Global Needle Free Blood Drawing Devices Market

Market Size in USD Billion

CAGR :

%

USD

576.55 Billion

USD

1,226.92 Billion

2025

2033

USD

576.55 Billion

USD

1,226.92 Billion

2025

2033

| 2026 –2033 | |

| USD 576.55 Billion | |

| USD 1,226.92 Billion | |

|

|

|

|

Needle Free Blood Drawing Devices Market Size

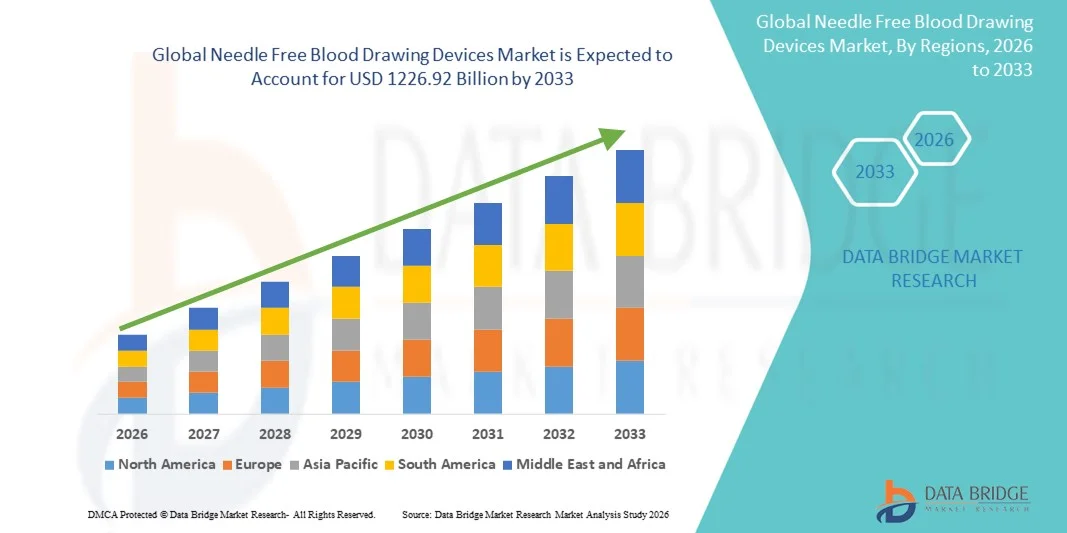

- The global Needle free blood drawing devices market size was valued at USD 576.55 billion in 2025 and is expected to reach USD 1226.92 billion by 2033, at a CAGR of 9.90% during the forecast period

- The market growth is largely fueled by the increasing demand for minimally invasive and painless blood collection methods, driven by rising patient awareness, the need for improved compliance in chronic disease monitoring, and the growth of diagnostic testing across hospitals, clinics, and laboratories

- Furthermore, advancements in needle-free technology, including jet injectors and vacuum-assisted blood collection systems, along with a focus on reducing needle-stick injuries and biohazard risks, are accelerating the uptake of Needle Free Blood Drawing Devices solutions, thereby significantly boosting the overall growth of the market

Needle Free Blood Drawing Devices Market Analysis

- Needle Free Blood Drawing Devices, including jet injectors and vacuum-assisted collection systems, are increasingly vital in modern healthcare due to their ability to enable painless, safe, and rapid blood collection, reduce needle-stick injuries, and improve patient compliance in hospitals, clinics, and diagnostic laboratories

- The escalating demand for Needle Free Blood Drawing Devices is primarily fueled by growing awareness of patient comfort, increasing chronic disease testing, and rising adoption in point-of-care and large-scale diagnostic settings, along with technological advancements that improve accuracy, safety, and ease of use

- North America dominated the needle free blood drawing devices market with the largest revenue share of approximately 38.6% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative medical devices, strong R&D presence, and a well-established network of hospitals, diagnostic centers, and research laboratories in the U.S.

- Asia-Pacific is expected to be the fastest growing region in the needle free blood drawing devices market during the forecast period, with an estimated CAGR of 8.1%, driven by increasing healthcare expenditure, expanding hospital networks, rising awareness of needle-free technologies, and growing adoption in emerging economies such as China and India

- The venepuncture devices segment dominated the market with a revenue share of approximately 62% in 2025, driven by their high accuracy, reliability, and compatibility with standard laboratory equipment

Report Scope and Needle Free Blood Drawing Devices Market Segmentation

|

Attributes |

Needle Free Blood Drawing Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Paxman Coolers (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Needle Free Blood Drawing Devices Market Trends

Growing Adoption of Minimally Invasive and Pain-Free Sampling Technologies

- A significant and accelerating trend in the global needle free blood drawing devices market is the increasing adoption of minimally invasive and pain-free blood collection solutions. These devices are designed to enhance patient comfort, reduce anxiety associated with needle use, and minimize the risk of complications during sampling

- For instance, hospitals, diagnostic centers, and home healthcare providers in Europe and North America are increasingly implementing needle-free blood drawing solutions, particularly for pediatric, geriatric, and needle-phobic patients, to improve patient compliance and satisfaction

- Healthcare facilities are integrating these devices into routine diagnostic workflows, enabling faster blood collection, reducing the risk of needlestick injuries among healthcare personnel, and lowering cross-contamination risks

- The trend is also driven by the rising demand for portable and user-friendly devices suitable for outpatient monitoring, home care, and telemedicine applications, where ease of use and patient comfort are critical

- Globally, the growing emphasis on patient-centric healthcare, infection control, and hospital-acquired infection prevention is further boosting the adoption of needle-free blood drawing technologies, making them an integral part of modern healthcare delivery

Needle Free Blood Drawing Devices Market Dynamics

Driver

Rising Demand for Safe, Efficient, and Patient-Friendly Blood Sampling

- The increasing focus on patient safety, operational efficiency, and infection prevention is a major driver for the global Needle Free Blood Drawing Devices market. These devices reduce the risk of healthcare-associated infections and occupational hazards, offering a safer alternative to traditional needles and syringe

- For instance, in 2024, a leading North American healthcare provider deployed needle-free blood collection devices across multiple clinics to reduce incidences of needlestick injuries and enhance patient safety during routine blood sampling

- Strict regulatory frameworks in the U.S., Europe, and parts of Asia emphasize the reduction of occupational hazards and the promotion of safer medical practices, further encouraging healthcare providers to adopt needle-free solutions

- Furthermore, the increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer, which require frequent blood monitoring, is creating strong demand for pain-free, efficient, and convenient blood sampling technologies

- The adoption of these devices in point-of-care testing, outpatient services, and home healthcare is also supporting preventive care initiatives globally, improving patient compliance and enabling better monitoring of health conditions in remote or underserved regions

Restraint/Challenge

High Costs and Limited Awareness Among Healthcare Providers

- Despite the clear benefits, the relatively high cost of advanced needle-free blood drawing systems remains a significant restraint, particularly for small clinics, diagnostic centers, and healthcare providers in developing regions. High initial investment and maintenance costs can limit the widespread adoption of these devices

- For instance, some laboratories in Latin America and South-East Asia have reported delays in implementing needle-free blood drawing solutions due to budget constraints and the higher upfront cost compared to conventional syringes and venipuncture methods

- Limited awareness and insufficient training among healthcare personnel regarding the proper use, maintenance, and advantages of these devices can also restrict market penetration

- Variability in reimbursement policies, lack of standardized adoption guidelines, and inconsistent regulatory support across different countries create additional challenges for large-scale implementation

- Overcoming these barriers through affordable, user-friendly device designs, healthcare professional training programs, and awareness campaigns about patient safety and operational efficiency will be essential for sustaining growth in the global needle free blood drawing devices market

Needle Free Blood Drawing Devices Market Scope

The market is segmented on the basis of type, technology type, and end users.

- By Product Type

On the basis of product type, the Needle Free Blood Drawing Devices market is segmented into handheld devices and wearable devices. The handheld devices segment dominated the largest market revenue share of approximately 57% in 2025, driven by their widespread adoption across hospitals, diagnostic centers, and research laboratories. Handheld devices offer precision, portability, and ease of use, enabling healthcare professionals to perform quick, minimally invasive blood collection. Their compatibility with various blood analysis systems, integration with electronic health records, and ability to reduce patient discomfort drive their preference. The segment’s strong presence in developed regions, particularly North America and Europe, contributes to high revenue generation. Ongoing product innovations focusing on ergonomic design, faster sample collection, and enhanced safety features further support dominance. Training programs and awareness initiatives by manufacturers enhance adoption among healthcare practitioners. The rising demand for point-of-care diagnostics, home health monitoring, and routine blood sampling also supports growth. Regulatory approvals and standardization of testing protocols reinforce confidence in handheld devices. High investment in R&D by market leaders, combined with strong distribution networks, ensures wide availability. Hospitals, diagnostic labs, and research organizations increasingly prefer handheld solutions due to their reliability and versatility.

The wearable devices segment is anticipated to witness the fastest CAGR of approximately 20.5% from 2026 to 2033, driven by increasing demand for continuous, non-invasive blood monitoring solutions. Wearable devices enable real-time sample collection and monitoring, reducing hospital visits and improving patient compliance. Their integration with mobile health applications, cloud-based monitoring systems, and telemedicine platforms enhances usability. Rapid technological advancements, miniaturization, and innovative sensor technologies contribute to accelerated adoption. Wearable devices are particularly gaining traction in chronic disease management, personalized healthcare, and home-care settings. Rising awareness of minimally invasive techniques and patient comfort further propels growth. Growing adoption in emerging economies due to increasing disposable income and healthcare digitization supports expansion. Manufacturers are investing heavily in product development, regulatory approvals, and strategic partnerships. Integration with electronic health records and AI-driven analytics is enhancing the value proposition. Expansion in fitness and wellness monitoring applications is creating additional market opportunities. Health insurance reimbursement programs and government initiatives in preventive healthcare drive adoption. Overall, wearable devices are emerging as a fast-growing segment with immense potential across both clinical and personal care settings.

- By Technology Type

On the basis of technology type, the market is segmented into venepuncture and touch-based devices. The venepuncture devices segment dominated the market with a revenue share of approximately 62% in 2025, driven by their high accuracy, reliability, and compatibility with standard laboratory equipment. Venepuncture-based needle-free devices enable rapid blood collection for routine testing, diagnostics, and research purposes. Hospitals, diagnostic centers, and research laboratories heavily rely on these devices for their efficiency and ease of integration with automated laboratory workflows. The segment benefits from strong regulatory support, clinical validation studies, and endorsements by healthcare institutions. Continuous innovations focusing on safety, pain reduction, and improved sample quality reinforce their dominance. Wide adoption in North America and Europe contributes significantly to market share. Growing demand for standardized, high-throughput blood collection methods supports revenue growth. Manufacturer collaborations with hospitals and laboratories accelerate product deployment. Training programs and technical support enhance clinical adoption. Rising prevalence of chronic diseases, preventive screenings, and routine lab testing drives demand. Venepuncture devices also see adoption in mobile healthcare and telemedicine initiatives.

The touch-based devices segment is projected to register the fastest CAGR of approximately 19.8% from 2026 to 2033, fueled by the demand for minimally invasive, patient-friendly solutions in hospitals and home-care settings. Touch-based devices reduce discomfort and infection risk while enabling rapid, precise blood sampling. Integration with mobile apps and cloud-based data management systems enhances monitoring and diagnostic efficiency. Increasing use in pediatric, geriatric, and outpatient care boosts adoption. Technological advancements, including sensor miniaturization, AI-assisted sampling, and automated collection, are driving growth. Emerging markets with increasing healthcare digitization present new opportunities. Regulatory approvals, clinical validation, and strong safety profiles enhance acceptance. Rising preference for wearable touch-based devices in home diagnostics and preventive healthcare contributes further. Expansion into research organizations and personalized healthcare markets accelerates growth. Health insurers and government initiatives promoting minimally invasive solutions also support market adoption. Continuous R&D investment ensures innovation, reliability, and scalability.

- By End Users

On the basis of end users, the market is segmented into hospitals, research organizations, diagnostic centers, personal clinics, and others. The hospitals segment dominated the largest market revenue share of approximately 48% in 2025, owing to high patient throughput, demand for accurate diagnostics, and integration with laboratory workflows. Hospitals are adopting needle-free devices to enhance patient comfort, reduce needle-stick injuries, and improve operational efficiency. The availability of training programs, robust supplier networks, and clinical validation studies further strengthens adoption. Hospitals in North America and Europe lead the market, leveraging advanced blood collection technologies to ensure quality patient care. Growing emphasis on automation, standardized protocols, and compliance with healthcare regulations reinforces hospital adoption. Continuous R&D investment in high-precision devices supports market dominance. Hospitals also drive revenue growth through bulk procurement agreements and long-term supply contracts. Adoption is further supported by increasing chronic disease prevalence and routine laboratory testing requirements. Partnerships with device manufacturers for hospital-based pilot programs encourage market penetration.

The research organizations segment is expected to witness the fastest CAGR of approximately 21.2% from 2026 to 2033, driven by the growing need for precise, efficient, and minimally invasive blood collection in clinical trials, drug discovery, and laboratory research. Research organizations increasingly adopt handheld and wearable devices to ensure sample integrity, improve workflow efficiency, and reduce human error. Integration with automated laboratory systems, data analytics platforms, and electronic lab notebooks enhances operational efficiency. Expansion of biotechnology and pharmaceutical research in North America, Europe, and Asia-Pacific fuels demand. Technological advancements, regulatory compliance, and government support for R&D initiatives accelerate adoption. Research labs prefer devices that offer high reproducibility, standardized sample collection, and compatibility with various assays. The increasing trend of decentralized clinical trials and personalized medicine drives the need for innovative blood collection solutions. Collaborations between device manufacturers and research institutes strengthen market penetration.

Needle Free Blood Drawing Devices Market Regional Analysis

- North America dominated the needle free blood drawing devices market with the largest revenue share of approximately 38.6% in 2025

- Supported by advanced healthcare infrastructure, high adoption of innovative medical devices, strong R&D presence, and a well-established network of hospitals, diagnostic centers, and research laboratories in the U.S.

- The region’s focus on patient-centric care and the growing preference for minimally invasive procedures further contribute to market growth

U.S. Needle Free Blood Drawing Devices Market Insight

The U.S. needle free blood drawing devices market captured the majority of North America’s revenue in 2025, driven by widespread adoption across hospitals, clinics, and diagnostic laboratories. Increasing investments in healthcare technology, patient safety initiatives, and government support for advanced medical devices are key factors propelling growth. Moreover, rising awareness about needle-free blood collection among patients and healthcare professionals is fueling demand for these devices.

Europe Needle Free Blood Drawing Devices Market Insight

The Europe needle free blood drawing devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing healthcare investments, stringent regulatory standards, and growing adoption of innovative diagnostic technologies. Key markets such as Germany, France, and the U.K. are witnessing significant demand across hospitals and diagnostic centers.

U.K. Needle Free Blood Drawing Devices Market Insight

The U.K. needle free blood drawing devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising demand for minimally invasive procedures, increased focus on patient comfort, and adoption of advanced medical devices across healthcare facilities. The robust healthcare infrastructure and increasing awareness of needle-free technologies support this growth.

Germany Needle Free Blood Drawing Devices Market Insight

Germany needle free blood drawing devices market is expected to expand at a considerable CAGR, fueled by technological advancements in medical devices, a well-established healthcare system, and strong R&D initiatives. Hospitals and research laboratories in Germany are increasingly adopting needle-free blood collection solutions to improve safety and efficiency.

Asia-Pacific Needle Free Blood Drawing Devices Market Insight

The Asia-Pacific needle free blood drawing devices market is expected to be the fastest-growing region in the Needle Free Blood Drawing Devices market during the forecast period, with an estimated CAGR of 8.1%. Growth is driven by increasing healthcare expenditure, expanding hospital networks, rising awareness of needle-free technologies, and growing adoption in emerging economies such as China and India.

Japan Needle Free Blood Drawing Devices Market Insight

Japan’s needle free blood drawing devices market is witnessing steady growth due to high healthcare standards, a strong focus on patient-centric care, and technological innovation in medical devices. The adoption of needle-free blood drawing solutions is increasing in hospitals and diagnostic centers to reduce patient discomfort and enhance procedural efficiency.

China Needle Free Blood Drawing Devices Market Insight

China needle free blood drawing devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding healthcare infrastructure, rising patient awareness, and growing adoption of advanced medical technologies. Increasing investments in hospitals and diagnostic facilities are further propelling the growth of needle-free blood drawing devices in the country.

Needle Free Blood Drawing Devices Market Share

The Needle Free Blood Drawing Devices industry is primarily led by well-established companies, including:

• Paxman Coolers (U.K.)

• Danaher Corporation (U.S.)

• Fresenius Kabi AG (Germany)

• Cardinal Health (U.S.)

• Terumo Corporation (Japan)

• Retractable Technologies, Inc. (U.S.)

• Nipro Corporation (Japan)

• Ortho Clinical Diagnostics (U.S.)

• Sekisui Diagnostics (Japan)

• SteriPath (U.S.)

• Hemogenyx Pharmaceuticals (U.K.)

• Micron Biomedical (U.S.)

• Vacuette (Austria)

• Innokas Medical (Finland)

• Precision Medical Devices (U.S.)

• Sarstedt AG & Co. (Germany)

• Greiner Bio-One (Austria)

• Medtronic (U.S.)

• Haemonetics Corporation (U.S.)

Latest Developments in Global Needle Free Blood Drawing Devices Market

- In November 2023, Becton, Dickinson and Company (BD), a global leader in medical technology, announced the commercial launch of its PIVO Pro Needle-Free Blood Collection Device in the U.S., designed to enable blood draws directly from peripheral IV catheters without additional needle sticks. The PIVO Pro builds on BD’s existing PIVO platform and is compatible with integrated IV catheter systems, helping reduce patient discomfort, minimize needlestick injuries for healthcare workers, and improve clinical workflow efficiency. The device received FDA 510(k) clearance and supports BD’s “One-Stick Hospital Stay” initiative, underscoring the company’s commitment to advancing patient-centric and needle-free blood collection technologies

- In March 2022, Vitestro, a Netherlands-based medical robotics company, unveiled its autonomous blood collection device that combines artificial intelligence, imaging, and robotic technology to automate blood draws with minimal human intervention. Although still in early clinical deployment, the system represents a major technological advancement toward reducing pain, anxiety, and procedural variability associated with traditional venipuncture. This development highlighted the growing convergence of robotics and needle-free or low-invasiveness blood collection solutions in modern healthcare settings

- In October 2022, Tasso, Inc., a U.S.-based blood collection device company, announced the expanded use of its Tasso+ self-collection device through partnerships with healthcare and diagnostic service providers. The Tasso+ device enables needle-free capillary blood collection from the upper arm and is designed for both clinical and at-home use. This development significantly broadened the application of needle-free blood drawing devices in decentralized testing, remote diagnostics, and population health screening programs, supporting the shift toward patient-managed sample collection

- In April 2024, YourBio Health, a medical device innovator specializing in painless blood collection, advanced its Touch Activated Phlebotomy (TAP) technology with increased clinical adoption and visibility across healthcare and diagnostic markets. The TAP device uses a bladeless microneedle array to collect blood without traditional needles, significantly reducing pain and anxiety. This development reinforced growing demand for wearable and handheld needle-free blood drawing devices, particularly for point-of-care testing, clinical trials, and remote health monitoring

- In January 2025, Carilion Clinic, a major U.S. healthcare system, announced the implementation of BD’s PIVO needle-free blood draw technology across its inpatient facilities, becoming one of the first health systems in its region to adopt the solution at scale. This deployment demonstrated real-world clinical adoption of needle-free blood drawing devices, highlighting benefits such as reduced patient discomfort, fewer venipunctures, and improved vascular access management, further validating the commercial viability of these technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.