Global Multivendor Atm Software Market

Market Size in USD Billion

CAGR :

%

USD

4.05 Billion

USD

22.63 Billion

2024

2032

USD

4.05 Billion

USD

22.63 Billion

2024

2032

| 2025 –2032 | |

| USD 4.05 Billion | |

| USD 22.63 Billion | |

|

|

|

|

Multivendor ATM Software Market Size

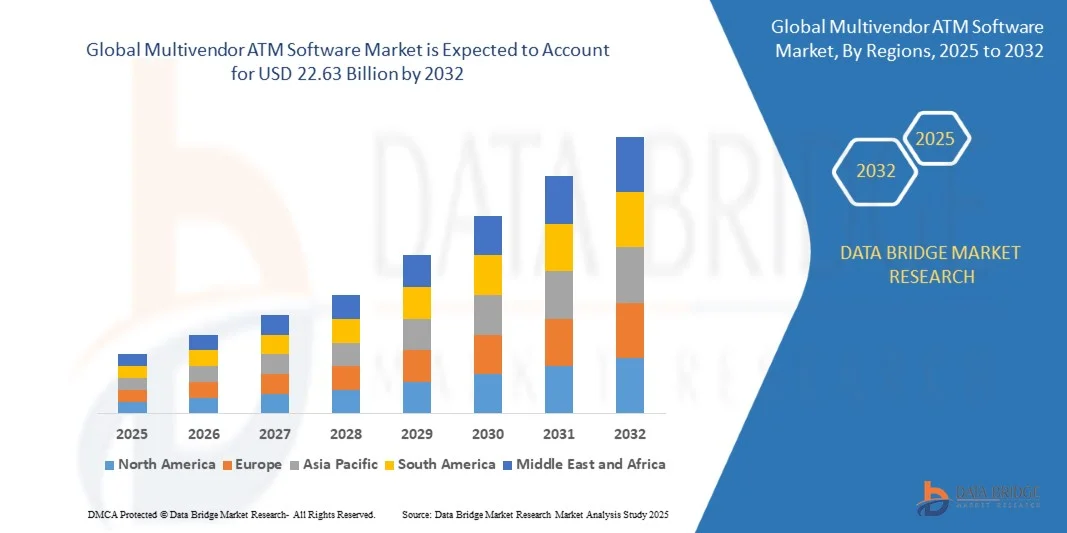

- The global multivendor ATM software market size was valued at USD 4.05 billion in 2024 and is expected to reach USD 22.63 billion by 2032, at a CAGR of 24.0% during the forecast period

- The market growth is largely fueled by the increasing digitalization of banking and financial services, coupled with the rising adoption of self-service technologies and ATM networks that require interoperable software solutions across multiple hardware vendors

- Furthermore, growing demand from banks and independent ATM deployers for secure, scalable, and flexible solutions that can manage heterogeneous ATM networks is driving the adoption of multivendor ATM software. These converging factors are accelerating the deployment of advanced ATM management systems, thereby significantly boosting the industry's growth

Multivendor ATM Software Market Analysis

- Multivendor ATM software enables financial institutions to operate and manage ATMs from multiple hardware manufacturers using a single platform. These systems provide real-time monitoring, remote management, predictive maintenance, and enhanced security features, supporting both banks and independent ATM deployers

- The escalating demand for multivendor ATM software is primarily driven by the need for operational efficiency, fraud prevention, compliance with regulatory standards, and the ability to offer enhanced customer experiences through modernized ATM networks

- North America dominated the multivendor ATM software market in 2024, due to the growing demand for secure, interoperable ATM networks and digital banking solutions

- Asia-Pacific is expected to be the fastest growing region in the multivendor ATM software market during the forecast period due to increasing digital banking adoption, urbanization, and technological advancements in countries such as China, India, and Japan

- Software segment dominated the market with a market share of 58.8% in 2024, due to the need for secure, scalable, and interoperable platforms that support a wide range of ATM functionalities. Banks and ATM deployers prioritize software solutions capable of real-time monitoring, multi-vendor support, and integration with various core banking systems. The increasing focus on digitalization, fraud prevention, and customer experience has reinforced software adoption across both mature and emerging markets. Advanced features such as analytics dashboards, remote configuration, and predictive maintenance contribute to its dominance

Report Scope and Multivendor ATM Software Market Segmentation

|

Attributes |

Multivendor ATM Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Multivendor ATM Software Market Trends

“Rise of Cloud-Based, AI-Enabled ATM Software”

- The multivendor ATM software market is increasingly shifting toward cloud-based, AI-enabled platforms that support enhanced functionality and flexibility across diverse banking and financial service environments. Cloud deployments allow banks to streamline ATM operations, improve scalability, and implement updates more cost-effectively than traditional setups

- For instance, NCR Corporation has launched multivendor software solutions leveraging cloud-based frameworks to enable real-time updates, centralized management, and advanced analytics. Similarly, Diebold Nixdorf has integrated AI-driven capabilities into its software, enhancing fraud detection, predictive maintenance, and customer personalization across ATM networks

- AI integration in multivendor ATM software is enabling smarter services such as transaction behavior analysis, biometric authentication, and anomaly detection. These advancements reduce risks of fraudulent activities while improving overall customer experience through faster and more personalized services

- The adoption of cloud frameworks also supports open banking and digital transformation strategies, enabling banks to integrate ATMs seamlessly with mobile platforms, customer relationship systems, and advanced analytics. This convergence is creating significant opportunities for enhancing omnichannel banking experiences

- The growth of self-service banking is further fueled by AI-powered ATM software that extends capabilities such as cardless withdrawals, voice-enabled interactions, and contextual customer engagement. These features align with the industry vision of more customer-centric and technologically enabled financial services

- The rise of cloud-based, AI-enabled ATM software signifies a fundamental evolution in financial services. By improving efficiency, supporting compliance, and enhancing customer trust, these technologies are setting the foundation for fully digitized and interoperable ATM ecosystems across global markets

Multivendor ATM Software Market Dynamics

Driver

“Demand for Secure, Interoperable ATM Solutions”

- The need for secure and interoperable platforms is a key driver for multivendor ATM software adoption. Banks and financial institutions seek solutions that can work seamlessly with diverse hardware, enabling flexibility and avoiding vendor lock-in while ensuring high levels of security and regulatory compliance

- For instance, KAL ATM Software provides vendor-independent solutions that operate across diverse ATM models and networks, supporting banks in managing cost efficiency and avoiding dependence on proprietary technologies. FIS Global also offers multivendor software platforms that emphasize interoperability, enabling financial institutions to standardize operations across heterogeneous ATM fleets

- Secure multivendor ATM solutions allow financial institutions to implement unified cybersecurity measures such as end-to-end encryption, biometric verification, and advanced monitoring. This ensures consistent levels of customer protection regardless of hardware type or geography

- The adoption of interoperable solutions helps banks reduce operational complexity and ensure agility in responding to evolving customer requirements. By unifying workflows across different systems, institutions are able to deliver uniform digital banking services with improved cost-effectiveness

- The increasing demand for multivendor, secure, and interoperable software highlights the financial industry’s focus on standardization, flexibility, and trust. These solutions are emerging as the cornerstone of modern ATM operations, ensuring resilience and competitiveness in a highly digitalized banking environment

Restraint/Challenge

“Integration with Diverse Hardware and Legacy Systems”

- The integration of multivendor ATM software across diverse hardware platforms and legacy systems presents a major challenge in the market. Many financial institutions still rely on outdated ATM infrastructure, which complicates efforts to deploy modern AI-enabled and cloud-based applications

- For instance, legacy ATMs managed by smaller financial institutions often lack the processing power, connectivity, or firmware compatibility required to run advanced multivendor software. Providers such as Diebold Nixdorf and NCR continue to face difficulties aligning new software innovations with older ATM generations still active in several regions

- Ensuring smooth interoperability demands significant customization, rigorous testing, and costly upgrades. These technical processes extend project timelines and increase implementation costs, discouraging banks operating with limited budgets from transitioning to modern platforms

- Another issue arises from the variety of hardware components in ATM fleets across different geographies, which complicates standardized updates and increases vulnerability to compatibility failures or downtime. This creates ongoing challenges for global deployment

- Overcoming these barriers requires greater industry collaboration on open standards, modular design frameworks, and phased migration paths for legacy equipment. Addressing such challenges will be critical for accelerating adoption and unlocking the full potential of multivendor ATM software in ensuring seamless and secure financial services delivery

Multivendor ATM Software Market Scope

The market is segmented on the basis of function, component, and end-user.

• By Function

On the basis of function, the multivendor ATM software market is segmented into card payment, bill payment, cash/cheque dispenser, passbook printer, cash/cheque deposit, and others. The card payment segment dominated the largest market revenue share in 2024, driven by the high frequency of card-based transactions globally and the growing preference for debit, credit, and prepaid card usage. Financial institutions and independent ATM deployers increasingly rely on robust software solutions to manage secure card transactions, prevent fraud, and ensure compliance with regulatory standards. The widespread adoption of EMV chip cards and contactless payments has further reinforced demand for card payment modules within multivendor ATM software platforms. The integration of advanced analytics, real-time monitoring, and multi-currency support also adds to the preference for this segment.

The cash/cheque deposit function is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for self-service banking and cashless ecosystems. Customers increasingly prefer deposit-enabled ATMs for convenience, minimizing in-branch visits and queue times. The rapid deployment of intelligent deposit automation and image-based cheque verification software enhances operational efficiency, driving adoption among banks and independent ATM deployers. This segment also benefits from technological advancements that ensure secure, error-free deposit processing.

• By Component

On the basis of component, the multivendor ATM software market is segmented into service and software. The software component held the largest market revenue share of 58.8% in 2024, driven by the need for secure, scalable, and interoperable platforms that support a wide range of ATM functionalities. Banks and ATM deployers prioritize software solutions capable of real-time monitoring, multi-vendor support, and integration with various core banking systems. The increasing focus on digitalization, fraud prevention, and customer experience has reinforced software adoption across both mature and emerging markets. Advanced features such as analytics dashboards, remote configuration, and predictive maintenance contribute to its dominance.

The service component is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising requirement for technical support, installation, maintenance, and upgrade services. As ATMs become increasingly sophisticated and interconnected, providers offering professional services ensure seamless operation and minimal downtime. The growing outsourcing trend in ATM management and the complexity of multivendor environments further drive demand for service components.

• By End User

On the basis of end user, the multivendor ATM software market is segmented into independent ATM deployers and banks and financial institutions. The banks and financial institutions segment dominated the largest market revenue share in 2024, owing to the extensive deployment of ATMs across branches to provide comprehensive banking services. Banks prefer robust, secure, and customizable software solutions to manage high transaction volumes, ensure regulatory compliance, and enhance customer convenience. The adoption of multivendor software allows seamless integration with legacy systems and support for multiple ATM hardware vendors, strengthening operational efficiency.

The independent ATM deployers segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the increasing trend of outsourced ATM operations and the expansion of ATMs in underbanked or high-footfall locations. Independent deployers seek flexible, cost-effective, and scalable software solutions to support diverse ATM networks. Technological advancements in mobile and cloud-enabled ATM management systems further encourage independent deployers to adopt multivendor software for enhanced security and real-time monitoring.

Multivendor ATM Software Market Regional Analysis

- North America dominated the multivendor ATM software market with the largest revenue share in 2024, driven by the growing demand for secure, interoperable ATM networks and digital banking solutions

- Financial institutions and independent ATM deployers in the region prioritize software that ensures seamless multivendor compatibility, real-time monitoring, and fraud prevention

- The widespread adoption is further supported by high banking penetration, advanced IT infrastructure, and strong regulatory compliance frameworks, establishing multivendor ATM software as a critical solution for both banks and independent deployers

U.S. Multivendor ATM Software Market Insight

The U.S. market captured the largest revenue share North America in 2024, fueled by the rapid digitization of banking services and the growing trend of outsourcing ATM operations. Banks and independent deployers are increasingly adopting multivendor software to manage heterogeneous ATM networks efficiently while ensuring security and compliance. The rising demand for mobile-enabled ATM management, real-time transaction monitoring, and cloud-integrated solutions further propels market growth. Moreover, the U.S. emphasis on customer convenience, coupled with advanced technological adoption, supports the continuous expansion of the multivendor ATM software market.

Europe Multivendor ATM Software Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent regulatory requirements, rising digital transaction volumes, and the modernization of legacy ATM systems. The region’s banks and independent ATM deployers increasingly rely on multivendor software to enhance operational efficiency and reduce downtime. Urbanization, the adoption of advanced payment technologies, and the preference for self-service banking solutions are further fostering market growth across residential, commercial, and public sectors.

U.K. Multivendor ATM Software Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, driven by increasing digital banking adoption and demand for efficient, interoperable ATM solutions. Concerns regarding security, fraud prevention, and compliance encourage banks and independent deployers to implement robust multivendor software. The strong fintech ecosystem, connected infrastructure, and growing e-commerce sector further stimulate the market, enabling seamless integration of ATM networks with mobile and web-based platforms.

Germany Multivendor ATM Software Market Insight

The Germany market is expected to expand at a considerable CAGR, fueled by the modernization of banking infrastructure and growing awareness of secure ATM operations. Banks and independent deployers increasingly adopt advanced software solutions that enable multivendor support, real-time monitoring, and predictive maintenance. Germany’s emphasis on technological innovation and efficient financial services promotes the widespread use of multivendor ATM software across both commercial and public banking networks.

Asia-Pacific Multivendor ATM Software Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing digital banking adoption, urbanization, and technological advancements in countries such as China, India, and Japan. The growing trend of self-service banking, expansion of independent ATM networks, and government initiatives supporting financial inclusion are accelerating software adoption. In addition, APAC’s emergence as a hub for fintech development and software innovation is enhancing the availability and affordability of multivendor ATM solutions.

Japan Multivendor ATM Software Market Insight

The Japan market is witnessing steady growth due to high technology adoption, urbanization, and demand for efficient ATM operations. Banks and independent deployers prioritize software solutions that ensure interoperability, minimize downtime, and provide advanced transaction monitoring. Japan’s aging population and preference for self-service banking solutions further drive demand for intuitive, reliable multivendor ATM software.

China Multivendor ATM Software Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, high digital banking penetration, and the expansion of independent ATM deployers. Banks and deployers increasingly adopt multivendor software to manage large-scale ATM networks efficiently, ensure security, and enable real-time monitoring. Government initiatives promoting digital payments and financial inclusion, combined with strong domestic software providers, are key factors propelling market growth in China.

Multivendor ATM Software Market Share

The multivendor ATM software industry is primarily led by well-established companies, including:

- Vortex Engineering Pvt. Ltd. (India)

- Diebold Nixdorf, Incorporated (U.S.)

- NCR Corporation (U.S.)

- Auriga, SpA (Italy)

- Renovite Inc. (U.S.)

- Clydestone (Ghana) Limited. (Ghana)

- Worldline (France)

- Euronet Worldwide, Inc. (U.S.)

- CashLink Global Systems Pvt. Ltd. (India)

- Voicecom (China)

- KAL (U.K.)

- GRGBanking (China)

- Printec Group (Austria)

Latest Developments in Multivendor ATM Software Market

- In September 2025, KAL announced that its Kalignite software suite is fully compatible with Microsoft's Windows 11 operating system. This update allows banks and independent ATM deployers to upgrade their existing ATM networks without costly hardware replacements. As Microsoft ends support for non-LTSC versions of Windows 10 on October 14, 2025, KAL's solution provides a cost-effective pathway to ensure continued security and compliance across diverse ATM fleets. The Kalignite Hypervisor enables seamless integration of Windows 11, modernizing user interfaces and enhancing operational efficiency without disrupting existing infrastructure

- In June 2025, Brink’s Company made a strategic investment in KAL ATM Software to redefine ATM managed services by prioritizing interoperability. This partnership enables Brink’s to offer customers the flexibility to choose the best ATM hardware and software combinations, enhancing service delivery and operational efficiency. By leveraging KAL's multivendor capabilities, Brink’s can provide a consistent customer experience across diverse ATM platforms, aligning with the growing market demand for flexible and scalable ATM solutions

- In January 2025, GRGBanking introduced a new cloud-based multivendor ATM software platform, offering banks and financial institutions a scalable and flexible solution for managing their ATM networks. The platform enables centralized monitoring, real-time analytics, and remote management of ATMs, reducing operational costs and improving service uptime. Adoption of cloud technology in ATM software reflects the industry’s shift toward digital transformation, allowing financial institutions to enhance customer experiences and streamline operations through advanced technological solutions

- In October 2024, a leading ATM software provider integrated biometric authentication features into its multivendor solutions, enhancing security and user convenience. This development allows financial institutions to offer more secure and personalized ATM services, catering to the growing demand for advanced security measures and aligning with global trends toward contactless and personalized banking experiences. Integration of biometric security increases consumer trust in ATM services, reduces fraud risks, and positions providers to meet stringent regulatory and compliance standards

- In August 2021, NCR Corporation acquired LibertyX, a cryptocurrency software provider, enabling NCR to integrate cryptocurrency transaction capabilities into its ATM software suite. This acquisition expands the range of services offered through ATMs and positions NCR at the forefront of the evolving digital currency landscape. Financial institutions can now meet the growing consumer demand for cryptocurrency transactions at ATMs, reflecting a key innovation trend in the multivendor ATM software market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.