Global Next Generation Antibody Drug Conjugate Adc Therapies Market

Market Size in USD Billion

CAGR :

%

USD

10.21 Billion

USD

30.80 Billion

2025

2033

USD

10.21 Billion

USD

30.80 Billion

2025

2033

| 2026 –2033 | |

| USD 10.21 Billion | |

| USD 30.80 Billion | |

|

|

|

|

Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Size

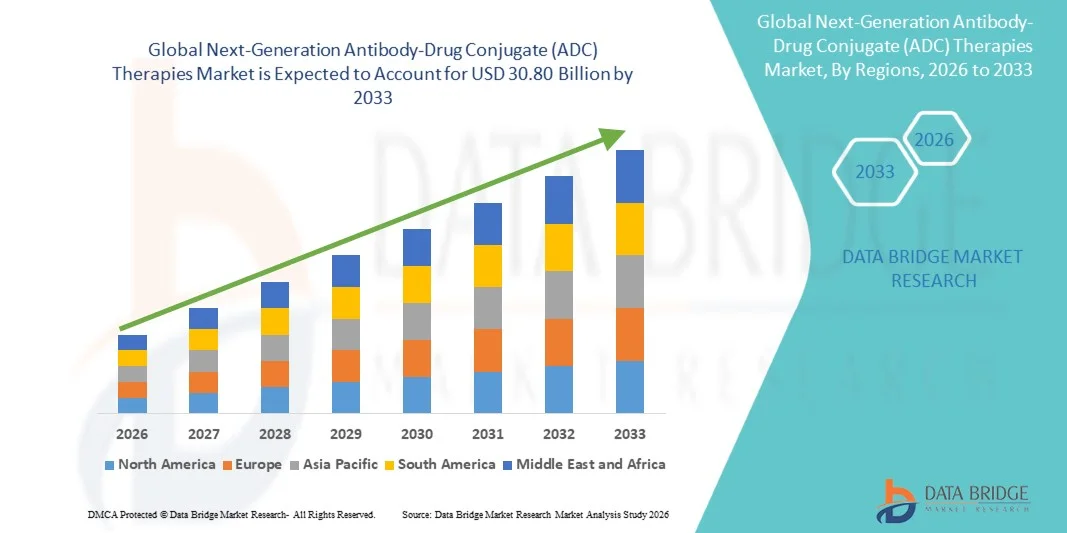

- The global next-generation Antibody-Drug Conjugate (ADC) therapies market size was valued at USD 10.21 billion in 2025 and is expected to reach USD 30.80 billion by 2033, at a CAGR of 14.80% during the forecast period

- The market growth is primarily driven by advancements in targeted cancer therapies, including improvements in linker technologies, payload design, and antibody engineering that enhance therapeutic precision while reducing systemic toxicity

- Furthermore, rising investments by pharmaceutical and biotechnology companies in R&D, expanded regulatory approvals for novel ADC candidates, and heightened focus on precision medicine are reinforcing demand for these therapies across both hematological and solid tumor indications. These converging factors are accelerating the uptake of next-generation ADC solutions, thereby significantly boosting the industry’s growth

Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Analysis

- Next-generation Antibody-Drug Conjugate (ADC) therapies, which combine targeted monoclonal antibodies with potent cytotoxic agents through advanced linker technologies, are increasingly vital in modern oncology treatment due to their improved targeting precision, reduced systemic toxicity, and potential to treat a wide range of hematologic and solid tumors

- The escalating demand for next-generation Antibody-Drug Conjugate (ADC) therapies is primarily fueled by rapid advancements in linker chemistry, innovative payload development, and site-specific conjugation technologies, along with rising R&D investments by pharmaceutical and biotechnology companies focused on targeted cancer therapies

- North America dominated the next-generation Antibody-Drug Conjugate (ADC) therapies market with the largest revenue share of 40.2% in 2025, supported by strong oncology drug adoption, a high cancer burden, advanced healthcare infrastructure, and an active clinical pipeline, with the U.S. leading in regulatory approvals and commercialization of novel ADC therapies

- Asia-Pacific is expected to be the fastest-growing region in the next-generation Antibody-Drug Conjugate (ADC) therapies market during the forecast period, driven by increasing healthcare spending, improving access to advanced cancer treatments, expanding biopharmaceutical capabilities, and rising awareness of precision oncology

- Breast cancer indication segment dominated the next-generation Antibody-Drug Conjugate (ADC) therapies market with a share of 35.9% in 2025, driven by strong clinical success of HER2- and Trop-2-targeted ADCs, broader label expansions, and growing use in both HER2-positive and HER2-low patient populations

Report Scope and Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Segmentation

|

Attributes |

Next-Generation Antibody-Drug Conjugate (ADC) Therapies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Trends

“Advancement Through Precision Engineering and Novel Payload Innovation”

- A significant and accelerating trend in the global next-generation Antibody-Drug Conjugate (ADC) therapies market is the deepening integration of novel linker chemistries, site-specific conjugation, and highly potent payload platforms. This fusion of technologies is significantly enhancing therapeutic precision and clinical outcomes in oncology treatment

- For instance, several recently developed ADCs integrate cleavable linker systems with high-potency topoisomerase I inhibitor payloads, allowing selective tumor cell killing while limiting systemic exposure. Similarly, emerging ADC platforms are designed to improve drug-to-antibody ratio control and stability in circulation

- Advanced engineering in next-generation Antibody-Drug Conjugate (ADC) therapies enables features such as optimized tumor targeting, improved internalization, and controlled payload release to maximize anti-tumor activity. For instance, some pipeline ADCs utilize site-specific conjugation to improve pharmacokinetics and reduce off-target toxicity. Furthermore, precision design capabilities offer developers the flexibility to tailor ADCs for specific tumor biology

- The seamless integration of ADC therapies with precision medicine frameworks and biomarker-guided treatment approaches facilitates more personalized oncology care. Through a single therapeutic strategy, clinicians can align ADC use with genomic profiling, targeted therapy plans, and combination regimens, creating a more unified and effective treatment experience

- This trend toward more selective, potent, and biologically optimized ADC systems is fundamentally reshaping expectations for targeted cancer therapy. Consequently, companies are developing next-generation ADCs with features such as dual-payload capability, improved stability, and expanded antigen targeting potential

- The demand for next-generation Antibody-Drug Conjugate (ADC) therapies offering higher efficacy and better safety profiles is growing rapidly across global oncology markets, as healthcare providers increasingly prioritize precision treatment and improved patient outcomes

- Rising collaboration between biotechnology firms and large pharmaceutical companies is accelerating platform innovation and global clinical development of next-generation ADC candidates

Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Dynamics

Driver

“Growing Need Due to Rising Cancer Burden and Targeted Therapy Adoption”

- The increasing global burden of cancer and the accelerating adoption of targeted oncology therapies are significant drivers for the heightened demand for next-generation Antibody-Drug Conjugate (ADC) therapies

- For instance, in recent years multiple biopharmaceutical companies have expanded ADC clinical programs focusing on solid tumors and hematologic malignancies, looking to improve survival outcomes through targeted cytotoxic delivery. Such strategies by key companies are expected to drive market growth in the forecast period

- As healthcare systems seek more effective cancer treatments with manageable safety profiles, next-generation Antibody-Drug Conjugate (ADC) therapies offer advanced mechanisms such as selective targeting and controlled drug release, providing a compelling alternative to conventional chemotherapy

- Furthermore, the growing adoption of precision medicine and biomarker-driven treatment decisions is making ADCs an integral component of modern oncology care, enabling more individualized therapeutic strategies

- The ability to combine ADCs with immunotherapies or targeted agents, along with strong clinical pipeline expansion and regulatory support, is propelling adoption across major oncology markets. The trend toward innovative biologics and specialized cancer care further contributes to market growth

- Increasing regulatory designations such as breakthrough therapy and fast-track status for ADC candidates are accelerating development timelines and encouraging investment

- Expanding clinical evidence demonstrating improved progression-free survival and response rates is strengthening physician confidence and supporting wider adoption

Restraint/Challenge

“Development Complexity and High Treatment Costs”

- Concerns surrounding the complex development processes and manufacturing requirements of next-generation Antibody-Drug Conjugate (ADC) therapies pose a significant challenge to broader market expansion. As ADCs require sophisticated biologic engineering and cytotoxic handling, production costs remain high

- For instance, stringent regulatory standards for safety, efficacy, and quality control in ADC development increase timelines and investment requirements, making market entry more demanding for smaller developers

- Addressing these development challenges through scalable manufacturing, process optimization, and regulatory alignment is crucial for sustainable growth. Companies are emphasizing advanced production technologies and strategic partnerships to manage these barriers. In addition, the relatively high cost of ADC therapy compared to traditional oncology treatments can limit accessibility in cost-sensitive healthcare systems

- While reimbursement frameworks are evolving, the premium pricing of biologic therapies can still restrict adoption, particularly in emerging markets where healthcare budgets are constrained

- Overcoming these challenges through cost-efficient manufacturing, broader reimbursement support, and continued clinical value demonstration will be vital for sustained market growth in next-generation Antibody-Drug Conjugate (ADC) therapies

- Managing toxicity profiles such as off-target effects and dose-limiting toxicities remains a clinical concern that can slow regulatory approvals and uptake

- Limited specialized manufacturing capacity and supply chain constraints for highly potent payloads can create bottlenecks in large-scale commercialization

Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Scope

The market is segmented on the basis of technology, target antigen, indication, and end user.

- By Technology

On the basis of technology, the next-generation Antibody-Drug Conjugate (ADC) therapies market is segmented into linker type, conjugation technology, and antibody type. The linker type segment dominated the market with the largest revenue share in 2025, driven by the critical role linkers play in ADC stability, payload release, and overall therapeutic index. Advanced cleavable and non-cleavable linkers directly influence efficacy and safety, making linker innovation central to next-generation ADC design. Pharmaceutical companies heavily invest in proprietary linker platforms to differentiate their ADC pipelines and improve clinical performance. The focus on reducing off-target toxicity and improving controlled drug release further strengthens this segment’s leadership. As clinical success increasingly depends on linker optimization, this segment continues to attract strong R&D attention and licensing activity.

The conjugation technology segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the industry shift toward site-specific conjugation and homogeneous drug-to-antibody ratios. These technologies enable better pharmacokinetics, reproducibility, and reduced toxicity compared to traditional stochastic methods. Biopharmaceutical firms are adopting next-generation conjugation platforms to enhance product differentiation and regulatory success. The growing number of partnerships focused on conjugation technologies is accelerating innovation. Demand for highly consistent ADC manufacturing and performance reliability further supports rapid expansion. As precision engineering becomes a priority, this segment is expected to see substantial technological and commercial growth.

- By Target Antigen

On the basis of target antigen, the market is segmented into HER2, Trop-2, CD30, CD79b, Nectin-4, CD19/CD22, and others. The HER2 segment dominated the market with the largest revenue share in 2025 due to the strong clinical success of HER2-targeted ADCs in breast and gastric cancers. Multiple approved therapies and label expansions have reinforced HER2 as a validated and commercially successful ADC target. Strong physician familiarity and established diagnostic pathways support continued adoption. The presence of a large eligible patient pool further sustains demand. Ongoing trials exploring HER2-low populations are expanding the treatment landscape. This maturity and clinical validation make HER2 the leading antigen segment.

The Trop-2 segment is projected to be the fastest growing from 2026 to 2033, driven by expanding clinical applications in breast, lung, and other solid tumors. Trop-2 is increasingly recognized as a high-value target due to its broad tumor expression. Promising clinical data are encouraging further pipeline development. Biotech firms are prioritizing Trop-2 programs to capture emerging opportunities. Rising regulatory approvals and late-stage trials are supporting momentum. As more indications are validated, growth in this segment is expected to accelerate.

- By Indication

On the basis of indication, the market is segmented into breast cancer, lung cancer, hematological malignancies, gastrointestinal cancers, gynecologic cancers, genitourinary cancers, and other solid tumors. The breast cancer segment dominated the market in 2025 with a market share of 35.9% owing to the high adoption of ADCs in HER2-positive and HER2-low breast cancer treatment. Several blockbuster ADC therapies are approved in this space. Strong survival benefits and response rates have driven physician preference. Breast cancer remains a major focus area for ADC clinical research. Continuous label expansions sustain market leadership. High disease prevalence further supports segment dominance.

The lung cancer segment is expected to be the fastest growing from 2026 to 2033 due to increasing exploration of ADCs in non-small cell lung cancer. Lung cancer represents a large unmet need globally. ADCs offer targeted options beyond chemotherapy and immunotherapy. Growing biomarker testing supports patient selection. Multiple candidates are advancing in late-stage trials. As clinical validation increases, rapid segment growth is anticipated. Biomarker-driven treatment is expanding. Multiple late-stage trials support future growth.

- By End User

On the basis of end user, the market is segmented into hospitals, oncology centers, specialty clinics, and research & academic institutes. The hospitals segment dominated the market in 2025 as most ADC therapies require controlled infusion settings and multidisciplinary oncology care. Hospitals have the infrastructure to manage complex biologic treatments. Availability of oncology specialists supports safe administration. Reimbursement frameworks are often hospital-centered. High patient inflow drives utilization. These factors collectively sustain hospital dominance.

The oncology centers segment is projected to be the fastest growing from 2026 to 2033 driven by the rise of specialized cancer treatment facilities. These centers focus exclusively on advanced oncology therapies. Personalized cancer care models favor specialized centers. Increasing outpatient oncology services support growth. Dedicated expertise in biologics improves treatment outcomes. As cancer care decentralizes, oncology centers are expected to expand rapidly. Dedicated expertise improves outcomes. Increasing cancer specialization supports rapid growth.

Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Regional Analysis

- North America dominated the next-generation Antibody-Drug Conjugate (ADC) therapies market with the largest revenue share of 40.2% in 2025, supported by strong oncology drug adoption, a high cancer burden, advanced healthcare infrastructure, and an active clinical pipeline, with the U.S. leading in regulatory approvals and commercialization of novel ADC therapies

- Healthcare providers in the region highly value the clinical benefits, targeted efficacy, and improved safety profiles offered by next-generation Antibody-Drug Conjugate (ADC) therapies, along with their compatibility with precision medicine and biomarker-based treatment approaches

- This widespread adoption is further supported by advanced healthcare infrastructure, high oncology spending, a strong presence of leading biopharmaceutical companies, and favorable regulatory pathways, establishing next-generation Antibody-Drug Conjugate (ADC) therapies as a preferred option in modern cancer treatment across major indications

The U.S. Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Insight

The U.S. next-generation Antibody-Drug Conjugate (ADC) therapies market captured the largest revenue share within North America in 2025, fueled by strong adoption of targeted oncology treatments and a robust clinical pipeline. Healthcare providers are increasingly prioritizing precision therapies that improve survival while reducing systemic toxicity. The presence of leading biopharmaceutical companies and active clinical research environments further propels market expansion. Moreover, supportive regulatory frameworks and accelerated approval pathways are significantly contributing to the growth of next-generation Antibody-Drug Conjugate (ADC) therapies across multiple cancer indications.

Europe Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Insight

The Europe next-generation Antibody-Drug Conjugate (ADC) therapies market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising cancer incidence and strong demand for innovative biologics. The region benefits from advanced healthcare systems and widespread adoption of precision oncology. European healthcare providers are increasingly incorporating ADCs into treatment protocols. Growth is also supported by collaborative research initiatives and regulatory support for novel therapies. Adoption is rising across major oncology centers and specialized cancer hospitals.

U.K. Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Insight

The U.K. next-generation Antibody-Drug Conjugate (ADC) therapies market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding oncology research and demand for targeted cancer care. Increasing cancer awareness and early diagnosis programs are encouraging advanced treatment uptake. The country’s strong clinical trial ecosystem supports ADC development. Government-backed healthcare systems facilitate access to innovative oncology drugs. Growing partnerships between academia and industry continue to stimulate market growth.

Germany Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Insight

The Germany next-generation Antibody-Drug Conjugate (ADC) therapies market is expected to expand at a considerable CAGR during the forecast period, fueled by high healthcare spending and strong focus on medical innovation. Germany’s well-established pharmaceutical sector promotes early adoption of advanced biologics. Demand for precision oncology solutions is rising steadily. Integration of biomarker-based treatment strategies supports ADC utilization. Strong reimbursement structures and research investments align with sustained market expansion.

Asia-Pacific Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Insight

The Asia-Pacific next-generation Antibody-Drug Conjugate (ADC) therapies market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising cancer burden and improving healthcare infrastructure. Increasing healthcare expenditures in countries such as China, Japan, and India are enabling access to advanced oncology treatments. The region is witnessing rapid expansion in biopharmaceutical capabilities. Government support for innovative therapies is strengthening market penetration. Growing awareness of targeted cancer treatments further accelerates adoption.

Japan Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Insight

The Japan next-generation Antibody-Drug Conjugate (ADC) therapies market is gaining momentum due to the country’s strong oncology research environment and demand for advanced therapeutics. Japan emphasizes early access to innovative cancer treatments. Adoption is supported by a sophisticated healthcare system. Integration of precision medicine into oncology care is expanding. In addition, collaborations between domestic firms and global biotech companies are driving ADC development and commercialization.

India Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Insight

The India next-generation Antibody-Drug Conjugate (ADC) therapies market accounted for a leading share in Asia-Pacific in 2025, attributed to the country’s growing cancer burden and expanding oncology infrastructure. India is emerging as a key destination for clinical research and biologics manufacturing. Increasing access to specialized cancer care is supporting ADC uptake. Government initiatives to strengthen cancer treatment capacity are influencing growth. Rising awareness of targeted therapies and improving affordability are key factors propelling the market in India.

Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market Share

The Next-Generation Antibody-Drug Conjugate (ADC) Therapies industry is primarily led by well-established companies, including:

- ADC Therapeutics SA (Switzerland)

- AstraZeneca (U.K.)

- Pfizer Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Novartis AG (Switzerland)

- AbbVie Inc. (U.S.)

- Bristol Myers Squibb Company (U.S.)

- Sanofi (France)

- Amgen Inc. (U.S.)

- Genentech, Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

- Synaffix BV (Netherlands)

- Genmab A/S (Denmark)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- GSK plc (U.K.)

- Bayer AG (Germany)

- Seattle Genetics, Inc. (U.S.)

What are the Recent Developments in Global Next-Generation Antibody-Drug Conjugate (ADC) Therapies Market?

- In November 2025, Avenzo Therapeutics was granted Fast Track designation by the U.S. FDA for AVZO‑103, a potential best‑in‑class bispecific antibody‑drug conjugate targeting Nectin‑4 and TROP2 for the treatment of patients with urothelial cancer previously treated with enfortumab vedotin, potentially accelerating its development and review

- In September 2025, the experimental ADC Raludotatug deruxtecan (DS‑6000) received FDA Breakthrough Therapy Designation for platinum‑resistant ovarian, primary peritoneal, or fallopian tube cancers expressing CDH6, signalling rapid advancement of novel ADC candidates in tough‑to‑treat tumor types

- In June 2025, the U.S. FDA expanded the indication for datopotamab deruxtecan‑dlnk (Datroway) to include locally advanced or metastatic EGFR‑mutated non‑small cell lung cancer after prior EGFR therapy and platinum‑based chemotherapy, highlighting broader ADC applications

- In May 2025, the U.S. FDA granted accelerated approval to Emrelis (telisotuzumab vedotin‑tllv), a first‑in‑class c‑Met‑directed antibody‑drug conjugate for previously treated advanced non‑small cell lung cancer with high c‑Met protein overexpression, offering a new targeted option where limited therapies existed

- In January 2025, the U.S. FDA approved Datroway (datopotamab deruxtecan‑dlnk), a Trop‑2‑directed antibody‑drug conjugate, for unresectable or metastatic hormone receptor‑positive, HER2‑negative breast cancer, expanding ADC use beyond traditional HER2‑targeted therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.