Global Nanowire Battery Market

Market Size in USD Million

CAGR :

%

USD

179.86 Million

USD

1,996.14 Million

2025

2033

USD

179.86 Million

USD

1,996.14 Million

2025

2033

| 2026 –2033 | |

| USD 179.86 Million | |

| USD 1,996.14 Million | |

|

|

|

|

Nanowire Battery Market Size

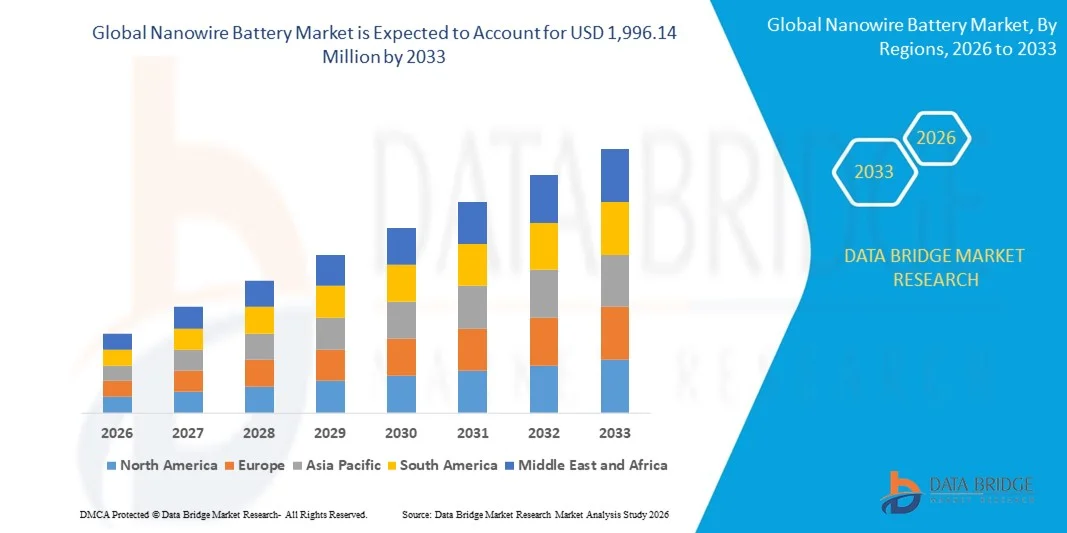

- The global nanowire battery market size was valued at USD 179.86 million in 2025 and is expected to reach USD 1,996.14 million by 2033, at a CAGR of 35.10% during the forecast period

- The market growth is largely fuelled by the rising demand for high-energy-density and fast-charging batteries in electric vehicles, consumer electronics, and renewable energy storage

- Increasing investment in research and development for advanced nanowire materials and scalable manufacturing processes is driving innovation and adoption across multiple industries

Nanowire Battery Market Analysis

- The market is witnessing significant technological advancements, including improvements in anode materials, electrolyte compatibility, and battery lifecycle, which are enhancing performance and reliability

- Growing adoption in electric vehicles, portable electronics, and grid energy storage is creating new applications and expanding the overall market potential

- North America dominated the nanowire battery market with the largest revenue share in 2025, driven by the rapid adoption of electric vehicles (EVs), renewable energy storage solutions, and the presence of advanced battery manufacturers

- Asia-Pacific region is expected to witness the highest growth rate in the global nanowire battery market, driven by rising EV production, technological advancements in battery materials, and expanding consumer electronics and industrial energy storage demand

- The semiconducting segment held the largest market revenue share in 2025, driven by its high electrical conductivity and superior energy storage efficiency. Semiconducting nanowires enable faster charge-discharge cycles and improved battery lifespan, making them particularly suitable for electric vehicles and high-performance electronics

Report Scope and Nanowire Battery Market Segmentation

|

Attributes |

Nanowire Battery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Nanowire Battery Market Trends

Rise of High-Energy-Density Nanowire Batteries

- The increasing adoption of nanowire battery technology is transforming the energy storage landscape by enabling higher energy density and faster charge-discharge cycles. The advanced architecture allows for improved battery performance, particularly in electric vehicles (EVs) and portable electronics, resulting in longer runtime and enhanced operational efficiency. In addition, the technology reduces thermal stress during cycling, enhancing safety and extending battery lifespan for high-demand applications

- The growing demand for compact, high-capacity batteries in consumer electronics and EVs is accelerating the development of silicon and lithium-based nanowire anode materials. These solutions are particularly effective in addressing energy density limitations of traditional lithium-ion batteries, supporting faster adoption in high-performance applications. Furthermore, they enable lighter battery packs, improving vehicle efficiency and reducing environmental impact

- The scalability and potential cost reduction of emerging nanowire battery manufacturing techniques are making them attractive for commercial and industrial energy storage solutions. Companies benefit from more efficient batteries without incurring excessive costs or production delays, enhancing competitiveness and sustainability. These developments also open opportunities for grid-scale energy storage and renewable energy integration, promoting green energy adoption

- For instance, in 2023, several EV manufacturers in China and the U.S. reported extended driving ranges and reduced charging times after integrating experimental nanowire battery prototypes in select vehicle models. These implementations allowed enhanced energy storage performance, lowering overall operational costs and improving market appeal. Early adopters also gained a competitive advantage by offering faster-charging, longer-lasting batteries to consumers

- While nanowire batteries are accelerating energy density and performance improvements, their impact depends on continued innovation, manufacturing scale-up, and integration with existing battery management systems. Manufacturers must focus on material optimization, cost-effective production, and safety validation to fully capitalize on this growing demand. In addition, collaborations with research institutions and governments can support faster commercialization and standardization across the industry

Nanowire Battery Market Dynamics

Driver

Rising Demand for High-Energy-Density and Fast-Charging Batteries

- The surge in electric vehicle adoption and renewable energy storage solutions is pushing battery manufacturers to explore nanowire technology as a next-generation solution. High-energy-density batteries enable longer driving ranges, faster charging, and more reliable energy storage performance. This trend is also boosting investments in research and development to optimize battery chemistries for diverse applications

- Companies are increasingly aware of the competitive advantage offered by advanced battery technologies, including improved cycle life, energy efficiency, and compact form factors. This awareness has led to higher R&D investments and pilot production initiatives across the battery supply chain. Enhanced performance enables OEMs to differentiate their products in a rapidly growing EV and consumer electronics market

- Government policies and incentives promoting EV adoption and clean energy infrastructure further support nanowire battery deployment. Regulatory frameworks encourage manufacturers to implement cutting-edge battery solutions, ensuring alignment with sustainability and efficiency goals. Supportive initiatives also include funding for pilot programs and collaborations aimed at achieving commercial viability at scale

- For instance, in 2022, the European Union funded several nanowire battery research projects targeting EVs and grid storage applications, boosting demand for pilot-scale and commercial-grade nanowire battery systems. The funding accelerated technology validation, reduced financial risk for developers, and strengthened the overall ecosystem for next-generation energy storage

- While demand and policy support are fueling market growth, there is still a need to scale up manufacturing, reduce production costs, and ensure safety and reliability for large-scale commercial applications. Companies are increasingly focusing on automating production processes and refining supply chains to meet growing global demand efficiently

Restraint/Challenge

High Production Cost and Manufacturing Complexity

- The high cost of producing nanowire anode materials and the complexity of integrating them into commercial battery cells make large-scale adoption challenging. Manufacturing precision and material handling require advanced facilities and skilled personnel, limiting accessibility for small-scale producers. These factors also contribute to longer lead times and increased capital expenditure requirements for new production lines

- Many regions face technological and supply chain constraints for nanowire battery production, including limited access to high-purity silicon, lithium, and specialized fabrication equipment. These constraints reduce the speed of commercialization and market penetration. In addition, geopolitical issues and trade restrictions can further affect raw material availability and supply chain stability

- Market growth is also impacted by safety concerns and the need for extensive validation, as high-capacity nanowire batteries can be prone to degradation or short-circuit risks if not properly engineered. Comprehensive testing and quality assurance protocols are essential to mitigate potential hazards, ensuring consumer trust and regulatory compliance

- For instance, in 2023, several pilot nanowire battery programs in Asia reported delays due to fabrication inconsistencies and yield losses, highlighting the need for improved process reliability. These incidents underscored the importance of developing standardized manufacturing procedures and robust quality control measures to minimize operational risks

- While nanowire battery technology continues to advance, addressing cost, production scale, and safety challenges is crucial. Stakeholders must focus on material innovation, automated manufacturing, and robust quality control to unlock long-term market potential. Strategic partnerships and collaborative R&D can also accelerate commercialization and expand adoption across multiple industries

Nanowire Battery Market Scope

The market is segmented on the basis of type, material type, and application.

- By Type

On the basis of type, the nanowire battery market is segmented into semiconducting, insulating, and molecular. The semiconducting segment held the largest market revenue share in 2025, driven by its high electrical conductivity and superior energy storage efficiency. Semiconducting nanowires enable faster charge-discharge cycles and improved battery lifespan, making them particularly suitable for electric vehicles and high-performance electronics.

The insulating segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to enhance battery safety and reduce internal short-circuit risks. Insulating nanowires are increasingly adopted in advanced battery architectures to ensure stability, thermal management, and reliable performance in both consumer electronics and industrial applications.

- By Material Type

On the basis of material type, the market is segmented into silicon, germanium, transition metal oxides, and gold. The silicon segment accounted for the largest revenue share in 2025, attributed to its high theoretical capacity and growing adoption in electric vehicles and portable devices. Silicon nanowires offer significant improvements in energy density and cycle life compared to conventional lithium-ion anodes.

The germanium segment is expected to witness the fastest growth from 2026 to 2033, driven by its superior conductivity, mechanical flexibility, and compatibility with next-generation battery technologies. Germanium-based nanowires are increasingly explored for high-performance applications requiring compact form factors and rapid energy delivery.

- By Application

On the basis of application, the market is segmented into consumer electronics, automotive, healthcare, energy storage, power generation, and others. The automotive segment held the largest revenue share in 2025, fueled by the rising adoption of electric vehicles and hybrid vehicles that require high-energy-density, fast-charging batteries.

The consumer electronics segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand for compact, long-lasting, and high-performance batteries in smartphones, laptops, wearable devices, and other portable electronics. The integration of nanowire batteries enhances device runtime, reduces charging frequency, and supports the miniaturization trend in modern electronics.

Nanowire Battery Market Regional Analysis

- North America dominated the nanowire battery market with the largest revenue share in 2025, driven by the rapid adoption of electric vehicles (EVs), renewable energy storage solutions, and the presence of advanced battery manufacturers

- Consumers and industries in the region are increasingly prioritizing high-energy-density, fast-charging, and long-life batteries, which are critical for EVs, consumer electronics, and industrial energy storage applications

- This widespread adoption is further supported by strong government incentives for clean energy, technological advancements in battery materials, and rising investments in research and development, establishing nanowire batteries as a preferred solution for next-generation energy storage

U.S. Nanowire Battery Market Insight

The U.S. nanowire battery market captured the largest revenue share in 2025 within North America, fueled by the growing demand for electric vehicles, portable electronics, and renewable energy storage. Manufacturers are increasingly focused on integrating high-performance nanowire anodes to improve energy density, reduce charging times, and extend battery life. Government incentives for EV adoption and sustainable energy infrastructure are also accelerating deployment, supporting commercial-scale production and adoption.

Europe Nanowire Battery Market Insight

The Europe nanowire battery market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations, the push for EV adoption, and growing demand for high-performance energy storage solutions. Increasing urbanization, coupled with strong R&D initiatives, is fostering the development of advanced nanowire battery technologies. European industries are also emphasizing energy efficiency and sustainability, which encourages the adoption of next-generation battery solutions in automotive, industrial, and consumer electronics applications.

U.K. Nanowire Battery Market Insight

The U.K. nanowire battery market is expected to witness significant growth from 2026 to 2033, driven by the rising trend of electric mobility, renewable energy integration, and government-backed clean energy initiatives. High demand for compact, high-capacity batteries in EVs and energy storage systems is accelerating the adoption of nanowire battery technology. In addition, the country’s focus on innovation, smart grid development, and industrial electrification is supporting the expansion of the market.

Germany Nanowire Battery Market Insight

The Germany nanowire battery market is expected to witness strong growth from 2026 to 2033, fueled by a high focus on EV manufacturing, advanced battery research, and sustainable energy initiatives. German manufacturers are increasingly investing in nanowire anode development to improve energy density, battery lifespan, and charging efficiency. The integration of nanowire batteries in automotive and industrial energy storage applications is gaining momentum, supported by technological expertise and stringent quality standards.

Asia-Pacific Nanowire Battery Market Insight

The Asia-Pacific nanowire battery market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing EV production, rising disposable incomes, and government incentives promoting clean energy adoption in countries such as China, Japan, and India. The region’s dominance in battery manufacturing and the availability of cost-effective raw materials are accelerating large-scale production. Technological advancements and supportive policies are also boosting adoption across automotive, consumer electronics, and industrial energy storage sectors.

Japan Nanowire Battery Market Insight

The Japan nanowire battery market is expected to witness rapid growth from 2026 to 2033 due to the country’s advanced technology ecosystem, high EV penetration, and demand for compact, high-performance batteries. Japanese manufacturers are integrating nanowire battery solutions in consumer electronics, EVs, and renewable energy applications to enhance energy efficiency and performance. The country’s aging population and focus on sustainable technology adoption are also driving demand for user-friendly, reliable battery solutions.

China Nanowire Battery Market Insight

The China nanowire battery market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s strong EV market, extensive battery manufacturing infrastructure, and rapid adoption of advanced energy storage solutions. China’s emphasis on smart grids, clean energy initiatives, and domestic R&D capabilities is propelling the development and commercialization of nanowire batteries. Affordable battery solutions, alongside robust government support, are key factors driving growth in automotive, consumer electronics, and industrial energy storage applications.

Nanowire Battery Market Share

The Nanowire Battery industry is primarily led by well-established companies, including:

- Amprius Technologies (U.S.)

- Sila Nanotechnologies Inc. (U.S.)

- OneD Material, Inc. (U.S.)

- SONY INDIA (India)

- NEXEON LTD (U.K.)

- NEI Corporation (U.S.)

- XGSciences (U.S.)

- Prieto Battery Inc. (U.S.)

- Panasonic Corporation (Japan)

- QuantumScape Corporation (U.S.)

- IMPRINT ENERGY (U.S.)

- Synergy Intact Private Limited (India)

- TOSHIBA CORPORATION (Japan)

- Amperex Technology Limited (China)

- Enwair (U.S.)

- EoCell, Inc (U.S.)

- Enovix (U.S.)

- SAMSUNG SDI CO., LTD. (South Korea)

- Hitachi Metals, Ltd. (Japan)

- Enevate Corporation (U.S.)

Latest Developments in Global Nanowire Battery Market

- In August 2025, Tesla (U.S.) announced the launch of a new research facility focused on advanced nanowire battery technologies. This development aims to strengthen Tesla's R&D capabilities, accelerate innovation, and enable the introduction of next-generation battery solutions for electric vehicles. The facility is expected to enhance energy storage performance, reduce charging times, and solidify Tesla's position as a technological leader in the EV battery market

- In September 2025, Samsung SDI (KR) entered into a strategic partnership with a leading research institution to integrate nanowire technology into next-generation battery systems. The collaboration will leverage academic expertise to improve battery efficiency, sustainability, and lifecycle performance. This initiative is anticipated to speed up commercialization of cutting-edge batteries, enhancing Samsung SDI’s competitive edge in the high-performance energy storage sector

- In July 2025, Amprius Technologies (U.S.) secured major funding to scale up production of silicon nanowire batteries. The investment will expand manufacturing capacity, allowing the company to meet rising demand in the electric vehicle and consumer electronics markets. This move positions Amprius as a key innovator, improving market accessibility to high-energy-density batteries and driving broader adoption of advanced battery solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Nanowire Battery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Nanowire Battery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Nanowire Battery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.