Global Motorcycle Drive Chain Market

Market Size in USD Billion

CAGR :

%

USD

5.47 Billion

USD

8.54 Billion

2025

2033

USD

5.47 Billion

USD

8.54 Billion

2025

2033

| 2026 –2033 | |

| USD 5.47 Billion | |

| USD 8.54 Billion | |

|

|

|

|

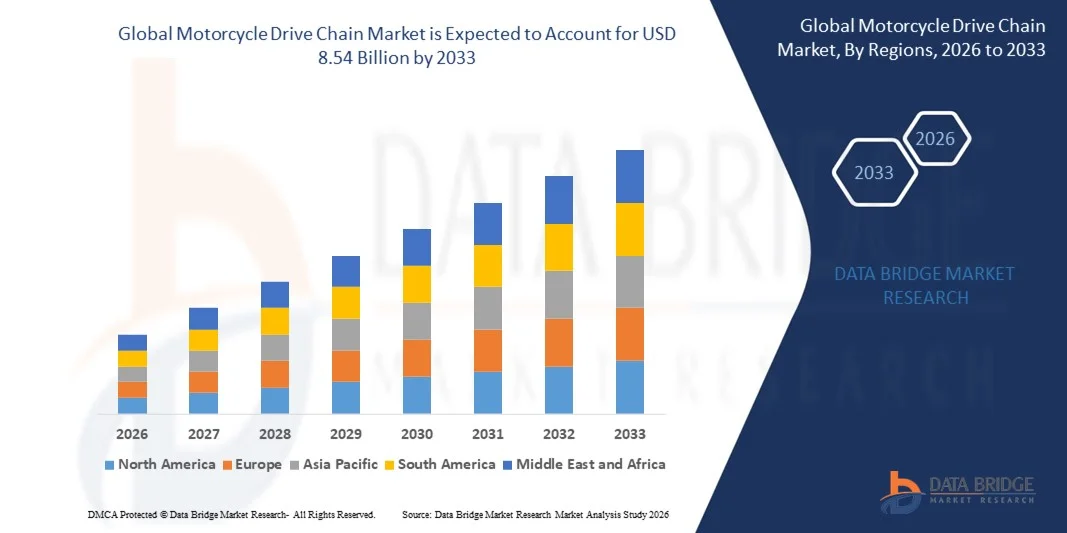

What is the Global Motorcycle Drive Chain Market Size and Growth Rate?

- The global motorcycle drive chain market size was valued at USD 5.47 billion in 2025 and is expected to reach USD 8.54 billion by 2033, at a CAGR of5.72% during the forecast period

- Increasing purchasing power of rural area population and lack of a well-established public transport system, the demand for motorcycles and scooters has considerably increased in rural areas is the main driving factor for the growth of motorcycle drive chain market

- High demand for two wheelers and its accessories is also a driving factor for the motorcycle drive chain market

What are the Major Takeaways of Motorcycle Drive Chain Market?

- Affordable price brackets for middle-class buyers, low environmental impact, associated freedom of movement in crowded urban environments and ease of parking is an opportunity for the growth of motorcycle drive chain market

- Need of regular maintenance is a challenge for the motorcycle drive chain market. However, increasing government initiatives and stringent emission norms, electric bikes are gaining popularity is the main restraint for the growth of motorcycle drive chain market

- Asia-Pacific dominated the motorcycle drive chain market with a 37.37% revenue share in 2025, driven by strong growth in motorcycle manufacturing, two-wheeler adoption, and rising demand for high-performance chains across China, India, Japan, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 9.74% from 2026 to 2033, driven by rising motorcycle sales, aftermarket customization trends, and growth in sports and touring motorcycles across the U.S. and Canada

- The Standard motorcycle segment dominated the market with a 40.2% share in 2025, driven by high production volume, cost-effectiveness, and widespread adoption across urban and semi-urban regions

Report Scope and Motorcycle Drive Chain Market Segmentation

|

Attributes |

Motorcycle Drive Chain Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Motorcycle Drive Chain Market?

Increasing Shift Toward Lightweight, High-Performance, and Durable Motorcycle Drive Chains

- The motorcycle drive chain market is witnessing strong adoption of advanced materials, lightweight alloys, and high-strength steels designed to support high-speed, high-torque, and long-life performance for motorcycles, scooters, and electric two-wheelers

- Manufacturers are introducing O-ring, X-ring, and Z-ring chains that offer improved lubrication retention, reduced wear, enhanced corrosion resistance, and longer service intervals

- Growing demand for low-maintenance, energy-efficient, and noise-reducing drive chains is driving usage across consumer motorcycles, sport bikes, and off-road vehicles globally

- For instance, companies such as RK JAPAN, Tsubakimoto Chain, D.I.D, L.G. Balakrishnan & Bros, and Regina Catene have upgraded their product lines with high-performance coatings, precision-engineered rollers, and reinforced link plates

- Increasing adoption of electric motorcycles, high-performance racing bikes, and custom motorcycles is accelerating the shift toward compact, high-durability drive chains

- As motorcycles become faster, lighter, and more performance-driven, Motorcycle Drive Chains will remain essential for efficiency, safety, and long-term reliability

What are the Key Drivers of Motorcycle Drive Chain Market?

- Rising demand for high-durability, corrosion-resistant, and low-maintenance drive chains to support long-lasting performance across motorcycles, scooters, and electric two-wheelers

- For instance, in 2025, leading companies such as RK JAPAN, Tsubakimoto Chain, D.I.D, Schaeffler Group, and Regina Catene enhanced their chains with advanced O-ring, X-ring, and surface treatments for improved wear resistance

- Growing motorcycle sales, rising popularity of high-performance and electric two-wheelers, and increased adoption of off-road and racing bikes are boosting demand for reliable drive chains globally

- Innovations in materials, surface coatings, heat treatment, and precision engineering have strengthened chain durability, load-bearing capacity, and efficiency

- Rising use of motorcycles in emerging markets, along with adoption of premium sport and touring motorcycles in developed regions, is creating demand for performance-oriented chains

- Supported by steady investments in manufacturing technology, R&D, and aftermarket distribution, the motorcycle drive chain market is expected to witness robust long-term growth

Which Factor is Challenging the Growth of the Motorcycle Drive Chain Market?

- High costs associated with premium, high-performance chains restrict adoption among budget-conscious consumers and small-scale motorcycle operators

- For instance, during 2024–2025, fluctuations in raw material prices, especially steel and alloy costs, and supply chain disruptions increased manufacturing costs for several global vendors

- Complexity in selecting appropriate chain types, sizes, and maintenance methods increases the need for technical expertise among distributors, workshops, and riders

- Limited awareness in emerging markets regarding high-performance, long-life chains slows adoption of premium chains

- Competition from low-cost chains, belt drives, and shaft drives creates pricing pressure and reduces differentiation in the mass-market segment

- To address these challenges, companies are focusing on cost-efficient production, quality certifications, aftermarket service support, and targeted marketing to expand global adoption of motorcycle drive chains

How is the Motorcycle Drive Chain Market Segmented?

The market is segmented on the basis of types of motorcycle, chain type, engine capacity, material type, distribution channel, and sales channel.

- By Types of Motorcycle

On the basis of types of motorcycle, the market is segmented into Standard, Cruiser, Sports, and Off-road. The Standard motorcycle segment dominated the market with a 40.2% share in 2025, driven by high production volume, cost-effectiveness, and widespread adoption across urban and semi-urban regions. Standard motorcycles extensively use durable drive chains optimized for fuel efficiency, low maintenance, and long service life.

The Sports segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by rising demand for high-performance motorcycles, advanced suspension systems, and lightweight drive chains designed for speed, torque, and precision handling. Growth in motorsports, racing events, and consumer preference for sporty motorcycles accelerates adoption of specialized chains.

- By Types of Chain

On the basis of chain type, the market is segmented into Standard Rolling Chain, O-Ring Chain, and X-Ring Chain. The O-Ring Chain segment dominated with a 38.5% share in 2025, owing to superior lubrication retention, corrosion resistance, and longer operational life.

The X-Ring Chain segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by advanced surface coatings, enhanced tensile strength, and adoption in premium motorcycles, electric bikes, and high-speed two-wheelers. These chains reduce friction, improve durability, and minimize maintenance costs, making them ideal for both OEMs and aftermarket segments.

- By Engine Capacity

On the basis of engine capacity, the market is segmented into Up to 150 CC, 151–300 CC, 301–500 CC, and Above 500 CC. The Up to 150 CC segment dominated with a 42.1% share in 2025, supported by mass adoption in developing regions and cost-effective maintenance.

The Above 500 CC segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by high-performance motorcycles, cruisers, and sports bikes requiring robust, high-strength drive chains capable of handling high torque and speed.

- By Material Type

On the basis of material type, the market is segmented into Mild Steel, Cast Steel, and Cast Iron. The Mild Steel segment dominated with a 41.3% share in 2025, due to its cost-effectiveness, sufficient durability, and ease of manufacturing for standard motorcycles.

The Cast Steel segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by high-performance, racing, and heavy-duty motorcycles requiring stronger, more wear-resistant drive chains.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Online and Offline. The Offline segment dominated with a 45.6% share in 2025, supported by established dealership networks, OEM tie-ups, and motorcycle service centers.

The Online segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by e-commerce expansion, ease of ordering, and increasing awareness of premium drive chains among consumers.

- By Sales Channel

On the basis of sales channel, the market is segmented into Original Equipment Manufacturers (OEMs) and Aftermarket. The OEM segment dominated with a 46.2% share in 2025, due to integration of high-quality chains in new motorcycles at the factory level.

The Aftermarket segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising motorcycle ownership, increased replacement demand, and consumer preference for upgraded high-performance chains for durability and efficiency.

Which Region Holds the Largest Share of the Motorcycle Drive Chain Market?

- Asia-Pacific dominated the motorcycle drive chain market with a 37.37% revenue share in 2025, driven by strong growth in motorcycle manufacturing, two-wheeler adoption, and rising demand for high-performance chains across China, India, Japan, South Korea, and Southeast Asia. Rapid expansion of automotive production, increasing urban mobility, and government initiatives promoting local manufacturing fuel demand for durable and reliable motorcycle drive chains across OEMs, aftermarket, and industrial segments

- Leading companies in Asia-Pacific are introducing advanced, high-tensile, corrosion-resistant chains, optimized for both standard and high-performance motorcycles, strengthening the region’s technological advantage. Continuous investment in R&D, smart manufacturing, and material innovation supports long-term market expansion

- High production volumes, skilled labor availability, and robust supplier ecosystems further reinforce Asia-Pacific’s market leadership

China Motorcycle Drive Chain Market Insight

China is the largest contributor to Asia-Pacific, supported by world-leading two-wheeler production, high-volume manufacturing capabilities, and strong government backing for industrial innovation. Rising adoption of motorcycles, electric two-wheelers, and high-speed sports bikes drives demand for premium chains with enhanced durability, strength, and low-maintenance features. Local production efficiency and competitive pricing further expand both domestic and export market adoption.

India Motorcycle Drive Chain Market Insight

India contributes significantly due to growing motorcycle ownership, expanding OEM and aftermarket networks, and government-backed Make-in-India initiatives. Rising demand for commuter, sports, and off-road motorcycles fuels chain replacement and upgrade markets. Increasing adoption of high-performance and electric motorcycles accelerates demand for advanced drive chains across the country.

Japan Motorcycle Drive Chain Market Insight

Japan shows steady growth, supported by advanced precision manufacturing, high-quality standards, and widespread use of premium motorcycles. Demand for high-performance chains in sports and cruiser motorcycles continues to expand, driven by consumer preference for durability, efficiency, and low maintenance.

South Korea Motorcycle Drive Chain Market Insight

South Korea contributes significantly due to strong domestic motorcycle manufacturing, high adoption of high-speed sports bikes, and advanced material chains. Increasing production of electric motorcycles and high-performance commuter bikes is boosting demand for premium drive chains optimized for torque and speed.

North America Motorcycle Drive Chain Market

North America is projected to register the fastest CAGR of 9.74% from 2026 to 2033, driven by rising motorcycle sales, aftermarket customization trends, and growth in sports and touring motorcycles across the U.S. and Canada. Increasing adoption of lightweight, high-strength chains for performance upgrades, racing, and recreational motorcycles accelerates regional market growth.

U.S. Motorcycle Drive Chain Market Insight

The U.S. is the largest contributor in North America, supported by strong aftermarket culture, motorsports popularity, and rising demand for premium motorcycles requiring high-performance chains. OEM tie-ups, aftermarket customization, and high consumer spending drive long-term market growth.

Canada Motorcycle Drive Chain Market Insight

Canada shows steady growth due to growing motorcycle ownership, touring and recreational bike demand, and adoption of advanced drive chains. Consumer preference for durability, low-maintenance chains, and aftermarket replacements fuels regional market expansion.

Which are the Top Companies in Motorcycle Drive Chain Market?

The motorcycle drive chain industry is primarily led by well-established companies, including:

- Qingdao Choho Industrial Co., Ltd (China)

- KMC INTERNATIONAL INC. (Japan)

- DAIDO KOGYO Co., LTD. (Japan)

- L.G. Balakrishnan & Bros Ltd. (India)

- Hangzhou SFR Technology Co., Ltd. (China)

- RK JAPAN (Japan)

- TIDC INDIA (India)

- Rockman Industries (India)

- Schaeffler Group (Germany)

- ENUMA CHAIN MFG. CO., LTD (Japan)

- Regina Catene Calibrate Spa (Italy)

- D.I.D Chain (Japan)

- ROMBO (Italy)

- TSUBAKI Rider (Japan)

- JT Sprockets (Japan)

- Tsubakimoto Chain (Japan)

- Jiangxi Hengjiu Chain Transmission Co., Ltd (China)

- Jomthai Asahi Co., Ltd (Thailand)

- The Diamond Chain Company (Italy)

What are the Recent Developments in Global Motorcycle Drive Chain Market?

- In March 2025, DID introduced the Race Ready Kits, featuring a comprehensive chain kit that includes an Exclusive Racing series DID chain and world-renowned Renthal-branded aluminum sprockets, providing racers with everything needed to optimize motorcycle drivetrains, marking a milestone in high-performance chain solutions

- In November 2024, L G Balakrishnan & Bros announced plans to invest USD 4.68 million to expand its manufacturing area by more than 9,500 square meters, aiming to produce sprockets, precision machining components, automotive chains, assembled engines, aluminum die-castings, and machined aluminum die-castings, reinforcing its commitment to advanced production capabilities and market growth

- In September 2024, Triumph Motorcycles India launched the new Speed T4 and 2024 Speed 400 models, featuring a 398cc, single-cylinder, liquid-cooled engine on both bikes, with the Speed T4 incorporating a new airbox, modified throttle body, updated engine map, and smaller sprocket, enhancing performance and rider experience in the mid-capacity segment

- In January 2024, Hero introduced the Hero CE001 Commemorative Edition, based on the Karizma XMR and inspired in part by the naked 2.5R Xtunt showcased at EICMA 2023, equipped with a 6-speed gearbox, hydraulic clutch actuator, premium carbon fiber chain cover, and golden anodized chain and sprocket, highlighting a blend of aesthetics and advanced drivetrain technology

- In December 2023, L G Balakrishnan & Bros launched the industry’s first chain sprocket kit for electric bikes, exclusively supplying it to Tork Motors, along with kits for the Ultraviolette F77, marking a significant step toward supporting EV drivetrain innovation and expanding aftermarket solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.