Global Nano Silica Market

Market Size in USD Billion

CAGR :

%

USD

6.44 Billion

USD

9.82 Billion

2024

2032

USD

6.44 Billion

USD

9.82 Billion

2024

2032

| 2025 –2032 | |

| USD 6.44 Billion | |

| USD 9.82 Billion | |

|

|

|

|

What is the Global Nano Silica Market Size and Growth Rate?

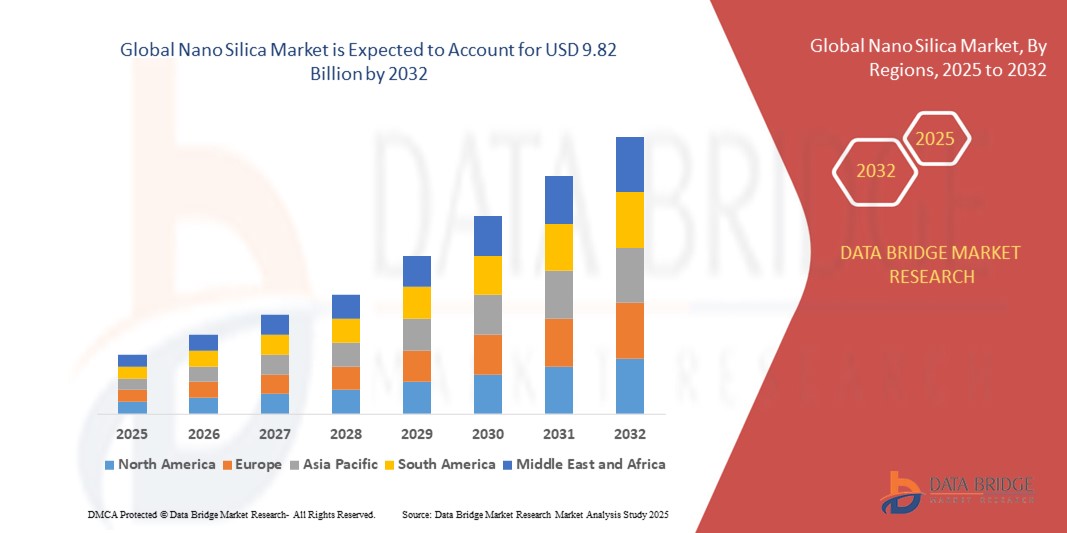

- The global nano silica market size was valued at USD 6.44 billion in 2024 and is expected to reach USD 9.82 billion by 2032, at a CAGR of 5.40% during the forecast period

- The essential factors contributing to the growth of the nano silica market in the forecast period of 2024 to 2031 include the increasing demand for nano silica in the rubber industry

- The growing use of nano silica as an additive in various applications is significantly contributing to the market’s growth. Nano silica’s high surface area and biocompatibility make it an ideal carrier for nucleic acids, offering potential breakthroughs in drug delivery and gene therapy

What are the Major Takeaways of Nano Silica Market?

- The growing usage of nano silica in RNA/DNA delivery systems presents a promising opportunity in the market. Nano silica’s high surface area and biocompatibility make it an ideal carrier for nucleic acids, offering potential breakthroughs in drug delivery and gene therapy

- With the increasing focus on precision medicine and targeted treatments, nano silica’s role in enhancing the efficiency of RNA/DNA delivery systems can lead to the development of innovative pharmaceuticals and therapies, expanding its application and market potential

- Asia-Pacific dominated the nano silica market with the largest revenue share of 32.15% in 2024, driven by increasing urbanization, rapid industrialization, and expanding infrastructure projects across the region

- Europe Nano Silica market is projected to grow at the fastest CAGR of 7.12% from 2025 to 2032, supported by stringent environmental regulations, a strong focus on sustainability, and advancements in industrial applications

- The P-Type segment dominated the nano silica market with the largest market revenue share of 43.2% in 2024, driven by its extensive use in concrete, coatings, and rubber applications due to its superior pozzolanic activity and enhanced mechanical strength

Report Scope and Nano Silica Market Segmentation

|

Attributes |

Nano Silica Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Nano Silica Market?

Rising Demand for High-Performance and Sustainable Nano Silica Solutions

- A significant and accelerating trend in the global nano silica market is the increasing focus on high-performance materials that provide enhanced durability, lightweight properties, and eco-friendly benefits. Manufacturers are integrating nano silica into coatings, concrete, rubber, and polymer applications to improve mechanical strength and resistance to wear and tear

- For instance, leading companies are developing surface-modified nano silica to enhance dispersibility in coatings and composites, enabling improved scratch resistance and transparency. Similarly, in construction, nano silica is being used to produce high-strength, low-permeability concrete, aligning with sustainability goals

- The trend also reflects the growing demand for green and energy-efficient materials, with companies investing in nano silica derived from renewable sources such as rice husk ash. This innovation caters to stricter environmental regulations while meeting industry requirements for high performance

- The integration of nano silica into diverse industries such as automotive, electronics, and construction is creating a more interconnected and sustainable materials ecosystem. Through advancements in nanotechnology, manufacturers are enabling superior product performance while reducing carbon footprints

- This shift toward high-performance and eco-conscious nano silica solutions is reshaping consumer and industrial expectations, prompting companies to develop advanced products tailored to both functional and regulatory demands

- As a result, the demand for nano silica is rapidly increasing across sectors, driven by sustainability goals, superior material performance, and regulatory compliance

What are the Key Drivers of Nano Silica Market?

- The increasing adoption of nano silica in construction for high-performance concrete and self-healing materials is a major growth driver, supported by rapid urbanization and infrastructure development

- For instance, in April 2024, Evonik Industries announced advancements in nano silica for coatings and sealants to enhance energy efficiency in building applications, driving market expansion

- Growing demand in automotive and electronics for lightweight, durable, and heat-resistant materials is further propelling the adoption of nano silica. Its role in tire manufacturing for better fuel efficiency and in electronic components for improved thermal management underlines its versatility

- In addition, rising environmental concerns and stricter regulations are encouraging the use of sustainable nano silica derived from agricultural waste, offering industries a cost-effective and eco-friendly alternative

- The market is also benefiting from the expansion of nanotechnology R&D and the increasing availability of user-friendly nano silica formulations, enabling broader applications across industrial sectors

Which Factor is challenging the Growth of the Nano Silica Market?

- High production costs and complex manufacturing processes remain significant challenges to the widespread adoption of nano silica, especially in price-sensitive regions

- For instance, the additional expenses associated with surface modification and dispersion technologies have limited the adoption of advanced nano silica in small and medium-scale industries

- Concerns regarding health and environmental impacts of nanoparticles, including inhalation risks and potential toxicity, have led to stricter regulations, slowing market penetration in some regions

- Addressing these challenges requires greater regulatory clarity, advanced safety protocols, and cost-reduction strategies through economies of scale and innovative production techniques. Companies such as Cabot Corporation and Wacker Chemie AG are investing in safer and more efficient manufacturing processes to build consumer trust

- Furthermore, limited awareness among end-users about the benefits of Nano Silica compared to conventional materials can hinder growth, particularly in developing markets

- Overcoming these hurdles through cost optimization, consumer education, and sustainable production methods will be essential for unlocking the full potential of the nano silica market

How is the Nano Silica Market Segmented?

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the nano silica market is segmented into P-Type, S-Type, and Type III. The P-Type segment dominated the nano silica market with the largest market revenue share of 43.2% in 2024, driven by its extensive use in concrete, coatings, and rubber applications due to its superior pozzolanic activity and enhanced mechanical strength. Industries prefer P-Type Nano Silica for improving durability and reducing permeability in construction materials, as well as enhancing performance in polymers and composites.

The S-Type segment is anticipated to witness the fastest growth rate of 21.7% from 2025 to 2032, fueled by its growing adoption in electronics and healthcare industries. S-Type Nano Silica’s uniform particle distribution and high purity make it ideal for applications such as semiconductor polishing and drug delivery systems. Its versatility and efficiency in advanced manufacturing processes are further driving its demand.

- By Application

On the basis of application, the nano silica market is segmented into Concrete, Rubber, Electronics, Healthcare, Coatings, Agriculture, Plastics, and Others. The Concrete segment accounted for the largest market revenue share in 2024, driven by increasing urbanization and the demand for high-performance building materials. Nano Silica enhances compressive strength, reduces micro-cracks, and improves sustainability by lowering cement content, making it highly preferred for modern infrastructure projects.

The Electronics segment is expected to witness the fastest CAGR from 2025 to 2032, supported by rising demand for advanced materials in semiconductors, printed circuit boards, and optical devices. Nano Silica’s ability to improve thermal stability, insulation, and miniaturization capabilities makes it essential for next-generation electronic components.

Which Region Holds the Largest Share of the Nano Silica Market?

- Asia-Pacific dominated the nano silica market with the largest revenue share of 32.15% in 2024, driven by increasing urbanization, rapid industrialization, and expanding infrastructure projects across the region. The rising demand for high-performance materials in construction, electronics, and coatings is significantly boosting Nano Silica adoption

- Industries in the region value Nano Silica’s superior mechanical properties, durability, and versatility, making it essential for applications such as concrete, rubber, and advanced electronics

- The growth is further supported by favorable government initiatives, rising disposable incomes, and the presence of leading manufacturers, making Asia-Pacific the central hub for Nano Silica production and consumption

China Nano Silica Market Insight

The China nano silica market captured the largest revenue share in Asia-Pacific in 2024, driven by its massive construction sector, increasing investments in smart cities, and rapid adoption of advanced materials in electronics and automotive industries. Strong domestic production capabilities and competitive pricing give China a leading edge, while government policies promoting sustainable building materials further accelerate market growth.

Japan Nano Silica Market Insight

The Japan nano silica market is expanding steadily, supported by its high-tech manufacturing ecosystem and focus on product quality. Demand is rising in electronics, healthcare, and precision engineering, where Nano Silica is used for enhanced performance and miniaturization. Japan’s emphasis on research and innovation fosters the development of high-purity Nano Silica, driving its adoption in premium applications.

India Nano Silica Market Insight

The India nano silica market is growing rapidly, fueled by increasing infrastructure development, government initiatives for smart cities, and rising industrialization. Demand for Nano Silica in concrete and coatings is strong, driven by the need for durable and sustainable materials. The country’s emerging electronics and automotive sectors also contribute to the expanding application base of Nano Silica.

Which Region is the Fastest Growing Region in the Nano Silica Market?

Europe nano silica market is projected to grow at the fastest CAGR of 7.12% from 2025 to 2032, supported by stringent environmental regulations, a strong focus on sustainability, and advancements in industrial applications. The region’s demand for eco-friendly, high-performance materials is driving Nano Silica adoption across construction, automotive, and specialty coatings.

Germany Nano Silica Market Insight

The Germany nano silica market is expanding significantly, driven by innovation in advanced manufacturing and the integration of Nano Silica into coatings, electronics, and automotive applications. The country’s emphasis on energy efficiency and sustainable materials aligns with the rising demand for Nano Silica-based solutions.

U.K. Nano Silica Market Insight

The U.K. nano silica market is experiencing strong growth due to increasing investments in infrastructure modernization and advanced materials for industrial applications. The push towards low-carbon construction and innovations in healthcare and electronics are further supporting market expansion.

Which are the Top Companies in Nano Silica Market?

The nano silica industry is primarily led by well-established companies, including:

- Evonik Industries (Germany)

- AkzoNobel N.V. (Netherlands)

- DuPont (U.S.)

- Cabot Corporation (U.S.)

- Nanopore Incorporated (U.K.)

- Nanostructured & Amorphous Materials, Inc. (NANOAMOR) (U.S.)

- Fuso Chemical Co. Ltd. (Japan)

- Wacker Chemie AG (Germany)

- Dow Corning Corporation (U.S.)

- Bee Chems (India)

What are the Recent Developments in Global Nano Silica Market?

- In November 2023, AkzoNobel introduced the first two products in its new Accelstyle range for the packaging coatings segment, specifically designed for the outer surface of traditional two-piece aluminum beverage cans. These products are formulated without bisphenols, styrene, and PFAS (per- and polyfluoroalkyl substances), underscoring the company’s commitment to sustainable and regulatory-compliant solutions. This launch positions AkzoNobel as a leader in eco-friendly innovations within the coatings market

- In July 2023, Fortis Life Sciences completed the acquisition of nanoComposix, a premium nanomaterials company specializing in assay development and diagnostics. This acquisition strengthens Fortis Life Sciences’ portfolio in advanced nanomaterials and enhances its capabilities in delivering high-performance diagnostic solutions. The move enables the company to expand its global presence in the rapidly growing nanotechnology sector

- In April 2023, Cabot Corporation finalized the acquisition of Shenzhen Sanshun Nano New Materials Co., Ltd. (SUSN), integrating the business into its Performance Chemicals Segment. This acquisition enhances Cabot’s market position in Nano Silica by expanding its product offerings and manufacturing footprint in Asia. The deal significantly strengthens Cabot’s ability to meet the rising demand for advanced materials globally

- In July 2023, Wacker Chemie AG announced plans to expand its HDK nanosilica production capacity in China, aiming to address the region’s surging demand for Nano Silica. China, being the world’s largest consumer of nanosilica, provides a strategic advantage for Wacker’s expansion, aligning with its growth strategy in high-potential markets. This development reinforces Wacker’s role as a key player in the global Nano Silica industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Nano Silica Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Nano Silica Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Nano Silica Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.