Global Motorcycle Market

Market Size in USD Billion

CAGR :

%

USD

153.12 Billion

USD

296.26 Billion

2024

2032

USD

153.12 Billion

USD

296.26 Billion

2024

2032

| 2025 –2032 | |

| USD 153.12 Billion | |

| USD 296.26 Billion | |

|

|

|

|

Motorcycle Market Size

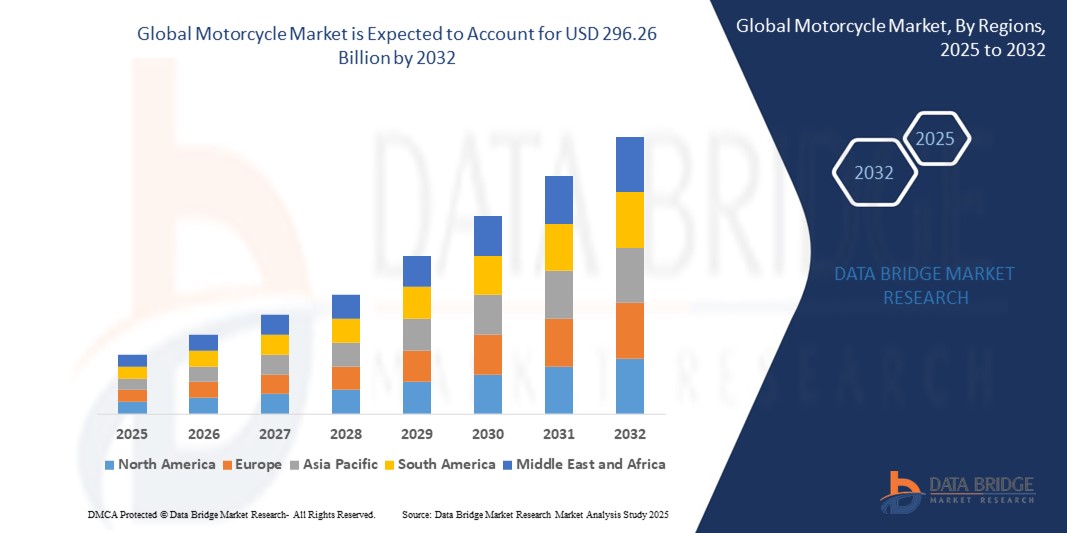

- The global motorcycle market was valued at USD 153.12 billion in 2024 and is expected to reach USD 296.26 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.60%, primarily driven by the increasing demand for motorcycles in emerging markets and the growing popularity of motorcycling as both a lifestyle and transportation mode

- This growth is fueled by factors such as rising disposable incomes, the expansion of urban infrastructure, and the increasing interest in eco-friendly motorcycles and electric bikes

Motorcycle Market Analysis

- Motorcycles are essential modes of transportation and recreation, offering versatility, affordability, and efficiency. They are increasingly popular in both developed and emerging markets, catering to a wide range of consumer needs, from daily commuting to leisure riding

- The demand for motorcycles is significantly driven by rising disposable incomes, especially in developing countries, as well as the growing preference for more sustainable transportation options, such as electric motorcycles

- The Asia-Pacific region stands out as one of the dominant regions for the global motorcycle market, driven by high motorcycle ownership, growing urban populations, and expanding infrastructure

- For instance, the motorcycle market in countries such as India, China, and Indonesia continues to grow due to their large populations, urbanization, and rising disposable incomes. These countries also see increasing government initiatives to promote eco-friendly transportation, contributing to the market's expansion

- Globally, motorcycles are an essential part of the automotive sector, with sales continuing to rise due to factors like improved fuel efficiency, the growing popularity of electric motorcycles, and the rise of motorcycling as a recreational activity

Report Scope and Motorcycle Market Segmentation

|

Attributes |

Motorcycle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Motorcycle Market Trends

"Growing Adoption of Electric Motorcycles and Sustainable Technologies"

- A significant trend in the global motorcycle market is the increasing adoption of electric motorcycles and sustainable technologies

- These advancements address rising environmental concerns and growing government regulations promoting eco-friendly transportation solutions, offering zero-emission alternatives to traditional gasoline-powered motorcycles

- For instance, electric motorcycles are gaining popularity in urban areas due to their lower environmental impact, reduced operating costs, and the increasing availability of charging infrastructure

- As battery technology improves and consumers prioritize sustainability, the demand for electric motorcycles is expected to continue growing, reshaping the market and accelerating the shift toward more sustainable mobility options

Motorcycle Market Dynamics

Driver

“Rising Demand Due to Urbanization and Changing Transportation Needs”

- The growing demand for motorcycles is being driven by urbanization, as motorcycles provide an efficient and cost-effective solution for navigating congested cities. With rising traffic congestion, motorcycles offer quicker travel times, making them a popular choice in metropolitan areas across the globe

- As the global population becomes more mobile and the need for flexible transportation solutions rises, motorcycles are increasingly being viewed as an affordable and convenient mode of transport, especially in regions with high population density and inadequate public transport infrastructure

- The growing trend of motorcycling as a recreational activity is also contributing to the rise in demand. Enthusiasts seek higher-performance motorcycles, driving innovations in design, engine capacity, and safety features. Additionally, motorcycles are being increasingly used for leisure and adventure tourism, further fueling market growth

- Environmental awareness and the shift towards sustainability are driving the adoption of electric motorcycles (e-motorcycles). As governments around the world implement stricter emission regulations and offer incentives for eco-friendly transportation, the electric motorcycle market is expected to grow rapidly, further expanding the global motorcycle market

- Increasing disposable incomes, particularly in emerging markets, is making motorcycles more accessible to a wider range of consumers. This trend is especially evident in regions such as Southeast Asia, India, and Latin America, where motorcycles offer a more affordable alternative to traditional cars

For instance,

- In June 2023, according to a report by the International Motorcycle Manufacturers Association (IMMA), motorcycle sales in India grew by 15% due to increased demand for both affordable transportation and recreational motorcycling. This trend is particularly driven by young adults and urban commuters looking for more efficient mobility solutions

- In July 2022, according to a study by the Electric Motorcycle Industry Association, global sales of electric motorcycles are forecasted to grow by over 25% annually over the next five years, driven by government policies supporting clean energy and the growing appeal of zero-emission transportation

- As a result of these factors, the demand for motorcycles continues to grow globally, positioning the motorcycle market for significant expansion

Opportunity

“Rising Adoption of Electric Motorcycles (E-Motorcycles)”

- The increasing demand for electric motorcycles presents a significant market opportunity. As governments around the world implement stricter emissions regulations and offer incentives for eco-friendly vehicles, the electric motorcycle market is poised for rapid growth. This shift towards clean energy solutions is expected to drive innovation in electric motorcycle designs, improving battery life, performance, and affordability

- As urban areas become more environmentally conscious and promote sustainable mobility, electric motorcycles offer a promising alternative to traditional gasoline-powered bikes, especially in regions with pollution concerns

For instance,

- In April 2024, according to a report by the International Energy Agency (IEA), the global market for electric motorcycles is expected to grow by 30% annually, driven by the expanding demand for zero-emission vehicles and government initiatives promoting green transportation. This growth is particularly strong in China, Europe, and North America, where e-motorcycles are becoming a key part of the sustainable mobility solution

- In August 2023, according to the Motorcycle Industry Council (MIC), the sales of recreational and touring motorcycles in North America increased by 18%, as more riders sought adventure and off-road experiences. The surge in demand for these motorcycles presents opportunities for manufacturers to develop more specialized models catering to the growing leisure market

- The global motorcycle market presents a wide range of opportunities driven by technological advancements, growing interest in sustainable transportation, and increasing consumer demand in emerging economies. These factors, along with the rising popularity of motorcycles as a recreational activity, make the motorcycle market a dynamic and promising industry to watch

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- The high cost of motorcycles, particularly premium models, poses a significant challenge for the market, especially affecting the purchasing decisions of consumers, particularly in developing regions

- Motorcycles, especially those with advanced features or from well-established brands, can often range from thousands to tens of thousands of dollars, making them unaffordable for a large portion of the population

- This substantial financial barrier can deter first-time buyers and lower-income consumers from entering the market, leading to slower adoption rates in certain regions

For instance,

- In January 2025, according to an article published by the International Motorcycle Manufacturers Association (IMMA), one of the key concerns surrounding the high cost of motorcycles is its impact on market accessibility. The high price point of motorcycles, particularly in developing nations, restricts their affordability, thereby limiting the potential for widespread adoption and affecting the growth of the market

- Consequently, such limitations can result in slower market growth in emerging economies, where affordability remains a major hurdle, ultimately hindering the overall growth of the global motorcycle market

Motorcycle Market Scope

The market is segmented on the basis of motorcycle type and engine capacity

|

Segmentation |

Sub-Segmentation |

|

By Motorcycle Type |

|

|

By Engine Capacity |

|

Motorcycle Market Regional Analysis

“North America is the Dominant Region in the Global Motorcycle Market”

- North America dominates the global motorcycle market, driven by strong demand for both recreational and utility motorcycles, a well-developed road network, and a high rate of motorcycle ownership

- The U.S. holds a significant share due to a large consumer base, growing interest in motorcycle tourism, and the presence of iconic motorcycle brands such as Harley-Davidson and Indian Motorcycles

- The availability of financing options, established infrastructure for motorcycle maintenance, and a favorable regulatory environment further bolster market growth

- Additionally, the increasing popularity of electric motorcycles and the rise of motorcycle sports are fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to register the highest growth rate in the global motorcycle market, driven by rapid urbanization, increasing disposable income, and a growing middle class

- Countries such as India, China, and Indonesia are emerging as key markets due to their large populations, expanding infrastructure, and the increasing need for affordable personal transportation options

- India, with its large youth population and growing motorcycle culture, continues to lead the region, while China’s demand for electric motorcycles and two-wheeler adoption for commuting is also seeing rapid growth

- Southeast Asian countries, such as Indonesia and Thailand, are seeing an increase in motorcycle sales driven by urban mobility and the demand for low-cost transportation. Moreover, the expanding presence of global motorcycle manufacturers and a rise in domestic production further contribute to market growth in the region

Motorcycle Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Honda Motor Co., Ltd. (Japan)

- Yamaha Motor Co., Ltd. (Japan)

- Harley-Davidson, Inc. (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Ducati Motor Holding S.p.A. (Italy)

- BMW Motorrad (Germany)

- Suzuki Motor Corporation (Japan)

- Triumph Motorcycles Ltd. (U.K.)

- Piaggio & C. S.p.A. (Italy)

- Indian Motorcycles (U.S.)

- KTM AG (Austria)

- Hero MotoCorp Ltd. (India)

- Bajaj Auto Limited (India)

- TVS Motor Company (India)

- Royal Enfield (India)

- Zhongneng Motorcycle Group (China)

- Qianjiang Motorcycle Co. (China)

- Loncin Motor (China)

- SYM (Sanyang Motor Co., Ltd.) (Taiwan)

- Benelli (Italy)

Latest Developments in Global Motorcycle Market

- In April 2021, Niu RQI introduced an electric motorcycle designed for the Chinese and European markets. This electric sports bike is equipped with cutting-edge technological features, including 5G IoT integration for ride data collection, an IoT-connected battery pack, a fully digital dashboard, anti-theft GPS tracking, and Bluetooth connectivity. The launch of this advanced electric motorcycle highlights the growing trend of innovation within the motorcycle industry, which is likely to influence the global motorcycle apparel market as well

- In January 2021, Qianjiang Motor, a two-wheeler manufacturer owned by Geely and the parent company of Benelli, unveiled an electric sports bike featuring a digital TFT instrument panel. The bike is equipped with Bluetooth connectivity and a dedicated app, enabling users to monitor key features such as battery charge, performance, geo-fencing, and more. The introduction of this technologically advanced electric sports bike signifies a growing shift toward connected vehicles in the motorcycle industry

- In October 2020, Yamaha launched Bluetooth-enabled technology for motorcycles through the Yamaha Connect X Application. Initially available with the Yamaha FZS-FI Dark Knight BS6 variant, these Bluetooth connectivity features can also be installed as an add-on accessory across the entire Yamaha FZ-FI and FZS-FI 150 cc motorcycle series. The introduction of this Bluetooth connectivity marks a significant advancement in the integration of digital technology in motorcycles, reflecting a broader trend within the industry

- In January 2020, Damon Motorcycles, based in Canada, unveiled a connected motorcycle incorporating BlackBerry QNX technology. The motorcycle is equipped with a 360-degree advanced warning system, featuring a range of sensors, including cameras, radar, and non-visual sensors, designed to detect potential threats on the road. The integration of advanced safety technologies in motorcycles, such as the 360-degree warning system, signifies a growing trend toward enhanced rider protection and connectivity

- In 2019, BOSCH introduced its Advanced Rider Assistance Systems (ARAS), featuring front collision avoidance and Help Connect for emergency situations. These systems were set to be integrated into motorcycles produced by Ducati, Kawasaki, and KTM by mid to late 2020. The introduction of BOSCH’s ARAS represents a significant advancement in motorcycle safety and technology, which is expected to influence the global motorcycle apparel market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MOTORCYCLE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MOTORCYCLE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MOTORCYCLE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 REGULATORY FRAMEWORK

5.2 TECHNOLOGICAL TRENDS

5.3 PORTER FIVE FORCES

5.4 REGULATORY STANDARDS

5.5 DEMAND FOR COMFORT AND LUXURY

5.6 TECHNOLOGICAL ADVANCEMENTS

5.7 FOCUS ON LIGHT WEIGHTING

5.8 SHIFT TOWARDS AUTONOMOUS VEHICLES

5.9 URBANIZATION AND RIDE-SHARING TRENDS

5.10 REGIONAL GROWTH OPPORTUNITIES

5.11 SUSTAINABILITY INITIATIVES

5.12 ECONOMIC FACTORS

5.12.1 INTEREST RATES

5.12.2 DISPOSABLE INCOMES

5.12.3 INFLATION

5.12.4 GDP

5.12.5 EXCHANGE RATES

5.12.6 UNEMPLOYMENT RATES

5.13 POLITICAL FACTORS

5.14 SOCIAL FACTORS

5.14.1 CHANGING CONSUMER TRENDS

5.14.2 POPULATION GROWTH

5.14.3 DEMOGRAPHIC SHIFTS

5.15 GEOPOLITICAL FACTORS

6. GLOBAL MOTORCYCLE MARKET, BY TYPE

6.1 OVERVIEW

6.2 MOTORCYCLE

6.2.1 BY BODY TYPE

6.2.1.1. commute/STANDARD

6.2.1.2. CRUISER

6.2.1.3. SPORTS

6.2.1.4. MOPED/scooters

6.2.1.5. off-road/ADVENTURE

6.2.1.6. TOURING

6.2.1.7. OTHERS

6.3 ATV

7. GLOBAL MOTORCYCLE MARKET, BY PROPULSION

7.1 OVERVIEW

7.2 IC ENGINE

7.2.1 BY ENGINE CAPACITY

7.2.1.1. UP TO 150 CC

7.2.1.2. 151-300 CC

7.2.1.3. 301-500 CC

7.2.1.4. 501-800 CC

7.2.1.5. 801-1000 CC

7.2.1.6. 1001-1600 CC

7.2.1.7. ABOVE 1600 CC

7.2.2 BY NUUMBER OF CYLINDERS

7.2.2.1. SINGLE CYLINDER

7.2.2.2. MULTI CYLINDER

7.3 ELECTRIC VEHICLE

7.3.1 BY MOTOR POWER

7.3.1.1. BELOW 2000 W

7.3.1.2. 2000 W TO 4000 W

7.3.1.3. 4000 W TO 6000 W

7.3.1.4. ABOVE 6000W

8. GLOBAL MOTORCYCLE MARKET, BY PRICE RANGE

8.1 OVERVIEW

8.2 LOW

8.3 MEDIUM

8.4 HIGH

9. GLOBAL MOTORCYCLE MARKET, BY CUSTOM TYPE

9.1 OVERVIEW

9.2 BUILT TO ORDER (BTO)

9.3 NON-CUSTOMIZED

10. GLOBAL MOTORCYCLE MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 OEMS

10.3 DISTRIBUTOR

11. GLOBAL MOTORCYCLE MARKET, BY REGION

GLOBAL MOTORCYCLE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

11.2 EUROPE

11.2.1 GERMANY

11.2.2 FRANCE

11.2.3 U.K.

11.2.4 ITALY

11.2.5 SPAIN

11.2.6 RUSSIA

11.2.7 TURKEY

11.2.8 BELGIUM

11.2.9 NETHERLANDS

11.2.10 NORWAY

11.2.11 FINLAND

11.2.12 SWITZERLAND

11.2.13 DENMARK

11.2.14 SWEDEN

11.2.15 POLAND

11.2.16 REST OF EUROPE

11.3 ASIA PACIFIC

11.3.1 JAPAN

11.3.2 CHINA

11.3.3 SOUTH KOREA

11.3.4 INDIA

11.3.5 AUSTRALIA & NEW ZEALAND

11.3.6 SINGAPORE

11.3.7 THAILAND

11.3.8 MALAYSIA

11.3.9 INDONESIA

11.3.10 PHILIPPINES

11.3.11 TAIWAN

11.3.12 VIETNAM

11.3.13 REST OF ASIA PACIFIC

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 MIDDLE EAST AND AFRICA

11.5.1 SOUTH AFRICA

11.5.2 EGYPT

11.5.3 SAUDI ARABIA

11.5.4 U.A.E

11.5.5 ISRAEL

11.5.6 OMAN

11.5.7 BAHRAIN

11.5.8 KUWAIT

11.5.9 QATAR

11.5.10 REST OF MIDDLE EAST AND AFRICA

12. GLOBAL MOTORCYCLE MARKET,COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

12.7 EXPANSIONS

12.8 REGULATORY CHANGES

12.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13. GLOBAL MOTORCYCLE MARKET, SWOT AND DBMR ANALYSIS

14. GLOBAL MOTORCYCLE MARKET, COMPANY PROFILE

14.1 SHARMAX MOTORCYCLES

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 GEOGRAPHIC PRESENCE

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 YAMAHA MOTOR CO., LTD.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 GEOGRAPHIC PRESENCE

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 PIAGGIO & C. SPA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 GEOGRAPHIC PRESENCE

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 KWANG YANG MOTOR CO.,LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 GEOGRAPHIC PRESENCE

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 BENELLI

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 GEOGRAPHIC PRESENCE

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 TAIWAN SANYANG MOTOR CO., LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 GEOGRAPHIC PRESENCE

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENTS

14.7 MV AGUSTA MOTOR S.P.A

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 GEOGRAPHIC PRESENCE

14.7.4 PRODUCT PORTFOLIO

14.7.5 RECENT DEVELOPMENTS

14.8 ZERO MOTORCYCLES, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 GEOGRAPHIC PRESENCE

14.8.4 PRODUCT PORTFOLIO

14.8.5 RECENT DEVELOPMENTS

14.9 XIAMEN XIASHING MOTORCYCLE CO., LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 GEOGRAPHIC PRESENCE

14.9.4 PRODUCT PORTFOLIO

14.9.5 RECENT DEVELOPMENTS

14.10 SUZUKI MOTOR CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 GEOGRAPHIC PRESENCE

14.10.4 PRODUCT PORTFOLIO

14.10.5 RECENT DEVELOPMENTS

14.11 HONDA MOTOR CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 GEOGRAPHIC PRESENCE

14.11.4 PRODUCT PORTFOLIO

14.11.5 RECENT DEVELOPMENTS

14.12 EICHER MOTORS LIMITED

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 GEOGRAPHIC PRESENCE

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENTS

14.13 HERO MOROCORP

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 GEOGRAPHIC PRESENCE

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENTS

14.14 TVS MOTOR COMPANY

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 GEOGRAPHIC PRESENCE

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENTS

14.15 HARLEY-DAVIDSON INC

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 GEOGRAPHIC PRESENCE

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENTS

14.16 BAJAJ AUTO LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 GEOGRAPHIC PRESENCE

14.16.4 PRODUCT PORTFOLIO

14.16.5 RECENT DEVELOPMENTS

14.17 DUCATI MOTOR HOLDING S.P.A

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 GEOGRAPHIC PRESENCE

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENTS

14.18 KAWASAKI HEAVY INDUSTRIES, LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 GEOGRAPHIC PRESENCE

14.18.4 PRODUCT PORTFOLIO

14.18.5 RECENT DEVELOPMENTS

14.19 TRIUMPH MOTORCYCLES

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 GEOGRAPHIC PRESENCE

14.19.4 PRODUCT PORTFOLIO

14.19.5 RECENT DEVELOPMENTS

14.20 BMW AG

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 GEOGRAPHIC PRESENCE

14.20.4 PRODUCT PORTFOLIO

14.20.5 RECENT DEVELOPMENTS

14.21 LIFAN

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 GEOGRAPHIC PRESENCE

14.21.4 PRODUCT PORTFOLIO

14.21.5 RECENT DEVELOPMENTS

14.22 KTM SPORTMOTORCYCLE GMBH

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 GEOGRAPHIC PRESENCE

14.22.4 PRODUCT PORTFOLIO

14.22.5 RECENT DEVELOPMENTS

14.23 POLARIS INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 GEOGRAPHIC PRESENCE

14.23.4 PRODUCT PORTFOLIO

14.23.5 RECENT DEVELOPMENTS

14.24 BAJAJ MOTORCYCLES

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 GEOGRAPHIC PRESENCE

14.24.4 PRODUCT PORTFOLIO

14.24.5 RECENT DEVELOPMENTS

14.25 AKT MOTORBIKES

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 GEOGRAPHIC PRESENCE

14.25.4 PRODUCT PORTFOLIO

14.25.5 RECENT DEVELOPMENTS

14.26 ZHEJIANG CFMOTO POWER CO., LTD.

14.26.1 COMPANY SNAPSHOT

14.26.2 REVENUE ANALYSIS

14.26.3 GEOGRAPHIC PRESENCE

14.26.4 PRODUCT PORTFOLIO

14.26.5 RECENT DEVELOPMENTS

14.27 HUSQVARNA

14.27.1 COMPANY SNAPSHOT

14.27.2 REVENUE ANALYSIS

14.27.3 GEOGRAPHIC PRESENCE

14.27.4 PRODUCT PORTFOLIO

14.27.5 RECENT DEVELOPMENTS

14.28 HYOSUNG MOTORCYCLES

14.28.1 COMPANY SNAPSHOT

14.28.2 REVENUE ANALYSIS

14.28.3 GEOGRAPHIC PRESENCE

14.28.4 PRODUCT PORTFOLIO

14.28.5 RECENT DEVELOPMENTS

14.29 KEEWAY

14.29.1 COMPANY SNAPSHOT

14.29.2 REVENUE ANALYSIS

14.29.3 GEOGRAPHIC PRESENCE

14.29.4 PRODUCT PORTFOLIO

14.29.5 RECENT DEVELOPMENTS

14.30 BRP

14.30.1 COMPANY SNAPSHOT

14.30.2 REVENUE ANALYSIS

14.30.3 GEOGRAPHIC PRESENCE

14.30.4 PRODUCT PORTFOLIO

14.30.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

15. CONCLUSION

16. QUESTIONNAIRE

17. RELATED REPORTS

18. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.