Global Natural Fiber Reinforced Plastics Nfrp Market

Market Size in USD Billion

CAGR :

%

USD

9.44 Billion

USD

23.37 Billion

2024

2032

USD

9.44 Billion

USD

23.37 Billion

2024

2032

| 2025 –2032 | |

| USD 9.44 Billion | |

| USD 23.37 Billion | |

|

|

|

|

Global Natural Fiber-reinforced Plastics (NFRP) Market Size

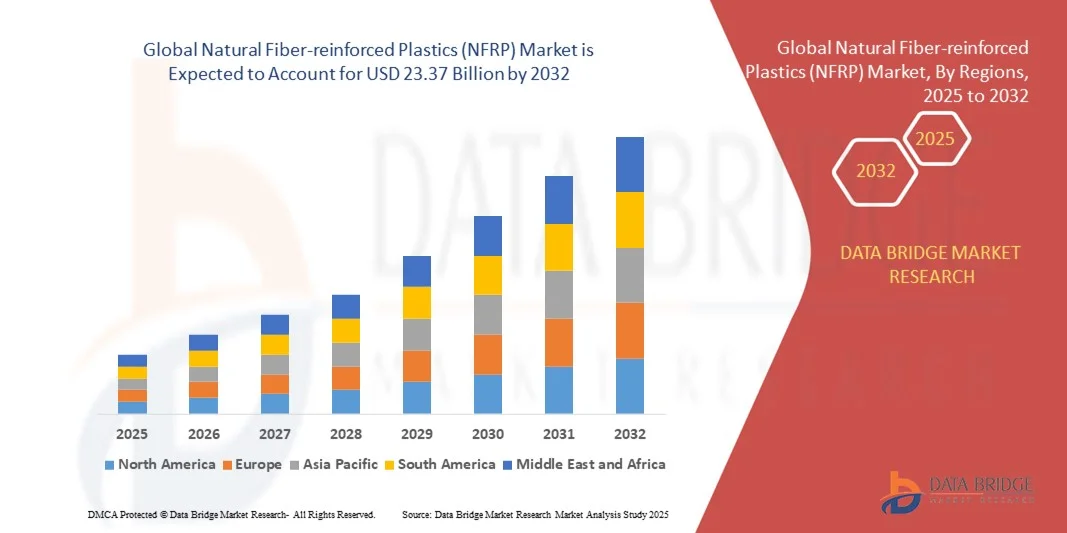

- The global Natural Fiber-reinforced Plastics (NFRP) Market size was valued at USD 9.44 billion in 2024 and is expected to reach USD 23.37 billion by 2032, growing at a CAGR of 12.00% during the forecast period

- Market expansion is driven by increasing demand for sustainable and lightweight materials across automotive, construction, and consumer goods industries, where eco-friendly alternatives to synthetic composites are gaining traction

- Additionally, advancements in bio-based resins and processing technologies are enhancing the performance of NFRPs, making them viable for high-performance applications and further propelling market growth

Global Natural Fiber-reinforced Plastics (NFRP) Market Analysis

- Natural Fiber-reinforced Plastics (NFRPs), which combine natural fibers like flax, hemp, jute, and kenaf with polymer matrices, are increasingly vital in modern manufacturing across automotive, construction, and consumer goods sectors due to their biodegradability, lightweight nature, and reduced environmental impact compared to synthetic composites

- The surging demand for NFRPs is primarily fueled by stricter environmental regulations, rising awareness of sustainable materials, and the growing shift of industries toward eco-friendly and cost-effective alternatives

- North America dominated the global NFRP market with the largest revenue share of 39.5% in 2024, driven by strong environmental policies, government incentives promoting green materials, and a mature automotive sector actively incorporating NFRPs into vehicle interiors and components

- Asia-Pacific is expected to be the fastest growing region in the NFRP market during the forecast period due to rapid industrialization, expanding construction activities, and increasing investments in sustainable manufacturing technologies

- The cellulose fibers segment dominated the market with the largest market revenue share of 48.5% in 2024, owing to its abundance, low cost, biodegradability, and high strength-to-weight ratio

Report Scope and Global Natural Fiber-reinforced Plastics (NFRP) Market Segmentation

|

Attributes |

Natural Fiber-reinforced Plastics (NFRP) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Natural Fiber-reinforced Plastics (NFRP) Market Trends

Enhanced Performance Through Hybrid Composites and Advanced Processing

- A significant and accelerating trend in the global Natural Fiber-reinforced Plastics (NFRP) Market is the evolution of hybrid composites and the adoption of advanced processing technologies such as compression molding, resin transfer molding (RTM), and 3D printing. These innovations are enhancing mechanical performance, enabling broader industrial adoption, and making NFRPs competitive with traditional synthetic composites.

- For Instance, manufacturers are increasingly combining natural fibers like flax or hemp with carbon or glass fibers to create hybrid composites that offer improved strength-to-weight ratios while retaining sustainability advantages. These materials are finding growing use in automotive applications such as door panels, dashboards, and trunk liners.

- Advancements in processing also play a critical role. Thermoforming and RTM are being optimized to better handle the variability of natural fibers, improving consistency and reducing defects. Additionally, companies like Bcomp are using proprietary technologies like ampliTex™ to engineer high-performance natural fiber fabrics that meet the strict specifications of motorsport and aerospace sectors.

- These technological breakthroughs are enabling precise tailoring of NFRP properties—such as stiffness, impact resistance, and thermal stability—according to specific application needs. As a result, industries are no longer limited to non-structural parts and are increasingly adopting NFRPs in load-bearing and functional components.

- The integration of data-driven simulation tools and automated manufacturing processes is also contributing to cost reductions and quality improvements, further accelerating the adoption of NFRPs across construction, packaging, and consumer electronics.

- This shift toward high-performance, application-specific NFRPs is reshaping industry expectations for bio-based materials. Consequently, companies such as TECNARO and UPM are investing in R&D to create next-generation composites that are not only sustainable but also engineered for demanding industrial performance.

- The rising demand for lightweight, durable, and environmentally friendly materials is fueling the growth of advanced NFRPs globally, particularly in sectors under regulatory pressure to reduce carbon emissions and material waste.

Global Natural Fiber-reinforced Plastics (NFRP) Market Dynamics

Driver

Growing Demand Driven by Sustainability Goals and Industrial Lightweighting

- The escalating global focus on sustainability and carbon footprint reduction, coupled with the need for lightweight materials across multiple industries, is a major driver for the increasing adoption of Natural Fiber-reinforced Plastics (NFRPs).

- For Instance, leading automotive manufacturers such as BMW and Mercedes-Benz have incorporated NFRPs into vehicle interiors and structural components to meet regulatory targets for emissions and improve fuel efficiency through weight reduction.

- NFRPs offer numerous advantages including biodegradability, lower density, and reduced energy consumption during manufacturing, making them a preferred alternative to synthetic composites in automotive, construction, and consumer goods sectors.

- Furthermore, governments across Europe and Asia are introducing regulations and incentive schemes favoring the use of bio-based materials. These policies, along with corporate ESG commitments, are accelerating R&D and adoption of NFRPs globally.

- The growing awareness among consumers and manufacturers about the environmental impacts of plastic waste is also contributing to the increased use of NFRPs in packaging and electronics. Brands seeking eco-friendly alternatives to conventional polymers are turning to NFRPs for both performance and branding advantages.

- Additionally, the increasing use of natural fibers such as flax, hemp, jute, and kenaf in composite manufacturing is providing rural economies with new opportunities, thus aligning sustainability goals with socio-economic development.

Restraint/Challenge

Material Inconsistency and Limited Heat Resistance

- Despite their many advantages, NFRPs face key challenges that can restrict broader adoption, particularly in high-performance or high-temperature applications. One significant limitation is the inherent inconsistency of natural fiber properties, which can vary depending on source, harvesting methods, and processing techniques.

- For instance, compared to glass or carbon fibers, natural fibers often show greater variability in tensile strength and moisture absorption, which can impact final product performance and manufacturing reliability. This variability can deter manufacturers who require precise and repeatable material behavior.

- Another major constraint is the limited heat resistance of natural fibers, which restricts their application in environments requiring high thermal stability. While research is ongoing to improve these properties through hybridization and surface treatments, NFRPs are currently not ideal for certain structural or under-the-hood automotive components.

- Furthermore, the lack of established global standards for testing and certifying NFRP materials creates hesitation among industries with stringent regulatory requirements. This results in longer development times and limits commercial scalability.

- Addressing these challenges through improved material processing, fiber treatment innovations, and the development of international quality standards will be critical to unlocking the full potential of NFRPs in advanced industrial applications.

Global Natural Fiber-reinforced Plastics (NFRP) Market Scope

The market is segmented on the basis of fiber, matrix, application, processing method, and end use.

- By Fiber

On the basis of fiber, the natural fiber-reinforced polymer composites market is segmented into cellulose fibers, lignin fibers, starch fibers, protein fibers, and others. The cellulose fibers segment dominated the market with the largest market revenue share of 48.5% in 2024, owing to its abundance, low cost, biodegradability, and high strength-to-weight ratio. These fibers are widely used in automotive, construction, and packaging applications, where sustainability and weight reduction are key priorities. Their compatibility with a variety of polymer matrices and ease of processing also contribute to their widespread adoption.

The lignin fibers segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by increasing R&D in lignin valorization and its potential to replace synthetic fibers. Lignin’s aromatic structure provides enhanced thermal stability and rigidity, making it attractive for high-performance applications, especially as demand rises for fully bio-based composite materials.

- By Matrix

Based on the matrix type, the market is segmented into thermoplastic polymers, thermosetting polymers, biodegradable polymers, and others. The thermoplastic polymers segment held the largest market revenue share of 41.6% in 2024, attributed to their recyclability, high toughness, and ability to be remolded. Thermoplastics like polypropylene and polyethylene are commonly used in automotive and consumer goods due to their lightweight, impact resistance, and ease of processing. Their compatibility with various fibers further drives demand.

The biodegradable polymers segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by stringent environmental regulations, consumer demand for sustainable packaging, and innovations in PLA, PHA, and other bio-based resins. These materials offer end-of-life compostability, making them ideal for eco-conscious applications in packaging and disposable products, especially in Europe and North America.

- By Application

On the basis of application, the market is segmented into automotive, construction, packaging, consumer products, aerospace & defense, and others. The automotive segment dominated the market with the largest revenue share of 34.3% in 2024, driven by the industry's emphasis on lightweight materials to enhance fuel efficiency and meet emission standards. Natural fiber composites are increasingly used in car interiors, door panels, and dashboards for their low density and sound insulation properties.

The packaging segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the global push for sustainable alternatives to plastic. Natural fiber-reinforced biopolymers offer biodegradable and compostable solutions, aligning with regulations against single-use plastics. The food and beverage sector is a key adopter, especially in trays, containers, and films.

- By Processing Method

Based on processing method, the market is segmented into injection molding, extrusion, compression molding, pultrusion, and others. The injection molding segment accounted for the largest market revenue share of 36.8% in 2024, due to its widespread use in mass production, particularly in automotive and consumer goods. This method allows for high-volume manufacturing of complex parts with excellent dimensional accuracy and surface finish.

The compression molding segment is expected to register the fastest CAGR from 2025 to 2032, driven by its suitability for high-strength applications and ability to process fiber mats effectively. This method is especially valuable in structural applications like automotive underbody parts and construction panels, where high fiber loading and strength are required.

- By End-Use

On the basis of end-use, the market is segmented into automotive, construction, packaging, consumer products, aerospace & defense, and others. The automotive sector dominated the market with the largest revenue share of 35.7% in 2024, reflecting strong adoption of sustainable and lightweight composite materials for both structural and interior components. OEMs are increasingly integrating natural fiber composites to meet regulatory and consumer demands for eco-friendly vehicles.

The consumer products segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by increased usage of sustainable materials in electronics, household goods, and furniture. Growing consumer awareness and corporate sustainability commitments are pushing manufacturers to replace conventional plastics with bio-based composites, especially in premium and eco-labeled product lines.

Global Natural Fiber-reinforced Plastics (NFRP) Market Regional Analysis

- North America dominated the Global Natural Fiber-reinforced Plastics (NFRP) Market with the largest revenue share of 39.5% in 2024, driven by stringent environmental regulations, widespread sustainability initiatives, and strong demand from the automotive and construction sectors

- Consumers and manufacturers in the region prioritize eco-friendly materials, and NFRPs offer an ideal solution due to their biodegradability, lightweight properties, and lower carbon footprint compared to traditional synthetic composites

- The region’s market leadership is further supported by robust R&D investments, government incentives for green materials, and the presence of leading automotive OEMs and construction companies integrating NFRPs into their products, making Europe a key hub for bio-composite innovation and adoption

U.S. NFRP Market Insight

The U.S. Natural Fiber-reinforced Plastics (NFRP) market captured the largest revenue share of 73% in North America in 2024, driven by strong demand from the automotive and construction sectors seeking sustainable and lightweight material solutions. Government initiatives promoting green materials and emissions reduction, alongside consumer preference for eco-friendly products, are contributing to the market's expansion. U.S.-based automotive OEMs are incorporating NFRPs into vehicle interiors and semi-structural components to meet fuel efficiency standards. Additionally, the rise of green building certifications like LEED is fostering increased adoption of NFRPs in insulation and interior applications.

Europe NFRP Market Insight

The Europe NFRP market is projected to grow at a steady CAGR throughout the forecast period, supported by stringent EU environmental regulations and widespread industry adoption of bio-composites. The region’s advanced recycling infrastructure and circular economy goals are boosting demand for biodegradable and recyclable materials. Automotive giants in Germany, France, and Italy continue to invest in natural fiber composites for weight reduction and lifecycle sustainability. Moreover, Europe’s active promotion of rural bioeconomy initiatives is creating a robust supply chain for flax, hemp, and kenaf fibers, further supporting the growth of the NFRP industry.

U.K. NFRP Market Insight

The U.K. NFRP market is expected to expand at a notable CAGR during the forecast period, driven by increasing regulatory pressure to reduce carbon emissions and construction waste. With rising focus on sustainable architecture and eco-certified buildings, NFRPs are gaining traction in cladding, insulation, and non-structural panels. British automakers and Tier 1 suppliers are also integrating NFRPs to meet both EU-aligned sustainability benchmarks and growing consumer demand for environmentally conscious vehicles. The UK’s growing innovation in materials science and its supportive policy environment are likely to bolster the adoption of NFRPs in high-value applications.

Germany NFRP Market Insight

The Germany NFRP market is anticipated to grow at a considerable CAGR, fueled by its leadership in automotive engineering and industrial innovation. German manufacturers are actively deploying NFRPs to reduce vehicle weight, improve fuel economy, and meet stringent EU CO₂ targets. The country’s push for sustainable construction practices and emphasis on energy-efficient building materials is further promoting the use of NFRPs in prefabricated panels and structural insulation. Moreover, Germany’s advanced R&D ecosystem, supported by collaborations between industry and academia, continues to develop high-performance bio-composites tailored for demanding applications.

Asia-Pacific NFRP Market Insight

The Asia-Pacific NFRP market is poised to grow at the fastest CAGR of 25.2% during the forecast period (2025–2032), driven by rapid industrialization, urbanization, and increasing awareness of sustainable materials. Countries like China, India, and Japan are witnessing rising demand for bio-based composites across automotive, electronics, and packaging sectors. Government initiatives promoting green construction and emission control are further accelerating adoption. As APAC emerges as a global manufacturing hub, low-cost production of natural fibers and composite materials is making NFRPs increasingly accessible. Local manufacturers are investing in fiber processing technologies to meet global quality standards.

Japan NFRP Market Insight

The Japan NFRP market is gaining momentum, supported by the country’s strong focus on sustainable innovation and energy-efficient materials. With a mature automotive industry and growing smart construction sector, the demand for lightweight and environmentally friendly materials is rising steadily. Japanese companies are incorporating NFRPs into consumer electronics casings, car interiors, and modular housing components. The country’s focus on precision engineering and high material performance aligns well with ongoing R&D into hybrid natural fiber composites. Furthermore, Japan’s aging infrastructure is opening new opportunities for retrofitting and green renovation projects using NFRPs.

China NFRP Market Insight

The China NFRP market accounted for the largest revenue share in Asia Pacific in 2024, driven by the nation’s aggressive push toward green manufacturing, sustainable construction, and electric vehicle production. The growing middle class and supportive government policies are fueling demand for eco-friendly alternatives to plastics and synthetic composites. China is investing heavily in hemp and kenaf cultivation for industrial applications, and domestic manufacturers are rapidly scaling up composite production. The integration of NFRPs into lightweight automotive components and green building materials is positioning China as a major global player in the NFRP value chain.

Global Natural Fiber-reinforced Plastics (NFRP) Market Share

The Natural Fiber-reinforced Plastics (NFRP industry is primarily led by well-established companies, including:

- Flexform SpA (Italy)

- Procotex (Belgium)

- TECNARO GmbH (Germany)

- UPM (Finland)

- Trex Company, Inc. (U.S.)

- Bcomp (Switzerland)

- Polyvlies Franz Beyer GmbH (Germany)

- Green Dot Bioplastic (U.S.)

- ADM (U.S.)

- DSM (Netherlands)

- BASF SE (Germany)

- Dow and DuPont (U.S.)

- Adisseo (France)

- Chr. Hansen Holding A/S (Denmark)

- Ajinomoto Co., Inc. (Japan)

- Prinova Group LLC (U.S.)

- Tianjin Prinova Group LLC (China)

- Jianfeng Natural Products R&D Co., Ltd (China)

- Cargill, Incorporated (U.S.)

- Barentz (Netherlands)

- Camlin Fine Sciences Ltd (India)

- Eastman Chemical Company (U.S.)

-

What are the Recent Developments in Global Natural Fiber-reinforced Plastics (NFRP) Market?

- In May 2023, Bcomp Ltd., a Switzerland-based leader in high-performance natural fiber composites, partnered with Porsche Motorsports to expand the use of its ampliTex™ and powerRibs™ technologies in electric racing vehicles. This collaboration aims to reduce weight and environmental impact while maintaining high structural performance, marking a major step in the adoption of sustainable materials in motorsports. The initiative showcases Bcomp’s commitment to innovation and its growing influence within the global NFRP market, especially in high-end automotive applications.

- In April 2023, UPM (Finland), a global biofore company, announced the commercial launch of its new UPM Formi EcoAce biocomposite material, which combines natural fibers with renewable polymers. This next-generation material is designed for use in durable goods and consumer electronics, offering a sustainable alternative to fossil-based plastics. The launch reflects UPM's strategic focus on circular economy principles and positions the company as a key driver in the shift toward bio-based NFRP solutions across various industrial sectors.

- In March 2023, TECNARO GmbH (Germany), a pioneer in thermoplastic biocomposites, announced the expansion of its ARBOLLOY® product line to cater to the construction and furniture industries. The updated formulations offer improved fire resistance and load-bearing capacity, enabling broader applications in modular construction and interior design. This development underlines TECNARO’s commitment to functional innovation and reinforces its position as a leading material supplier in the evolving NFRP landscape.

- In February 2023, Trex Company, Inc. (U.S.), a leading manufacturer of wood-alternative decking, unveiled a new product line made from upcycled natural fibers and recycled polyethylene. Designed for sustainable outdoor living, the enhanced composite decking line delivers improved strength, moisture resistance, and aesthetic appeal. Trex’s initiative highlights the growing role of recycled natural fibers in mainstream building materials and underscores the company’s leadership in green innovation within the construction sector.

- In January 2023, Procotex Corporation (Belgium), a global supplier of flax and other technical fibers, announced the establishment of a new fiber treatment and processing facility in Eastern Europe to meet growing demand for NFRPs in automotive and industrial applications. The new plant is aimed at increasing production efficiency and supporting the European circular economy. This expansion reflects Procotex’s strategic commitment to strengthening the NFRP supply chain and promoting sustainable material use across key end-user industries.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Natural Fiber Reinforced Plastics Nfrp Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Natural Fiber Reinforced Plastics Nfrp Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Natural Fiber Reinforced Plastics Nfrp Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.