Global Neo And Challenger Bank Market

Market Size in USD Billion

CAGR :

%

USD

6.41 Billion

USD

8.45 Billion

2021

2029

USD

6.41 Billion

USD

8.45 Billion

2021

2029

| 2022 –2029 | |

| USD 6.41 Billion | |

| USD 8.45 Billion | |

|

|

|

|

Market Analysis and Size

According to Forbes, banks are expected to become invisible, connected, insights-driven and purposeful by the year 2030. Consumers are inclining towards neobanks and digital challenger as they are more digital, agile and innovative than a traditional banking system. These banks have successfully taken over various verticals, including payments and transfers, among others.

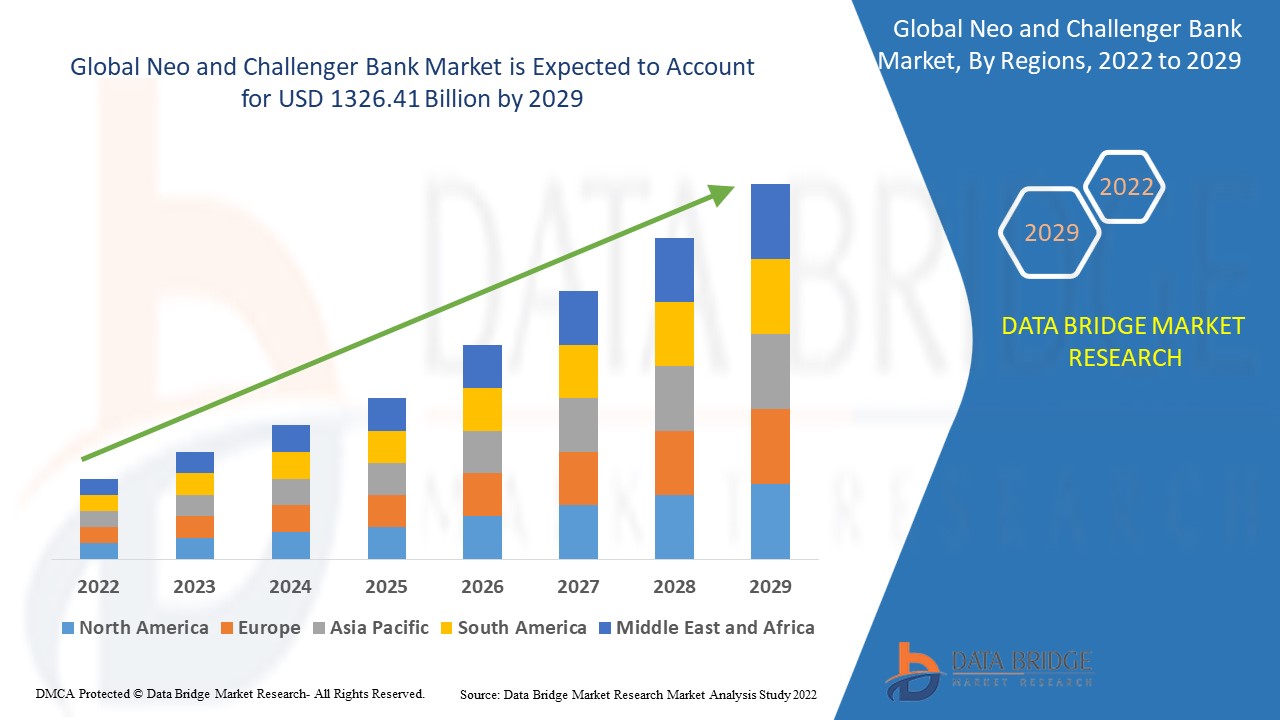

Global Neo and Challenger Bank Market was valued at USD 6.41 billion in 2021 and is expected to reach USD 1326.41 billion by 2029, registering a CAGR of 47.80% during the forecast period of 2022-2029. “Mobile Banking” is expected to witness high growth owing to the rapid digitization and adoption of smartphones globally. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Market Definition

A neobank refers to financial tech startup that mainly focuses on delivering excellent customer experience. The major aim of the technology is acquiring as many clients as possible. It facilitates lending, payment options, and money transfers, among other banking services. Digital challenger banks are known to be similar to traditional banking institutions, but they do not require or have physical presence.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Neo Bank, Challenger Bank), Application (Personal, Business), Services Provided (Checking and Savings Account, Payment and Money Transfer, Loans, Mobile Banking, Investment Accounts, Retirement Savings, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Atom bank (UK), Fidor Solutions AG (Germany), Monzo Bank Limited (UK), Moven Enterprise (US), N26 GmbH (Germany), Tandem Bank Limited (UK), Pockit LTD (UK), UBank (Australia), PRETA S.A.S. (France), WeBank (China), Holvi Payment Services Ltd (Finaland), Hello bank (France), KOHO Financial Inc. (Canada), Rocket Bank (Russia), Soon Banque (France), Banco Bilbao Vizcaya Argentaria, S.A. (Spain), Starling Bank (UK), and DBS Bank India Limited (India), among others |

|

Market Opportunities |

|

Neo and Challenger Bank Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Need for Advanced Features in Banking

The emergence of neo and challenger banks the banking industry incorporating advance features, client-centric products and services, and real-time services acts as one of the major factors driving the neo and challenger bank market.

- Increase in Popularity of Challenger Banks

The increase in the popularity of challenger banks owing to its services such as investments and savings accounts, mobile banking, lending, checking and merchant accounts, among others accelerate the market growth. These banks are also considered beneficial for buying and selling of cryptocurrency, insurance products and retirement savings.

- Higher Interest Rates

The increase in adoption of these banks due to their higher interest rates over traditional banks further influence the market. Also, the increase in government and regulatory supports toward banking operations has a positive impact on the market growth.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the neo and challenger bank market.

Opportunities

Furthermore, online offerings to unbanked population in the emerging economies extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Also, the introduction of both Artificial Intelligence (AI) and Machine Learning (ML) will further expand the market.

Restraints/Challenges

On the other hand, issues with maintaining strong customer relations via online services along with good customer experience are expected to obstruct market growth. Limited profitability for these start-up banks is projected to challenge the neo and challenger bank market in the forecast period of 2022-2029.

This neo and challenger bank market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on neo and challenger bank market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Neo and Challenger Bank Market

COVID-19 had a positive impact on the neo and challenger bank market due to the rise in number of end users adopting neo and challenger bank solutions tools during the outbreak of COVID-19. An increase in the adoption of these banks for services, including Payment and Money Transfer, Checking and Savings Account, and Mobile Banking was witnessed owing to the strict lockdowns and social distancing to contain the spread of the virus. The neo and challenger bank market is expected to witness high growth in the post-pandemic scenario owing to the rise in awareness regarding the potential benefits of neo and challenger bank.

Recent Developments

- In May’2022, Neo Financial became a part of Canada’s unicorns after securing a $185 million CAD Series C round at a valuation of more than $1 billion. The round marked the third consecutive round that Peter Thiel-backed firm Valar Ventures leading for Neo.

Global Neo and Challenger Bank Market Scope and Market Size

The neo and challenger bank market is segmented on the basis of type, services provided, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Neo Bank

- Challenger Bank

Small Challenger

Large Challenger

Services Provided

- Checking and Savings Account

- Payment and Money Transfer

- Loans

- Mobile Banking

- Investment Accounts

- Retirement Savings

- Others

Application

- Personal

- Business

Neo and Challenger Bank Market Regional Analysis/Insights

The neo and challenger bank market is analysed and market size insights and trends are provided by country, type, services provided, and application as referred above.

The countries covered in the neo and challenger bank market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the neo and challenger bank market due to the prevalence of the major financial institutions and increased consumer awareness within the region.

Asia-Pacific (APAC) is expected to witness significant growth during the forecast period of 2022 to 2029 because of the growth of the banking sector in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Neo and Challenger Bank Market

The neo and challenger bank market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to neo and challenger bank market.

Some of the major players operating in neo and challenger bank market are

- Atom bank (UK)

- Fidor Solutions AG (Germany)

- Monzo Bank Limited (UK)

- Moven Enterprise (US)

- N26 GmbH (Germany)

- Tandem Bank Limited (UK)

- Pockit LTD (UK)

- UBank (Australia)

- PRETA S.A.S. (France)

- WeBank (China)

- Holvi Payment Services Ltd (Finaland)

- Hello bank (France)

- KOHO Financial Inc. (Canada)

- Rocket Bank (Russia)

- Soon Banque (France)

- Banco Bilbao Vizcaya Argentaria, S.A. (Spain)

- Starling Bank (UK)

- DBS Bank India Limited (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL NEO AND CHALLENGER BANK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL NEO AND CHALLENGER BANK MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL NEO AND CHALLENGER BANK MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CASE STUDIES

5.2 REGULATORY FRAMEWORK

5.3 TECHNOLOGICAL TRENDS

5.4 PRICING ANALYSIS

5.5 VALUE CHAIN ANALYSIS

6 GLOBAL NEO AND CHALLENGER BANK MARKET, BY SERVICE TYPE

6.1 OVERVIEW

6.2 MOBILE BANKING

6.3 PAYMENT & MONEY TRANSFER

6.4 LOANS

6.5 SAVINGS ACCOUNT

6.6 TAXATION

6.7 OTHERS

7 GLOBAL NEO AND CHALLENGER BANK MARKET, BY LAYER TYPE

7.1 OVERVIEW

7.2 TRANSACTION MONITORING AND COMPLIANCE

7.3 PAYMENT GATEWAYS

7.4 MULTIPLE BANKING PARTNERS

7.5 EMERGING TECH ACCESS READY

7.6 OTHERS

8 GLOBAL NEO AND CHALLENGER BANK MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 SMALL SCALE ORGANIZATIONS

8.3 MEDIUM SCALE ORGANIZATIONS

8.4 LARGE SCALE ORGANIZATIONS

9 GLOBAL NEO AND CHALLENGER BANK MARKET, BY END-USE

9.1 OVERVIEW

9.2 IT & TELECOMMUNICATION

9.2.1 BY SERVICE TYPE

9.2.1.1. MOBILE BANKING

9.2.1.2. PAYMENT & MONEY TRANSFER

9.2.1.3. LOANS

9.2.1.4. SAVINGS ACCOUNT

9.2.1.5. TAXATION

9.2.1.6. OTHERS

9.3 EDUCATION

9.3.1 BY SERVICE TYPE

9.3.1.1. MOBILE BANKING

9.3.1.2. PAYMENT & MONEY TRANSFER

9.3.1.3. LOANS

9.3.1.4. SAVINGS ACCOUNT

9.3.1.5. TAXATION

9.3.1.6. OTHERS

9.4 TRAVEL & HOSPITALITY

9.4.1 BY SERVICE TYPE

9.4.1.1. MOBILE BANKING

9.4.1.2. PAYMENT & MONEY TRANSFER

9.4.1.3. LOANS

9.4.1.4. SAVINGS ACCOUNT

9.4.1.5. TAXATION

9.4.1.6. OTHERS

9.5 E-COMMERCE

9.5.1 BY SERVICE TYPE

9.5.1.1. MOBILE BANKING

9.5.1.2. PAYMENT & MONEY TRANSFER

9.5.1.3. LOANS

9.5.1.4. SAVINGS ACCOUNT

9.5.1.5. TAXATION

9.5.1.6. OTHERS

9.6 OTHERS

9.6.1 BY SERVICE TYPE

9.6.1.1. MOBILE BANKING

9.6.1.2. PAYMENT & MONEY TRANSFER

9.6.1.3. LOANS

9.6.1.4. SAVINGS ACCOUNT

9.6.1.5. TAXATION

9.6.1.6. OTHERS

10 GLOBAL NEO AND CHALLENGER BANK MARKET, BY REGION

GLOBAL NEO AND CHALLENGER BANK MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

10.2 EUROPE

10.2.1 GERMANY

10.2.2 FRANCE

10.2.3 U.K.

10.2.4 ITALY

10.2.5 SPAIN

10.2.6 RUSSIA

10.2.7 TURKEY

10.2.8 BELGIUM

10.2.9 NETHERLANDS

10.2.10 SWITZERLAND

10.2.11 REST OF EUROPE

10.3 ASIA PACIFIC

10.3.1 JAPAN

10.3.2 CHINA

10.3.3 SOUTH KOREA

10.3.4 INDIA

10.3.5 AUSTRALIA

10.3.6 SINGAPORE

10.3.7 THAILAND

10.3.8 MALAYSIA

10.3.9 INDONESIA

10.3.10 PHILIPPINES

10.3.11 REST OF ASIA PACIFIC

10.4 SOUTH AMERICA

10.4.1 BRAZIL

10.4.2 ARGENTINA

10.4.3 REST OF SOUTH AMERICA

10.5 MIDDLE EAST AND AFRICA

10.5.1 SOUTH AFRICA

10.5.2 EGYPT

10.5.3 SAUDI ARABIA

10.5.4 U.A.E

10.5.5 ISRAEL

10.5.6 REST OF MIDDLE EAST AND AFRICA

11 GLOBAL NEO AND CHALLENGER BANK MARKET,COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.5 MERGERS & ACQUISITIONS

11.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

11.7 EXPANSIONS

11.8 REGULATORY CHANGES

11.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12 GLOBAL NEO AND CHALLENGER BANK MARKET, SWOT AND DBMR ANALYSIS

13 GLOBAL NEO AND CHALLENGER BANK MARKET, COMPANY PROFILE

13.1 MONZO BANK LIMITED

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 GEOGRAPHIC PRESENCE

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 FIDOR SOLUTIONS AG

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 GEOGRAPHIC PRESENCE

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 SIMPLE FINANCE TECHNOLOGY CORPORATION

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 GEOGRAPHIC PRESENCE

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 UBANK LIMITED

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 GEOGRAPHIC PRESENCE

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 TANDEM BANK

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 GEOGRAPHIC PRESENCE

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ATOM BANK PLC

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 GEOGRAPHIC PRESENCE

13.6.4 PRODUCT PORTFOLIO

13.6.5 RECENT DEVELOPMENTS

13.7 WEBANK

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 GEOGRAPHIC PRESENCE

13.7.4 PRODUCT PORTFOLIO

13.7.5 RECENT DEVELOPMENTS

13.8 MOVENCORP, INC

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 GEOGRAPHIC PRESENCE

13.8.4 PRODUCT PORTFOLIO

13.8.5 RECENT DEVELOPMENTS

13.9 NUMBER26 GMBH

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 GEOGRAPHIC PRESENCE

13.9.4 PRODUCT PORTFOLIO

13.9.5 RECENT DEVELOPMENTS

13.1 MY BANK

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 GEOGRAPHIC PRESENCE

13.10.4 PRODUCT PORTFOLIO

13.10.5 RECENT DEVELOPMENTS

13.11 ORANGE BANK

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 GEOGRAPHIC PRESENCE

13.11.4 PRODUCT PORTFOLIO

13.11.5 RECENT DEVELOPMENTS

13.12 AIRSTAR BANK

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 GEOGRAPHIC PRESENCE

13.12.4 PRODUCT PORTFOLIO

13.12.5 RECENT DEVELOPMENTS

13.13 FREO MONEY

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 GEOGRAPHIC PRESENCE

13.13.4 PRODUCT PORTFOLIO

13.13.5 RECENT DEVELOPMENTS

13.14 BIGPAY

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 GEOGRAPHIC PRESENCE

13.14.4 PRODUCT PORTFOLIO

13.14.5 RECENT DEVELOPMENTS

13.15 MONESE

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 GEOGRAPHIC PRESENCE

13.15.4 PRODUCT PORTFOLIO

13.15.5 RECENT DEVELOPMENTS

13.16 VIVID MONEY

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 GEOGRAPHIC PRESENCE

13.16.4 PRODUCT PORTFOLIO

13.16.5 RECENT DEVELOPMENTS

13.17 ATOM BANK

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 GEOGRAPHIC PRESENCE

13.17.4 PRODUCT PORTFOLIO

13.17.5 RECENT DEVELOPMENTS

13.18 STARLING BANK

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 GEOGRAPHIC PRESENCE

13.18.4 PRODUCT PORTFOLIO

13.18.5 RECENT DEVELOPMENTS

13.19 VOLT BANK

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 GEOGRAPHIC PRESENCE

13.19.4 PRODUCT PORTFOLIO

13.19.5 RECENT DEVELOPMENTS

13.2 TONIK BANK

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 GEOGRAPHIC PRESENCE

13.20.4 PRODUCT PORTFOLIO

13.20.5 RECENT DEVELOPMENTS

13.21 MA FRENCH BANK

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 GEOGRAPHIC PRESENCE

13.21.4 PRODUCT PORTFOLIO

13.21.5 RECENT DEVELOPMENTS

13.22 CURVE

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 GEOGRAPHIC PRESENCE

13.22.4 PRODUCT PORTFOLIO

13.22.5 RECENT DEVELOPMENTS

13.23 OOKNORTH

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 GEOGRAPHIC PRESENCE

13.23.4 PRODUCT PORTFOLIO

13.23.5 RECENT DEVELOPMENTS

13.24 BUNQ

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 GEOGRAPHIC PRESENCE

13.24.4 PRODUCT PORTFOLIO

13.24.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

17 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.