Global Nachos Market

Market Size in USD Billion

CAGR :

%

USD

1.37 Billion

USD

2.13 Billion

2024

2032

USD

1.37 Billion

USD

2.13 Billion

2024

2032

| 2025 –2032 | |

| USD 1.37 Billion | |

| USD 2.13 Billion | |

|

|

|

|

Nachos Market Size

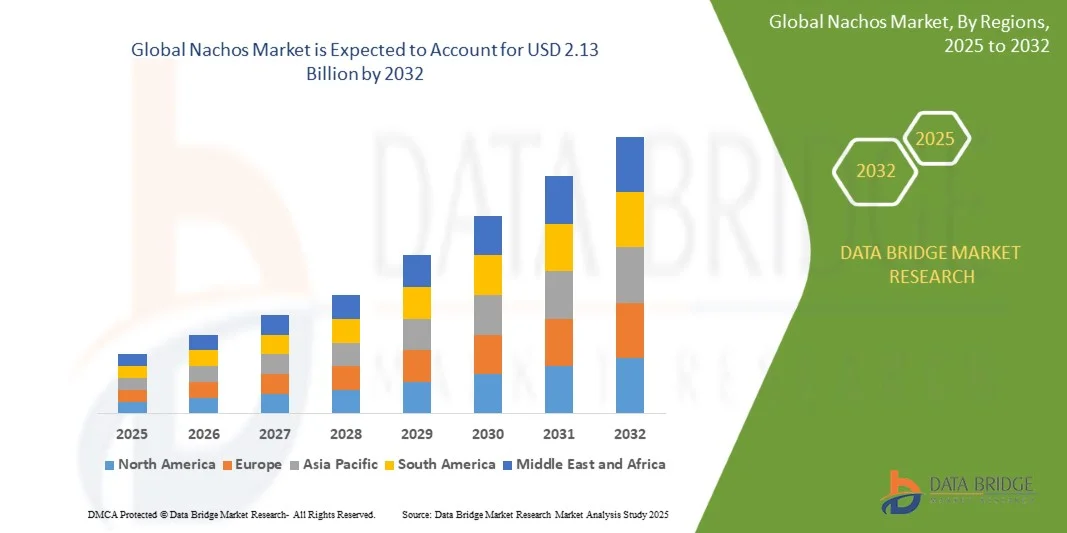

- The global nachos market size was valued at USD 1.37 billion in 2024 and is expected to reach USD 2.13 billion by 2032, at a CAGR of 5.7% during the forecast period

- The market growth is largely fueled by the increasing global demand for convenient, ready-to-eat snack products and the growing influence of Western snacking culture across emerging economies. The expanding popularity of Tex-Mex cuisine, coupled with the rising consumption of flavored and premium snack varieties, is significantly boosting nacho sales across retail and foodservice channels

- Furthermore, changing consumer lifestyles, higher disposable incomes, and growing demand for on-the-go snacking options are driving manufacturers to innovate with diverse flavors, healthier ingredients, and attractive packaging formats, thereby strengthening the overall market expansion

Nachos Market Analysis

- Nachos are a popular tortilla-based snack made from corn chips typically served with toppings such as cheese, sauces, or seasonings. They are widely consumed as both a quick snack and a social-sharing food, appealing to a broad demographic across households, restaurants, and entertainment venues

- The rising popularity of convenience foods, increasing penetration of global snack brands, and continuous product innovation—such as baked and vegan nachos—are the key factors propelling the market. In addition, the growing trend of home entertainment and casual dining is further accelerating nacho consumption worldwide

- North America dominated the nachos market with a share of 46.1% in 2024, due to the strong snacking culture, high consumption of convenience foods, and widespread popularity of Tex-Mex cuisine

- Asia-Pacific is expected to be the fastest growing region in the nachos market during the forecast period due to increasing urbanization, westernization of diets, and rising disposable incomes

- Classic nachos segment dominated the market with a market share of 39.1% in 2024, due to their widespread consumer acceptance and easy availability across retail and foodservice channels. Their familiarity, versatility with dips, and suitability for both individual snacking and group sharing drive continued demand. The rising popularity of Tex-Mex cuisine and frequent inclusion of nachos in restaurant menus have further reinforced their dominance across global markets

Report Scope and Nachos Market Segmentation

|

Attributes |

Nachos Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nachos Market Trends

“Rising Demand for Healthier and Plant-Based Snack Options”

- The nachos market is experiencing a notable shift toward healthier and plant-based snack alternatives as consumers increasingly prioritize nutrition, sustainability, and dietary diversity. Snack producers are reformulating traditional nachos by incorporating whole grains, legumes, and vegetable-based ingredients while reducing artificial additives and saturated fats to cater to evolving health-conscious preferences

- For instance, PepsiCo’s Doritos launched plant-based and air-popped variations that contain less oil and feature chickpea flour for increased protein content. Similarly, Beanitos offers nacho-style chips made from whole beans, providing fiber-rich and gluten-free snack choices for wellness-focused consumers

- There is a growing preference for nachos that use natural seasonings and clean-label formulations without synthetic preservatives. These healthier profiles appeal to both younger demographics seeking trendy snack innovations and older consumers aiming for balanced nutrition without sacrificing flavor

- In addition, the popularity of plant-based diets is encouraging manufacturers to introduce vegan nacho cheese toppings made from nuts, soy, or root vegetables. These toppings complement plant-derived chips, creating fully vegan nacho snack kits that target expanding vegan and flexitarian markets

- Brands are also experimenting with functional ingredients such as chia seeds, flax, and quinoa to create nachos that offer additional health benefits, including omega-3 fatty acids and antioxidants. This fusion of indulgence and functionality is adding value to product lines and expanding premium snack offerings

- As health and sustainability continue to influence consumer buying decisions, the demand for plant-based and better-for-you nacho options is expected to become an enduring driver in global snack innovation. This shift positions nachos as part of a broader wellness-oriented snacking trend shaping the packaged food industry

Nachos Market Dynamics

Driver

“Increasing Popularity of Convenience and On-the-Go Foods”

- The rising consumer need for quick, accessible, and ready-to-eat snack formats is a significant driver for the nachos market. Busy lifestyles and urbanization are leading individuals to seek portable snack options that deliver both flavor and convenience without complex preparation requirements

- For instance, Conagra Brands markets ready-to-eat nachos under its various snack portfolios by offering portion-controlled packaging and microwavable trays, enabling easy consumption at home, work, or during travel. Similarly, General Mills has expanded nacho-inspired snack kits designed for quick assembly and immediate serving in various settings

- Packaged nachos are often available in resealable bags, single-serve packets, and easy-open containers, making them suitable for both individual snacking and sharing occasions. This portability enhances product accessibility and widens its appeal across multiple consumer segments

- In addition, the expansion of ready-to-eat meal sections in supermarkets, convenience stores, and online platforms has enabled nachos to reach a broader base of consumers who value time-saving snack solutions. This distribution flexibility ensures consistent availability across urban and suburban markets

- With global consumers increasingly valuing convenience alongside taste, nachos have established themselves as a versatile snack capable of fitting into numerous consumption scenarios. The emphasis on portable, ready-made formats will continue to be a core growth driver for the category in the coming years

Restraint/Challenge

“Fluctuating Prices of Raw Materials”

- Volatile prices of key raw materials such as corn, vegetable oil, seasonings, and dairy-based cheese ingredients present a significant challenge to nacho manufacturers. Seasonal yield variations, climate impacts, and supply chain disruptions often lead to sudden changes in input costs, affecting profitability and pricing stability

- For instance, corn price fluctuations in major producing regions such as the United States and Brazil have influenced the cost of nacho chip production for companies such as Frito-Lay, which relies heavily on bulk corn supplies. Similarly, rising dairy prices directly impact the cost of producing cheese-based nacho toppings across global markets

- Manufacturers are often forced to adjust product formulations or portion sizes to manage expenses, risking potential changes in taste or quality. This can influence consumer perception and brand loyalty, especially in competitive snack segments where flavor consistency is vital

- In addition, geopolitical factors, transportation costs, and commodity trade restrictions can further exacerbate raw material price instability. These factors complicate long-term procurement planning and make cost forecasting difficult for both large-scale and regional snack producers

- While some brands mitigate these risks by diversifying suppliers and investing in contract-based raw material sourcing, market volatility remains a persistent challenge. Managing this instability will require strategic supply chain resilience and innovation in ingredient sourcing to sustain competitiveness in the global nachos market

Nachos Market Scope

The market is segmented on the basis of type, consumer preferences, occasion, packaging type, and flavor profile.

• By Type

On the basis of type, the nachos market is segmented into classic nachos, loaded nachos, nachos with alternative tortilla chips, sweet nachos, and DIY nachos kits. The classic nachos segment dominated the largest market revenue share of 39.1% in 2024, owing to their widespread consumer acceptance and easy availability across retail and foodservice channels. Their familiarity, versatility with dips, and suitability for both individual snacking and group sharing drive continued demand. The rising popularity of Tex-Mex cuisine and frequent inclusion of nachos in restaurant menus have further reinforced their dominance across global markets.

The loaded nachos segment is expected to witness the fastest growth rate from 2025 to 2032, driven by evolving consumer preferences toward indulgent and customizable snack options. Loaded nachos, featuring toppings such as cheese, meats, beans, and sauces, cater to consumers seeking filling yet convenient meals or snacks. Their increasing presence in quick-service restaurants and growing popularity in event catering and sports-viewing occasions enhance their market penetration, particularly among younger consumers seeking flavorful, shareable food experiences.

• By Consumer Preferences

On the basis of consumer preferences, the nachos market is segmented into health-conscious consumers, gourmet enthusiasts, and casual snackers. The casual snackers segment held the largest market share in 2024, supported by the product’s role as a convenient, affordable, and enjoyable snack for everyday consumption. Nachos appeal strongly to this group due to their availability in multiple flavors, easy portioning, and compatibility with dips and sauces. The growing snacking culture, particularly among millennials and Gen Z, continues to sustain strong demand within this segment.

The health-conscious consumers segment is projected to record the fastest CAGR from 2025 to 2032, driven by the increasing adoption of baked, multigrain, and low-sodium nachos. Consumers are increasingly favoring snacks made from natural or plant-based ingredients, prompting manufacturers to launch clean-label and gluten-free variants. The shift toward mindful snacking and balanced indulgence is prompting innovation in product formulation, positioning healthier nachos as a rapidly expanding category within the overall market.

• By Occasion

On the basis of occasion, the nachos market is segmented into movie nights, game day snacks, social gatherings, outdoor events and picnics, and late-night snacks. The movie nights segment dominated the market in 2024 due to nachos’ strong association with entertainment and at-home streaming experiences. Their convenient, mess-free format and compatibility with multiple dips make them a preferred companion for leisure viewing. The growing culture of home entertainment and family streaming subscriptions has further supported steady demand.

The game day snacks segment is expected to experience the fastest growth from 2025 to 2032, driven by the rising popularity of sports events and community viewing gatherings. Nachos are increasingly featured in party platters and stadium menus, benefiting from their shareable nature and bold flavor appeal. Seasonal sports events and increasing consumption during major tournaments in the U.S., Europe, and Latin America are significantly boosting category expansion in this segment.

• By Packaging Type

On the basis of packaging type, the nachos market is segmented into single-serve packs, family-size bags, catering trays, resealable packs, and eco-friendly packaging options. The family-size bags segment held the dominant market share in 2024, owing to their popularity among households and social gatherings. These packs provide value for money, longer freshness retention, and convenience for sharing during events or at-home entertainment. Their strong distribution through supermarkets and club stores further reinforces their lead.

The eco-friendly packaging options segment is anticipated to witness the fastest growth from 2025 to 2032, supported by rising environmental awareness and consumer preference for sustainable snack packaging. Brands are increasingly adopting biodegradable, recyclable, or compostable materials to reduce plastic use and enhance brand perception. The growing alignment of snack purchasing decisions with eco-conscious values is expected to drive steady growth in this emerging segment.

• By Flavor Profile

On the basis of flavor profile, the nachos market is segmented into spicy nachos, cheesy nachos, BBQ flavor, sour cream and onion, and sweet and savory combinations. The cheesy nachos segment dominated the market in 2024, driven by its universal appeal and strong association with comfort snacking. The rich and creamy flavor profile attracts consumers across age groups and regions, making it a staple in both retail and foodservice menus. The versatility of cheese-based toppings and dips continues to reinforce its leadership.

The spicy nachos segment is projected to register the fastest growth from 2025 to 2032, attributed to increasing global demand for bold and intense flavor experiences. Younger consumers, especially in Asia-Pacific and Latin America, are showing a growing preference for chili-infused and pepper-based seasonings. The introduction of regional spice blends and limited-edition spicy variants is further propelling market traction for this segment.

Nachos Market Regional Analysis

- North America dominated the nachos market with the largest revenue share of 46.1% in 2024, driven by the strong snacking culture, high consumption of convenience foods, and widespread popularity of Tex-Mex cuisine

- Consumers in the region prefer nachos for their versatility, flavor variety, and suitability for both home and social occasions

- The increasing demand for ready-to-eat snacks and the growing trend of premiumization in snack products further strengthen market growth. The U.S. remains the core growth contributor due to high product innovation, brand presence, and the expanding retail snack sector

U.S. Nachos Market Insight

The U.S. nachos market captured the largest revenue share in 2024 within North America, fueled by the high penetration of packaged snacks and the popularity of nachos in restaurants, movie theaters, and sports events. Consumers increasingly prefer convenient, shareable snack options, with loaded and flavored nachos gaining traction. The rise of health-conscious snacking is also boosting demand for baked and multigrain variants. Robust retail networks and frequent product launches from leading snack brands continue to drive market expansion across the U.S.

Europe Nachos Market Insight

The Europe nachos market is projected to expand at a significant CAGR throughout the forecast period, driven by growing consumer interest in global cuisines and increasing acceptance of nachos as a casual and party snack. Rising demand for convenient, on-the-go foods and the influence of Mexican and American dining trends are fueling adoption across supermarkets, cafes, and entertainment venues. Consumers are also showing interest in healthier variants with reduced salt and fat content. The U.K., Germany, and Spain are among the leading markets within the region.

U.K. Nachos Market Insight

The U.K. nachos market is expected to grow steadily during the forecast period, supported by the rising popularity of Mexican food culture and the increasing consumption of ready-to-eat snacks. Nachos are becoming a staple in pubs, cinemas, and home entertainment setups. The market benefits from strong retail distribution, frequent flavor innovations, and growing demand for healthier snack options such as baked and gluten-free nachos.

Germany Nachos Market Insight

The Germany nachos market is expected to expand at a healthy CAGR, driven by growing consumer preference for international flavors and the rising demand for convenient, high-quality snacks. Germany’s focus on clean-label and natural ingredients is encouraging brands to offer nachos with organic corn and sustainable packaging. The increasing popularity of nachos in bars and quick-service restaurants is further contributing to market growth.

Asia-Pacific Nachos Market Insight

The Asia-Pacific nachos market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by increasing urbanization, westernization of diets, and rising disposable incomes. The growing popularity of global snack brands and the expansion of modern retail chains are accelerating product visibility and consumption. Younger consumers, particularly in China, Japan, and India, are driving demand for spicy and fusion-flavored nachos. The convenience factor and affordability of packaged nachos also appeal strongly to the expanding middle-class population.

China Nachos Market Insight

China accounted for the largest market revenue share within Asia-Pacific in 2024, supported by a rapidly growing snack industry and increasing preference for Western-inspired foods. Local manufacturers are introducing innovative flavor combinations to cater to regional tastes. The expansion of e-commerce platforms and convenience stores has improved product accessibility, boosting both household and on-the-go consumption.

Japan Nachos Market Insight

The Japan nachos market is gaining traction due to rising demand for premium, imported, and artisanal snack products. Japanese consumers value quality and novelty, which encourages the adoption of gourmet nachos with unique flavors. The market is further supported by the growth of convenience stores and the popularity of ready-to-eat snack packs. The increasing integration of nachos into casual dining menus also contributes to the country’s steady market growth.

Nachos Market Share

The nachos industry is primarily led by well-established companies, including:

- AMICA CHIPS Spa (Italy)

- Arca Continental SAB de CV (Mexico)

- Axium Foods Inc. (U.S.)

- Bahlsen GmbH and Co. KG (Germany)

- Balance Foods Inc. (U.S.)

- Conagra Brands Inc. (U.S.)

- Cornitos (India)

- General Mills Inc. (U.S.)

- ITC Ltd. (India)

- Kellogg Co. (U.S.)

- Kelly Ges.mbH (Austria)

- Nacho King Corp. (Philippines)

- Old Dutch Foods Ltd. (Canada)

- Orenda Foods Pvt. Ltd. (India)

- PepsiCo Inc. (U.S.)

- Ricos Products Co. (U.S.)

- San Carlo Gruppo Alimentare SpA (Italy)

- The Good Bean Inc. (U.S.)

- The Hershey Co. (U.S.)

- Universal Robina Corp. (Philippines)

Latest Developments in Nachos Market

- In May 2024, Hershey’s completed the acquisition of Reese’s Snack Creations, a subsidiary specializing in snack mixes, including nacho-flavored varieties. This strategic move marked Hershey’s expansion into the savory snack segment, diversifying its traditional confectionery portfolio. The acquisition strengthens Hershey’s competitive positioning in the growing snacking industry, allowing it to leverage its strong distribution network and brand recognition to capture a larger share of the global nachos and savory snacks market

- In March 2024, Gruma announced a strategic partnership with Taco Bell to become the exclusive supplier of tortilla chips and tortillas for its U.S. restaurants. This collaboration enhances Gruma’s market presence and secures a consistent demand stream from one of the leading fast-food chains. The partnership is expected to boost production volumes, brand visibility, and revenue within the U.S. nachos segment, solidifying Gruma’s role as a dominant player in the tortilla-based snack industry

- In January 2024, Frito-Lay, a subsidiary of PepsiCo, launched a new line of vegan-friendly nacho chips in the U.S., responding to the rising consumer shift toward plant-based food options. This innovation supports the brand’s sustainability goals while attracting health-conscious and flexitarian consumers. The launch broadens Frito-Lay’s product portfolio and also strengthens PepsiCo’s leadership in the evolving better-for-you snack category, where plant-based formulations are gaining rapid traction

- In February 2022, PepsiCo expanded its portfolio of healthy snacks in Europe, achieving a tenfold increase in sales of snack foods with Nutri-Scores of B or higher. The initiative underscores the company’s commitment to nutritional improvement and aligns with growing consumer demand for healthier snacking alternatives. By diversifying into products such as fruit-based snacks and popcorn, PepsiCo reinforced its position as a forward-thinking global player in the competitive snack market

- In January 2022, PepsiCo’s Frito-Lay North America division introduced Lay’s Mille-Feuille Potato Chips, a premium offering with multiple crispy layers and distinctive flavor combinations. This product innovation aimed to elevate consumer snacking experiences by merging texture variety with gourmet-style flavors such as cheddar, parmesan, gouda, and sour cream & onion. The launch enhanced Frito-Lay’s premium product line and strengthened its foothold in the high-value, indulgent snack segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Nachos Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Nachos Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Nachos Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.