Global Modular Logic Analyzer Market

Market Size in USD Million

CAGR :

%

USD

131.97 Million

USD

381.77 Million

2024

2032

USD

131.97 Million

USD

381.77 Million

2024

2032

| 2025 –2032 | |

| USD 131.97 Million | |

| USD 381.77 Million | |

|

|

|

|

Modular Logic Analyzer Market Size

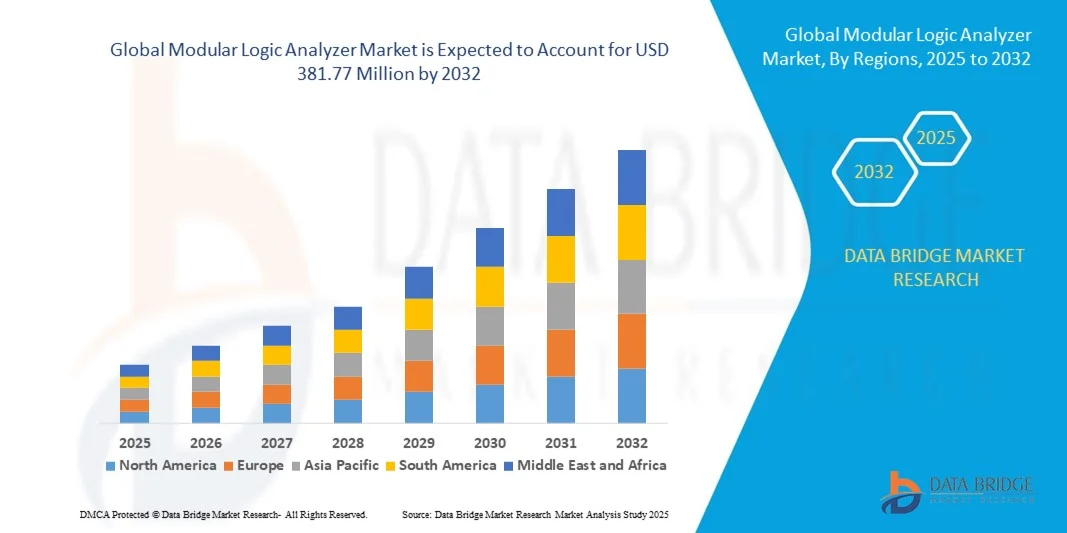

- The global modular logic analyzer market size was valued at USD 131.97 million in 2024 and is expected to reach USD 381.77 million by 2032, at a CAGR of 14.20% during the forecast period

- The market growth is largely fueled by the increasing complexity of integrated circuits, processors, and memory devices, driving the demand for high-precision, scalable, and customizable testing solutions across semiconductor, electronics, and automotive industries

- Furthermore, rising adoption of modular logic analyzers in research and development, industrial automation, and academic applications is establishing these analyzers as essential tools for efficient debugging, validation, and optimization of high-speed digital systems. These converging factors are accelerating the uptake of modular logic analyzer solutions, thereby significantly boosting the industry’s growth

Modular Logic Analyzer Market Analysis

- Modular logic analyzers, offering multi-channel, real-time signal capture and analysis, are increasingly critical components in modern semiconductor, electronics, and industrial testing environments due to their enhanced accuracy, scalability, and integration with software-based analysis tools

- The escalating demand for modular logic analyzers is primarily fueled by the growing need for automated testing solutions, rising adoption of high-channel-count analyzers for complex system testing, and increasing focus on reducing time-to-market for ICs, processors, and memory devices

- North America dominated the modular logic analyzer market with a share of 36.5% in 2024, due to the strong presence of semiconductor and electronics manufacturers, as well as increased R&D spending in advanced testing solutions

- Asia-Pacific is expected to be the fastest growing region in the modular logic analyzer market during the forecast period due to rapid industrialization, growing electronics and semiconductor manufacturing hubs, and increased R&D activities in countries such as China, Japan, and India

- 32–80 segment dominated the market with a market share of 43% in 2024, due to its ideal balance of functionality and cost-effectiveness. This segment meets the requirements of most mid-range testing and debugging scenarios, offering sufficient channels for complex signal analysis without the higher cost of ultra-high channel models. Industries such as electronics manufacturing and semiconductor testing often prefer this range for routine validation and troubleshooting. The availability of scalable modular options and integration with advanced software tools further boosts its adoption

Report Scope and Modular Logic Analyzer Market Segmentation

|

Attributes |

Modular Logic Analyzer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Modular Logic Analyzer Market Trends

Adoption of High-Channel-Count, Software-Integrated Analyzers

- The modular logic analyzer market is expanding steadily as test and measurement industries increasingly adopt high-channel-count and software-integrated analyzers to meet advanced debugging and validation requirements. Driven by complex circuit designs, high-speed data protocols, and multi-domain electronic systems, modular logic analyzers provide flexible, scalable, and precise analysis capabilities across R&D and production environments

- For instance, Keysight Technologies has introduced PXI-based modular logic analyzers with seamless software integration into its PathWave platform, offering enhanced signal correlation, automated testing, and real-time protocol decoding. This marks the industry’s shift toward unified hardware-software platforms that streamline performance and accelerate data analytics in intelligent electronics testing

- High-channel-count architectures are becoming crucial for debugging embedded systems, FPGAs, and system-on-chip (SoC) designs where multiple signal streams require synchronized and parallel analysis. Modular analyzers provide the scalability and bandwidth necessary to handle these complex configurations while enabling high-speed capture and protocol-level troubleshooting

- Software integration is another major trend transforming the market, allowing engineers to access cloud-based data storage, automated reporting, and AI-supported diagnostics. These capabilities simplify complex testing workflows and reduce human error, enhancing productivity and result accuracy

- The growing use of modular designs within aerospace, automotive, and consumer electronics sectors also supports flexible test setups, enabling users to adapt system modules to specific application requirements. Compact PXI/PXIe-based analyzers with plug-in functionality reduce lab space and costs while offering high-precision measurement performance

- As device miniaturization and signal complexity continue to grow, the adoption of advanced software-integrated modular logic analyzers is becoming essential for next-generation electronics validation. Their expanded analytical capacity, cross-platform compatibility, and agile architecture are redefining performance standards across high-end test engineering applications globally

Modular Logic Analyzer Market Dynamics

Driver

Demand for Automated, Precise Testing

- Increasing demand for automated and highly precise electronic testing solutions is a key driver of the modular logic analyzer market. As electronic devices become more complex and integrate high-speed communication protocols, the need for tools capable of accurate, real-time digital signal analysis has risen sharply

- For instance, Tektronix, Inc. offers advanced modular analyzers supporting automated trigger systems and programmable test routines, enabling seamless validation of embedded software and hardware interactions. These capabilities cater to industries such as automotive electronics, semiconductor design, and industrial automation where efficiency and repeatability are critical

- The trend toward automation in test engineering is reducing human error, improving test throughput, and shortening development cycles. Modular analyzers integrated with scripting and software-driven data visualization tools allow engineers to perform fast, standardized evaluations across multiple digital interfaces simultaneously

- Moreover, applications in artificial intelligence, 5G, and IoT electronics development demand precise timing and signal validation where even microsecond-level deviations impact performance. Automated modular analyzers provide synchronized multi-channel capture, accurate timing measurements, and flexible trigger customization to ensure consistent results in mission-critical testing environments

- The push for quality assurance and faster time-to-market in electronics innovation is strengthening global demand for efficient, automated logic testing systems. As R&D investments increase across digital technology sectors, modular logic analyzers will remain critical instruments to ensure precision and reliability through the entire product development lifecycle

Restraint/Challenge

High Cost Limiting Adoption

- The high cost of modular logic analyzers continues to be a major barrier to wider adoption, particularly among small and mid-sized electronics manufacturers and research institutions. The integration of high-speed data acquisition hardware, sophisticated software suites, and scalable modular platforms significantly increases upfront investment and operational expenses

- For instance, Rohde & Schwarz has indicated that while modular test systems provide superior flexibility and functionality, their total cost of ownership—including calibration, licensing, and periodic upgrades—can restrict deployment in cost-sensitive projects and academic environments. This affects adoption rates outside high-budget industrial R&D facilities

- The requirement for specialized personnel to configure and operate modular systems adds to implementation costs. Maintenance and calibration expenses further elevate ownership complexity compared to traditional standalone bench analyzers

- In addition, rapid technological advancements in high-frequency and digital signal design often lead to quick obsolescence of test equipment, compelling frequent reinvestment to maintain compatibility with emerging standards. This dynamic poses financial challenges for organizations managing limited capital budgets

- To address these challenges, manufacturers are introducing scalable licensing models, modular upgrade paths, and hybrid systems combining analog and digital test capabilities. As competition and standardization increase, innovations in cost-efficient design and software-defined architectures are expected to gradually improve the affordability and market reach of modular logic analyzers globally

Modular Logic Analyzer Market Scope

The market is segmented on the basis of channel count, application, and industry vertical.

- By Channel Count

On the basis of channel count, the modular logic analyzer market is segmented into 2–32, 32–80, and >80 channels. The 32–80 channel segment dominated the market with the largest revenue share of 43% in 2024, driven by its ideal balance of functionality and cost-effectiveness. This segment meets the requirements of most mid-range testing and debugging scenarios, offering sufficient channels for complex signal analysis without the higher cost of ultra-high channel models. Industries such as electronics manufacturing and semiconductor testing often prefer this range for routine validation and troubleshooting. The availability of scalable modular options and integration with advanced software tools further boosts its adoption.

The >80 channel segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for high-density testing in complex integrated circuits and multicore processor environments. These analyzers enable parallel capture of multiple signals, enhancing efficiency in research, development, and production testing. Large-scale semiconductor and communication device manufacturers are adopting >80 channel systems to accelerate time-to-market and ensure high-quality standards. The growing complexity of digital systems and the push toward multi-functional modular analyzers drive this rapid adoption trend.

- By Application

On the basis of application, the market is segmented into integrated circuits, processors, memory devices, and personal computers. The integrated circuit segment dominated the market in 2024, attributed to the ever-increasing complexity and miniaturization of IC designs. Logic analyzers are critical for IC development and debugging, allowing engineers to capture and analyze multiple signals simultaneously. The rising demand for high-speed, low-power ICs in consumer electronics and industrial applications further boosts the adoption of modular logic analyzers. Integration with automated testing software and support for multiple signal standards strengthens their utility in design verification and validation.

The processors segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing adoption of multi-core and high-performance processors across computing, networking, and automotive applications. Advanced logic analyzers help designers monitor processor behavior, optimize performance, and detect timing errors efficiently. The rising need for real-time testing of complex microprocessor architectures supports the rapid growth of this segment.

- By Industry Vertical

On the basis of industry vertical, the market is segmented into automotive and transportation, aerospace and defense, IT and telecommunications, education and government, electronics and semiconductor, industrial, and healthcare. The electronics and semiconductor segment dominated the market in 2024, owing to the critical role of modular logic analyzers in testing, debugging, and validating chips, boards, and systems. The continuous innovation in semiconductor design, including high-speed and low-power devices, necessitates advanced modular analyzers for accurate signal capture and timing analysis. Semiconductor manufacturers increasingly rely on modular analyzers for prototyping, production testing, and quality assurance.

The automotive and transportation segment is projected to register the fastest growth rate from 2025 to 2032, fueled by the rising adoption of advanced driver-assistance systems (ADAS), electric vehicles, and connected car technologies. Logic analyzers assist in validating complex electronic control units (ECUs), in-vehicle communication networks, and sensor integration. Growing investments in automotive electronics and the push for safer, smarter vehicles drive demand for modular logic analyzers in this sector.

Modular Logic Analyzer Market Regional Analysis

- North America dominated the modular logic analyzer market with the largest revenue share of 36.5% in 2024, driven by the strong presence of semiconductor and electronics manufacturers, as well as increased R&D spending in advanced testing solutions

- Companies in the region highly value high-precision, scalable, and customizable analyzers for IC, processor, and memory device testing

- This widespread adoption is further supported by robust industrial infrastructure, a technologically skilled workforce, and the growing demand for automated testing in electronics and semiconductor development

U.S. Modular Logic Analyzer Market Insight

The U.S. modular logic analyzer market captured the largest revenue share in 2024 within North America, fueled by the rapid growth of semiconductor fabrication, consumer electronics, and advanced computing applications. Manufacturers increasingly prioritize high-channel-count analyzers to support complex IC and processor testing. The adoption of modular analyzers integrated with software-based analysis tools enables efficient debugging and faster time-to-market for electronic products. Moreover, the strong focus on innovation in defense, aerospace, and automotive electronics drives continuous demand for versatile logic analyzers in the U.S.

Europe Modular Logic Analyzer Market Insight

The Europe modular logic analyzer market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing electronics R&D investments, stringent quality standards, and rising industrial automation. The growth of automotive electronics, smart manufacturing, and aerospace sectors is boosting demand for high-performance analyzers. European companies are also investing in modular solutions for testing and validation of ICs, memory devices, and processors. Germany, France, and the Netherlands are emerging as key hubs for logic analyzer adoption across industrial and academic research applications.

U.K. Modular Logic Analyzer Market Insight

The U.K. modular logic analyzer market is expected to grow at a noteworthy CAGR during the forecast period, fueled by the expansion of semiconductor design and electronics manufacturing activities. Increasing adoption of modular analyzers in higher education, research institutes, and electronics testing labs is contributing to market growth. The U.K.’s emphasis on innovation, coupled with growing government-backed initiatives for technology development, supports the demand for precision testing solutions.

Germany Modular Logic Analyzer Market Insight

The Germany modular logic analyzer market is anticipated to expand at a considerable CAGR, driven by the country’s advanced industrial base and leadership in electronics and semiconductor innovation. Companies are increasingly investing in modular analyzers to support IC, processor, and memory device development. Germany’s focus on automation, R&D, and sustainability in manufacturing fosters adoption of high-channel-count, energy-efficient analyzers. The integration of software-enabled analysis tools with modular systems is becoming increasingly common in both commercial and academic applications.

Asia-Pacific Modular Logic Analyzer Market Insight

The Asia-Pacific modular logic analyzer market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid industrialization, growing electronics and semiconductor manufacturing hubs, and increased R&D activities in countries such as China, Japan, and India. The expansion of IC fabrication facilities, memory device production, and processor development is driving demand for modular analyzers. Moreover, government initiatives to promote technology innovation and the increasing adoption of automated testing solutions are boosting the market across the region.

Japan Modular Logic Analyzer Market Insight

The Japan market is witnessing significant growth due to the country’s advanced electronics industry, high-tech research environment, and demand for reliable testing solutions. Modular analyzers are extensively used for IC, processor, and memory device validation, ensuring performance and quality standards. The integration of modular analyzers with automated test software and high-channel-count configurations supports the testing of complex systems. In addition, the focus on automotive electronics, consumer devices, and industrial automation is fueling the adoption of modular logic analyzers in Japan.

China Modular Logic Analyzer Market Insight

The China modular logic analyzer market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid growth in semiconductor manufacturing, electronics production, and digital infrastructure development. Domestic electronics and semiconductor companies are increasingly deploying modular analyzers for IC, processor, and memory device testing. The government’s push toward advanced manufacturing, smart factories, and high-tech research facilities, combined with affordable and scalable analyzer solutions, is accelerating market growth. China is emerging as both a manufacturing hub and a major consumer of advanced modular logic analyzers in the APAC region.

Modular Logic Analyzer Market Share

The modular logic analyzer industry is primarily led by well-established companies, including:

- Keysight Technologies (U.S.)

- Rohde & Schwarz (Germany)

- National Instruments Corp (U.S.)

- Yokogawa India Ltd. (India)

- Teledyne Technologies Incorporated (U.S.)

- Advantest Corporation (Japan)

- Arm Limited (U.K.)

- GAO Tek & GAO Group Inc. (U.S.)

- RIGOL Technologies, Inc (China)

- Saleae, Inc (U.S.)

- Good Will Instrument Co., Ltd. (Taiwan)

- ZEROPLUS Technology Co., Ltd. (Taiwan)

- Qingdao Hantek Electronic Co., Ltd. (China)

- NCI (U.S.)

- Scientech Technologies Pvt. Ltd (India)

- OWON Technology (China)

- Ikalogic SAS (France)

- StemLabs (U.S.)

- GSAS Micro Systems Pvt Ltd (India)

Latest Developments in Global Modular Logic Analyzer Market

- In November 2024, Tektronix showcased new products at the electronica 2024 exhibition, including an oscilloscope probe with RF isolation technology and a high-capacity power supply. These innovations enhance Tektronix’s modular test solution offerings, enabling more precise testing of high-speed digital and power electronics. The development strengthens the company’s position in the modular logic analyzer market, particularly for high-performance industrial and semiconductor applications, and is expected to drive adoption among electronics manufacturers seeking versatile and accurate testing equipment

- In August 2024, Keysight Technologies launched the U4164A logic analyzer module, designed to support high-speed memory traffic analysis, including DDR and LPDDR interfaces. This module enhances the company’s modular analyzer portfolio by offering improved state mode operation up to 4 Gb/s, meeting the growing demand for precise debugging and validation of memory-intensive ICs and processors. The launch is poised to strengthen Keysight’s market presence and influence purchasing decisions in semiconductor design and testing environments

- In March 2024, Keysight Technologies entered into a strategic partnership with Q-CTRL to develop advanced infrastructure for quantum software testing. While focused on quantum technologies, this initiative underscores Keysight’s commitment to expanding its modular test and measurement capabilities in emerging high-tech markets. The collaboration signals potential future innovations in modular logic analyzers and positions the company to capture new growth opportunities in next-generation electronics and high-complexity testing applications

- In March 2024, Rohde & Schwarz launched the R&S FSPN 50 phase noise analyzer, capable of measuring signals up to 50 GHz. This development strengthens the company’s modular test solutions portfolio by providing high-frequency signal analysis capabilities, which are critical for advanced IC, processor, and communication device testing. The introduction of this high-precision analyzer is expected to increase market adoption among semiconductor and electronics companies requiring robust, scalable testing solutions for complex systems

- In January 2024, Fortive Corporation completed the acquisition of EA Elektro-Automatik, a specialist in power electronics and test equipment. This strategic acquisition expands Fortive’s test and measurement offerings, including modular logic analyzers, by integrating advanced power testing capabilities. The move is likely to strengthen the company’s market position, enabling it to provide comprehensive solutions for electronics manufacturers and semiconductor companies, thereby driving growth in the modular logic analyzer segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Modular Logic Analyzer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Modular Logic Analyzer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Modular Logic Analyzer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.