Global Mtor Inhibitor Oncology Drug Market

Market Size in USD Billion

CAGR :

%

USD

2.52 Billion

USD

5.32 Billion

2025

2033

USD

2.52 Billion

USD

5.32 Billion

2025

2033

| 2026 –2033 | |

| USD 2.52 Billion | |

| USD 5.32 Billion | |

|

|

|

|

mTOR Inhibitor Oncology Drug Market Size

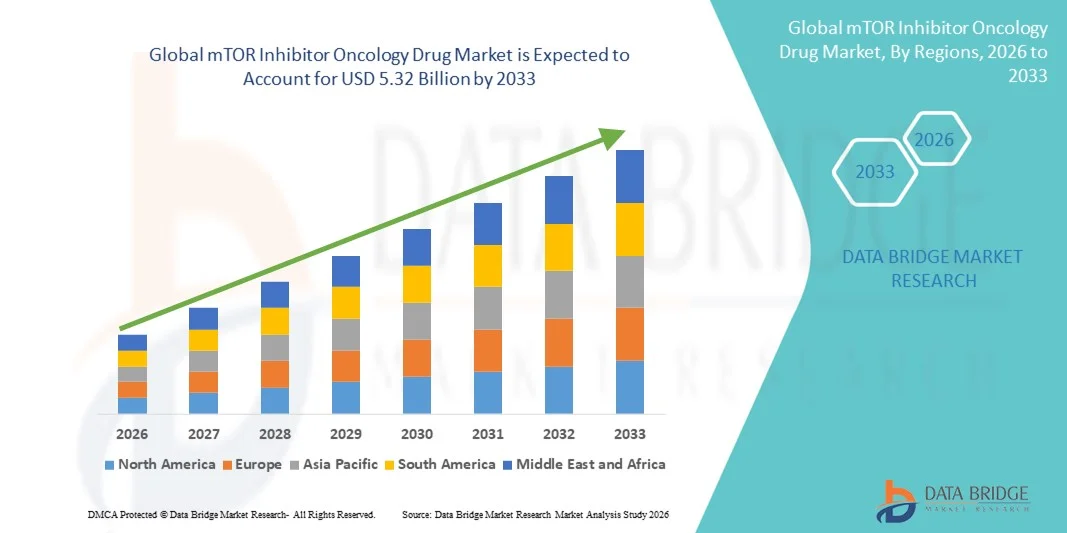

- The global mTOR inhibitor oncology drug market size was valued at USD 2.52 billion in 2025 and is expected to reach USD 5.32 billion by 2033, at a CAGR of 9.80% during the forecast period

- The market growth is largely driven by the rising global burden of cancer and the increasing adoption of targeted therapies, as mTOR inhibitors play a critical role in inhibiting tumor growth and cancer cell proliferation across multiple oncology indications

- Furthermore, ongoing advancements in precision oncology, expanding clinical applications in solid tumors and rare cancers, and continued R&D investments by pharmaceutical companies are strengthening the clinical relevance of mTOR inhibitors, thereby significantly supporting the market’s long-term growth trajectory

mTOR Inhibitor Oncology Drug Market Analysis

- mTOR inhibitors, which target the mammalian target of rapamycin signaling pathway to inhibit cancer cell growth and proliferation, are increasingly important components of modern oncology treatment regimens due to their effectiveness across multiple solid tumors and rare cancer indications

- The growing demand for mTOR inhibitor oncology drugs is primarily driven by the rising global cancer burden, increased adoption of targeted and precision therapies, and expanding clinical validation of mTOR pathway inhibition in oncology treatment protocols

- North America dominated the mTOR inhibitor oncology drug market with 40.7% revenue share in 2025, supported by advanced healthcare infrastructure, high oncology drug expenditure, strong clinical research activity, and the presence of major pharmaceutical companies, particularly in the United States

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by increasing cancer incidence, improving access to oncology treatments, expanding healthcare infrastructure, and rising investments in pharmaceutical research and development

- Rapamycin derivatives segment dominated the mTOR inhibitor oncology drug market with a market share of 65.2% in 2025, owing to their established clinical use, multiple regulatory approvals, and widespread adoption in routine oncology practice

Report Scope and mTOR Inhibitor Oncology Drug Market Segmentation

|

Attributes |

mTOR Inhibitor Oncology Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

mTOR Inhibitor Oncology Drug Market Trends

Rising Adoption of Combination and Precision Oncology Therapies

- A significant and accelerating trend in the global mTOR inhibitor oncology drug market is the growing use of these agents in combination therapy regimens alongside immunotherapies, hormone therapies, and other targeted drugs to enhance efficacy and overcome tumor resistance mechanisms

- For instance, mTOR inhibitors such as everolimus are increasingly being combined with endocrine therapies in hormone-receptor-positive breast cancer and with other targeted agents in renal cell carcinoma to improve progression-free survival outcomes

- Advances in molecular diagnostics and biomarker-driven treatment selection are enabling oncologists to better identify patient populations that are most likely to benefit from mTOR pathway inhibition, improving treatment personalization and clinical outcomes

- The integration of mTOR inhibitors into precision oncology frameworks supports more tailored treatment strategies, allowing clinicians to align therapy choices with tumor biology, genetic alterations, and disease stage across multiple cancer types

- This shift toward personalized and combination-based oncology care is reshaping treatment protocols, encouraging pharmaceutical companies to expand clinical trials exploring novel mTOR-based combinations and new indications

- Consequently, demand for mTOR inhibitors is steadily increasing across major oncology centers as healthcare systems emphasize targeted, evidence-based cancer therapies that offer improved efficacy and manageable safety profiles

- In addition, increased real-world evidence generation and post-marketing studies are strengthening confidence in long-term mTOR inhibitor use, supporting broader adoption in routine oncology practice

mTOR Inhibitor Oncology Drug Market Dynamics

Driver

Growing Global Cancer Burden and Shift Toward Targeted Therapies

- The rising incidence and prevalence of cancer worldwide, combined with the shift away from conventional chemotherapy toward targeted therapies, is a major driver supporting demand for mTOR inhibitor oncology drugs

- For instance, in recent years, regulatory authorities have expanded approvals for mTOR inhibitors across multiple cancer indications, reinforcing their role in modern oncology treatment algorithms

- As clinicians seek therapies that selectively target cancer-driving pathways while minimizing systemic toxicity, mTOR inhibitors offer a compelling therapeutic option compared to traditional cytotoxic treatments

- Furthermore, increased awareness of the mTOR signaling pathway’s role in tumor growth, angiogenesis, and metabolism is strengthening physician confidence and prescribing rates for these agents

- The expansion of oncology healthcare infrastructure, improved reimbursement frameworks, and rising oncology drug spending in both developed and emerging markets are further accelerating market growth

- Together, these factors are driving sustained adoption of mTOR inhibitors across hospitals, specialty cancer centers, and advanced oncology clinics globally

- Ongoing investments by pharmaceutical companies in oncology-focused research and clinical development are increasing the availability of mTOR inhibitors across both common and rare cancer types

- In addition, the rising prevalence of age-related cancers is contributing to higher demand for targeted therapies such as mTOR inhibitors that can be used in long-term disease management

Restraint/Challenge

Therapy Resistance, Safety Concerns, and High Treatment Costs

- The development of drug resistance and the occurrence of adverse effects such as metabolic disturbances, immunosuppression, and mucositis present notable challenges to the broader adoption of mTOR inhibitor oncology drugs

- For instance, prolonged mTOR pathway inhibition can lead to adaptive resistance mechanisms in cancer cells, reducing long-term treatment effectiveness in certain patient populations

- Managing safety concerns through dose optimization and combination strategies increases treatment complexity, which can limit use in frail or elderly patients with comorbid conditions

- In addition, the high cost of branded mTOR inhibitors places a financial burden on healthcare systems and patients, particularly in low- and middle-income countries with limited reimbursement coverage

- Variability in regulatory approval timelines and access to advanced oncology therapies across regions further constrains uniform market penetration

- Overcoming these challenges through improved combination regimens, development of next-generation mTOR inhibitors with better safety profiles, and expanded access programs will be critical for sustained market growth

- Limited availability of predictive biomarkers for treatment response also restricts optimal patient selection, potentially impacting therapy outcomes

- Moreover, competition from alternative targeted therapies and immuno-oncology agents may limit market expansion in certain cancer indications where multiple treatment options exist

mTOR Inhibitor Oncology Drug Market Scope

The market is segmented on the basis of drug class, indication, end user, and distribution channel.

- By Drug Class

On the basis of drug class, the global mTOR inhibitor oncology drug market is segmented into rapamycin derivatives (rapalogs), next-generation mtor inhibitors, emerging inhibitors, and others. The rapamycin derivatives segment dominated the market in 2025 with a market share of 65.2%, driven by their long-standing clinical use, multiple regulatory approvals, and established efficacy across several cancer indications such as renal cell carcinoma, breast cancer, and neuroendocrine tumors. Drugs such as everolimus and temsirolimus are widely prescribed due to strong physician familiarity, extensive clinical data, and inclusion in standard oncology treatment guidelines. Their availability across both monotherapy and combination regimens further strengthens their dominant position. In addition, the presence of branded as well as generic formulations supports wider patient access, particularly in cost-sensitive markets.

The next-generation mTOR inhibitors segment is expected to witness the fastest growth during the forecast period, supported by ongoing clinical development of agents targeting both mTORC1 and mTORC2 complexes. These advanced inhibitors are designed to overcome resistance and safety limitations associated with first-generation rapalogs. Increasing investment by pharmaceutical companies in next-generation oncology pipelines and rising interest in combination therapy strategies are accelerating the clinical evaluation of these agents. As precision oncology advances, next-generation inhibitors are expected to gain traction in hard-to-treat and resistant cancer populations.

- By Indication

On the basis of indication, the market is segmented into oncology, immunosuppressive therapy, organ transplantation, rare genetic disorders, and other indications. The oncology segment dominated the market in 2025, driven by the expanding use of mTOR inhibitors in cancer treatment compared to non-oncology applications. The rising global cancer burden and increasing preference for targeted therapies have positioned oncology as the primary revenue-generating segment. mTOR inhibitors are increasingly utilized in solid tumors and rare cancers due to their ability to inhibit tumor growth and angiogenesis. Continuous clinical trials and expanding approvals in oncology indications further reinforce the dominance of this segment.

The rare genetic disorders segment is expected to grow at the fastest rate during the forecast period, supported by increasing diagnosis rates and improved awareness of mTOR pathway involvement in rare diseases. Advances in genetic testing and precision medicine are enabling earlier identification of eligible patient populations. In addition, favorable regulatory incentives for orphan drugs and growing research focus on mTOR signaling in rare conditions are driving segment expansion. Although smaller in size, this segment presents strong growth potential due to unmet medical needs.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty cancer centers, transplant clinics, research institutions, and other healthcare facilities. The hospital segment dominated the market in 2025, owing to the high volume of cancer patients receiving diagnosis and treatment in hospital settings. Hospitals serve as primary centers for oncology drug administration, especially for complex cases requiring multidisciplinary care. The availability of advanced diagnostic infrastructure, oncology specialists, and reimbursement mechanisms further supports higher adoption of mTOR inhibitors in hospitals. In addition, hospitals play a key role in initiating combination therapies and managing treatment-related adverse effects.

The specialty cancer centers segment is expected to be the fastest growing during the forecast period, driven by the rising preference for specialized oncology care. These centers focus on advanced targeted therapies, personalized treatment plans, and clinical trial participation. Increasing investments in cancer-specific infrastructure and the growing number of dedicated oncology institutes worldwide are supporting rapid growth. Specialty centers are also early adopters of next-generation mTOR inhibitors and innovative combination regimens.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment held the largest market share in 2025, supported by the fact that most mTOR inhibitor oncology drugs are prescribed and dispensed within hospital settings. Oncology treatments often require strict monitoring, controlled dispensing, and coordination with clinical care teams, which favors hospital pharmacies. In addition, hospital pharmacies are integral to managing complex oncology regimens, including dose adjustments and combination therapies. Strong procurement contracts and reimbursement integration further reinforce their dominant position.

The online pharmacies segment is projected to witness the fastest growth over the forecast period, driven by increasing adoption of digital healthcare platforms and the growing availability of oral mTOR inhibitors. Improved logistics, home delivery services, and enhanced patient convenience are encouraging uptake of online pharmacy channels. This trend is particularly strong in regions with expanding telemedicine services and chronic cancer management models. As regulatory frameworks evolve, online distribution is expected to gain further traction, especially for long-term oncology therapies.

mTOR Inhibitor Oncology Drug Market Regional Analysis

- North America dominated the mTOR inhibitor oncology drug market with 40.7% revenue share in 2025, supported by advanced healthcare infrastructure, high oncology drug expenditure, strong clinical research activity, and the presence of major pharmaceutical companies, particularly in the United States

- Healthcare providers in the region place strong emphasis on precision medicine, early adoption of novel oncology drugs, and evidence-based treatment protocols, supporting widespread use of mTOR inhibitors across multiple cancer indications

- This strong market position is further reinforced by high healthcare expenditure, favorable reimbursement policies, robust clinical research activity, and the presence of leading pharmaceutical companies, establishing North America as the primary revenue-generating region for mTOR inhibitor oncology drugs

U.S. mTOR Inhibitor Oncology Drug Market Insight

The U.S. mTOR inhibitor oncology drug market captured the largest revenue share within North America in 2025, driven by the high prevalence of cancer and the early adoption of targeted and precision oncology therapies. Oncologists in the U.S. increasingly prioritize pathway-specific treatments such as mTOR inhibitors to improve clinical outcomes and reduce systemic toxicity. The strong presence of leading pharmaceutical companies, extensive clinical trial activity, and rapid regulatory approvals further support market expansion. Moreover, favorable reimbursement frameworks and high oncology drug spending significantly contribute to sustained demand across hospital and specialty cancer care settings.

Europe mTOR Inhibitor Oncology Drug Market Insight

The Europe mTOR inhibitor oncology drug market is projected to expand at a steady CAGR throughout the forecast period, primarily driven by rising cancer incidence and growing emphasis on personalized medicine. Increasing adoption of targeted therapies within national healthcare systems is supporting the integration of mTOR inhibitors into standard oncology treatment protocols. European countries are also witnessing growth in clinical research and cross-border oncology collaborations. In addition, strong regulatory oversight and improving access to innovative cancer therapies are fostering market growth across both Western and Eastern Europe.

U.K. mTOR Inhibitor Oncology Drug Market Insight

The U.K. mTOR inhibitor oncology drug market is anticipated to grow at a notable CAGR during the forecast period, supported by the expanding use of targeted cancer therapies within the National Health Service. Rising awareness of molecular oncology and increasing adoption of precision treatment approaches are encouraging the use of mTOR inhibitors in select cancer indications. The U.K.’s strong academic research ecosystem and participation in international oncology trials further contribute to market development. In addition, government support for cancer research and innovation is expected to sustain long-term growth.

Germany mTOR Inhibitor Oncology Drug Market Insight

The Germany mTOR inhibitor oncology drug market is expected to expand at a considerable CAGR, driven by the country’s advanced healthcare infrastructure and strong focus on oncology innovation. Germany’s well-established pharmaceutical and biotechnology sector supports rapid adoption of novel targeted therapies, including mTOR inhibitors. Increasing cancer screening rates and early diagnosis are leading to higher treatment uptake. Furthermore, the country’s emphasis on evidence-based medicine and reimbursement for innovative oncology drugs supports consistent market growth.

Asia-Pacific mTOR Inhibitor Oncology Drug Market Insight

The Asia-Pacific mTOR inhibitor oncology drug market is poised to grow at the fastest CAGR during the forecast period, driven by increasing cancer incidence, improving healthcare access, and rising oncology awareness across the region. Countries such as China, Japan, and India are witnessing rapid expansion of oncology treatment infrastructure and growing adoption of targeted therapies. Government initiatives to strengthen cancer care and expand pharmaceutical manufacturing capabilities are further supporting market growth. In addition, increasing participation in global clinical trials is accelerating the availability of mTOR inhibitors across APAC markets.

Japan mTOR Inhibitor Oncology Drug Market Insight

The Japan mTOR inhibitor oncology drug market is gaining momentum due to the country’s advanced medical technology, aging population, and high cancer prevalence. Japanese healthcare providers emphasize precision medicine and targeted therapies, supporting the adoption of mTOR inhibitors in oncology treatment regimens. Strong regulatory standards and rapid integration of innovative drugs into clinical practice further contribute to market growth. Moreover, ongoing research into combination therapies is expanding the clinical use of mTOR inhibitors across multiple cancer types.

India mTOR Inhibitor Oncology Drug Market Insight

The India mTOR inhibitor oncology drug market accounted for a significant share in Asia-Pacific in 2025, driven by rising cancer incidence, expanding healthcare infrastructure, and increasing access to targeted therapies. India’s growing middle class and improving insurance coverage are enabling greater affordability of advanced oncology drugs. The presence of strong domestic pharmaceutical manufacturers and availability of cost-effective formulations are further supporting market penetration. In addition, government initiatives focused on cancer care expansion and early diagnosis are expected to propel sustained market growth in India.

mTOR Inhibitor Oncology Drug Market Share

The mTOR Inhibitor Oncology Drug industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- AstraZeneca (U.K.)

- Takeda Pharmaceutical Company Limited (Japan)

- Bristol-Myers Squibb Company (U.S.)

- Bayer AG (Germany)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla Ltd. (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Glenmark Pharmaceuticals Ltd. (India)

- Zydus Lifesciences (India)

- Hikma Pharmaceuticals PLC (U.K.)

- AbbVie Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- GSK plc (U.K.)

- Biocon Limited (India)

- Aadi Bioscience Inc. (U.S.)

- Exelixis Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

What are the Recent Developments in Global mTOR Inhibitor Oncology Drug Market?

- In November 2025, Rakovina Therapeutics showcased compelling preclinical data on AI-discovered CNS-penetrant ATR/mTOR dual inhibitors at the 2025 Society for Neuro-Oncology Annual Meeting, highlighting the discovery of novel compounds designed to cross the blood–brain barrier, co-target ATR and mTOR pathways in PTEN-deficient tumors, and exhibit potent inhibition and promising activity against brain-involved cancers

- In October 2025, clinical trial data for RMC-5552, a bi-steric mTORC1-selective inhibitor, showed promising activity and tolerability in patients with advanced solid tumors, demonstrating disease control in a significant proportion of treated patients and a complete response in a case of PTEN- and PIK3CA-altered endometrial cancer, reinforcing clinical potential for deep, selective mTORC1

- In December 2022, Revolution Medicines published findings on the discovery and synthesis of RMC-5552, a first-in-class bi-steric mTORC1-selective inhibitor, detailing its exceptional selectivity for mTORC1 over mTORC2, deep pathway inhibition, and potential to address resistance mechanisms, marking a key advancement in next-generation mTOR oncology inhibitor

- In October 2021, research on Rapalink-1, a dual-site mTOR inhibitor, reported enhanced tumor suppression and innovative molecular design, contributing to scientific understanding of advanced mTOR inhibitory mechanisms that can inform future oncology therapeutics with dual mTOR targeting potential

- In June 2021, Revolution Medicines published a scientific paper describing a novel class of bi-steric mTORC1 inhibitors including RMC-5552, demonstrating potent anti-tumor activity in preclinical cancer models and laying the groundwork for clinical development of this promising targeted therapy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.