Global Nail Care Packaging Market

Market Size in USD Billion

CAGR :

%

USD

14.37 Billion

USD

20.44 Billion

2025

2033

USD

14.37 Billion

USD

20.44 Billion

2025

2033

| 2026 –2033 | |

| USD 14.37 Billion | |

| USD 20.44 Billion | |

|

|

|

|

Nail Care Packaging Market Size

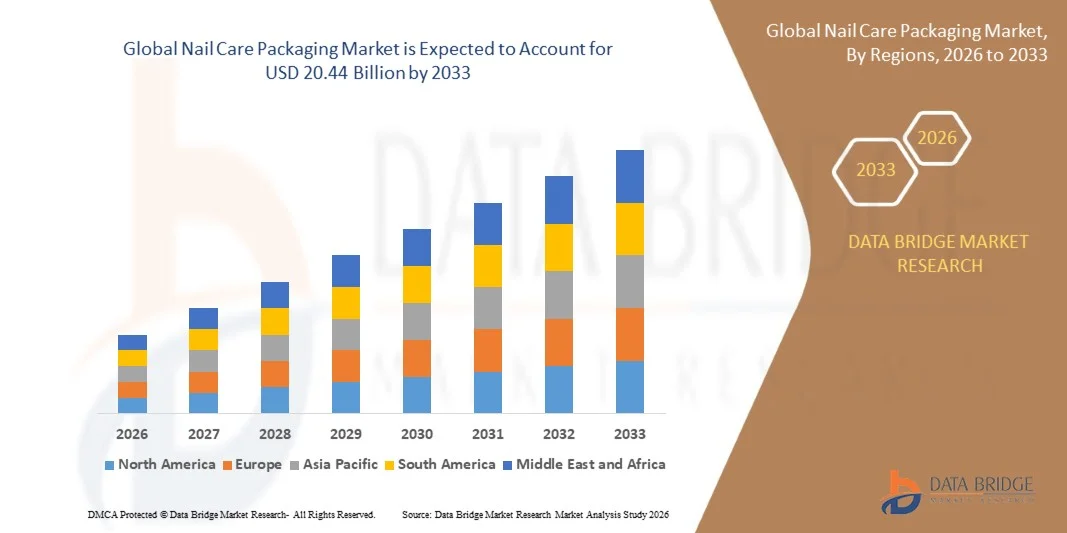

- The global nail care packaging market size was valued at USD 14.37 billion in 2025 and is expected to reach USD 20.44 billion by 2033, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by the rising consumption of nail care and personal grooming products, supported by increasing beauty consciousness and frequent product launches across mass-market and premium nail care brands

- Furthermore, growing emphasis on product aesthetics, convenience, and sustainability is driving demand for innovative, functional, and eco-friendly packaging formats. These combined factors are accelerating the adoption of advanced nail care packaging solutions, thereby significantly boosting overall market growth

Nail Care Packaging Market Analysis

- Nail care packaging, encompassing bottles, jars, pots, tubes, and pouches designed for polishes, treatments, and removers, plays a critical role in product protection, visual appeal, and ease of application across both professional and at-home usage

- The increasing demand for nail care packaging is primarily driven by the expansion of nail salons, rising DIY manicure trends, and growing preference for sustainable and premium packaging solutions that enhance brand differentiation and consumer experience

- North America dominated the nail care packaging market with a share of 42.86% in 2025, due to strong consumption of nail care products, a well-established cosmetics industry, and high demand for premium and sustainable packaging solutions

- Asia-Pacific is expected to be the fastest growing region in the nail care packaging market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing beauty consciousness across emerging economies

- Plastic segment dominated the market with a market share of 58.5% in 2025, due to its cost efficiency, durability, and versatility in molding into diverse packaging shapes and sizes. Plastic packaging supports mass production and ensures resistance against breakage, which is critical for liquid nail care products during transportation and retail handling. Its compatibility with various closure and applicator systems further drives widespread adoption

Report Scope and Nail Care Packaging Market Segmentation

|

Attributes |

Nail Care Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nail Care Packaging Market Trends

“Rising Adoption of Sustainable and Eco-Friendly Nail Care Packaging”

- A prominent trend in the nail care packaging market is the growing adoption of sustainable and eco-friendly packaging solutions, driven by increasing consumer awareness around environmental impact and responsible beauty consumption. Nail polish brands and manicure product manufacturers are actively shifting toward recyclable, refillable, and reduced-plastic packaging formats to align with evolving sustainability expectations

- For instance, companies such as OPI and Essie have introduced packaging initiatives focused on recyclable glass bottles and responsibly sourced outer cartons to reduce environmental footprint. These efforts support brand differentiation while responding to rising demand for environmentally conscious nail care products across global markets

- The use of post-consumer recycled materials in caps, brushes, and secondary packaging is gaining momentum as brands aim to lower virgin plastic usage. This transition is influencing packaging suppliers to innovate material blends that maintain durability, chemical resistance, and aesthetic appeal

- Refill-oriented nail polish systems are emerging as brands explore long-term sustainability strategies that reduce packaging waste. This approach is gradually reshaping consumer engagement by encouraging repeat purchases through refill models rather than single-use containers

- Premium and professional nail care segments are emphasizing minimalistic and eco-focused packaging designs that balance visual appeal with sustainability goals. These design trends are strengthening the role of packaging as a brand value communicator in retail and salon environments

- The increasing alignment between sustainability commitments and packaging innovation is reinforcing this trend across the nail care packaging market. This shift is supporting long-term market growth by integrating environmental responsibility into mainstream nail care product development

Nail Care Packaging Market Dynamics

Driver

“Rising Influence of Nail Art, DIY Manicure Kits, and At-Home Nail Care”

- The growing popularity of nail art and at-home manicure routines is a major driver for the nail care packaging market, as consumers increasingly seek convenient, easy-to-use, and visually appealing packaging formats. This trend has expanded demand for packaging that supports frequent usage, portability, and organized storage of nail care products

- For instance, companies such as Sally Hansen and Kiss Products offer DIY manicure kits and nail art collections packaged in compact, user-friendly containers designed for home application. These packaging formats enhance consumer experience while supporting product accessibility for non-professional users

- At-home nail care routines are encouraging brands to develop packaging that ensures product longevity and spill prevention during repeated use. This is strengthening demand for high-quality closures, brushes, and applicator-integrated designs

- E-commerce growth in beauty products is further amplifying the need for durable and protective nail care packaging that can withstand shipping conditions. This driver is influencing packaging design priorities toward functionality and safety

- The continued expansion of DIY nail care culture is sustaining long-term demand for innovative and consumer-centric packaging solutions. This driver is positioning nail care packaging as a critical enabler of product adoption and repeat usage across global beauty markets

Restraint/Challenge

“Complexity in Balancing Sustainability with Cost-Effective Packaging Design”

- The nail care packaging market faces challenges in balancing sustainable material adoption with cost-effective packaging design, as eco-friendly materials often involve higher sourcing and processing expenses. These cost pressures are particularly significant for mass-market nail care brands operating in price-sensitive segments

- For instance, packaging suppliers working with brands such as Revlon and Coty must align sustainability targets with strict cost structures while ensuring packaging compatibility with solvent-based nail formulations. This balancing act increases design complexity and limits rapid scalability of sustainable solutions

- Eco-friendly alternatives must meet stringent performance requirements such as chemical resistance, leak prevention, and shelf stability, which adds to material testing and development costs. These technical constraints slow the transition away from conventional plastics

- Smaller brands face additional challenges in absorbing higher packaging costs without impacting product pricing or margins. This can restrict the adoption of innovative sustainable packaging formats across emerging market players

- The ongoing challenge of aligning environmental goals with affordability continues to influence packaging decisions in the nail care industry. Addressing this complexity remains essential for achieving sustainable growth while maintaining commercial viability in the nail care packaging market

Nail Care Packaging Market Scope

The market is segmented on the basis of packaging format, material, and application.

• By Packaging Format

On the basis of packaging format, the nail care packaging market is segmented into cosmetic pots, cosmetic jars, bottles, pouches, tubes, and others. The bottles segment dominated the market with the largest revenue share in 2025, supported by their widespread use for nail polish, removers, and liquid nail treatments. Bottles offer precise dispensing, strong product protection, and high compatibility with brushes and applicators, making them a preferred choice for both mass-market and premium nail care brands. Their ease of labeling and branding further strengthens adoption across retail and professional channels.

The pouches segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for lightweight, travel-friendly, and sustainable packaging formats. Brands are increasingly adopting refill pouches to reduce plastic usage and logistics costs while appealing to environmentally conscious consumers. The flexibility in design and lower material consumption makes pouches an attractive option for emerging nail care product launches.

• By Material

On the basis of material, the nail care packaging market is segmented into plastic, glass, metal, paper, and others. The plastic segment accounted for the dominant market share of 58.5% in 2025 due to its cost efficiency, durability, and versatility in molding into diverse packaging shapes and sizes. Plastic packaging supports mass production and ensures resistance against breakage, which is critical for liquid nail care products during transportation and retail handling. Its compatibility with various closure and applicator systems further drives widespread adoption.

The glass segment is projected to grow at the fastest rate during the forecast period, fueled by increasing preference for premium and aesthetically appealing packaging. Glass is often associated with high-end nail polish and treatment products due to its superior chemical resistance and recyclability. Growing consumer focus on sustainable and luxury packaging solutions continues to support accelerated growth of this segment.

• By Application

On the basis of application, the nail care packaging market is segmented into salons, spas, cosmetic treatment centres, beauty parlors, retail shops, and others. The retail shops segment dominated the market in 2025, driven by strong consumer demand for at-home nail care products and the extensive presence of nail care brands across supermarkets, specialty stores, and online retail platforms. Packaging designed for retail emphasizes visual appeal, shelf stability, and branding, which significantly influences purchase decisions.

The salons segment is anticipated to register the fastest growth from 2026 to 2033, supported by the rising number of professional nail salons and increasing spending on nail grooming services. Salons demand durable, functional, and bulk-friendly packaging that supports frequent usage and hygienic dispensing. The growing trend of professional-grade nail treatments is accelerating demand for customized and high-performance packaging solutions within this segment.

Nail Care Packaging Market Regional Analysis

- North America dominated the nail care packaging market with the largest revenue share of 42.86% in 2025, driven by strong consumption of nail care products, a well-established cosmetics industry, and high demand for premium and sustainable packaging solutions

- Consumers in the region place significant emphasis on product aesthetics, convenience, and hygiene, encouraging brands to invest in innovative packaging formats such as air-tight bottles, precision applicators, and refill-friendly designs

- This dominance is further supported by high disposable incomes, strong presence of global nail care brands, and widespread retail penetration across specialty beauty stores and e-commerce platforms, reinforcing North America’s leadership in the market

U.S. Nail Care Packaging Market Insight

The U.S. nail care packaging market captured the largest revenue share within North America in 2025, fueled by high demand for nail polish, nail treatments, and at-home manicure products. Consumers increasingly prefer visually appealing and functional packaging that enhances ease of application and storage. The strong presence of professional nail salons, along with rising DIY nail care trends and rapid product launches by cosmetic brands, continues to drive packaging innovation. In addition, growing awareness of sustainable materials is encouraging the adoption of recyclable and refillable nail care packaging solutions.

Europe Nail Care Packaging Market Insight

The Europe nail care packaging market is projected to expand at a steady CAGR during the forecast period, driven by rising demand for eco-friendly packaging and stringent regulations on plastic usage. European consumers demonstrate a strong preference for sustainable, minimalist, and premium packaging designs. The region’s mature beauty and personal care industry, combined with increasing focus on recyclability and reduced material usage, is supporting growth across both mass-market and premium nail care segments.

U.K. Nail Care Packaging Market Insight

The U.K. nail care packaging market is anticipated to grow at a notable CAGR, supported by increasing spending on personal grooming and strong demand for salon-quality nail products. The rise of independent beauty brands and online-first cosmetic companies is driving demand for distinctive and brand-centric packaging. In addition, the U.K.’s well-developed retail and e-commerce infrastructure enables rapid adoption of innovative nail care packaging formats.

Germany Nail Care Packaging Market Insight

The Germany nail care packaging market is expected to witness consistent growth during the forecast period, driven by high consumer awareness regarding sustainability and product quality. German brands prioritize durable, recyclable, and premium-looking packaging, particularly for nail treatments and professional-use products. The country’s strong manufacturing base and emphasis on environmentally responsible packaging solutions further support market expansion.

Asia-Pacific Nail Care Packaging Market Insight

The Asia-Pacific nail care packaging market is poised to grow at the fastest CAGR from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing beauty consciousness across emerging economies. The growing popularity of nail art, professional salons, and social media-driven beauty trends is accelerating demand for innovative and visually attractive packaging. In addition, the region’s role as a major manufacturing hub is improving the affordability and availability of diverse nail care packaging solutions.

Japan Nail Care Packaging Market Insight

The Japan nail care packaging market is gaining traction due to strong demand for precision-focused, compact, and high-quality packaging solutions. Japanese consumers value cleanliness, ease of use, and aesthetic appeal, which influences the design of nail care packaging. The popularity of premium nail products and professional nail services is further driving demand for sophisticated and functional packaging formats.

China Nail Care Packaging Market Insight

The China nail care packaging market accounted for the largest revenue share in Asia Pacific in 2025, driven by rapid urbanization, a growing middle-class population, and increasing adoption of beauty and grooming products. The expansion of domestic cosmetic brands, along with strong e-commerce penetration, is fueling demand for cost-effective yet visually appealing packaging. Moreover, the growing influence of nail art trends and frequent product launches continues to propel the nail care packaging market in China.

Nail Care Packaging Market Share

The nail care packaging industry is primarily led by well-established companies, including:

- Diamond Cosmetics (India)

- Baralan USA (U.S.)

- Bottle Coatings (U.S.)

- Poly Chromatic (U.S.)

- GCC Packaging Group (U.A.E.)

- Virospack (Spain)

- Kosmetech (South Korea)

- Cosmetic Index (U.S.)

- Gidea Packaging (Italy)

- Corpack (Canada)

- HCT Packaging (U.S.)

- MJS Packaging (U.S.)

Latest Developments in Global Nail Care Packaging Market

- In September 2025, Estée Lauder strengthened the nail care packaging market by introducing an augmented reality feature on its e-commerce platform that allows consumers to virtually try nail shades and designs before purchase. This digital integration enhances consumer confidence, improves online conversion rates, and reduces product returns, encouraging brands to align packaging, product presentation, and digital experience more closely. The move highlights how technology-driven engagement is indirectly shaping packaging demand by supporting premium and visually differentiated nail care offerings

- In August 2025, Revlon advanced the nail care packaging market through a strategic partnership with a sustainable materials provider to develop biodegradable packaging solutions. This initiative reinforces sustainability as a key competitive differentiator and accelerates the shift toward eco-friendly materials across nail care packaging. The collaboration is expected to influence purchasing decisions among environmentally conscious consumers, strengthening brand loyalty while pushing competitors to adopt greener packaging alternatives

- In July 2025, L'Oréal expanded its influence on the nail care packaging market by launching a new nail care range packaged entirely in recyclable materials. This development supports the growing industry focus on circular economy practices and reduces the environmental footprint of nail care products. L'Oréal’s scale and market presence are likely to drive wider adoption of recyclable packaging formats across both mass-market and premium nail care segments

- In June 2025, Coty announced the redesign of its nail care packaging portfolio to include refillable bottles and reduced-material components. This move is expected to lower packaging waste while improving long-term cost efficiency for brands and consumers. By promoting refill-based usage models, Coty is influencing the market toward sustainable packaging systems rather than single-use formats

- In May 2025, Shiseido introduced minimalist nail care packaging with lightweight glass and paper-based secondary materials to enhance recyclability and shelf appeal. This initiative reflects rising consumer preference for premium yet environmentally responsible packaging in the nail care segment. The launch is likely to accelerate innovation in material selection and packaging design, particularly in high-end and professional nail care markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Nail Care Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Nail Care Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Nail Care Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.