Global Molecular Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

25.80 Billion

USD

70.05 Billion

2024

2032

USD

25.80 Billion

USD

70.05 Billion

2024

2032

| 2025 –2032 | |

| USD 25.80 Billion | |

| USD 70.05 Billion | |

|

|

|

|

Molecular Diagnostics Market Size

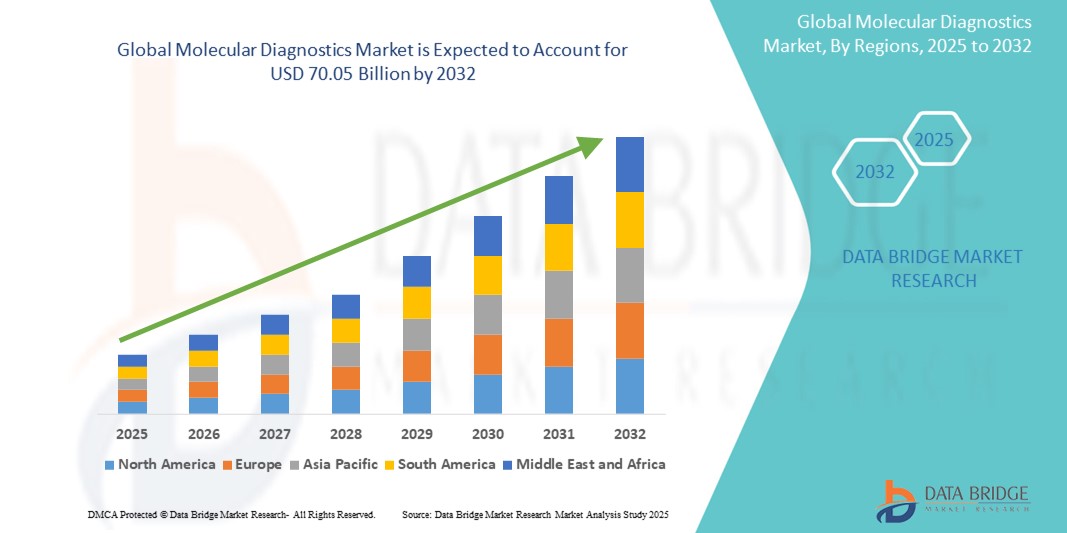

- The global molecular diagnostics market was valued at USD 25.8 billion in 2024 and is expected to reach USD 70.05 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 13.30%, primarily driven by high usage of PCR

- This growth is driven by factors such as accuracy and sensitivity and rapid turnaround time

Molecular Diagnostics Market Analysis

- Molecular diagnostics refers to a field of medical testing that utilizes molecular biology techniques, such as PCR and NGS, to detect and monitor diseases, identify genetic predispositions, and guide targeted therapies, widely applied in healthcare, clinical laboratories, and research settings

- Market growth is driven by the rising prevalence of infectious diseases and chronic conditions, increasing demand for personalized medicine, and the growing adoption of advanced diagnostic technologies such as real-time PCR and next-generation sequencing

- The market is evolving with technological innovations in automated platforms, integration of AI and machine learning for result interpretation, and the development of portable, point-of-care diagnostic devices enhancing speed, accuracy, and accessibility

- For instance, companies such as Roche and Thermo Fisher Scientific are leveraging digital technologies and automation to deliver faster, more precise molecular diagnostic solutions tailored to clinical and laboratory needs

- The molecular diagnostics market is expected to witness sustained growth, supported by ongoing advancements in genomics, expanding healthcare infrastructure, and increased investment in early disease detection and precision medicine initiatives

Report Scope and Molecular Diagnostics Market Segmentation

|

Attributes |

Molecular Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Molecular Diagnostics Market Trends

“Increasing Adoption of Liquid Biopsy Techniques”

- One prominent trend in the global molecular diagnostics market is the increasing adoption of liquid biopsy techniques

- This trend is driven by the growing demand for non-invasive diagnostic methods, the need for real-time monitoring of disease progression, and the rising emphasis on personalized treatment strategies, particularly in oncology

- For instance, companies such as Guardant Health and Biocept are advancing liquid biopsy technologies that analyze circulating tumor DNA (ctDNA) and other biomarkers to enable early cancer detection and therapy selection

- The continued shift toward minimally invasive procedures, along with technological improvements in biomarker detection and genomic analysis, is accelerating the integration of liquid biopsy into routine clinical practice

- As healthcare systems focus on precision medicine, early diagnosis, and improved patient outcomes, liquid biopsy is expected to play a transformative role in expanding access to timely, accurate, and personalized diagnostics across various disease areas

Molecular Diagnostics Market Dynamics

Driver

“Increasing Elderly Population”

- The growing elderly population is a key driver of growth in the global molecular diagnostics market

- This demographic shift is contributing to a higher incidence of age-related diseases such as cancer, cardiovascular disorders, and neurodegenerative conditions, driving the demand for early and accurate diagnostic solutions

- As the aging population requires more frequent health monitoring and personalized care, molecular diagnostics offers non-invasive, rapid, and precise testing options suited for chronic disease management and preventive healthcare

- Benefits such as early detection, targeted therapy guidance, and real-time disease tracking are making molecular diagnostics an essential tool in elderly care strategies across healthcare systems

- Diagnostic solution providers are responding by developing user-friendly, minimally invasive platforms tailored to the needs of aging patients and expanding access through home-based testing and telehealth integration

For instance,

- Roche and Abbott are advancing molecular testing tools for early detection of cancer and infectious diseases, specifically addressing the diagnostic needs of the elderly

- Thermo Fisher Scientific is enhancing its genomic platforms to support personalized diagnostics for age-related genetic risks

- As the global population continues to age and healthcare priorities shift toward prevention and personalized care, the role of molecular diagnostics is expected to expand significantly in supporting long-term health outcomes for older adults

Opportunity

“Increasing Demand for Molecular Diagnostics in Point-of-Care Setting”

- The growing demand for molecular diagnostics in point-of-care (POC) settings presents a significant opportunity in the molecular diagnostics market. By enabling rapid, on-site testing, POC diagnostics are enhancing accessibility, speed, and clinical decision-making in real-time

- Advancements in portable technologies, user-friendly assay formats, and integrated sample-to-result systems are empowering healthcare providers to deliver immediate diagnostic insights in settings such as clinics, emergency rooms, and remote locations

- Features such as compact design, minimal sample requirements, and automated workflows are being leveraged to support quicker diagnosis and treatment initiation, particularly in infectious disease management and chronic care monitoring

For instance,

- Cepheid’s GeneXpert and Abbott’s ID NOW platforms are widely used in decentralized healthcare environments for fast, accurate molecular testing

- bioMérieux is developing compact molecular systems aimed at streamlining diagnostics in urgent care and low-resource settings

- As global healthcare systems strive to improve patient outcomes, reduce diagnostic delays, and expand access to quality care, the continued evolution of point-of-care molecular diagnostics is poised to unlock new opportunities in both developed and emerging markets

Restraint/Challenge

“Increasing Regulatory Approvals”

- The growing number of regulatory approvals and compliance requirements presents a significant challenge for the molecular diagnostics market. While approvals are essential for ensuring safety and efficacy, the complexity and variability of global regulatory processes can slow product development and market entry

- This challenge is particularly pronounced for companies seeking to launch innovative diagnostic technologies across multiple regions, as they must navigate differing standards, documentation, and approval timelines.

- Lengthy approval processes can delay the availability of critical diagnostic tools, increase development costs, and create barriers for smaller or emerging players in the market

For instance,

- Startups often face extended timeframes when seeking FDA or CE mark approval for novel molecular assays, which can hinder commercialization strategies

- Without streamlined regulatory pathways and international harmonization, the molecular diagnostics market may face delays in innovation rollout, limiting timely access to advanced diagnostics and impacting patient care outcomes

Molecular Diagnostics Market Scope

The market is segmented on the basis of products, technology, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Products |

|

|

By Technology |

|

|

By Application |

|

|

By End User

|

|

Molecular Diagnostics Market Regional Analysis

“North America is the Dominant Region in the Molecular Diagnostics Market”

- North America dominates the molecular diagnostics market, driven by the increased healthcare expenditure, advanced healthcare facilities, and a well-established healthcare system that supports innovation and accessibility

- U.S. holds a significant share due to its high per capita healthcare spending, a large number of research institutions and biotech companies, and widespread consumer awareness about the importance of early disease detection and personalized medicine

- Leading companies in North America continue to innovate with next-generation diagnostic platforms, integrating artificial intelligence, molecular biology advancements, and cloud technologies. This has resulted in more efficient, scalable, and accurate diagnostic solutions that improve patient outcomes and healthcare delivery

- With strong infrastructure, an aging population, and rising consumer demand for precision healthcare, North America is expected to maintain its position as the largest and most advanced market for molecular diagnostics throughout the forecast period from 2025 to 2032

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the molecular diagnostics market, driven by rapid demographic shifts, an aging population, and an increasing prevalence of diseases such as cancer and infectious conditions

- Countries such as China, India, and Japan are leading the regional growth due to their expanding healthcare infrastructure, government initiatives to improve healthcare access, and rising awareness about early disease detection

- The region is also experiencing significant advancements in healthcare technology, including telemedicine, genomics, and mobile health diagnostics, which are boosting demand for advanced molecular diagnostic tools capable of handling large patient volumes and offering accurate, cost-effective testing

- With increasing healthcare digitization, government support for biotechnology advancements, and the growing adoption of personalized medicine, Asia-Pacific is positioned as the fastest-growing regional market for molecular diagnostics. As healthcare systems continue to evolve, Asia-Pacific will continue to expand its market share from 2025 to 2032, becoming a major hub for molecular diagnostic innovation and adoption

Molecular Diagnostics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Hologic, Inc. (U.S.)

- bioMérieux SA (France)

- Abbott Laboratories (U.S.)

- QIAGEN N.V. (Netherlands)

- Thermo Fisher Scientific Inc. (U.S.)

- Siemens AG (Germany)

- Danaher Corporation (U.S.)

- Myriad Genetics, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Becton, Dickinson and Company (BD) (U.S.)

- DiaSorin S.p.A. (Italy)

- Grifols, S.A. (Spain)

- QuidelOrtho Corporation (U.S.)

- Genetic Signatures Limited (Australia)

- MDxHealth SA (Belgium)

- Exact Sciences Corporation (U.S.)

- Biocartis Group NV (Belgium)

- TBG Diagnostics Limited (Australia)

- GenMark Diagnostics, Inc. (U.S.)

- Luminex Corporation (U.S.)

- HTG Molecular Diagnostics, Inc. (U.S.)

- Vela Diagnostics (Singapore)

- Amoy Diagnostics Co., Ltd. (China)

- Molbio Diagnostics Pvt. Ltd. (India)

- geneOmbio Technologies Pvt. Ltd. (India)

Latest Developments in Global Molecular Diagnostics Market

- In 2021, Roche completed the acquisition of TIB Molbiol Group. TIB Molbiol Group has about 45 CE-IVD-approved assays for diagnosing inherited genetic testing, infectious diseases, transplant medicine, and hematology testing

- In 2020, Roche Diagnostics India launched the Cobas 8800 and the Cobas 6800 at the National Institute of Cholera and Enteric Diseases, Kolkata, to help the SARS CoV-2 diagnostic testing. The Roche Cobas 6800/8800 systems deliver test findings in a time of three and a half hours and allow greater operational efficiency, flexibility, and the quickest time-to-results

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MOLECULAR DIAGNOSTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MOLECULAR DIAGNOSTICS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MOLECULAR DIAGNOSTICS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER'S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNOLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 GLOBAL MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT AND SERVICES

17.1 OVERVIEW

17.2 PRODUCT

17.2.1 INSTRUMENTS

17.2.1.1. BY TYPE

17.2.1.1.1. FULLY AUTOMATED

17.2.1.1.2. SEMI-AUTOMATED

17.2.1.1.3. MANUAL

17.2.1.2. BY MODALITY

17.2.1.2.1. PORTABLE

17.2.1.2.2. STANDALONE

17.2.1.2.3. BENCHTOP

17.2.2 REAGENTS AND KITS

17.2.2.1. KITS

17.2.2.1.1. DNA EXTRACTION AND PURIFICATION KITS

17.2.2.1.1.1 PLASMID MINIPREP AND MAXIPREP KITS

17.2.2.1.1.2 PLASMID PURIFICATION KITS

17.2.2.1.1.3 PCR PURIFICATION KITS

17.2.2.1.1.4 GENOMIC DNA PURIFICATION KITS

17.2.2.1.1.5 OTHERS

17.2.2.1.2. RNAI AND RNA REAGENTS

17.2.2.1.3. NUCLEIC ACID PURIFICATION KITS

17.2.2.1.4. NUCLEIC ACID SYNTHESIS KITS, BUFFERS & REAGENTS

17.2.2.1.5. HPV KITS

17.2.2.1.6. TB KITS

17.2.2.1.7. DEPLETION KITS

17.2.2.1.8. OTHERS

17.2.2.2. QC SETS AND PANELS

17.2.2.2.1. CONTROL PANEL

17.2.2.2.1.1 MULTIPLEX VAGINAL CONTROL PANEL

17.2.2.2.1.2 HUMAN PAPILLOMAVIRUS (HPV) CONTROL PANEL

17.2.2.2.1.3 CANDIDA VAGINITIS/TRICHOMONAS VAGINALIS (CV/TV) CONTROL PANEL

17.2.2.2.1.4 CT/NG CONTROL PANEL

17.2.2.2.1.5 BACTERIAL VAGINOSIS (BV) CONTROL PANEL

17.2.2.2.1.6 CELLULARITY CONTROL

17.2.2.2.1.7 RESPIRATORY CONTROL PANEL

17.2.2.2.1.8 FLU/RSV/SARS-COV-2 CONTROL PANEL

17.2.2.2.1.8.1. NXG CONTROL PANEL

17.2.2.2.1.8.2. COMPLETE CONTROL PANEL

17.2.2.2.1.8.3. OTHERS

17.2.2.2.1.9 MPN PANEL

17.2.2.2.1.10 AML PANEL

17.2.2.2.1.11 QC PANEL

17.2.2.2.1.12 ALL PANEL

17.2.2.2.1.13 VERIFICATION PANEL

17.2.2.2.1.14 OTHERS

17.2.2.3. MUTATIONS DETECTION KIT

17.2.2.3.1. KRAS PCR KIT

17.2.2.3.2. EGFR KIT

17.2.2.3.3. BRAF MUTATION KIT

17.2.2.3.4. AML1-ETO KIT

17.2.2.3.5. NRAS MUTATION KIT

17.2.2.3.6. CALR KIT

17.2.2.3.7. FLT3 MUTATION DETECTION

17.2.2.3.8. C-KIT MUTATION DETECTION KIT

17.2.2.3.9. MGMT METHYLATION DETECTION KIT

17.2.2.3.10. CBFB-MYH11 KIT

17.2.2.3.11. GENE FUSIONS DETECTION KIT

17.2.2.3.12. OTHER KITS AND ASSAYS

17.2.2.4. ENZYMES

17.2.2.4.1. POLYMERASES

17.2.2.4.2. LIGASES

17.2.2.4.3. RESTRICTION ENDONUCLEASES

17.2.2.4.4. REVERSE TRANSCRIPTASES

17.2.2.4.5. PHOSPHATASES

17.2.2.4.6. PROTEASES AND PROTEINASES

17.2.2.4.7. DNA LADDERS

17.2.2.4.8. OTHER ENZYMES

17.2.2.5. BUFFERS

17.2.2.6. PRIMERS

17.2.2.7. OTHERS

17.3 SOFTWARE AND SERVICES

17.3.1 SERVICES

17.3.1.1. INSTRUMENT REPAIR SERVICES

17.3.1.1.1. ON-SITE REPAIR SERVICES

17.3.1.1.2. OFF-SITE REPAIR SERVICES

17.3.1.2. TRAINING SERVICES

17.3.1.2.1. PCR BASED MOLECULAR DIAGNOSTICS

17.3.1.2.2. IMMUNOHISTOCHEMISTRY (IHC)

17.3.1.2.3. VIRAL LOAD TESTING

17.3.1.2.4. INTERPHASE CHROMOSOME PROFILING (ICP)

17.3.1.2.5. OTHERS

17.3.1.3. COMPLIANCE SERVICES

17.3.1.3.1. IQ/OQ & PM/OQ SERVICES

17.3.1.3.2. INSTALLATION SERVICES

17.3.1.3.3. VALIDATION SERVICES

17.3.1.3.4. OTHER SERVICES

17.3.1.4. SCALABLE AUTOMATION SERVICES

17.3.1.4.1. AUTOMATION FOR HIGH-CONTENT SCREENING (HCS)

17.3.1.4.2. AUTOMATION FOR HIGH-THROUGHPUT PLATE-BASED ASSAYS

17.3.1.4.3. AUTOMATION FOR HIGH-THROUGHPUT CLONE SCREENING

17.3.1.5. CALIBRATION SERVICES

17.3.1.6. MAINTENANCE SERVICES

17.3.1.7. INSTRUMENT RELOCATION SERVICES

17.3.1.7.1. PLATE RECERTIFICATION

17.3.1.7.2. FACTORY APPROVED PARTS

17.3.1.7.3. INSTRUMENT PERFORMANCE EVALUATION

17.3.1.7.4. OTHER SERVICES

17.3.1.8. HARDWARE CUSTOMIZATION

17.3.1.9. PERFORMANCE ASSURANCE SERVICES

17.3.1.10. DESIGN AND DEVELOPMENT SERVICES

17.3.1.11. SUPPLY CHAIN SOLUTIONS

17.3.1.12. CLINICAL RESEARCH SERVICES

17.3.1.13. OTHER SERVICES

17.3.2 SOFTWARE

17.3.2.1. BY TYPE

17.3.2.1.1. INTEGRATED

17.3.2.1.2. STANDALONE

17.3.2.2. BY DEPLOYMENT

17.3.2.2.1. CLOUD BASES

17.3.2.2.2. ON-PREMISES

17.3.2.2.3. HYBRID

18 GLOBAL MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY

18.1 OVERVIEW

18.2 POLYMERASE CHAIN REACTION (PCR)

18.2.1 BY TYPE

18.2.1.1. REAL-TIME PCR

18.2.1.2. DIGITAL PCR

18.2.1.3. REVERSE TRANSCRIPTASE PCR

18.2.1.4. QUANTITATIVE FLUORESCENT PCR

18.2.1.5. COLD PCR

18.2.1.6. OTHERS

18.2.2 BY PRODUCT AND SERVICES

18.2.2.1. PRODUCT

18.2.2.2. SERVICES AND SOFTWARE

18.3 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY (INAAT)

18.3.1 BY PRODUCT AND SERVICES

18.3.1.1. PRODUCT

18.3.1.2. SERVICES AND SOFTWARE

18.4 NEXT GENERATION SEQUENCING (NGS)

18.4.1 BY PRODUCT AND SERVICES

18.4.1.1. PRODUCT

18.4.1.2. SERVICES AND SOFTWARE

18.5 CYTOGENETICS

18.5.1 BY PRODUCT AND SERVICES

18.5.1.1. PRODUCT

18.5.1.2. SERVICES AND SOFTWARE

18.6 CAPILLARY ELECTROPHORESIS

18.6.1 BY PRODUCT AND SERVICES

18.6.1.1. PRODUCT

18.6.1.2. SERVICES AND SOFTWARE

18.7 IN SITU HYBRIDIZATION (ISH OR FISH)

18.7.1 BY PRODUCT AND SERVICES

18.7.1.1. PRODUCT

18.7.1.2. SERVICES AND SOFTWARE

18.8 MOLECULAR IMAGING

18.8.1 BY TYPE

18.8.1.1. OPTICAL IMAGING

18.8.1.2. FDG-PET

18.8.1.3. OTHERS

18.8.2 BY PRODUCT AND SERVICES

18.8.2.1. PRODUCT

18.8.2.2. SERVICES AND SOFTWARE

18.9 MASS SPECTROMETRY (MS)

18.9.1 BY PRODUCT AND SERVICES

18.9.1.1. PRODUCT

18.9.1.2. SERVICES AND SOFTWARE

18.1 CHIPS AND MICROARRAY

18.10.1 BY PRODUCT AND SERVICES

18.10.1.1. PRODUCT

18.10.1.2. SERVICES AND SOFTWARE

18.11 OTHERS

19 GLOBAL MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION

19.1 OVERVIEW

19.2 ONCOLOGY TESTING

19.2.1 ONCOLOGY, BY CANCER TYPE

19.2.1.1. BREAST CANCER

19.2.1.1.1. MARKET VALUE (USD MILLION)

19.2.1.1.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.1.1.3. AVERAGE TEST COST (USD)

19.2.1.2. COLORECTAL CANCER

19.2.1.2.1. MARKET VALUE (USD MILLION)

19.2.1.2.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.1.2.3. AVERAGE TEST COST (USD)

19.2.1.3. LUNG CANCER

19.2.1.3.1. MARKET VALUE (USD MILLION)

19.2.1.3.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.1.3.3. AVERAGE TEST COST (USD)

19.2.1.4. PROSTATE CANCER

19.2.1.4.1. MARKET VALUE (USD MILLION)

19.2.1.4.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.1.4.3. AVERAGE TEST COST (USD)

19.2.1.5. OTHERS

19.2.2 ONCOLOGY, BY TECHNOLOGY

19.2.2.1. POLYMERASE CHAIN REACTION (PCR)

19.2.2.1.1. MARKET VALUE (USD MILLION)

19.2.2.1.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.2.1.3. AVERAGE TEST COST (USD)

19.2.2.2. ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY (INAAT)

19.2.2.2.1. MARKET VALUE (USD MILLION)

19.2.2.2.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.2.2.3. AVERAGE TEST COST (USD)

19.2.2.3. NEXT GENERATION SEQUENCING (NGS)

19.2.2.3.1. MARKET VALUE (USD MILLION)

19.2.2.3.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.2.3.3. AVERAGE TEST COST (USD)

19.2.2.4. CYTOGENETICS

19.2.2.4.1. MARKET VALUE (USD MILLION)

19.2.2.4.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.2.4.3. AVERAGE TEST COST (USD)

19.2.2.5. CAPILLARY ELECTROPHORESIS

19.2.2.5.1. MARKET VALUE (USD MILLION)

19.2.2.5.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.2.5.3. AVERAGE TEST COST (USD)

19.2.2.6. IN SITU HYBRIDIZATION (ISH OR FISH)

19.2.2.6.1. MARKET VALUE (USD MILLION)

19.2.2.6.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.2.6.3. AVERAGE TEST COST (USD)

19.2.2.7. MOLECULAR IMAGING

19.2.2.7.1. MARKET VALUE (USD MILLION)

19.2.2.7.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.2.7.3. AVERAGE TEST COST (USD)

19.2.2.8. MASS SPECTROMETRY (MS)

19.2.2.8.1. MARKET VALUE (USD MILLION)

19.2.2.8.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.2.8.3. AVERAGE TEST COST (USD)

19.2.2.9. CHIPS AND MICROARRAY

19.2.2.9.1. MARKET VALUE (USD MILLION)

19.2.2.9.2. MARKET VOLUME (NUMBER OF TESTS)

19.2.2.9.3. AVERAGE TEST COST (USD)

19.2.2.10. OTHERS

19.3 PHARMACOGENOMICS

19.3.1 POLYMERASE CHAIN REACTION (PCR)

19.3.1.1. MARKET VALUE (USD MILLION)

19.3.1.2. MARKET VOLUME (NUMBER OF TESTS)

19.3.1.3. AVERAGE TEST COST (USD)

19.3.2 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY (INAAT)

19.3.2.1. MARKET VALUE (USD MILLION)

19.3.2.2. MARKET VOLUME (NUMBER OF TESTS)

19.3.2.3. AVERAGE TEST COST (USD)

19.3.3 NEXT GENERATION SEQUENCING (NGS)

19.3.3.1. MARKET VALUE (USD MILLION)

19.3.3.2. MARKET VOLUME (NUMBER OF TESTS)

19.3.3.3. AVERAGE TEST COST (USD)

19.3.4 CYTOGENETICS

19.3.4.1. MARKET VALUE (USD MILLION)

19.3.4.2. MARKET VOLUME (NUMBER OF TESTS)

19.3.4.3. AVERAGE TEST COST (USD)

19.3.5 CAPILLARY ELECTROPHORESIS

19.3.5.1. MARKET VALUE (USD MILLION)

19.3.5.2. MARKET VOLUME (NUMBER OF TESTS)

19.3.5.3. AVERAGE TEST COST (USD)

19.3.6 IN SITU HYBRIDIZATION (ISH OR FISH)

19.3.6.1. MARKET VALUE (USD MILLION)

19.3.6.2. MARKET VOLUME (NUMBER OF TESTS)

19.3.6.3. AVERAGE TEST COST (USD)

19.3.7 MOLECULAR IMAGING

19.3.7.1. MARKET VALUE (USD MILLION)

19.3.7.2. MARKET VOLUME (NUMBER OF TESTS)

19.3.7.3. AVERAGE TEST COST (USD)

19.3.8 MASS SPECTROMETRY (MS)

19.3.8.1. MARKET VALUE (USD MILLION)

19.3.8.2. MARKET VOLUME (NUMBER OF TESTS)

19.3.8.3. AVERAGE TEST COST (USD)

19.3.9 CHIPS AND MICROARRAY

19.3.9.1. MARKET VALUE (USD MILLION)

19.3.9.2. MARKET VOLUME (NUMBER OF TESTS)

19.3.9.3. AVERAGE TEST COST (USD)

19.3.10 OTHERS

19.4 MICROBIOLOGY

19.4.1 POLYMERASE CHAIN REACTION (PCR)

19.4.1.1. MARKET VALUE (USD MILLION)

19.4.1.2. MARKET VOLUME (NUMBER OF TESTS)

19.4.1.3. AVERAGE TEST COST (USD)

19.4.2 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY (INAAT)

19.4.2.1. MARKET VALUE (USD MILLION)

19.4.2.2. MARKET VOLUME (NUMBER OF TESTS)

19.4.2.3. AVERAGE TEST COST (USD)

19.4.3 NEXT GENERATION SEQUENCING (NGS)

19.4.3.1. MARKET VALUE (USD MILLION)

19.4.3.2. MARKET VOLUME (NUMBER OF TESTS)

19.4.3.3. AVERAGE TEST COST (USD)

19.4.4 CYTOGENETICS

19.4.4.1. MARKET VALUE (USD MILLION)

19.4.4.2. MARKET VOLUME (NUMBER OF TESTS)

19.4.4.3. AVERAGE TEST COST (USD)

19.4.5 CAPILLARY ELECTROPHORESIS

19.4.5.1. MARKET VALUE (USD MILLION)

19.4.5.2. MARKET VOLUME (NUMBER OF TESTS)

19.4.5.3. AVERAGE TEST COST (USD)

19.4.6 IN SITU HYBRIDIZATION (ISH OR FISH)

19.4.6.1. MARKET VALUE (USD MILLION)

19.4.6.2. MARKET VOLUME (NUMBER OF TESTS)

19.4.6.3. AVERAGE TEST COST (USD)

19.4.7 MOLECULAR IMAGING

19.4.7.1. MARKET VALUE (USD MILLION)

19.4.7.2. MARKET VOLUME (NUMBER OF TESTS)

19.4.7.3. AVERAGE TEST COST (USD)

19.4.8 MASS SPECTROMETRY (MS)

19.4.8.1. MARKET VALUE (USD MILLION)

19.4.8.2. MARKET VOLUME (NUMBER OF TESTS)

19.4.8.3. AVERAGE TEST COST (USD)

19.4.9 CHIPS AND MICROARRAY

19.4.9.1. MARKET VALUE (USD MILLION)

19.4.9.2. MARKET VOLUME (NUMBER OF TESTS)

19.4.9.3. AVERAGE TEST COST (USD)

19.4.10 OTHERS

19.5 PRENATAL TESTS

19.5.1 SICKLE CELL DISEASE

19.5.1.1. MARKET VALUE (USD MILLION)

19.5.1.2. MARKET VOLUME (NUMBER OF TESTS)

19.5.1.3. AVERAGE TEST COST (USD)

19.5.2 CYSTIC FIBROSIS

19.5.2.1. MARKET VALUE (USD MILLION)

19.5.2.2. MARKET VOLUME (NUMBER OF TESTS)

19.5.2.3. AVERAGE TEST COST (USD)

19.5.3 TAY-SACHS DISEASE

19.5.3.1. MARKET VALUE (USD MILLION)

19.5.3.2. MARKET VOLUME (NUMBER OF TESTS)

19.5.3.3. AVERAGE TEST COST (USD)

19.5.4 OTHERS

19.6 TISSUE TYPING TEST

19.6.1 POLYMERASE CHAIN REACTION (PCR)

19.6.1.1. MARKET VALUE (USD MILLION)

19.6.1.2. MARKET VOLUME (NUMBER OF TESTS)

19.6.1.3. AVERAGE TEST COST (USD)

19.6.2 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY (INAAT)

19.6.2.1. MARKET VALUE (USD MILLION)

19.6.2.2. MARKET VOLUME (NUMBER OF TESTS)

19.6.2.3. AVERAGE TEST COST (USD)

19.6.3 NEXT GENERATION SEQUENCING (NGS)

19.6.3.1. MARKET VALUE (USD MILLION)

19.6.3.2. MARKET VOLUME (NUMBER OF TESTS)

19.6.3.3. AVERAGE TEST COST (USD)

19.6.4 CYTOGENETICS

19.6.4.1. MARKET VALUE (USD MILLION)

19.6.4.2. MARKET VOLUME (NUMBER OF TESTS)

19.6.4.3. AVERAGE TEST COST (USD)

19.6.5 CAPILLARY ELECTROPHORESIS

19.6.5.1. MARKET VALUE (USD MILLION)

19.6.5.2. MARKET VOLUME (NUMBER OF TESTS)

19.6.5.3. AVERAGE TEST COST (USD)

19.6.6 IN SITU HYBRIDIZATION (ISH OR FISH)

19.6.6.1. MARKET VALUE (USD MILLION)

19.6.6.2. MARKET VOLUME (NUMBER OF TESTS)

19.6.6.3. AVERAGE TEST COST (USD)

19.6.7 MOLECULAR IMAGING

19.6.7.1. MARKET VALUE (USD MILLION)

19.6.7.2. MARKET VOLUME (NUMBER OF TESTS)

19.6.7.3. AVERAGE TEST COST (USD)

19.6.8 MASS SPECTROMETRY (MS)

19.6.8.1. MARKET VALUE (USD MILLION)

19.6.8.2. MARKET VOLUME (NUMBER OF TESTS)

19.6.8.3. AVERAGE TEST COST (USD)

19.6.9 CHIPS AND MICROARRAY

19.6.9.1. MARKET VALUE (USD MILLION)

19.6.9.2. MARKET VOLUME (NUMBER OF TESTS)

19.6.9.3. AVERAGE TEST COST (USD)

19.6.10 OTHERS

19.7 BLOOD SCREENING

19.7.1 POLYMERASE CHAIN REACTION (PCR)

19.7.1.1. MARKET VALUE (USD MILLION)

19.7.1.2. MARKET VOLUME (NUMBER OF TESTS)

19.7.1.3. AVERAGE TEST COST (USD)

19.7.2 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY (INAAT)

19.7.2.1. MARKET VALUE (USD MILLION)

19.7.2.2. MARKET VOLUME (NUMBER OF TESTS)

19.7.2.3. AVERAGE TEST COST (USD)

19.7.3 NEXT GENERATION SEQUENCING (NGS)

19.7.3.1. MARKET VALUE (USD MILLION)

19.7.3.2. MARKET VOLUME (NUMBER OF TESTS)

19.7.3.3. AVERAGE TEST COST (USD)

19.7.4 CYTOGENETICS

19.7.4.1. MARKET VALUE (USD MILLION)

19.7.4.2. MARKET VOLUME (NUMBER OF TESTS)

19.7.4.3. AVERAGE TEST COST (USD)

19.7.5 CAPILLARY ELECTROPHORESIS

19.7.5.1. MARKET VALUE (USD MILLION)

19.7.5.2. MARKET VOLUME (NUMBER OF TESTS)

19.7.5.3. AVERAGE TEST COST (USD)

19.7.6 IN SITU HYBRIDIZATION (ISH OR FISH)

19.7.6.1. MARKET VALUE (USD MILLION)

19.7.6.2. MARKET VOLUME (NUMBER OF TESTS)

19.7.6.3. AVERAGE TEST COST (USD)

19.7.7 MOLECULAR IMAGING

19.7.7.1. MARKET VALUE (USD MILLION)

19.7.7.2. MARKET VOLUME (NUMBER OF TESTS)

19.7.7.3. AVERAGE TEST COST (USD)

19.7.8 MASS SPECTROMETRY (MS)

19.7.8.1. MARKET VALUE (USD MILLION)

19.7.8.2. MARKET VOLUME (NUMBER OF TESTS)

19.7.8.3. AVERAGE TEST COST (USD)

19.7.9 CHIPS AND MICROARRAY

19.7.9.1. MARKET VALUE (USD MILLION)

19.7.9.2. MARKET VOLUME (NUMBER OF TESTS)

19.7.9.3. AVERAGE TEST COST (USD)

19.7.10 OTHERS

19.8 CARDIOVASCULAR DISEASES TESTING

19.8.1 POLYMERASE CHAIN REACTION (PCR)

19.8.1.1. MARKET VALUE (USD MILLION)

19.8.1.2. MARKET VOLUME (NUMBER OF TESTS)

19.8.1.3. AVERAGE TEST COST (USD)

19.8.2 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY (INAAT)

19.8.2.1. MARKET VALUE (USD MILLION)

19.8.2.2. MARKET VOLUME (NUMBER OF TESTS)

19.8.2.3. AVERAGE TEST COST (USD)

19.8.3 NEXT GENERATION SEQUENCING (NGS)

19.8.3.1. MARKET VALUE (USD MILLION)

19.8.3.2. MARKET VOLUME (NUMBER OF TESTS)

19.8.3.3. AVERAGE TEST COST (USD)

19.8.4 CYTOGENETICS

19.8.4.1. MARKET VALUE (USD MILLION)

19.8.4.2. MARKET VOLUME (NUMBER OF TESTS)

19.8.4.3. AVERAGE TEST COST (USD)

19.8.5 CAPILLARY ELECTROPHORESIS

19.8.5.1. MARKET VALUE (USD MILLION)

19.8.5.2. MARKET VOLUME (NUMBER OF TESTS)

19.8.5.3. AVERAGE TEST COST (USD)

19.8.6 IN SITU HYBRIDIZATION (ISH OR FISH)

19.8.6.1. MARKET VALUE (USD MILLION)

19.8.6.2. MARKET VOLUME (NUMBER OF TESTS)

19.8.6.3. AVERAGE TEST COST (USD)

19.8.7 MOLECULAR IMAGING

19.8.7.1. MARKET VALUE (USD MILLION)

19.8.7.2. MARKET VOLUME (NUMBER OF TESTS)

19.8.7.3. AVERAGE TEST COST (USD)

19.8.8 MASS SPECTROMETRY (MS)

19.8.8.1. MARKET VALUE (USD MILLION)

19.8.8.2. MARKET VOLUME (NUMBER OF TESTS)

19.8.8.3. AVERAGE TEST COST (USD)

19.8.9 CHIPS AND MICROARRAY

19.8.9.1. MARKET VALUE (USD MILLION)

19.8.9.2. MARKET VOLUME (NUMBER OF TESTS)

19.8.9.3. AVERAGE TEST COST (USD)

19.8.10 OTHERS

19.9 NEUROLOGICAL DISEASES TESTING

19.9.1 POLYMERASE CHAIN REACTION (PCR)

19.9.1.1. MARKET VALUE (USD MILLION)

19.9.1.2. MARKET VOLUME (NUMBER OF TESTS)

19.9.1.3. AVERAGE TEST COST (USD)

19.9.2 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY (INAAT)

19.9.2.1. MARKET VALUE (USD MILLION)

19.9.2.2. MARKET VOLUME (NUMBER OF TESTS)

19.9.2.3. AVERAGE TEST COST (USD)

19.9.3 NEXT GENERATION SEQUENCING (NGS)

19.9.3.1. MARKET VALUE (USD MILLION)

19.9.3.2. MARKET VOLUME (NUMBER OF TESTS)

19.9.3.3. AVERAGE TEST COST (USD)

19.9.4 CYTOGENETICS

19.9.4.1. MARKET VALUE (USD MILLION)

19.9.4.2. MARKET VOLUME (NUMBER OF TESTS)

19.9.4.3. AVERAGE TEST COST (USD)

19.9.5 CAPILLARY ELECTROPHORESIS

19.9.5.1. MARKET VALUE (USD MILLION)

19.9.5.2. MARKET VOLUME (NUMBER OF TESTS)

19.9.5.3. AVERAGE TEST COST (USD)

19.9.6 IN SITU HYBRIDIZATION (ISH OR FISH)

19.9.6.1. MARKET VALUE (USD MILLION)

19.9.6.2. MARKET VOLUME (NUMBER OF TESTS)

19.9.6.3. AVERAGE TEST COST (USD)

19.9.7 MOLECULAR IMAGING

19.9.7.1. MARKET VALUE (USD MILLION)

19.9.7.2. MARKET VOLUME (NUMBER OF TESTS)

19.9.7.3. AVERAGE TEST COST (USD)

19.9.8 MASS SPECTROMETRY (MS)

19.9.8.1. MARKET VALUE (USD MILLION)

19.9.8.2. MARKET VOLUME (NUMBER OF TESTS)

19.9.8.3. AVERAGE TEST COST (USD)

19.9.9 CHIPS AND MICROARRAY

19.9.9.1. MARKET VALUE (USD MILLION)

19.9.9.2. MARKET VOLUME (NUMBER OF TESTS)

19.9.9.3. AVERAGE TEST COST (USD)

19.9.10 OTHERS

19.1 INFECTIOUS DISEASES TESTING

19.10.1 BY TYPE

19.10.1.1. COVID-19

19.10.1.1.1. MARKET VALUE (USD MILLION)

19.10.1.1.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.1.1.3. AVERAGE TEST COST (USD)

19.10.1.2. HEPATITIS

19.10.1.2.1. MARKET VALUE (USD MILLION)

19.10.1.2.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.1.2.3. AVERAGE TEST COST (USD)

19.10.1.3. HIV

19.10.1.3.1. MARKET VALUE (USD MILLION)

19.10.1.3.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.1.3.3. AVERAGE TEST COST (USD)

19.10.1.4. CT/NG

19.10.1.4.1. MARKET VALUE (USD MILLION)

19.10.1.4.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.1.4.3. AVERAGE TEST COST (USD)

19.10.1.5. HAI

19.10.1.5.1. MARKET VALUE (USD MILLION)

19.10.1.5.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.1.5.3. AVERAGE TEST COST (USD)

19.10.1.6. HPV

19.10.1.6.1. MARKET VALUE (USD MILLION)

19.10.1.6.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.1.6.3. AVERAGE TEST COST (USD)

19.10.1.7. TUBERCULOSIS

19.10.1.7.1. MARKET VALUE (USD MILLION)

19.10.1.7.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.1.7.3. AVERAGE TEST COST (USD)

19.10.1.8. INFLUENZA

19.10.1.8.1. MARKET VALUE (USD MILLION)

19.10.1.8.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.1.8.3. AVERAGE TEST COST (USD)

19.10.1.9. VECTOR-BORNE DISEASE

19.10.1.9.1. MALERIA

19.10.1.9.1.1 MARKET VALUE (USD MILLION)

19.10.1.9.1.2 MARKET VOLUME (NUMBER OF TESTS)

19.10.1.9.1.3 AVERAGE TEST COST (USD)

19.10.1.9.2. DENGUE

19.10.1.9.2.1 MARKET VALUE (USD MILLION)

19.10.1.9.2.2 MARKET VOLUME (NUMBER OF TESTS)

19.10.1.9.2.3 AVERAGE TEST COST (USD)

19.10.1.9.3. ZIKA VIRUS

19.10.1.9.3.1 MARKET VALUE (USD MILLION)

19.10.1.9.3.2 MARKET VOLUME (NUMBER OF TESTS)

19.10.1.9.3.3 AVERAGE TEST COST (USD)

19.10.1.9.4. OTHERS

19.10.2 BY TECHNOLOGY

19.10.2.1. POLYMERASE CHAIN REACTION (PCR)

19.10.2.1.1. MARKET VALUE (USD MILLION)

19.10.2.1.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.2.1.3. AVERAGE TEST COST (USD)

19.10.2.2. ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY (INAAT)

19.10.2.2.1. MARKET VALUE (USD MILLION)

19.10.2.2.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.2.2.3. AVERAGE TEST COST (USD)

19.10.2.3. NEXT GENERATION SEQUENCING (NGS)

19.10.2.3.1. MARKET VALUE (USD MILLION)

19.10.2.3.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.2.3.3. AVERAGE TEST COST (USD)

19.10.2.4. CYTOGENETICS

19.10.2.4.1. MARKET VALUE (USD MILLION)

19.10.2.4.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.2.4.3. AVERAGE TEST COST (USD)

19.10.2.5. CAPILLARY ELECTROPHORESIS

19.10.2.5.1. MARKET VALUE (USD MILLION)

19.10.2.5.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.2.5.3. AVERAGE TEST COST (USD)

19.10.2.6. IN SITU HYBRIDIZATION (ISH OR FISH)

19.10.2.6.1. MARKET VALUE (USD MILLION)

19.10.2.6.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.2.6.3. AVERAGE TEST COST (USD)

19.10.2.7. MOLECULAR IMAGING

19.10.2.7.1. MARKET VALUE (USD MILLION)

19.10.2.7.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.2.7.3. AVERAGE TEST COST (USD)

19.10.2.8. MASS SPECTROMETRY (MS)

19.10.2.8.1. MARKET VALUE (USD MILLION)

19.10.2.8.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.2.8.3. AVERAGE TEST COST (USD)

19.10.2.9. CHIPS AND MICROARRAY

19.10.2.9.1. MARKET VALUE (USD MILLION)

19.10.2.9.2. MARKET VOLUME (NUMBER OF TESTS)

19.10.2.9.3. AVERAGE TEST COST (USD)

19.10.2.10. OTHERS

19.11 OTHERS

20 GLOBAL MOLECULAR DIAGNOSTICS MARKET, BY TESTING SITE

20.1 OVERVIEW

20.2 LABORATORY BASED

20.3 POINT OF CARE TESTING

21 GLOBAL MOLECULAR DIAGNOSTICS MARKET, BY END USER

21.1 OVERVIEW

21.2 HOSPITALS CORE LABORATORIES

21.3 HOSPITAL ALTERNATIVE SITES

21.3.1 CLINICS

21.3.2 REFERENCE LABORATORIES

21.3.3 DIAGNOSTIC CENTERS

21.3.4 ACADEMIC & RESEARCH INSTITUTES

21.3.5 OTHERS

21.4 DECENTRALIZED TEST SITES

21.4.1 DECENTRALIZED CLINICAL LABORATORIES

21.4.2 PHARMACIES

21.4.3 HOMECARE SETTING

21.5 OTHERS

22 GLOBAL MOLECULAR DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 DIRECT TENDERS

22.3 RETAIL SALES

22.3.1 ONLINE SALES

22.3.2 OFFLINES SALES

22.4 OTHERS

23 GLOBAL MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY

GLOBAL MOLECULAR DIAGNOSTICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 NORTH AMERICA

23.1.1 U.S.

23.1.2 CANADA

23.1.3 MEXICO

23.2 EUROPE

23.2.1 GERMANY

23.2.2 FRANCE

23.2.3 U.K.

23.2.4 ITALY

23.2.5 SPAIN

23.2.6 RUSSIA

23.2.7 TURKEY

23.2.8 BELGIUM

23.2.9 NETHERLANDS

23.2.10 SWITZERLAND

23.2.11 REST OF EUROPE

23.3 ASIA-PACIFIC

23.3.1 JAPAN

23.3.2 CHINA

23.3.3 SOUTH KOREA

23.3.4 INDIA

23.3.5 AUSTRALIA

23.3.6 SINGAPORE

23.3.7 THAILAND

23.3.8 MALAYSIA

23.3.9 INDONESIA

23.3.10 PHILIPPINES

23.3.11 REST OF ASIA-PACIFIC

23.4 SOUTH AMERICA

23.4.1 BRAZIL

23.4.2 ARGENTINA

23.4.3 PERU

23.4.4 CHILE

23.4.5 COLOMBIA

23.4.6 VENEZUELA

23.4.7 REST OF SOUTH AMERICA

23.5 MIDDLE EAST AND AFRICA

23.5.1 SOUTH AFRICA

23.5.2 SAUDI ARABIA

23.5.3 UAE

23.5.4 EGYPT

23.5.5 ISRAEL

23.5.6 REST OF MIDDLE EAST AND AFRICA

23.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 GLOBAL SWINE AND POULTRY RESPIRATORY DISEASES TREATMENT MARKET , COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: GLOBAL

24.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.3 COMPANY SHARE ANALYSIS: EUROPE

24.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

24.5 MERGERS & ACQUISITIONS

24.6 NEW PRODUCT DEVELOPMENT & APPROVALS

24.7 EXPANSIONS

24.8 REGULATORY CHANGES

24.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 GLOBAL MOLECULAR DIAGNOSTICS MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.2 MERGERS & ACQUISITIONS

25.3 NEW PRODUCT DEVELOPMENT & APPROVALS

25.4 EXPANSIONS

25.5 REGULATORY CHANGES

25.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL MOLECULAR DIAGNOSTICS MARKET, SWOT AND DBMR ANALYSIS

27 GLOBAL MOLECULAR DIAGNOSTICS MARKET, COMPANY PROFILE

27.1 ABBOTT

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 SIEMENS HEALTHCARE PRIVATE LIMITED

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 THERMO FISHER SCIENTIFIC INC.

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 BD

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 BIOMÉRIEUX SA

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 DANAHER CORPORATION

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 HOLOGIC, INC.

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 MYRIAD GENETICS, INC.

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 QIAGEN

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 AGILENT TECHNOLOGIES, INC.

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 QUIDEL CORPORATION.

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 BIO-RAD LABORATORIES, INC.

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 ILLUMINA, INC.

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 IMMUCOR (WERFEN, S.A.)

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 DIASORIN S.P.A

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

27.16 SD BIOSENSOR

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPMENTS

27.17 F. HOFFMANN-LA ROCHE LTD

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPMENTS

27.18 GENEPATH DIAGNOSTICS

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPMENTS

27.19 EXACT SCIENCES CORPORATION

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPMENTS

27.2 GUARDANT HEALTH

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPMENTS

27.21 REVVITY INC.

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPMENTS

27.22 CARIS LIFE SCIENCES.

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPMENTS

27.23 RANDOX LABORATORIES LTD.

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.23.5 RECENT DEVELOPMENTS

27.24 DAAN GENE CO., LTD.

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPMENTS

27.25 JIANGSU MACRO & MICRO-TEST MED-TECH CO., LTD.

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPMENTS

27.26 GENOBIO PHARMACEUTICAL CO., LTD. (ERA BIOLOGY GROUP)

27.26.1 COMPANY OVERVIEW

27.26.2 REVENUE ANALYSIS

27.26.3 GEOGRAPHIC PRESENCE

27.26.4 PRODUCT PORTFOLIO

27.26.5 RECENT DEVELOPMENTS

27.27 LEPU MEDICAL TECHNOLOGY(BEIJING)CO.,LTD.

27.27.1 COMPANY OVERVIEW

27.27.2 REVENUE ANALYSIS

27.27.3 GEOGRAPHIC PRESENCE

27.27.4 PRODUCT PORTFOLIO

27.27.5 RECENT DEVELOPMENTS

27.28 PROMEGA CORPORATION

27.28.1 COMPANY OVERVIEW

27.28.2 REVENUE ANALYSIS

27.28.3 GEOGRAPHIC PRESENCE

27.28.4 PRODUCT PORTFOLIO

27.28.5 RECENT DEVELOPMENTS

27.29 TRIPLEX INTERNATIONAL BIOSCIENCES CO. LTD.

27.29.1 COMPANY OVERVIEW

27.29.2 REVENUE ANALYSIS

27.29.3 GEOGRAPHIC PRESENCE

27.29.4 PRODUCT PORTFOLIO

27.29.5 RECENT DEVELOPMENTS

27.3 MGMED

27.30.1 COMPANY OVERVIEW

27.30.2 REVENUE ANALYSIS

27.30.3 GEOGRAPHIC PRESENCE

27.30.4 PRODUCT PORTFOLIO

27.30.5 RECENT DEVELOPMENTS

27.31 MOLBIO DIAGNOSTICS PVT. LTD.

27.31.1 COMPANY OVERVIEW

27.31.2 REVENUE ANALYSIS

27.31.3 GEOGRAPHIC PRESENCE

27.31.4 PRODUCT PORTFOLIO

27.31.5 RECENT DEVELOPMENTS

27.32 GENOME DIAGNOSTICS PVT. LTD.

27.32.1 COMPANY OVERVIEW

27.32.2 REVENUE ANALYSIS

27.32.3 GEOGRAPHIC PRESENCE

27.32.4 PRODUCT PORTFOLIO

27.32.5 RECENT DEVELOPMENTS

27.33 VELA DIAGNOSTICS

27.33.1 COMPANY OVERVIEW

27.33.2 REVENUE ANALYSIS

27.33.3 GEOGRAPHIC PRESENCE

27.33.4 PRODUCT PORTFOLIO

27.33.5 RECENT DEVELOPMENTS

27.34 SHANGHAI CHUANGKUN BIO

27.34.1 COMPANY OVERVIEW

27.34.2 REVENUE ANALYSIS

27.34.3 GEOGRAPHIC PRESENCE

27.34.4 PRODUCT PORTFOLIO

27.34.5 RECENT DEVELOPMENTS

27.35 TRANSGEN BIOTECH CO., LTD.

27.35.1 COMPANY OVERVIEW

27.35.2 REVENUE ANALYSIS

27.35.3 GEOGRAPHIC PRESENCE

27.35.4 PRODUCT PORTFOLIO

27.35.5 RECENT DEVELOPMENTS

27.36 NANJING VAZYME BIOTECH CO.,LTD.

27.36.1 COMPANY OVERVIEW

27.36.2 REVENUE ANALYSIS

27.36.3 GEOGRAPHIC PRESENCE

27.36.4 PRODUCT PORTFOLIO

27.36.5 RECENT DEVELOPMENTS

27.37 WUXI NEST BIOTECHNOLOGY CO.,LTD

27.37.1 COMPANY OVERVIEW

27.37.2 REVENUE ANALYSIS

27.37.3 GEOGRAPHIC PRESENCE

27.37.4 PRODUCT PORTFOLIO

27.37.5 RECENT DEVELOPMENTS

27.38 HANGZHOU BIGFISH BIO-TECH CO., LTD.

27.38.1 COMPANY OVERVIEW

27.38.2 REVENUE ANALYSIS

27.38.3 GEOGRAPHIC PRESENCE

27.38.4 PRODUCT PORTFOLIO

27.38.5 RECENT DEVELOPMENTS

27.39 MAGGENOME TECHNOLOGIES PVT. LTD.

27.39.1 COMPANY OVERVIEW

27.39.2 REVENUE ANALYSIS

27.39.3 GEOGRAPHIC PRESENCE

27.39.4 PRODUCT PORTFOLIO

27.39.5 RECENT DEVELOPMENTS

27.4 YANENG BIOSCIENCE (SHENZHEN) CO., LTD.

27.40.1 COMPANY OVERVIEW

27.40.2 REVENUE ANALYSIS

27.40.3 GEOGRAPHIC PRESENCE

27.40.4 PRODUCT PORTFOLIO

27.40.5 RECENT DEVELOPMENTS

27.41 MERIDIAN BIOSCIENCE

27.41.1 COMPANY OVERVIEW

27.41.2 REVENUE ANALYSIS

27.41.3 GEOGRAPHIC PRESENCE

27.41.4 PRODUCT PORTFOLIO

27.41.5 RECENT DEVELOPMENTS

28 RELATED REPORTS

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.