Global Modified Bitumen Market

Market Size in USD Billion

CAGR :

%

USD

45.15 Billion

USD

69.82 Billion

2025

2033

USD

45.15 Billion

USD

69.82 Billion

2025

2033

| 2026 –2033 | |

| USD 45.15 Billion | |

| USD 69.82 Billion | |

|

|

|

|

Modified Bitumen Market Size

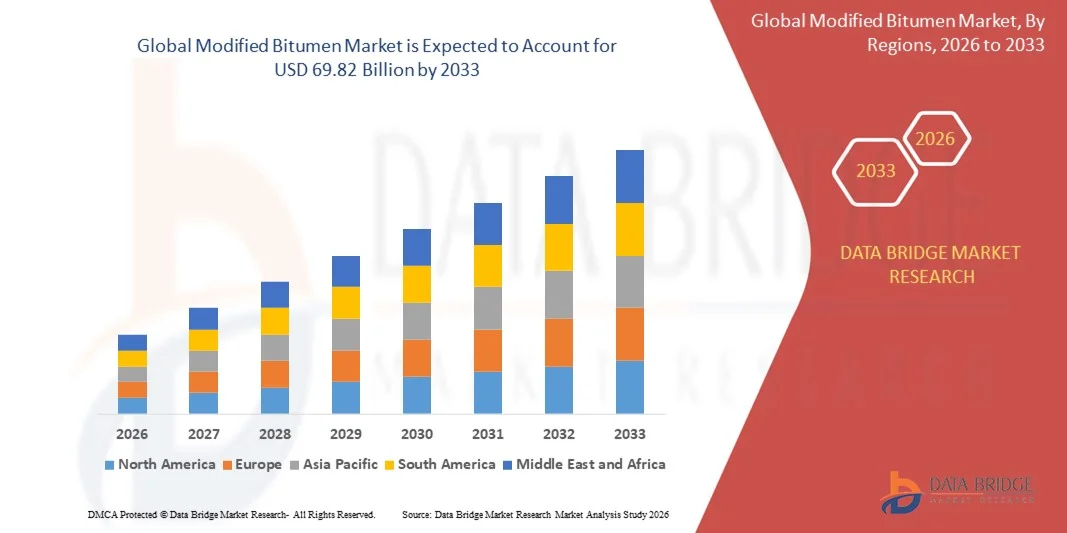

- The global modified bitumen market size was valued at USD 45.15 billion in 2025 and is expected to reach USD 69.82 billion by 2033, at a CAGR of 5.60% during the forecast period

- The market growth is largely fuelled by increasing demand for durable, weather-resistant roofing and paving materials in commercial, residential, and industrial infrastructure projects

- Rising urbanization and government investments in road construction, highways, and transportation networks are further accelerating the adoption of modified bitumen products

Modified Bitumen Market Analysis

- Increasing awareness about long-lasting roofing and paving solutions is driving the adoption of modified bitumen across emerging and developed economies

- Technological advancements in polymer modification and additives are enhancing performance characteristics such as flexibility, UV resistance, and thermal stability, creating new growth opportunities

- North America dominated the modified bitumen market with the largest revenue share in 2025, driven by growing infrastructure development, urbanization, and the adoption of polymer-modified bitumen in road construction and roofing projects

- Asia-Pacific region is expected to witness the highest growth rate in the global modified bitumen market, driven by rising construction activities, increased adoption of SBS and APP-modified bitumen, and expanding urban and industrial development across countries such as China, Japan, and India

- The SBS segment held the largest market revenue share in 2025, driven by its superior elasticity, thermal stability, and resistance to cracking in road and roofing applications. SBS-modified bitumen provides enhanced performance under heavy traffic and extreme weather, making it a preferred choice for highways, urban roads, and commercial roofing projects

Report Scope and Modified Bitumen Market Segmentation

|

Attributes |

Modified Bitumen Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Modified Bitumen Market Trends

Rise of Polymer-Modified Bitumen in Infrastructure and Roofing Applications

- The growing focus on durable and weather-resistant infrastructure is transforming the modified bitumen market by driving the adoption of polymer-modified bitumen (PMB) in road construction, roofing, and paving applications. PMB enhances elasticity, thermal stability, and resistance to cracking, resulting in longer-lasting pavements and reduced maintenance costs. Increasing regulatory standards for road quality and urban infrastructure durability are further reinforcing adoption across both developed and emerging markets

- Increasing investments in highways, urban roads, and commercial and residential roofing projects are accelerating the adoption of modified bitumen. Contractors prefer PMB and SBS-modified bitumen for their superior performance under heavy traffic and extreme weather conditions. The rising demand for sustainable and long-lasting materials in smart city projects is also contributing to wider market penetration

- The ease of handling and applicability of modern modified bitumen products make them attractive for both new construction and maintenance projects. These solutions allow faster construction cycles and improved long-term performance. In addition, improvements in storage, transport, and application technology are reducing operational delays and costs for contractors

- For instance, in 2023, several highway projects in the U.S. and Europe reported enhanced road durability and reduced maintenance frequency after using SBS-modified bitumen in pavement layers. These projects highlighted the material's resistance to rutting, thermal cracking, and water damage, validating its long-term cost-effectiveness

- While modified bitumen adoption is rising, market growth depends on continued R&D, development of eco-friendly formulations, and awareness among contractors and governments about the benefits of advanced bitumen products. Government incentives, green building certifications, and funding for sustainable infrastructure further support market expansion

Modified Bitumen Market Dynamics

Driver

Growing Infrastructure Development and Increasing Demand for Durable Pavements

- The surge in global road construction, airport runways, and commercial and residential roofing projects is driving demand for modified bitumen. These products enhance durability, resist thermal and mechanical stresses, and reduce maintenance costs. Increasing urbanization and population growth are fueling large-scale paving and roofing projects worldwide

- Governments and private contractors are increasingly prioritizing high-performance bitumen to ensure long-lasting infrastructure and meet regulatory standards for road quality and safety. Public-private partnerships and large-scale infrastructure funding initiatives are providing additional momentum for market growth

- Investments in smart cities, urbanization, and transportation networks are further supporting market expansion, boosting adoption of polymer-modified bitumen and other advanced formulations. Integration of modified bitumen in green and energy-efficient construction projects is also expanding its applications across commercial and residential sectors

- For instance, in 2022, the European Union and U.S. federal government allocated funds for highway rehabilitation and airport paving projects, increasing demand for SBS and APP-modified bitumen. These initiatives demonstrated the material's superior performance in high-traffic and extreme weather conditions, driving further adoption

- While infrastructure growth is a key driver, consistent quality, cost efficiency, and awareness of advanced modified bitumen benefits are crucial for sustained market adoption. Collaborations between material suppliers, construction firms, and research organizations are helping optimize formulations for regional conditions

Restraint/Challenge

High Production Costs and Limited Adoption in Small-Scale Projects

- The high price of polymer-modified bitumen compared to conventional asphalt limits its usage in smaller-scale paving and roofing projects. Many contractors continue to use standard bitumen due to budget constraints. Fluctuating raw material prices, including polymers and additives, further exacerbate cost pressures

- In several regions, lack of technical knowledge among contractors about the advantages of modified bitumen reduces adoption rates, particularly in rural or less-developed areas. Training programs, technical workshops, and certification courses are still limited, creating a knowledge gap that slows market growth

- Supply chain limitations and inconsistent availability of high-performance modified bitumen can delay project timelines and affect uniform application. Transportation challenges, regional storage limitations, and dependency on key polymer suppliers contribute to supply volatility

- For instance, in 2023, infrastructure projects in Sub-Saharan Africa and Southeast Asia reported delays and cost overruns due to both high prices and limited access to polymer-modified bitumen. These setbacks highlighted the need for local production facilities and improved logistics networks to meet growing demand

- While formulations continue to improve, overcoming cost barriers, educating contractors, and expanding distribution channels remain critical for unlocking long-term market potential. Strategic partnerships, government subsidies, and investments in local manufacturing are key strategies for market stakeholders to enhance accessibility and affordability

Modified Bitumen Market Scope

The market is segmented on the basis of modifier type, application method, and end-use industry.

- By Modifier Type

On the basis of modifier type, the modified bitumen market is segmented into Styrene-Butadiene-Styrene (SBS), Atactic Polypropylene (APP), Crumb Rubber, Natural Rubber, and Others. The SBS segment held the largest market revenue share in 2025, driven by its superior elasticity, thermal stability, and resistance to cracking in road and roofing applications. SBS-modified bitumen provides enhanced performance under heavy traffic and extreme weather, making it a preferred choice for highways, urban roads, and commercial roofing projects.

The APP segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its UV resistance, aging stability, and ease of processing. APP-modified bitumen is particularly popular in roofing applications due to its high durability, weather resistance, and long-term cost efficiency, often serving as the preferred solution for both new construction and maintenance projects.

- By Application Method

On the basis of application method, the modified bitumen market is segmented into Hot Asphalt, Cold Asphalt, Torch Applied, and Others. The Hot Asphalt segment held the largest market revenue share in 2025, driven by its strong adhesion, uniform application, and superior performance in road construction and large-scale infrastructure projects. Hot asphalt ensures durability, reduces maintenance costs, and provides a reliable solution for highways, airport runways, and urban roads.

The Torch Applied segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its convenience, quick curing, and excellent waterproofing properties. Torch applied modified bitumen is widely adopted in roofing and waterproofing applications due to its ease of installation, long service life, and cost efficiency, making it highly preferred for both new and renovation projects.

- By End-Use Industry

On the basis of end-use industry, the modified bitumen market is segmented into Road Construction, Building Construction, and Others. The Road Construction segment held the largest market revenue share in 2025, fueled by growing investments in highways, urban roads, and airport runways, requiring high-performance bitumen to withstand heavy traffic and extreme weather conditions.

The Building Construction segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising adoption of SBS and APP-modified bitumen in commercial and residential roofing, waterproofing, and paving applications. The segment benefits from urbanization, infrastructure development, and increasing focus on durable, long-lasting building materials.

Modified Bitumen Market Regional Analysis

- North America dominated the modified bitumen market with the largest revenue share in 2025, driven by growing infrastructure development, urbanization, and the adoption of polymer-modified bitumen in road construction and roofing projects

- Contractors and governments in the region highly value the enhanced durability, elasticity, and thermal stability offered by modified bitumen, which reduces maintenance costs and extends the lifespan of pavements and roofs

- This widespread adoption is further supported by high investment in transportation networks, highways, and commercial and residential construction projects, establishing modified bitumen as a preferred solution for both public and private infrastructure projects

U.S. Modified Bitumen Market Insight

The U.S. modified bitumen market captured the largest revenue share in 2025 within North America, fueled by extensive road rehabilitation, airport paving projects, and commercial and residential roofing initiatives. Contractors are increasingly prioritizing polymer-modified bitumen (PMB) and SBS-modified bitumen for their superior performance under heavy traffic and extreme weather conditions. Moreover, government infrastructure funding and sustainability-focused construction practices are significantly contributing to market expansion, with new projects emphasizing long-term durability and reduced maintenance costs.

Europe Modified Bitumen Market Insight

The Europe modified bitumen market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by urbanization, stringent road quality standards, and increasing adoption of SBS and APP-modified bitumen in highways and roofing applications. European governments are investing in infrastructure modernization, while contractors are emphasizing sustainable and high-performance materials. The market growth is supported across commercial, municipal, and residential construction projects, with modified bitumen increasingly used in both new constructions and renovations.

U.K. Modified Bitumen Market Insight

The U.K. modified bitumen market is expected to witness robust growth from 2026 to 2033, driven by government road maintenance initiatives and rising demand for durable roofing solutions. In addition, the preference for polymer-modified bitumen in highway and urban development projects is increasing due to its superior weather resistance and low maintenance requirements. The country’s infrastructure modernization programs, along with a growing focus on high-performance pavements, are expected to continue driving market growth.

Germany Modified Bitumen Market Insight

The Germany modified bitumen market is expected to witness steady growth from 2026 to 2033, fueled by the country’s focus on infrastructure longevity, energy-efficient construction, and sustainable material adoption. Contractors are adopting SBS and APP-modified bitumen for urban roads, bridges, and commercial roofing to enhance durability and reduce lifecycle costs. Integration of advanced modified bitumen with innovative construction techniques is also contributing to increased demand across both residential and commercial sectors.

Asia-Pacific Modified Bitumen Market Insight

The Asia-Pacific modified bitumen market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, expanding road networks, and growing industrial and residential construction in countries such as China, India, and Japan. Government initiatives to develop smart cities and improve highway infrastructure are fueling adoption, while rising awareness of long-term cost efficiency and durability benefits is encouraging the use of polymer-modified bitumen. In addition, the region’s growing manufacturing capabilities for bitumen products are improving affordability and accessibility.

Japan Modified Bitumen Market Insight

The Japan modified bitumen market is expected to witness strong growth from 2026 to 2033 due to the country’s high focus on durable infrastructure, technological advancements, and stringent safety and construction standards. SBS and APP-modified bitumen are increasingly preferred for roads, airports, and commercial roofing projects, supported by government infrastructure investments. Moreover, Japan’s aging urban infrastructure is creating demand for maintenance and rehabilitation projects, which are driving adoption of high-performance modified bitumen solutions.

China Modified Bitumen Market Insight

The China modified bitumen market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, extensive road and airport development, and strong industrial growth. The adoption of SBS and APP-modified bitumen is increasing due to government emphasis on high-quality and long-lasting pavements and roofing solutions. Furthermore, availability of domestic manufacturers producing advanced bitumen products at competitive prices is further propelling the market across both public and private construction projects.

Modified Bitumen Market Share

The Modified Bitumen industry is primarily led by well-established companies, including:

- BITUMINA HI-TECH PAVEMENT BINDERS LLC (U.S.)

- Colas Group (France)

- Dow (U.S.)

- Exxon Mobil Corporation (U.S.)

- Firestone Building Products (U.S.)

- Fosroc, Inc (U.K.)

- GAF (U.S.)

- Gazprom Neft PJSC (Russia)

- Global Road Technology International Holdings (HK) Limited (Hong Kong)

- Hincol (India)

- Breedon Group plc (U.K.)

- Nynas AB (Sweden)

- Orlen Asfalt Sp. z o.o (Poland)

- ROSNEFT (Russia)

- Royal Dutch Shell (Netherlands)

- Saint-Gobain Weber (France)

- Sika AG (Switzerland)

- SOPREMA S.A.S (France)

- Texsa Systems slu (Spain)

- Total SE (France)

- W. R. Grace & Co.-Conn. (U.S.)

Latest Developments in Global Modified Bitumen Market

- In February 2025, Icopal launched a new bitumen flat roofing association, aimed at promoting bitumen-based flat roofing systems globally. The initiative provides a unified platform to enhance industry standards, drive innovation, and share best practices. It focuses on supporting the adoption of advanced modified bitumen technologies, addressing the growing demand for durable and high-performance roofing solutions. This development is expected to strengthen market confidence, encourage wider implementation of premium roofing systems, and positively impact the overall growth of the global modified bitumen market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Modified Bitumen Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Modified Bitumen Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Modified Bitumen Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.