Global Natural Fibre Textile Market

Market Size in USD Billion

CAGR :

%

USD

16.57 Billion

USD

29.33 Billion

2025

2033

USD

16.57 Billion

USD

29.33 Billion

2025

2033

| 2026 –2033 | |

| USD 16.57 Billion | |

| USD 29.33 Billion | |

|

|

|

|

Natural Fibre Textile Market Size

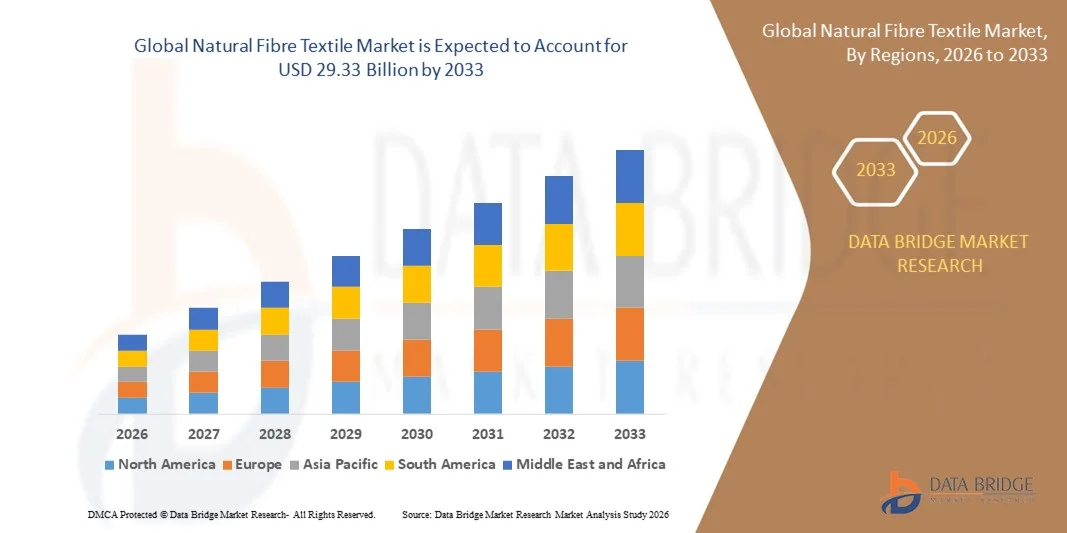

- The global natural fibre textile market size was valued at USD 16.57 billion in 2025 and is expected to reach USD 29.33 billion by 2033, at a CAGR of 7.40% during the forecast period

- The market growth is largely fuelled by the increasing consumer preference for sustainable and eco-friendly fabrics, driven by environmental awareness and fashion trends emphasizing natural materials

- Rising adoption of natural fibres in apparel, home textiles, and industrial applications is supporting steady demand, as manufacturers focus on high-quality, biodegradable, and hypoallergenic fabrics

Natural Fibre Textile Market Analysis

- Growing focus on sustainable and organic fashion is driving investment in natural fibre cultivation, spinning, and weaving technologies, with brands emphasizing transparency and traceability in their supply chains

- Increasing demand from emerging economies, coupled with rising disposable incomes and lifestyle changes, is expanding market opportunities for natural fibre textiles across various applications

- North America dominated the natural fibre textile market with the largest revenue share in 2025, driven by rising consumer preference for sustainable and biodegradable textiles, as well as increasing awareness regarding eco-friendly fashion and home furnishings

- Asia-Pacific region is expected to witness the highest growth rate in the global natural fibre textile market, driven by rapid urbanization, increasing disposable incomes, rising demand for eco-friendly apparel, and government support for the textile and agricultural sectors

- The Cellulose-Based Natural Fibre segment held the largest market revenue share in 2025, driven by the widespread availability of cotton, flax, and hemp, and their strong adoption in apparel and home textiles. These fibres are favored for their biodegradability, comfort, and versatility, making them a preferred choice for manufacturers focusing on sustainable and eco-friendly products

Report Scope and Natural Fibre Textile Market Segmentation

|

Attributes |

Natural Fibre Textile Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Barnhardt Natural Fibres (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Natural Fibre Textile Market Trends

Rising Demand for Sustainable and Eco-Friendly Textiles

- The growing preference for natural fibre textiles is transforming the global textile landscape by promoting sustainability and reducing environmental impact. Natural fibres such as cotton, wool, flax, and hemp offer biodegradable, renewable, and low-carbon alternatives to synthetic textiles, aligning with consumer and regulatory focus on eco-conscious products. This trend is boosting adoption across apparel, home textiles, and technical fabrics, while also encouraging brands to adopt circular economy models and reduce reliance on petroleum-based fibres

- Increasing awareness of environmental and health concerns is accelerating demand for organic and chemical-free natural fibres. Consumers and brands are seeking textiles produced without harmful dyes, pesticides, or synthetic additives, supporting adoption in fashion, interior design, and personal care textiles. The emphasis on wellness and sustainable sourcing is encouraging manufacturers to innovate in fibre cultivation and processing, develop eco-friendly dyeing techniques, and improve traceability across supply chains

- The versatility and comfort of natural fibres are driving their use in diverse applications, from casual wear to industrial fabrics. Improved processing technologies enhance durability, softness, and performance, making natural fibres competitive with synthetic alternatives. This trend encourages manufacturers to expand product portfolios, integrate smart textile features, and cater to evolving consumer expectations in performance and sustainability

- For instance, in 2023, European and North American apparel brands launched collections using organically certified cotton and hemp fabrics, resulting in higher consumer engagement and market growth. These initiatives improved brand credibility while promoting environmentally friendly fashion practices and influencing wider adoption of eco-conscious sourcing across the industry

- While adoption is rising, sustained growth relies on improving fibre quality, supply chain efficiency, and consumer education. Investments in sustainable agriculture, advanced processing, and certification standards are essential to maintain competitiveness and long-term market expansion, while collaborations between growers, manufacturers, and retailers enhance scalability and innovation

Natural Fibre Textile Market Dynamics

Driver

Growing Consumer Preference for Eco-Friendly and Biodegradable Textiles

- Increasing consumer awareness about environmental sustainability is driving demand for natural fibre textiles. Shoppers are favoring biodegradable and renewable fibres over synthetic alternatives to reduce ecological footprints and support ethical production practices. This shift is fueling growth across apparel, home textiles, and industrial fabrics, while also encouraging brands to adopt environmentally conscious marketing and product positioning strategies

- The health and comfort benefits of natural fibres, including breathability, hypoallergenic properties, and temperature regulation, are further promoting adoption. Consumers are actively seeking clothing and home textiles that enhance well-being while adhering to eco-conscious values, driving innovation in moisture-wicking, thermoregulating, and antimicrobial natural fibre products

- Regulatory policies and sustainability initiatives are encouraging manufacturers to adopt organic and naturally sourced fibres. Programs supporting chemical-free cultivation, fair trade, and low-impact manufacturing are stimulating industry investment and product innovation, while certification schemes and eco-labels help build consumer trust and drive brand loyalty in competitive markets

- For instance, in 2022, the European Union implemented stricter guidelines on sustainable textile labelling and organic fibre sourcing, driving higher demand for certified natural fibres and encouraging manufacturers to expand eco-friendly offerings. This also prompted cross-border collaborations and investments in traceable supply chains to meet international regulatory requirements

- While sustainability is a strong growth driver, ensuring consistent quality, scaling production, and maintaining supply chain transparency are crucial for continued adoption and market expansion. Investments in mechanized harvesting, improved logistics, and capacity building among fibre producers will strengthen the natural fibre ecosystem globally

Restraint/Challenge

High Production Costs and Supply Chain Limitations

- The high cost of cultivating and processing natural fibres compared to synthetic alternatives limits market adoption, particularly in price-sensitive regions. Organic certification, labour-intensive harvesting, and sustainable processing add to production expenses, affecting product pricing and accessibility. Additional costs associated with eco-friendly dyeing, packaging, and logistics further impact affordability for consumers and manufacturers

- Limited availability of high-quality fibres and infrastructure challenges, especially in developing regions, constrain large-scale production. Inconsistent fibre properties, seasonal fluctuations, and lack of mechanized processing reduce efficiency and market penetration, prompting manufacturers to seek alternative sourcing strategies or invest in local cultivation and processing capabilities

- Supply chain inefficiencies, including transportation, storage, and certification complexities, hinder timely delivery and product scalability. These limitations affect manufacturers’ ability to meet growing global demand and expand into new markets, often resulting in stock shortages and delayed product launches in international retail channels

- For instance, in 2023, textile producers in South Asia reported delays in organic cotton supply due to certification backlogs and logistic challenges, impacting production schedules and revenue growth. Such issues highlight the importance of digital supply chain management and collaborative frameworks between growers and manufacturers to ensure reliability

- Addressing cost, quality, and supply chain constraints through technological innovation, mechanization, and sustainable sourcing strategies is critical for unlocking the full potential of the global natural fibre textile market. Strategic partnerships, investment in processing technologies, and adoption of circular economy models will further strengthen market resilience and long-term expansion

Natural Fibre Textile Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the natural fibre textile market is segmented into Cellulose-Based Natural Fibre and Protein-Based Fibre. The Cellulose-Based Natural Fibre segment held the largest market revenue share in 2025, driven by the widespread availability of cotton, flax, and hemp, and their strong adoption in apparel and home textiles. These fibres are favored for their biodegradability, comfort, and versatility, making them a preferred choice for manufacturers focusing on sustainable and eco-friendly products.

The Protein-Based Fibre segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for wool, silk, and other animal-derived fibres in high-end fashion, technical fabrics, and medical textiles. Protein-based fibres are particularly valued for their superior insulation, durability, and softness, which enhance product performance and appeal in premium and specialty applications.

- By Application

On the basis of application, the natural fibre textile market is segmented into Automotive, Textiles, Insulation, and Medical Applications. The Textiles segment held the largest revenue share in 2025 due to strong demand in apparel, home textiles, and fashion industries emphasizing sustainability and comfort.

The Medical Applications segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising use of natural fibres in surgical garments, wound dressings, and healthcare fabrics. Natural fibres’ biodegradability, hypoallergenic properties, and breathability make them ideal for healthcare applications, supporting market expansion and innovation.

Natural Fibre Textile Market Regional Analysis

- North America dominated the natural fibre textile market with the largest revenue share in 2025, driven by rising consumer preference for sustainable and biodegradable textiles, as well as increasing awareness regarding eco-friendly fashion and home furnishings

- Consumers in the region highly value the environmental benefits, comfort, and durability offered by natural fibre textiles, including cotton, wool, flax, and hemp. The integration of certified organic fabrics into apparel and home textiles is fostering widespread adoption

- This trend is further supported by stringent environmental regulations, high disposable incomes, and growing demand for ethically sourced products, establishing natural fibre textiles as a preferred choice for both industrial and consumer applications

U.S. Natural Fibre Textile Market Insight

The U.S. natural fibre textile market captured the largest revenue share in 2025 within North America, fueled by increasing demand for organic and sustainable fabrics in apparel, home furnishings, and technical textiles. Consumers are prioritizing eco-friendly and chemical-free products, while brands are incorporating certified fibres to enhance credibility. The growing focus on health, comfort, and sustainability is encouraging manufacturers to expand natural fibre offerings, further strengthening market growth.

Europe Natural Fibre Textile Market Insight

The Europe natural fibre textile market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising adoption of organic fibres and government initiatives promoting sustainable production practices. Increasing urbanization and consumer awareness regarding environmental impact are boosting demand. The region is experiencing significant growth across fashion, home textiles, and industrial applications, with natural fibres being increasingly used in both new product launches and renovations.

U.K. Natural Fibre Textile Market Insight

The U.K. natural fibre textile market is expected to witness strong growth from 2026 to 2033, fueled by consumer preference for sustainable, biodegradable, and ethically sourced fabrics. Growing interest in eco-conscious fashion, coupled with government support for organic farming and textile certification programs, is promoting the adoption of natural fibres. Retailers and manufacturers are leveraging these trends to enhance brand value and product differentiation.

Germany Natural Fibre Textile Market Insight

The Germany natural fibre textile market is expected to witness robust growth from 2026 to 2033, driven by increasing awareness of sustainable production, high-quality natural fibres, and demand for eco-friendly textiles in both apparel and industrial applications. Germany’s strong manufacturing base, emphasis on innovation, and environmental consciousness are promoting the adoption of natural fibres. Integration of advanced processing technologies ensures durability, softness, and performance, aligning with consumer expectations.

Asia-Pacific Natural Fibre Textile Market Insight

The Asia-Pacific natural fibre textile market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing demand for eco-friendly fabrics in countries such as China, India, and Japan. The region is witnessing higher adoption of organic cotton, hemp, and wool across apparel, home textiles, and industrial applications. Government initiatives supporting sustainable agriculture and textile manufacturing are further boosting market expansion.

Japan Natural Fibre Textile Market Insight

The Japan natural fibre textile market is expected to witness strong growth from 2026 to 2033 due to increasing consumer preference for high-quality, eco-friendly fabrics and the integration of natural fibres in fashion and home textiles. The market is supported by advanced textile processing technologies and a strong focus on comfort, health, and sustainability. Moreover, Japan’s aging population is driving demand for soft, hypoallergenic, and breathable textiles suitable for all age groups.

China Natural Fibre Textile Market Insight

The China natural fibre textile market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s extensive textile manufacturing base, rising middle-class population, and increasing adoption of organic and chemical-free fibres. China is a leading producer and consumer of natural fibres, and growing awareness regarding sustainability and health benefits is driving demand across apparel, home textiles, and industrial fabrics. Government policies promoting organic cultivation and environmentally friendly manufacturing are key factors propelling market growth.

Natural Fibre Textile Market Share

The Natural Fibre Textile industry is primarily led by well-established companies, including:

• Barnhardt Natural Fibres (U.S.)

• Advanced Environmental Recycling Technologies, Inc. (U.S.)

• BComp Ltd (Switzerland)

• The Natural Fibre Company (U.K.)

• UPM (Finland)

• TECNARO GMBH (Germany)

• Procotex SA Corporation NV (Belgium)

• FlexForm Technologies (U.S.)

• Greengram B.V (Netherlands)

• Trex Company, Inc. (U.S.)

• Fibreon (U.S.)

• LENZING AG (Austria)

• China National Cotton Group Corp (China)

• Grasim Industries Limited (India)

• Shandong Ruyi Technology Group Co., Ltd (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Natural Fibre Textile Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Natural Fibre Textile Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Natural Fibre Textile Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.