Global Neopentyl Glycol Market

Market Size in USD Billion

CAGR :

%

USD

1.44 Billion

USD

2.25 Billion

2025

2033

USD

1.44 Billion

USD

2.25 Billion

2025

2033

| 2026 –2033 | |

| USD 1.44 Billion | |

| USD 2.25 Billion | |

|

|

|

|

Neopentyl Glycol Market Size

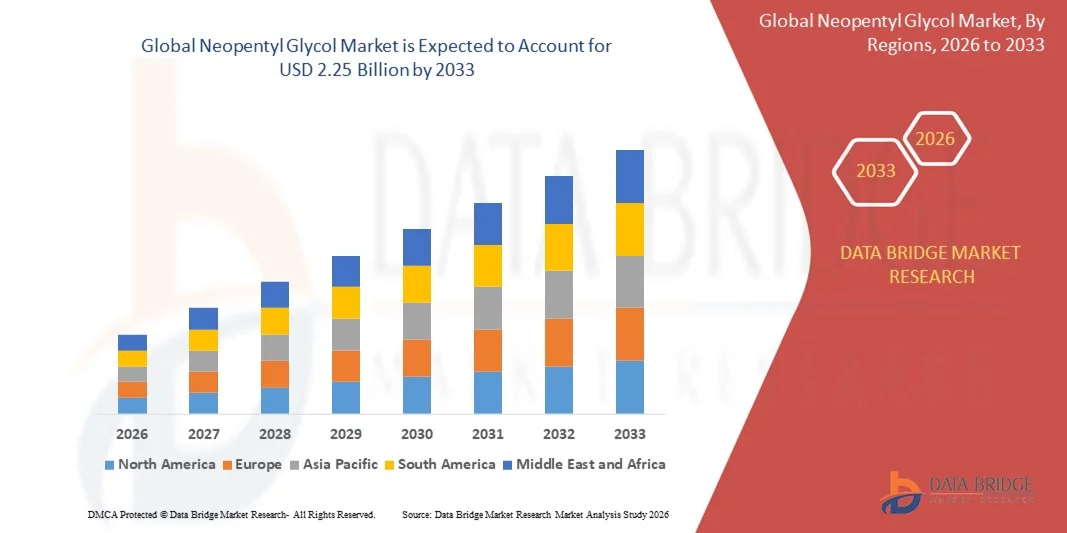

- The global neopentyl glycol market size was valued at USD 1.44 billion in 2025 and is expected to reach USD 2.25 billion by 2033, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the rising demand for high-performance polyester and alkyd resins across coatings, automotive, and construction industries, as neopentyl glycol plays a critical role in enhancing durability, chemical resistance, and outdoor stability of finished materials

- Furthermore, the increasing shift toward low-VOC and environmentally friendly powder coatings is strengthening the need for neopentyl glycol as a preferred raw material, accelerating adoption across advanced manufacturing, architectural applications, and industrial coating technologies

Neopentyl Glycol Market Analysis

- Neopentyl glycol, widely used in producing resilient coating resins, adhesives, and high-performance polymers, is becoming increasingly essential across sectors due to its ability to deliver superior hydrolytic stability, weather resistance, and long-term durability in end products

- The escalating demand for neopentyl glycol is primarily driven by rapid industrial expansion, the growth of sustainable coating systems, and rising consumption of advanced materials in automotive, construction, and chemical manufacturing industries

- Asia-Pacific dominated the neopentyl glycol market with a share of 44.66% in 2025, due to strong expansion in resin manufacturing, rising consumption of powder coatings, and the region’s leadership in chemical production

- North America is expected to be the fastest growing region in the neopentyl glycol market during the forecast period due to increasing demand for neopentyl-glycol-based resins in automotive coatings, industrial coatings, and high-performance composite materials

- Coatings segment dominated the market with a market share of 63.6% in 2025, due to strong demand for durable, weather-resistant, and chemical-stable coating systems across industrial, automotive, and architectural sectors. Neopentyl glycol provides outstanding hydrolytic stability, improved hardness, and enhanced UV resistance, making it a key ingredient in high-performance coating resins. The shift toward powder coatings due to sustainability regulations reinforces segment leadership. Manufacturers rely heavily on neopentyl-glycol-based resins to meet rising requirements for long-lasting and environmentally compliant coatings. Expanding infrastructure and construction spending globally continues to strengthen this segment

Report Scope and Neopentyl Glycol Market Segmentation

|

Attributes |

Neopentyl Glycol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Neopentyl Glycol Market Trends

Rising Adoption of Low-VOC and Sustainable Coating Resins

- The neopentyl glycol market is experiencing significant growth due to the increasing regulatory push for environmentally friendly products, with manufacturers developing novel resins that reduce volatile organic compound (VOC) emissions This transformation is accelerating the adoption of low-VOC and sustainable coating resins as preferred solutions in building and automotive applications

- For instance, BASF and Eastman Chemical are investing in research and commercial production of bio-based neopentyl glycol, enabling sustainable powder coatings and alkyd resins for industrial and consumer markets These product launches support broader industry goals for green chemistry and facilitate compliance with evolving environmental standards in regions such as the EU

- Stringent regulations across North America, Europe, and Asia-Pacific are driving innovation toward greener resins by enforcing stricter standards for VOC emissions and hazardous pollutants Companies in the market thus prioritize sustainable formulation and eco-efficient manufacturing, which are central to retaining market share and customer loyalty

- The rapid expansion of infrastructure and green building projects is fostering heightened demand for NPG-based resins because of their durability, chemical resistance, and long service life This trend is expected to remain strong with global construction sector growth and the adoption of advanced coating technologies

- Digital supply chains and circular economy models are emerging, as leaders focus on sustainability and waste minimization These approaches promote the lifecycle extension of NPG products and align with customer expectations for sustainable procurement

- The drive towards low-VOC, sustainable resins is fundamentally reshaping the neopentyl glycol market, ensuring long-term growth as buyers prioritize products that deliver superior environmental and performance benefits

Neopentyl Glycol Market Dynamics

Driver

Expanding Demand for High-Performance Polyester and Alkyd Resins

- The robust demand for high-performance polyester and alkyd resins is fueling substantial growth in the neopentyl glycol market These resins are critical for producing coatings, adhesives, and plasticizers that meet the stringent requirements of automotive, electronics, and construction industries

- For instance, Perstorp and Mitsubishi Gas Chemical have expanded their portfolios of specialized NPG grades for powder coatings and heat-resistant resins, addressing the need for superior weatherproofing, stability, and flexibility in industrial applications These developments are pivotal for sectoral innovation and market expansion

- The rapid industrialization in Asia-Pacific and continued infrastructure investments globally are increasing consumption of durable coating resins NPG-based products deliver enhanced protection against corrosion and environmental damage, supporting their popularity in strategic sectors

- Rising interest in lightweight and energy-efficient vehicles is highlighting the importance of high-performance adhesives and coatings This market dynamic is prompting manufacturers to prioritize NPG as a preferred chemical intermediate for advanced resin formulations

- The combined effect of technological advancement, expanding application scope, and regional production capacity is ensuring sustained demand for NPG, with companies investing in capacity additions and innovative product ranges to remain competitive

Restraint/Challenge

Fluctuating Raw Material Prices

- Extensive volatility in the prices of raw materials such as formaldehyde and isobutyraldehyde is a persistent challenge affecting production costs and profit margins for neopentyl glycol manufacturers These fluctuations create uncertainty in long-term planning and pricing strategies for producers in the global market

- For instance, Chemanalyst reported repeated declines in NPG prices throughout September 2025 in India, reflecting ongoing instability in the market Manufacturers such as LG Chem and BASF have had to adapt their supply chain management and procurement strategies to cope with these variations

- Global supply chain disruptions or regional shortages of petrochemical feedstocks directly impact NPG availability and cost, occasionally leading to production delays and shortages for high-demand segments These unpredictable shifts require extensive contingency planning and flexible sourcing agreements

- Efforts to transition towards bio-based and alternative raw materials are gaining attention, but these solutions may introduce new complexities such as supply limitations and increased production costs while striving for sustainability

- Navigating raw material price fluctuations requires market participants to balance cost control, supply security, and ongoing product innovation, which remains a critical determinant of market performance and long-term resilience

Neopentyl Glycol Market Scope

The market is segmented on the basis of type, application, and end-use industries.

- By Type

On the basis of type, the neopentyl glycol market is segmented into flake, molten, and slurry. The flake segment dominated the market with the largest revenue share in 2025, driven by its high purity, long-term stability, and superior handling characteristics. Manufacturers prefer flake-grade neopentyl glycol due to its ease of transport, reduced contamination risk, and compatibility with large-scale resin production. Its strong adoption across powder coatings, saturated polyesters, and high-durability industrial coatings further supports market leadership. In addition, the segment benefits from increasing demand for performance materials requiring excellent weather resistance, gloss retention, and chemical stability. The segment continues to be favored in global industrial applications due to its efficiency in formulation and wide acceptance in established supply chains.

The molten segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by expanding usage in continuous manufacturing systems. Molten neopentyl glycol offers operational advantages such as direct feed into reactors, reduced processing time, and improved production efficiency for large resin manufacturers. Its suitability for automated and energy-efficient production lines makes it increasingly preferred by chemical facilities upgrading to advanced processing technologies. Growing adoption in high-throughput polyester and alkyd resin production strengthens this growth trajectory. The reduction in packaging waste and logistics handling also supports molten-form expansion across major chemical hubs.

- By Application

On the basis of application, the neopentyl glycol market is segmented into coatings, adhesives and sealants, and insulation. The coatings segment dominated the market with the largest share of 63.6% in 2025, supported by strong demand for durable, weather-resistant, and chemical-stable coating systems across industrial, automotive, and architectural sectors. Neopentyl glycol provides outstanding hydrolytic stability, improved hardness, and enhanced UV resistance, making it a key ingredient in high-performance coating resins. The shift toward powder coatings due to sustainability regulations reinforces segment leadership. Manufacturers rely heavily on neopentyl-glycol-based resins to meet rising requirements for long-lasting and environmentally compliant coatings. Expanding infrastructure and construction spending globally continues to strengthen this segment.

The adhesives and sealants segment is expected to register the fastest CAGR from 2026 to 2033, driven by increasing demand for high-strength bonding materials in automotive, construction, electronics, and packaging industries. Neopentyl glycol enhances flexibility, adhesion strength, and moisture resistance, making it essential for modern adhesive formulations. Rising adoption of lightweight vehicles increases the use of advanced adhesives in place of mechanical fasteners, accelerating segment growth. Its role in producing low-shrinkage and high-durability sealants further boosts consumption. Rapid industrial expansion across emerging markets enhances the demand for neopentyl-glycol-based adhesive solutions.

- By End-Use Industries

On the basis of end-use industries, the neopentyl glycol market is segmented into paints, automotive, construction, chemicals, plastics, and textiles. The paints industry dominated the market in 2025, driven by extensive use of neopentyl glycol in producing high-durability coating resins. Its ability to improve weatherability, gloss retention, and chemical resistance makes it indispensable for industrial, architectural, and marine coatings. Government focus on low-VOC and eco-friendly coatings strengthens reliance on neopentyl-glycol-based formulations. The rapid adoption of powder coatings in appliances, machinery, and metal fabrication also contributes to segment leadership. Growing global infrastructure development further increases paint and coating consumption.

The automotive industry is anticipated to witness the fastest growth from 2026 to 2033, supported by rising demand for advanced coatings, adhesives, and composite materials in modern vehicles. Neopentyl glycol contributes to corrosion protection, heat stability, and long-term durability in automotive coatings used on vehicle bodies and components. The expansion of electric vehicle manufacturing increases the need for high-performance insulating and heat-resistant materials derived from neopentyl glycol. Global automotive production growth across Asia-Pacific and Europe amplifies the adoption of neopentyl-glycol-based intermediates. Increasing performance expectations for lightweight and high-durability automotive materials continue to accelerate industry adoption.

Neopentyl Glycol Market Regional Analysis

- Asia-Pacific dominated the neopentyl glycol market with the largest revenue share of 44.66% in 2025, driven by strong expansion in resin manufacturing, rising consumption of powder coatings, and the region’s leadership in chemical production

- The cost-effective manufacturing landscape and increasing investments in specialty intermediates are accelerating market growth across major economies

- Rapid industrialization, expanding construction activities, and the growing presence of global coating manufacturers continue to strengthen consumption of neopentyl glycol in the region

China Neopentyl Glycol Market Insight

China held the largest share of the Asia-Pacific neopentyl glycol market in 2025 due to its dominant position in polyester resin production and large-scale chemical manufacturing capabilities. The country's strong export base, continuous capacity expansions, and government policies supporting high-value chemical output are major contributors. Rising demand from construction, automotive coatings, and industrial applications further strengthens China’s leadership in the regional market.

India Neopentyl Glycol Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, supported by expanding infrastructure projects, rising demand for powder coatings, and growth in domestic chemical production. Increasing investments in resin manufacturing and rapid expansion of the automotive and construction sectors are boosting consumption. Government initiatives promoting industrial development and import substitution in chemicals further enhance India’s growth prospects in the neopentyl glycol market.

Europe Neopentyl Glycol Market Insight

The Europe neopentyl glycol market is expanding steadily, driven by the region’s demand for high-performance coatings, stringent environmental regulations, and strong presence of advanced chemical manufacturing facilities. Focus on sustainable coating systems, low-VOC formulations, and high-durability materials is supporting market expansion. Rising adoption of specialized resins in automotive, industrial, and architectural applications further contributes to steady growth across the region.

Germany Neopentyl Glycol Market Insight

Germany’s neopentyl glycol market is supported by its well-established chemical manufacturing base, leadership in automotive coatings, and extensive R&D capabilities. The country’s emphasis on high-performance resins, export-driven production, and environmental compliance strengthens demand. Strong utilization in industrial coatings, powder coatings, and specialty resin formulations reinforces Germany’s position as one of Europe’s key markets.

U.K. Neopentyl Glycol Market Insight

The U.K. market benefits from a mature chemicals sector, rising investment in high-performance materials, and growing demand for specialized resins used in construction and industrial applications. Efforts to strengthen local supply chains and expand domestic resin production contribute to market stability. Collaboration among manufacturers, universities, and research centers also supports innovation in neopentyl-glycol-based formulations.

North America Neopentyl Glycol Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for neopentyl-glycol-based resins in automotive coatings, industrial coatings, and high-performance composite materials. Rising reshoring of chemical production, expansion of advanced material manufacturing, and strong focus on sustainable coating technologies support rapid growth. Growing adoption of powder coatings and specialty resins across multiple industries further strengthens regional expansion.

U.S. Neopentyl Glycol Market Insight

The U.S. accounted for the largest share of the North America market in 2025, supported by a robust industrial base, strong presence of resin manufacturers, and continuous innovation in advanced coating technologies. High demand from automotive, construction, and industrial sectors drives consumption of high-performance neopentyl-glycol-based materials. Established distribution networks and significant investments in sustainable and next-generation coating systems reinforce the U.S. position as the leading market in the region.

Neopentyl Glycol Market Share

The neopentyl glycol industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Eastman Chemical Company (U.S.)

- LG Chem (South Korea)

- Mitsubishi Gas Chemical Company, Inc. (Japan)

- OQ Chemicals GmbH (Germany)

- Perstorp (Sweden)

- Wanhua (China)

- Celanese Corporation (U.S.)

- Polioli S.p.A. (Italy)

- Oleon NV (Belgium)

- Shenjiang (China)

- NYU Tandon (U.S.)

- AKEE Group (China)

- Guanhua Chemical (China)

- Knagteweiye (China)

- Xinhua Pharm (China)

- Jinan IFT Science & Technology (China)

- Zouping Fenlian Biotech Co., Ltd. (China)

- Eastar Holding Group Company Limited (China)

Latest Developments in Global Neopentyl Glycol Market

- In July 2023, Zhejiang Guanghua Technology Co., Ltd. and BASF entered a letter of intent to supply neopentyl glycol from BASF’s Zhanjiang Verbund site to KHUA, strengthening BASF’s capability to meet rising demand for low-emission powder coatings across Asia-Pacific and China. This collaboration enhances regional supply security, expands BASF’s customer reach, and supports the growing shift toward sustainable coating formulations within high-growth end-use industries

- In October 2022, BASF invested in a new neopentyl glycol plant in China with a production capacity of 80,000 metric tons, increasing its total annual capacity to 335,000 metric tons. This investment significantly boosts BASF’s production scale and positions the company to cater more effectively to China’s rapidly expanding powder coatings market. The new capacity also reinforces BASF’s competitive advantage in supplying high-performance intermediates to regional resin and coatings manufacturers

- In September 2022, BASF introduced NPG ZeroPCF, a neopentyl glycol grade with a cradle-to-gate product carbon footprint of zero, produced using the company’s biomass balance approach. This launch marks a major step toward sustainable raw material innovation, supporting market migration toward low-carbon intermediates. It also strengthens BASF’s leadership in environmentally responsible chemical solutions, aligning with growing customer and regulatory demand for decarbonized material inputs

- In September 2022, OQ Chemicals launched neopentyl glycol diheptanoate targeted at the personal care and cosmetics industry, expanding neopentyl-glycol-based applications beyond traditional industrial uses. This new product supports the industry’s transition toward silicone-free formulations and meets increasing demand for multifunctional, high-performance emollients. The development enhances OQ Chemicals’ portfolio reach and opens new growth avenues in consumer-driven specialty chemical segments

- In September 2020, BASF-YPC Co., Ltd., a joint venture between SINOPEC and BASF, expanded its neopentyl glycol production capacity in China by 40,000 metric tons. This expansion reinforced the growing regional demand for eco-friendly powder coatings and strengthened localized manufacturing capabilities. The increased capacity also supports supply chain stability and underpins China’s rapidly advancing coatings and specialty chemicals sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Neopentyl Glycol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Neopentyl Glycol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Neopentyl Glycol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.