Global Mulch Films Market

Market Size in USD Billion

CAGR :

%

USD

8.30 Billion

USD

12.83 Billion

2023

2031

USD

8.30 Billion

USD

12.83 Billion

2023

2031

| 2024 –2031 | |

| USD 8.30 Billion | |

| USD 12.83 Billion | |

|

|

|

|

Mulch Films Market Size

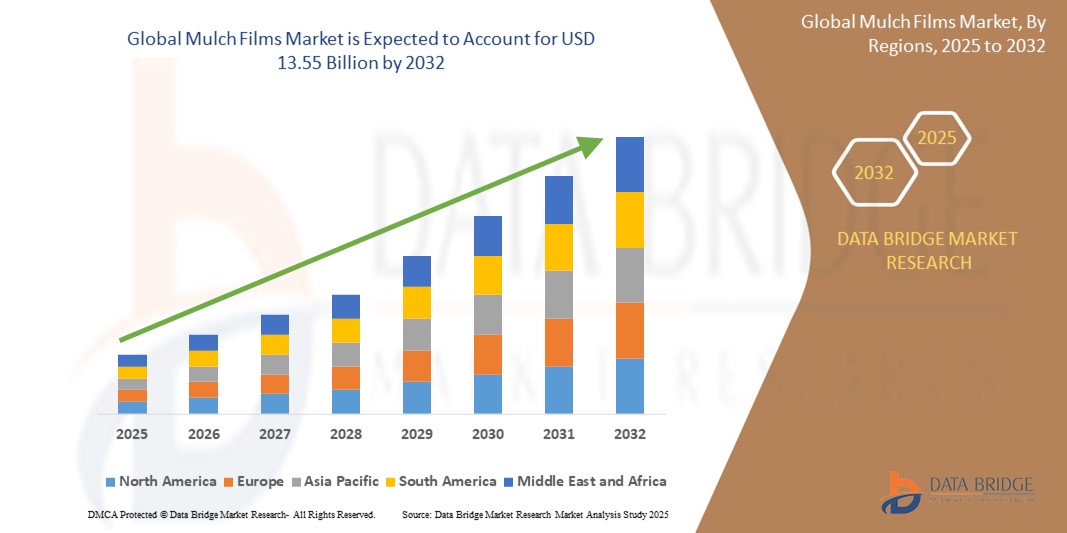

- The global mulch films market size was valued at USD 8.76 billion in 2024 and is expected to reach USD 13.55 billion by 2032, at a CAGR of 5.60% during the forecast period

- The market growth is primarily driven by the increasing adoption of advanced agricultural practices, rising demand for sustainable farming solutions, and the need to enhance crop yield and quality in response to growing global food demand

- The growing emphasis on eco-friendly and biodegradable mulch films, coupled with technological advancements in polymer materials, is significantly boosting the industry's expansion

Mulch Films Market Analysis

- Mulch films, used to cover soil in agricultural and horticultural applications, play a critical role in modern farming by improving soil moisture retention, controlling weed growth, and enhancing crop productivity

- The rising demand for mulch films is fueled by increasing awareness of sustainable agriculture, the need for water conservation in arid regions, and the adoption of precision farming techniques

- Asia-Pacific dominated the mulch films market with the largest revenue share of 42.5% in 2024, driven by extensive agricultural activities, large-scale farming, and government initiatives promoting modern farming techniques in countries such as China and India

- Europe is expected to be the fastest-growing region during the forecast period due to stringent environmental regulations, growing adoption of biodegradable mulch films, and increasing investment in sustainable agriculture

- The black mulch films segment dominated the largest market revenue share of 38.5% in 2024, driven by its widespread use in agricultural farms for effective weed control, soil temperature regulation, and moisture retention

Report Scope and Mulch Films Market Segmentation

|

Attributes |

Mulch Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mulch Films Market Trends

“Increasing Adoption of Biodegradable and Advanced Materials”

- The global mulch films market is experiencing a significant trend toward the adoption of biodegradable and advanced materials, such as Polylactic Acid (PLA) and Polyhydroxyalkanoate (PHA), driven by growing environmental concerns and regulatory pressures on plastic waste

- These advanced materials enable sustainable farming by decomposing naturally in the soil, reducing plastic residue and environmental impact while maintaining benefits such as weed suppression, moisture retention, and soil temperature regulation

- Biodegradable mulch films, such as those made from starch-based polymers, are gaining traction as they eliminate the need for post-harvest film removal, saving time and labor costs for farmers

- For instance, companies such as BASF SE and Novamont S.p.A. are developing certified soil-biodegradable mulch films, such as Ecovio and MATER-BI, which comply with stringent environmental standards and enhance soil health

- This trend is increasing the appeal of mulch films for eco-conscious farmers and horticulturists, particularly in regions with strong sustainability mandates such as Europe

- Advanced mulch films with UV stabilization and antimicrobial properties are being developed to enhance durability and suppress weed growth, further improving crop yield and sustainability

Mulch Films Market Dynamics

Driver

“Rising Demand for Sustainable Agriculture and Higher Crop Yields”

- Increasing global population and food demand are driving the adoption of mulch films in agricultural farms and horticulture to enhance crop productivity and resource efficiency

- Mulch films improve soil moisture retention, regulate soil temperature, and reduce weed growth, leading to higher crop yields and reduced reliance on herbicides and irrigation

- Government initiatives and subsidies, particularly in Asia-Pacific, are promoting the use of mulch films to address water scarcity and improve agricultural output, with countries such as China and India leading adoption

- The proliferation of smart agriculture technologies, such as IoT-enabled sensors for real-time soil monitoring, is enhancing the effectiveness of mulch films by optimizing water and nutrient use

- Major agricultural producers are increasingly integrating mulch films as standard practice to meet the growing demand for high-value crops such as fruits, vegetables, and flowers

Restraint/Challenge

“High Cost of Biodegradable Films and Regulatory Complexities”

- The high initial cost of biodegradable mulch films, which can be 1.5 to 2 times more expensive than traditional polyethylene films, poses a significant barrier to adoption, particularly for small-scale farmers in cost-sensitive markets

- The production and application of advanced mulch films, such as those with UV stabilization or multilayer technologies, require substantial investment in manufacturing and installation, limiting accessibility in emerging markets

- Environmental regulations and varying standards across countries, such as restrictions on non-biodegradable plastics in Europe, create compliance challenges for manufacturers and increase operational complexity

- Concerns about the durability and effectiveness of biodegradable films compared to conventional polyethylene films, particularly in extreme weather conditions, can deter adoption among farmers seeking reliable performance

- These factors may slow market growth in regions with limited financial resources or inconsistent regulatory frameworks, despite the push for sustainable practices

Mulch Films market Scope

The market is segmented on the basis of type, application, and element.

- By Type

On the basis of type, the global mulch films market is segmented into clear/transparent, black, colored, degradable, and others. The black mulch films segment dominated the largest market revenue share of 38.5% in 2024, driven by its widespread use in agricultural farms for effective weed control, soil temperature regulation, and moisture retention. Black mulch films, such as those used in strawberry farming in Spain, prevent sunlight from reaching weed seeds, enhancing crop quality.

The degradable mulch films segment is expected to witness the fastest growth rate of 8.7% from 2025 to 2032, fueled by rising environmental concerns and regulatory restrictions on plastic waste. Biodegradable films, such as BASF’s ecovio M, decompose naturally, reducing soil contamination and aligning with sustainable agriculture practices.

- By Application

On the basis of application, the global mulch films market is segmented into agricultural farms and horticulture. The agricultural farms segment dominated the market with a revenue share of 62.3% in 2024, driven by the extensive use of mulch films in large-scale crop cultivation, such as vegetables and fruits, to enhance yield and conserve water. The segment benefits from the growing global demand for food and the adoption of modern farming techniques.

The horticulture segment is anticipated to experience the fastest growth rate of 7.9% from 2025 to 2032, propelled by the expanding floriculture and greenhouse farming industries. Mulch films in horticulture, particularly in Europe and North America, improve crop quality by maintaining optimal soil conditions in controlled environments.

- By Element

On the basis of element, the global mulch films market is segmented into Linear Low-Density Polyethylene (LLDPE), Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Ethylene-Vinyl Acetate (EVA), Polylactic Acid (PLA), Polyhydroxyalkanoate (PHA), and others. The LLDPE segment held the largest market revenue share of 42.8% in 2024, owing to its superior strength, flexibility, and water retention properties, making it ideal for harsh agricultural environments.

The PLA segment is expected to witness the fastest growth rate of 9.2% from 2025 to 2032, driven by its biodegradability and alignment with circular economy principles. PLA-based mulch films, derived from renewable resources such as corn starch, decompose naturally, reducing environmental impact and meeting the demand for eco-friendly solutions

Mulch Films Market Regional Analysis

- Asia-Pacific dominated the mulch films market with the largest revenue share of 42.5% in 2024, driven by extensive agricultural activities, large-scale farming, and government initiatives promoting modern farming techniques in countries such as China and India

- Europe is expected to be the fastest-growing region during the forecast period due to stringent environmental regulations, growing adoption of biodegradable mulch films, and increasing investment in sustainable agriculture

U.S. Mulch Films Market Insight

The U.S. mulch films market is expected to witness significant growth, fueled by strong demand in agricultural farms and growing awareness of soil health benefits. The trend toward sustainable agriculture and increasing regulations promoting biodegradable films boost market expansion. The integration of mulch films in organic farming and aftermarket applications creates a robust product ecosystem.

Europe Mulch Films Market Insight

The Europe mulch films market is expected to witness the fastest growth rate, supported by stringent regulations promoting sustainable agriculture and environmental conservation. Consumers seek films that enhance crop yields while reducing environmental impact. The growth is prominent in both agricultural farms and horticulture, with countries such as Germany and France showing significant uptake due to rising environmental concerns and modern farming techniques.

U.K. Mulch Films Market Insight

The U.K. market for mulch films is expected to witness rapid growth, driven by demand for improved crop productivity and soil conservation in agricultural and horticultural settings. Increased interest in biodegradable films and rising awareness of water conservation benefits encourage adoption. Evolving environmental regulations influence consumer choices, balancing efficacy with sustainability.

Germany Mulch Films Market Insight

Germany is expected to witness the fastest growth rate in mulch films, attributed to its advanced agricultural sector and high consumer focus on sustainability and efficiency. German farmers prefer technologically advanced films, such as PLA and PHA, that enhance soil health and reduce water usage. The integration of these films in precision agriculture and organic farming supports sustained market growth.

Asia-Pacific Mulch Films Market Insight

The Asia-Pacific region dominates the global mulch films market with the largest revenue share of 46.14% in 2024, driven by extensive agricultural activities and rising food demand in countries such as China, India, and Japan. Increasing awareness of water conservation, weed control, and crop yield enhancement boosts demand. Government initiatives promoting sustainable farming and advanced agricultural practices further encourage the use of mulch films.

Japan Mulch Films Market Insight

Japan’s mulch films market is expected to witness rapid growth due to strong consumer preference for high-quality, biodegradable mulch films that enhance crop productivity and sustainability. The presence of major agricultural innovators and integration of mulch films in modern farming accelerate market penetration. Rising interest in organic farming also contributes to growth.

China Mulch Films Market Insight

China holds the largest share of the Asia-Pacific mulch films market, propelled by rapid urbanization, rising agricultural output, and increasing demand for sustainable farming solutions. The country’s growing population and focus on food security support the adoption of advanced mulch films. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Mulch Films Market Share

The mulch films industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Berry Global Inc. (U.S.)

- Dow (U.S.)

- RKW Group (Germany)

- Kingfa Sci.&Tech. Co.,Ltd. (China)

- BioBag International AS (Norway)

- Al-Pack Enterprises Ltd. (Canada)

- Armando Alvarez Group (Spain)

- Novamont S.p.A. (Italy)

- Rani Group (Finland)

- Polythene UK Ltd (U.K.)

- Kuraray America, Inc. (U.S.)

What are the Recent Developments in Global Mulch Films Market?

- In June 2024, NUREL SA earned the prestigious TÜV OK biodegradable SOIL certification for its biopolymer range designed for agricultural mulching applications. This certification confirms that NUREL’s products fully biodegrade in soil without leaving harmful residues, aligning with the company’s mission to promote sustainable and environmentally responsible farming practices. In addition, NUREL’s biopolymers comply with the EN 17033 standard, ensuring both biodegradability and performance in real-world agricultural conditions. This milestone reinforces NUREL’s leadership in advancing eco-friendly plastic alternatives that support soil health and reduce environmental impact

- In April 2024, the U.S. Department of Agriculture (USDA) awarded a four-year, $744,000 grant to a research team led by Lehigh University and UMass Lowell to develop biodegradable mulch films that not only suppress weeds and conserve water but also nourish soil and reduce plastic pollution. These innovative films will integrate biopolymers such as PLA and PHA with urea-based nutrient cocrystals, enabling them to decompose naturally while releasing fertilizers. The project aims to replace conventional plastic mulch with eco-friendly, nutrient-enhancing alternatives, supporting sustainable farming and healthier soils

- In March 2024, Sulzer partnered with Balrampur Chini Mills Limited (BCML) to supply advanced polylactic acid (PLA) production technologies for India’s first bioplastics plant. Located adjacent to BCML’s sugarcane processing facility, the plant will produce 75,000 tons annually of compostable and fully recyclable bioplastics using sugarcane as the primary feedstock. This initiative highlights the growing shift toward agriculture-based bioplastic production, including applications such as biodegradable mulch films, and supports India’s broader sustainability goals by reducing reliance on fossil-based plastics

- In October 2023, BioBag International AS launched BioAgri, a biodegradable mulch film tailored for agricultural use. Designed to replace conventional plastic mulch, BioAgri fully decomposes in soil after use, eliminating the need for manual removal and reducing environmental impact. This innovation supports sustainable farming by addressing the growing concern over plastic waste in agriculture, while maintaining the benefits of traditional mulch—such as weed suppression, moisture retention, and soil temperature regulation. BioAgri is certified compostable and aligns with EU standards for biodegradability in soil

- In October 2023, Mondi plc partnered with Cotesi S.A. to launch Advantage Kraft Mulch, a 100% kraft paper mulch film designed to replace conventional plastic alternatives in agriculture. Created from responsibly sourced wood with no plastic or coating, this industrially compostable solution offers comparable protection against weeds, erosion, and weather while naturally decomposing after harvest. Certified under DIN EN 13432, the mulch film adds organic matter to the soil, eliminating the need for costly removal or recycling. This collaboration reflects a shared commitment to sustainable farming practices and reducing plastic pollution in agriculture

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.