Global Neonatal Jaundice Intravenous Immunoglobulin Market

Market Size in USD Million

CAGR :

%

USD

24.46 Million

USD

39.84 Million

2024

2032

USD

24.46 Million

USD

39.84 Million

2024

2032

| 2025 –2032 | |

| USD 24.46 Million | |

| USD 39.84 Million | |

|

|

|

|

Neonatal Jaundice Intravenous Immunoglobulin Market Size

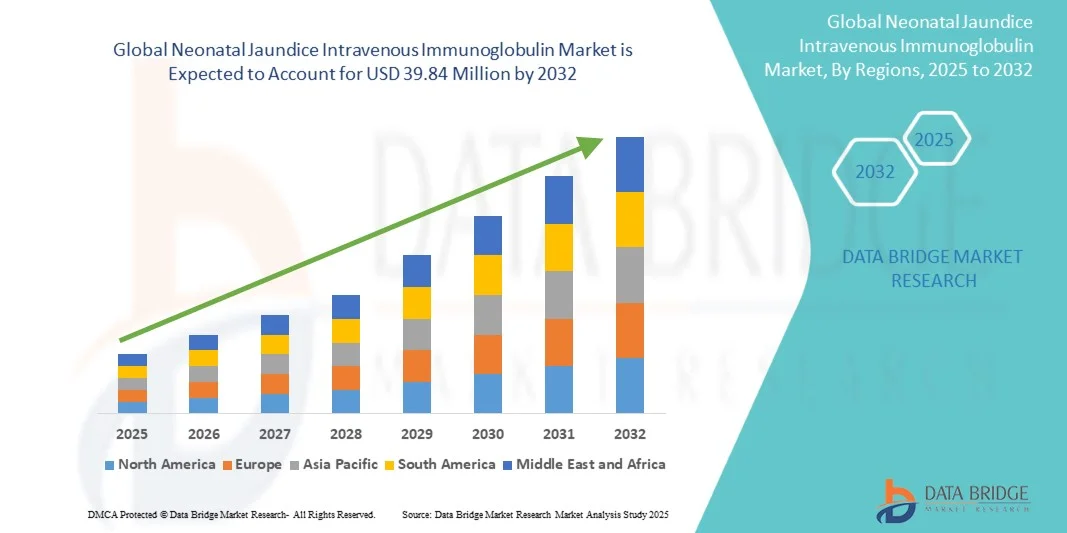

- The neonatal jaundice intravenous immunoglobulin market size was valued at USD 24.46 million in 2024 and is expected to reach USD 39.84 million by 2032, at a CAGR of 6.29% during the forecast period

- The market growth is primarily driven by the increasing prevalence of neonatal jaundice associated with hemolytic disease of the newborn, along with the rising adoption of IVIG therapy as an effective alternative to exchange transfusion in severe cases

- Moreover, advancements in plasma-derived immunoglobulin production, coupled with expanding neonatal intensive care infrastructure and improved access to specialized treatments across developing regions, are propelling market expansion and strengthening the overall therapeutic landscape

Neonatal Jaundice Intravenous Immunoglobulin Market Analysis

- Neonatal Intravenous immunoglobulin (IVIG), used as a therapeutic option for severe neonatal jaundice particularly in cases of hemolytic disease of the newborn has become an important component of advanced neonatal care due to its effectiveness in reducing bilirubin levels and minimizing the need for exchange transfusion

- The rising incidence of neonatal hyperbilirubinemia, increasing awareness of early diagnosis and treatment, and expanding access to neonatal intensive care units (NICUs) are key factors driving the growing adoption of IVIG therapy in hospitals and specialized pediatric centers

- North America dominated the neonatal jaundice intravenous immunoglobulin market with the largest revenue share of 42.1% in 2024, attributed to well-established healthcare infrastructure, high availability of plasma-derived products, and favorable reimbursement frameworks supporting advanced neonatal treatments

- Asia-Pacific is projected to be the fastest-growing region in the neonatal jaundice intravenous immunoglobulin market during the forecast period, fueled by rising birth rates, growing investments in neonatal healthcare, and improved access to immunoglobulin therapies in developing economies

- The liquid IVIG segment dominated the neonatal jaundice intravenous immunoglobulin market with a market share of 47.8% in 2024, owing to its ready-to-use formulation, reduced preparation time, and increasing preference in NICUs for emergency management of severe hyperbilirubinemia

Report Scope and Neonatal Jaundice Intravenous Immunoglobulin Market Segmentation

|

Attributes |

Neonatal Jaundice Intravenous Immunoglobulin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Neonatal Jaundice Intravenous Immunoglobulin Market Trends

“Advancements in High-Purity and Ready-to-Use Formulations”

- A significant trend in the neonatal jaundice IVIG market is the increasing focus on high-purity, ready-to-use formulations, which improve safety and reduce preparation time in neonatal intensive care units (NICUs), enhancing operational efficiency

- For instance, liquid IVIG products allow rapid administration in severe hyperbilirubinemia cases without the need for reconstitution, ensuring timely treatment for critically ill neonates

- These advanced formulations also minimize contamination risks and dosing errors, providing clinicians with more reliable and precise delivery of immunoglobulin therapy in delicate neonatal cases

- The development of standardized IgG concentration products with pathogen safety enhancements is enabling more predictable therapeutic outcomes and reducing the such aslihood of adverse reactions in newborns

- This trend toward safer, faster, and clinically optimized IVIG products is shaping treatment protocols and driving hospitals to update their NICU practices to incorporate newer IVIG options

- The demand for such advanced IVIG solutions is rising globally, particularly in markets with growing awareness of neonatal jaundice complications and the need for streamlined hospital workflows for high-risk newborns

Neonatal Jaundice Intravenous Immunoglobulin Market Dynamics

Driver

“Rising Incidence of Severe Neonatal Jaundice and Hemolytic Disease”

- The growing prevalence of severe neonatal hyperbilirubinemia and isoimmune hemolytic disease is a key factor propelling the adoption of IVIG therapy in hospitals, specialty pediatric centers, and NICUs

- For instance, increasing occurrences of ABO and Rh incompatibility in newborns are driving early and frequent IVIG use as a safer alternative to invasive exchange transfusions

- Awareness campaigns, early screening programs, and routine neonatal bilirubin monitoring are boosting early diagnosis, leading to timely IVIG administration and improved clinical outcomes

- Hospitals are investing in expanded NICU infrastructure and advanced treatment protocols, ensuring rapid availability of IVIG for critically ill neonates, which encourages higher adoption rates

- Clinicians favor IVIG because it reduces the need for invasive procedures, lowers associated risks such as anemia and infections, and improves overall recovery and survival rates for newborns

- The growing focus on improving survival and health outcomes in neonates globally continues to drive consistent demand for IVIG products

- The continuous emphasis on enhancing neonatal survival rates and health outcomes worldwide is supporting the sustained demand and adoption of IVIG therapy across both developed and developing regions

Restraint/Challenge

“High Cost and Limited Accessibility in Emerging Regions”

- The high cost of IVIG therapy and restricted availability in some emerging markets remain significant barriers, limiting broader adoption and market penetration for neonatal treatment

- For instance, smaller hospitals, rural clinics, or low-resource healthcare centers may struggle to procure premium IVIG formulations, preventing timely treatment for severe cases

- Dependence on plasma-derived products and supply chain complexities can lead to shortages, delayed administration, and treatment interruptions in critical neonatal care

- Healthcare providers in low-resource regions may lack trained personnel to safely administer IVIG, further restricting market growth and accessibility

- Despite ongoing efforts to improve distribution networks and affordability, pricing remains a constraint, particularly for hospitals in price-sensitive economies or regions with limited insurance coverage

- Addressing these challenges through cost-reduction strategies, government support programs, and improved logistics will be essential to enable wider adoption and ensure equitable access to IVIG therapies globally

- While efforts are being made to improve distribution and affordability, pricing remains a barrier for widespread adoption in price-sensitive regions

- Overcoming these challenges through cost reduction strategies, improved logistics, and government support is essential for sustained market growth

Neonatal Jaundice Intravenous Immunoglobulin Market Scope

The market is segmented on the basis of product type, source, indication, end user, and distribution channel.

- By Product Type

On the basis of product type, the neonatal jaundice intravenous immunoglobulin market is segmented into Liquid IVIG, Lyophilized IVIG, and IVIG Concentrates. The liquid IVIG segment dominated the market with the largest revenue share of 47.8% in 2024, owing to its ready-to-use formulation that reduces preparation time and minimizes dosing errors. Hospitals and NICUs prefer liquid IVIG for emergency cases of severe hyperbilirubinemia, where rapid treatment is critical. The formulation is compatible with modern infusion pumps, standardized IgG concentrations, and enhanced pathogen safety, providing clinicians with a reliable treatment option. Its adoption is strong in developed markets with advanced neonatal care infrastructure. The ease of workflow integration and reduced risk of contamination further strengthen its position. The segment continues to benefit from rising awareness of IVIG efficacy and streamlined hospital operations.

The IVIG Concentrates segment is expected to witness the fastest CAGR during 2025–2032, driven by increasing demand for high-purity, low-volume formulations that reduce fluid load in fragile neonates. Concentrates are particularly useful in NICUs with limited space or for infants with severe comorbidities. Ongoing innovations in stability, pathogen reduction, and infusion efficiency are boosting adoption. Emerging markets are witnessing higher uptake as healthcare facilities seek optimized therapies. Concentrates also provide flexibility in dosing, which appeals to clinicians managing variable bilirubin levels. Increased regulatory approvals and investment in new manufacturing processes further support growth.

- By Source

On the basis of source, the neonatal jaundice intravenous immunoglobulin market is segmented into plasma-derived IVIG and recombinant immunoglobulin products. The plasma-derived IVIG segment dominated the market with the largest share in 2024, due to its long-established clinical validation and wide availability. Hospitals prefer plasma-derived products for their proven efficacy in treating isoimmune hemolytic disease and severe hyperbilirubinemia. The segment benefits from strong regulatory approvals and extensive manufacturing and distribution networks. Continuous improvements in purification and pathogen safety have enhanced clinician confidence. Plasma-derived IVIG also supports standardized dosing protocols, ensuring predictable outcomes. Developed regions with mature neonatal healthcare systems continue to lead adoption.

The recombinant immunoglobulin products segment is expected to witness the fastest growth during 2025–2032, fueled by R&D in alternative immunoglobulin sources with reduced pathogen risk. Recombinant products offer scalable production and consistency in IgG concentration, which appeals to technologically advanced healthcare settings. Clinical trials and emerging approvals are encouraging adoption in high-income countries. The segment is also gaining interest in markets focused on innovation and safety. As hospitals seek safer, next-generation therapies, recombinant IVIG is expected to capture increasing market share. The segment growth is further supported by manufacturers’ focus on improving accessibility and formulation stability.

- By Indication

On the basis of indication, the neonatal jaundice intravenous immunoglobulin market is segmented into isoimmune hemolytic disease of the newborn, severe hyperbilirubinemia refractory to phototherapy, and prophylactic use in high-risk neonates. The isoimmune hemolytic disease segment dominated the market with the largest revenue share in 2024, as IVIG is primarily administered to prevent or reduce the need for exchange transfusions. Hospitals and NICUs follow clinical guidelines recommending IVIG for ABO or Rh incompatibility cases. The therapy improves neonatal outcomes by lowering bilirubin levels safely. The segment benefits from widespread awareness among clinicians about its efficacy. Early intervention protocols in developed regions further support adoption. Strong evidence from clinical studies has reinforced confidence in using IVIG for this indication.

The severe hyperbilirubinemia refractory to phototherapy segment is expected to witness the fastest growth during 2025–2032, driven by increasing cases of neonates unresponsive to conventional phototherapy. Rising birth rates in emerging economies, coupled with expanding NICU capacity, are driving adoption. Clinicians are adopting IVIG as a safer, non-invasive alternative to exchange transfusion. Awareness campaigns and training programs are facilitating early intervention. Growing emphasis on improving neonatal survival and health outcomes further supports this segment. Technological improvements in monitoring and dosing also enhance confidence in using IVIG for this indication.

- By End User

On the basis of end user, the neonatal jaundice intravenous immunoglobulin market is segmented into hospitals, maternity & birthing centers, pediatric specialty centers, and government health institutions. The hospital segment dominated the market with the largest revenue share in 2024, due to the presence of advanced NICUs, trained neonatal specialists, and infrastructure required to safely administer IVIG. Hospitals also maintain established procurement systems ensuring timely product availability. Adoption is high because hospitals handle the most critical neonatal jaundice cases. Clinicians rely on hospital protocols for precise dosing and monitoring. Developed countries with large hospital networks further strengthen this segment. Hospitals also play a central role in clinical trials and adoption of new IVIG formulations.

The maternity & birthing centers segment is expected to witness the fastest growth during 2025–2032, driven by rising awareness and integration of neonatal care in maternity units. Emerging regions are expanding specialized care in maternity facilities to manage high-risk newborns. Early intervention and proximity to NICU services facilitate rapid IVIG administration. Clinicians increasingly prefer on-site availability to reduce referral delays. Expansion of private maternity centers with advanced neonatal care is fueling market growth. Growing investments in maternal and newborn health programs further enhance adoption in this segment.

- By Distribution Channel

On the basis of distribution channel, the neonatal jaundice intravenous immunoglobulin market is segmented into hospital pharmacies, wholesale distributors, and retail pharmacies. The hospital pharmacies segment dominated the market with the largest share in 2024, as IVIG is primarily administered in hospital settings under strict monitoring. Hospital pharmacies maintain cold-chain storage, proper dosing protocols, and timely supply. Hospitals prefer direct procurement to ensure product quality and availability. Developed healthcare systems have robust hospital pharmacy networks supporting high adoption. Hospital pharmacies also facilitate clinical data collection and adherence to guidelines. The segment benefits from centralized purchasing and bulk inventory management.

The wholesale distributors segment is expected to witness the fastest growth during 2025–2032, driven by the need to supply IVIG to emerging regions and smaller healthcare facilities. Distributors help overcome logistical challenges and ensure timely delivery to hospitals, maternity centers, and specialty clinics. Expansion of regional distribution networks improves accessibility. Growing number of healthcare facilities in developing markets supports higher IVIG distribution. Partnerships with manufacturers enable scaling of supply in underserved areas. Increasing investments in healthcare infrastructure enhance the distributor role in market growth.

Neonatal Jaundice Intravenous Immunoglobulin Market Regional Analysis

- North America dominated the neonatal jaundice intravenous immunoglobulin market with the largest revenue share of 42.1% in 2024, attributed to well-established healthcare infrastructure, high availability of plasma-derived products, and favorable reimbursement frameworks supporting advanced neonatal treatments

- Hospitals and NICUs in the region prioritize IVIG therapy due to its proven efficacy in reducing the need for exchange transfusions in severe cases of isoimmune hemolytic disease and hyperbilirubinemia

- The widespread adoption is further supported by high healthcare expenditure, strong reimbursement frameworks, and a technologically advanced medical ecosystem, enabling hospitals to access high-purity IVIG formulations reliably

U.S. Neonatal Jaundice Intravenous Immunoglobulin Market Insight

The U.S. neonatal jaundice intravenous immunoglobulin market captured the largest revenue share of 82% in 2024 within North America, driven by advanced neonatal care infrastructure and widespread adoption of IVIG therapy for severe hyperbilirubinemia and isoimmune hemolytic disease. Hospitals and NICUs prioritize high-purity, ready-to-use IVIG formulations to reduce the need for exchange transfusions and improve clinical outcomes. The growing focus on early diagnosis, routine bilirubin monitoring, and proactive neonatal care further supports market growth. Strong reimbursement frameworks and efficient distribution networks ensure timely availability of IVIG products. Moreover, the integration of clinical guidelines and evidence-based protocols is increasing clinician confidence in IVIG therapy. High awareness among healthcare providers and parents continues to propel adoption across both public and private healthcare facilities.

Europe Neonatal Jaundice IVIG Market Insight

The Europe neonatal jaundice intravenous immunoglobulin market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing awareness of neonatal jaundice management and well-established healthcare infrastructure. Rising urbanization and improved access to specialized NICUs are supporting higher adoption rates. Hospitals and maternity centers are increasingly incorporating IVIG into treatment protocols for severe cases, complemented by government-led neonatal screening programs. The preference for standardized, pathogen-safe IVIG formulations is fostering consistent use in both developed and emerging European countries. Clinical evidence supporting IVIG efficacy enhances physician confidence. Growth is also supported by expanding training programs for neonatal care professionals and rising investment in pediatric healthcare facilities.

U.K. Neonatal Jaundice IVIG Market Insight

The U.K. neonatal jaundice intravenous immunoglobulin market is anticipated to grow at a noteworthy CAGR, driven by rising home births with access to NICU-level care and increasing demand for effective, non-invasive therapies. Concerns over severe hyperbilirubinemia complications and the need to prevent exchange transfusions are encouraging hospitals and maternity centers to adopt IVIG. The country’s strong healthcare infrastructure, coupled with robust neonatal care guidelines, ensures reliable supply and administration. High clinician awareness and government support for neonatal health initiatives continue to stimulate market adoption. Moreover, evidence-based protocols and training programs reinforce confidence in IVIG therapy. The integration of IVIG into standardized neonatal treatment pathways is expected to further drive growth.

Germany Neonatal Jaundice IVIG Market Insight

The Germany neonatal jaundice intravenous immunoglobulin market is expected to expand at a considerable CAGR, fueled by strong neonatal healthcare infrastructure and emphasis on advanced, safe therapies. Hospitals and specialty centers prioritize IVIG due to its proven efficacy in managing severe jaundice and hemolytic disease in neonates. The focus on reducing invasive procedures, such as exchange transfusions, supports higher IVIG adoption. Germany’s regulatory emphasis on product safety and pathogen-reduced formulations enhances market confidence. Increasing awareness among neonatologists and investment in NICU equipment further promote adoption. Integration of IVIG into national clinical protocols ensures widespread, consistent usage. The country’s strong research and development ecosystem also encourages innovation in IVIG formulations.

Asia-Pacific Neonatal Jaundice IVIG Market Insight

The Asia-Pacific neonatal jaundice intravenous immunoglobulin market is poised to grow at the fastest CAGR of 25% during 2025–2032, driven by increasing birth rates, expanding NICU infrastructure, and rising awareness of neonatal jaundice management. Hospitals and maternity centers are adopting IVIG therapy to prevent severe complications and reduce exchange transfusion requirements. Government initiatives promoting maternal and child health, along with growing private healthcare investment, support market expansion. The region’s improving access to high-purity IVIG formulations enhances treatment availability. Manufacturers are expanding distribution networks to emerging economies, increasing affordability and adoption. Rising clinical training programs for neonatal care professionals further contribute to growth.

Japan Neonatal Jaundice IVIG Market Insight

The Japan neonatal jaundice intravenous immunoglobulin market is gaining momentum due to advanced NICU facilities, high awareness of neonatal care, and rising demand for safe, effective therapies. Hospitals are increasingly adopting IVIG for severe jaundice cases, particularly for isoimmune hemolytic disease. The integration of IVIG therapy into routine neonatal protocols supports consistent usage. Japan’s technologically advanced healthcare system and focus on patient safety enhance market adoption. Growing clinical evidence demonstrating efficacy and reduced need for exchange transfusions further encourages hospital uptake. The aging population and emphasis on quality neonatal care are expected to sustain demand across residential and hospital-based care settings.

India Neonatal Jaundice IVIG Market Insight

The India neonatal jaundice intravenous immunoglobulin market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, increasing hospital births, and rising awareness of neonatal jaundice complications. Hospitals and maternity centers are adopting IVIG as a safer, non-invasive alternative to exchange transfusions. Government programs promoting maternal and child health, along with rising healthcare expenditure, support market growth. Domestic and international IVIG manufacturers are enhancing distribution and affordability, making therapy more accessible. Expansion of NICU facilities and training programs for neonatal care professionals further increase adoption. Growing middle-class populations and technological adoption in healthcare continue to propel market demand.

Neonatal Jaundice Intravenous Immunoglobulin Market Share

The neonatal jaundice intravenous immunoglobulin industry is primarily led by well-established companies, including:

- CSL (Australia)

- Grifols S.A. (Spain)

- Octapharma AG (Switzerland)

- Kedrion (U.S.)

- Biotest AG (Germany)

- Bio Products Laboratory (U.K.)

- Takeda Pharmaceutical Company Limited (Japan)

- Baxter (U.S.)

- Taibang Bio Group Co., Ltd. (China)

- Shanghai RAAS Blood Products Co., Ltd. (China)

- Hualan Biological Engineering Inc. (China)

- ADMA Biologics, Inc. (U.S.)

- EMERGENT (U.S.)

- Kamada Pharmaceuticals. (Israel)

- GC Biopharma (South Korea)

- Intas Pharmaceuticals Ltd. (India)

- BioTest Pharma (U.S.)

- Sanquin Plasma Products (Netherlands)

- LFB S.A. (France)

What are the Recent Developments in Neonatal jaundice intravenous immunoglobulin market?

- In July 2025, GC Biopharma presented new research on the viscosity characteristics of its intravenous immunoglobulin (IVIG) products at the International Society on Thrombosis and Haemostasis (ISTH) 2025 conference. The study highlighted that hyperviscosity is a known risk factor for IVIG-associated adverse events, such as thromboembolism. The findings underscored the importance of optimizing IVIG formulations to minimize viscosity, thereby enhancing patient safety and treatment efficacy

- In June 2025, Takeda announced that the U.S. Food and Drug Administration (FDA) approved GAMMAGARD LIQUID ERC, a ready-to-use liquid immunoglobulin therapy with low immunoglobulin A (IgA) content. While initially approved for primary immunodeficiency (PI) in individuals aged two years and older, this product's development and approval process may influence future IVIG therapies for neonatal jaundice

- In March 2025, the National Institute for Health and Care Excellence (NICE) updated its guidelines on the detection and management of hyperbilirubinemia in newborns. The updated guidelines recommend that intravenous immunoglobulin (IVIG) should not be used routinely to treat infants with severe hyperbilirubinemia caused by Rh or ABO antibody-mediated hemolytic disease

- In September 2024, GC Biopharma USA, Inc. announced the launch and distribution of ALYGLO, its first 10% intravenous immunoglobulin (IVIG) therapy. This product is designed for the treatment of adult patients aged 17 years and older with primary immunodeficiency (PI). The introduction of ALYGLO represents a significant advancement in IVIG therapies, potentially influencing future formulations for neonatal care

- In February 2024, Johnson & Johnson announced that the U.S. Food and Drug Administration (FDA) granted Breakthrough Therapy Designation to nipocalimab for the treatment of individuals at high risk for severe hemolytic disease of the fetus and newborn (HDFN). This designation is based on results from the Phase 2 UNITY clinical trial for HDFN, and Phase 3 clinical trial enrollment is underway

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.