Global Nematicides Market

Market Size in USD Billion

CAGR :

%

USD

1.63 Billion

USD

2.18 Billion

2024

2032

USD

1.63 Billion

USD

2.18 Billion

2024

2032

| 2025 –2032 | |

| USD 1.63 Billion | |

| USD 2.18 Billion | |

|

|

|

|

What is the Global Nematicides Market Size and Growth Rate?

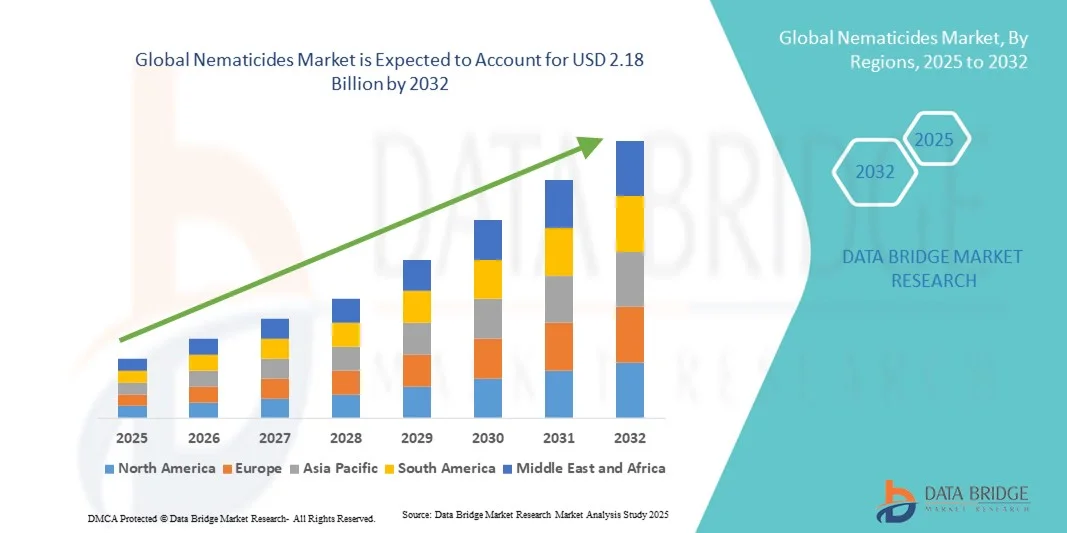

- The global nematicides market size was valued at USD 1.63 billion in 2024 and is expected to reach USD 2.18 billion by 2032, at a CAGR of 3.65% during the forecast period

- The increase in the preference towards organic food products among consumers across the globe acts as one of the major factors driving the growth of nematicides market. The rise in trend of bio-nematicides due to urging adoption of sustainable agriculture practices, and advancements in farming practices and technology accelerate the market growth

- The rise in in emphasis on integrated pest management solutions and support of various governments in encouraging development of bio-nematicides as a substitute of conventional synthetic pesticides further influence the market

What are the Major Takeaways of Nematicides Market?

- Surge in incidences of pollutions, high demand for high-value crops, rise in usage of various forms of biological products, increase in concerns regarding environment and crop losses due to pest attacks positively affect the nematicides market

- Furthermore, rise in demand for customized solutions targeted toward specific pests and usage of biologicals to gain traction extend profitable opportunities to the market players

- North America dominated the nematicides market with the largest revenue share of 37.1% in 2024, driven by rising awareness of crop protection solutions, technological adoption in agriculture, and the presence of advanced farming practices

- The Asia-Pacific nematicides market is poised to grow at the fastest CAGR of 10.98% during 2025–2032, driven by increasing adoption of modern farming techniques, urbanization, and rising disposable incomes in countries such as China, India, and Japan

- The Root-Knot Nematodes segment dominated the market with the largest revenue share of 42.8% in 2024, owing to their widespread prevalence and the significant crop losses they cause across vegetables, fruits, and field crops

Report Scope and Nematicides Market Segmentation

|

Attributes |

Nematicides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Nematicides Market?

Integration of Sustainable Biological Solutions and Precision Agriculture

- A prominent and accelerating trend in the global Nematicides market is the growing shift toward sustainable, biologically-based solutions combined with precision agriculture technologies. Farmers and agribusinesses are increasingly adopting bio-nematicides and environmentally friendly chemical alternatives to reduce reliance on synthetic chemicals and improve soil health

- For instance, products from companies such as Koppert Biological Systems and Marrone Bio Innovations offer bio-based nematodes and microbial formulations that target nematode pests while preserving beneficial soil organisms, supporting sustainable farming practices.

- Integration with precision agriculture enables nematicides to be applied more efficiently, using data-driven approaches such as GPS-guided spraying, soil health mapping, and AI-based pest prediction. This reduces over-application, minimizes environmental impact, and enhances crop yield and quality

- The seamless incorporation of nematicides with smart farming platforms allows farmers to monitor pest populations in real-time, track application efficiency, and optimize treatment schedules. This creates a highly data-driven, automated crop protection workflow

- This trend toward biologically sustainable solutions coupled with digital farming tools is fundamentally transforming nematode management strategies, prompting companies such as Syngenta and BASF to develop next-generation nematicides that are both eco-friendly and highly effective

- Rising awareness of sustainable farming practices, regulatory encouragement for reduced chemical use, and improved operational efficiency are driving rapid adoption of these integrated nematicide solutions globally

What are the Key Drivers of Nematicides Market?

- Increasing concerns about crop losses due to nematode infestations, coupled with the rising need for sustainable agricultural practices, are major drivers for the Nematicides market

- In March 2024, Syngenta launched a new bio-nematicide designed for vegetable crops that reduces nematode populations without harming soil microbiota, reflecting the industry’s push toward eco-friendly solutions

- Rising global food demand and the need to improve crop yield efficiency are compelling farmers to adopt effective nematode management strategies, driving demand for both chemical and biological nematicides

- Technological advancements in precision agriculture, including AI-based pest monitoring and GPS-enabled application tools, are further boosting market growth by enabling targeted and optimized nematicide use

- The ease of integrating nematicides with automated irrigation, fertilization, and crop monitoring systems enhances operational efficiency, saving time and reducing costs for both small-scale and commercial farmers

- Growing awareness of soil health and sustainable agriculture, combined with regulatory support for reduced chemical dependency, ensures continued market expansion across multiple regions

Which Factor is Challenging the Growth of the Nematicides Market?

- Environmental and regulatory constraints on synthetic chemical nematicides pose a significant challenge to market growth, as stricter safety regulations limit chemical usage in agriculture

- For instance, regulatory bans on certain chemical nematicides in the European Union and North America have led some farmers to seek alternative, often costlier, solutions

- In addition, the relatively high cost and slower efficacy of biological nematicides compared to traditional chemical options can discourage adoption, particularly among smallholder farmers or in developing regions

- Uncertainty regarding the performance of bio-based nematicides under diverse climatic and soil conditions adds to adoption challenges, with some farmers hesitant to switch from proven chemical treatments

- Overcoming these obstacles requires further innovation in formulation efficacy, increased farmer education on sustainable practices, and more cost-effective, scalable production of bio-nematicides

- Enhanced research, government incentives, and broader availability of integrated pest management solutions will be essential to drive sustained growth and adoption of nematicides globally

How is the Nematicides Market Segmented?

The market is segmented on the basis of nematode, type, form, mode of application, and crop type.

- By Nematode

On the basis of nematode type, the nematicides market is segmented into Root-Knot Nematodes, Cyst Nematodes, and Others. The Root-Knot Nematodes segment dominated the market with the largest revenue share of 42.8% in 2024, owing to their widespread prevalence and the significant crop losses they cause across vegetables, fruits, and field crops. Farmers and agribusinesses prioritize effective management solutions targeting these nematodes, driving strong demand for both chemical and bio-based nematicides. The segment benefits from extensive research and development aimed at improving control efficiency while minimizing environmental impact.

The Cyst Nematodes segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, fueled by increasing adoption of precision application techniques, the rising prevalence of cyst nematodes in high-value crops, and the growing awareness of integrated pest management (IPM) practices that combine chemical, biological, and cultural control measures for effective nematode suppression.

- By Type

On the basis of nematicide type, the market is segmented into Fumigants, Carbamates, Organophosphates, Bio-Nematicides, and Others. The Fumigants segment held the largest market revenue share of 39.5% in 2024, supported by their broad-spectrum activity, rapid action, and consistent effectiveness in controlling nematode populations in high-value crops and commercial fields. Fumigants are preferred for pre-planting soil treatment, providing growers with reliable nematode suppression across diverse soil types.

The Bio-Nematicides segment is projected to register the fastest growth rate of 23.4% during 2025–2032, driven by increasing demand for eco-friendly and sustainable crop protection solutions. Growing consumer awareness about chemical residues, stringent environmental regulations, and government incentives for adopting biological alternatives are encouraging farmers to integrate bio-nematicides into conventional pest management strategies.

- By Form

On the basis of formulation, the nematicides market is segmented into Granular Form, Liquid Form, Emulsifiable Concentrates, and Others. The Granular Form segment dominated the market with a revenue share of 41% in 2024, as granular nematicides provide easy soil incorporation, uniform distribution, and prolonged residual activity, making them suitable for both large-scale field crops and high-value horticulture. Farmers value the convenience and precision offered by granular formulations in targeted nematode control applications.

The Liquid Form segment is expected to witness the fastest CAGR of 21.5% from 2025 to 2032, owing to its suitability for drenching, soil dressing, and integration with automated irrigation systems. Liquids allow precise dosing, improved coverage, and better compatibility with modern mechanized and precision agriculture techniques, driving growth in both commercial and smallholder farms.

- By Mode of Application

On the basis of application mode, the nematicides market is segmented into Fumigation, Drenching, Soil Dressing, and Seed Treatment. The Fumigation segment held the largest market revenue share of 40.3% in 2024, due to its rapid, broad-spectrum control of nematodes and ability to prepare soil before planting high-value crops such as vegetables, fruits, and nursery plants. Fumigation remains the preferred choice for commercial agriculture where early nematode control is critical for yield optimization.

The Seed Treatment segment is expected to witness the fastest CAGR of 22.7% during 2025–2032, driven by the increasing adoption of coated seeds integrated with bio-nematicides and chemicals. Seed treatment provides early-stage protection against nematodes, reduces crop losses, enhances seedling vigor, and aligns with sustainable farming practices that reduce field application of nematicides.

- By Crop Type

On the basis of crop type, the nematicides market is segmented into Macroindicators, Field Crops, Fruits and Nuts, Vegetables, Grains and Cereals, Pulses and Oilseeds, Commercial Crops, and Others. The Vegetables segment dominated the market with the largest revenue share of 44% in 2024, as vegetable crops are highly susceptible to root-knot and cyst nematodes, leading to significant economic losses. Growers increasingly rely on both chemical and bio-based nematicides to maintain crop quality, yield, and market standards.

The Field Crops segment is anticipated to witness the fastest CAGR of 21.9% from 2025 to 2032, fueled by the expansion of cereal, pulse, and oilseed cultivation worldwide and the integration of nematode management into large-scale farming operations. The rise of precision agriculture, soil monitoring technologies, and sustainable pest management practices further contributes to the growing adoption of nematicides in field crops.

Which Region Holds the Largest Share of the Nematicides Market?

- North America dominated the nematicides market with the largest revenue share of 37.1% in 2024, driven by rising awareness of crop protection solutions, technological adoption in agriculture, and the presence of advanced farming practices

- Farmers and agribusinesses in the region highly value the efficiency, reliability, and ease of application offered by modern nematicides, helping to protect high-value crops and optimize yield

- The widespread adoption is further supported by advanced agricultural infrastructure, high mechanization levels, and the availability of skilled labor, making North America a critical hub for Nematicides consumption

U.S. Nematicides Market Insight

The U.S. nematicides market captured the largest revenue share of 81% in 2024 within North America, driven by rapid adoption of integrated pest management practices and precision agriculture. Farmers are increasingly prioritizing nematode control to maintain crop quality and profitability. Advanced distribution networks, strong R&D investment, and the growing use of biological and chemical nematicides further support market growth. The U.S. market is also fueled by government incentives promoting sustainable agriculture and effective pest management solutions.

Europe Nematicides Market Insight

The Europe nematicides market is projected to expand at a substantial CAGR during the forecast period, driven by stringent agricultural regulations, the increasing need for sustainable crop protection, and rising awareness about nematode-induced crop losses. Adoption is strong across field crops, vegetables, and high-value horticulture, supported by advanced farming infrastructure and government initiatives promoting integrated pest management. European farmers increasingly prefer eco-friendly nematicides to comply with environmental standards and enhance crop yield.

U.K. Nematicides Market Insight

The U.K. nematicides market is expected to grow steadily due to the rising demand for high-quality crop protection and the adoption of sustainable agriculture practices. Increased focus on vegetable, fruit, and nursery crops, alongside modern integrated pest management techniques, encourages the use of effective nematicides. In addition, the country’s robust research infrastructure and growing awareness among farmers regarding crop losses from nematodes support market expansion.

Germany Nematicides Market Insight

The Germany nematicides market is anticipated to grow at a considerable CAGR during the forecast period, driven by the adoption of advanced agricultural practices, sustainable crop protection methods, and technological innovation in the agrochemical sector. Farmers’ growing focus on protecting high-value crops from nematode infestations, coupled with strict environmental regulations and demand for eco-conscious solutions, promotes the adoption of nematicides across Germany.

Which Region is the Fastest Growing Region in the Nematicides Market?

The Asia-Pacific nematicides market is poised to grow at the fastest CAGR of 10.98% during 2025–2032, driven by increasing adoption of modern farming techniques, urbanization, and rising disposable incomes in countries such as China, India, and Japan. The growing focus on crop yield improvement, government initiatives promoting sustainable agriculture, and the rising awareness of nematode-related crop losses are accelerating demand. Furthermore, APAC is emerging as a production hub for both chemical and bio-nematicides, improving affordability and accessibility for a wider farmer base.

Japan Nematicides Market Insight

The Japan nematicides market is gaining traction due to the country’s emphasis on high-tech agriculture, precision farming, and the need for effective crop protection solutions. Farmers are increasingly using nematicides integrated with smart farming practices to prevent losses from root-knot and cyst nematodes, especially in vegetables and high-value crops. The aging farming population also drives demand for easy-to-use, efficient nematicide solutions.

China Nematicides Market Insight

The China nematicides market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, modernization of agriculture, and growing crop intensification. China’s large middle-class farmer base, increasing government support for sustainable crop protection, and the expansion of domestic nematicide manufacturing contribute to market growth. The push toward smart agriculture and increased adoption of bio-nematicides in addition to chemical solutions is further fueling demand.

Which are the Top Companies in Nematicides Market?

The nematicides industry is primarily led by well-established companies, including:

- Syngenta Crop Protection AG (Switzerland)

- Bayer AG (Germany)

- Corteva Agriscience (U.S.)

- BASF SE (Germany)

- UPL Limited (India)

- Bionema (U.K.)

- Vegalab SA (Switzerland)

- STK bio‑ag technologies (Netherlands)

- Andermatt Biocontrol AG (Switzerland)

- Koppert Biological Systems (Netherlands)

- Biobest Group NV (Belgium)

- Certis USA L.L.C. (U.S.)

- Valent BioSciences LLC (U.S.)

- Novozymes (Denmark)

- IPL Biologicals Limited (India)

- Terramera Inc. (Canada)

- Khandelwal Bio Fertilizer (India)

- Isagro (Italy)

- Gowan Company (U.S.)

- Parry America, Inc. (U.S.)

- Barrix Agro Sciences Pvt Ltd. (India)

- BioWorks Inc. (U.S.)

- Marrone Bio Innovations (U.S.)

- Nufarm (Australia)

- Bioline AgriSciences Ltd (U.K.)

- Biofa GmbH (Germany)

- BioConsortia, Inc. (U.S.)

- McLaughlin Gormley King Company (U.S.)

- W. Neudorff GmbH KG (Germany)

What are the Recent Developments in Global Nematicides Market?

- In March 2025, FMC Corporation expanded its biological crop protection platform in Canada by collaborating with Novonesis (formerly Novozymes A/S), a leading provider of plant biosolutions, strengthening its foothold in the biological nematicides market and enhancing crop protection efficiency

- In February 2025, BASF pre-launched Votivo Prime, a biological contact nematicide containing Bacillus firmus strain 1-1582, at the fourth EnBio event in Argentina, marking a significant advancement in sustainable nematode management solutions

- In January 2025, American Vanguard Corporation, through its crop business unit AMVAC, entered into a regional distribution agreement with DPH Biologicals to expand its GreenSolutions portfolio, including BellaTrove Companion Maxx, an EPA-approved biocontrol product providing both fungicidal and nematicidal activity, reinforcing its commitment to integrated pest management strategies

- In December 2023, Syngenta launched Certano, a microbiological bionematicide and the company's first biological product specifically designed for sugarcane cultivation, offering enhanced crop yield and sustainable pest control solutions

- In December 2022, Corteva launched Lumialza, its first bionematicide for seed treatment in Brazil, containing Bacillus amyloliquefaciens strain PTA-4838, providing farmers with an innovative approach to nematode management and supporting sustainable agricultural practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.