Global Narrowband Iot Market

Market Size in USD Billion

CAGR :

%

USD

5.20 Billion

USD

9.60 Billion

2024

2032

USD

5.20 Billion

USD

9.60 Billion

2024

2032

| 2025 –2032 | |

| USD 5.20 Billion | |

| USD 9.60 Billion | |

|

|

|

|

Narrowband Internet of Things (IoT) Market Size

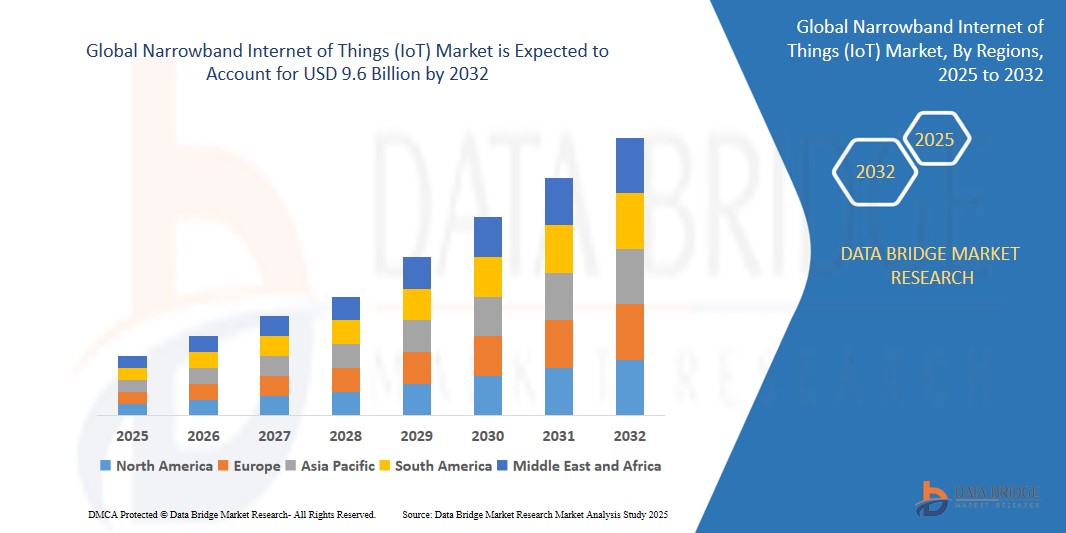

- The global Narrowband Internet of Things (IoT) market was valued at approximately USD 5.2 billion in 2024 and is projected to reach USD 9.6 billion by 2032, growing at a CAGR of 8.2% during the forecast period.

- This growth is driven by factors such as the rising demand for low-power, wide-area connectivity solutions across sectors including utilities, smart cities, manufacturing, and logistics. The expanding use of NB-IoT in smart meters, asset tracking, street lighting, and environmental monitoring, coupled with government-backed digital transformation initiatives and the rollout of 5G infrastructure, is significantly accelerating market expansion.

Narrowband Internet of Things (IoT) Market Analysis

- Narrowband IoT helps to connect the devices more simply and proficiently on already established mobile networks. Its demand is increasing owing to several reasons, for instance very lower component cost, low power consumption, network security and reliability among others.

- The high deployment flexibility with GSM, WCDMA or LTE is expected to influence the growth of narrowband internet of things (IoT) market.

- North America leads the Narrowband internet of things (IoT) market because of the leading device manufacturers and network service providers centering on testing and commercial deployment of solutions for consumer and industrial applications.

- Asia-pacific is expected to be the fastest growing region in the Narrowband Internet of Things (IoT) market during the forecast period driven by rapid urbanization, strong government initiatives promoting smart city development, and the widespread adoption of IoT-enabled infrastructure

- In 2025, the Smart Meters segment is projected to dominate the Narrowband Internet of Things (IoT) market under the By Device category, holding the largest market share of 34.87%. This growth is driven by widespread deployment of smart grid infrastructure across utilities for electricity, gas, and water monitoring. The ability of smart meters to support low-power, wide-area connectivity makes NB-IoT an ideal communication backbone for reliable and cost-efficient data transmission. Regulatory push for energy efficiency and remote diagnostics is further accelerating adoption globally.

Report Scope and Narrowband Internet of Things (IoT) Market Segmentation

|

Attributes |

Narrowband Internet of Things (IoT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Narrowband Internet of Things (IoT) Market Trends

“Smart connectivity powers next-gen IoT expansion”

- The Narrowband Internet of Things (IoT) market is witnessing robust growth, fueled by the demand for low-power, wide-area connectivity to support billions of connected devices across utilities, transportation, manufacturing, and smart city infrastructure. NB-IoT is becoming the backbone for scalable IoT deployments requiring low latency, long battery life, and deep indoor penetration.

- • The trend toward smart infrastructure—such as smart meters, smart streetlights, environmental sensors, and asset tracking devices—is accelerating, driven by urbanization, digital transformation initiatives, and cost-effective LPWAN technologies. Telecom operators and governments are increasingly deploying NB-IoT networks to support national digital roadmaps and public safety frameworks.

- For instance, in January 2025, the Narrowband Internet of Things (IoT) industry saw rapid innovation in edge-based AI integration, enhancing localized decision-making. With rising complexity in AI models, hybrid AI systems now balance computational loads between the cloud and edge, improving responsiveness in smart devices like wearables, detectors, and industrial sensors.

- Governments, telecom providers, and tech firms are jointly investing in NB-IoT rollouts to support sustainable urban living, efficient energy use, and real-time monitoring systems. As a result, NB-IoT is evolving from a niche LPWAN protocol into a cornerstone of mass-scale IoT infrastructure across both developed and emerging economies

Narrowband Internet of Things (IoT) Market Dynamics

Driver

“Smart cities and utility automation drive NB-IoT surge”

- The rapid development of smart cities and the increasing need for efficient utility management are primary drivers of the Narrowband Internet of Things (IoT) market. Governments and private sectors are heavily investing in NB-IoT-enabled infrastructure to support smart metering, street lighting, waste management, and public safety systems.

- Narrowband IoT is preferred due to its low power consumption, wide coverage, and cost-effectiveness, making it ideal for large-scale, long-term deployments across urban and rural landscapes. Utility companies are leveraging NB-IoT to collect real-time consumption data, reduce operational costs, and enhance service reliability.

- Additionally, environmental regulations and sustainability goals are accelerating the shift toward connected solutions that minimize energy waste and optimize resource usage.

- For instance, On April 2025, Nulaxy launched its Air in-Flight Bluetooth Narrowband IoT Transmitter at a 40% discount, offering wireless streaming from wired sources to Bluetooth earbuds. With Bluetooth 5.3 support and 20 hours of battery life, this product exemplifies the integration of NB-IoT technology into compact consumer electronics.

- As urbanization continues to rise globally, the demand for seamless, low-power connectivity will further propel the adoption of NB-IoT across smart infrastructure and utility sectors.

Opportunity

“Emerging markets fuel growth potential”

- Emerging economies offer significant opportunities for Narrowband Internet of Things (IoT) adoption as regions like Asia-Pacific, Africa, and Latin America accelerate their digital transformation and smart infrastructure initiatives.

- Governments are rolling out supportive policies and low-power wide-area networks (LPWANs) to boost IoT penetration in rural and semi-urban areas, particularly for applications like smart metering, agriculture, waste management, and urban mobility.

- Local enterprises and startups are also entering the space with low-cost, adaptable NB-IoT solutions tailored to the unique demands of these markets, creating avenues for public-private partnerships and rapid deployment.

- For instance, On April 2025, Sennheiser introduced the Accentum Wireless SE special edition in India at a reduced price of ₹10,990, bundled with the BTD600 dongle. While primarily a consumer tech release, it signals the broader integration of wireless and IoT capabilities in emerging markets where demand for smart, connected devices is accelerating.

- With rising digital literacy, mobile connectivity, and urban expansion, NB-IoT providers have a strong window of opportunity to scale innovations across critical sectors like agriculture, utilities, and public safety in high-growth economies.

Restraint/Challenge

“High costs hinder wide adoption”

- Despite the growing benefits of NB-IoT solutions, high initial deployment costs and infrastructure requirements remain a major hurdle, especially for small and medium enterprises (SMEs) in developing nations.

- NB-IoT often demands specialized hardware, software integrations, and network upgrades, which can be financially challenging for low-resource settings. Additionally, the lack of trained personnel and technical know-how further restricts adoption in rural and underdeveloped areas.

- Moreover, ongoing maintenance, network coverage issues, and scalability limitations in remote zones slow down large-scale implementations.

- For instance, In July 2021, a report revealed that global data-localization measures had more than doubled, with 62 countries enforcing 144 restrictions. These data flow barriers—especially in nations like China, Indonesia, Russia, and South Africa—complicate IoT deployment and raise costs, as firms must adapt to multiple storage and compliance standards.

- To overcome these restraints, solution providers must invest in simplified plug-and-play modules, offer flexible financing models, and partner with governments for digital infrastructure rollouts to enable broader and equitable adoption of Narrowband IoT systems

Narrowband Internet of Things (IoT) Market Scope

The market is segmented on the basis component, deployment type, device, application software, technology services, smart applications and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Type |

|

|

By Device |

|

|

By Application Software |

|

|

By Technology Services |

|

|

By Smart Application |

|

|

By End User |

|

In 2025, the Smart Meters is projected to dominate the market with a largest share in by device segment

In 2025, the Smart Meters segment is projected to dominate the Narrowband Internet of Things (IoT) market under the By Device category, holding the largest market share of 34.87%. This growth is driven by widespread deployment of smart grid infrastructure across utilities for electricity, gas, and water monitoring. The ability of smart meters to support low-power, wide-area connectivity makes NB-IoT an ideal communication backbone for reliable and cost-efficient data transmission. Regulatory push for energy efficiency and remote diagnostics is further accelerating adoption globally

The Smart Metering is expected to account for the largest share during the forecast period in Narrowband Internet of Things (IoT) market

In 2025, the Smart Metering segment under the By Smart Application category is anticipated to account for the second-largest share, capturing 31.42% of the market in 2025. The increasing need for real-time consumption data, predictive maintenance, and demand forecasting has made smart metering a top priority for utility providers and city administrators. The long battery life, deep coverage, and secure communication provided by NB-IoT make it especially suitable for smart metering rollouts in both urban and remote areas.

Narrowband Internet of Things (IoT) Market Regional Analysis

“North America Holds the Largest Share in the Narrowband Internet of Things (IoT) Market”

- North America dominates the Narrowband Internet of Things (IoT) market, driven by the early adoption of IoT technologies, a strong ecosystem of telecom providers, and widespread deployment of NB-IoT in smart infrastructure. The region benefits from robust investments in smart city projects, utilities, healthcare, and industrial automation.

- The U.S. leads the market due to its advanced digital infrastructure and increasing use of NB-IoT for smart metering, asset tracking, connected vehicles, and public safety systems. Strategic partnerships between telecom operators and IoT platform providers further enhance adoption.

- Canada and Mexico are also experiencing growth due to expanding smart utility programs and a focus on improving operational efficiencies across public and private sectors using NB-IoT networks.

- Additionally, the emphasis on sustainability, data-driven decision-making, and long-range IoT connectivity in both urban and rural settings contributes to the region's leading position in the market.

“Asia-Pacific is Projected to Register the Highest CAGR in the Narrowband Internet of Things (IoT) Market”

- The Asia-Pacific region is expected to witness the highest CAGR in the NB-IoT market during the forecast period, fueled by large-scale smart city initiatives, rising industrial digitization, and government-backed connectivity rollouts.

- China is a major growth engine, with aggressive deployment of NB-IoT in smart meters, parking systems, streetlights, and environmental monitoring. Supportive regulations, cost-effective module manufacturing, and strong telecom infrastructure play a key role.

- India, South Korea, and Southeast Asian countries are ramping up investments in smart governance, agriculture IoT, logistics, and infrastructure monitoring, further propelling market growth.

- The region’s rapid urbanization, expanding middle class, and demand for affordable, energy-efficient connectivity solutions make it a hotspot for NB-IoT innovation and expansion.

Narrowband Internet of Things (IoT) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AT&T Intellectual Property (U.S.)

- Orange (France)

- SK TELECOM CO., LTD. (South Korea)

- Arm Limited (United Kingdom)

- Vodafone Limited (United Kingdom)

- China Unicom (Hong Kong) Limited (China)

- Deutsche Telekom AG (Germany)

- Telstra Corporation Limited (Australia)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Nokia (Finland)

- Sierra Wireless (Canada)

- Qualcomm Technologies, Inc. (U.S.)

- u-blox (Switzerland)

- ZTE Corporation (China)

- SEQUANS Communications (France)

- Sercomm Corporation (Taiwan)

- Thales Group (France)

- Telit (U.K./Italy) (Note: Originally founded in Italy, now HQ in London)

- Samsung (South Korea)

- Intel Corporation (U.S.)

Latest Developments in Global Narrowband Internet of Things (IoT) Market

- On March 17, 2025, TRASNA Solutions acquired u-blox’s cellular IoT module business. This strategic move includes intellectual property, technology, and personnel, allowing TRASNA to strengthen its position in the NB-IoT space and accelerate innovation in low-power, wide-area connectivity solutions for industrial and consumer IoT applications.

- In January 2024, Airtel Business partnered with Adani Energy Solutions to power over 20 million smart meters via its nationwide NB-IoT network. The collaboration supports real-time data collection, enhanced utility management, and improved energy efficiency, showcasing a massive scale deployment of NB-IoT in India’s energy sector.

- In July 2024, STMicroelectronics launched its ST87M01 module using Ceva's Dragonfly NB-IoT platform. The integration delivers reliable, low-power cellular connectivity with built-in GNSS, targeting smart meters, asset trackers, and industrial IoT, supporting scalable deployment with extended battery life and accurate location tracking.

- In February 2024, BT rolled out a nationwide NB-IoT network in the UK, enabling smart city innovations. The network supports low-bandwidth devices for infrastructure monitoring, energy management, and water usage. It reflects growing government and private sector interest in smart infrastructure supported by efficient IoT connectivity.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.