Global Mobile Video Surveillances Market

Market Size in USD Billion

CAGR :

%

USD

2.90 Billion

USD

5.28 Billion

2024

2032

USD

2.90 Billion

USD

5.28 Billion

2024

2032

| 2025 –2032 | |

| USD 2.90 Billion | |

| USD 5.28 Billion | |

|

|

|

|

Mobile Video Surveillances Market Size

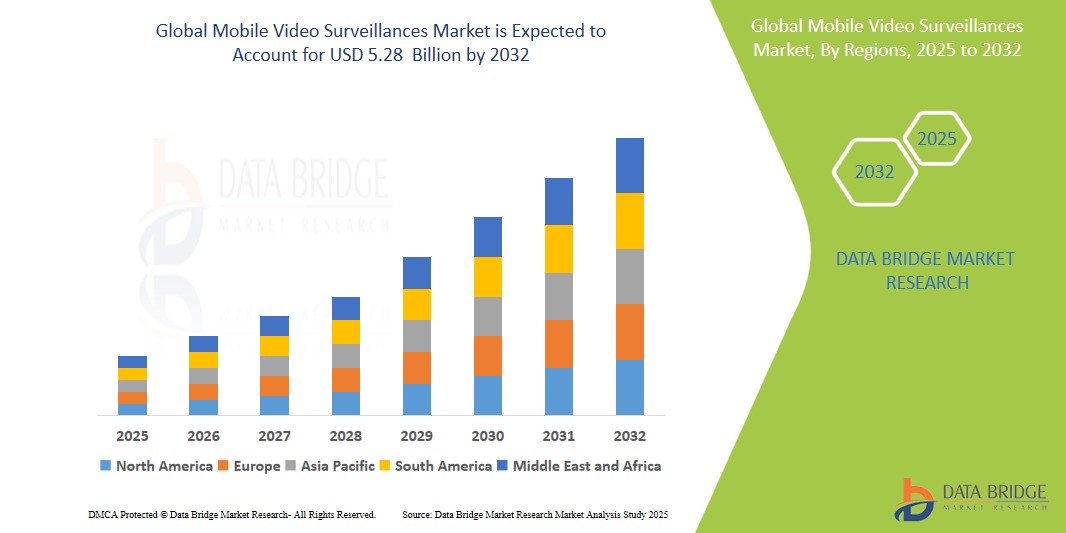

- The global Mobile Video Surveillance market size is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 5.28 billion by 2032, at a CAGR of 8.5% during the forecast period.

- This growth is driven by increasing security concerns, the adoption of AI and IoT in surveillance systems, and the expansion of smart city initiatives globally.

Mobile Video Surveillances Market Analysis

- The Mobile Video Surveillance market encompasses portable camera systems and monitoring solutions that enable real-time video capture, transmission, and analysis, used in dynamic environments like public transit, law enforcement, and construction for flexible security.

- The demand for mobile video surveillance is significantly driven by rising global security concerns, with violent crime rates at 395.7 incidents per 100,000 people in the U.S. in 2021, and the need for real-time monitoring in urban and remote areas.

- Asia Pacific is expected to dominate the Mobile Video Surveillance market due to rapid urbanization and smart city projects in countries like China and India, holding a 35.0% market share in 2023.

- North America is expected to be the fastest-growing region due to technological advancements and high adoption of advanced surveillance solutions, projected to grow at a CAGR of 9.0%.

- The Public Transit segment is expected to dominate the market with a market share of 40.0% in 2025 due to its critical role in ensuring passenger safety and deterring criminal activities.

Report Scope and Mobile Video Surveillances Market Segmentation

|

Attributes |

Mobile Video Surveillances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mobile Video Surveillances Market Trends

“Integration of AI and Video Analytics in Mobile Surveillance”

- A prominent trend in the Mobile Video Surveillance market is the increasing integration of AI and video analytics, with the AI-driven surveillance segment projected to grow at a CAGR of 9.5% during the forecast period.

- The Hardware segment is estimated to hold the highest market share of 50.0% in 2025, owing to the high utilization of cameras, storage solutions, and video encoders in mobile surveillance systems.

- For instance, in May 2022, Hanwha Techwin released its PNM-C12083RVD and PNM-C7083RVD multi-directional cameras with AI capabilities, enhancing object tracking and security.

- This trend is driving demand for intelligent, real-time monitoring solutions across transportation and public safety applications.

Mobile Video Surveillances Market Dynamics

Driver

“Rising Global Security Concerns and Smart City Initiatives”

- The increasing global security concerns, with 40% of police agencies adopting digital surveillance technologies by 2022, and the expansion of smart city projects, with 50% of global smart city investments in Asia Pacific, are significantly contributing to the Mobile Video Surveillance market growth.

- Mobile video surveillance systems enable real-time monitoring, reducing criminal activities by 15% in public transit and enhancing situational awareness in dynamic environments.

- For instance, in November 2023, Motorola Solutions unveiled the LTE-enabled V500 body camera, enhancing real-time field intelligence for emergency response.

- As urbanization and security needs grow, the demand for mobile surveillance continues to expand, ensuring flexible and efficient security solutions.

Opportunity

“Adoption of Cloud-Based Surveillance Solutions”

- The growing adoption of cloud-based surveillance solutions, with 60% of organizations adopting cloud storage by 2025, offers significant opportunities for market growth by enabling scalable, remote access to video feeds.

- Cloud-based systems reduce infrastructure costs by 20% and improve accessibility for industries like transportation and law enforcement.

- For instance, in 2024, Axis Communications introduced cloud-integrated mobile surveillance solutions, improving scalability for public transit applications by 12%.

- This opportunity drives market expansion by enabling cost-effective, scalable surveillance solutions.

Restraint/Challenge

“Privacy and Security Concerns with Video Data”

- Privacy and security concerns, with 30% of mobile video surveillance systems reported as vulnerable to data breaches in 2024, and public apprehension about video data misuse pose significant barriers to the market.

- These challenges require substantial investments in secure protocols and encryption technologies, increasing costs for operators.

- For instance, in 2024, 25% of global mobile surveillance deployments faced scrutiny due to privacy regulations, impacting adoption rates.

- These issues can hinder market growth, necessitating robust data protection measures.

Mobile Video Surveillances Market Scope

The market is segmented on the basis offering, application, and system type..

|

Segmentation |

Sub-Segmentation |

|

By Offering |

|

|

By Application |

Public Transit

|

|

By System Type |

|

In 2025, the Public Transit is projected to dominate the market with a largest share in application segment

The Public Transit segment is expected to dominate the Mobile Video Surveillance Market with the largest share of 56.22% in 2025, driven by the growing emphasis on passenger safety, vandalism prevention, and real-time incident response.

Rising investments in smart transportation systems and government mandates for surveillance in buses, trains, and subways are fueling adoption. High-definition cameras, live streaming capabilities, and remote access solutions are increasingly being deployed across public transportation fleets to monitor activities and ensure commuter safety.

The Software is expected to account for the largest share during the forecast period in technology market

In 2025, the Software segment is expected to dominate the offering category of the market with the largest market share of 51.31%, due to increasing demand for advanced video management systems (VMS), AI-based analytics, and cloud-based storage solutions.

Mobile Video Surveillances Market Regional Analysis

“North America Holds the Largest Share in the Mobile Video Surveillances Market”

- N North America dominates the Mobile Video Surveillance market, driven by increasing demand for public safety, the presence of smart city initiatives, and strong government investments in transit security systems.

- The U.S. accounts for the largest share due to widespread deployment of surveillance solutions across public transit, law enforcement vehicles, school buses, and commercial fleets.

- The growing adoption of AI-powered video analytics, facial recognition, and cloud-based monitoring software also enhances the appeal of mobile surveillance technologies in the region.

- Additionally, major industry players like Axis Communications, Motorola Solutions, and Genetec have a strong operational base in the U.S., supporting rapid technology penetration and innovation.

“Asia-Pacific is Projected to Register the Highest CAGR in the Mobile Video Surveillances Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the Mobile Video Surveillance market, fueled by rapid urbanization, growing smart city projects, and increasing demand for mass transit security.

- Countries such as China, India, and Japan are experiencing a surge in deployment of mobile surveillance systems across railways, metros, public buses, and police vehicles to deter crime and monitor traffic incidents.

- Rising security concerns, government mandates for surveillance infrastructure, and investments in 5G and IoT technologies further support market growth.

- The expansion of local and regional video surveillance solution providers is also contributing to increased adoption and affordability.

Mobile Video Surveillances Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Axis Communications AB (Sweden)

- Hanwha Techwin Co., Ltd. (South Korea)

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- Bosch Security Systems, LLC (Germany)

- Dahua Technology Co., Ltd. (China)

- FLIR Systems, Inc. (U.S.)

- Pelco by Schneider Electric (U.S.)

- Salient Systems Corporation (U.S.)

- Apollo Video Technology (U.S.)

- Seon (Canada)

Latest Developments in Global Mobile Video Surveillances Market

- In February 2025, Motorola Solutions announced the launch of its VB450 body-worn camera designed for use in mobile environments such as public transportation and law enforcement vehicles. This device features enhanced video stabilization, LTE connectivity, and seamless integration with CommandCentral software, allowing real-time video uploads for faster response and evidence management.

- In December 2024, Axis Communications introduced its P1468-XLE Network Camera, certified for use in mobile and harsh environments, including transit vehicles. The camera offers 4K resolution, wide dynamic range, and built-in cybersecurity features, making it ideal for deployment in trains, buses, and emergency response vehicles

- In November 2024, Safe Fleet unveiled its next-generation MobileView 8.0 platform, a cloud-connected video surveillance and fleet management software designed for school buses and public transit systems. It includes AI-driven behavior analysis, incident detection, and GPS integration, providing comprehensive oversight of vehicle operations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.