Global Nasal Spray Emergency Migraine Drug Market

Market Size in USD Million

CAGR :

%

USD

189.23 Million

USD

307.80 Million

2024

2032

USD

189.23 Million

USD

307.80 Million

2024

2032

| 2025 –2032 | |

| USD 189.23 Million | |

| USD 307.80 Million | |

|

|

|

|

Nasal Spray Emergency Migraine Drug Market Size

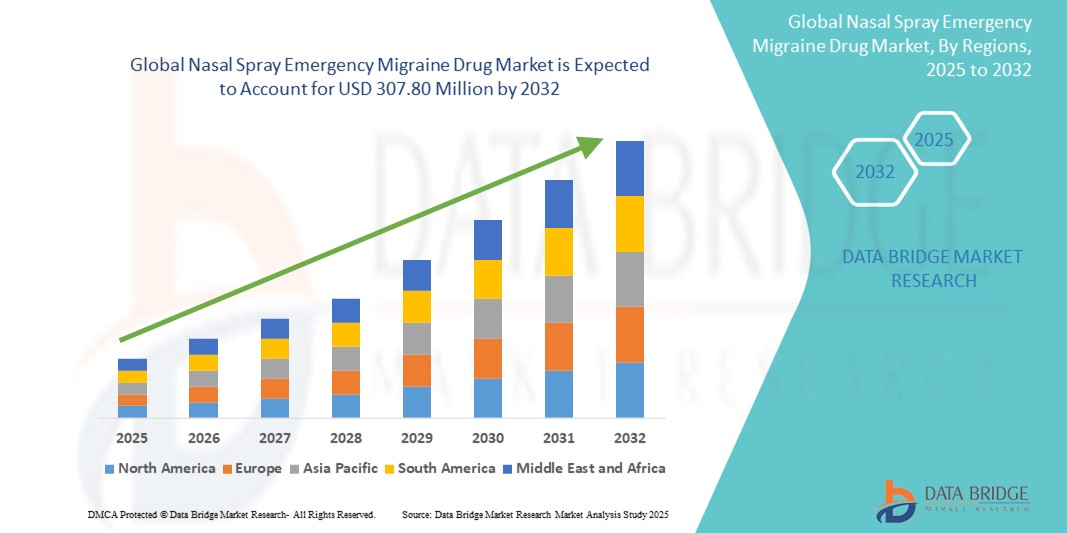

- The global nasal spray emergency migraine drug market size was valued at USD 189.23 million in 2024 and is expected to reach USD 307.80 million by 2032, at a CAGR of 6.27% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within nasal drug delivery systems, particularly in emergency care settings, leading to increased preference for fast-acting, non-invasive migraine treatments. These developments are enhancing the appeal of nasal spray formulations among both healthcare providers and patients

- Furthermore, rising consumer demand for rapid, user-friendly, and self-administered solutions for acute migraine relief is establishing nasal spray emergency migraine drugs as the preferred alternative to oral or injectable medications. These converging factors are accelerating the uptake of Nasal spray emergency migraine drug solutions, thereby significantly boosting the industry's growth

Nasal Spray Emergency Migraine Drug Market Analysis

- Nasal spray emergency migraine drugs, offering rapid and non-invasive delivery of active ingredients, are becoming increasingly vital in acute migraine management due to their fast onset of action, ease of use, and effectiveness even during nausea or vomiting episodes—common migraine symptoms

- The escalating demand for these nasal spray solutions is primarily driven by the rising global prevalence of migraine, growing awareness of effective emergency treatments, and increasing preference for non-oral and self-administered drug formats

- North America dominated the nasal spray emergency migraine drug market with the largest revenue share of 38.7% in 2024, supported by high diagnosis rates, favorable reimbursement frameworks, advanced healthcare infrastructure, and the rapid adoption of innovative drug delivery systems. The U.S., in particular, is witnessing substantial market growth, driven by ongoing product launches and increasing demand for fast-acting treatments among migraine patients

- Asia-Pacific is expected to be the fastest-growing region in the nasal spray emergency migraine Drug market during the forecast period, attributed to a growing patient pool, increasing awareness of migraine management, rising healthcare expenditure, and improving access to neurological care in emerging economies such as India and China

- Adults segment dominated the nasal spray emergency migraine drug market with a market share of 86.7% in 2024, attributed to the higher prevalence of migraine in adults, especially women aged 18–55, and the widespread availability of nasal spray treatments targeted toward adult migraine sufferers

Report Scope and Nasal Spray Emergency Migraine Drug Market Segmentation

|

Attributes |

Nasal Spray Emergency Migraine Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nasal Spray Emergency Migraine Drug Market Trends

“Rising Demand for Rapid, Self-Administered Relief Options”

- A significant and accelerating trend in the global nasal spray emergency migraine drug market is the growing preference for fast-acting, non-invasive therapies that patients can self-administer during acute migraine episodes. This demand is primarily driven by the need for rapid onset of action, especially in situations where nausea or vomiting makes oral medications ineffective

- For instance, novel intranasal migraine drugs such as Tosymra (sumatriptan nasal spray) and Trudhesa (DHE mesylate nasal spray) are gaining traction due to their ability to bypass the gastrointestinal tract and deliver relief within minutes. These products have been designed for convenient use and portability, making them ideal for emergency situations

- Technological innovations in nasal spray delivery systems are also enhancing the precision and absorption of these medications, ensuring more effective and consistent therapeutic outcomes. New devices feature optimized spray patterns, dose accuracy, and user-friendly designs, which contribute to higher patient satisfaction and adherence

- The seamless integration of these treatments into emergency kits and their growing availability through retail and e-pharmacy channels have further accelerated market penetration. Healthcare providers are increasingly recommending nasal sprays for patients who require reliable, on-the-go migraine relief

- This shift toward more intelligent, user-centered drug delivery solutions is fundamentally reshaping patient expectations in migraine care. Consequently, companies such as Impel Pharmaceuticals are focusing on refining intranasal delivery platforms, including precision olfactory delivery technology, to enhance the efficiency and comfort of acute migraine treatment

- The demand for nasal spray emergency migraine drugs is growing rapidly across both developed and emerging markets, as consumers and clinicians alike prioritize efficacy, speed, and ease of administration in managing severe migraine episodes

Nasal Spray Emergency Migraine Drug Market Dynamics

Driver

“Growing Need Due to Increasing Migraine Prevalence and Demand for Rapid Relief”

- The rising global prevalence of migraine and the growing need for fast-acting relief options are major drivers fueling the demand for nasal spray emergency migraine drugs. With millions affected by sudden and debilitating migraine attacks, the ability to administer treatment quickly and effectively—especially when nausea impairs oral drug absorption—has become a clinical and consumer priority

- For instance, in February 2023, Impel Pharmaceuticals announced the commercial availability of Trudhesa (Dihydroergotamine mesylate), a precision olfactory delivery (POD)-enabled nasal spray that delivers rapid relief for acute migraine episodes. The innovation showcases how companies are prioritizing non-oral therapies to meet patient needs in emergency settings

- Nasal spray delivery allows for direct absorption through the nasal mucosa, enabling faster onset of action compared to traditional oral medications. This is especially critical during migraine attacks accompanied by vomiting or gastrointestinal issues

- Furthermore, increased awareness about migraines as a serious neurological condition—not merely a headache—has led to broader diagnosis rates and growing prescriptions of advanced acute therapies, thereby supporting market growth

- The convenience of portable, self-administered nasal sprays, combined with improved insurance coverage and direct-to-consumer marketing strategies, is driving adoption across both developed and emerging markets. Pharmaceutical firms are also focusing on making these products available through retail pharmacies and telemedicine channels to enhance accessibility

Restraint/Challenge

“Limited Awareness, High Costs, and Regulatory Constraints”

- Despite their benefits, nasal spray emergency migraine drugs face challenges related to limited public awareness, higher costs, and regulatory barriers in certain regions. Many patients are still unfamiliar with nasal therapies or default to over-the-counter analgesics, delaying adoption

- The relatively high price of innovative nasal migraine drugs such as Tosymra or Trudhesa can also hinder uptake, particularly in low- and middle-income countries where insurance coverage is limited

- Moreover, regulatory hurdles, such as strict approval processes and reimbursement complexities, can delay product launches and restrict access in some markets

- Addressing these challenges will require a multi-pronged approach involving physician education, patient awareness campaigns, pricing strategies, and the development of cost-effective generic alternatives. Companies that invest in broader patient support programs and regional regulatory navigation will be better positioned for long-term success

Nasal Spray Emergency Migraine Drug Market Scope

The market is segmented on the basis of type, drug delivery, age group, dosage strength, and distribution channel.

- By Type

On the basis of type, the nasal spray emergency migraine drug market is segmented into triptans, ditans, gepants, nsaids, and others. The triptans segment dominated the largest market revenue share of 44.8% in 2024, driven by their established clinical efficacy and wide availability in nasal spray form (e.g., sumatriptan, zolmitriptan).

The gepants segment is projected to witness the fastest growth rate of 21.5% CAGR from 2025 to 2032, due to the introduction of CGRP-targeting therapies offering better tolerability and efficacy for refractory migraine cases.

- By Drug Delivery

On the basis of drug delivery, the market is segmented into single-dose and multi-dose. The single-dose segment held the largest revenue share of 62.3% in 2024, preferred for acute, one-time migraine relief with minimized contamination risk.

The multi-dose segment is expected to grow at the fastest CAGR of 20.1% over the forecast period, supported by rising patient demand for cost-effective, repeat-use treatment options.

- By Age Group

On the basis of age group, the market is segmented into adults and pediatric. The adults segment accounted for the largest market share of 86.7% in 2024, attributed to the higher prevalence of migraine in adults, especially women aged 18–55.

The pediatric segment is projected to grow at the fastest CAGR of 18.4% during 2025–2032, driven by increasing awareness and diagnosis of pediatric migraine and development of age-appropriate formulations.

- By Dosage Strength

On the basis of dosage strength, the market is segmented into 5 mg, 10 mg, 20 mg, and Others. The 20 mg dosage segment dominated with a market share of 47.2% in 2024, commonly used in sumatriptan nasal sprays and other high-efficacy emergency treatments.

The 10 mg segment is expected to record the fastest CAGR of 19.9%, owing to its suitability for moderate migraine episodes and emerging product launches in this category.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, and others. Hospital Pharmacies held the largest share of 38.6% in 2024, supported by access to immediate treatments in emergency settings and physician-prescribed therapies.

Online pharmacies are anticipated to grow at the fastest CAGR of 22.8%, driven by the surge in digital healthcare, ease of ordering, and increasing consumer preference for home delivery services.

Nasal Spray Emergency Migraine Drug Market Regional Analysis

- North America dominated the nasal spray emergency migraine drug market with the largest revenue share of 38.7% in 2024, driven by the increasing prevalence of migraine cases, strong presence of key pharmaceutical players, and rapid adoption of nasal spray formulations for fast relief

- Consumers in the region prefer non-invasive and quick-relief treatments, with rising demand for innovative nasal therapies such as zavegepant

- This growth is further supported by high healthcare spending, favorable reimbursement policies, and a robust regulatory framework, making North America a key driver in the global market

U.S. Nasal Spray Emergency Migraine Drug Market Insight

The U.S. nasal spray emergency migraine drug market captured the largest revenue share of 51.50% in 2024 within North America, attributed to increasing awareness of migraine-specific nasal spray drugs, early FDA approvals (e.g., Tosymra, Trudhesa), and widespread availability through pharmacies and e-commerce. The market also benefits from a growing patient population seeking faster, more effective acute treatments. Pharmaceutical innovation and direct-to-consumer marketing have further solidified the U.S. as a major contributor to the segment.

Europe Nasal Spray Emergency Migraine Drug Market Insight

The Europe nasal spray emergency migraine drug market is projected to register a substantial CAGR of 6.9% during the forecast period, driven by the rise in migraine prevalence, a shift toward rapid-acting drug delivery systems, and increasing awareness of nasal administration's efficacy. Countries like Germany, France, and the U.K. are witnessing strong adoption due to improved healthcare infrastructure and accessibility to newer drug options.

U.K. Nasal Spray Emergency Migraine Drug Market Insight

The U.K. nasal spray emergency migraine drug market is expected to grow at a noteworthy CAGR during the forecast period, backed by increased public health awareness campaigns, rising prescription volumes for triptan-based sprays, and a favorable regulatory environment supporting nasal formulation adoption. Additionally, the trend toward self-managed care and over-the-counter accessibility is contributing to market expansion.

Germany Nasal Spray Emergency Migraine Drug Market Insight

The Germany nasal spray emergency migraine drug market is poised to expand significantly due to rising patient preference for fast-acting migraine therapies and increased awareness of nasal drug delivery benefits. Germany’s strong pharmaceutical R&D capabilities and growing use of digital health platforms to manage chronic conditions are reinforcing demand for effective acute treatment options like nasal sprays.

Asia-Pacific Nasal Spray Emergency Migraine Drug Market Insight

The Asia-Pacific nasal spray emergency migraine drug market is poised to grow at the fastest CAGR of 10.9% during the forecast period of 2025 to 2032, driven by increasing migraine diagnosis rates, a rapidly urbanizing population, and expanding access to healthcare services in countries like China, Japan, and India. The rising focus on patient-centric care, along with improved availability of branded and generic nasal migraine therapies, is contributing to strong market momentum.

Japan Nasal Spray Emergency Migraine Drug Market Insight

The Japan nasal spray emergency migraine drug market is witnessing robust growth due to the country’s advanced medical infrastructure, aging population, and strong preference for innovative drug delivery systems. The integration of digital platforms in healthcare and government support for migraine awareness further enhance the country’s market outlook.

China Nasal Spray Emergency Migraine Drug Market Insight

The China nasal spray emergency migraine drug market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by a growing middle class, increased diagnosis of neurological disorders, and expanding retail and hospital pharmacy networks. The local production of cost-effective nasal therapies and government efforts to improve chronic disease management are boosting overall adoption.

Nasal Spray Emergency Migraine Drug Market Share

The nasal spray emergency migraine drug industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Lilly (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Amneal Pharmaceuticals, Inc. (U.S.)

- Bausch Health Companies Inc. (Canada)

- Impel Pharmaceuticals Inc. (U.S.)

- GSK plc. (U.K.)

- AstraZeneca plc (U.K.)

- Johnson & Johnson and its affiliates (U.S.)

- Zosano Pharma Corporation (U.S.)

- Dr. Reddy’s Laboratories Ltd. (India)

- Lupin Limited (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Novartis AG (Switzerland)

- Catalent, Inc. (U.S.)

- Recipharm AB (Sweden)

- Amgen Inc. (U.S.)

- AptarGroup, Inc. (U.S.)

- Bayer AG (Germany)

- MedPharm Ltd. (U.K.)

Latest Developments in Global Nasal Spray Emergency Migraine Drug Market

- In March 2023, Pfizer Inc. announced the FDA approval of ZAVZPRET (zavegepant) nasal spray for the acute treatment of migraine in adults. ZAVZPRET is the first and only calcitonin gene-related peptide (CGRP) receptor antagonist nasal spray approved in the United States, offering a fast-acting, non-oral alternative for migraine sufferers. This approval significantly strengthens Pfizer’s presence in the CNS and migraine treatment segment

- In September 2022, Impel Pharmaceuticals announced the commercial launch of TRUDHESA, a dihydroergotamine mesylate (DHE) nasal spray, in the U.S. market for the acute treatment of migraine with or without aura in adults. Delivered using Impel’s proprietary Precision Olfactory Delivery (POD) technology, TRUDHESA bypasses the gut, making it suitable for patients experiencing nausea or vomiting during migraine attacks

- In June 2023, Bausch Health Companies Inc. and Kitasato Pharmaceutical Industry announced a strategic collaboration to co-develop a next-generation intranasal migraine treatment targeting Asian markets. The focus is on rapid absorption technology to cater to regions with rising migraine prevalence and demand for fast relief

- In August 2023, Aptar Pharma launched an upgraded unit-dose nasal spray system designed specifically for central nervous system (CNS) therapies, including emergency migraine treatment. The device ensures consistent dosing and ease of use, enhancing drug bioavailability through intranasal administration

- In November 2023, Dr. Reddy’s Laboratories Ltd. received final FDA approval for its generic Sumatriptan Nasal Spray, a bioequivalent version of GlaxoSmithKline’s Imitrex. This move expands affordable migraine treatment options and strengthens Dr. Reddy’s footprint in the U.S. generics market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.