Global Motion Sensor Market

Market Size in USD Billion

CAGR :

%

USD

8.50 Billion

USD

14.99 Billion

2024

2032

USD

8.50 Billion

USD

14.99 Billion

2024

2032

| 2025 –2032 | |

| USD 8.50 Billion | |

| USD 14.99 Billion | |

|

|

|

|

Motion Sensor Market Size

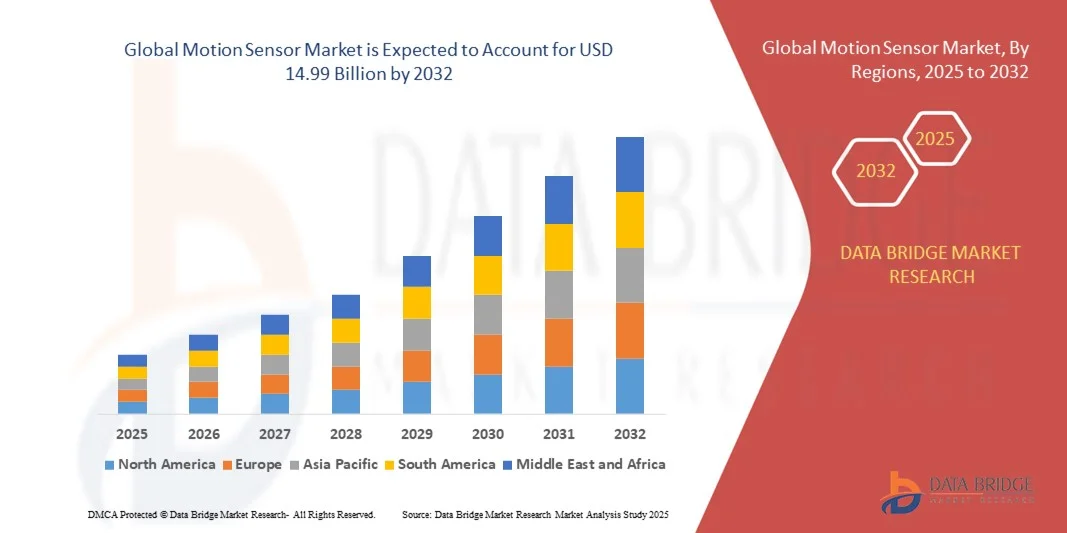

- The global motion sensor market size was valued at USD 8.50 billion in 2024 and is expected to reach USD 14.99 billion by 2032, at a CAGR of 7.35% during the forecast period

- The market growth is largely fuelled by the rising demand for automation across industries, including consumer electronics, automotive, and industrial manufacturing

- Increasing adoption of smart home technologies, surveillance systems, and IoT-enabled devices is significantly contributing to the widespread use of motion sensors for safety and energy efficiency

Motion Sensor Market Analysis

- The motion sensor market is witnessing robust growth due to its expanding role in applications such as security systems, gaming, robotics, and healthcare monitoring

- The growing integration of motion detection features in smartphones, wearables, and smart appliances is reshaping user experiences through enhanced interactivity and convenience

- North America dominated the motion sensor market with the largest revenue share of 38.67% in 2024, driven by the growing adoption of smart devices, automation technologies, and IoT-based systems across multiple industries. The demand for motion sensors is particularly strong in consumer electronics and automotive applications, supported by high technology penetration and robust industrial automation infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global motion sensor market, driven by expansion of consumer electronics production, growing adoption of smart home technologies, and rising investments in industrial automation and automotive innovation

- The active segment held the largest market revenue share in 2024, driven by its ability to emit energy in the form of ultrasonic waves or microwaves and detect reflections to sense motion with high accuracy. Active motion sensors are widely used in automatic doors, industrial automation systems, and security applications due to their superior range and reliability under various environmental conditions

Report Scope and Motion Sensor Market Segmentation

|

Attributes |

Motion Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• STMicroelectronics (Switzerland) |

|

Market Opportunities |

• Integration Of Motion Sensors In Smart Home Ecosystems |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Motion Sensor Market Trends

Integration Of Motion Sensors In Smart Home Devices

- The growing adoption of smart home technologies is significantly transforming the motion sensor market, as these sensors serve as a core component for home automation and security systems. Their ability to detect movement and trigger automated responses enhances convenience, safety, and energy efficiency across residential settings. With the rise of connected living, consumers are increasingly integrating motion sensors into smart lighting and security systems to create personalized, energy-efficient environments that adapt to user behavior in real time

- Increasing consumer demand for intelligent lighting, intrusion detection, and energy-saving applications is fuelling the use of motion sensors in connected devices. Motion-activated systems reduce energy consumption and provide seamless control over lighting, HVAC, and surveillance systems. This growing demand is supported by global sustainability goals and government initiatives encouraging smart building infrastructure adoption to reduce carbon footprints and enhance occupant comfort

- Advancements in miniaturization and wireless communication technologies are allowing manufacturers to integrate motion sensors into compact and multi-functional smart home devices. This has expanded their use beyond security into everyday applications, including smart speakers, appliances, and entertainment systems. The trend toward compact, multifunctional, and low-power sensors is enabling device manufacturers to develop sleeker designs with enhanced responsiveness and user customization features

- For instance, in 2024, several global electronics brands introduced next-generation smart home cameras equipped with high-precision PIR and ultrasonic motion sensors to improve motion detection accuracy while reducing false alarms. This innovation enhanced home security and increased consumer confidence in automated systems. Such developments demonstrate the market’s shift toward intelligent sensing solutions that combine AI analytics with real-time motion detection to improve efficiency and reliability

- While motion sensors are becoming integral to smart homes, their effectiveness depends on continued innovation in sensing technologies, energy management, and AI-based analytics. Manufacturers are increasingly focusing on user-centric design and compatibility with multi-platform ecosystems to strengthen market growth. Collaborative efforts between sensor developers and smart home ecosystem providers are also promoting interoperability, ensuring a smooth and connected user experience across devices

Motion Sensor Market Dynamics

Driver

Rising Demand For Consumer Electronics And IoT Devices

- The proliferation of smartphones, wearable devices, and IoT-enabled gadgets is a major driver for the motion sensor market. These sensors play a critical role in enabling functionalities such as gesture control, screen rotation, fitness tracking, and augmented reality applications. The continuous expansion of IoT ecosystems in both industrial and consumer domains is creating new avenues for motion sensing technologies, particularly for automation and smart living solutions

- Consumers’ increasing preference for motion-enabled features that enhance convenience and interactivity is boosting demand for MEMS-based motion sensors, which offer high precision and low power consumption. The integration of these sensors in everyday devices has become a key differentiator for product performance and user experience. This trend aligns with growing expectations for personalized and intelligent device functionalities, reinforcing the need for advanced motion detection accuracy and seamless connectivity

- Technological advancements such as sensor fusion and AI integration are improving motion detection accuracy and responsiveness. This evolution supports advanced functionalities in gaming consoles, VR/AR systems, and autonomous devices, driving sustained adoption across multiple industries. Sensor fusion technology, which combines data from multiple sensors, is particularly valuable for creating more precise, context-aware motion tracking systems across consumer and industrial applications

- For instance, in 2023, leading smartphone manufacturers incorporated multi-axis motion sensors to improve activity recognition and power efficiency in fitness tracking applications. This innovation strengthened sensor demand within the consumer electronics ecosystem. The adoption of multi-axis sensors not only enhances device capabilities but also paves the way for the integration of real-time analytics and predictive monitoring features in connected devices

- While the growing IoT network continues to expand motion sensor deployment, manufacturers must address issues related to data privacy, signal interference, and power optimization to ensure long-term adoption across sectors. Continued focus on miniaturization and improved communication protocols will be critical for supporting the next generation of compact, energy-efficient devices with seamless sensor integration

Restraint/Challenge

High Production Cost And Sensor Integration Complexity

- The high production and calibration costs associated with advanced motion sensors, particularly those using MEMS and infrared technologies, pose a significant challenge for manufacturers. These costs often translate into higher product prices, limiting affordability in cost-sensitive markets. Moreover, fluctuating raw material prices and manufacturing precision requirements contribute to increased production costs, putting pressure on profit margins and limiting scalability for smaller firms

- Integrating motion sensors into compact electronic devices requires precision engineering and complex calibration to maintain performance accuracy. Variations in temperature, pressure, and electromagnetic interference can impact sensor reliability, increasing the need for quality control and testing infrastructure. Manufacturers are required to balance miniaturization with performance stability, a challenge that adds to development costs and extends product testing cycles

- The complexity of integrating multi-sensor systems with AI and connectivity modules also increases development time and cost. This is particularly challenging for small and mid-sized manufacturers with limited R&D budgets. To overcome these barriers, companies are investing in modular designs and standardized sensor interfaces that allow easier integration across platforms while reducing development timelines

- For instance, in 2024, several component manufacturers reported production delays due to supply chain disruptions in MEMS components, further escalating costs and affecting timely delivery to electronics producers. Such disruptions have highlighted the need for supply chain diversification and local sourcing to mitigate dependency on limited suppliers of critical sensor components

- While innovation and automation are gradually reducing manufacturing costs, overcoming integration challenges remains essential. Companies must invest in advanced fabrication processes and standardized platforms to achieve scalable, cost-effective sensor deployment. Strategic partnerships with technology providers and government support for domestic manufacturing can also help drive cost reduction and ensure sustainable market growth

Motion Sensor Market Scope

The global motion sensor market is segmented on the basis of motion technology, embedded sensor, function, and application.

- By Motion Technology

On the basis of motion technology, the motion sensor market is segmented into active, passive, and others. The active segment held the largest market revenue share in 2024, driven by its ability to emit energy in the form of ultrasonic waves or microwaves and detect reflections to sense motion with high accuracy. Active motion sensors are widely used in automatic doors, industrial automation systems, and security applications due to their superior range and reliability under various environmental conditions.

The passive segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the growing use of passive infrared (PIR) sensors in smart homes and lighting systems. These sensors consume less power and offer cost-effective motion detection, making them ideal for residential and commercial applications. Their ability to detect body heat and movement without emitting energy contributes to their increasing adoption in energy-efficient and security-focused systems.

- By Embedded Sensor

On the basis of embedded sensor, the motion sensor market is segmented into MEMS accelerometer, MEMS gyroscope, MEMS magnetometer, and sensor combos. The MEMS accelerometer segment dominated the market in 2024 due to its extensive use in smartphones, wearables, and automotive safety systems for detecting orientation, vibration, and movement. The compact size, low power consumption, and precision of MEMS accelerometers make them a preferred choice across multiple industries.

The sensor combos segment is projected to register notable growth from 2025 to 2032, driven by the increasing integration of multi-axis sensors to provide comprehensive motion tracking and enhanced accuracy. Combining accelerometers, gyroscopes, and magnetometers allows improved performance in navigation, gaming, and virtual reality systems, which is boosting demand for advanced combo sensors.

- By Function

On the basis of function, the motion sensor market is segmented into fully-automatic and semi-automatic. The fully-automatic segment accounted for the largest market share in 2024, owing to its growing use in smart lighting, security systems, and consumer electronics that require instant and autonomous response to motion. Fully-automatic sensors enhance convenience, safety, and energy efficiency by eliminating manual intervention in motion-based operations.

The semi-automatic segment is projected to register notable growth from 2025 to 2032, supported by its increasing application in industrial automation and automotive systems where controlled human-machine interaction is required. These sensors offer higher precision and flexibility, enabling customized responses depending on operational needs.

- By Application

On the basis of application, the motion sensor market is segmented into consumer electronics, automotive application, industrial application, healthcare, commercial, residential, aerospace & defence, and others. The consumer electronics segment held the largest market revenue share in 2024, primarily due to widespread sensor adoption in smartphones, gaming devices, and wearable gadgets. Motion sensors are key components in enhancing user experience through features such as gesture control, screen rotation, and fitness tracking.

The automotive application segment is projected to register notable growth from 2025 to 2032, driven by the increasing integration of motion sensors in advanced driver assistance systems (ADAS), airbag deployment systems, and vehicle stability control. The rising demand for autonomous and connected vehicles is further accelerating the adoption of motion sensing technologies across the automotive industry.

Motion Sensor Market Regional Analysis

• North America dominated the motion sensor market with the largest revenue share of 38.67% in 2024, driven by the growing adoption of smart devices, automation technologies, and IoT-based systems across multiple industries. The demand for motion sensors is particularly strong in consumer electronics and automotive applications, supported by high technology penetration and robust industrial automation infrastructure

• The region’s technological leadership and strong presence of major electronics manufacturers further strengthen its market dominance. Increasing investments in smart homes, industrial automation, and security surveillance systems are propelling the demand for motion sensors across both residential and commercial sectors

• Moreover, the region’s focus on innovation, coupled with advancements in MEMS technology and AI integration, continues to enhance product efficiency and market growth, positioning North America as a key hub for sensor innovation and deployment

U.S. Motion Sensor Market Insight

The U.S. motion sensor market captured the largest revenue share in 2024 within North America, driven by rapid adoption of automation technologies across manufacturing, automotive, and consumer electronics sectors. Motion sensors are increasingly used in smart home devices, autonomous vehicles, and industrial robots, contributing to energy savings and operational efficiency. The strong ecosystem of IoT device manufacturers and continued government initiatives toward digital transformation are further strengthening the market landscape. In addition, growing demand for advanced safety and security systems in both residential and commercial applications is expected to sustain market growth over the forecast period

Europe Motion Sensor Market Insight

The Europe motion sensor market is expected to witness steady growth from 2025 to 2032, driven by stringent safety regulations, increasing adoption of Industry 4.0 technologies, and demand for energy-efficient automation solutions. The rise in smart home installations and connected vehicle technologies across the region is significantly contributing to market expansion. European consumers and industries are prioritizing sustainability, leading to a higher focus on motion-enabled energy-saving systems. Moreover, the growing use of motion sensors in healthcare and security systems further boosts market adoption across diverse applications

U.K. Motion Sensor Market Insight

The U.K. motion sensor market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing investments in smart infrastructure, home automation, and industrial modernization. The rise in demand for security and surveillance systems, alongside the growing popularity of IoT-enabled devices, is driving sensor adoption. The U.K.’s ongoing digital transformation initiatives and advancements in robotics, transportation, and defense sectors are creating new opportunities for motion sensor integration across applications

Germany Motion Sensor Market Insight

The Germany motion sensor market is expected to witness robust growth from 2025 to 2032, supported by the country’s strong industrial base and leadership in automotive and manufacturing technologies. The demand for high-performance motion sensors is rising due to advancements in autonomous vehicles, industrial robotics, and smart factory systems. Germany’s commitment to technological innovation and sustainability, combined with its emphasis on precision engineering, continues to promote the adoption of MEMS-based motion sensors across multiple industries

Asia-Pacific Motion Sensor Market Insight

The Asia-Pacific motion sensor market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, expanding consumer electronics production, and strong government support for smart manufacturing. Countries such as China, Japan, South Korea, and India are leading contributors, with growing adoption of automation technologies in factories and vehicles. The rising penetration of smartphones, wearables, and IoT-enabled systems is further accelerating market growth. In addition, favorable manufacturing costs and the presence of major semiconductor suppliers enhance the region’s competitive advantage

Japan Motion Sensor Market Insight

The Japan motion sensor market is expected to witness significant growth from 2025 to 2032, attributed to the country’s advanced electronics industry, strong focus on automation, and high demand for compact, energy-efficient sensors. Japan’s aging population and technological innovation drive the adoption of motion sensors in healthcare, robotics, and smart home applications. The integration of AI and sensor fusion technologies is enhancing performance accuracy, supporting the development of next-generation automation systems across industries

China Motion Sensor Market Insight

The China motion sensor market accounted for the largest revenue share in Asia Pacific in 2024, driven by its dominant position in global electronics manufacturing and rapid growth in the automotive and industrial sectors. The country’s expanding smart device production, government initiatives promoting industrial automation, and increasing use of smart city infrastructure are key growth drivers. Domestic manufacturers are focusing on cost-effective, high-performance motion sensors to meet growing demand across consumer electronics, robotics, and security applications, further strengthening China’s leadership in the regional market

Motion Sensor Market Share

The Motion Sensor industry is primarily led by well-established companies, including:

• STMicroelectronics (Switzerland)

• Murata Manufacturing Co., Ltd. (Japan)

• Honeywell International Inc. (U.S.)

• Freescale Semiconductor, Inc. (U.S.)

• Analog Devices, Inc. (U.S.)

• Microchip Technology Inc. (U.S.)

• TDK Corporation (Japan)

• Panasonic Corporation (Japan)

• NXP Semiconductors (Netherlands)

• Safran Colibrys SA (Switzerland)

• Sensinova (India)

• Vernier Software & Technology (U.S.)

• Theben AG (Germany)

Latest Developments in Global Motion Sensor Market

- In April 2024, Aqara introduced its latest innovation, the Motion and Light Sensor P2, featuring the advanced Thread protocol and full compliance with the Matter standard. This development aims to enhance cross-platform interoperability across major smart home ecosystems such as Amazon Alexa, Apple Home, Google Home, and Samsung SmartThings. With Matter’s local networking capabilities, the P2 offers faster response times and improved reliability. This launch is expected to strengthen Aqara’s presence in the smart home market by addressing growing consumer demand for seamless and efficient motion sensing solutions

- In March 2024, Sentech, Inc. completed the acquisition of Xensor, LLC’s assets, a company specializing in advanced magnetic position measurement technologies such as Hall Effect and proximity sensors. This strategic acquisition expands Sentech’s industrial sensor portfolio and enhances its technological capabilities in precision sensing applications. The move is expected to improve the company’s competitive edge, foster innovation in sensor solutions, and positively impact the global motion sensor market by advancing integration and performance standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Motion Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Motion Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Motion Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.