Global Navigation Air Traffic Control Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.75 Billion

USD

4.70 Billion

2025

2033

USD

2.75 Billion

USD

4.70 Billion

2025

2033

| 2026 –2033 | |

| USD 2.75 Billion | |

| USD 4.70 Billion | |

|

|

|

|

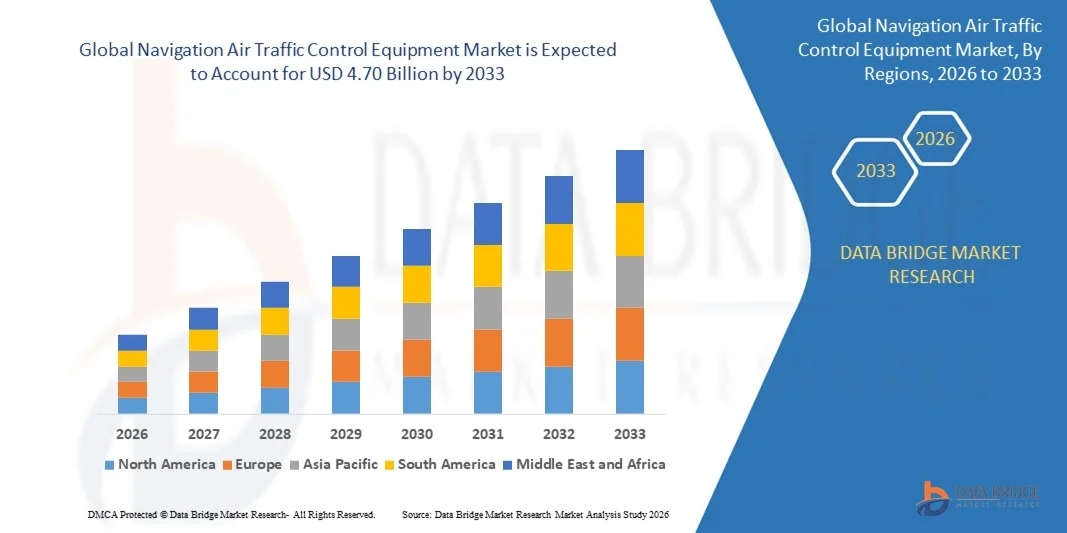

What is the Global Navigation Air Traffic Control Equipment Market Size and Growth Rate?

- The global navigation air traffic control equipment market size was valued at USD 2.75 billion in 2025 and is expected to reach USD 4.70 billion by 2033, at a CAGR of6.90% during the forecast period

- The rapid increase in air traffic will subsequently result in the amplified demand for air traffic control equipment which has been directly influencing the growth of navigation air traffic control equipment market

- Also, the growing need for construction of new airports along with high growth and modernization of the existing ones to address growing passenger and freight traffic are also flourishing the growth of the navigation air traffic control equipment market

What are the Major Takeaways of Navigation Air Traffic Control Equipment Market?

- Deployment of automation in the air traffic control equipment is also positively impacting the growth of the market. Furthermore, the rapid urbanization, increasing population, rising disposable incomes and increase in the standard of living associated with the significant improvements in commercial aspects of controlling equipment are also lifting the growth of the navigation air traffic control equipment market

- The major factors that determine the growth of the navigation air traffic control equipment market is the growing need for better airspace management

- North America dominated the navigation air traffic control equipment market with a 43.7% revenue share in 2025, driven by the presence of advanced air traffic management systems, modernization of legacy ATC infrastructure, and adoption of integrated radar and communication devices across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.36% from 2026 to 2033, driven by rapid aviation growth, rising number of new airports, and modernization of existing facilities across China, Japan, India, Singapore, and South Korea

- The Radar Devices segment dominated the market with a 41.2% share in 2025, driven by rising adoption of advanced air traffic surveillance systems, long-range detection radars, and multi-mode radar platforms

Report Scope and Navigation Air Traffic Control Equipment Market Segmentation

|

Attributes |

Navigation Air Traffic Control Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Navigation Air Traffic Control Equipment Market?

Rising Adoption of Advanced, Modular, and Integrated Air Traffic Control Systems

- The navigation air traffic control equipment market is witnessing growing adoption of modular, high-precision, and integrated radar, communication, and surveillance systems designed to enhance air traffic monitoring, safety, and efficiency

- Manufacturers are introducing next-generation, software-defined, and easily upgradeable systems that improve situational awareness, simplify integration with existing ATC infrastructure, and reduce operational downtime across airports and control centers

- Increasing demand for cost-effective, scalable, and interoperable solutions is driving usage across regional, national, and international air traffic management systems

- For instance, Thales, Raytheon, Honeywell, L3Harris, and Lockheed Martin have expanded their ATC product portfolios with enhanced radar accuracy, integrated ADS-B receivers, and software-based traffic management tools

- Rising need for real-time traffic monitoring, rapid system deployment, and safety compliance is accelerating the adoption of integrated navigation ATC systems

- As air traffic volumes grow globally and digitalization advances, Navigation Air Traffic Control Equipments are expected to remain central to airport modernization, safety optimization, and efficient airspace management

What are the Key Drivers of Navigation Air Traffic Control Equipment Market?

- Growing demand for highly reliable, modular, and upgradeable ATC systems to ensure seamless air traffic operations in increasingly congested airspaces

- For instance, in 2025, Thales, Raytheon, and Honeywell launched enhanced radar and communication platforms capable of supporting multi-airport, cross-border operations

- Expansion of civil aviation, cargo operations, and unmanned aerial systems is boosting the deployment of ATC equipment across North America, Europe, and Asia-Pacific

- Advancements in radar precision, real-time data processing, surveillance technologies, and AI-driven analytics have improved operational accuracy and safety compliance

- Rising adoption of ADS-B, remote towers, and digital ATC platforms is creating demand for integrated, next-generation equipment capable of real-time monitoring

- Supported by ongoing investments in airport modernization, government aviation programs, and international aviation safety initiatives, the navigation air traffic control equipment market is expected to witness sustained global growth

Which Factor is Challenging the Growth of the Navigation Air Traffic Control Equipment Market?

- High capital expenditure for advanced ATC systems, including radar, sensors, and communication networks, limits adoption among cost-sensitive airports and emerging nations

- For instance, during 2024–2025, fluctuations in semiconductor availability, sensor technology costs, and supply chain disruptions increased equipment procurement expenses for several global vendors

- Stringent international aviation regulations, certification processes, and safety compliance standards increase implementation complexity for manufacturers and operators

- Limited awareness and expertise in emerging markets regarding system interoperability, software integration, and ATC infrastructure requirements restrict optimal deployment

- Competition from legacy systems, low-cost radar providers, and regional communication networks creates pricing pressures and reduces product differentiation

- To address these challenges, companies are focusing on cost-efficient system design, modular upgrades, training programs, and global support services to increase adoption of advanced navigation air traffic control equipments worldwide

How is the Navigation Air Traffic Control Equipment Market Segmented?

The market is segmented on the basis of device type, airport type, and end user.

- By Device Type

On the basis of device type, the market is segmented into Proximity Devices, Information System Devices, Radar Devices, Simulator Devices, and Safety & Navigational Devices. The Radar Devices segment dominated the market with a 41.2% share in 2025, driven by rising adoption of advanced air traffic surveillance systems, long-range detection radars, and multi-mode radar platforms. Airports, air navigation service providers, and defense organizations rely on radar devices for real-time traffic monitoring, collision avoidance, and situational awareness. These devices provide superior accuracy, range, and integration capabilities, making them critical for both civil and military airspace management.

The Simulator Devices segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing investment in pilot training, system testing, and crew preparedness. Growth in flight training academies and advanced simulation technologies is driving simulator deployment globally.

- By Airport Type

On the basis of airport type, the market is segmented into Brownfield and Greenfield airports. The Brownfield segment dominated the market with a 57.5% share in 2025, fueled by modernization and expansion of existing airports to accommodate growing passenger traffic, cargo operations, and compliance with ICAO and FAA standards. Existing facilities are increasingly adopting advanced navigation, radar, and communication devices to enhance operational efficiency, safety, and airspace management.

The Greenfield segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising investments in new airport infrastructure across Asia-Pacific, the Middle East, and Africa. Expanding aviation networks, government-backed infrastructure projects, and private airport development are accelerating adoption of cutting-edge ATC devices in newly constructed airports.

- By End User

On the basis of end user, the market is segmented into Commercial Aircraft, Private Aircraft, and Military Aircraft. The Commercial Aircraft segment dominated the market with a 49.8% share in 2025, supported by rising global passenger traffic, fleet expansion, and strict aviation safety regulations. Airlines and airport operators increasingly rely on ATC equipment for navigation, collision avoidance, and situational awareness to optimize flight operations and reduce delays.

The Military Aircraft segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by modernization of air defense fleets, increasing procurement of fighter jets, UAVs, and multi-role aircraft, and investments in advanced radar and communication systems. Defense agencies’ focus on enhanced situational awareness, secure communication, and airspace control is propelling demand for military-grade navigation and safety devices.

Which Region Holds the Largest Share of the Navigation Air Traffic Control Equipment Market?

- North America dominated the navigation air traffic control equipment market with a 43.7% revenue share in 2025, driven by the presence of advanced air traffic management systems, modernization of legacy ATC infrastructure, and adoption of integrated radar and communication devices across the U.S. and Canada. Strong government investment in aviation safety, civil-military airspace integration, and airport upgrades continues to fuel regional demand

- Leading companies are focusing on deploying high-performance radar, simulator, and safety devices, enhancing reliability, situational awareness, and operational efficiency. Regulatory emphasis on aviation safety, compliance with ICAO standards, and airspace modernization further reinforces North America’s market leadership

- Advanced R&D ecosystems, high aviation traffic, and adoption of innovative navigation solutions continue to drive sustained growth

U.S. Navigation Air Traffic Control Equipment Market Insight

The U.S. is the largest contributor in North America, supported by increasing investments in air traffic surveillance, airport expansion, and defense-grade ATC systems. Growing modernization of commercial and military airports, integration of AI-assisted radar, and deployment of simulator devices for training programs drive adoption. Strong aviation infrastructure, regulatory compliance frameworks, and technological advancements in aerospace electronics further support market expansion.

Canada Navigation Air Traffic Control Equipment Market Insight

Canada contributes significantly to regional growth, driven by upgrades to existing airports, expansion of civil aviation infrastructure, and government-led digital air traffic initiatives. Deployment of radar, proximity, and navigational devices in commercial and military airports enhances operational safety and efficiency. Sustainability programs, automation of air traffic operations, and investments in simulator-based training programs further bolster adoption.

Asia-Pacific Navigation Air Traffic Control Equipment Market

Asia-Pacific is projected to register the fastest CAGR of 10.36% from 2026 to 2033, driven by rapid aviation growth, rising number of new airports, and modernization of existing facilities across China, Japan, India, Singapore, and South Korea. Strong demand for integrated radar, simulator, and safety devices in commercial, private, and military airports accelerates market adoption. Government-backed aviation infrastructure projects, air traffic expansion, and investments in digital ATC solutions are driving regional growth.

China Navigation Air Traffic Control Equipment Market Insight

China is the largest contributor to Asia-Pacific, supported by massive airport construction, government airspace modernization programs, and deployment of advanced radar and safety equipment. Increasing demand for simulator devices for pilot training and large-scale adoption of AI-enabled navigation systems fuels growth. Strong local manufacturing and technology innovation enhance domestic production and export potential.

Japan Navigation Air Traffic Control Equipment Market Insight

Japan shows steady growth due to modernization of existing airports, advanced aviation technology, and high safety standards. Adoption of simulator and information system devices for training and operations, along with investments in automated ATC systems, drives regional growth. Emphasis on low-latency operations, energy-efficient solutions, and resilient air traffic infrastructure further supports expansion.

India Navigation Air Traffic Control Equipment Market Insight

India is emerging as a major growth hub, driven by the development of greenfield airports, modernization of brownfield airports, and government-supported digital aviation initiatives. Increasing adoption of radar, safety, and simulator devices across commercial and military operations accelerates demand. Growth in domestic air travel, defense modernization, and regional connectivity programs further boosts market penetration.

South Korea Navigation Air Traffic Control Equipment Market Insight

South Korea contributes significantly due to growing aviation traffic, strong military airspace monitoring requirements, and investment in next-generation ATC systems. Expansion of commercial airports, deployment of high-accuracy radar devices, and simulator-based training solutions enhance operational efficiency. Innovation in system integration, safety protocols, and digital airspace management continues to propel market growth.

Which are the Top Companies in Navigation Air Traffic Control Equipment Market?

The navigation air traffic control equipment industry is primarily led by well-established companies, including:

- Thales Group (France)

- Raytheon Company (U.S.)

- Indra Sistemas SA (Spain)

- L3Harris Technologies, Inc. (U.S.)

- Honeywell International, Inc. (U.S.)

- ALTYS Technologies (France)

- BAE Systems (U.K.)

- Adacel Technologies Limited (Australia)

- NAV CANADA (Canada)

- ConVi GmbH (Germany)

- Aeronav Inc. (Canada)

- ARTISYS s.r.o (Czech Republic)

- Easat Radar Systems Limited (U.K.)

- Intelcan Technosystems Inc. (Canada)

- Kutta Technologies, Inc. (U.S.)

- General Dynamics Mission Systems, Inc. (U.S.)

- NEC Corporation (Japan)

- Leonardo s.P.a. (Italy)

- Northrop Grumman Corporation (U.S.)

- Lockheed Martin Corporation (U.S.)

What are the Recent Developments in Global Navigation Air Traffic Control Equipment Market?

- In April 2025, Maryland approved a USD 22.2 million budget for the construction of a new air traffic control tower at Martin State Airport, aiming to enhance operational efficiency, safety, and monitoring capabilities, marking a significant step forward in regional air traffic infrastructure

- In February 2025, Canada’s Department of National Defense awarded Indra a contract worth over EUR 13 million (EUR 15.07 million) to modernize ground-to-air communications, providing approximately 600 advanced, adaptable radios integrated with cutting-edge technologies, strengthening air traffic management and defense operations nationwide

- In July 2023, the FAA in collaboration with ATCA launched the Advancing Acquisitions Challenge to improve the FAA’s procurement and acquisition processes by soliciting innovative suggestions from industry stakeholders, promoting efficiency, transparency, and better operational outcomes

- In May 2023, Indra reinforced its global leadership in Air Traffic Management (ATM) with the establishment of its U.S. subsidiary, Indra Air Traffic Inc., expanding its presence in North America and providing advanced air traffic management solutions to support safe and efficient airspace operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.