Global Natural Colorants Market

Market Size in USD Billion

CAGR :

%

USD

2.50 Billion

USD

3.32 Billion

2025

2033

USD

2.50 Billion

USD

3.32 Billion

2025

2033

| 2026 –2033 | |

| USD 2.50 Billion | |

| USD 3.32 Billion | |

|

|

|

|

Natural Colorants Market Size

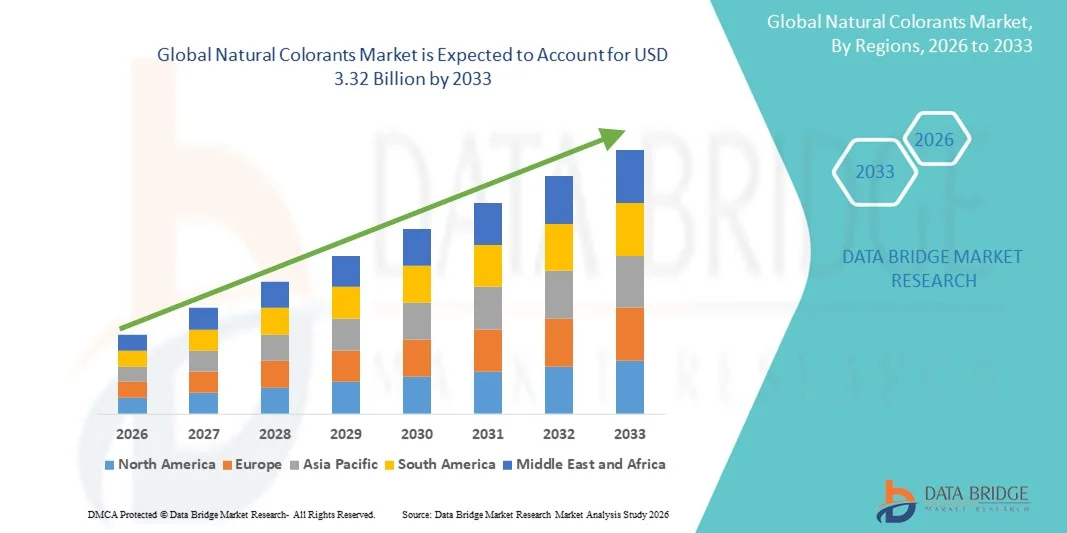

- The global natural colorants market size was valued at USD 2.50 billion in 2025 and is expected to reach USD 3.32 billion by 2033, at a CAGR of 3.60% during the forecast period

- The market growth is largely fuelled by increasing consumer preference for clean-label and naturally sourced ingredients, along with growing demand from the food, beverage, and cosmetic industries

- Rising health awareness and regulatory support for natural additives are further contributing to market expansion

Natural Colorants Market Analysis

- The market is witnessing innovation in extraction technologies and formulation methods, enhancing stability and color intensity of natural colorants

- Increasing emphasis on sustainability and eco-friendly sourcing practices by manufacturers is positively impacting market growth

- North America dominated the natural colorants market with the largest revenue share in 2025, driven by strong consumer preference for clean-label foods, strict regulations on synthetic additives, and rising demand for natural ingredients across food, beverage, and cosmetic industries

- Asia-Pacific region is expected to witness the highest growth rate in the global natural colorants market, driven by increasing urbanization, changing dietary habits, growth in processed food consumption, expanding food manufacturing capacity, and supportive government initiatives promoting natural ingredients

- The annatto-based colorings segment held the largest market revenue share in 2025, driven by its wide acceptance in food processing and its ability to provide stable yellow to orange hues. Annatto colorants are extensively used due to their natural origin, regulatory approval across major markets, and compatibility with a wide range of food products

Report Scope and Natural Colorants Market Segmentation

|

Attributes |

Natural Colorants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Natural Colorants Market Trends

Rising Adoption of Clean-Label and Plant-Based Colorants

- The growing preference for natural and clean-label colorants is transforming the food, beverage, and cosmetic industries by significantly reducing reliance on synthetic dyes and artificial additives. These colorants help manufacturers respond to increasing consumer concerns around food safety, health risks, and ingredient transparency. As a result, brands are able to enhance product appeal, strengthen trust, and improve overall market positioning

- Increasing demand for natural colorants in processed foods, beverages, confectionery, and personal care products is accelerating overall market adoption. These applications are particularly prominent in regions with strict food safety regulations and labeling norms. Rising consumer awareness about wellness, nutrition, and sustainability is further driving consistent and long-term demand growth

- The versatility and improved stability of modern natural colorants make them suitable for diverse processing conditions such as heat, pH variation, and light exposure. Advancements in formulation technologies allow these colorants to be easily incorporated into multiple product matrices. This supports product innovation, ensures uniform color quality, and helps extend shelf life across applications

- For instance, in 2023, several beverage manufacturers in Europe reported improved consumer acceptance and higher repeat purchase rates after replacing synthetic dyes with natural colorants. These changes enhanced brand perception and aligned products with clean-label trends. The shift also improved competitiveness in premium and health-focused beverage segments

- While natural colorant adoption is increasing steadily, long-term market impact depends on sustainable sourcing, cost efficiency, and regulatory compliance. Manufacturers must invest in reliable raw material supply chains and advanced extraction technologies. Focus on scalable production methods will be critical to meeting growing global demand effectively

Natural Colorants Market Dynamics

Driver

Growing Consumer Preference for Natural and Sustainable Ingredients

- Rising awareness among consumers regarding the potential health risks associated with synthetic dyes is a major driver for natural colorants. Shoppers are increasingly scrutinizing ingredient labels and favoring products made with plant-based and non-toxic components. This shift is compelling manufacturers to reformulate products to align with clean-label and sustainability trends

- Expansion of the processed food, beverage, and cosmetic industries is further fueling the adoption of natural colorants. Products such as confectionery, dairy items, beverages, personal care products, and baked goods rely heavily on visual appeal. Natural pigments enhance aesthetics while supporting functional and nutritional positioning of these products

- Government regulations and industry standards promoting the use of natural and safe ingredients are strengthening market growth. Policies restricting synthetic additives and encouraging transparent labeling are accelerating the shift toward natural colorants. Certification programs and eco-friendly initiatives are reinforcing consumer trust and manufacturer adoption

- For instance, in 2022, several food manufacturers in North America and Europe reformulated their product portfolios using natural colorants. These initiatives resulted in increased consumer engagement, improved brand loyalty, and stronger market penetration across multiple product categories

- While consumer demand and regulatory backing are strong growth drivers, challenges persist in maintaining consistent color intensity and quality. Scaling production while controlling costs remains a key concern for manufacturers. Continuous innovation is required to balance performance, affordability, and sustainability

Restraint/Challenge

High Production Cost and Limited Availability of Natural Sources

- The premium cost of high-quality natural colorants, especially those derived from rare or exotic plant sources, restricts adoption among small and mid-sized manufacturers. Price-sensitive product segments often struggle to absorb higher ingredient costs. As a result, some markets continue to rely on lower-cost synthetic alternatives

- Limited availability and seasonal dependence of natural raw materials can disrupt supply chains and production planning. Fluctuations in crop yields and climate conditions affect consistency in supply and pricing. These sourcing challenges are particularly significant in developing regions with limited agricultural infrastructure

- Technical complexities in extraction, stabilization, and formulation of natural colorants further restrict their widespread use. Maintaining color strength, uniformity, and shelf stability requires advanced processing expertise. Improper formulation can lead to fading, uneven appearance, or reduced product acceptance

- For instance, in 2023, several confectionery and beverage producers in Asia experienced delays in new product launches due to shortages of beetroot and annatto extracts. These disruptions negatively impacted revenue growth, supply commitments, and market expansion plans

- While technological advancements are improving extraction efficiency and color stability, addressing cost and supply chain challenges remains critical. Market players must focus on sustainable cultivation, scalable sourcing models, and cost-effective processing solutions. Overcoming these restraints will be essential to unlocking long-term market potential

Natural Colorants Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the natural colorants market is segmented into annatto-based colorings, beet-red, turmeric-based colorings, carmine and cochineal-based colorings, and others. The annatto-based colorings segment held the largest market revenue share in 2025, driven by its wide acceptance in food processing and its ability to provide stable yellow to orange hues. Annatto colorants are extensively used due to their natural origin, regulatory approval across major markets, and compatibility with a wide range of food products.

The beet-red segment is expected to witness the fastest growth rate from 2026 to 2033, supported by rising demand for clean-label and plant-based ingredients. Beet-red colorants are increasingly preferred for their vibrant red shades and suitability in beverages, confectionery, and dairy products, making them a popular choice among health-focused manufacturers.

- By Application

On the basis of application, the natural colorants market is segmented into bakery, dairy, meat and meat products, cosmetics, and others. The bakery segment accounted for the largest revenue share in 2025, driven by growing demand for naturally colored breads, cakes, and confectionery items. Manufacturers are increasingly replacing synthetic dyes with natural alternatives to meet clean-label requirements and enhance product appeal.

The cosmetics segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising consumer preference for natural and chemical-free personal care products. Natural colorants are gaining traction in cosmetics due to their perceived safety, skin-friendly properties, and alignment with sustainability and ethical beauty trends.

Natural Colorants Market Regional Analysis

- North America dominated the natural colorants market with the largest revenue share in 2025, driven by strong consumer preference for clean-label foods, strict regulations on synthetic additives, and rising demand for natural ingredients across food, beverage, and cosmetic industries

- Consumers in the region highly value transparency, health benefits, and sustainability, encouraging manufacturers to replace artificial dyes with plant-based and naturally derived colorants

- This widespread adoption is further supported by high disposable incomes, advanced food processing infrastructure, and strong presence of key natural ingredient manufacturers, positioning natural colorants as a preferred choice across multiple end-use sectors

U.S. Natural Colorants Market Insight

The U.S. natural colorants market captured the largest revenue share in 2025 within North America, fueled by increasing consumer awareness regarding food safety and clean-label products. Food and beverage manufacturers are actively reformulating products to eliminate synthetic dyes and comply with regulatory standards. Growing demand from bakery, dairy, beverages, and personal care segments, along with innovation in extraction and stabilization technologies, continues to support market expansion in the country.

Europe Natural Colorants Market Insight

The Europe natural colorants market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent food safety regulations and strong consumer inclination toward organic and natural products. The region’s well-established food and cosmetic industries are increasingly adopting natural pigments to meet regulatory compliance and sustainability goals. Continuous innovation and demand across bakery, dairy, and cosmetic applications are accelerating market growth.

U.K. Natural Colorants Market Insight

The U.K. natural colorants market is expected to witness the fastest growth rate from 2026 to 2033, supported by rising health awareness and regulatory pressure to reduce artificial additives in food products. Manufacturers are focusing on natural alternatives to meet clean-label trends, particularly in beverages, confectionery, and bakery products. The country’s strong retail and private-label presence further supports adoption.

Germany Natural Colorants Market Insight

The Germany natural colorants market is expected to witness the fastest growth rate from 2026 to 2033, driven by strong demand for sustainable and organic food products. Germany’s emphasis on environmental responsibility and high-quality standards is encouraging manufacturers to adopt natural pigments across food, beverage, and cosmetic applications. Advanced processing technologies and strong R&D capabilities further strengthen market growth.

Asia-Pacific Natural Colorants Market Insight

The Asia-Pacific natural colorants market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, changing dietary habits, and growing awareness of natural ingredients. Rising demand from food processing, beverages, and cosmetics, supported by increasing disposable incomes and expanding manufacturing capacity, is accelerating market adoption across the region.

Japan Natural Colorants Market Insight

The Japan natural colorants market is expected to witness the fastest growth rate from 2026 to 2033 due to strong consumer focus on food quality, safety, and natural ingredients. The adoption of natural colorants is increasing across traditional foods, beverages, and cosmetics. Innovation in fermentation-based and plant-derived pigments further supports market growth.

China Natural Colorants Market Insight

The China natural colorants market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid growth in the food and beverage sector and increasing regulatory scrutiny of synthetic additives. Expanding middle-class population, rising health consciousness, and strong domestic manufacturing capabilities are driving widespread adoption of natural colorants across food, beverage, and personal care industries.

Natural Colorants Market Share

The Natural Colorants industry is primarily led by well-established companies, including:

• ADM (U.S.)

• Chr. Hansen Holding A/S (Denmark)

• Naturex (France)

• Sensient Technologies Corporation (U.S.)

• Dow (U.S.)

• FMC Corporation (U.S.)

• DDW The Color House (U.S.)

• Allied Biotech Corporation (Taiwan)

• Kalsec Inc (U.S.)

• Döhler (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.