Global Next Generation Anode Materials Market

Market Size in USD Billion

CAGR :

%

USD

10.95 Billion

USD

30.16 Billion

2024

2032

USD

10.95 Billion

USD

30.16 Billion

2024

2032

| 2025 –2032 | |

| USD 10.95 Billion | |

| USD 30.16 Billion | |

|

|

|

|

Next Generation Anode Materials Market Size

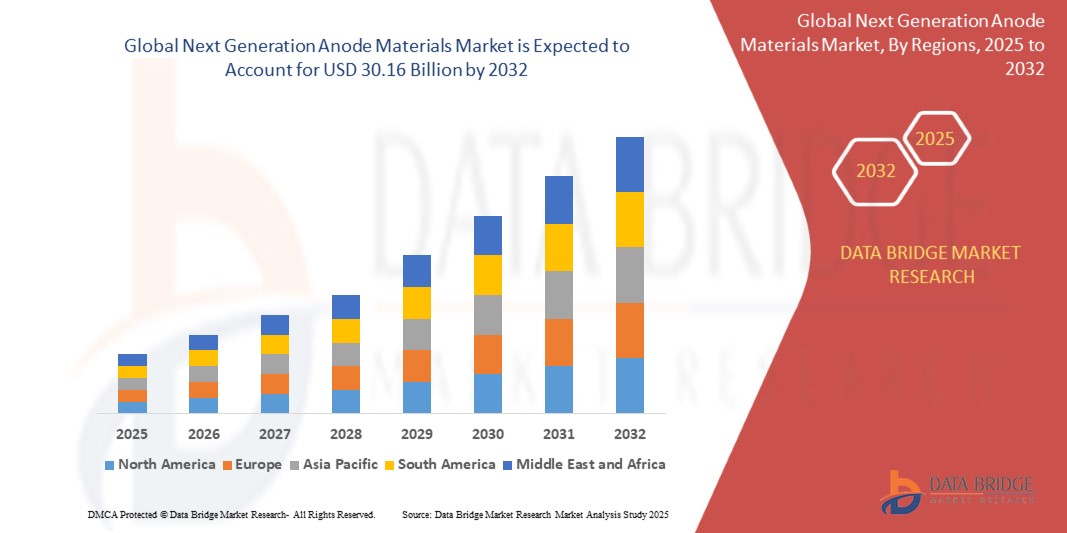

- The global next generation anode materials market size was valued at USD 10.95 billion in 2024 and is expected to reach USD 30.16 billion by 2032, at a CAGR of 13.5% during the forecast period

- The market growth is largely fuelled by the rising demand for high-performance lithium-ion batteries, increasing adoption of electric vehicles, and advancements in energy storage technologies

- Growing investment in research and development by major battery manufacturers and material science companies is accelerating innovation and scaling of advanced anode solutions

Next Generation Anode Materials Market Analysis

- Growing focus on improving battery efficiency, capacity, and charging speed is driving innovation in next generation anode materials such as silicon-based, lithium metal, and graphene

- The shift toward electric mobility and renewable energy storage is boosting demand for high-energy-density battery components

- Asia-Pacific dominated the next generation anode materials market with the largest revenue share of 41.8% in 2024, driven by the robust growth of electric vehicle production, widespread industrialization, and ongoing advancements in battery technologies across countries such as China, Japan, and South Korea

- North America region is expected to witness the highest growth rate in the global next generation anode materials market, driven by accelerating electric vehicle adoption, energy storage development, and efforts to localize battery supply chains. Government funding programs and technology-driven R&D activities are creating a favorable environment for the commercialization of advanced anode materials

- The silicon/silicon oxide blends segment dominated the market with the largest market revenue share of 36.4% in 2024, driven by their significantly higher lithium storage capacity and compatibility with existing lithium-ion battery manufacturing processes. These materials are being increasingly adopted for enhancing the performance of electric vehicle batteries, offering improved energy density and cycle life

Report Scope and Next Generation Anode Materials Market Segmentation

|

Attributes |

Next Generation Anode Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Next Generation Anode Materials Market Trends

“Rising Adoption of Silicon-Based Anode Materials”

- Silicon-based anodes are gaining traction due to their ability to deliver significantly higher energy density—up to ten times that of conventional graphite anodes

- Battery manufacturers are increasingly investing in silicon-composite and nano-structured designs to overcome issues such as volume expansion during charge cycles

- The demand for long-range electric vehicles and fast-charging portable devices is accelerating the shift toward silicon-based materials in battery construction

- Ongoing research is focused on improving the structural stability and life cycle performance of silicon anodes, which remain key barriers to commercialization

- For instance, Sila Nanotechnologies has partnered with Mercedes-Benz to integrate its next-gen silicon anode technology into future electric vehicle battery platforms

Next Generation Anode Materials Market Dynamics

Driver

“Rising Demand for High-Energy-Density Batteries in Electric Vehicles”

- The growing need for extended EV driving range and reduced charging time is pushing automakers to adopt batteries with higher energy storage capabilities

- Traditional graphite anodes have reached near-maximum performance limits, prompting a transition to advanced materials such as silicon, graphene, and lithium-metal

- These new materials offer improved electrochemical performance, enabling faster charge-discharge rates and increased battery life without compromising safety

- Government initiatives, such as EV subsidies and emission reduction targets, are catalyzing investment in next-generation battery components

- For instance, the European Union’s Green Deal includes funding for innovative battery technologies to support its goal of carbon neutrality by 2050

Restraint/Challenge

“High Production Costs and Scalability Issues”

- Advanced anode materials often involve intricate synthesis methods and require precise manufacturing conditions, resulting in higher production costs

- Silicon-based anodes, while promising, face challenges such as expansion during cycling, which necessitates expensive design adaptations and materials

- Scaling up from lab-based innovations to mass-market production is technically complex and financially intensive, limiting rapid commercialization

- These factors restrict the adoption of next-generation anodes in cost-sensitive sectors such as smartphones and mass-market EVs

- For instance, many early-stage companies developing graphene and silicon-based anodes struggle to secure funding and infrastructure for industrial-scale production, delaying market entry

-

Next Generation Anode Materials Market Scope

The market is segmented on the basis of material, application, and end user.

• By Material

On the basis of material, the next generation anode materials market is segmented into silicon/silicon oxide blends, lithium titanate-based anode materials, carbon nanotubes-based anode materials, graphene-based anode materials, metal oxides-based anode materials, and others. The silicon/silicon oxide blends segment dominated the market with the largest market revenue share of 36.4% in 2024, driven by their significantly higher lithium storage capacity and compatibility with existing lithium-ion battery manufacturing processes. These materials are being increasingly adopted for enhancing the performance of electric vehicle batteries, offering improved energy density and cycle life.

The graphene-based anode materials segment is expected to witness the fastest growth rate from 2025 to 2032, owing to their superior conductivity, mechanical strength, and fast charge-discharge capabilities. Growing research investments and commercialization of graphene-based technologies in battery applications are supporting the expansion of this segment across high-performance energy storage solutions.

• By Application

On the basis of application, the market is segmented into fuel cell, capacitors, lead acid batteries, and lithium-ion batteries. The lithium-ion batteries segment held the largest revenue share in 2024 due to the growing demand for high-capacity, energy-efficient batteries in electric vehicles, portable electronics, and grid storage systems. The performance benefits provided by next generation anode materials are key to supporting evolving requirements in lithium-ion battery advancements.

The fuel cell segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing government and industry investment in clean energy alternatives. The use of advanced anode materials enhances fuel cell efficiency, making them viable for commercial and industrial applications in transportation and stationary power systems.

• By End User

On the basis of end user, the market is segmented into transportation, electrical and electronics, energy storage, aerospace and defence, industrial user, automotive, and others. The automotive segment accounted for the largest market revenue share in 2024, led by surging electric vehicle production and the demand for batteries with longer life, higher energy density, and faster charging times. Automakers are investing heavily in advanced anode technologies to meet evolving consumer and regulatory expectations.

The aerospace and defence segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the need for lightweight, high-performance energy storage systems in satellites, unmanned aerial vehicles, and mission-critical applications. The ability of next generation anode materials to offer enhanced reliability and energy efficiency makes them ideal for defence-grade battery technologies.

Next Generation Anode Materials Market Regional Analysis

- Asia-Pacific dominated the next generation anode materials market with the largest revenue share of 41.8% in 2024, driven by the robust growth of electric vehicle production, widespread industrialization, and ongoing advancements in battery technologies across countries such as China, Japan, and South Korea

- The region benefits from strong government support for energy transition, rising investments in battery manufacturing, and a growing number of strategic collaborations between material suppliers and automakers

- In addition, the region’s well-established supply chain, low manufacturing costs, and presence of leading battery manufacturers are contributing significantly to market expansion

China Next Generation Anode Materials Market Insight

The China market captured the largest revenue share within Asia-Pacific in 2024, driven by the country’s dominance in the global lithium-ion battery production landscape. China is a key hub for the development and scaling of advanced anode materials such as silicon blends and graphene-based components. Government-led initiatives focused on electric vehicle adoption and energy storage systems are further boosting demand. The presence of domestic raw material suppliers and battery giants is strengthening the supply chain, making China pivotal to global market growth.

Japan Next Generation Anode Materials Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032, supported by its strong R&D ecosystem and focus on high-efficiency battery technologies. Japan continues to lead in innovation around solid-state batteries and silicon-based anode development. Demand for compact, fast-charging batteries in electric mobility and consumer electronics is shaping growth. Partnerships between Japanese material companies and global EV manufacturers are expected to further accelerate commercialization of advanced anode technologies.

North America Next Generation Anode Materials Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, fuelled by growing investments in domestic battery production, electric vehicle expansion, and energy storage infrastructure. The region is placing strong emphasis on reducing supply chain dependency and promoting innovation through government-backed R&D programs. Technological advancements and funding initiatives in the U.S. and Canada are encouraging companies to scale up the development of next-generation anode materials for sustainable battery solutions.

U.S. Next Generation Anode Materials Market Insight

The U.S. market is expected to witness the fastest growth rate from 2025 to 2032, supported by significant developments in silicon-based and lithium-metal anode research. Federal investments in battery innovation through the Department of Energy and partnerships with leading universities and private players are advancing commercialization. The presence of EV manufacturers such as Tesla, coupled with strategic moves to localize battery material production, is creating strong momentum for the adoption of next-generation anode technologies.

Europe Next Generation Anode Materials Market Insight

Europe is expected to witness the fastest growth rate from 2025 to 2032, driven by the region’s clean energy targets and the establishment of battery gigafactories. Countries such as Germany, Sweden, and France are heavily investing in battery innovation to support the electric vehicle transition and renewable energy storage needs. The demand for environmentally friendly and high-performance battery materials is encouraging the development of sustainable anode alternatives across the continent.

Germany Next Generation Anode Materials Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032, backed by its advanced automotive industry and push toward battery innovation. The country is investing in research programs focusing on silicon and graphene-based materials for next-generation batteries. Collaboration between automotive OEMs and material suppliers is enhancing the industrialization of new anode technologies, with growing adoption expected across both electric vehicles and stationary energy systems

U.K. Next Generation Anode Materials Market Insight

The U.K. next generation anode materials market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing investments in battery technology and a strong national commitment to zero-emission mobility. Government-backed initiatives such as the Faraday Battery Challenge and expansion of local battery manufacturing facilities are boosting demand for advanced anode materials. The U.K.'s focus on electric vehicle development and grid-scale energy storage is fostering research in silicon and graphene-based anodes. Moreover, collaborations between universities, startups, and automakers are accelerating innovation and commercialization, strengthening the country's position in the European battery materials ecosystem.

Next Generation Anode Materials Market Share

The Next Generation Anode Materials industry is primarily led by well-established companies, including:

- AMPRIUS TECHNOLOGIES (U.S.)

- Albemarle Corporation (U.S.)

- Altairnano (U.S.)

- Sunrun (U.S.)

- Resonac Holdings Corporation. (Japan)

- Leydenjar Technologies B.V. (Netherlands)

- NanoGraf Corporation (U.S.)

- Nexeon Ltd. (U.K.)

- Shanghai Shanshan Technology Co., Ltd. (China)

- OneD Battery Sciences (U.S.)

- pH Matter L.L.C. (U.S.)

- Sila Nanotechnologies Inc. (U.S.)

- Talga Group. (Australia)

- JSR Corporation (Japan)

- Enovix Corporation (U.S.)

- Paraclete Energy, Inc. (U.S.)

Latest Developments in Global Next Generation Anode Materials Market

- In June 2021, Talga Group Ltd announced a strategic expansion of its graphite projects in Sweden to scale up its resource base. This development aims to meet the rising demand from the electric vehicle and battery industries across Europe. By reinforcing its production capacity, Talga enhances its ability to support sustainable energy solutions, strengthening its market presence in the region and contributing to the growth of next generation anode materials

- In March 2021, JSR Corporation launched the JSR Bioscience and Informatics R&D Center (JSR BiRD) in Kawasaki City as part of its innovation-led development strategy. This initiative is designed to accelerate advancements in life sciences while supporting research in next generation anode materials. The move is expected to drive cross-sectoral innovation, reinforce JSR’s R&D capabilities, and support long-term growth in advanced battery and healthcare technologies

- In October 2021, Showa Denko Materials Co., Ltd. established a wholly owned subsidiary, Energy Storage Devices Spin-Off Preparation Co., Ltd., focused on energy storage innovation. This structural move aims to accelerate the development and commercialization of advanced storage solutions. By aligning with its materials expertise, the company strengthens its global competitiveness and positions itself as a key player in the rapidly expanding next generation anode materials market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Next Generation Anode Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Next Generation Anode Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Next Generation Anode Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.