Global Neonicotinoid Pesticide Market

Market Size in USD Billion

CAGR :

%

USD

1.97 Billion

USD

3.24 Billion

2024

2032

USD

1.97 Billion

USD

3.24 Billion

2024

2032

| 2025 –2032 | |

| USD 1.97 Billion | |

| USD 3.24 Billion | |

|

|

|

|

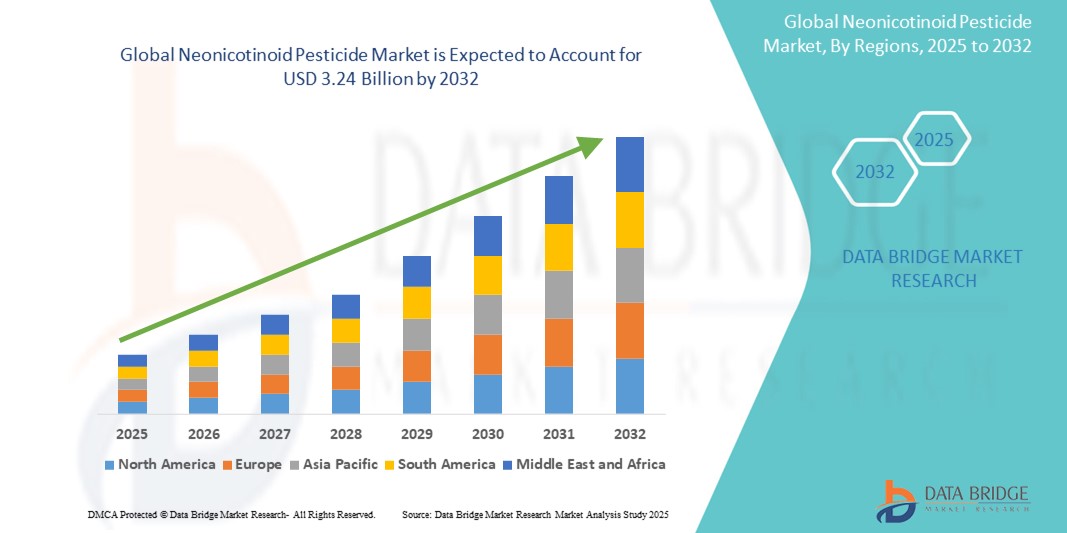

What is the Global Neonicotinoid Pesticide Market Size and Growth Rate?

- The global neonicotinoid pesticide market size was valued at USD 1.97 billion in 2024 and is expected to reach USD 3.24 billion by 2032, at a CAGR of6.40% during the forecast period

- Market growth is primarily driven by increasing global demand for effective crop protection solutions that offer high efficacy against pests while minimizing harm to crops and enhancing agricultural productivity

- Furthermore, the expanding global population, rising food security concerns, and growing adoption of modern farming practices are reinforcing the demand for neonicotinoid pesticides, propelling significant industry expansion in the coming years

What are the Major Takeaways of Neonicotinoid Pesticide Market?

- Neonicotinoid Pesticides, known for their systemic action and long-lasting protection against pests, are becoming essential tools for modern agriculture, offering enhanced crop yields, reduced pest infestations, and improved farm productivity across diverse geographies

- The rising demand for neonicotinoid pesticides is significantly driven by their effectiveness against a wide range of insect pests, regulatory support for sustainable pest management, and farmers' growing preference for efficient, low-labor crop protection solutions

- North America dominated the neonicotinoid pesticide market with the largest revenue share of 42.6% in 2024, fueled by strong demand for effective crop protection solutions, growing awareness regarding pest resistance management, and the region's highly developed agricultural sector

- Asia Pacific neonicotinoid pesticide market is projected to grow at the fastest CAGR of 13.8% during 2025 to 2032, driven by rapid agricultural expansion, rising food demand, and increasing awareness of crop protection solutions in countries such as China, India, and Southeast Asian nations

- The Imidacloprid segment dominated the neonicotinoid pesticide market with the largest market revenue share of 36.4% in 2024, driven by its broad-spectrum insecticidal properties and widespread use across various crops

Report Scope and Neonicotinoid Pesticide Market Segmentation

|

Attributes |

Neonicotinoid Pesticide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Neonicotinoid Pesticide Market?

“Rising Preference for Systemic and Target-Specific Crop Protection”

- A significant and accelerating trend in the global neonicotinoid pesticide market is the growing preference for systemic, target-specific pesticides that minimize collateral damage to beneficial insects while offering long-lasting crop protection

- Neonicotinoids, known for their ability to be absorbed by plant tissues and act internally, are increasingly favored for their efficiency in controlling pests such as aphids, whiteflies, and beetles without the need for frequent reapplications. For instance, products containing Imidacloprid or Thiamethoxam are widely adopted for protecting cereals, fruits, and vegetable crops globally

- Innovation within the market focuses on developing new-generation neonicotinoids with improved selectivity and reduced environmental persistence to meet evolving regulatory standards. Companies are also integrating advanced formulations to enhance application efficiency and mitigate resistance build-up among target pests

- Furthermore, the rising global emphasis on food security and maximizing agricultural productivity with minimal environmental footprint is pushing manufacturers to invest in neonicotinoids that deliver precise pest control, ensuring higher crop yields and reduced economic losses for farmers

- The adoption of Integrated Pest Management (IPM) programs across major agricultural economies further drives demand for neonicotinoids as key components in balanced pest control strategies, especially in regions facing increasing pest pressures due to climate change

- Consequently, manufacturers such as Bayer AG, Syngenta, and Sumitomo Chemical are advancing neonicotinoid portfolios with novel chemistries that align with sustainable agriculture goals and strict global regulations

What are the Key Drivers of Neonicotinoid Pesticide Market?

- The global rise in food demand, driven by population growth and urbanization, is a significant factor accelerating the need for effective pest control solutions, thereby boosting the neonicotinoid pesticide market

- For instance, in January 2025, Sumitomo Chemical strengthened its crop protection presence in Europe with the acquisition of Philagro and Kenogard, enhancing its neonicotinoid distribution and market share across major agricultural economies such as France and Spain

- In addition, the systemic action of neonicotinoids, which allows for internal plant protection against pests without harming most non-target organisms, makes them attractive to farmers seeking reliable, broad-spectrum solutions

- The growing threat of invasive pests and the need to reduce crop losses are further propelling neonicotinoid adoption, especially in high-value crops such as fruits, vegetables, and oilseeds

- Favorable government policies in developing economies supporting agricultural modernization, combined with advancements in formulation technology that reduce environmental impact, are key contributors to the market's expansion

- Moreover, neonicotinoids play an essential role in pest management for seed treatments, foliar sprays, and soil applications, offering versatility that supports their widespread use in diverse climatic regions

Which Factor is challenging the Growth of the Neonicotinoid Pesticide Market?

- Increasing regulatory scrutiny over the environmental and ecological impact of neonicotinoid pesticides, particularly concerning pollinators such as bees, poses a significant challenge to market growth

- For instance, the European Union has imposed restrictions on certain neonicotinoids (e.g., Imidacloprid, Thiamethoxam, Clothianidin) due to concerns over their potential role in pollinator decline, influencing product usage patterns globally

- Public awareness campaigns and environmental activism are also putting pressure on policymakers to tighten restrictions, thereby limiting market expansion, especially in environmentally sensitive regions

- Furthermore, pest resistance to neonicotinoids is emerging as a critical concern, driving the need for continuous innovation in formulations and integrated pest management practices to sustain product efficacy

- High development costs associated with creating new-generation, eco-friendly neonicotinoids, coupled with lengthy regulatory approval processes, present financial and operational hurdles for manufacturers

- Overcoming these challenges requires significant investment in R&D, transparent collaboration with regulators, and the development of safer, more sustainable neonicotinoid alternatives to ensure long-term market viability

How is the Neonicotinoid Pesticide Market Segmented?

The market is segmented on the basis of type, crop type, and application method.

• By Type

On the basis of type, the neonicotinoid pesticide market is segmented into Imidacloprid, Thiamethoxam, Clothianidin, Dinotefuran, Acetamiprid, and Others. The Imidacloprid segment dominated the Neonicotinoid Pesticide market with the largest market revenue share of 36.4% in 2024, driven by its broad-spectrum insecticidal properties and widespread use across various crops. Imidacloprid is highly effective against sucking pests such as aphids, whiteflies, and beetles, making it a preferred choice for both seed treatments and foliar applications globally. Its versatility and proven efficacy continue to support strong demand, especially in cereals, vegetables, and fruits.

The Thiamethoxam segment is expected to witness the fastest CAGR from 2025 to 2032, attributed to its systemic action, high efficiency at low application rates, and increasing adoption in Integrated Pest Management (IPM) programs. Thiamethoxam offers reliable control of early-season pests and is favored in regions focusing on sustainable agricultural practices due to its lower environmental persistence compared to some other neonicotinoids.

• By Crop Type

On the basis of crop type, the neonicotinoid pesticide market is segmented into Cereals, Oilseed, Fruits, Vegetables, Pulses, and Others. The Cereals segment accounted for the largest market revenue share of 38.7% in 2024, driven by the critical need to protect staple crops such as wheat, rice, and maize from yield-reducing pests. Neonicotinoid seed treatments and foliar sprays play a vital role in safeguarding cereal crops during their vulnerable early growth stages, contributing to food security and higher agricultural productivity.

The Vegetables segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by increasing global consumption of vegetables, rising demand for pest-free produce, and the expansion of high-value horticultural farming. Neonicotinoid pesticides are extensively used in vegetable cultivation to control a wide range of pests while ensuring crop quality and appearance, which is essential for both domestic and export markets.

• By Application Method

On the basis of application method, the neonicotinoid pesticide market is segmented into Seed Treatment, Foliar Spray, Soil Treatment, and Others. The Seed Treatment segment dominated the market with the largest market revenue share of 41.5% in 2024, attributed to its effectiveness in providing early-stage pest protection, reducing the need for multiple foliar applications, and enhancing crop emergence and yield potential. Seed treatment with neonicotinoids is especially prevalent in large-scale cereal and oilseed cultivation, offering targeted, cost-effective pest control.

The Foliar Spray segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its ability to offer flexible, in-season pest management solutions across diverse crop types. Foliar applications allow precise timing of pest control, making them suitable for managing sudden pest outbreaks in high-value crops such as fruits and vegetables, thus ensuring marketable yield and quality.

Which Region Holds the Largest Share of the Neonicotinoid Pesticide Market?

- North America dominated the neonicotinoid pesticide market with the largest revenue share of 42.6% in 2024, fueled by strong demand for effective crop protection solutions, growing awareness regarding pest resistance management, and the region's highly developed agricultural sector

- Farmers across the U.S. and Canada rely heavily on neonicotinoid pesticides for their proven efficacy in controlling a broad spectrum of pests, particularly in major crops such as corn, soybeans, and cereals. The region's technological advancement, high-yield farming practices, and established regulatory frameworks also support market expansion

- Furthermore, ongoing R&D efforts, the development of advanced formulations, and the rising focus on sustainable farming practices are reinforcing the dominance of North America in the neonicotinoid pesticide market

U.S. Neonicotinoid Pesticide Market Insight

U.S. neonicotinoid pesticide market accounted for the largest revenue share of 79.4% within North America in 2024, driven by the country's vast agricultural landscape, particularly in row crops and horticulture. The widespread use of Neonicotinoids such as Imidacloprid and Clothianidin in seed treatments and foliar sprays has made them integral to pest management strategies. In addition, the increasing emphasis on integrated pest management (IPM) and resistance mitigation is driving steady demand, while regulatory clarity around product usage continues to support market stability.

Canada Neonicotinoid Pesticide Market Insight

Canada neonicotinoid pesticide market is witnessing steady growth, supported by the country's robust agricultural industry and the need for pest control in crops such as canola, cereals, and pulses. Despite regulatory scrutiny on certain Neonicotinoids, Canadian farmers continue to adopt advanced crop protection solutions that maximize yields while addressing pest pressures. Growing investments in research and alternative formulations are also shaping the market landscape in Canada.

Europe Neonicotinoid Pesticide Market Insight

Europe neonicotinoid pesticide market is projected to grow moderately over the forecast period, shaped by evolving regulatory policies and increasing demand for sustainable pest management. The European Union's restrictions on certain Neonicotinoids have driven innovation towards safer alternatives and targeted applications. The region’s focus on sustainable agriculture, combined with advanced research into pest resistance, is contributing to ongoing market activity across key farming nations such as Germany, France, and Spain.

Which Region is the Fastest Growing Region in the Neonicotinoid Pesticide Market?

Asia Pacific neonicotinoid pesticide market is projected to grow at the fastest CAGR of 13.8% during 2025 to 2032, driven by rapid agricultural expansion, rising food demand, and increasing awareness of crop protection solutions in countries such as China, India, and Southeast Asian nations. The region’s large-scale cultivation of rice, fruits, and vegetables, combined with the adoption of modern farming techniques, is fueling demand for Neonicotinoid Pesticides. In addition, supportive government initiatives aimed at improving agricultural productivity and pest control effectiveness are accelerating market growth.

China Neonicotinoid Pesticide Market Insight

China neonicotinoid pesticide market captured the largest revenue share in Asia Pacific in 2024, attributed to the country's vast agricultural sector and growing pest management challenges. The increasing emphasis on enhancing crop yields to meet domestic food demand, coupled with the popularity of Neonicotinoid-based seed treatments and foliar sprays, is driving market growth. China's strong manufacturing capabilities and domestic production of active ingredients further contribute to market expansion.

India Neonicotinoid Pesticide Market Insight

India neonicotinoid pesticide market is anticipated to grow at a remarkable CAGR during the forecast period, driven by the country’s large-scale cultivation of fruits, vegetables, pulses, and cereals. Rising concerns over crop losses due to pests, coupled with increasing farmer awareness about modern crop protection solutions, are fueling adoption. Government programs supporting integrated pest management and higher yields are also boosting the market for Neonicotinoid Pesticides in India.

Japan Neonicotinoid Pesticide Market Insight

Japan neonicotinoid pesticide market is expanding steadily, supported by advanced agricultural technologies, high-value crop cultivation, and strict quality standards. Japanese farmers prioritize efficient pest control to protect produce, particularly fruits, vegetables, and ornamental crops. The emphasis on precision farming, combined with research-driven product innovation, is contributing to consistent demand for Neonicotinoid Pesticides across the country.

Which are the Top Companies in Neonicotinoid Pesticide Market?

The neonicotinoid pesticide industry is primarily led by well-established companies, including:

- Adama Agricultural Solutions Ltd. (Israel)

- American Vanguard Corporation (U.S.)

- Arysta LifeScience Corporation (Japan)

- BASF SE (Germany)

- FMC Corporation (U.S.)

- Mitsui Chemicals Agro, Inc. (Japan)

- Nissan Chemical Corporation (Japan)

- Nufarm Limited (Australia)

- Sumitomo Chemical Company, Limited (Japan)

- Syngenta AG (Switzerland)

- UPL Limited (India)

- Nippon Soda Co., Ltd. (Japan)

- Dhanuka Agritech Limited (India)

- PI Industries Ltd. (India)

- Rallis India Limited (India)

- Kumiai Chemical Industry Co., Ltd. (Japan)

- Isagro S.p.A. (Italy)

- Albaugh, LLC (U.S.)

- Excel Crop Care Limited (India)

- Rotam CropSciences Ltd. (Hong Kong)

What are the Recent Developments in Global Neonicotinoid Pesticide Market?

- In January 2025, Sumitomo Chemical Co., Ltd. announced the full acquisition of two European crop protection sales companies, Philagro in France and Kenogard in Spain, both previously joint ventures involving Sumitomo Chemical and Nissan Chemical Corporation. This strategic acquisition strengthens Sumitomo Chemical's footprint in the European crop protection market, particularly in France and Spain, recognized as global leaders in agriculture

- In November 2024, FMC Corporation finalized the sale of its Global Specialty Solutions (GSS) business unit to Envu, allowing FMC to sharpen its strategic focus exclusively on its core agricultural operations. This move aligns with FMC's long-term objective of reinforcing its leadership position in crop protection and agricultural solutions

- In September 2023, ADAMA introduced its self-manufactured insecticide formulations Cosayr and Lapidos in India, marketed under the brand name Chlorantraniliprole (CTPR). These innovative products effectively target pests in paddy and sugarcane crops, supporting higher yields and exemplifying ADAMA’s ongoing commitment to innovation-driven agricultural productivity

- In May 2023, BASF received an exclusive new mode of action classification for its Axalion Active insecticide from The Insecticide Resistance Action Committee (IRAC), now listed under Group 36. Axalion represents a breakthrough solution for farmers by targeting chordotonal organs, offering effective pest control and combating resistance to piercing and sucking pests

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.