Global Motorcycles Market

Market Size in USD Million

CAGR :

%

USD

109.69 Million

USD

164.55 Million

2024

2032

USD

109.69 Million

USD

164.55 Million

2024

2032

| 2025 –2032 | |

| USD 109.69 Million | |

| USD 164.55 Million | |

|

|

|

|

Motorcycles Market Size

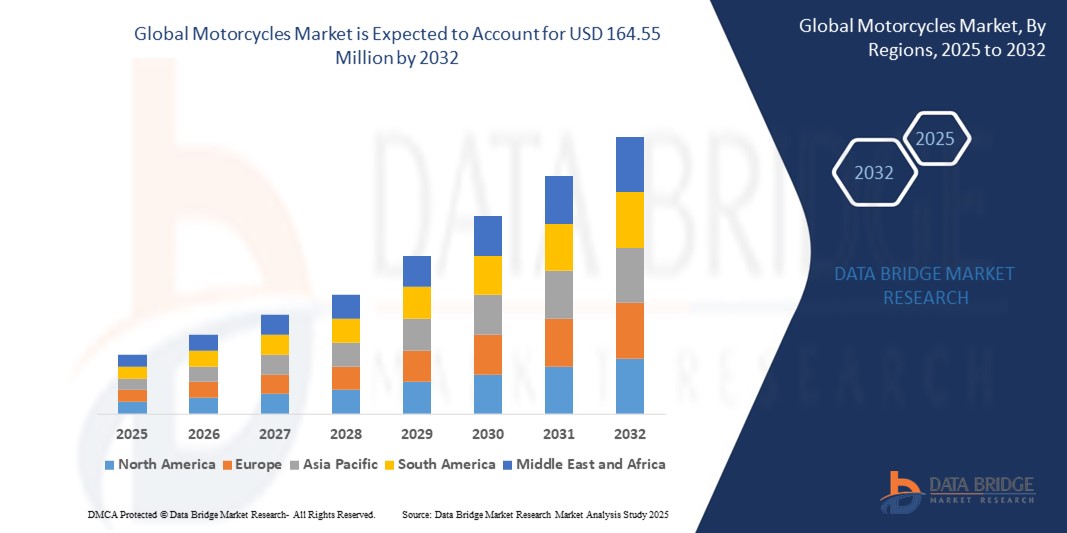

- The global motorcycles market size was valued at USD 109.69 million in 2024 and is expected to reach USD 164.55 million by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the increasing demand for affordable and fuel-efficient transportation, rising urban population, and the growing popularity of electric two-wheelers across developing and developed economies

- In addition, rapid industrialization, the emergence of motorcycle-sharing platforms, and advancements in smart connectivity and safety features are supporting market expansion globally

Motorcycles Market Analysis

- The market is witnessing strong demand for scooters and low-displacement motorcycles in emerging regions due to their cost-effectiveness and suitability for urban commuting

- Developed regions are experiencing rising interest in high-performance, touring, and electric motorcycles, supported by lifestyle preferences, environmental awareness, and regulatory support

- Europe dominated the global motorcycles market with the largest revenue share in 2024, supported by strong demand for premium, touring, and adventure motorcycles across major countries such as Germany and the U.K.

- Asia-Pacific region is expected to witness the highest growth rate in the global motorcycles market, driven by rapid urbanization, rising disposable incomes, expanding middle-class population, and growing demand for cost-effective personal mobility solutions across countries such as India, China, and Indonesia

- The on road segment held the largest market revenue share of 46.5% in 2024, driven by growing urban commutes, enhanced fuel efficiency, and broad accessibility across various demographics. These motorcycles are commonly used for daily travel and are favored for their affordability and low maintenance costs. With increasing demand for cost-effective personal transport, the on road category continues to dominate in both developed and emerging economies

Report Scope and Motorcycles Market Segmentation

|

Attributes |

Motorcycles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Motorcycles Market Trends

“Rising Demand for Electric Motorcycles”

- Increasing consumer demand for environmentally friendly mobility is driving the adoption of electric motorcycles

- Government incentives, subsidies, and tax benefits are encouraging the shift from fuel-powered to electric bikes

- Advancements in lithium-ion battery technology and fast-charging infrastructure are improving vehicle efficiency and range

- Younger consumers are drawn to electric motorcycles for their sleek design, lower operational costs, and digital integration features

- For instance, NIU Technologies in China has seen significant sales growth due to its affordable and connected electric scooters

Motorcycles Market Dynamics

Driver

“Expanding Urbanization and Rising Middle-Class Income”

- Rapid urban growth in emerging economies is making motorcycles a preferred solution for navigating congested roads

- The rising middle-class population has increased purchasing power, enabling more individuals to afford personal vehicles

- Availability of installment-based financing and affordable insurance options is boosting first-time motorcycle ownership

- Manufacturers are catering to various price segments, making motorcycles accessible to a wide income range

- For instance, in Vietnam, motorcycles account for over 85% of all registered vehicles due to affordability and convenience

Restraint/Challenge

“Stringent Emission Regulations and Safety Concerns”

- Implementation of emission standards such as Euro 5 and BS-VI is increasing production costs and limiting low-cost models

- Compliance with environmental norms requires advanced engine technology and catalytic systems, affecting profit margins

- Concerns about rider safety, especially in countries with weak enforcement of helmet laws, deter potential buyers

- Poor road infrastructure in developing nations increases the risk of accidents and injuries for motorcyclists

- For instance, the World Health Organization reported that 28% of global road traffic deaths in 2023 involved two- or three-wheeled vehicles

Motorcycles Market Scope

The motorcycles market is segmented into six notable segments based on type, engine capacity, application, propulsion type, price range, and end user.

• By Type

On the basis of type, the motorcycles market is segmented into on road, off road, and scooters. The on road segment held the largest market revenue share of 46.5% in 2024, driven by growing urban commutes, enhanced fuel efficiency, and broad accessibility across various demographics. These motorcycles are commonly used for daily travel and are favored for their affordability and low maintenance costs. With increasing demand for cost-effective personal transport, the on road category continues to dominate in both developed and emerging economies.

The scooters segment is expected to witness a fastest growth rate from 2025 to 2032, propelled by rising demand among younger riders and female consumers. Scooters offer better maneuverability in congested traffic and are often seen as a practical solution in densely populated cities, particularly in countries such as India and Vietnam.

• By Engine Capacity

On the basis of engine capacity, the motorcycles market is segmented into up to 200cc, 200cc to 400cc, 400cc to 800cc, and more than 800cc. The up to 200cc segment dominated the market in 2024 due to its widespread use for urban commuting and affordability. This category appeals largely to first-time buyers and is prominent in regions with cost-sensitive consumers.

The 400cc to 800cc segment is expected to witness a fastest growth rate from 2025 to 2032, supported by increased interest in long-distance touring and mid-range sports bikes. Riders in Europe and North America are especially drawn to this segment for its balance between performance and cost.

• By Application

On the basis of application, the motorcycles market is segmented into handlers and postures. The handlers segment accounted for the larger market share in 2024, driven by the dominance of standard, easy-to-control motorcycles that are suitable for diverse age groups and skill levels.

The postures segment is expected to witness a fastest growth rate from 2025 to 2032, reflecting the increasing demand for ergonomically designed motorcycles catering to comfort during long rides, especially in touring and adventure categories.

• By Propulsion Type

On the basis of propulsion type, the motorcycles market is segmented into internal combustion engine and electric. The internal combustion engine segment dominated the market in 2024 due to its established infrastructure, mature technology, and wider product availability across global markets.

The electric segment, however, is expected to witness a fastest growth rate from 2025 to 2032, fuelled by tightening emission regulations and increasing government incentives promoting clean mobility solutions. Countries such as China and the Netherlands are witnessing a significant uptick in electric two-wheeler adoption.

• By Price Range

On the basis of price range, the motorcycles market is segmented into low, mid, and high. The low-price range segment held the largest share in 2024, particularly due to demand in emerging economies such as India, Indonesia, and Bangladesh where cost-effectiveness is a primary purchasing factor.

The mid-price range is expected to witness a fastest growth rate from 2025 to 2032, as consumers increasingly seek better performance and features without entering premium pricing brackets.

• By End User

On the basis of end user, the motorcycles market is segmented into cruiser, adventure, touring, standard, and sports. The standard segment captured the highest revenue share in 2024, thanks to its adaptability and broad appeal across commuting and recreational use.

The adventure segment is expected to witness a fastest growth rate from 2025 to 2032, driven by rising popularity of off-road exploration and multi-purpose riding, particularly in North America and parts of Europe.

Motorcycles Market Regional Analysis

- Europe dominated the global motorcycles market with the largest revenue share in 2024, supported by strong demand for premium, touring, and adventure motorcycles across major countries such as Germany and the U.K.

- High consumer interest in leisure motorcycling, a well-established infrastructure, and favorable environmental regulations promoting electric two-wheelers contribute to the region’s market leadership

- The presence of leading OEMs and increasing investments in R&D for advanced propulsion technologies further enhance growth prospects across both urban and rural areas

Germany Motorcycles Market Insight

The Germany captured a significant share of the European motorcycles market in 2024, driven by the country’s deep-rooted motorcycling culture, preference for high-performance bikes, and strong manufacturing capabilities. German consumers are increasingly adopting adventure and electric motorcycles, while favorable government incentives and infrastructure development are accelerating e-mobility adoption

U.K. Motorcycles Market Insight

The U.K. motorcycles market is expected to witness a fastest growth rate from 2025 to 2032, steadily due to rising urban congestion, high commuting costs, and a growing preference for efficient two-wheeled transport. The government’s promotion of sustainable mobility, paired with the increasing popularity of electric scooters and commuter bikes, is expected to drive long-term market expansion

North America Motorcycles Market Insight

The North America holds a prominent position in the global motorcycles market, supported by robust demand for cruiser, touring, and sports motorcycles. The region benefits from a large base of recreational riders, strong brand loyalty, and a well-established sales and service infrastructure. Consumers continue to favor motorcycles with larger engine capacities and integrated smart features

U.S. Motorcycles Market Insight

The U.S. motorcycles market accounted for the majority share in North America in 2024, driven by a strong affinity for motorcycling culture and rising interest in adventure and electric motorcycles. The presence of iconic brands, coupled with growing adoption of connected and autonomous technologies, is expected to drive market innovation and expansion

Asia-Pacific Motorcycles Market Insight

The Asia-Pacific is expected to witness a fastest growth rate from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and increasing demand for affordable mobility solutions. Countries such as China, India, and Indonesia are witnessing robust sales due to a large working population, government incentives for EVs, and widespread adoption of two-wheelers for daily commuting

China Motorcycles Market Insight

The China led the Asia-Pacific motorcycles market in 2024, owing to its massive consumer base, rapid urban development, and strong domestic manufacturing ecosystem. Although regulatory restrictions exist in some cities, the growing trend toward electric mobility and smart connectivity is sustaining demand across urban and rural areas

Japan Motorcycles Market Insight

The Japan motorcycles market is expected to witness a fastest growth rate from 2025 to 2032, supported by a technology-forward consumer base, a preference for reliable and efficient transportation, and a rising interest in electric motorcycles. The country’s aging population and focus on compact urban mobility solutions further drive demand for lightweight, low-emission two-wheelers

Motorcycles Market Share

The Motorcycles industry is primarily led by well-established companies, including:

- Bajaj Auto Ltd. (India)

- BMW AG (Germany)

- Ducati Motor Holding S.p.A (Italy)

- Eicher Motors Limited (India)

- Hero MotoCorp Ltd. (India)

- China Jiailng Industrial Co., Ltd (China)

- Honda Motor Co., Ltd. (Japan)

- KTM Sportmotorcycle GmbH (Austria)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Piaggio and C. SpA (Italy)

- Suzuki Motor Corporation (Japan)

- Triumph Motorcycles (U.K.)

- TVS Motor Company (India)

- Vmoto Limited (Australia)

- Yamaha Motor Co., Ltd. (Japan)

- Zero Motorcycles, Inc (U.S.)

Latest Developments in Global Motorcycles Market

- In January 2024, Raptee Energy, an emerging electric vehicle startup, unveiled its high-voltage drivetrain at the Tamil Nadu Global Investor Meet (GIM). The drivetrain boasts impressive specifications, including a top speed of 135 km/h and a driving range of 150 km. The company plans to officially launch this innovative vehicle by April 2024

- In March 2023, Hero MotoCorp of India partnered with Zero Motorcycles from California, USA, committing up to USD 60 million to the collaboration. This partnership aims for Zero to develop powertrains while leveraging Hero MotoCorp's manufacturing scale, sourcing capabilities, and marketing expertise for electric motorcycles. This strategic alliance is set to enhance Hero MotoCorp's electric motorcycle offerings significantly

- In February 2023, Yamaha, the Japanese motorcycle manufacturer, announced updates to its entire two-wheeler lineup in India, transitioning to the On-Board Diagnostic (OBD-II) system effective April 2023. The updated models, including the FZS-Fi V4 Deluxe, FZ-X, and MT-15 V2 Deluxe, will now feature a standard Traction Control System (TCS) designed to enhance safety. This system optimizes ignition timing and fuel injection to prevent excessive wheel slippage, improving power delivery and rider control, particularly during cornering. In addition, Yamaha plans to introduce new gasoline models by the end of 2023

- In January 2023, Hero MotoCorp, India's leading two-wheeler manufacturer, announced the commencement of trial production for motorcycles powered by E20 fuel, which can utilize various blends of E10 and E20. The company is conducting commercial production trials for flex-fuel motorcycles aimed at the 100-125 cc mass market segment. This initiative is part of Hero MotoCorp's efforts to embrace sustainable fuel solutions in the two-wheeler industry

- In January 2023, Bajaj Auto announced its entry into the premium two-wheeler segment with plans to manufacture KTM bikes featuring higher displacement engines (over 390cc) for both domestic and international markets. The company is actively incorporating these models into its production strategy, set to roll out in the coming months. This move marks Bajaj Auto's commitment to expanding its portfolio in the growing premium motorcycle sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.