Global Myasthenia Gravis Disease Market

Market Size in USD Million

CAGR :

%

USD

861.02 Million

USD

1,969.99 Million

2024

2032

USD

861.02 Million

USD

1,969.99 Million

2024

2032

| 2025 –2032 | |

| USD 861.02 Million | |

| USD 1,969.99 Million | |

|

|

|

|

Myasthenia Gravis Disease Market Size

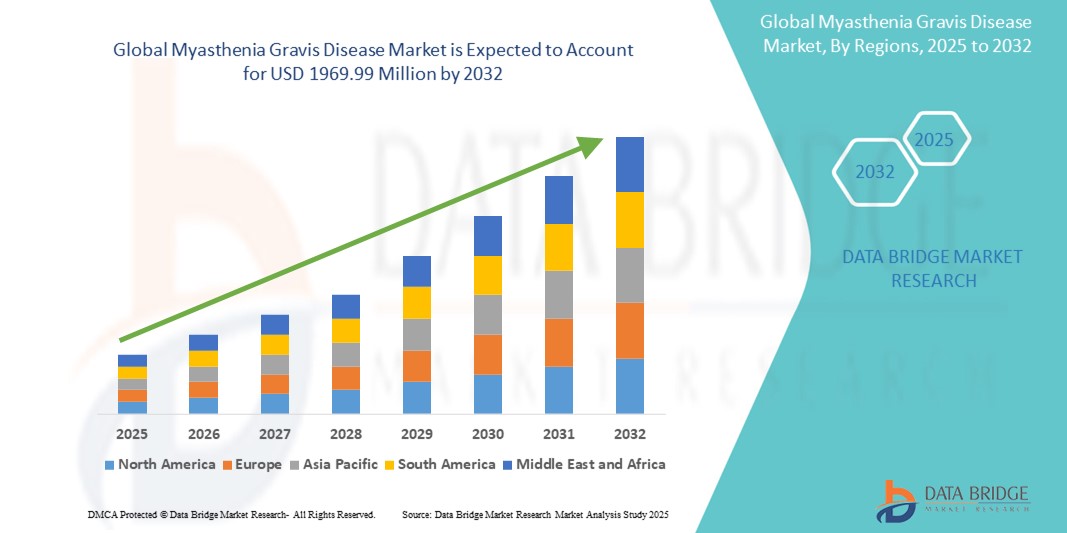

- The global myasthenia gravis disease market size was valued at USD 861.02 million in 2024 and is expected to reach USD 1969.99 million by 2032, at a CAGR of 10.9% during the forecast period

- The market growth is primarily driven by increasing awareness of myasthenia gravis, advancements in diagnostic techniques, and the development of novel treatment options, including targeted therapies and biologics

- Rising prevalence of autoimmune diseases, coupled with growing healthcare expenditure and demand for personalized medicine, is further propelling the adoption of advanced treatment solutions for myasthenia gravis

Myasthenia Gravis Disease Market Analysis

- Myasthenia gravis, an autoimmune neuromuscular disorder characterized by muscle weakness and fatigue, is seeing increased demand for effective diagnostics and treatments due to rising global incidence and improved healthcare access

- The market is fueled by advancements in immunosuppressive therapies, biologics, and minimally invasive surgical techniques, alongside growing patient awareness and early diagnosis initiatives

- North America dominated the myasthenia gravis disease market with the largest revenue share of 42.5% in 2024, driven by advanced healthcare infrastructure, high adoption of novel therapies, and the presence of key market players. The U.S. leads in research and development, with significant investments in biologics and clinical trials

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to increasing healthcare investments, rising awareness, and growing prevalence of autoimmune disorders due to urbanization and lifestyle changes

- The blood test segment dominated the largest market revenue share of 38.5% in 2024, driven by its high sensitivity in detecting acetylcholine receptor antibodies, which are present in approximately 85-90% of patients with generalized myasthenia gravis

Report Scope and Myasthenia Gravis Disease Market Segmentation

|

Attributes |

Myasthenia Gravis Disease Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Myasthenia Gravis Disease Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The Global Myasthenia Gravis Disease Market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies facilitate advanced data processing, offering deeper insights into patient diagnostics, treatment outcomes, and disease progression

- AI-driven platforms are being developed to analyze patient data, such as antibody levels and muscle response patterns, to predict disease exacerbations and tailor personalized treatment plans

- For instances, companies are leveraging AI to optimize immunosuppressive therapy dosages or identify candidates for thymectomy based on historical patient data and real-time health metrics

- This trend enhances the precision and efficiency of myasthenia gravis management, making treatments more appealing to healthcare providers and patients

- AI algorithms can evaluate a wide range of patient behaviors and clinical data, including response to cholinesterase inhibitors, adverse effects of corticosteroids, and patterns of myasthenic crises.

Myasthenia Gravis Disease Market Dynamics

Driver

“Rising Demand for Advanced Diagnostics and Targeted Therapies”

- Growing awareness of myasthenia gravis and the demand for precise diagnostic tools, such as single-fiber electromyography (EMG) and antibody blood tests, are key drivers for the market

- Advanced treatment options, including monoclonal antibodies and complement inhibitors, enhance patient outcomes and quality of life, boosting market growth

- Government initiatives and regulatory approvals, particularly in North America, such as the FDA’s approval of zilucoplan for generalized myasthenia gravis, are accelerating the adoption of novel therapies

- The expansion of healthcare infrastructure and the integration of IoT in medical devices support real-time patient monitoring and faster data-driven decisions

- Pharmaceutical companies are increasingly investing in biologics and immunotherapies as standard or adjunctive treatments to meet patient needs and improve disease management

Restraint/Challenge

“High Cost of Novel Therapies and Data Privacy Concerns”

- The high cost of advanced treatments, such as monoclonal antibodies and plasmapheresis, poses a significant barrier to adoption, particularly in emerging markets

- Implementing diagnostic tools such as single-fiber EMG and integrating them into healthcare systems can be complex and expensive

- Data privacy and security concerns are a major challenge, as patient data collected for AI-driven analytics and remote monitoring is sensitive and subject to breaches or misuse

- The varied regulatory frameworks across countries for data protection and clinical trials create operational challenges for global pharmaceutical companies and healthcare providers

- These factors may limit market growth in regions with high cost sensitivity or stringent data privacy regulations, such as Europe and parts of Asia-Pacific

Myasthenia Gravis Disease market Scope

The market is segmented on the basis of diagnosis, treatment type, route of administration, end users, and distribution channel.

- By Diagnosis

On the basis of diagnosis, the global myasthenia gravis disease market is segmented into edrophonium test, blood test, repetitive nerve stimulation, single-fiber electromyography (EMG), and others. The blood test segment dominated the largest market revenue share of 38.5% in 2024, driven by its high sensitivity in detecting acetylcholine receptor antibodies, which are present in approximately 85-90% of patients with generalized myasthenia gravis. This non-invasive method is widely adopted for accurate and early diagnosis.

The single-fiber electromyography (EMG) segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior sensitivity in diagnosing myasthenia gravis, particularly in cases with negative antibody tests. Advancements in electrophysiological techniques and increasing adoption in specialized neurology centers further accelerate its growth.

- By Treatment Type

On the basis of treatment type, the global myasthenia gravis disease market is segmented into cholinesterase inhibitors, corticosteroids, immunosuppressants, plasmapheresis, autologous hematopoietic stem cell transplantation (HSCT), surgery, and others. The cholinesterase inhibitors segment is expected to hold the largest market revenue share of 32.5% in 2024, primarily due to their widespread use as first-line symptomatic treatment, improving neuromuscular transmission with drugs such as pyridostigmine.

The immunosuppressants segment is anticipated to experience the fastest growth rate of 12.8% from 2025 to 2032, fueled by the rising adoption of targeted therapies, such as monoclonal antibodies, and advancements in biologics that offer improved efficacy and reduced side effects compared to traditional corticosteroids.

- By Route of Administration

On the basis of route of administration, the global myasthenia gravis disease market is segmented into oral and parenteral. The oral segment is expected to hold the largest market revenue share of 68.5% in 2024, driven by the convenience and widespread use of oral medications such as cholinesterase inhibitors and corticosteroids for long-term symptom management.

The parenteral segment is expected to witness the fastest growth rate of 14.2% from 2025 to 2032, propelled by the increasing use of intravenous therapies such as plasmapheresis, intravenous immunoglobulin (IVIg), and novel monoclonal antibodies for severe cases and myasthenic crises.

- By End Users

On the basis of end users, the global myasthenia gravis disease market is segmented into hospitals, homecare, specialty clinics, and others. The hospitals segment is expected to hold the largest market revenue share of 45.5% in 2024, driven by the availability of advanced diagnostic tools, specialized neurology departments, and comprehensive treatment options for managing acute exacerbations and myasthenic crises.

The specialty clinics segment is anticipated to witness robust growth from 2025 to 2032, fueled by the increasing preference for specialized care in neuromuscular disorders, offering tailored treatment plans and access to cutting-edge therapies such as biologics.

- By Distribution Channel

On the basis of distribution channel, the global myasthenia gravis disease market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment is expected to hold the largest market revenue share of 52.5% in 2024, owing to the high demand for specialized medications, including parenteral therapies and biologics, which are primarily dispensed through hospital settings.

The online pharmacy segment is expected to witness the fastest growth rate of 16.5% from 2025 to 2032, driven by the increasing adoption of e-commerce platforms for prescription medications, offering convenience, competitive pricing, and improved access in remote areas.

Myasthenia Gravis Disease Market Regional Analysis

- North America dominated the myasthenia gravis disease market with the largest revenue share of 42.5% in 2024, driven by advanced healthcare infrastructure, high adoption of novel therapies, and the presence of key market players. The U.S. leads in research and development, with significant investments in biologics and clinical trials

- Patients and healthcare providers prioritize innovative treatments such as immunosuppressive therapies, biologics, and thymectomy procedures to manage symptoms and improve quality of life, particularly in regions with aging populations

- Market growth is supported by advancements in diagnostic techniques, such as electromyography and antibody testing, alongside increasing adoption of novel therapeutics in both hospital and outpatient settings

U.S. Myasthenia Gravis Disease Market Insight

The U.S. myasthenia gravis disease market captured the largest revenue share of 89.9% in 2024 within North America, fueled by strong healthcare spending, widespread awareness of autoimmune disorders, and access to cutting-edge treatments. The trend towards personalized medicine and increasing regulatory approvals for biologics, such as eculizumab and rituximab, further boost market expansion. Collaborations between pharmaceutical companies and research institutes complement treatment adoption, creating a robust ecosystem.

Europe Myasthenia Gravis Disease Market Insight

The European myasthenia gravis disease market is expected to witness significant growth, supported by a strong emphasis on healthcare innovation and patient-centric care. Patients seek advanced therapies that improve muscle strength and reduce fatigue while ensuring safety. Growth is prominent in both clinical trials and treatment adoption, with countries such as Germany and France showing significant uptake due to rising autoimmune disease prevalence and supportive reimbursement policies.

U.K. Myasthenia Gravis Disease Market Insight

The U.K. market for myasthenia gravis disease is expected to witness rapid growth, driven by increasing demand for effective symptom management and improved quality of life in urban and rural settings. Growing awareness of diagnostic advancements and therapeutic options encourages adoption. Evolving healthcare policies and guidelines influence treatment choices, balancing efficacy with accessibility.

Germany Myasthenia Gravis Disease Market Insight

Germany is expected to witness rapid growth in the myasthenia gravis disease market, attributed to its advanced healthcare system and high focus on patient outcomes and therapeutic innovation. German patients prefer biologics and targeted therapies that enhance muscle function and contribute to long-term disease management. The integration of these treatments in specialized clinics and research-driven hospitals supports sustained market growth.

Asia-Pacific Myasthenia Gravis Disease Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding healthcare access, rising autoimmune disease diagnoses, and increasing disposable incomes in countries such as China, India, and Japan. Growing awareness of symptom management, early diagnosis, and advanced therapies is boosting demand. Government initiatives promoting healthcare modernization and disease awareness further encourage the adoption of novel treatments.

Japan Myasthenia Gravis Disease Market Insight

Japan’s myasthenia gravis disease market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced therapies that enhance patient outcomes and safety. The presence of leading pharmaceutical manufacturers and integration of biologics in treatment protocols accelerate market penetration. Rising interest in personalized medicine also contributes to growth.

China Myasthenia Gravis Disease Market Insight

China holds the largest share of the Asia-Pacific myasthenia gravis disease market, propelled by rapid urbanization, rising healthcare investments, and increasing demand for autoimmune disease solutions. The country’s growing middle class and focus on healthcare innovation support the adoption of advanced therapies. Strong domestic research capabilities and competitive pricing enhance market accessibility.

Myasthenia Gravis Disease Market Share

The myasthenia gravis disease industry is primarily led by well-established companies, including:

- Alexion Pharmaceuticals, Inc. (U.S.)

- Bausch Health Companies Inc. (Canada)

- Novartis AG (Switzerland)

- Amneal Pharmaceuticals LLC (U.S.)

- Zydus Group (India)

- Avadel (Ireland)

- Dr. Reddy’s Laboratories Ltd (India)

- Fresenius Kabi AG (Germany)

- Endo Inc. (U.S.)

- Amphastar Pharmaceuticals, Inc. (U.S.)

- Viatris Inc. (U.S.)

- Aurobindo Pharma (India)

- Pfizer Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Alkem (India)

- Hikma Pharmaceuticals PLC (U.K.)

What are the Recent Developments in Global Myasthenia Gravis Disease Market?

- In April 2025, Johnson & Johnson received FDA approval for IMAAVY (nipocalimab-aahu), a new FcRn blocker designed to treat generalized myasthenia gravis (gMG). This marks the first FcRn inhibitor approved for both anti-acetylcholine receptor (AChR) and anti-muscle-specific kinase (MuSK) antibody-positive patients aged 12 and older. The approval was based on findings from the Vivacity-MG3 Phase 3 trial, which demonstrated significant symptom improvement compared to placebo. IMAAVY™ is expected to be available in May 2025, offering long-lasting disease control and expanding treatment options for gMG patients

- In April 2025, The National Pharmaceutical Regulatory Agency (NPRA) in Malaysia issued a directive requiring all registration holders of statin-containing products to update their local package inserts and consumer medication information leaflets. This update reflects the potential risk of statins inducing or aggravating myasthenia gravis (MG), an autoimmune disorder characterized by muscle weakness and fatigue. The directive applies to 186 registered statin products, including atorvastatin, simvastatin, rosuvastatin, lovastatin, pravastatin, and pitavastatin

- In January 2025, Cartesian Therapeutics, Inc. received FDA approval under the Special Protocol Assessment (SPA) process for its Phase 3 AURORA trial of Descartes-08, an mRNA cell therapy candidate for myasthenia gravis (MG). This agreement confirms that the trial design meets regulatory standards to support a future Biologics License Application (BLA), pending trial results. The randomized, double-blind, placebo-controlled study will evaluate Descartes-08’s efficacy in approximately 100 participants, focusing on MG-ADL score improvements

- In October 2023, UCB received FDA approval for ZILBRYSQ® (zilucoplan), a once-daily subcutaneous C5 complement inhibitor for generalized myasthenia gravis (gMG) in anti-acetylcholine receptor (AChR) antibody-positive adults. This approval followed the Phase 3 RAISE study, which demonstrated statistically significant symptom improvements compared to placebo. With ZILBRYSQ and RYSTIGGO, UCB became the first company to offer two distinct targeted therapies for gMG

- In June 2023, UCB received FDA approval for RYSTIGGO (rozanolixizumab-noli), a subcutaneous monoclonal antibody designed to treat generalized myasthenia gravis (gMG) in adults who are anti-acetylcholine receptor (AChR) or anti-muscle-specific tyrosine kinase (MuSK) antibody positive. This approval was based on findings from the Phase 3 MycarinG study, which demonstrated statistically significant improvements in daily activities such as breathing, talking, and swallowing. RYSTIGGO® is the first FDA-approved treatment for both AChR and MuSK antibody-positive gMG patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MYASTHENIA GRAVIS DISEASE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MYASTHENIA GRAVIS DISEASE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.1.1 PATENT LANDSCAPE

6.1.2 USPTO NUMBER

6.1.3 PATENT EXPIRY

6.1.4 EPIO NUMBER

6.1.5 PATENT STRENGTH AND QUALITY

6.1.6 PATENT CLAIMS

6.1.7 PATENT CITATIONS

6.1.8 PATENT LITIGATION AND LICENSING

6.1.9 FILE OF PATENT

6.1.10 PATENT RECEIVED CONTRIES

6.1.11 TECHNOLOGY BACKGROUND

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH SPECIALIST

6.8 OTHER KOL SNAPSHOTS

7 EPIDEMIOLOGY

7.1 INCIDENCE OF ALL BY GENDER

7.2 TREATMENT RATE

7.3 MORTALITY RATE

7.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

7.5 PATIENT TREATMENT SUCCESS RATES

8 MERGERS AND ACQUISITION

8.1 LICENSING

8.2 COMMERCIALIZATION AGREEMENTS

9 REGULATORY FRAMEWORK

9.1 REGULATORY APPROVAL PROCESS

9.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

9.3 REGULATORY APPROVAL PATHWAYS

9.4 LICENSING AND REGISTRATION

9.5 POST-MARKETING SURVEILLANCE

9.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

10 PIPELINE ANALYSIS

10.1 CLINICAL TRIALS AND PHASE ANALYSIS

10.2 DRUG THERAPY PIPELINE

10.3 PHASE III CANDIDATES

10.4 PHASE II CANDIDATES

10.5 PHASE I CANDIDATES

10.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR GLOBAL MYASTHENIA GRAVIS DISEASE

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yest Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR GLOBAL MYASTHENIA GRAVIS DISEASE MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

11 MARKETED DRUG ANALYSIS

11.1 DRUG

11.1.1 BRAND NAME

11.1.2 GENERICS NAME

11.2 THERAPEUTIC INDIACTION

11.3 PHARACOLOGICAL CLASS OD THE DRUG

11.4 DRUG PRIMARY INDICATION

11.5 MARKET STATUS

11.6 MEDICATION TYPE

11.7 DRUG DOSAGES FORM

11.8 DOSAGES AVAILABILITY

11.9 DRUG ROUTE OF ADMINISTRATION

11.1 DOSING FREQUENCY

11.11 DRUG INSIGHT

11.12 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

11.12.1 FORECAST MARKET OUTLOOK

11.12.2 CROSS COMPETITION

11.12.3 THERAPEUTIC PORTFOLIO

11.12.4 CURRENT DEVELOPMENT SCENARIO

12 MARKET ACCESS

12.1 10-YEAR MARKET FORECAST

12.2 CLINICAL TRIAL RECENT UPDATES

12.3 ANNUAL NEW FDA APPROVED DRUGS

12.4 DRUGS MANUFACTURER AND DEALS

12.5 MAJOR DRUG UPTAKE

12.6 CURRENT TREATMENT PRACTICES

12.7 IMPACT OF UPCOMING THERAPY

13 R & D ANALYSIS

13.1 COMPARATIVE ANALYSIS

13.2 DRUG DEVELOPMENTAL LANDSCAPE

13.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

13.4 THERAPEUTIC ASSESSMENT

13.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

14 MARKET OVERVIEW

14.1 DRIVERS

14.2 RESTRAINTS

14.3 OPPORTUNITIES

14.4 CHALLENGES

15 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, BY DISEASE TYPE

15.1 OVERVIEW

15.2 OCULAR MYASTHENIA GRAVIS

15.3 GENERALIZED MYASTHENIA GRAVIS

15.3.1 MILD GENERALIZED

15.3.2 MODERATE GENERALIZED

15.3.3 SEVERE GENERALIZED

15.4 CONGENITAL MYASTHENIC SYNDROMES (CMS)

15.5 TRANSIENT NEONATAL MYASTHENIA GRAVIS

15.6 JUVENILE MYASTHENIA GRAVIS

16 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, BY TREATMENT TYPE

16.1 OVERVIEW

16.2 MEDICATION

16.2.1 CHOLINESTERASE INHIBITORS

16.2.1.1. PYRIDOSTIGMINE

16.2.1.2. NEOSTIGMINE

16.2.2 IMMUNOSUPPRESSANTS

16.2.2.1. CORTICOSTEROIDS (E.G., PREDNISONE)

16.2.2.2. NON-STEROIDAL IMMUNOSUPPRESSANTS

16.2.2.2.1. AZATHIOPRINE

16.2.2.2.2. OTHERS

16.2.3 MONOCLONAL ANTIBODIES

16.2.3.1. ANTI-CD20 MONOCLONAL ANTIBODIES (E.G., RITUXIMAB)

16.2.3.2. COMPLEMENT INHIBITORS

16.2.3.2.1. ECULIZUMAB

16.2.3.2.2. OTHERS

16.2.3.3. FCRN ANTAGONISTS (E.G., EFGARTIGIMOD)

16.2.4 EMERGING DRUGS

16.3 SURGICAL TREATMENT

16.3.1 THYMECTOMY

16.3.1.1. OPEN THYMECTOMY

16.3.1.2. MINIMALLY INVASIVE THYMECTOMY

16.4 PLASMAPHERESIS AND INTRAVENOUS IMMUNOGLOBULIN (IVIG)

16.4.1 PLASMAPHERESIS

16.4.2 IVIG

16.4.2.1. POLYCLONAL IVIG

16.4.2.2. SUBCUTANEOUS IVIG

16.5 EMERGING THERAPIES

16.5.1 GENE THERAPY

16.5.2 CELL THERAPY

16.5.3 TARGETED IMMUNOTHERAPIES

17 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, BY DIAGNOSIS

17.1 OVERVIEW

17.2 EDROPHONIUM TEST

17.3 BLOOD TEST

17.4 REPETITIVE NERVE STIMULATION

17.5 SINGLE-FIBER ELECTROMYOGRAPHY (EMG)

17.6 OTHERS

18 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, BY ROUTE OF ADMINISTRATION

18.1 OVERVIEW

18.2 ORAL

18.3 PARENTERAL

18.4 SUBCUTANEOUS

18.5 OTHERS

19 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, BY DOSAGE FORM

19.1 OVERVIEW

19.2 TABLET

19.3 CAPSULE

19.4 INJECTABLE

19.5 OTHER

20 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, BY AGE GROUP

20.1 OVERVIEW

20.2 PEDIATRIC

20.3 ADULTS

20.4 GERIATRIC

21 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, BY GENDER

21.1 OVERVIEW

21.2 MALE

21.3 FEMALE

22 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, BY END USER

22.1 OVERVIEW

22.2 HOSPITALS

22.2.1 GENERAL HOSPITALS

22.2.2 SPECIALTY HOSPITALS

22.3 CLINICS

22.3.1 NEUROLOGY CLINICS

22.3.2 SPECIALTY MYASTHENIA GRAVIS TREATMENT CENTERS

22.4 HOMECARE SETTINGS

22.5 RESEARCH AND ACADEMIC INSTITUTES

23 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 HOSPITAL

23.3 PHARMACIES

23.4 RETAIL PHARMACIES

23.5 ONLINE PHARMACIES

23.6 SPECIALTY PHARMACIES

24 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, SWOT AND DBMR ANALYSIS

25 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, BY REGION

GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

26.1 NORTH AMERICA

26.1.1 U.S.

26.1.2 CANADA

26.1.3 MEXICO

26.2 EUROPE

26.2.1 GERMANY

26.2.2 U.K.

26.2.3 ITALY

26.2.4 FRANCE

26.2.5 SPAIN

26.2.6 RUSSIA

26.2.7 SWITZERLAND

26.2.8 TURKEY

26.2.9 BELGIUM

26.2.10 NETHERLANDS

26.2.11 DENMARK

26.2.12 SWEDEN

26.2.13 POLAND

26.2.14 NORWAY

26.2.15 FINLAND

26.2.16 REST OF EUROPE

26.3 ASIA-PACIFIC

26.3.1 JAPAN

26.3.2 CHINA

26.3.3 SOUTH KOREA

26.3.4 INDIA

26.3.5 SINGAPORE

26.3.6 THAILAND

26.3.7 INDONESIA

26.3.8 MALAYSIA

26.3.9 PHILIPPINES

26.3.10 AUSTRALIA

26.3.11 NEW ZEALAND

26.3.12 VIETNAM

26.3.13 TAIWAN

26.3.14 REST OF ASIA-PACIFIC

26.4 SOUTH AMERICA

26.4.1 BRAZIL

26.4.2 ARGENTINA

26.4.3 REST OF SOUTH AMERICA

26.5 MIDDLE EAST AND AFRICA

26.5.1 SOUTH AFRICA

26.5.2 EGYPT

26.5.3 BAHRAIN

26.5.4 UNITED ARAB EMIRATES

26.5.5 KUWAIT

26.5.6 OMAN

26.5.7 QATAR

26.5.8 SAUDI ARABIA

26.5.9 REST OF MEA

26.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

27 GLOBAL MYASTHENIA GRAVIS DISEASE MARKET, COMPANY PROFILE

27.1 ALEXION PHARMACEUTICALS

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 ARGENX

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 UCB PHARMA

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 IMMUNOVANT

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 JANSSEN PHARMACEUTICALS (JOHNSON & JOHNSON)

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 HORIZON THERAPEUTICS

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 CATALYST PHARMACEUTICALS

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 TG THERAPEUTICS

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 MITSUBISHI TANABE PHARMA CORPORATION

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 APELLIS PHARMACEUTICALS

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 NOVARTIS

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 ASTELLAS PHARMA

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 ADAMIS PHARMACEUTICALS CORPORATION

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 CURAVAC

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 SHANGHAI PHARMACEUTICALS

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

27.16 BIOHAVEN PHARMACEUTICALS

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPMENTS

28 RELATED REPORTS

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.