Global Needle Free Diabetes Care Market

Market Size in USD Billion

CAGR :

%

USD

17.30 Billion

USD

29.70 Billion

2025

2033

USD

17.30 Billion

USD

29.70 Billion

2025

2033

| 2026 –2033 | |

| USD 17.30 Billion | |

| USD 29.70 Billion | |

|

|

|

|

Needle-Free Diabetes Care Market Size

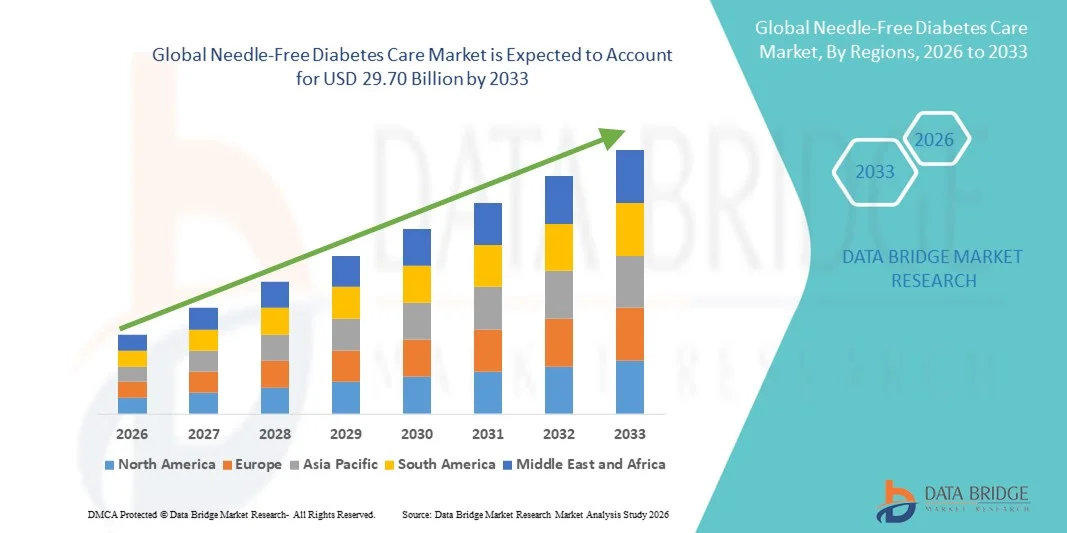

- The global needle-free diabetes care market size was valued at USD 17.30 billion in 2025 and is expected to reach USD 29.70 billion by 2033, at a CAGR of 6.99% during the forecast period

- The market growth is largely fueled by the rising prevalence of diabetes worldwide, increasing demand for non‑invasive and patient‑friendly insulin delivery and monitoring solutions, and continuous technological advancements in needle‑free drug delivery and glucose management systems that enhance patient comfort, compliance, and clinical outcomes

- Furthermore, growing awareness among patients and healthcare providers about the benefits of needle‑free technologies over traditional injection methods including reduced pain, lower risk of infections, and improved quality of life is driving adoption in both homecare and clinical settings,

Needle-Free Diabetes Care Market Analysis

- Needle-free diabetes care devices, offering non-invasive insulin delivery and glucose management, are increasingly vital components of modern diabetes treatment in both homecare and clinical settings due to their enhanced patient comfort, improved compliance, and reduced risk of infections

- The escalating demand for needle-free diabetes care solutions is primarily fueled by the rising prevalence of diabetes worldwide, growing awareness of non-invasive treatment benefits, and a preference among patients and healthcare providers for painless and convenient alternatives to traditional injections

- North America dominated the needle-free diabetes care market with the largest revenue share of 40.2% in 2025, characterized by early adoption of advanced medical technologies, high healthcare spending, and a strong presence of key industry players, with the U.S. witnessing substantial growth in needle-free device usage, particularly in homecare settings and outpatient clinics, driven by innovations in insulin jet injectors and smart drug delivery systems

- Asia-Pacific is expected to be the fastest-growing region in the needle-free diabetes care market during the forecast period due to increasing diabetes prevalence, expanding healthcare infrastructure, and rising disposable incomes

- Insulin delivery segment dominated the needle-free diabetes care market with a market share of 47.5% in 2025, driven by their established effectiveness, ease of use, and growing acceptance among patients seeking non-invasive alternatives to conventional injections

Report Scope and Needle-Free Diabetes Care Market Segmentation

|

Attributes |

Needle-Free Diabetes Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Needle-Free Diabetes Care Market Trends

Integration with Digital Health Platforms and Smart Monitoring

- A significant and accelerating trend in the global needle-free diabetes care market is the growing integration with digital health platforms and continuous glucose monitoring (CGM) systems, enhancing patient convenience, adherence, and real-time diabetes management

- For instance, insulin jet injectors now sync with smartphone apps to track dosage, send reminders, and record glucose levels, providing patients and clinicians with actionable data

- Smart needle-free devices leverage AI algorithms to predict optimal insulin delivery timing, detect anomalies in glucose trends, and provide alerts for missed doses, improving overall treatment outcomes

- The integration of needle-free devices with telemedicine and remote monitoring platforms allows healthcare providers to monitor multiple patients simultaneously, adjust therapies remotely, and reduce clinic visits

- The development of compact, portable, and wearable needle-free devices is enhancing usability for on-the-go patients and promoting adherence in everyday life

- Increasing partnerships between device manufacturers and digital health companies are accelerating innovation and introducing new features such as automated insulin dosing and personalized feedback

- This trend toward connected, data-driven, and patient-centric diabetes management is fundamentally transforming patient expectations for convenience, adherence, and personalized care

- The demand for devices that offer seamless digital integration is growing rapidly across homecare and clinical sectors, as patients increasingly prioritize painless, connected, and user-friendly solutions

Needle-Free Diabetes Care Market Dynamics

Driver

Rising Diabetes Prevalence and Preference for Non-Invasive Solutions

- The increasing global prevalence of diabetes, coupled with the growing awareness of needle-free and non-invasive insulin delivery options, is a significant driver for the heightened adoption of needle-free diabetes care devices

- For instance, in March 2025, Antares Pharma introduced a new needle-free insulin injector with integrated connectivity to mobile health apps, aiming to improve adherence and patient convenience

- As patients seek more comfortable and pain-free alternatives to conventional injections, needle-free devices offer precise dosing, reduced anxiety, and improved quality of life, making them a preferred choice

- Furthermore, expanding healthcare access, increasing patient education on modern diabetes management, and the growing popularity of home-based care are driving market adoption

- The ease of use, portability, and compatibility with digital health tools, alongside the ability to track and manage insulin administration remotely, are key factors propelling adoption in both developed and emerging regions

- Technological advancements in needle-free insulin delivery, such as faster absorption and improved bioavailability, are enhancing therapeutic outcomes and boosting market demand

- Increasing government and private initiatives to promote non-invasive diabetes care solutions in both homecare and institutional settings are creating additional growth opportunities

Restraint/Challenge

High Device Cost and Regulatory Compliance Hurdles

- The relatively high cost of advanced needle-free diabetes care devices compared to conventional insulin pens and syringes is a significant challenge to widespread adoption, especially in price-sensitive regions

- For instance, premium needle-free insulin injectors with digital connectivity or integrated CGM features often command a higher price, limiting access for patients in developing countries

- In addition, navigating stringent regulatory approvals for medical devices across different countries can delay market entry and increase development costs for manufacturers

- Concerns about device reliability, dosing accuracy, and proper patient usage require extensive training and awareness campaigns, which can be barriers to adoption

- While prices are gradually decreasing and generic options are emerging, the perceived premium for needle-free technology continues to hinder adoption among cost-conscious patients

- Limited awareness and trust among patients and healthcare providers regarding the efficacy of needle-free insulin delivery compared to traditional methods can slow adoption

- Reimbursement challenges in certain regions, where insurance coverage for needle-free devices is limited, pose an additional hurdle for market expansion

- Overcoming these challenges through affordable device options, streamlined regulatory pathways, and patient education will be vital for sustained growth in the needle-free diabetes care market

Needle-Free Diabetes Care Market Scope

The market is segmented on the basis of device types, treatment, application, and end users.

- By Device Type

On the basis of device type, the needle-free diabetes care market is segmented into treatment devices and diagnostic devices. The treatment devices segment dominated the market with the largest revenue share of 60% in 2025, driven by their central role in insulin delivery and diabetes management. These devices include insulin jet injectors, inhalers, and insulin patches, which offer non-invasive alternatives to conventional needles, improving patient comfort and adherence. The market demand is fueled by patients’ preference for painless administration and increasing integration with digital health platforms for remote monitoring. Clinics and homecare settings also favor treatment devices due to their ease of use and compatibility with continuous glucose monitoring systems. In addition, innovations such as AI-enabled insulin dosing and mobile app connectivity further boost adoption. Overall, treatment devices remain the backbone of the needle-free diabetes care market due to their direct impact on patient outcomes.

The diagnostic devices segment is anticipated to witness the fastest growth rate of 11% CAGR from 2026 to 2033, driven by the rising adoption of non-invasive glucose monitoring and early detection technologies. These include needle-free glucose meters and sensors that reduce patient discomfort and allow frequent monitoring without finger pricks. The increasing prevalence of diabetes worldwide and awareness of the benefits of painless diagnostics fuel market expansion. Diagnostic devices also see strong uptake in hospitals and clinics for continuous monitoring and patient education. Integration with mobile apps and telehealth platforms enhances their attractiveness for home-based care. In addition, government initiatives promoting early diabetes detection are supporting growth in this segment.

- By Treatment

On the basis of treatment, the market is segmented into oral insulin, inhaled insulin, insulin patch, and others. The insulin patch segment dominated the market with a revenue share of 35% in 2025, owing to its convenience, portability, and precise dosing capabilities. Insulin patches allow continuous insulin delivery without repeated injections, improving adherence and quality of life for patients. Their design flexibility and ease of integration with wearable digital health platforms make them attractive for both homecare and clinical settings. The market growth is further supported by technological innovations in patch materials, dosing accuracy, and app connectivity. Patients increasingly prefer patches for discreet, painless, and long-acting insulin administration. Pharmaceutical companies are also expanding their product portfolios with advanced patch designs, strengthening this segment’s dominance. Overall, insulin patches are considered the most user-friendly and widely accepted needle-free treatment option.

The inhaled insulin segment is expected to witness the fastest CAGR of 12% from 2026 to 2033, driven by patient demand for rapid-acting, non-invasive insulin alternatives. Inhaled insulin is particularly beneficial for those requiring quick glucose control, offering an attractive alternative to subcutaneous injections. Adoption is growing in developed regions with high awareness of modern diabetes care, as well as in emerging markets as devices become more affordable. Strong support from clinical guidelines and ongoing innovations in inhaler design enhance the segment’s growth. Integration with smart monitoring systems and mobile apps for dosage tracking also boosts acceptance. Patients value inhaled insulin for its convenience, portability, and reduced stigma compared to traditional needles.

- By Application

On the basis of application, the market is segmented into insulin delivery and other applications. The insulin delivery segment dominated the needle-free diabetes care market with a market share of 47.5% in 2025, driven by the primary role of needle-free devices in managing diabetes. This segment includes insulin jet injectors, patches, and inhalers that provide non-invasive, accurate, and convenient insulin administration. Adoption is supported by patient preference for painless treatment and the integration of devices with digital health platforms. Healthcare providers and homecare users favor needle-free insulin delivery for improved adherence, reduced infection risk, and better glycemic control. Technological innovations such as automated dosing and remote monitoring enhance the effectiveness and appeal of this segment. Regulatory approvals and clinical endorsements further strengthen market confidence in insulin delivery devices.

The other applications segment is expected to witness the fastest growth rate of 10.5% CAGR from 2026 to 2033, including needle-free delivery of adjunctive therapies and experimental treatments such as peptide or GLP-1 administration. Growth is driven by increasing research and adoption of multi-drug delivery systems and combination therapies. Hospitals and clinical research centers are exploring these applications for better patient compliance and pain-free treatment protocols. The rise of personalized medicine and homecare therapeutic solutions further supports expansion. These applications benefit from integration with telehealth platforms and wearable monitoring devices. In addition, government initiatives and funding for diabetes innovation accelerate adoption of alternative needle-free therapies.

- By End User

On the basis of end user, the market is segmented into diagnostic centers, hospitals & clinics, and other end users. The hospitals & clinics segment dominated the market with a revenue share of 55% in 2025, owing to high adoption of needle-free treatment and diagnostic devices in clinical settings. Hospitals prioritize non-invasive devices to enhance patient comfort, reduce needle-stick injuries, and improve adherence to insulin therapy. Clinics use these devices for continuous monitoring, training, and remote patient management. The market is further strengthened by collaborations between hospitals and device manufacturers to introduce advanced needle-free solutions. Homecare programs run by hospitals also encourage adoption of these devices. In addition, the availability of trained healthcare professionals to guide patients increases trust and usage.

The other end users segment is expected to witness the fastest CAGR of 12% from 2026 to 2033, which includes homecare patients, wellness centers, and remote monitoring programs. Growth is driven by the rising demand for patient-centric, self-administered treatments and the expansion of telemedicine. Homecare adoption is supported by increasing awareness of needle-free diabetes devices, convenience, and safety advantages. Integration with mobile health apps allows patients to monitor insulin usage, set reminders, and share data with healthcare providers. The rising prevalence of diabetes in emerging markets and increasing disposable incomes further accelerate adoption. Government initiatives promoting home-based care and chronic disease management also support this segment’s rapid growth.

Needle-Free Diabetes Care Market Regional Analysis

- North America dominated the needle-free diabetes care market with the largest revenue share of 40.2% in 2025, characterized by early adoption of advanced medical technologies, high healthcare spending, and a strong presence of key industry players

- Patients and healthcare providers in the region highly value the convenience, pain-free insulin delivery, and seamless integration of needle-free devices with digital health platforms and continuous glucose monitoring systems

- This widespread adoption is further supported by high healthcare spending, early adoption of advanced medical technologies, and the presence of leading device manufacturers, establishing needle-free diabetes care as a preferred solution in both homecare and clinical settings

U.S. Needle-Free Diabetes Care Market Insight

The U.S. needle-free diabetes care market captured the largest revenue share of 82% in 2025 within North America, fueled by the rapid adoption of non-invasive insulin delivery devices and rising awareness of modern diabetes management solutions. Patients increasingly prioritize convenience, pain-free insulin administration, and real-time monitoring through connected digital health platforms. The growing preference for homecare and telemedicine, combined with robust demand for integrated mobile app and wearable device support, further propels the market. Moreover, the presence of leading device manufacturers and ongoing technological innovations in insulin patches, inhalers, and jet injectors significantly contribute to market expansion.

Europe Needle-Free Diabetes Care Market Insight

The Europe needle-free diabetes care market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by government initiatives promoting diabetes care, reimbursement policies, and the rising need for painless and patient-friendly treatment solutions. The increase in urbanization, coupled with higher healthcare awareness and adoption of digital health devices, is fostering market growth. European patients are drawn to the convenience, accuracy, and integration of needle-free devices with continuous glucose monitoring systems. The region is experiencing significant growth across hospitals, clinics, and homecare applications, with needle-free devices being incorporated into both new treatment programs and ongoing chronic care plans.

U.K. Needle-Free Diabetes Care Market Insight

The U.K. needle-free diabetes care market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising patient preference for non-invasive insulin delivery and advanced glucose monitoring systems. Concerns regarding injection-related pain, compliance issues, and chronic diabetes management are encouraging patients and healthcare providers to adopt needle-free solutions. The U.K.’s robust healthcare infrastructure, strong telemedicine adoption, and high awareness of digital health solutions are expected to continue stimulating market growth.

Germany Needle-Free Diabetes Care Market Insight

The Germany needle-free diabetes care market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of diabetes management, patient-centric care approaches, and the adoption of advanced non-invasive devices. Germany’s well-developed healthcare infrastructure, emphasis on innovation, and focus on quality medical devices promote adoption in both hospitals and homecare settings. Integration with digital health platforms and telemonitoring services is becoming increasingly common, with a strong preference for reliable, accurate, and easy-to-use needle-free devices aligning with local patient and provider expectations.

Asia-Pacific Needle-Free Diabetes Care Market Insight

The Asia-Pacific needle-free diabetes care market is poised to grow at the fastest CAGR of 24% from 2026 to 2033, driven by rising diabetes prevalence, increasing disposable incomes, and expanding healthcare infrastructure in countries such as China, Japan, and India. The growing awareness of non-invasive treatment options, combined with government initiatives promoting chronic disease management, is fueling adoption. In addition, APAC is emerging as both a manufacturing hub for needle-free diabetes devices and a rapidly expanding consumer market, making devices more affordable and accessible to a larger patient base.

Japan Needle-Free Diabetes Care Market Insight

The Japan needle-free diabetes care market is gaining momentum due to the country’s aging population, high technology adoption, and strong emphasis on quality healthcare. Patients increasingly prefer needle-free devices for convenience, pain-free insulin administration, and integration with home monitoring and digital health solutions. The rise of smart home healthcare systems and connected devices, alongside the demand for easier-to-use solutions in both residential and clinical settings, is driving market expansion.

India Needle-Free Diabetes Care Market Insight

The India needle-free diabetes care market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing middle class, and increasing awareness of modern diabetes management solutions. India represents one of the largest emerging markets for non-invasive diabetes care, with hospitals, clinics, and homecare users increasingly adopting insulin patches, inhalers, and jet injectors. Government initiatives promoting smart healthcare and affordable device options, alongside strong domestic and international manufacturers, are key factors propelling market growth in India.

Needle-Free Diabetes Care Market Share

The Needle-Free Diabetes Care industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Dexcom, Inc. (U.S.)

- Medtronic (Ireland)

- Insulet Corporation (U.S.)

- Tandem Diabetes Care (U.S.)

- Valeritas, Inc. (U.S.)

- PharmaJet (U.S.)

- Senseonics Holdings, Inc. (U.S.)

- Nemaura Medical Inc. (U.K.)

- Portal Instruments (U.S.)

- Antares Pharma, Inc. (U.S.)

- INJEX Pharma AG (Switzerland)

- GlySens Incorporated (U.S.)

- MannKind Corporation (U.S.)

- BD (U.S.)

- Novo Nordisk A/S (Denmark)

- Ascensia Diabetes Care (Switzerland)

- OmniPod (U.S.)

- Sequel Med Tech, LLC (U.S.)

What are the Recent Developments in Global Needle-Free Diabetes Care Market?

- In September 2025, the U.S. Food and Drug Administration granted De Novo classification to Biolinq Shine, the first fully autonomous needle‑free glucose biosensor that tracks glucose without requiring a subcutaneous introducer needle, marking a significant regulatory milestone for wearable needle‑free glucose monitoring

- In August 2025, NuGen Medical Devices announced the development of a new needle‑free injection system featuring an internal sterile insulin cartridge, designed to simplify dosing and enhance safety compared with current InsuJet devices

- In July 2025, NuGen Medical Devices unveiled a dedicated French e‑commerce site for its InsuJet™ needle‑free insulin delivery system, allowing patients in France to directly access product info, purchasing, and optional nurse‑led onboarding support for easier adoption

- In November 2024, NuGen Medical Devices commercially launched InsuJet™ in Canada, placing starter kits into pharmacies shortly after World Diabetes Day, expanding patient access to pain‑free insulin delivery

- In July 2022, Health Canada granted insulin‑specific approval for NuGen’s InsuJet™ needle‑free injection system, the first such approval in the country for pain‑free insulin delivery, potentially enabling insurance coverage and broader adoption

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.