Global Mobile Photo Printer Market

Market Size in USD Billion

CAGR :

%

USD

4.70 Billion

USD

7.50 Billion

2024

2032

USD

4.70 Billion

USD

7.50 Billion

2024

2032

| 2025 –2032 | |

| USD 4.70 Billion | |

| USD 7.50 Billion | |

|

|

|

|

Mobile Photo Printer Market Size

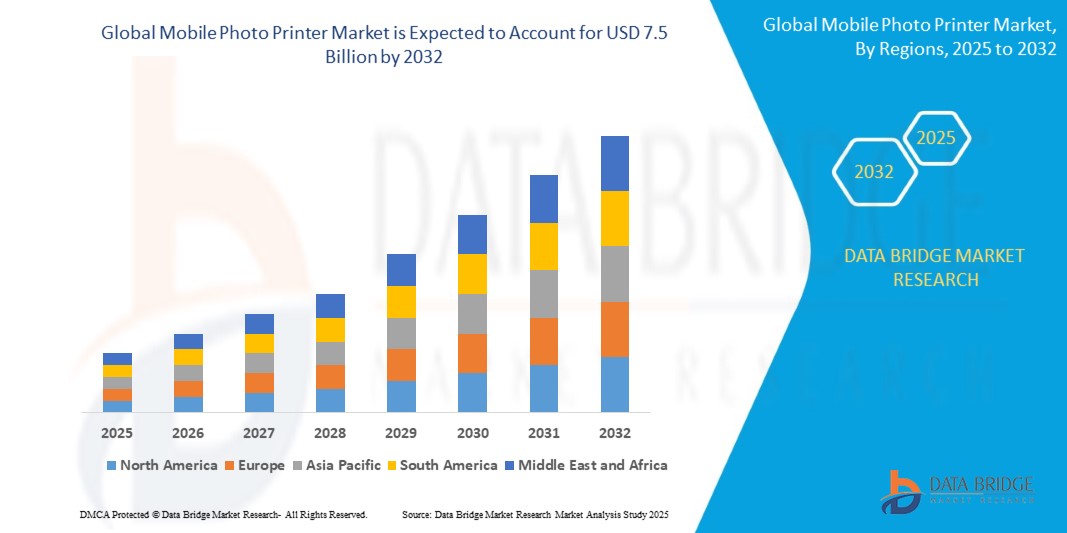

- The Mobile Photo Printer Market was valued at USD 4.7 Billion in 2025 and is projected to reach USD 7.5 Billion by 2032, growing at a CAGR of 7% during the forecast period.

- Growth is driven by the rising popularity of smartphone photography, increasing demand for instant and portable printing solutions, and advancements in wireless connectivity, companion printing apps, and AR-enhanced photo technology. Younger consumers, in particular, are embracing mobile printers for scrapbooking, journaling, event printing, and personalized gifting experiences.

Mobile Photo Printer Market Analysis

- Mobile photo printers are compact, wireless devices that allow users to print photos instantly from smartphones, tablets, and other portable devices using Bluetooth, Wi-Fi, or app-based connectivity.

- The market is driven by the surge in mobile photography and the desire for tangible, personalized prints—especially among younger demographics such as Gen Z and millennials who engage heavily with social media and visual content.

- ZINK and dye-sublimation technologies are gaining popularity due to their affordability, ease of use, and ink-free or high-resolution printing capabilities. These technologies offer convenience for on-the-go printing without requiring complex maintenance.

- The integration of AR filters, editing tools, and app-based customization has enhanced the appeal of mobile photo printers, allowing users to add interactive and creative elements to their prints.

- Advancements in portability, battery life, and compatibility with both iOS and Android platforms are expanding adoption across personal, event, and small business use cases.

Report Scope and Mobile Photo Printer Market Segmentation

|

Attributes |

Mobile Photo Printer Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mobile Photo Printer Market Trends

“Portability, Personalization, and App Integration Redefining Photo Printing”

- A key and rapidly advancing trend in the Mobile Photo Printer Market is the growing consumer preference for portable, pocket-sized printers that deliver instant printouts directly from smartphones via Bluetooth or Wi-Fi.

- Integration with companion mobile apps is transforming the user experience—allowing for editing, collage creation, filters, AR overlays, and direct social media connectivity before printing.

- The rise of hybrid devices that combine digital cameras with in-built printers is gaining traction, appealing to consumers seeking retro-style instant photography with modern digital convenience.

- Manufacturers are focusing on inkless and eco-friendly printing technologies like ZINK to cater to environmentally conscious consumers while reducing maintenance needs.

- Event-based and personal-use printing trends such as scrapbooking, photo booths, and gifting are driving demand for creative, user-friendly printers that support diverse paper types and formats.

Mobile Photo Printer Market Dynamics

Driver

“Smartphone Photography, On-the-Go Printing, and App Integration Fueling Market Growth”

- The rapid rise of smartphone photography and mobile-first lifestyles is driving the adoption of mobile photo printers, which provide users with tangible, instant prints from their digital photos.

- Increasing consumer demand for personalized, DIY experiences—such as scrapbooking, journaling, and gifting—has made mobile printers an attractive tool for creative expression.

- Portable, app-controlled printers with wireless connectivity (Bluetooth, Wi-Fi) enable on-the-go usage at events, parties, and travel, offering convenience and immediate satisfaction.

- Major tech brands are integrating smartphone apps with editing tools, AR filters, and collage templates, enhancing the functionality and user experience of photo printers.

- The availability of ink-free technologies like ZINK and innovations in dye-sublimation printing are reducing maintenance, simplifying usage, and supporting eco-conscious consumer trends.

Restraint/Challenge

“High Consumable Costs, Limited Print Size, and Battery Constraints Hindering Mass Adoption”

- Despite growing interest, the high cost of consumables—such as ZINK paper and dye-sublimation cartridges—discourages frequent use among budget-conscious consumers.

- Limited print size and resolution compared to traditional or desktop photo printers may not meet the expectations of professional users or those seeking archival-quality prints.

- Short battery life and slower print speeds can be inconvenient for continuous use, especially at events or during travel, limiting the device’s practicality.

- Some mobile printers have limited compatibility with non-mainstream smartphone models or operating systems, which may create user frustration.

- Environmental concerns about single-use paper and plastic components are rising, particularly among eco-conscious buyers who seek sustainable printing alternatives.

Mobile Photo Printer Market Scope

The market is segmented on the basis of product type, technology, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Technology |

|

|

By Connectivity |

|

|

By End User |

|

• By Product Type

Product types include Portable, Compact, and Desktop Photo Printers.Portable Photo Printers account for the largest market share due to their compact size, battery-powered operation, and ease of use with smartphones—making them popular for personal, travel, and on-the-go printing.Compact Photo Printers are favored for home use, offering better print quality and larger photo output while maintaining space efficiency.Desktop Photo Printers, though less portable, are used in small businesses and studios for higher-volume photo printing and often feature superior resolution and media compatibility.

• By Technology

Technologies include ZINK (Zero Ink), Dye-Sublimation, Inkjet, Laser, and Thermal.ZINK technology holds the largest share due to its inkless printing method, lower maintenance, and widespread use in portable printers like HP Sprocket and Polaroid Zip.Dye-Sublimation printers offer superior print quality with smoother gradients, making them ideal for photo enthusiasts and event photographers.Inkjet technology is used in hybrid or multifunction photo printers, valued for color accuracy.Laser printers, though limited in mobile formats, are emerging in compact models with fast printing speeds.Thermal printers are commonly used in business applications due to their reliability and speed in producing small-sized prints and labels.

•By Connectivity

Connectivity types include Wired and Wireless.Wireless photo printers hold the dominant market share, driven by the popularity of smartphones and tablets that rely on Wi-Fi, Bluetooth, or NFC connectivity for seamless printing. Consumers increasingly prefer cable-free printing for convenience, portability, and compatibility with iOS and Android apps. Wireless printers also support cloud printing and social media integration, further enhancing their appeal across personal and commercial applications.Wired photo printers, though less common in the mobile segment, are still used in compact or desktop configurations where stable connections and faster data transfer are required. These are typically favored in home offices, small studios, or retail setups where consistent output and connectivity are prioritized over mobility.

• By End User

End users include Individual Consumers and Commercial/Business Users.Individual Consumers dominate the market, driven by increasing adoption of photo journaling, scrapbooking, instant gifting, and everyday mobile photography. The appeal of instant personalization and app-based printing boosts this segment.Commercial/Business Users include event organizers, tourism companies, photo booth operators, and retail outlets offering custom printing services. This segment is growing steadily with demand for on-the-spot branded printing, promotional materials, and high-speed portable solutions.

Mobile Photo Printer Market Regional Analysis

- North America dominates the Mobile Photo Printer Market with the largest revenue share in 2025, driven by strong smartphone penetration, high consumer spending on tech gadgets, and early adoption of portable photo printing devices. The presence of key players such as HP, Canon, and Polaroid, along with robust retail distribution channels, fuels market leadership.

- In the United States, rising demand for instant printing for social events, scrapbooking, and DIY gifts supports market expansion. Integration with mobile apps, voice assistants, and cloud platforms further enhances consumer experience and convenience.

United States Mobile Photo Printer Market Insight

The U.S. Mobile Photo Printer Market captured the largest revenue share within North America in 2025. High disposable income, strong e-commerce adoption, and widespread smartphone usage are driving demand. Frequent product launches by leading brands and the popularity of app-driven printing further contribute to market growth.

Europe Mobile Photo Printer Market Insight

The Europe Mobile Photo Printer Market is expected to grow steadily through 2032. Demand is driven by increasing interest in photography, creative printing, and eco-friendly print solutions. Consumer preferences for personalization, coupled with growth in hybrid camera-printer sales, support regional market expansion.

Germany Mobile Photo Printer Market Insight

Germany is a key market in Europe, supported by strong consumer electronics infrastructure and a culture of digital photography. The adoption of portable printing devices for travel, events, and creative hobbies is rising. Additionally, retail support and innovation in print quality are helping manufacturers expand their footprint.

France Mobile Photo Printer Market Insight

France’s Mobile Photo Printer Market is growing due to rising interest in artistic and home décor printing. Increased social media activity and content creation culture are fueling demand for aesthetic, on-the-go print solutions. Strong support from electronics retailers and tech-savvy youth contributes to this momentum.

Asia-Pacific Mobile Photo Printer Market Insight

The Asia-Pacific region is projected to grow at the fastest CAGR through 2032, led by countries such as China, Japan, South Korea, and India. Growth is driven by rising smartphone penetration, youth-driven trends in instant photo printing, and increasing online retail availability of portable photo printers.

Japan Mobile Photo Printer Market Insight

Japan’s market is defined by high technological innovation, compact device preference, and strong photo culture. Demand for mini printers integrated with mobile apps and AR filters is rising, particularly among younger demographics and urban consumers with high aesthetic preferences.

China Mobile Photo Printer Market Insight

China leads the Asia-Pacific region in revenue share in 2025, backed by a booming smartphone market, strong e-commerce growth, and the popularity of social sharing. Domestic tech brands and global players are expanding aggressively with affordable, app-integrated portable printers.

Mobile Photo Printer Market Share

The Mobile Photo Printer Market is primarily led by consumer electronics brands, camera companies, and portable printer innovators. These players compete based on product portability, print quality, app integration, and affordability. Key companies include:

- Bay Photo Lab

- Brothers International Ltd.

- Canon Inc.

- Cimpress

- Digitalab

- Fujifilm Holdings Corporation

- Hannto Technology Co., Ltd.

- Hiti Digital, Inc.

- LG Corporation

- Polaroid

- Seiko Epson Corporation

- Shutterfly Inc.

- Snapfish

- Sony Corporation

- The Eastman Kodak Company

- The Hewlett-Packard (HP)

- Zebra Technologies

Latest Developments in Mobile Photo Printer Market

- In February 2025, Canon Inc. launched the SELPHY CP2000, a compact dye-sublimation photo printer featuring USB-C support, enhanced wireless connectivity, and a redesigned companion app for easier editing and printing.

- In January 2025, Fujifilm introduced the Instax Mini Link 2 SE, offering new AR filters, gesture control, and Bluetooth pairing for real-time photo printing from smartphones.

- In November 2024, HP Inc. expanded its Sprocket lineup with the Sprocket Studio Plus, a higher-resolution portable printer capable of 4x6-inch borderless prints with app-driven editing and collage features.

- In September 2024, Kodak unveiled the Mini 3 Retro Portable Printer, using dye-sublimation technology and supporting both Android and iOS via the Kodak app, with features for sticker printing and frame customization.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MOBILE PHOTO PRINTER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MOBILE PHOTO PRINTER MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MOBILE PHOTO PRINTER MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES ANALYSIS

5.2 TECHNOLOGY TRENDS

6 GLOBAL MOBILE PHOTO PRINTER MARKET, BY FORM FACTOR

6.1 OVERVIEW

6.2 POCKET PHOTO PRINTER

6.3 COMPACT PHOTO PRINTER

7 GLOBAL MOBILE PHOTO PRINTER MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ZINK (ZERO INK)

7.3 DYE-SUBLIMATION

7.3.1 BY DYE COLOR

7.3.1.1. CMY

7.3.1.2. CMYK

7.3.1.3. RGB

7.4 INSTANT FILM

7.5 OTHERS

8 GLOBAL MOBILE PHOTO PRINTER MARKET, BY CONNECTIVITY

8.1 OVERVIEW

8.2 WIRELESS

8.3 WIRED

9 GLOBAL MOBILE PHOTO PRINTER MARKET, BY PAPER SIZE

9.1 OVERVIEW

9.2 2 X 3 INCHES

9.3 3 X 4 INCHES

9.4 4 X 6 INCHES

9.5 OTHERS

10 GLOBAL MOBILE PHOTO PRINTER MARKET, BY PRINT OUTPUT

10.1 OVERVIEW

10.2 MONOCHROME

10.3 COLOR

11 GLOBAL MOBILE PHOTO PRINTER MARKET, BY PRICE RANGE

11.1 OVERVIEW

11.2 LOW

11.3 MEDIUM

11.4 HIGH

12 GLOBAL MOBILE PHOTO PRINTER MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 INDIVIDUAL

12.3 COMMERCIAL

13 GLOBAL MOBILE PHOTO PRINTER MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 ONLINE

13.3 OFFLINE

14 GLOBAL MOBILE PHOTO PRINTER MARKET, BY GEOGRAPHY

14.1 GLOBALMOBILE PHOTO PRINTER MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1.1 NORTH AMERICA

14.1.1.1. U.S.

14.1.1.2. CANADA

14.1.1.3. MEXICO

14.1.2 EUROPE

14.1.2.1. GERMANY

14.1.2.2. FRANCE

14.1.2.3. U.K.

14.1.2.4. ITALY

14.1.2.5. SPAIN

14.1.2.6. RUSSIA

14.1.2.7. TURKEY

14.1.2.8. BELGIUM

14.1.2.9. NETHERLANDS

14.1.2.10. SWITZERLAND

14.1.2.11. DENMARK

14.1.2.12. POLAND

14.1.2.13. SWEDEN

14.1.2.14. NORWAY

14.1.2.15. FINLAND

14.1.2.16. REST OF EUROPE

14.1.3 ASIA PACIFIC

14.1.3.1. JAPAN

14.1.3.2. CHINA

14.1.3.3. SOUTH KOREA

14.1.3.4. INDIA

14.1.3.5. AUSTRALIA

14.1.3.6. SINGAPORE

14.1.3.7. THAILAND

14.1.3.8. MALAYSIA

14.1.3.9. INDONESIA

14.1.3.10. PHILIPPINES

14.1.3.11. NEW ZEALAND

14.1.3.12. VIETNAM

14.1.3.13. TAIWAN

14.1.3.14. REST OF ASIA PACIFIC

14.1.4 SOUTH AMERICA

14.1.4.1. BRAZIL

14.1.4.2. ARGENTINA

14.1.4.3. REST OF SOUTH AMERICA

14.1.5 MIDDLE EAST AND AFRICA

14.1.5.1. SOUTH AFRICA

14.1.5.2. EGYPT

14.1.5.3. SAUDI ARABIA

14.1.5.4. U.A.E

14.1.5.5. ISRAEL

14.1.5.6. KUWAIT

14.1.5.7. OMAN

14.1.5.8. QATAR

14.1.5.9. BAHRAIN

14.1.5.10. REST OF MIDDLE EAST AND AFRICA

14.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 GLOBAL MOBILE PHOTO PRINTER MARKET,COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL MOBILE PHOTO PRINTER MARKET , SWOT & DBMR ANALYSIS

17 GLOBAL MOBILE PHOTO PRINTER MARKET, COMPANY PROFILE

17.1 CANON

17.1.1 COMPANY SNAPSHOT

17.1.2 GEOGRAPHIC PRESENCE

17.1.3 REVENUE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 FUJIFILM

17.2.1 COMPANY SNAPSHOT

17.2.2 GEOGRAPHIC PRESENCE

17.2.3 REVENUE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 HP

17.3.1 COMPANY SNAPSHOT

17.3.2 GEOGRAPHIC PRESENCE

17.3.3 REVENUE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 KODAK

17.4.1 COMPANY SNAPSHOT

17.4.2 GEOGRAPHIC PRESENCE

17.4.3 REVENUE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 POLAROID

17.5.1 COMPANY SNAPSHOT

17.5.2 GEOGRAPHIC PRESENCE

17.5.3 REVENUE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 PRYNT

17.6.1 COMPANY SNAPSHOT

17.6.2 GEOGRAPHIC PRESENCE

17.6.3 REVENUE ANALYSIS

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENT

17.7 LG

17.7.1 COMPANY SNAPSHOT

17.7.2 GEOGRAPHIC PRESENCE

17.7.3 REVENUE ANALYSIS

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENT

17.8 SERENELIFE HOME, LLC.

17.8.1 COMPANY SNAPSHOT

17.8.2 GEOGRAPHIC PRESENCE

17.8.3 REVENUE ANALYSIS

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENT

17.9 EPSON

17.9.1 COMPANY SNAPSHOT

17.9.2 GEOGRAPHIC PRESENCE

17.9.3 REVENUE ANALYSIS

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENT

17.1 LIFE PRINT PHOTOS

17.10.1 COMPANY SNAPSHOT

17.10.2 GEOGRAPHIC PRESENCE

17.10.3 REVENUE ANALYSIS

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENT

17.11 TOMY KIIPIX

17.11.1 COMPANY SNAPSHOT

17.11.2 GEOGRAPHIC PRESENCE

17.11.3 REVENUE ANALYSIS

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENT

17.12 VUPOINTSHARE

17.12.1 COMPANY SNAPSHOT

17.12.2 GEOGRAPHIC PRESENCE

17.12.3 REVENUE ANALYSIS

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENT

17.13 BROTHER

17.13.1 COMPANY SNAPSHOT

17.13.2 GEOGRAPHIC PRESENCE

17.13.3 REVENUE ANALYSIS

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENT

17.14 INSTASHARE

17.14.1 COMPANY SNAPSHOT

17.14.2 GEOGRAPHIC PRESENCE

17.14.3 REVENUE ANALYSIS

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENT

17.15 HITI

17.15.1 COMPANY SNAPSHOT

17.15.2 GEOGRAPHIC PRESENCE

17.15.3 REVENUE ANALYSIS

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENT

17.16 DNP

17.16.1 COMPANY SNAPSHOT

17.16.2 GEOGRAPHIC PRESENCE

17.16.3 REVENUE ANALYSIS

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENT

17.17 MITSUBISHI

17.17.1 COMPANY SNAPSHOT

17.17.2 GEOGRAPHIC PRESENCE

17.17.3 REVENUE ANALYSIS

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENT

17.18 SONY

17.18.1 COMPANY SNAPSHOT

17.18.2 GEOGRAPHIC PRESENCE

17.18.3 REVENUE ANALYSIS

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENT

17.19 XIAOMI

17.19.1 COMPANY SNAPSHOT

17.19.2 GEOGRAPHIC PRESENCE

17.19.3 REVENUE ANALYSIS

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENT

17.2 CASIO

17.20.1 COMPANY SNAPSHOT

17.20.2 GEOGRAPHIC PRESENCE

17.20.3 REVENUE ANALYSIS

17.20.4 PRODUCT PORTFOLIO

17.20.5 RECENT DEVELOPMENT

17.21 SKYMALL

17.21.1 COMPANY SNAPSHOT

17.21.2 GEOGRAPHIC PRESENCE

17.21.3 REVENUE ANALYSIS

17.21.4 PRODUCT PORTFOLIO

17.21.5 RECENT DEVELOPMENT

17.22 MPRINT

17.22.1 COMPANY SNAPSHOT

17.22.2 GEOGRAPHIC PRESENCE

17.22.3 REVENUE ANALYSIS

17.22.4 PRODUCT PORTFOLIO

17.22.5 RECENT DEVELOPMENT

17.23 PRINTOMATIC

17.23.1 COMPANY SNAPSHOT

17.23.2 GEOGRAPHIC PRESENCE

17.23.3 REVENUE ANALYSIS

17.23.4 PRODUCT PORTFOLIO

17.23.5 RECENT DEVELOPMENT

17.24 RICOH

17.24.1 COMPANY SNAPSHOT

17.24.2 GEOGRAPHIC PRESENCE

17.24.3 REVENUE ANALYSIS

17.24.4 PRODUCT PORTFOLIO

17.24.5 RECENT DEVELOPMENT

17.25 XEROX

17.25.1 COMPANY SNAPSHOT

17.25.2 GEOGRAPHIC PRESENCE

17.25.3 REVENUE ANALYSIS

17.25.4 PRODUCT PORTFOLIO

17.25.5 RECENT DEVELOPMENT

17.26 ZINK

17.26.1 COMPANY SNAPSHOT

17.26.2 GEOGRAPHIC PRESENCE

17.26.3 REVENUE ANALYSIS

17.26.4 PRODUCT PORTFOLIO

17.26.5 RECENT DEVELOPMENT

17.27 ICODIS

17.27.1 COMPANY SNAPSHOT

17.27.2 GEOGRAPHIC PRESENCE

17.27.3 REVENUE ANALYSIS

17.27.4 PRODUCT PORTFOLIO

17.27.5 RECENT DEVELOPMENT

17.28 SELPIC

17.28.1 COMPANY SNAPSHOT

17.28.2 GEOGRAPHIC PRESENCE

17.28.3 REVENUE ANALYSIS

17.28.4 PRODUCT PORTFOLIO

17.28.5 RECENT DEVELOPMENT

18 CONCLUSION

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Mobile Photo Printer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mobile Photo Printer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mobile Photo Printer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.