Global Natural Flavours And Fragrances Market

Market Size in USD Billion

CAGR :

%

USD

9.57 Billion

USD

13.77 Billion

2024

2032

USD

9.57 Billion

USD

13.77 Billion

2024

2032

| 2025 –2032 | |

| USD 9.57 Billion | |

| USD 13.77 Billion | |

|

|

|

|

Natural Flavours and Fragrances Market Size

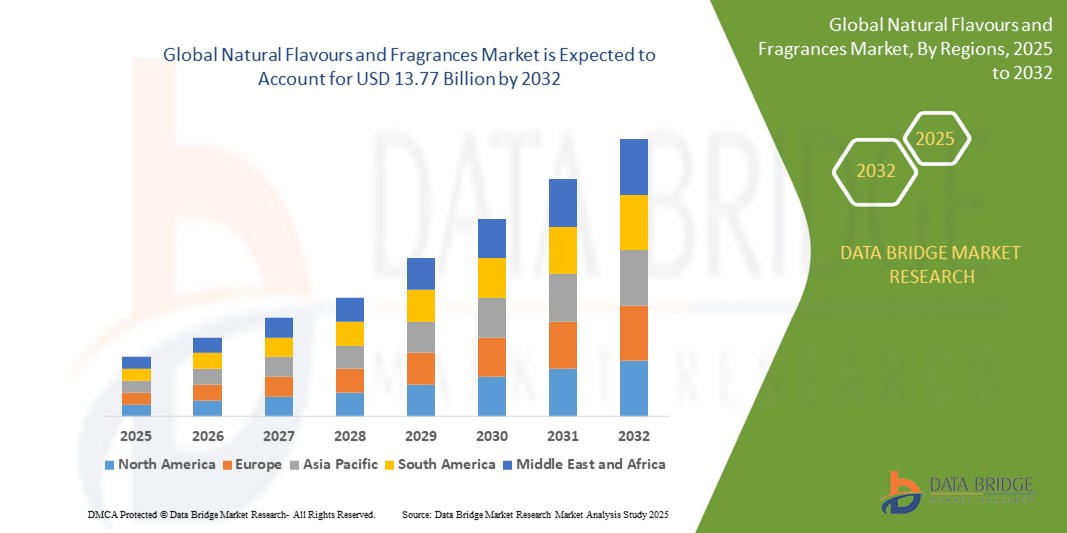

- The global natural flavours and fragrances market size was valued at USD 9.57 billion in 2024 and is expected to reach USD 13.77 billion by 2032, at a CAGR of 4.65% during the forecast period

- The market growth is largely fuelled by the increasing consumer shift towards clean-label, plant-based, and sustainable products, alongside heightened demand across food and beverage, personal care, and home care industries

- Growing preference for organic and non-GMO ingredients in both developed and emerging economies is further accelerating the adoption of natural flavours and fragrances across various product categories

Natural Flavours and Fragrances Market Analysis

- The natural flavours and fragrances market is experiencing steady expansion as consumers increasingly demand transparency in product composition, prompting manufacturers to replace synthetic additives with plant-derived alternatives

- Innovations in extraction techniques and biotechnology are enabling the production of cost-effective, high-purity natural ingredients, thereby expanding application across a wide array of end-use industries

- Europe dominated the natural flavours and fragrances market with the largest revenue share of 29.5% in 2024, driven by increasing consumer preference for clean label and organic products, particularly across food, beverages, and personal care sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global natural flavours and fragrances market, driven by evolving consumer lifestyles, a booming food and beverage industry, and increased investment from global players seeking to tap into emerging economies such as China, India, and Southeast Asia

- The liquid segment accounted for the largest revenue share in 2024, owing to its widespread usage in beverages, sauces, and cosmetics where easy blending and uniform dispersion are crucial. Liquid forms also provide a more immediate sensory impact, enhancing the aroma and taste profile of finished products

Report Scope and Natural Flavours and Fragrances Market Segmentation

|

Attributes |

Natural Flavours and Fragrances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Clean-Label and Organic Products • Expansion of Natural Ingredients in Emerging Markets |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Natural Flavours and Fragrances Market Trends

“Surging Consumer Shift Toward Botanical-Based Wellness and Lifestyle Products”

- Consumers are increasingly gravitating toward botanical-based wellness and lifestyle products, seeking natural solutions that align with holistic health, sustainability, and clean-label values, which is significantly shaping product formulations across food, beverage, and personal care segments

- The demand for natural fragrances derived from lavender, chamomile, peppermint, and other herbs is rising sharply in aromatherapy, spa treatments, and organic skincare, driven by consumer perception that plant-based scents support mood and well-being

- In the food and beverage sector, natural flavour blends sourced from citrus fruits, vanilla, and spices are being prioritized over artificial alternatives, especially in health-positioned products such as functional beverages, flavored teas, and vegan snacks

- For instance, brands such as Aveda and Lush have integrated essential oils and plant extracts into their fragrance and skincare lines, while food companies such as Chobani and KIND Snacks have introduced naturally flavored yogurts and bars to appeal to health-conscious consumers

- These evolving preferences are compelling manufacturers to reformulate portfolios, increase investment in botanical sourcing, and adopt clean extraction techniques to remain competitive and relevant in a nature-driven consumer landscape

Natural Flavours and Fragrances Market Dynamics

Driver

“Growing Consumer Demand for Natural and Organic Products”

• The increasing global preference for organic and nature-derived ingredients is fuelling demand for natural flavours and fragrances, as both consumers and manufacturers shift away from synthetic additives due to perceived health risks and environmental concerns

• In the personal care segment, products such as deodorants, shampoos, and lotions are being reformulated with essential oils, fruit distillates, and floral waters to meet growing interest in green beauty, while the food industry is experiencing a surge in natural flavor demand from health-oriented consumers

• Large-scale manufacturers are adopting cold-press and solvent-free extraction methods to enhance ingredient purity and reduce chemical exposure, appealing to label-conscious buyers and environmentally responsible retailers

• For instance, The Body Shop has promoted the use of community-sourced natural fragrances across its body care range, and beverage brands such as LaCroix and Spindrift are gaining traction by offering sparkling drinks with naturally extracted fruit essences

• This surge in demand is supported by clean label movements, international regulatory alignment, and the premiumization trend that encourages consumers to pay more for natural authenticity, reinforcing the long-term market viability of natural flavours and fragrances

Restraint/Challenge

“High Costs and Supply Chain Volatility Associated with Natural Inputs”

• High production costs related to extraction, preservation, and supply chain logistics are hampering wider adoption of natural flavours and fragrances, especially for cost-sensitive manufacturers targeting mass-market applications

• Limited availability of quality raw materials such as essential oils, citrus concentrates, and exotic herbs introduces price volatility and supply inconsistencies, which make it difficult for producers to maintain consistent formulation and pricing

• Environmental risks such as droughts, floods, and pest outbreaks in key growing regions are further disrupting supply chains, leading to unpredictable production cycles and reduced scalability for natural ingredient sourcing

• For instance, fluctuating yields of lemon and orange crops in Spain and Italy have impacted the European natural flavour market, while lavender and rose oil production in Bulgaria and Turkey has seen year-to-year price spikes due to climatic variability and labor constraints

• These limitations are discouraging some manufacturers from fully transitioning to natural profiles, especially in lower-tier products, thereby slowing down the penetration of natural flavours and fragrances in mainstream and emerging markets

Natural Flavours and Fragrances Market Scope

The market is segmented on the basis of product type, application, and form.

- By Form

On the basis of form, the market is segmented into liquid and dry. The liquid segment accounted for the largest revenue share in 2024, owing to its widespread usage in beverages, sauces, and cosmetics where easy blending and uniform dispersion are crucial. Liquid forms also provide a more immediate sensory impact, enhancing the aroma and taste profile of finished products.

The dry segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its extended shelf life, ease of storage, and suitability for powdered formulations such as soups, snacks, nutraceuticals, and supplements. Dry forms are also gaining traction in the pharmaceutical industry for tablet and capsule formulations due to their stability and processing benefits.

- By Application

On the basis of application, the natural flavours and fragrances market is segmented into flavors and fragrances. The flavors segment held the largest revenue share of 54.1% in 2024, primarily due to growing consumer preference for natural ingredients in food and beverages. Demand for natural flavorings in confectionery, dairy, and health drinks is accelerating, supported by increasing health awareness and regulatory restrictions on synthetic additives.

The fragrances segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rise in demand for clean-label personal care, home care, and cosmetic products. Natural fragrances derived from plant-based sources are gaining traction as sustainable and skin-friendly alternatives to synthetic counterparts, especially among eco-conscious consumers.

- By Technology

On the basis of technology, the natural flavours and fragrances market is segmented into extraction and distillation. The extraction segment dominated the market in 2024, supported by its suitability for producing concentrated compounds from fruits, herbs, and spices. This method ensures high flavor retention and is widely used in the production of essential oils and food additives. The ability to customize extract concentrations enhances its use across diverse end-user industries.

The distillation segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its efficiency in isolating pure aromatic compounds. Steam and hydro distillation techniques are increasingly applied for obtaining high-quality essential oils, especially in perfumery and therapeutic applications. Rising investments in advanced distillation setups are expected to further support segment growth.

- By Product

On the basis of product, the natural flavours and fragrances market is segmented into essential oils and dried crops. The essential oils segment accounted for the largest market share in 2024, owing to their versatile application in food, personal care, and aromatherapy products. The high demand for pure, therapeutic-grade essential oils is fueling growth, particularly as consumers shift toward plant-based wellness solutions.

The dried crops segment is expected to witness the fastest growth rate from 2025 to 2032, supported by their cost-effectiveness, extended shelf life, and strong demand in tea blends, seasonings, and cosmetic formulations. The trend toward minimally processed and authentic ingredients has increased the adoption of dried herbs, flowers, and spices in natural product manufacturing.

Natural Flavours and Fragrances Market Regional Analysis

• Europe dominated the natural flavours and fragrances market with the largest revenue share of 29.5% in 2024, driven by increasing consumer preference for clean label and organic products, particularly across food, beverages, and personal care sectors

• The region’s strict regulatory framework promoting natural ingredients and sustainability is further encouraging manufacturers to invest in natural flavour and fragrance formulations

• The market growth is further supported by strong demand in countries such as France, Germany, and Italy, where premium and botanical-based offerings continue to attract health-conscious and environmentally aware consumers

Germany Natural Flavours and Fragrances Market Insight

The Germany natural flavours and fragrances market accounted for the largest revenue share within Europe in 2024, driven by the country’s strong food processing, cosmetics, and pharmaceutical industries. The increasing demand for naturally derived aroma compounds in functional foods and organic personal care products continues to support the sector. Furthermore, the presence of global fragrance companies and local research institutions has bolstered innovation in green extraction technologies, positioning Germany as a key player in the European market.

U.K. Natural Flavours and Fragrances Market Insight

The U.K. natural flavours and fragrances market is expected to witness the fastest growth rate from 2025 to 2032, driven by heightened consumer focus on health, wellness, and sustainability. The country's mature food and beverage industry is actively reformulating products with clean-label ingredients, while the beauty and personal care sector is rapidly embracing botanical and plant-based fragrance solutions. In addition, the growing demand for allergen-free, vegan, and transparent products is prompting manufacturers to adopt natural compounds derived from essential oils, fruits, and herbs. Retailers are also supporting the trend by expanding their natural product offerings, especially in private label brands.

North America Natural Flavours and Fragrances Market Insight

The North America market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising awareness of health and wellness, along with a shift in consumer preference away from synthetic ingredients. Clean-label demands are influencing food, beverage, and cosmetic brands to reformulate using natural components. Moreover, advancements in natural extraction methods and a strong presence of flavour and fragrance formulators are supporting regional expansion.

U.S. Natural Flavours and Fragrances Market Insight

The U.S. natural flavours and fragrances market captured the largest share in North America in 2024, underpinned by increasing demand in processed foods, functional beverages, and organic personal care products. Manufacturers are responding to consumer calls for transparency and plant-based solutions by integrating more botanical extracts, essential oils, and fermentation-based flavours. In addition, the rise of natural wellness trends and premium fragrance lines is fuelling demand for sophisticated natural profiles.

Asia-Pacific Natural Flavours and Fragrances Market Insight

The Asia-Pacific natural flavours and fragrances market is expected to witness the fastest growth rate from 2025 to 2032, driven by population growth, rising disposable incomes, and evolving consumption patterns in countries such as China, India, and Japan. There is increasing demand for authentic, natural ingredients in traditional foods, personal care, and herbal remedies. Growing urbanization, coupled with heightened awareness of food safety and clean beauty, is fostering adoption of natural alternatives across applications.

China Natural Flavours and Fragrances Market Insight

The China market accounted for the largest share within Asia-Pacific in 2024, supported by a thriving food and cosmetics industry and a growing trend toward healthier lifestyles. Natural flavours and fragrances are being integrated into functional beverages, ready-to-eat meals, and premium skincare products. Moreover, government regulations favouring green chemistry and the presence of several large-scale ingredient suppliers are accelerating the adoption of nature-derived solutions.

Japan Natural Flavours and Fragrances Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032, supported by a deep cultural affinity for natural ingredients and minimalist, functional products. The country's aging population and health-conscious consumers are driving demand for naturally flavoured food supplements, functional beverages, and gentle, non-synthetic fragrances in skincare. Traditional Japanese botanicals such as yuzu, matcha, and sakura are being increasingly used in natural formulations, blending innovation with heritage. Furthermore, Japan’s reputation for quality and precision in manufacturing is encouraging investment in advanced extraction technologies that preserve natural aromas and flavours while meeting regulatory standards.

Natural Flavours and Fragrances Market Share

The Natural Flavours and Fragrances industry is primarily led by well-established companies, including:

- Givaudan (Switzerland)

- Sensient Technologies Corporation (U.S.)

- International Flavors & Fragrances Inc. (U.S.)

- Symrise (Germany)

- Kerry Group plc (Ireland)

- Firmenich SA (Switzerland)

- Paris Fragrances (U.S.)

- Takasago International Corporation (Japan)

- ADM (U.S.)

- Huabao International Holdings Limited (China)

Latest Developments in Global Natural Flavours and Fragrances Market

- In March 2023, Robertet Group completed the acquisition of Aroma Esencial, a Spain-based firm specializing in fractionation and molecular distillation. This strategic move enhances Robertet's capabilities in producing high-purity ingredients for the fine fragrance sector. The acquisition is expected to strengthen the company’s position in the natural fragrance market by expanding its product portfolio and manufacturing expertise

- In October 2022, Sensient Technologies Corporation launched a new 21,000-square-foot customer and innovation lab in Somerset, New Jersey. This facility aims to foster collaborative research and development in beauty, personal care, and savory flavor segments. The lab is poised to accelerate innovation, enhance product development, and support customer partnerships, thereby boosting Sensient’s market competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Natural Flavours And Fragrances Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Natural Flavours And Fragrances Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Natural Flavours And Fragrances Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.