability, ease of use, and wide adoption in small and medium-sized healthcare facilities. Single head systems offer a balance between image quality and operational simplicity, making them ideal for routine nuclear imaging procedures such as cardiac or renal scans.

Report Scope and Mobile Gamma Cameras Market Segmentation

|

Attributes |

Mobile Gamma Cameras Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mobile Gamma Cameras Market Trends

Enhanced Convenience Through Advanced Imaging and Portability

- A significant and accelerating trend in the global mobile gamma cameras market is the integration of compact, portable, and high-resolution imaging systems that provide clinicians with enhanced diagnostic flexibility. The ability to transport gamma cameras to different clinical settings, patient bedsides, or remote locations significantly improves workflow efficiency and patient care

- For instance, portable mobile gamma cameras such as the latest SPECT and PET/SPECT hybrid systems allow physicians to perform nuclear imaging procedures without requiring patients to visit fixed imaging suites, reducing delays in diagnosis and treatment. Similarly, compact handheld gamma probes enable intraoperative imaging for oncology and cardiac procedures, providing real-time guidance during surgeries

- Advanced detector technology in modern mobile gamma cameras offers high sensitivity and accuracy, facilitating early detection of tumors, organ dysfunctions, and other clinical conditions. For example, state-of-the-art CZT (Cadmium Zinc Telluride) detectors enhance spatial resolution while minimizing radiation exposure. These advancements make mobile gamma cameras suitable for diverse applications across hospitals, outpatient centers, and specialized clinics

- Integration with digital imaging platforms and software analytics enables centralized monitoring, image storage, and automated reporting. Physicians can access and analyze patient scans quickly, improving diagnostic accuracy and clinical decision-making

- The trend towards compact, high-performance, and interconnected gamma imaging systems is reshaping user expectations in diagnostic and surgical environments. Consequently, manufacturers are developing portable Mobile Gamma Cameras with features such as real-time imaging, multi-modality compatibility, and ergonomic designs for ease of use in varied clinical scenarios

- The demand for mobile gamma cameras that combine portability, high-resolution imaging, and workflow efficiency is growing rapidly across both hospital and outpatient settings, as healthcare providers increasingly prioritize faster, safer, and more accurate diagnostic procedures

Mobile Gamma Cameras Market Dynamics

Driver

Growing Need Due to Expanding Diagnostic Applications and Portable Imaging

- The increasing demand for precise, on-site nuclear imaging for oncology, cardiology, and orthopedics is a significant driver for the heightened adoption of mobile gamma cameras

- For instance, in April 2024, Siemens Healthineers announced the launch of its portable SPECT gamma camera system, designed for use in remote or space-limited healthcare facilities, enhancing accessibility to high-quality imaging. Such initiatives by key companies are expected to drive market growth in the forecast period

- Mobile gamma cameras enable real-time imaging during surgical procedures, reducing patient transport and enabling faster clinical decision-making

- Rising prevalence of chronic diseases such as cancer and cardiovascular disorders is increasing the need for nuclear imaging solutions in both hospital and outpatient settings

- The portability and compact design of these systems allow healthcare providers to expand diagnostic capabilities to smaller clinics, mobile health units, and rural hospitals

- Technological advancements such as hybrid imaging systems, enhanced detector sensitivity, and integrated software analytics are improving accuracy and reducing radiation exposure

- Increasing healthcare infrastructure investments in emerging markets provide opportunities for mobile gamma camera adoption in previously underserved regions

- The ability to perform rapid scans, minimize patient movement, and deliver accurate results is driving strong demand for portable imaging solutions

- Training programs for healthcare professionals and easier integration into existing workflows further encourage adoption

- Overall, the trend toward convenient, accurate, and portable imaging systems is propelling the Mobile Gamma Cameras market forward

Restraint/Challenge

High Costs and Regulatory Constraints

- The relatively high cost of advanced mobile gamma cameras can limit adoption, especially in smaller clinics or developing regions. Sophisticated detector technology and multi-modality integration contribute to the premium pricing

- Regulatory approval processes for nuclear imaging devices vary across countries, potentially delaying market entry and increasing operational costs for manufacturers

- Maintenance, calibration, and training requirements for mobile gamma cameras add to the total cost of ownership, which may deter smaller healthcare facilities

- Safety concerns related to radiation exposure, while minimal in modern systems, require adherence to strict protocols, adding complexity to deployment

- Some healthcare providers remain hesitant to invest in portable imaging systems until cost-benefit analyses demonstrate clear improvements in workflow and patient outcomes

- Reimbursement policies in certain regions may not fully cover mobile gamma camera procedures, limiting their adoption in outpatient or remote settings

- Companies must invest in ongoing research and development to reduce operational costs, improve safety features, and simplify device usability

- While prices are gradually decreasing with technological advancements, the upfront investment and infrastructure requirements still pose a barrier to broader adoption

- Education on the clinical benefits, safety protocols, and operational efficiency of mobile gamma cameras is essential to overcome market hesitancy

- Overall, addressing cost, regulatory, and operational challenges will be crucial for sustained growth in the Mobile Gamma Cameras market

Mobile Gamma Cameras Market Scope

The market is segmented on the basis of product type, indications, and end users.

- By Product Type

On the basis of product type, the mobile gamma cameras market is segmented into single head mobile gamma camera, double head mobile gamma camera, triple head mobile gamma camera, and hand held mobile gamma camera. The single head mobile gamma camera segment dominated the largest market revenue share of 42.8% in 2024, owing to its affordability, ease of use, and wide adoption in small and medium-sized healthcare facilities. Single head systems offer a balance between image quality and operational simplicity, making them ideal for routine nuclear imaging procedures such as cardiac or renal scans. Hospitals and specialized clinics often prefer single head units for their lower installation and maintenance costs. These systems are portable, enabling bedside imaging and use in outpatient settings. The segment benefits from high reliability, minimal training requirements, and compatibility with standard nuclear medicine protocols. In addition growing awareness of mobile imaging benefits in early diagnosis drives consistent demand. Accessibility in emerging markets, where budget constraints limit multi-head adoption, further strengthens this segment. Technological improvements such as enhanced detector sensitivity and reduced radiation dose make single head cameras more effective. Overall, single head mobile gamma cameras remain the most widely used product type globally.

The double head mobile gamma camera segment is expected to witness the fastest CAGR of 21.3% from 2025 to 2032, driven by its superior imaging resolution, higher sensitivity, and ability to perform complex nuclear imaging procedures. Double head systems are preferred in cardiac, hepatobiliary, and oncological applications where precise localization is critical. Hospitals and cancer research institutes increasingly adopt these systems for improved diagnostic accuracy. Growing investments in healthcare infrastructure, particularly in urban centers and specialized clinics, support rapid adoption. The ability to capture multiple angles simultaneously reduces scan time and enhances patient comfort. Integration with advanced imaging software and digital analytics further improves clinical workflow. Demand is also fueled by rising prevalence of chronic diseases requiring nuclear imaging. Portable configurations allow use in multi-departmental setups. Regulatory approvals and reimbursement policies in favor of advanced imaging solutions accelerate growth. Overall, double head systems are expanding rapidly due to technological advantages and increasing clinical requirements.

- By Indications

On the basis of indications, the mobile gamma cameras market is segmented into cardiac imaging, breast imaging, hepatobiliary imaging, GI imaging, renal imaging, brain imaging, and others. The Cardiac Imaging segment held the largest market revenue share of 40.5% in 2024, as cardiovascular diseases remain a leading cause of morbidity worldwide. Mobile gamma cameras provide essential diagnostic tools for detecting perfusion defects, ischemia, and myocardial infarctions. Hospitals and specialized cardiac centers prefer mobile systems for bedside and outpatient cardiac assessments. Cardiac imaging requires precise, high-sensitivity imaging, which drives adoption of mobile cameras equipped with advanced detectors. Portable gamma cameras enable timely diagnosis in emergency or critical care settings. Increased awareness among patients and clinicians about early detection of cardiac conditions boosts demand. Continuous improvements in software analytics and image reconstruction enhance diagnostic accuracy. Integration with hospital PACS systems and workflow optimization also contribute to adoption. Overall, cardiac imaging dominates due to high clinical necessity and established procedural protocols.

The Breast Imaging segment is expected to witness the fastest CAGR of 19.7% from 2025 to 2032, fueled by rising breast cancer prevalence and increased screening initiatives globally. Mobile gamma cameras allow accurate sentinel lymph node mapping and intraoperative guidance in breast cancer surgeries. Clinics and hospitals are increasingly adopting these portable imaging systems to provide targeted, minimally invasive procedures. Enhanced detector sensitivity and hybrid imaging modalities improve lesion localization. Rising patient awareness and government-supported screening programs boost adoption. The ability to perform bedside imaging reduces patient movement and streamlines workflow. Technological advances such as compact CZT detectors and multi-modality integration drive clinical preference. Improved affordability and expanding reimbursement policies also contribute. Overall, the breast imaging segment is growing rapidly due to rising clinical demand and technological innovation.

- By End Users

On the basis of end users, the mobile gamma cameras market is segmented into hospitals, ambulatory surgical centers, cancer research institutes, and specialized clinics. The hospitals segment accounted for the largest market revenue share of 48.2% in 2024, owing to high patient volume, advanced diagnostic requirements, and multiple departmental usage. Hospitals adopt mobile gamma cameras for diverse applications including cardiac, renal, and oncological imaging. High throughput and availability of trained nuclear medicine specialists support widespread deployment. The segment benefits from established infrastructure, regulatory approvals, and integration with existing diagnostic systems. Hospitals also leverage mobile cameras for intraoperative imaging during complex procedures. The demand is reinforced by increasing chronic disease prevalence and focus on early detection. Funding and insurance coverage enable hospitals to invest in advanced equipment. Overall, hospitals dominate as primary end users due to scale, resource availability, and varied clinical applications.

The ambulatory surgical centers segment is anticipated to witness the fastest CAGR of 20.5% from 2025 to 2032, driven by the rise of outpatient and minimally invasive procedures requiring precise intraoperative imaging. Mobile gamma cameras enable real-time imaging for surgical guidance, improving outcomes and reducing patient stay. Adoption is increasing in urban and suburban centers where efficient patient throughput is critical. Technological advancements, compact design, and ease of integration into smaller facilities encourage rapid uptake. Growing prevalence of outpatient nuclear medicine procedures and cost-effectiveness of mobile solutions further support adoption. Improved patient comfort and workflow optimization contribute to segment growth. Training programs and support services provided by manufacturers facilitate usage in ambulatory settings. Expanding insurance coverage for advanced imaging enhances affordability. Overall, ambulatory surgical centers are witnessing fast growth due to procedural efficiency and operational advantages.

Mobile Gamma Cameras Market Regional Analysis

- North America dominated the mobile gamma cameras market with the largest revenue share of 41.3% in 2024

- Supported by a strong presence of key manufacturers, high adoption of advanced medical imaging systems, and substantial healthcare expenditure

- The market experienced notable growth due to the increasing use of mobile gamma cameras in nuclear medicine, cardiology, and oncology applications, along with innovations in compact and high-resolution imaging systems

U.S. Mobile Gamma Cameras Market Insight

The U.S. mobile gamma cameras market captured the largest revenue share in 2024 within North America, fueled by the rising demand for point-of-care imaging and the adoption of compact, high-resolution systems. Hospitals and clinics increasingly utilize mobile gamma cameras for nuclear medicine, cardiology, and oncology diagnostics. Technological advancements, such as improved detector efficiency, better image processing software, and portability, have contributed to the market expansion, supporting timely clinical decision-making and enhanced patient outcomes.

Europe Mobile Gamma Cameras Market Insight

The Europe mobile gamma cameras market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising demand for functional imaging, stringent healthcare standards, and increasing adoption of portable imaging devices. Growth is supported by investments in healthcare infrastructure, an aging population, and the need for high-quality imaging in oncology, cardiology, and surgical procedures. Countries such as Germany, France, and Italy are witnessing increasing deployment in hospitals and diagnostic centers.

U.K. Mobile Gamma Cameras Market Insight

The U.K mobile gamma cameras market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by the adoption of mobile imaging systems in hospitals and specialty clinics. The increasing prevalence of chronic diseases, such as cancer and cardiac conditions, and the growing need for early diagnosis are key factors contributing to growth. The market benefits from the country’s well-developed healthcare infrastructure and supportive policies for advanced medical technologies.

Germany Mobile Gamma Cameras Market Insight

The Germany mobile gamma cameras market is expected to expand at a considerable CAGR during the forecast period, driven by rising investments in nuclear medicine, oncology, and cardiology departments, as well as the demand for innovative imaging solutions. German hospitals and diagnostic centers are increasingly integrating portable gamma cameras to enable flexible imaging workflows, improve patient throughput, and enhance procedural efficiency.

Asia-Pacific Mobile Gamma Cameras Market Insight

The Asia-Pacific mobile gamma cameras market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032. Growth is attributed to rising healthcare infrastructure investments, growing awareness of nuclear imaging, and increasing urbanization in countries such as China, India, and Japan. The adoption of mobile gamma cameras in hospitals and diagnostic centers is further encouraged by expanding healthcare access, technological advancements, and cost-effective solutions.

Japan Mobile Gamma Cameras Market Insight

The Japan mobile gamma cameras market is gaining momentum due to the country’s high healthcare standards, increasing demand for functional imaging, and the need for compact imaging solutions in hospitals. Hospitals are adopting mobile gamma cameras for cardiology, oncology, and surgical imaging to enhance patient care, reduce imaging turnaround times, and facilitate bedside diagnostics.

China Mobile Gamma Cameras Market Insight

The China mobile gamma cameras market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country's expanding healthcare infrastructure, rising prevalence of chronic diseases, and increasing investment in nuclear medicine and oncology imaging. Hospitals and specialty clinics are adopting mobile gamma cameras for their portability, flexibility, and ability to deliver high-quality imaging in various clinical settings, supporting early diagnosis and improved patient outcomes.

Mobile Gamma Cameras Market Share

The mobile gamma cameras industry is primarily led by well-established companies, including:

- Catalyst MedTech (U.S.)

- Spectrum Dynamics Medical (U.S.)

- DDD-Diagnostic A/S (Denmark)

- Mediso Ltd. (Hungary)

- MiE GmbH (Germany)

- Oncovision (Spain)

- Dilon Technologies (U.S.)

- Crystal Photonics GmbH (Germany)

- Adolesco (Sweden)

- Gammasonics Institute of Medical Research Pty. Ltd. (Australia)

- Siemens Healthineers AG (Germany)

- General Electric Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

Latest Developments in Global Mobile Gamma Cameras Market

- In January 2023, Dilon Technologies introduced the Ranger Vision+, a next-generation mobile gamma camera designed for enhanced portability and imaging performance. Weighing just 10 kg, the Ranger Vision+ is optimized for use in various environments, including healthcare facilities, emergency vehicles, and clinics. This launch underscores Dilon's commitment to advancing functional imaging solutions in nuclear medicine

- In September 2025, Digirad Corporation unveiled the Cardius-3, an all-in-one mobile gamma camera tailored for cardiac imaging. As the first and only dedicated cardiac triple-head gamma camera, the Cardius-3 offers high count imaging capabilities, meeting the needs of hospitals, imaging centers, and physician offices. This development highlights Digirad's leadership in providing specialized imaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.