Global Naphthenic Acid Market

Market Size in USD Million

CAGR :

%

USD

81.08 Million

USD

99.56 Million

2024

2032

USD

81.08 Million

USD

99.56 Million

2024

2032

| 2025 –2032 | |

| USD 81.08 Million | |

| USD 99.56 Million | |

|

|

|

|

What is the Global Naphthenic Acid Market Size and Growth Rate?

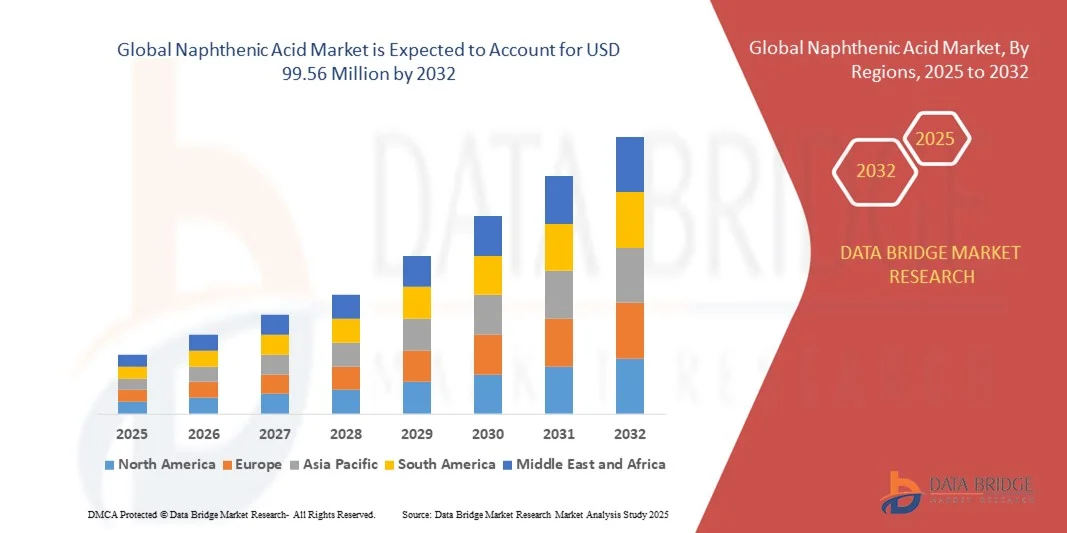

- The global naphthenic acid market size was valued at USD 81.08 million in 2024 and is expected to reach USD 99.56 million by 2032, at a CAGR of 2.60% during the forecast period

- The growing awareness regarding the benefits of the acid which will tends to protect wooden products from decomposition and decaying, increasing usages of acid as fuel additive in jet engines and locomotives, rising applications of the products in developing economies, high penetration along with availability of low cost of product, rising importance for engine life protection are some of the major as well as important factors which will likely to accelerate the growth of the naphthenic acid market

What are the Major Takeaways of Naphthenic Acid Market?

- Expansion of construction sector along with surging levels of investment for the growth of the timber based products, increasing global aircraft fleet for commercial as well as defence purposes which will further contribute by generating immense opportunities that will led to the growth of the naphthenic acid market

- Asia-Pacific dominated the naphthenic acid market with the largest revenue share of 41.5% in 2024, driven by the region’s expanding industrial base, rapid urbanization, and the strong presence of lubricant and paint manufacturing industries

- The North America naphthenic acid market is poised to grow at the fastest CAGR of 5.4% during the forecast period (2025–2032), driven by rising environmental regulations and increasing adoption of eco-friendly industrial additives

- The Refined Naphthenic Acid segment dominated the market with the largest revenue share of 67.4% in 2024, primarily due to its widespread use in producing metal naphthenates, lubricants, and industrial coatings

Report Scope and Naphthenic Acid Market Segmentation

|

Attributes |

Naphthenic Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Naphthenic Acid Market?

Rising Adoption of Naphthenic Acid in Lubricants and Metalworking Fluids

- A significant and accelerating trend in the global Naphthenic Acid market is its increasing use in lubricants, metalworking fluids, and greases due to its excellent solubility, stability, and corrosion resistance properties. These applications are seeing heightened demand as industries shift toward performance-oriented and eco-friendly solutions.

- For instance, Nynas AB has expanded its range of naphthenic base oils tailored for industrial lubricants to meet rising demand for high-viscosity, thermally stable, and environmentally compliant formulations.

- Naphthenic Acid’s chemical stability and low pour point make it ideal for use in metalworking, transformer oils, and tire manufacturing, where consistent performance under varying temperature conditions is essential. This is prompting leading producers to enhance their refining and extraction capabilities.

- Moreover, industries such as automotive, construction, and electrical are increasingly adopting naphthenic-based formulations for improved lubricity and oxidative stability, promoting operational efficiency and reduced equipment wear.

- This growing preference for naphthenic-based specialty fluids over conventional paraffinic types is expected to drive innovation, especially in bio-based derivatives and advanced industrial lubricants.

- Overall, the market trend indicates a steady shift toward sustainable, high-performance chemical applications, positioning Naphthenic Acid as a crucial material in the evolving industrial lubricants landscape.

What are the Key Drivers of Naphthenic Acid Market?

- The rising demand for metal naphthenates in paint driers, wood preservatives, and fuel additives is a primary driver of the Naphthenic Acid market. These compounds play an essential role in enhancing drying speed, corrosion resistance, and surface durability in industrial coatings

- For instance, in June 2024, Umicore expanded its metal naphthenate production in Belgium to cater to the growing global need for efficient catalysts and chemical intermediates, boosting the company’s industrial chemical portfolio

- The rapid industrialization across emerging economies, particularly in China, India, and Southeast Asia, is fueling demand for lubricants and additives derived from Naphthenic Acid for machinery and heavy-duty applications

- Furthermore, the growing preference for eco-friendly substitutes in manufacturing processes is driving chemical producers to focus on low-toxicity and low-volatility Naphthenic Acid formulations that comply with global environmental standards

- The expansion of automotive, energy, and construction industries, coupled with technological advancements in refining and extraction, is expected to further propel market growth

- Overall, these factors collectively strengthen the market’s long-term growth outlook, emphasizing industrial modernization, sustainability, and performance optimization as key market growth drivers

Which Factor is Challenging the Growth of the Naphthenic Acid Market?

- Environmental and regulatory challenges associated with naphthenic acid production and disposal represent a significant restraint on market expansion. The compound’s potential toxicity to aquatic life and its bioaccumulative nature have raised environmental compliance costs for producers

- For instance, in March 2023, the European Chemicals Agency (ECHA) introduced stricter safety regulations for the handling and disposal of naphthenic-based derivatives to reduce industrial chemical emissions and contamination risks

- Volatile raw material prices due to fluctuations in crude oil supply and refining output also hinder consistent production and pricing strategies for manufacturers

- In addition, limited availability of high-purity naphthenic feedstock in certain regions poses challenges to supply chain stability, forcing companies to explore alternative sourcing or refining technologies

- Competition from synthetic and bio-based substitutes, such as fatty acid derivatives, further pressures market players to innovate and optimize cost structures

- Overcoming these challenges through technological advancements, regulatory compliance, and sustainable production practices will be critical for ensuring the long-term viability and competitiveness of the global Naphthenic Acid market

How is the Naphthenic Acid Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the naphthenic acid market is segmented into Refined Naphthenic Acid and High-purity Naphthenic Acid. The Refined Naphthenic Acid segment dominated the market with the largest revenue share of 67.4% in 2024, primarily due to its widespread use in producing metal naphthenates, lubricants, and industrial coatings. Refined Naphthenic Acid offers excellent solubility and stability, making it ideal for formulating metal soaps and chemical intermediates. Its strong demand in paints, inks, and fuel additives stems from its ability to enhance drying time, improve anti-corrosion properties, and increase formulation efficiency.

The High-purity Naphthenic Acid segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing utilization in specialty chemicals, pharmaceuticals, and high-grade lubricants. The growing need for low-impurity and environmentally compliant formulations is prompting manufacturers to invest in advanced refining technologies to meet stringent industrial standards and regulatory requirements.

- By Application

On the basis of application, the naphthenic acid market is segmented into Paint and Ink Driers, Wood Preservatives, Fuel and Lubricant Additives, Rubber Additives, and Other Applications. The Paint and Ink Driers segment accounted for the largest market revenue share of 38.6% in 2024, driven by extensive demand from the construction, automotive, and industrial coating sectors. Naphthenic Acid serves as a key precursor in producing metal naphthenates such as cobalt and manganese driers, which accelerate drying times and improve film hardness in paints and varnishes.

The Fuel and Lubricant Additives segment is projected to register the fastest CAGR from 2025 to 2032, owing to the rising use of Naphthenic Acid-based additives that enhance oxidation stability, corrosion resistance, and engine performance. Increasing global consumption of lubricants in automotive, marine, and manufacturing industries is expected to significantly contribute to the segment’s rapid growth, strengthening its role in energy-efficient and high-performance formulations.

Which Region Holds the Largest Share of the Naphthenic Acid Market?

- Asia-Pacific dominated the naphthenic acid market with the largest revenue share of 41.5% in 2024, driven by the region’s expanding industrial base, rapid urbanization, and the strong presence of lubricant and paint manufacturing industries. The growing demand for metal naphthenates, wood preservatives, and lubricant additives in China, Japan, and India has been a major driver for market expansion

- The region benefits from low-cost production capabilities, easy access to raw materials, and a robust export network supporting the global chemical supply chain. Furthermore, ongoing investments in infrastructure and industrial development are amplifying the consumption of Naphthenic Acid across multiple end-use industries, including construction, automotive, and energy

- The Asia-Pacific market’s growth is reinforced by supportive government policies promoting manufacturing and the growing presence of domestic chemical producers, positioning the region as the global hub for Naphthenic Acid production and exports

China Naphthenic Acid Market Insight

The China naphthenic acid market captured the largest revenue share of 57% in 2024 within Asia-Pacific, fueled by a strong demand for paint driers, lubricants, and metal processing chemicals. The country’s growing industrial output and the presence of leading manufacturers enable large-scale production and cost competitiveness. Government initiatives such as “Made in China 2025” continue to strengthen the chemical manufacturing ecosystem, encouraging the use of refined and high-purity Naphthenic Acid in high-performance applications. Moreover, China’s growing exports to North America and Europe are further boosting its dominance in the regional market.

Japan Naphthenic Acid Market Insight

The Japan naphthenic acid market is projected to grow steadily during the forecast period, driven by high demand for eco-friendly lubricants and industrial coatings. Japan’s emphasis on sustainable and high-quality chemical formulations supports the use of Naphthenic Acid in automotive, electronics, and machinery sectors. The country’s technologically advanced manufacturing base and adherence to stringent environmental regulations are encouraging innovation in low-impurity Naphthenic Acid production, enhancing its competitiveness in the global market.

India Naphthenic Acid Market Insight

The India naphthenic acid market is expanding rapidly, driven by infrastructure growth, increased construction activities, and industrialization. The demand for Naphthenic Acid in paint and lubricant additives is surging as the country witnesses a rise in automotive manufacturing and public works projects. Government initiatives such as “Make in India” and investments in smart city projects are further contributing to domestic chemical production and consumption. In addition, the growing presence of small and medium-scale chemical manufacturers is making India an emerging production hub in the Asia-Pacific region.

Which Region is the Fastest Growing Region in the Naphthenic Acid Market?

The North America naphthenic acid market is poised to grow at the fastest CAGR of 5.4% during the forecast period (2025–2032), driven by rising environmental regulations and increasing adoption of eco-friendly industrial additives. The region’s robust chemical and lubricant industries, along with growing demand for sustainable alternatives in paints, coatings, and wood preservatives, are fueling market growth.

U.S. Naphthenic Acid Market Insight

The U.S. naphthenic acid market accounted for the largest revenue share of 79% in 2024 within North America, supported by the country’s strong industrial base and focus on high-performance lubricants. Increased investment in renewable energy, infrastructure, and green chemistry is driving demand for Naphthenic Acid-based additives. Furthermore, the presence of major chemical manufacturers and advancements in refining technologies are expected to sustain the country’s market leadership.

Canada Naphthenic Acid Market Insight

The Canada naphthenic acid market is witnessing considerable growth, propelled by the rising consumption of wood preservatives and lubricant additives in the forestry and automotive sectors. The country’s focus on environmental sustainability and renewable product development supports the adoption of high-purity Naphthenic Acid formulations. In addition, collaborations between local manufacturers and global distributors are expected to enhance market accessibility and strengthen Canada’s role in the North American market.

Which are the Top Companies in Naphthenic Acid Market?

The naphthenic acid industry is primarily led by well-established companies, including:

- Haihang Industry (China)

- Merck KGaA (Germany)

- Merichem Company (U.S.)

- Shanghai Changfeng Chemical Industrial Factory (China)

- Shenyang Zhang Ming Chemical Co., Ltd. (China)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- Umicore (Belgium)

- Jiangxi JYT Chemical Co., Ltd. (China)

- MOLBASE (China)

- JIGCHEM UNIVERSAL (India)

- Mil-Spec Industries Corporation (U.S.)

- A. B. ENTERPRISES (India)

- PETROPERÚ S.A. (Peru)

- Dorf Ketal Chemicals (I) Pvt. Ltd. (India)

- Apurva Chemicals (India)

- Todini Metals And Chemicals India Pvt Ltd. (India)

- Royal Chemicals (India). (India)

- Leo Chemo Plast Pvt. Ltd. (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Naphthenic Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Naphthenic Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Naphthenic Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.