Global Mobile Wallet Payment Technologies Market

Market Size in USD Billion

CAGR :

%

USD

19.71 Billion

USD

65.52 Billion

2025

2033

USD

19.71 Billion

USD

65.52 Billion

2025

2033

| 2026 –2033 | |

| USD 19.71 Billion | |

| USD 65.52 Billion | |

|

|

|

|

Mobile Wallet Payment Technologies Market Size

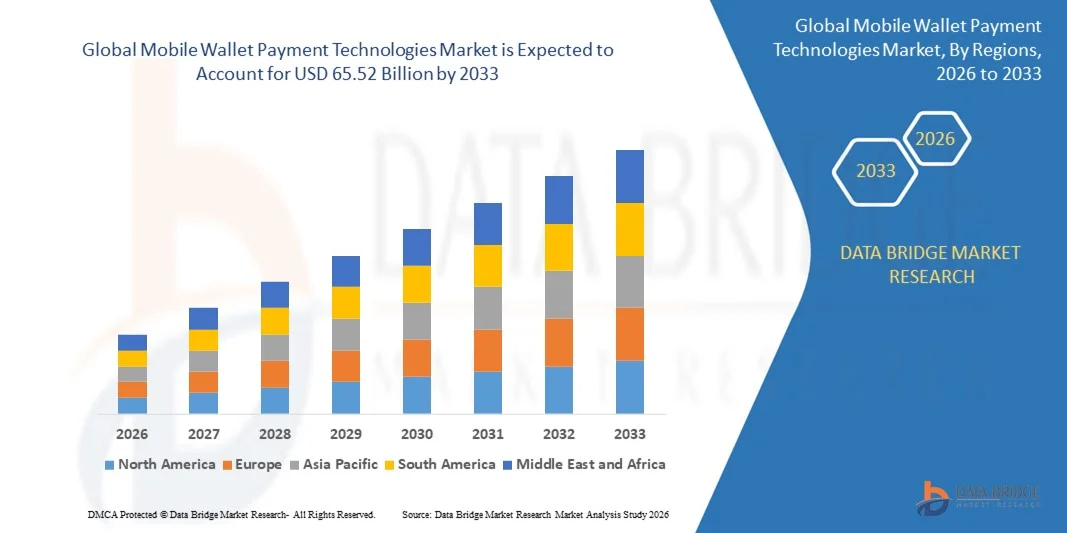

- The global mobile wallet payment technologies market size was valued at USD 19.71 billion in 2025 and is expected to reach USD 65.52 billion by 2033, at a CAGR of 16.20% during the forecast period

- The market growth is largely fuelled by the rising adoption of contactless payments, increasing smartphone penetration, and growing demand for secure and convenient digital payment solutions

- Expanding e-commerce activities and supportive government initiatives promoting cashless transactions are further accelerating market development

Mobile Wallet Payment Technologies Market Analysis

- The market is witnessing strong growth due to rapid digital transformation across retail, transportation, and financial sectors, supported by advancements in NFC, QR code, and biometric authentication technologies

- Increasing consumer preference for frictionless, real-time, and secure payment experiences is encouraging service providers to offer innovative wallet features and strengthen cybersecurity frameworks

- North America dominated the mobile wallet payment technologies market with the largest revenue share in 2025, driven by the rising adoption of digital finance, strong penetration of smartphones, and the rapid shift toward contactless payments across retail and transportation

- Asia-Pacific region is expected to witness the highest growth rate in the global mobile wallet payment technologies market, driven by rising digitalization, rapid urbanization, and government-led cashless economy initiatives

- The remote payment segment held the largest market revenue share in 2025 driven by the widespread adoption of app-based transactions that support bill payments, online purchases, and peer-to-peer transfers. Remote mobile wallets offer seamless integration with e-commerce platforms, enhanced security layers, and faster checkout capabilities, making them a preferred option for consumers across both developed and emerging markets

Report Scope and Mobile Wallet Payment Technologies Market Segmentation

|

Attributes |

Mobile Wallet Payment Technologies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Mastercard (U.S.) • Boku Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Mobile Wallet Payment Technologies Market Trends

Rise of Contactless and Real-Time Mobile Payment Solutions

• The rapid rise of contactless and tap-to-pay solutions is transforming the mobile wallet payment technologies landscape by enabling instant, secure, and seamless transactions. The convenience and speed of these systems support higher consumer adoption, particularly in urban regions where digital payments are becoming the preferred method for everyday purchases. This shift is further strengthened by increasing POS terminal upgrades and growing trust in touch-free payments following the global move toward hygienic transactions

• The increasing demand for real-time payment processing across retail, transportation, and hospitality sectors is accelerating the deployment of NFC-enabled smartphones and QR-based mobile payment platforms. These tools are especially beneficial in areas with limited access to traditional banking, helping bridge financial inclusion gaps. The growing digital ecosystem, supported by fintech innovation and interoperable payment networks, continues to amplify real-time transaction capabilities

• The affordability and ease of mobile wallet apps are driving their usage across both developed and emerging markets, supporting routine payments such as bill settlements, peer-to-peer transfers, and in-store purchases. Consumers benefit from enhanced convenience and reduced dependence on cash. The integration of loyalty programs, cashback features, and personalized financial tools further increases user engagement and repeat usage

• For instance, in 2023, several retail chains across Southeast Asia reported a surge in customer transactions after integrating QR-based wallet payments, improving checkout efficiency and boosting customer satisfaction. Retailers also observed reduced queues and smoother peak-hour operations due to faster payment processing. This adoption trend encouraged more small merchants to transition toward digital acceptance to remain competitive

• While mobile wallet adoption is growing rapidly, its long-term impact depends on continued innovation, cybersecurity enhancements, and wider merchant acceptance. Payment providers must prioritize fraud prevention, seamless integration, and user-friendly design to fully capitalize on this rising demand. Expanding offline payment capabilities and cross-border compatibility will also be crucial to supporting future global scalability

Mobile Wallet Payment Technologies Market Dynamics

Driver

Increasing Shift Toward Digital Payments and Rising Smartphone Penetration

• The global transition from cash-based to digital transactions is pushing consumers, retailers, and financial institutions to adopt mobile wallet solutions as a secure and efficient payment alternative. The convenience of instant transactions and reduced dependency on physical cash is accelerating market uptake. The growth of fintech apps and improved network connectivity further supports widespread acceptance across various demographics

• Consumers are increasingly aware of the benefits of mobile wallets, including reward programs, faster checkout, secure authentication, and the ability to manage multiple payment methods in a single platform. This shift is further supported by the expansion of e-commerce and app-based services. Gamification features and tailored promotions within mobile wallets are also improving customer retention rates

• Government initiatives encouraging digital financial systems, such as cashless policies and national payment platforms, are strengthening infrastructure for mobile wallet adoption. These efforts are enhancing user trust and enabling broader ecosystem development. Public–private collaborations and regulatory support for real-time payment rails are further accelerating the shift toward mobile transactions

• For instance, in 2022, several European and Asia-Pacific countries expanded digital payment mandates for public services and small businesses, significantly boosting mobile wallet registrations and transaction volume. This expansion encouraged faster onboarding of unbanked populations into formal financial systems. The ripple effect of this adoption also promoted payment technology investments among local merchants

• While strong consumer demand and supportive regulatory frameworks are driving market expansion, challenges remain in interoperability, cybersecurity, and merchant training to ensure seamless adoption. Ensuring cross-platform compatibility and reducing transaction failures will be essential to maintaining consumer trust. Continued awareness campaigns and merchant incentives will further support ecosystem growth

Restraint/Challenge

Cybersecurity Risks and Limited Digital Infrastructure in Emerging Economies

• Rising cybersecurity threats such as data breaches, phishing attacks, and unauthorized access continue to challenge the mobile wallet ecosystem. Advanced security tools including encryption, tokenization, and biometric authentication require significant investment, limiting adoption for smaller providers. Increasing sophistication in cyberattacks also demands continuous updates to fraud detection systems

• Many developing regions still face inadequate digital infrastructure, including unreliable internet connectivity and limited smartphone penetration. These constraints hinder mobile wallet usage and reduce trust in digital payment systems, delaying industry growth. Power supply instability and outdated telecom infrastructure further restrict consistent access to digital services

• Market penetration is further restricted by low digital literacy and limited merchant acceptance in remote areas, where cash remains the dominant payment method. This gap often results in slower adoption and reduced transaction volume. Training programs and subsidized hardware distribution remain crucial for overcoming these barriers

• For instance, in 2023, several African and South Asian markets reported that a substantial portion of small vendors lacked compatible devices or training to accept mobile payments, impacting ecosystem expansion. Many merchants also expressed concerns about transaction fees and system reliability. These challenges continue to hinder the shift from cash-based operations

• While mobile payment technologies continue to advance, addressing security concerns, infrastructure limitations, and education gaps remains essential for unlocking full market potential. Strengthening regulatory frameworks, promoting public awareness, and enhancing telecom capacity will play a key role in bridging regional disparities. Long-term growth will rely heavily on collaborative efforts between governments, fintech companies, and network providers

Mobile Wallet Payment Technologies Market Scope

The market is segmented on the basis of type, purchase type, and end user.

- By Type

On the basis of type, the mobile wallet payment technologies market is segmented into proximity payment and remote payment. The remote payment segment held the largest market revenue share in 2025 driven by the widespread adoption of app-based transactions that support bill payments, online purchases, and peer-to-peer transfers. Remote mobile wallets offer seamless integration with e-commerce platforms, enhanced security layers, and faster checkout capabilities, making them a preferred option for consumers across both developed and emerging markets.

The proximity payment segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising usage of NFC-enabled smartphones and QR-based systems that enable instant in-store payments. Proximity wallets are increasingly popular due to their convenience, speed, and strong adoption across retail outlets and transportation services. The expansion of contactless infrastructure worldwide further supports rapid growth in this segment.

- By Purchase Type

On the basis of purchase type, the mobile wallet payment technologies market is segmented into airtime transfers and top-ups, money transfers and payments, merchandise and coupons, and travel and ticketing. The money transfers and payments segment held the largest market revenue share in 2025 due to rising demand for quick, secure, and low-cost digital transactions across domestic and cross-border applications. This segment benefits from increasing integration with banking systems, government digital initiatives, and strong uptake among users seeking alternatives to traditional cash-based payments.

The travel and ticketing segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising digitalization across public transport, airlines, and event ticketing platforms. Mobile wallets are increasingly used for seamless booking, check-ins, and automated fare collection, offering a convenient alternative to physical tickets. Growing adoption of QR-based and NFC-enabled ticketing solutions is expected to further accelerate this segment’s expansion.

- By End User

On the basis of end user, the mobile wallet payment technologies market is segmented into hospitality and tourism sector, BFSI, media and entertainment, retail sector, education, and IT and telecom. The retail sector held the largest market revenue share in 2025 owing to rapid adoption of contactless payments, loyalty program integrations, and mobile-based checkout systems. Retailers increasingly leverage mobile wallets to improve transaction speed, enhance customer experience, and support omnichannel commerce strategies, contributing to strong segment dominance.

The BFSI segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising digital banking penetration and increasing integration of mobile wallets with financial services such as micro-lending, insurance payments, and savings tools. Financial institutions are accelerating adoption to improve operational efficiency, offer secure digital transaction solutions, and expand customer engagement through mobile-first platforms.

Mobile Wallet Payment Technologies Market Regional Analysis

- North America dominated the mobile wallet payment technologies market with the largest revenue share in 2025, driven by the rising adoption of digital finance, strong penetration of smartphones, and the rapid shift toward contactless payments across retail and transportation

- Consumers in the region highly value the speed, security, and convenience offered by mobile wallets, supported by advanced authentication tools such as biometrics, tokenization, and real-time fraud detection

- This widespread adoption is further supported by high disposable incomes, advanced digital infrastructure, and the rising preference for cashless transactions, establishing mobile wallets as a preferred mode of payment for both consumers and businesses

U.S. Mobile Wallet Payment Technologies Market Insight

The U.S. mobile wallet payment technologies market captured the largest revenue share in 2025 within North America, fueled by the expanding ecosystem of contactless payments and the rapid transition toward digital-first financial solutions. Consumers are increasingly relying on mobile wallets for daily transactions, peer-to-peer transfers, and online purchases. The growing popularity of app-based services, combined with robust demand for secure authentication features and faster checkout experiences, continues to drive market growth. Moreover, the strong integration of mobile wallets with e-commerce platforms, ride-hailing apps, and retail payment systems is significantly contributing to market expansion.

Europe Mobile Wallet Payment Technologies Market Insight

The Europe mobile wallet payment technologies market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent digital payment regulations, strong cybersecurity frameworks, and increasing consumer preference for secure, cashless transactions. The rise of open banking initiatives and enhanced interoperability across payment service providers further supports adoption. European consumers are also embracing mobile payment solutions for their convenience in public transport, retail, and hospitality. The region is witnessing notable growth across both urban and semi-urban markets, with mobile wallets being integrated into broader digital finance ecosystems.

U.K. Mobile Wallet Payment Technologies Market Insight

The U.K. mobile wallet payment technologies market is expected to witness the fastest growth rate from 2026 to 2033, driven by the accelerating trend toward digital payments and strong consumer trust in fintech innovations. Concerns regarding transaction safety, combined with the demand for contactless solutions, are pushing both consumers and merchants toward mobile wallet adoption. The U.K.’s highly developed digital infrastructure, expanding e-commerce sector, and high smartphone penetration are expected to continue supporting market growth. The increasing use of mobile wallets in public transport, retail stores, and online services is further enhancing market momentum.

Germany Mobile Wallet Payment Technologies Market Insight

The Germany mobile wallet payment technologies market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of digital security and growing confidence in mobile-based financial transactions. Germany’s strong emphasis on privacy protection and secure payment technologies aligns with the rising use of mobile wallets for retail and service-based payments. The country’s advanced digital infrastructure and rising adoption of NFC-enabled devices are supporting market penetration. Furthermore, the integration of mobile wallets with banking apps and merchant payment systems is becoming increasingly common, reflecting the shift toward secure digital finance solutions.

Asia-Pacific Mobile Wallet Payment Technologies Market Insight

The Asia-Pacific mobile wallet payment technologies market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, expanding smartphone penetration, and rising demand for digital payment solutions in countries such as China, India, and Japan. The region's strong push toward digital financial inclusion, supported by government-backed initiatives and fintech innovation, is accelerating mobile wallet usage. In addition, APAC’s position as a global hub for mobile payment technology development enhances affordability and accessibility, enabling widespread adoption across both urban and rural markets.

Japan Mobile Wallet Payment Technologies Market Insight

The Japan mobile wallet payment technologies market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s advanced technological environment, growing demand for convenience, and rapid adoption of contactless payment systems. Japanese consumers place strong emphasis on safety and reliability, driving adoption of highly secure mobile wallet platforms integrated with transportation, retail, and service sectors. The increasing integration of mobile wallets with IoT devices and smart city infrastructure is further fueling market growth. Moreover, Japan’s aging population is expected to drive demand for easy-to-use digital payment solutions.

China Mobile Wallet Payment Technologies Market Insight

The China mobile wallet payment technologies market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s massive digital user base, strong mobile ecosystem, and widespread adoption of QR-based and app-based payment systems. China stands as one of the world’s largest markets for digital payments, with mobile wallets increasingly used across retail, transportation, hospitality, and peer-to-peer transactions. The push toward smart cities, expanding digital commerce, and strong domestic fintech players continue to accelerate market growth, supported by high consumer acceptance and seamless platform integration.

Mobile Wallet Payment Technologies Market Share

The Mobile Wallet Payment Technologies industry is primarily led by well-established companies, including:

• Mastercard (U.S.)

• Econet Wireless Zimbabwe (Zimbabwe)

• Visa (U.S.)

• Fortumo (Estonia)

• American Express Company (U.S.)

• Boku Inc. (U.S.)

• Airtel India (India)

• Stripe (U.S.)

• PayPal (U.S.)

• Microsoft (U.S.)

• Vodacom (South Africa)

• Google (U.S.)

• PayU (Netherlands)

• Comviva (India)

• Novatti Group Pty Ltd (Australia)

• Paysafe Holdings UK Limited (U.K.)

• Bank of America Corporation (U.S.)

• Wirecard (Germany)

• First Data Corporation (U.S.)

• Paytm (India)

• Apple Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.