Global Mycorrhizae Based Biofertilizers Market

Market Size in USD Million

CAGR :

%

USD

871.09 Million

USD

140.86 Million

2024

2032

USD

871.09 Million

USD

140.86 Million

2024

2032

| 2025 –2032 | |

| USD 871.09 Million | |

| USD 140.86 Million | |

|

|

|

|

Global Mycorrhizae-based Biofertilizers Market Size

Global Mycorrhizae-based Biofertilizers Market Size

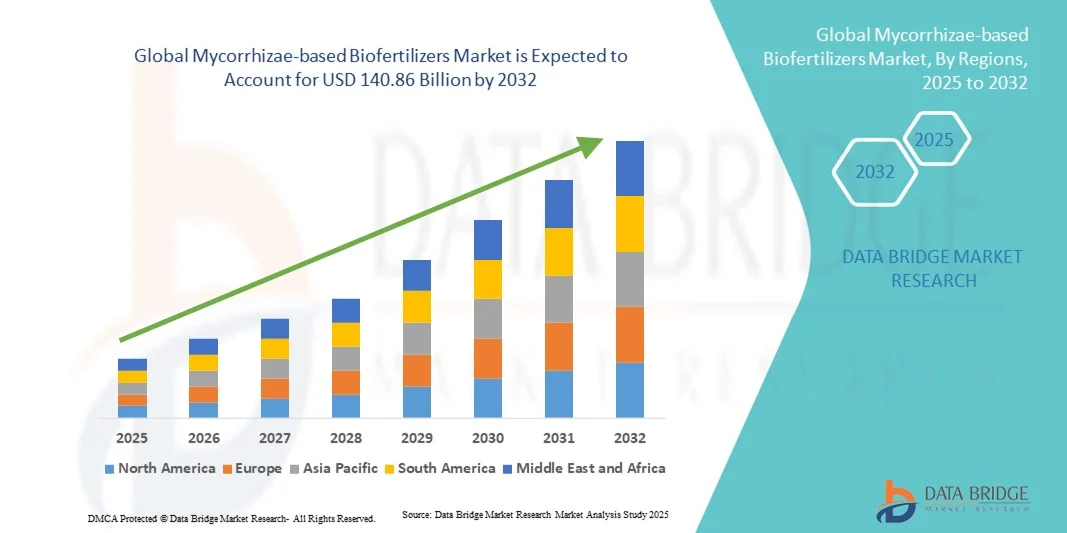

- The global mycorrhizae-based biofertilizers market size was valued at USD 871.09 million in 2024 and is expected to reach USD 140.86 billion by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely driven by the rising demand for sustainable agricultural practices, combined with increasing awareness about soil health and the adverse effects of chemical fertilizers

- Furthermore, advancements in microbial technology and supportive government initiatives promoting organic farming are accelerating the adoption of mycorrhizae-based biofertilizers, thereby significantly boosting the industry's growth

Global Mycorrhizae-based Biofertilizers Market Analysis

- Mycorrhizae-based biofertilizers, which enhance plant nutrient uptake through symbiotic associations between fungi and plant roots, are becoming increasingly vital in sustainable agriculture due to their ability to improve soil health, reduce chemical input dependence, and support higher crop yields in both organic and conventional farming systems

- The growing demand for mycorrhizae-based biofertilizers is primarily fueled by increasing awareness of eco-friendly farming practices, concerns over soil degradation, and the global shift towards organic food production

- North America dominated the mycorrhizae-based biofertilizers market with the largest revenue share of 36.5% in 2024, characterized by large agricultural economies, supportive government policies, and increasing adoption of sustainable farming practices, particularly in countries like India and China where awareness and application of biofertilizers are rising rapidly

- Asia-Pacific is expected to be the fastest-growing region in the mycorrhizae-based biofertilizers market during the forecast period due to growing consumer demand for organic produce and increasing investment in regenerative agriculture

- The cereals and grains segment dominated the market with the largest market revenue share of 42.8% in 2024, driven by the widespread cultivation of staple crops such as wheat, rice, and maize, which benefit significantly from enhanced nutrient uptake and improved soil health provided by mycorrhizal associations

Report Scope and Global Mycorrhizae-based Biofertilizers Market Segmentation

|

Attributes |

Mycorrhizae-based Biofertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Mycorrhizae-based Biofertilizers Market Trends

Enhanced Crop Productivity Through AI and Microbial Intelligence

- A significant and accelerating trend in the global Mycorrhizae-based Biofertilizers Market is the deepening integration with artificial intelligence (AI) and data-driven precision agriculture platforms. This technological convergence is significantly enhancing the efficiency, consistency, and predictability of biofertilizer application across diverse farming systems.

- For instance, AI-powered platforms such as CropX and Taranis are being used to analyze soil microbiome data, allowing farmers to optimize the timing and dosage of mycorrhizal inoculants for maximum root colonization and nutrient uptake. These insights help tailor inputs based on real-time field conditions, crop type, and soil health indicators.

- AI integration enables smart diagnostics and monitoring tools that assess plant-soil interactions, detect deficiencies, and predict outcomes of biofertilizer applications. For example, platforms utilizing satellite imagery and machine learning can detect stress patterns in crops and recommend targeted use of mycorrhizae-based solutions to boost resilience and yields.

- The seamless integration of microbial intelligence with precision agriculture tools is facilitating more sustainable and cost-effective farming practices. By leveraging AI, farmers can map biological activity in soils, track improvements in root biomass, and measure carbon sequestration benefits, contributing to regenerative agriculture goals.

- This trend toward more intelligent, responsive, and biology-driven farming systems is fundamentally reshaping expectations for fertilizer technologies. Companies such as Premier Tech and UPL Limited are investing in AI-enabled platforms that support real-time decision-making and customized application strategies for microbial inputs like mycorrhizae.

- The demand for AI-integrated biofertilizer solutions is growing rapidly across both developed and emerging markets, as farmers increasingly seek to enhance productivity, reduce environmental impact, and improve profitability through precision biological inputs.

Global Mycorrhizae-based Biofertilizers Market Dynamics

Driver

Growing Need Due to Soil Degradation and Sustainable Farming Demands

- The rising global concern over soil degradation, declining fertility, and the long-term impact of chemical fertilizers is significantly driving the demand for mycorrhizae-based biofertilizers across various agricultural sectors. As farmers and governments increasingly prioritize sustainable farming practices, biologically derived solutions are gaining widespread acceptance.

- For instance, in March 2024, UPL Limited announced the expansion of its Natural Plant Protection (NPP) division, focusing on microbial-based solutions, including mycorrhizae, to promote regenerative agriculture across Asia and Latin America. Such strategic initiatives are accelerating the integration of biofertilizers into mainstream farming.

- Mycorrhizae-based biofertilizers provide critical benefits such as enhanced nutrient uptake, drought resistance, and improved soil structure, offering a powerful alternative to synthetic inputs. Their ability to form symbiotic relationships with plant roots supports higher crop productivity and better environmental outcomes.

- Additionally, the global movement toward organic and residue-free food production is making these biofertilizers a preferred input among both large-scale and smallholder farmers. Government support in the form of subsidies, training programs, and bio-input certification policies further strengthens their adoption.

- The demand for sustainable and cost-effective agricultural inputs is also being fueled by consumer preference for organic food, the rising cost of chemical fertilizers, and global initiatives to reduce carbon footprints in farming. The scalability of mycorrhizal products for various crops—including cereals, vegetables, and horticulture—continues to drive market growth across developed and emerging regions.

Restraint/Challenge

Limited Awareness and Variability in Efficacy Across Soil Types

- A major challenge facing the global mycorrhizae-based biofertilizers market is the limited awareness among farmers, particularly in developing regions, about the benefits and proper usage of these microbial inputs. Inadequate technical knowledge often leads to inconsistent application or underutilization of the product, reducing overall effectiveness.

- For instance, many smallholder farmers remain unfamiliar with microbial soil amendments or lack access to proper training, making them more reliant on traditional chemical fertilizers despite growing environmental concerns.

- Additionally, the efficacy of mycorrhizae can vary significantly based on soil conditions, crop type, pH, and environmental factors. In some cases, native mycorrhizal populations already present in the soil may compete with introduced strains, diminishing their intended impact. This variability poses a challenge in ensuring predictable outcomes and scalability.

- Quality control and standardization of biofertilizer formulations also remain concerns in certain regions, where regulatory oversight is weak and counterfeit or substandard products are prevalent. This undermines farmer confidence and slows market adoption.

- Overcoming these challenges requires robust extension services, farmer education programs, and public-private partnerships to ensure the correct use of high-quality, scientifically validated biofertilizers. Investment in R&D and site-specific formulations tailored to regional agronomic conditions will be essential for building farmer trust and expanding global usage.

Global Mycorrhizae-based Biofertilizers Market Scope

The market is segmented on the basis of crop, form, and application.

- By Crop

On the basis of crop, the global mycorrhizae-based biofertilizers market is segmented into cereals and grains, pulses and oilseeds, fruits and vegetables, and others. The cereals and grains segment dominated the market with the largest market revenue share of 42.8% in 2024, driven by the widespread cultivation of staple crops such as wheat, rice, and maize, which benefit significantly from enhanced nutrient uptake and improved soil health provided by mycorrhizal associations. These crops are often grown on a large scale, making them key targets for biofertilizer application to increase yield and promote sustainable farming practices.

The fruits and vegetables segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising demand for high-value horticultural produce and the increasing shift toward organic farming. Growers in this segment are more likely to adopt biofertilizers to improve crop quality, shelf life, and soil biodiversity, especially in export-oriented markets.

- By Form

On the basis of form, the global mycorrhizae-based biofertilizers market is segmented into liquid and powder formulations. The powder segment dominated the market with the largest revenue share of 57.3% in 2024, due to its longer shelf life, ease of storage, and cost-effectiveness. Powder-based mycorrhizae products are commonly used in large-scale agriculture and can be applied through broadcasting, mixing with soil, or coating seeds. Their ability to remain stable under various environmental conditions makes them a preferred choice, especially in regions with limited cold chain infrastructure.

The liquid segment is expected to register the fastest CAGR from 2025 to 2032, driven by its superior microbial viability, faster colonization rate, and ease of application through irrigation systems and foliar sprays. Liquid formulations are particularly gaining traction in high-value crops and greenhouse farming, where precise nutrient management and rapid results are critical.

- By Application

On the basis of application, the global mycorrhizae-based biofertilizers market is segmented into soil treatment and seed treatment. The soil treatment segment held the largest market revenue share of 63.9% in 2024, driven by the growing focus on soil fertility restoration, organic matter enrichment, and microbial diversity enhancement. Soil treatment allows mycorrhizal fungi to establish symbiotic relationships with a broader root network, improving nutrient cycling and plant resilience. This method is widely used in field crops and orchard plantations where comprehensive soil health management is prioritized.

The seed treatment segment is projected to witness the fastest CAGR from 2025 to 2032, due to its cost-efficiency, precision, and ease of integration with existing seed coating technologies. It enables early colonization of plant roots, providing immediate benefits to seedling development and stress resistance. Seed treatment is increasingly popular among commercial seed producers and farmers seeking enhanced germination and uniform crop establishment, particularly in horticulture and cereals.

Global Mycorrhizae-based Biofertilizers Market Regional Analysis

- North America dominated the global mycorrhizae-based biofertilizers market with the largest revenue share of 36.5% in 2024, driven by the region’s vast agricultural base, growing demand for sustainable farming practices, and increasing government initiatives promoting organic inputs.

- Farmers in countries like India, China, and Indonesia are adopting mycorrhizae-based biofertilizers to improve soil health, reduce chemical fertilizer dependence, and enhance crop yields in a cost-effective manner.

- This widespread adoption is further supported by strong agricultural research infrastructure, rising awareness of regenerative farming benefits, and growing export demand for organic produce. Additionally, favorable policies, subsidies, and public-private partnerships across the region are helping to scale adoption among smallholder and commercial farmers alike, establishing Asia-Pacific as the leading market for mycorrhizae-based biofertilizers in both conventional and organic agriculture.

U.S. Global Mycorrhizae-based Biofertilizers Market Insight

The U.S. Global Mycorrhizae-based Biofertilizers Market captured the largest revenue share of 78% in 2024 within North America, driven by the growing adoption of sustainable agricultural practices and increased regulatory support for organic farming. U.S. farmers are progressively shifting toward biologically based inputs due to concerns over soil degradation, rising input costs, and environmental sustainability. The presence of major biofertilizer producers and increasing consumer demand for organic and residue-free food are fueling market expansion. Furthermore, government initiatives, including subsidies and certification programs, are accelerating the adoption of mycorrhizae-based solutions across large-scale farming operations and specialty crop sectors.

Europe Global Mycorrhizae-based Biofertilizers Market Insight

The Europe Global Mycorrhizae-based Biofertilizers Market is projected to expand at a substantial CAGR throughout the forecast period, fueled by stringent environmental regulations, the EU’s Green Deal policies, and rising awareness of soil health. European countries are aggressively reducing reliance on synthetic agrochemicals, which has opened opportunities for microbial biofertilizers such as mycorrhizae. The demand is particularly strong in organic farming, horticulture, and viticulture. Public-private partnerships and EU-funded research projects are further supporting innovation and commercialization, while increasing consumer preference for organic and sustainable produce drives farmer-level adoption across the region.

U.K. Global Mycorrhizae-based Biofertilizers Market Insight

The U.K. Global Mycorrhizae-based Biofertilizers Market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by expanding organic farming acreage and increased awareness of regenerative agriculture. British farmers are increasingly investing in soil health, biodiversity, and carbon sequestration, all of which align with the use of mycorrhizal biofertilizers. Policy support post-Brexit, including environmental land management schemes (ELMs), encourages a shift away from conventional fertilizers. The trend is further backed by strong retail and consumer demand for sustainably sourced and organic food products, reinforcing the use of biological inputs in U.K. agriculture.

Germany Global Mycorrhizae-based Biofertilizers Market Insight

The Germany Global Mycorrhizae-based Biofertilizers Market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s commitment to environmental sustainability, organic certification standards, and innovation in agricultural biotechnology. German farmers are early adopters of precision agriculture, and the integration of microbial inputs like mycorrhizae is gaining momentum. Increasing demand for organic produce, coupled with consumer trust in eco-labeled products, is promoting biofertilizer use. Germany's strong R&D ecosystem, supportive regulations, and agricultural extension services also contribute to a favorable environment for the growth of mycorrhizal products across diverse crop segments.

Asia-Pacific Global Mycorrhizae-based Biofertilizers Market Insight

The Asia-Pacific Global Mycorrhizae-based Biofertilizers Market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, fueled by expanding agricultural economies, increasing awareness of soil health, and rising demand for chemical-free food. Countries such as India, China, and Indonesia are witnessing rapid adoption of mycorrhizae-based inputs due to government support, low-cost labor, and strong domestic production capabilities. The shift toward sustainable farming practices and increasing acceptance of biofertilizers among smallholder farmers are further propelling the market. Public-sector initiatives and NGO-led training programs also enhance farmer education and product uptake across the region.

Japan Global Mycorrhizae-based Biofertilizers Market Insight

The Japan Global Mycorrhizae-based Biofertilizers Market is gaining momentum due to the nation’s focus on sustainable agriculture, aging farmer population, and high technological integration in farming. Japanese farmers are embracing precision agriculture and environmentally friendly practices, making mycorrhizal biofertilizers an attractive alternative to synthetic inputs. The use of controlled environment agriculture (CEA) and vertical farming also supports demand for tailored biological inputs. Furthermore, government programs encouraging eco-certification and climate-smart agriculture are expected to boost market growth, particularly in horticulture and specialty crops like tea, fruits, and vegetables.

China Global Mycorrhizae-based Biofertilizers Market Insight

The China Global Mycorrhizae-based Biofertilizers Market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country’s large-scale farming operations, government-led soil health initiatives, and the increasing push for sustainable agriculture. As part of its national strategy to reduce chemical fertilizer use, China has introduced multiple policies supporting biofertilizer adoption, especially in major grain-producing provinces. Mycorrhizae-based products are being integrated into programs promoting organic and green food certifications. China’s vast domestic manufacturing base and growing export-oriented agri-businesses are contributing to rapid product availability and market scalability, making it a key player in the Asia-Pacific biofertilizer ecosystem.

Global Mycorrhizae-based Biofertilizers Market Share

The Mycorrhizae-based Biofertilizers industry is primarily led by well-established companies, including:

- Novozymes A/S (Denmark)

- UPL Limited (India)

- Groundwork AG (Israel)

- Plant Health Care Plc (U.S.)

- Valent BioSciences (U.S.)

- Agrotechnologias Naturales ATENS (Spain)

- Vegalab S.A. (Switzerland)

- Lallemand Inc. (Canada)

- Agrinos (U.S.)

- AgriLife (India)

- Sustane Natural Fertilizer (U.S.)

- T. Stanes & Company Limited (India)

- Ezzy BioSciences (India)

- Asfertglobal (Portugal)

- Privi Life Sciences (India)

- PHMS Technocare Private Limited (India)

- Sikko Industries (India)

- Symbiom SRO (Czech Republic)

- Helena Agri-Enterprises, LLC (U.S.)

- Tainio Biologicals, Inc. (U.S.)

- Neologie Bio Innovations I Private Limited (India)

What are the Recent Developments in Global Mycorrhizae-based Biofertilizers Market?

- In April 2023, UPL Limited, a global leader in sustainable agriculture solutions, launched a strategic initiative under its Natural Plant Protection (NPP) division to scale up the use of mycorrhizae-based biofertilizers across Africa and Latin America. This initiative focuses on improving soil health and crop productivity through the adoption of biological inputs, particularly in regions facing soil degradation and low-input farming challenges. By leveraging its global R&D capabilities and localized field support, UPL aims to accelerate the transition toward regenerative agriculture, reaffirming its commitment to environmentally responsible farming.

- In March 2023, Premier Tech Ltd., a Canada-based innovator in agronomic and horticultural solutions, introduced a new generation of high-performance mycorrhizal inoculants under its Pro-Mix brand. The launch features enhanced microbial formulations designed to improve phosphorus uptake and water efficiency in high-value crops. Targeting commercial greenhouse growers and organic producers, this development underscores Premier Tech’s focus on precision biological inputs that support sustainable and scalable crop management practices.

- In March 2023, Plant Health Care Plc (US) announced the successful commercial expansion of its proprietary Myconate technology—a root growth enhancer that stimulates native mycorrhizal fungi—in multiple Southeast Asian markets. This expansion supports the company’s mission to increase yield sustainably in smallholder farming systems while reducing the environmental impact of synthetic fertilizers. The move aligns with rising regional demand for climate-resilient agriculture and low-cost biological solutions, reinforcing Plant Health Care’s leadership in microbial product innovation.

- In February 2023, Lallemand Inc., a Canadian biotech company, partnered with leading European agri-input distributors to launch Rhizoglomus+, a mycorrhizal product optimized for temperate climate cereal crops. The product features a consortium of robust fungal strains aimed at improving nutrient cycling and root system development. This collaboration marks a strategic step toward expanding Lallemand’s footprint in sustainable agriculture markets across Europe, particularly among large-scale grain producers seeking to reduce nitrogen dependence and improve soil health.

- In January 2023, T. Stanes & Company Limited, an India-based pioneer in biofertilizer manufacturing, launched a new liquid mycorrhizae formulation targeted at smallholder farmers cultivating vegetables and pulses. Developed through in-house R&D, the product enhances nutrient uptake and plant vigor under rainfed conditions. The launch aligns with the Indian government’s push for organic and natural farming, showcasing T. Stanes’ commitment to accessible and scalable solutions for sustainable agriculture in emerging markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.