Global Molecular Sieves Market

Market Size in USD Million

CAGR :

%

USD

4,398.92 Million

USD

6,802.33 Million

2022

2030

USD

4,398.92 Million

USD

6,802.33 Million

2022

2030

| 2023 –2030 | |

| USD 4,398.92 Million | |

| USD 6,802.33 Million | |

|

|

|

|

Molecular Sieves Market Analysis and Size

Molecular sieves are the type of synthetic zeolite materials engineered with pores of even sizes and structures. They are used for riveting liquids and gas molecules that are smaller than the effective diameters of the pores. It is a kind of a fast-drying agent and keeps the ability to trap moisture quickly compared to silica gel.

The increase in demand in the oil and gas industry acts as one of the major factors driving the growth of the molecular sieves market. The rise in the demand in the automotive and transportation industries, rising awareness for the treatment of hazardous organic materials in the wastewater, increase in government initiatives and rise in per capita disposable incomes accelerate the molecular sieves market growth. Furthermore, the rapid development of anti-microbial zeolite molecular sieves and the high growth prospects in the pharmaceutical industry extends profitable opportunities to the market players.

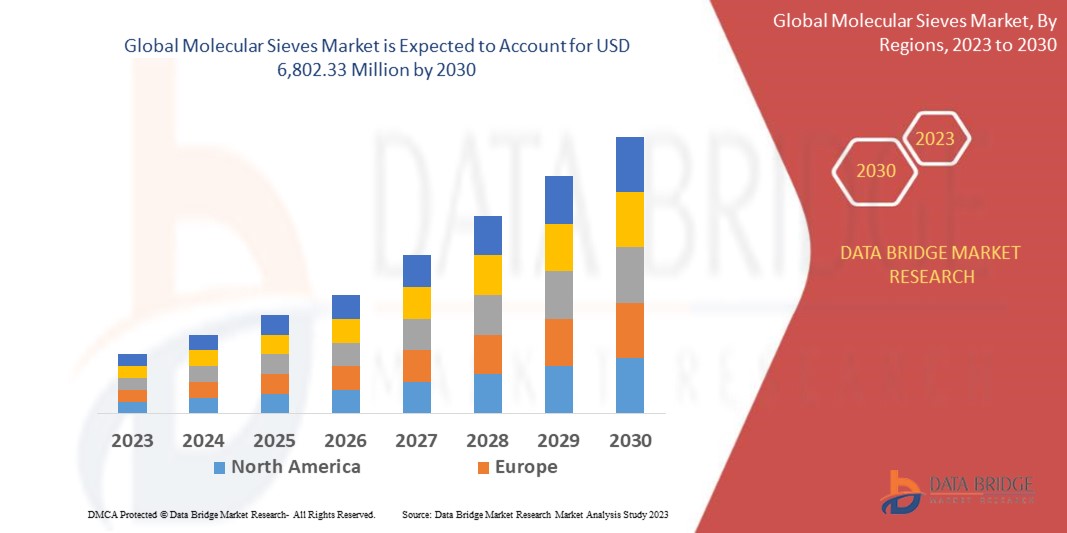

Data Bridge Market Research analyses that the molecular sieves market which was USD 4,398.92 million in 2022, would rocket up to USD 6,802.33 million by 2030, and is expected to undergo a CAGR of 5.6% during the forecast period of 2023 to 2030.

“Zeolite Y” dominates the type segment of the molecular sieves market owing to its broad range of applications across various industries. They are extensively used in gas separation, petrochemical refining, adsorption processes, catalysis, and other industrial processes. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Molecular Sieves Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Type (4A, 3A, 5A, 13X, Zeolite Y, and Others), Size (Microporous, Mesoporous, and Macroporous), Shape (Beads, Pellets, and Powder), Product (Carbon, Clay, Porous Glass, Silica Gel, Zeolite, Others), End User (Oil & Gas, Automotive, Packaging, Coatings, Wastewater Treatment, Detergents, and Others) |

|

Countries Covered |

North America (U.S., Canada, and Mexico), South America (Brazil, Argentina, and Rest of South America), Europe (Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, and the rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and the rest of Asia-Pacific), Middle East and Africa (U.A.E, Saudi Arabia, Egypt, South Africa, Israel, and the rest of Middle East and Africa) |

|

Market Players Covered |

Honeywell International Inc. (U.S.), BASF SE (Germany), Clariant AG (Switzerland), Tosoh Corporation (Japan), W. R. Grace & Co.-Conn. (U.S.), SHOWA DENKO K.K. (Japan), ZEOCHEM AG (Switzerland), KNT Group (South Korea), Arkema (France), PQ Corporation (U.S.), CWK Chemiewerk Bad Köstritz GmbH (Germany), NALCO India (India), Dalian Haixin Chemical Industrial Co., Ltd. (China), Sorbead India (India), Rive Technology (U.S.), ANTEN CHEMICAL CO., LTD. (Taiwan), Industrias Químicas del Ebro, S.A. (Spain), International Zeolite Corp (Canada), St. Cloud Mining (U.S.), and Huiying Chemical Industry (Xiamen) Co., Ltd. (China). |

|

Market Opportunities |

|

Market Definition

Molecular sieves refers to highly porous materials with a well-defined structure composed of regular cavities and channels. They are typically crystalline metal aluminosilicates or other inorganic materials. Molecular sieves have the ability to selectively adsorb molecules based on their size and shape. The structure of molecular sieves consists of a network of interconnected channels and cavities of precise dimensions. These channels act as molecular-sized sieves, allowing small molecules to enter and be adsorbed while excluding larger molecules.

Molecular sieves are widely used in various applications such as gas separation, dehydration of liquids and gases, purification of chemicals, catalysis, and drying of solvents. They are particularly effective in removing water and other impurities from liquids and gases, making them essential in industries such as oil and gas, petrochemical, pharmaceuticals, and electronics.

Global Molecular Sieves Market Dynamics

Drivers:

- Growing demand from oil and gas industry: The oil and gas industry is a significant driver of the molecular sieves market. Molecular sieves are extensively used in the oil and gas sector for the separation and purification of gases, removal of impurities, and dehydration processes. With the increasing global energy demand and exploration of unconventional oil and gas reserves, the demand for molecular sieves is expected to rise.

- Increasing demand for cleaner fuels: The focus on environmental sustainability and the need for cleaner fuels has led to the growing demand for molecular sieves in fuel refining processes. Molecular sieves play a crucial role in the removal of impurities, such as sulfur compounds, from fuels, thus improving their quality and reducing emissions. Stringent regulations regarding fuel quality and emission standards are driving the demand for molecular sieves in the refining industry.

- Growing demand for water treatment solutions: The need for efficient water treatment solutions is a key driver for the molecular sieves market. Molecular sieves are used in water treatment processes to remove contaminants, such as heavy metals and organic compounds, and to improve water quality. The increasing focus on water scarcity, water reuse, and stringent water quality regulations drive the demand for molecular sieves in the water treatment sector.

2. Restraints:

- High cost of molecular sieves: The cost of molecular sieves can be relatively high, primarily due to the manufacturing processes and the use of specialized materials. This cost factor can limit their adoption, especially in price-sensitive industries or regions. The high cost of molecular sieves may deter some end-users from incorporating them into their processes, thereby restraining market growth.

- Easy availability of alternatives: The market faces competition from alternative materials and technologies that can provide similar functions as molecular sieves. For example, membrane-based separation techniques and other adsorbents may serve as substitutes in certain applications. The availability of alternatives can impact the demand for molecular sieves and pose a restraint on market growth.

3. Opportunities:

- Advancements in petrochemical and refining industries: The petrochemical and refining sectors play a vital role in the global economy. Molecular sieves find extensive applications in these industries for various processes, including gas drying, olefin separation, and hydrocarbon purification. As these industries undergo technological advancements and capacity expansions, the demand for molecular sieves is expected to grow. The ongoing developments in the petrochemical and refining sectors present lucrative opportunities for molecular sieve manufacturers.

- Expansion of pharmaceutical and healthcare industries: The pharmaceutical and healthcare sectors are experiencing significant growth worldwide. Molecular sieves find applications in pharmaceutical manufacturing, including the drying and purification of solvents, as well as in controlled drug release systems. With the expansion of these industries, the demand for molecular sieves in pharmaceutical and healthcare applications is expected to increase, creating opportunities for market growth.

4. Challenges:

- Technical complexity and customization: The application of molecular sieves often involves complex technical requirements and customization to meet specific industry needs. Tailoring molecular sieves to different applications and optimizing their performance can be a challenge due to the intricate nature of the materials and the need for specialized expertise. Manufacturers must invest in research and development capabilities and collaborate closely with end-users to provide customized solutions, which can be a time-consuming and resource-intensive process.

This molecular sieves market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Molecular Sieves market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Development

- In July 2022, OMRON Healthcare introduced a medical molecular sieve-based oxygen concentrator. The portable oxygen concentrator utilizes Pressure Swing Adsorption (PSA) technology to separate nitrogen, oxygen, and other elements, providing a continuous supply of high-purity oxygen with more than 90% concentration output. This advancement in molecular sieve technology aims to meet the therapy and lifestyle needs of patients with COPD and respiratory problems. The OMRON Oxygen Concentrator incorporates high-quality medical molecular sieves to ensure the efficiency and quality of the oxygen while maintaining portability. It caters to the portable needs of various oxygen users, including highly active individuals or those requiring continuous flow.

Global Molecular Sieves Market Scope

The molecular sieves market is segmented on the basis of type, size, shape, product, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- 4A

- 3A

- 5A

- 13X

- ZEOLITE Y

- Others

Size

- Microporous

- Mesoporous

- Macroporous

Shape

- Beads

- Pellets

- Powder

Product

- Carbon

- Clay

- Porous Glass

- Silica Gel

- Zeolite

- Others

End User

- Oil & Gas

- Automotive

- Packaging

- Coatings

- Wastewater Treatment

- Detergents

- Others

Molecular Sieves Market Regional Analysis/Insights

The molecular sieves market is analysed and market size insights and trends are provided by element and application and are referenced above. The countries covered in the molecular sieves market report are U.S., Canada, and Mexico in North America, Brazil, Argentina, and the rest of South America in South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, and the rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and the rest of Asia-Pacific in Asia-Pacific, and U.A.E, Saudi Arabia, Egypt, South Africa, Israel, and the rest of the Middle East and Africa.

Asia-Pacific dominates the molecular sieves market owing to growing urbanization and rapid industrialization over the coming years.

Europe is expected to be the fastest growing market during the forecast period of 2023 to 2030, owing to the high growth of various end-use industries, such as packaging, oil and gas, automotive, and coatings.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Molecular Sieves Market Share Analysis

The molecular sieves market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the molecular sieves market.

Some of the major players operating in the molecular sieves market are:

- Honeywell International Inc. (U.S.)

- BASF SE (Germany)

- Clariant AG (Switzerland)

- Tosoh Corporation (Japan)

- W. R. Grace & Co.-Conn. (U.S.)

- SHOWA DENKO K.K. (Japan)

- ZEOCHEM AG (Switzerland)

- KNT Group (South Korea)

- Arkema (France)

- PQ Corporation (U.S.)

- CWK Chemiewerk Bad Köstritz GmbH (Germany)

- NALCO India (India)

- Dalian Haixin Chemical Industrial Co., Ltd. (China)

- Sorbead India (India)

- Rive Technology (U.S.)

- ANTEN CHEMICAL CO., LTD. (Taiwan)

- Industrias Químicas del Ebro, S.A. (Spain)

- International Zeolite Corp (Canada)

- St. Cloud Mining (U.S.)

- Huiying Chemical Industry (Xiamen) Co., Ltd. (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MOLECULAR SIEVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MOLECULAR SIEVES MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL MOLECULAR SIEVES MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 IMPORT EXPORT SCENARIO

5.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.4 PORTER’S FIVE FORCES

5.5 VENDOR SELECTION CRITERIA

5.6 PESTEL ANALYSIS

5.7 REGULATION COVERAGE

5.7.1 PRODUCT CODES

5.7.2 CERTIFIED STANDARDS

5.7.3 SAFETY STANDARDS

5.7.3.1. MATERIAL HANDLING & STORAGE

5.7.3.2. TRANSPORT & PRECAUTIONS

5.7.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 GLOBAL MOLECULAR SIEVES MARKET, BY PRODUCT, 2021-2030, (USD MILLION) (KILO TONS)

9.1 OVERVIEW

9.2 4A

9.3 3A

9.4 5A

9.5 10A

9.6 13X

9.7 CARBON MOLECULAR SIEVE

9.8 ZEOLITE Y

9.9 OTHERS

10 GLOBAL MOLECULAR SIEVES MARKET, BY SIZE, 2021-2030, (USD MILLION)

10.1 OVERVIEW

10.2 MICROPOROUS

10.3 MESOPOROUS

10.4 MACROPOROUS

11 GLOBAL MOLECULAR SIEVES MARKET, BY FORM, 2021-2030, (USD MILLION)

11.1 OVERVIEW

11.2 BEADS

11.3 PELLETS

11.4 POWDERS

11.5 OTHERS (IF ANY)

12 GLOBAL MOLECULAR SIEVES MARKET, BY MATERIAL, 2021-2030, (USD MILLION)

12.1 OVERVIEW

12.2 ACTIVATED CARBON

12.3 CLAY

12.4 POROUS GLASS

12.5 SILICA GEL

12.6 ZEOLITE

12.7 OTHERS

13 GLOBAL MOLECULAR SIEVES MARKET, BY APPLICATION, 2021-2030, (USD MILLION)

13.1 OVERVIEW

13.2 GAS PURIFICATION

13.2.1 GAS PURIFICATION, BY APPLICATION

13.2.1.1. NATURAL GAS

13.2.1.2. INDUSTRIAL GASES (NON-MEDICAL)

13.2.2 GAS PURIFIUCATION, BY MOLECULAR SIEVE TYPE

13.2.2.1. 4A

13.2.2.2. 3A

13.2.2.3. 5A

13.2.2.4. 10A

13.2.2.5. 13X

13.2.2.6. CARBON MOLECULAR SIEVE

13.2.2.7. ZEOLITE Y

13.2.2.8. OTHERS

13.3 MEDICAL OXYGEN

13.3.1 MEDICAL OVYGEN, BY APPLICATION

13.3.1.1. PRODUCTION

13.3.1.2. CONCENTRATORS

13.3.2 MEDICAL, BY MOLECULAR SIEVE TYPE

13.3.2.1. 4A

13.3.2.2. 3A

13.3.2.3. 5A

13.3.2.4. 10A

13.3.2.5. 13X

13.3.2.6. CARBON MOLECULAR SIEVE

13.3.2.7. ZEOLITE Y

13.3.2.8. OTHERS

13.4 ENERGY

13.4.1 ENERGY, BY CATEGORY

13.4.1.1. ENERGY STORAGE

13.4.1.2. ENERGY COOLING

13.4.1.3. ENERGY HEATING

13.4.2 ENERGY, BY MOLECULAR SIEVE TYPE

13.4.2.1. 4A

13.4.2.2. 3A

13.4.2.3. 5A

13.4.2.4. 10A

13.4.2.5. 13X

13.4.2.6. CARBON MOLECULAR SIEVE

13.4.2.7. ZEOLITE Y

13.4.2.8. OTHERS

13.5 REFINING AND PETROCHEMICALS

13.5.1 REFINING AND PETROCHEMICALS, BY MOLECULAR SIEVE TYPE

13.5.1.1. 4A

13.5.1.2. 3A

13.5.1.3. 5A

13.5.1.4. 10A

13.5.1.5. 13X

13.5.1.6. CARBON MOLECULAR SIEVE

13.5.1.7. ZEOLITE Y

13.5.1.8. OTHERS

13.6 CHEMICAL INDUSTRY

13.6.1 CHEMICAL INDUSTRY, BY APPLICATION

13.6.1.1. BULK CHEMICALS

13.6.1.2. SPECIALTY CHEMICALS

13.6.1.2.1. COATINGS

13.6.1.2.2. ADHESIVES

13.6.1.2.3. SEALANTS

13.6.1.2.4. ELASTOMERS

13.6.2 CHEMICAL INDUSTRY, BY MOLECULAR SIEVE TYPE

13.6.2.1. 4A

13.6.2.2. 3A

13.6.2.3. 5A

13.6.2.4. 10A

13.6.2.5. 13X

13.6.2.6. CARBON MOLECULAR SIEVE

13.6.2.7. ZEOLITE Y

13.6.2.8. OTHERS

13.7 AIR/ SEWAGE PURIFICATION

13.7.1 AIR / SEWAGE PURIFICATION, BY MOLECULAR SIEVE TYPE

13.7.1.1. 4A

13.7.1.2. 3A

13.7.1.3. 5A

13.7.1.4. 10A

13.7.1.5. 13X

13.7.1.6. CARBON MOLECULAR SIEVE

13.7.1.7. ZEOLITE Y

13.7.1.8. OTHERS

13.8 REFERIGERATION

13.8.1 REFERIGERATION, BY MOLECULAR SIEVE TYPE

13.8.1.1. 4A

13.8.1.2. 3A

13.8.1.3. 5A

13.8.1.4. 10A

13.8.1.5. 13X

13.8.1.6. CARBON MOLECULAR SIEVE

13.8.1.7. ZEOLITE Y

13.8.1.8. OTHERS

13.9 ABSORBANTS

13.9.1 ABSORBANTS, BY MOLECULAR SIEVE TYPE

13.9.1.1. 4A

13.9.1.2. 3A

13.9.1.3. 5A

13.9.1.4. 10A

13.9.1.5. 13X

13.9.1.6. CARBON MOLECULAR SIEVE

13.9.1.7. ZEOLITE Y

13.9.1.8. OTHERS

13.1 BUILDING & CONSTRUCTION

13.10.1 BUILDING & CONSTRUCTION, BY UTILITY

13.10.1.1. RESIDENTIAL

13.10.1.2. COMMERCIAL

13.10.2 BUILDING & CONSTRUCTION, BY MOLECULAR SIEVE TYPE

13.10.2.1. 4A

13.10.2.2. 3A

13.10.2.3. 5A

13.10.2.4. 10A

13.10.2.5. 13X

13.10.2.6. CARBON MOLECULAR SIEVE

13.10.2.7. ZEOLITE Y

13.10.2.8. OTHERS

13.11 PHARMACEUTICAL

13.11.1 PHARMACEUTICAL, BY MOLECULAR SIEVE TYPE

13.11.1.1. 4A

13.11.1.2. 3A

13.11.1.3. 5A

13.11.1.4. 10A

13.11.1.5. 13X

13.11.1.6. CARBON MOLECULAR SIEVE

13.11.1.7. ZEOLITE Y

13.11.1.8. OTHERS

13.12 DETERGENTS AND COSMETICS

13.12.1 DETERGENTS AND COSMETICS, BY MOLECULAR SIEVE TYPE

13.12.1.1. 4A

13.12.1.2. 3A

13.12.1.3. 5A

13.12.1.4. 10A

13.12.1.5. 13X

13.12.1.6. CARBON MOLECULAR SIEVE

13.12.1.7. ZEOLITE Y

13.12.1.8. OTHERS

13.13 WASTE WATER TREATMENT / EFFLUENT TREATMENT

13.13.1 WASTE WATER TREATMENT / EFFLUENT TREATMENT, BY MOLECULAR SIEVE TYPE

13.13.1.1. 4A

13.13.1.2. 3A

13.13.1.3. 5A

13.13.1.4. 10A

13.13.1.5. 13X

13.13.1.6. CARBON MOLECULAR SIEVE

13.13.1.7. ZEOLITE Y

13.13.1.8. OTHERS

13.14 AGRICULTURAL PRODUCTS

13.14.1 AGRICULTURAL PRODUCTS, BY MOLECULAR SIEVE TYPE

13.14.1.1. 4A

13.14.1.2. 3A

13.14.1.3. 5A

13.14.1.4. 10A

13.14.1.5. 13X

13.14.1.6. CARBON MOLECULAR SIEVE

13.14.1.7. ZEOLITE Y

13.14.1.8. OTHERS

13.15 AUTOMOTIVE

13.15.1 AUTOMOTIVE, BY MOLECULAR SIEVE TYPE

13.15.1.1. 4A

13.15.1.2. 3A

13.15.1.3. 5A

13.15.1.4. 10A

13.15.1.5. 13X

13.15.1.6. CARBON MOLECULAR SIEVE

13.15.1.7. ZEOLITE Y

13.15.1.8. OTHERS

13.16 NUCLEAR INDUSTRY

13.16.1 NUCLEAR INDUSTRY, BY MOLECULAR SIEVE TYPE

13.16.1.1. 4A

13.16.1.2. 3A

13.16.1.3. 5A

13.16.1.4. 10A

13.16.1.5. 13X

13.16.1.6. CARBON MOLECULAR SIEVE

13.16.1.7. ZEOLITE Y

13.16.1.8. OTHERS

13.17 FOOD AND BEVERAGE

13.17.1 FOOD AND BEVERAGE, BY MOLECULAR SIEVE TYPE

13.17.1.1. 4A

13.17.1.2. 3A

13.17.1.3. 5A

13.17.1.4. 10A

13.17.1.5. 13X

13.17.1.6. CARBON MOLECULAR SIEVE

13.17.1.7. ZEOLITE Y

13.17.1.8. OTHERS

13.18 PACKAGING

13.18.1 PACKAGING, BY MOLECULAR SIEVE TYPE

13.18.1.1. 4A

13.18.1.2. 3A

13.18.1.3. 5A

13.18.1.4. 10A

13.18.1.5. 13X

13.18.1.6. CARBON MOLECULAR SIEVE

13.18.1.7. ZEOLITE Y

13.18.1.8. OTHERS

13.19 OTHERS

14 GLOBAL MOLECULAR SIEVES MARKET, BY GEOGRAPHY, 2021-2030 (USD MILLION) (KILO TONS)

GLOBAL MOLECULAR SIEVES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 U.K.

14.2.3 ITALY

14.2.4 FRANCE

14.2.5 SPAIN

14.2.6 SWITZERLAND

14.2.7 RUSSIA

14.2.8 TURKEY

14.2.9 BELGIUM

14.2.10 NETHERLANDS

14.2.11 SWITZERLAND

14.2.12 DENMARK

14.2.13 NORWAY

14.2.14 FINLAND

14.2.15 SWEDEN

14.2.16 REST OF EUROPE

14.3 ASIA-PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 SINGAPORE

14.3.6 THAILAND

14.3.7 INDONESIA

14.3.8 MALAYSIA

14.3.9 PHILIPPINES

14.3.10 AUSTRALIA

14.3.11 NEW ZEALAND

14.3.12 HONG KONG

14.3.13 TAIWAN

14.3.14 REST OF ASIA-PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 EGYPT

14.5.3 SAUDI ARABIA

14.5.4 UNITED ARAB EMIRATES

14.5.5 ISRAEL

14.5.6 BAHRAIN

14.5.7 KUWAIT

14.5.8 OMAN

14.5.9 QATAR

14.5.10 REST OF MIDDLE EAST AND AFRICA

15 GLOBAL MOLECULAR SIEVES MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL MOLECULAR SIEVES MARKET – COMPANY PROFILE

16.1 ARKEMA

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 PRODUCTION CAPACITY OVERVIEW

16.1.4 SWOT ANALYSIS

16.1.5 REVENUE ANALYSIS

16.1.6 RECENT UPDATES

16.2 AXENS

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 PRODUCTION CAPACITY OVERVIEW

16.2.4 SWOT ANALYSIS

16.2.5 REVENUE ANALYSIS

16.2.6 RECENT UPDATES

16.3 BASF SE

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 PRODUCTION CAPACITY OVERVIEW

16.3.4 SWOT ANALYSIS

16.3.5 REVENUE ANALYSIS

16.3.6 RECENT UPDATES

16.4 CLARIANT

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 PRODUCTION CAPACITY OVERVIEW

16.4.4 SWOT ANALYSIS

16.4.5 REVENUE ANALYSIS

16.4.6 RECENT UPDATES

16.5 HONEYWELL CORPORATION INC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 PRODUCTION CAPACITY OVERVIEW

16.5.4 SWOT ANALYSIS

16.5.5 REVENUE ANALYSIS

16.5.6 RECENT UPDATES

16.6 DALIAN ABSORTBENT CO. LTD

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 PRODUCTION CAPACITY OVERVIEW

16.6.4 SWOT ANALYSIS

16.6.5 REVENUE ANALYSIS

16.6.6 RECENT UPDATES

16.7 DESICCA CHEMICALS PVT. LTD

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 PRODUCTION CAPACITY OVERVIEW

16.7.4 SWOT ANALYSIS

16.7.5 REVENUE ANALYSIS

16.7.6 RECENT UPDATES

16.8 HENGYE INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 PRODUCTION CAPACITY OVERVIEW

16.8.4 SWOT ANALYSIS

16.8.5 REVENUE ANALYSIS

16.8.6 RECENT UPDATES

16.9 JIUZHOU CHEMICALS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 PRODUCTION CAPACITY OVERVIEW

16.9.4 SWOT ANALYSIS

16.9.5 REVENUE ANALYSIS

16.9.6 RECENT UPDATES

16.1 KNT GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 PRODUCTION CAPACITY OVERVIEW

16.10.4 SWOT ANALYSIS

16.10.5 REVENUE ANALYSIS

16.10.6 RECENT UPDATES

16.11 KURARAY CO. LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 PRODUCTION CAPACITY OVERVIEW

16.11.4 SWOT ANALYSIS

16.11.5 REVENUE ANALYSIS

16.11.6 RECENT UPDATES

16.12 LUOYANG JALON MICRO-NANO NEW MATERIALS CO. LTD

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 PRODUCTION CAPACITY OVERVIEW

16.12.4 SWOT ANALYSIS

16.12.5 REVENUE ANALYSIS

16.12.6 RECENT UPDATES

16.13 MERCK KGAA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 PRODUCTION CAPACITY OVERVIEW

16.13.4 SWOT ANALYSIS

16.13.5 REVENUE ANALYSIS

16.13.6 RECENT UPDATES

16.14 SHOWA DENKO K.K.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 PRODUCTION CAPACITY OVERVIEW

16.14.4 SWOT ANALYSIS

16.14.5 REVENUE ANALYSIS

16.14.6 RECENT UPDATES

16.15 SORBEAD INDIA

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 PRODUCTION CAPACITY OVERVIEW

16.15.4 SWOT ANALYSIS

16.15.5 REVENUE ANALYSIS

16.15.6 RECENT UPDATES

16.16 TOSOH CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 PRODUCTION CAPACITY OVERVIEW

16.16.4 SWOT ANALYSIS

16.16.5 REVENUE ANALYSIS

16.16.6 RECENT UPDATES

16.17 W. R. GRACE & CO.-CONN.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 PRODUCTION CAPACITY OVERVIEW

16.17.4 SWOT ANALYSIS

16.17.5 REVENUE ANALYSIS

16.17.6 RECENT UPDATES

16.18 ZEOCHEM AG

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 PRODUCTION CAPACITY OVERVIEW

16.18.4 SWOT ANALYSIS

16.18.5 REVENUE ANALYSIS

16.18.6 RECENT UPDATES

16.19 ZEOLYST INTERNATIONAL

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 PRODUCTION CAPACITY OVERVIEW

16.19.4 SWOT ANALYSIS

16.19.5 REVENUE ANALYSIS

16.19.6 RECENT UPDATES

16.2 INTERRA GLOBAL

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 PRODUCTION CAPACITY OVERVIEW

16.20.4 SWOT ANALYSIS

16.20.5 REVENUE ANALYSIS

16.20.6 RECENT UPDATES

16.21 JAXON FILTRATION

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 PRODUCTION CAPACITY OVERVIEW

16.21.4 SWOT ANALYSIS

16.21.5 REVENUE ANALYSIS

16.21.6 RECENT UPDATES

16.22 FUJIFILM GROUP

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 PRODUCTION CAPACITY OVERVIEW

16.22.4 SWOT ANALYSIS

16.22.5 REVENUE ANALYSIS

16.22.6 RECENT UPDATES

16.23 CWK CHEMIEWERK BAD KÖSTRITZ GMBH

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 PRODUCTION CAPACITY OVERVIEW

16.23.4 SWOT ANALYSIS

16.23.5 REVENUE ANALYSIS

16.23.6 RECENT UPDATES

16.24 NALCO INDIA

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 PRODUCTION CAPACITY OVERVIEW

16.24.4 SWOT ANALYSIS

16.24.5 REVENUE ANALYSIS

16.24.6 RECENT UPDATES

16.25 DALIAN HAIXIN CHEMICAL CO., LTD

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 PRODUCTION CAPACITY OVERVIEW

16.25.4 SWOT ANALYSIS

16.25.5 REVENUE ANALYSIS

16.25.6 RECENT UPDATES

16.26 ANTENCHEM

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 PRODUCTION CAPACITY OVERVIEW

16.26.4 SWOT ANALYSIS

16.26.5 REVENUE ANALYSIS

16.26.6 RECENT UPDATES

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Molecular Sieves Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Molecular Sieves Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Molecular Sieves Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.