Global Network Engineering Services Market

Market Size in USD Billion

CAGR :

%

USD

54.67 Billion

USD

104.99 Billion

2024

2032

USD

54.67 Billion

USD

104.99 Billion

2024

2032

| 2025 –2032 | |

| USD 54.67 Billion | |

| USD 104.99 Billion | |

|

|

|

|

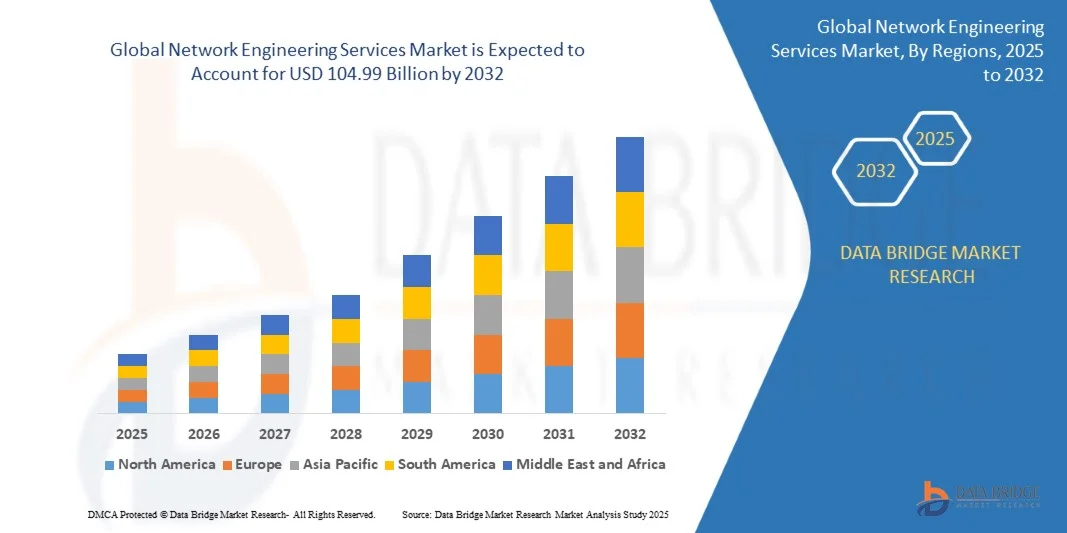

What is the Global Network Engineering Services Market Size and Growth Rate?

- The global network engineering services market size was valued at USD 54.67 billion in 2024 and is expected to reach USD 104.99 billion by 2032, at a CAGR of 8.50% during the forecast period

- The market growth is primarily driven by increasing adoption of connected devices and technological advancements in smart home and enterprise environments, which are accelerating digitalization across residential, commercial, and industrial sectors

- Moreover, rising consumer demand for secure, seamless, and integrated network solutions is positioning Network Engineering Services as a key choice for access control, IT infrastructure management, and system automation, fueling robust industry growth

What are the Major Takeaways of Network Engineering Services Market?

- Network Engineering Services, providing digital, electronic, and cloud-based solutions for access control, data routing, and network optimization, are becoming indispensable in modern security, IT, and smart building ecosystems. Their remote management capabilities and integration with IoT platforms enhance operational efficiency

- The growing uptake of smart devices, rising cybersecurity concerns, and the increasing need for streamlined, automated network management are the primary drivers accelerating the adoption of Network Engineering Services solutions across residential, commercial, and industrial applications

- North America dominated the network engineering services market with the largest revenue share of 32.58% in 2024, driven by widespread adoption of smart home devices, growing digital infrastructure, and increasing enterprise demand for managed network solution

- The Asia-Pacific network engineering services market is poised to grow at the fastest CAGR of 10.58% during 2025–2032, driven by rapid urbanization, technological adoption, and rising enterprise digitalization in countries such as China, Japan, and India

- The Managed Services segment dominated the market with the largest revenue share of 52.3% in 2024, driven by the growing demand for end-to-end network management, real-time monitoring, and predictive maintenance

Report Scope and Network Engineering Services Market Segmentation

|

Attributes |

Network Engineering Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Network Engineering Services Market?

“Integration of AI and Smart Automation for Enhanced Network Management”

- A notable and accelerating trend in the global network engineering services market is the deep integration of artificial intelligence (AI) and automation tools into network management platforms. This development is enhancing operational efficiency, predictive maintenance, and real-time monitoring for enterprises and service providers

- For instance, AI-enabled network orchestration platforms can proactively detect anomalies, optimize traffic, and allocate resources dynamically, reducing downtime and improving service quality. Similarly, predictive analytics in managed network services enable companies to anticipate failures and implement preemptive measures, strengthening reliability

- AI integration also allows for automated configuration, intelligent threat detection, and policy-driven network management. Vendors such as Cisco and Juniper are leveraging AI-driven analytics to provide actionable insights, reducing manual intervention and operational costs

- The convergence of AI with network services facilitates centralized management of hybrid networks, cloud infrastructure, and IoT devices, creating unified and automated operations

- This trend toward smarter, self-optimizing networks is reshaping enterprise expectations for agility, reliability, and cost efficiency, driving vendors to innovate continuously

- Demand for AI-enabled network engineering services is rising across sectors such as telecom, BFSI, and IT, where seamless network performance and security are critical

What are the Key Drivers of Network Engineering Services Market?

- Increasing reliance on high-speed data networks, IoT proliferation, and digital transformation initiatives are major growth drivers for network engineering services

- For instance, enterprises are deploying advanced SD-WAN, cloud networking, and 5G services to enhance operational efficiency and connectivity. Such strategies are expected to sustain industry growth during the forecast period

- The need for robust cybersecurity, real-time monitoring, and predictive analytics compels organizations to adopt managed network services that offer comprehensive visibility and control over network assets

- Growing adoption of hybrid cloud, IoT devices, and enterprise mobility solutions is boosting demand for intelligent network services that can handle complex, distributed environments

- Convenience and operational efficiency, including automated provisioning, performance optimization, and predictive fault detection, are motivating both SMEs and large enterprises to integrate network engineering services into their IT infrastructure

- Rising regulatory compliance requirements and service-level agreement (SLA) commitments further reinforce the adoption of professional network engineering solutions

Which Factor is Challenging the Growth of the Network Engineering Services Market?

- Security vulnerabilities, particularly in software-defined networks and cloud-integrated environments, present significant adoption challenges. As network engineering services depend heavily on digital infrastructure, they are susceptible to cyberattacks, data breaches, and configuration errors

- High deployment costs for AI-driven or fully managed network solutions can be a barrier, especially for small enterprises or organizations in emerging markets. While some vendors offer scalable, cost-effective options, advanced features such as predictive analytics or zero-touch provisioning often come at a premium

- Market growth may also be hindered by a shortage of skilled network engineers capable of managing AI-integrated systems and hybrid networks. Organizations may struggle to find personnel with expertise in AI, cloud orchestration, and network security

- Overcoming these challenges requires investments in cybersecurity, workforce upskilling, and cost-optimized service offerings. Vendors focusing on automated management, intuitive interfaces, and affordable deployment models are such asly to accelerate market adoption

- Despite these hurdles, the convergence of AI, automation, and predictive network management is expected to drive long-term growth and transform enterprise networking practices

How is the Network Engineering Services Market Segmented?

The market is segmented on the basis of service type, connection type, organization size, and end-use.

• By Service Type

On the basis of service type, the network engineering services market is segmented into Professional Services and Managed Services. The Managed Services segment dominated the market with the largest revenue share of 52.3% in 2024, driven by the growing demand for end-to-end network management, real-time monitoring, and predictive maintenance. Enterprises increasingly prefer outsourcing network operations to third-party providers to ensure reliability, reduce operational costs, and leverage advanced AI-driven solutions. Managed Services also enable organizations to scale their network infrastructure efficiently, support hybrid cloud environments, and maintain compliance with evolving cybersecurity regulations.

The Professional Services segment is anticipated to witness the fastest CAGR of 18.9% from 2025 to 2032, fueled by the growing need for consulting, network design, implementation, and optimization services. Companies are investing in professional expertise to deploy complex SD-WAN, 5G, and hybrid networking solutions. The rising complexity of enterprise networks and demand for tailored solutions are expected to further accelerate this segment’s adoption.

• By Connection Type

On the basis of connection type, the network engineering services market is segmented into Wired and Wireless. The Wired segment accounted for the largest market revenue share of 55.4% in 2024, driven by the reliability, high bandwidth, and low-latency performance offered by wired solutions, which remain crucial for data centers, enterprise offices, and industrial networks. Wired connections are preferred in mission-critical applications requiring stable throughput and minimal interference.

The Wireless segment is expected to witness the fastest CAGR of 20.2% from 2025 to 2032, fueled by the rapid adoption of Wi-Fi 6, 5G, and IoT-enabled devices in enterprises. Wireless Network Engineering Services provide flexibility, mobility, and ease of deployment across distributed office environments, campuses, and remote locations, meeting the increasing demand for scalable and agile networking solutions. The growing hybrid work model and the proliferation of mobile devices are key factors driving wireless adoption globally.

• By Organization Size

On the basis of organization size, the network engineering services market is segmented into Small and Medium-Sized Enterprises (SMEs) and Large Size Enterprises. Large enterprises dominated the market with the largest revenue share of 61.7% in 2024, driven by their extensive network infrastructure requirements, multi-location operations, and need for sophisticated managed services and cybersecurity solutions. Large organizations often implement advanced AI-driven network management and SD-WAN solutions to optimize performance, reduce downtime, and ensure data security across global operations.

The SME segment is anticipated to witness the fastest CAGR of 19.5% from 2025 to 2032, fueled by increasing awareness of network optimization, affordable managed service offerings, and scalable solutions tailored for smaller organizations. SMEs are progressively adopting cloud-based services, wireless networks, and predictive network analytics to improve operational efficiency and competitiveness.

• By End-Use

On the basis of end-use, the network engineering services market is segmented into Communication Service Providers (CSPs) and Enterprises. The Enterprise segment accounted for the largest market revenue share of 58.6% in 2024, driven by the growing reliance on robust, secure, and scalable networking solutions to support digital transformation initiatives, IoT integration, and hybrid cloud adoption. Enterprises are increasingly deploying AI-driven network management, predictive analytics, and managed services to optimize connectivity, reduce operational costs, and enhance security.

The CSP segment is expected to witness the fastest CAGR of 18.7% from 2025 to 2032, fueled by the rising demand for managed services, high-speed data networks, and 5G deployment. CSPs are investing in advanced Network Engineering Services to improve service delivery, ensure network reliability, and address the increasing connectivity requirements of both residential and business customers globally.

Which Region Holds the Largest Share of the Network Engineering Services Market?

- North America dominated the network engineering services market with the largest revenue share of 32.58% in 2024, driven by widespread adoption of smart home devices, growing digital infrastructure, and increasing enterprise demand for managed network solutions

- Consumers and businesses in the region highly value advanced connectivity, seamless integration, and robust cybersecurity features offered by Network Engineering Services, making them essential for modern digital ecosystems

- The strong presence of tech-savvy populations, high disposable incomes, and advanced IT infrastructure further solidify North America’s position as a key market for both residential and commercial network solutions

U.S. Network Engineering Services Market Insight

The U.S. network engineering services market captured the largest revenue share of 81% within North America in 2024, fueled by the rapid adoption of cloud-based solutions, AI-enabled network management, and enterprise digital transformation initiatives. Businesses are increasingly prioritizing secure, scalable, and automated networking solutions. The growing deployment of SD-WAN, 5G-enabled infrastructure, and AI-driven monitoring systems is significantly propelling market expansion. Moreover, the presence of major network engineering service providers and technology innovators enhances the overall adoption of advanced network solutions.

Europe Network Engineering Services Market Insight

The Europe network engineering services market is projected to expand at a substantial CAGR during the forecast period, driven by stringent data protection regulations, increasing enterprise IT spending, and rising adoption of managed network services. European companies are leveraging Network Engineering Services to optimize operations, improve network reliability, and support digitalization initiatives. The growing demand spans commercial, industrial, and government sectors, with businesses integrating secure and scalable network solutions into their digital strategies.

U.K. Network Engineering Services Market Insight

The U.K. network engineering services market is anticipated to grow at a noteworthy CAGR, driven by rising enterprise investments in digital transformation and network automation. Concerns regarding data security and operational efficiency encourage organizations to adopt managed and professional network services. In addition, the country’s strong IT infrastructure and tech-forward business ecosystem support continued growth in the adoption of advanced networking solutions.

Germany Network Engineering Services Market Insight

The Germany network engineering services market is expected to expand at a considerable CAGR, fueled by the country’s focus on Industry 4.0, smart manufacturing, and digital infrastructure modernization. Enterprises are increasingly deploying AI-driven monitoring, secure network management, and wireless connectivity solutions. Germany’s emphasis on innovation, sustainability, and reliable connectivity promotes the adoption of advanced Network Engineering Services across residential, commercial, and industrial sectors.

Which Region is the Fastest Growing Region in the Network Engineering Services Market?

The Asia-Pacific network engineering services market is poised to grow at the fastest CAGR of 10.58% during 2025–2032, driven by rapid urbanization, technological adoption, and rising enterprise digitalization in countries such as China, Japan, and India. The region’s increasing focus on smart infrastructure, IoT integration, and cloud-based solutions is accelerating the adoption of Network Engineering Services. In addition, APAC’s emergence as a technology and manufacturing hub is making network solutions more affordable and accessible across enterprises and residential segments.

Japan Network Engineering Services Market Insight

The Japan network engineering services market is gaining momentum due to the country’s high-tech culture, increasing enterprise digitization, and growing smart home adoption. Network Engineering Services integration with IoT, AI, and cloud platforms is enhancing operational efficiency and network reliability, particularly in commercial and industrial sectors.

China Network Engineering Services Market Insight

The China network engineering services market accounted for the largest market revenue share in APAC in 2024, supported by rapid urbanization, expanding enterprise IT infrastructure, and rising adoption of smart technologies. The push for smart cities, cloud networking, and advanced connectivity solutions is fueling growth across residential, commercial, and industrial segments. Affordable services and strong domestic providers further drive market expansion.

Which are the Top Companies in Network Engineering Services Market?

The network engineering services industry is primarily led by well-established companies, including:

- Sincera Technologies (U.S.)

- Juniper Networks, Inc. (U.S.)

- Datavision, Inc. (U.S.)

- Cyient (India)

- HCL Technologies Limited (India)

- Accenture (Ireland)

- Infosys Limited (India)

- Advance Digital Systems, Inc. (U.S.)

- Movate (U.S.)

- Hughes Systique Corporation (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Aviat Networks, Inc. (U.S.)

- Calsoft Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Arista Networks, Inc. (U.S.)

- Nokia Corporation (Finland)

- Hewlett Packard Enterprise (HPE) (U.S.)

- Dell Technologies, Inc. (U.S.)

- Extreme Networks, Inc. (U.S.)

- Ericsson AB (Sweden)

- Broadcom Inc. (U.S.)

- IBM Corporation (U.S.)

- F5 Networks, Inc. (U.S.)

- Palo Alto Networks, Inc. (U.S.)

- Fortinet, Inc. (U.S.)

- Check Point Software Technologies Ltd. (Israel)

What are the Recent Developments in Global Network Engineering Services Market?

- In January 2024, Aviat Networks, Inc. collaborated with PT Smartfren Telecom Tbk to deliver private wireless networks both indoors and outdoors, providing ultra-reliable high-speed connectivity and automation services to private network customers across Indonesia, strengthening its presence in the APAC region

- In February 2023, Calsoft Inc. launched a new 5G lab offering solutions for deploying 5G services in public cloud environments such as AWS, enabling companies to leverage cloud-based 5G infrastructure efficiently and expand their network service capabilities

- In November 2022, Juniper Networks participated in and powered SuperComputing 2022, an international conference on high-performance computing, storage, networking, and analysis, fostering collaboration among private companies, government agencies, and academic institutions, and showcasing its expertise in advanced networking solutions

- In August 2022, Ericsson and SkyMax Network Limited signed a two-year Memorandum of Understanding to develop 5G broadband networks across sub-Saharan Africa for corporate enterprises, highlighting Ericsson’s commitment to expanding 5G infrastructure in emerging markets

- In April 2022, Accenture acquired AFD.TECH, a network services provider, to strengthen its expertise in the design, engineering, deployment, and operation of next-generation networks including fiber optics and 5G, enhancing its global network engineering service offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.