Global Next Generation Biometrics Market

Market Size in USD Billion

CAGR :

%

USD

43.34 Billion

USD

158.57 Billion

2025

2033

USD

43.34 Billion

USD

158.57 Billion

2025

2033

| 2026 –2033 | |

| USD 43.34 Billion | |

| USD 158.57 Billion | |

|

|

|

|

What is the Global Next Generation Biometrics Market Size and Growth Rate?

- The global next generation biometrics market size was valued at USD 43.34 billion in 2025 and is expected to reach USD 158.57 billion by 2033, at a CAGR of17.60% during the forecast period

- The growing integration of biometrics in smartphones, inclination of growth toward e-passport program, rising usages of the biometric system in criminal identification, cloud computing and e-commerce solutions, prevalence of favourable government initiatives to restrict illegal entry, rising demand of the technology as it offers a high degree of privacy, accuracy, ease of use, interoperability, and uniformity across the system, growing awareness about the benefits offered by biometrics are some of the major as well as vital factors which will likely to augment the growth of the next generation biometrics market

What are the Major Takeaways of Next Generation Biometrics Market?

- Increasing government funding for deploying biometric technology across various economic sectors along with rising number of applications in healthcare, government, defence, and border security to commercial security, travel and immigration, and banking and finance which will further contribute by generating massive opportunities that will lead to the growth of the next generation biometrics market

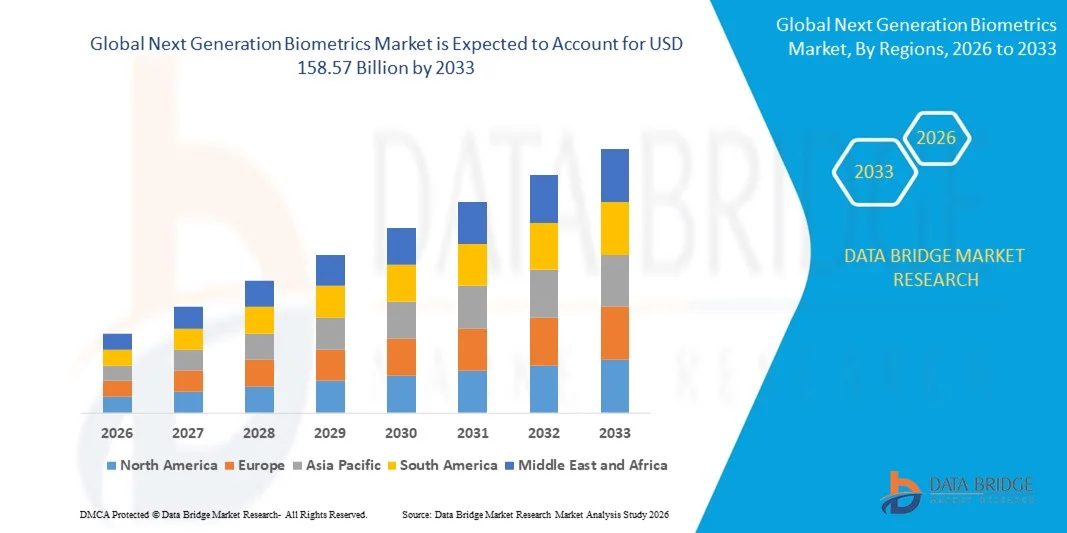

- North America dominated the next generation biometrics market with a 43.2% revenue share in 2025, driven by high adoption of advanced biometric hardware, multi-modal solutions, and services across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 11.2% from 2026 to 2033, driven by rising adoption of biometric authentication in BFSI, government, airports, healthcare, and consumer electronics across China, Japan, India, South Korea, and Southeast Asia

- The Hardware segment dominated the market with a 42.3% share in 2025, driven by strong demand for biometric scanners, sensors, fingerprint readers, face recognition cameras, iris scanners, and multi-modal authentication devices across BFSI, government, and enterprise sectors

Report Scope and Next Generation Biometrics Market Segmentation

|

Attributes |

Next Generation Biometrics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Next Generation Biometrics Market?

Increasing Shift Toward High-Speed, Compact, and PC-Based Next Generation Biometrics

- The next generation biometrics market is experiencing strong adoption of compact, portable, and high-precision biometric devices designed to support secure authentication, identity verification, and advanced access control systems

- Manufacturers are introducing multi-modal, AI-enabled, and software-defined biometric solutions that offer rapid data capture, real-time analysis, deep integration with enterprise systems, and compatibility with cloud and edge platforms

- Growing demand for cost-efficient, lightweight, and scalable biometric devices is driving deployment across government facilities, corporate offices, banking, airports, and healthcare centers

- For instance, companies such as NEC, Thales, HID Global, Suprema, and 3M have upgraded their biometric offerings with enhanced multi-modal capabilities, AI-driven facial and fingerprint recognition, and seamless cloud integration

- Increasing need for fast, secure, and reliable identity verification is accelerating the shift toward AI-powered, PC- and cloud-integrated biometric solutions

- As security and digital identity requirements rise, Next Generation Biometrics will remain critical for access control, identity management, and secure authentication in multiple sectors

What are the Key Drivers of Next Generation Biometrics Market?

- Rising demand for accurate, fast, and multi-modal biometric systems to support secure identity verification and authentication in enterprise, government, and public applications

- For instance, in 2025, companies such as NEC, Thales, Suprema, HID Global, and Safran expanded their portfolios with AI-powered face, fingerprint, and iris recognition solutions, along with advanced cloud and mobile integration

- Growing adoption of IoT-enabled devices, smart offices, airports, transportation hubs, and healthcare systems is boosting demand for advanced biometric solutions across the U.S., Europe, and Asia-Pacific

- Advancements in AI, machine learning, data encryption, and cloud-enabled analytics have enhanced the performance, speed, and reliability of biometric devices

- Rising regulatory requirements for secure identity management, GDPR compliance, and national ID programs are creating strong demand for high-accuracy, multi-modal biometric solutions

- Supported by continuous investments in security, identity management, and digital transformation initiatives, the Next Generation Biometrics market is expected to witness robust long-term growth

Which Factor is Challenging the Growth of the Next Generation Biometrics Market?

- High costs associated with premium, multi-modal, and AI-powered biometric systems limit adoption among SMEs and smaller institutions

- For instance, during 2024–2025, fluctuations in sensor costs, specialized hardware shortages, and extended lead times increased manufacturing costs for several global vendors

- Complexity in integrating multi-modal systems with legacy infrastructure, cloud platforms, and enterprise IT systems increases the need for skilled engineers and training

- Limited awareness in emerging markets regarding multi-modal biometric solutions, AI capabilities, and compliance requirements slows adoption

- Competition from single-modal biometric devices, access cards, mobile authentication apps, and software-based identity verification creates pricing pressure and reduces differentiation

- To overcome these challenges, companies are focusing on cost-optimized devices, training programs, AI-driven analytics, and cloud integration to increase adoption of Next Generation Biometrics worldwide

How is the Next Generation Biometrics Market Segmented?

The market is segmented on the basis of component, function, technology, authentication type, and vertical.

- By Component

On the basis of component, the next generation biometrics market is segmented into Hardware, Solutions, and Services. The Hardware segment dominated the market with a 42.3% share in 2025, driven by strong demand for biometric scanners, sensors, fingerprint readers, face recognition cameras, iris scanners, and multi-modal authentication devices across BFSI, government, and enterprise sectors. Hardware solutions offer rapid enrollment, real-time verification, and high-accuracy recognition, making them essential for access control, identity verification, and secure transactions.

The Services segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing adoption of cloud-based identity management, biometric system integration, software updates, maintenance, and consulting services. Rising reliance on outsourced system management and analytics services further propels service adoption in emerging markets.

- By Function

On the basis of function, the market is segmented into Contact, Non-Contact, and Others. The Non-Contact segment dominated the market with a 51.2% share in 2025, supported by growing demand for touchless authentication across healthcare, airports, BFSI, and commercial facilities. Non-contact systems, including facial recognition, iris scanning, and voice verification, offer enhanced hygiene, speed, and safety, making them increasingly preferred in post-pandemic environments.

The Contact segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by secure fingerprint and palm-based authentication requirements in high-security zones, banking applications, and industrial access points. Technological improvements in sensor accuracy and integration with mobile and IoT platforms are driving its adoption.

- By Technology

On the basis of technology, the market is segmented into Fingerprint, Face, Iris, Palm, Voice, Signature, DNA, and Others. The Fingerprint segment dominated the market with a 38.7% share in 2025, owing to its widespread adoption in mobile devices, banking, law enforcement, and enterprise security. Fingerprint scanners are cost-effective, easy to integrate, and provide high accuracy for authentication.

The Face Recognition segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by AI-enabled analytics, increasing use in airports, smart cities, and commercial sectors, and rising preference for touchless authentication solutions. Advancements in deep learning, 3D imaging, and multi-modal verification further support face recognition adoption.

- By Vertical

On the basis of vertical, the market is segmented into BFSI, Military and Defence, Government, Law Enforcement, Enterprises, Commercial Sector, Residential Homes, Airports, Healthcare, Consumer Electronics, and Others. The BFSI segment dominated the market with a 35.9% share in 2025, due to high adoption of biometrics for secure transactions, fraud prevention, and customer authentication.

The Military and Defence vertical is expected to grow at the fastest CAGR from 2026 to 2033, propelled by stringent security requirements, increasing adoption of multi-modal biometric systems, and the need for secure access control in defense installations and critical infrastructure.

- By Authentication Type

On the basis of authentication type, the market is segmented into Single Factor Authentication and Multi-Factor Authentication. The Single Factor Authentication segment dominated the market with a 55.4% share in 2025, owing to its simplicity, lower cost, and rapid deployment across mobile devices, offices, and commercial applications.

The Multi-Factor Authentication segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising cybersecurity concerns, regulatory compliance, and demand for high-security access in BFSI, government, and enterprise environments. Multi-factor solutions combining fingerprints, facial recognition, and PINs enhance security and reduce identity fraud, boosting adoption across critical sectors.

Which Region Holds the Largest Share of the Next Generation Biometrics Market?

- North America dominated the next generation biometrics market with a 43.2% revenue share in 2025, driven by high adoption of advanced biometric hardware, multi-modal solutions, and services across the U.S. and Canada. Increasing demand for secure authentication in BFSI, government, military, healthcare, and enterprise sectors fuels growth. Strong investments in AI, IoT, and cloud-enabled identity management solutions further enhance regional market dominance

- Leading North American companies are launching innovative biometric systems with enhanced speed, accuracy, multi-factor authentication, and integration capabilities. Continuous focus on R&D, talent availability, and advanced electronics infrastructure strengthens the region’s technological advantage

- High regulatory compliance, advanced innovation ecosystems, and strong adoption across defense, corporate, and commercial sectors reinforce North America’s leadership in the global market

U.S. Next Generation Biometrics Market Insight

The U.S. is the largest contributor within North America, supported by extensive adoption of fingerprint, facial, iris, and palm recognition systems across government, BFSI, healthcare, and enterprise sectors. High demand for multi-factor authentication, secure mobile payments, and access control systems drives hardware and software adoption. Presence of leading vendors, strong startup ecosystems, and high investment in R&D further accelerates market growth.

Canada Next Generation Biometrics Market Insight

Canada contributes significantly to regional growth, driven by expanding enterprise adoption, government-backed digital identity programs, and robust healthcare and financial sectors. Universities and R&D centers utilize biometric technologies for testing, prototyping, and deployment in industrial and commercial applications. Skilled workforce availability and supportive innovation policies boost long-term adoption.

Asia-Pacific Next Generation Biometrics Market

Asia-Pacific is projected to register the fastest CAGR of 11.2% from 2026 to 2033, driven by rising adoption of biometric authentication in BFSI, government, airports, healthcare, and consumer electronics across China, Japan, India, South Korea, and Southeast Asia. Expanding electronics manufacturing, AI-based security systems, and smart city initiatives accelerate demand. Rapid deployment of mobile biometrics, facial recognition systems, and multi-modal solutions is supporting strong market growth in the region.

China Next Generation Biometrics Market Insight

China is the largest contributor in Asia-Pacific due to massive investment in digital identity, surveillance, smart city infrastructure, and electronics manufacturing. High adoption of facial recognition, fingerprint scanners, and multi-factor authentication across BFSI, transportation, and government sectors drives demand for advanced biometric systems. Local vendors and competitive pricing accelerate market penetration domestically and internationally.

Japan Next Generation Biometrics Market Insight

Japan shows steady growth supported by advanced IT infrastructure, electronics manufacturing, and smart enterprise adoption. Government and commercial sectors emphasize secure authentication, robotics, and automated identity management, supporting premium biometric system adoption. Rising demand for non-contact and high-speed authentication solutions reinforces long-term market expansion.

India Next Generation Biometrics Market Insight

India is emerging as a major growth hub due to government-led digital identity initiatives, expanding BFSI and telecom sectors, and startup ecosystem growth. Increasing use of embedded biometrics in access control, mobile payments, and enterprise security drives adoption. Investments in R&D, AI-based authentication, and smart infrastructure further accelerate market growth.

South Korea Next Generation Biometrics Market Insight

South Korea contributes significantly with strong adoption of facial, iris, and palm-based biometric systems across consumer electronics, BFSI, and government sectors. Growth in AI servers, advanced electronics, and smart security applications drives demand for high-accuracy, multi-modal biometric solutions. Technological innovation and robust digital infrastructure support sustained market expansion.

Which are the Top Companies in Next Generation Biometrics Market?

The next generation biometrics industry is primarily led by well-established companies, including:

- Safran (France)

- NEC Corporation (Japan)

- 3M (U.S.)

- FUJITSU (Japan)

- SUPREMA (South Korea)

- HID Global Corporation (U.S.)

- Fulcrum Biometrics, Inc. (U.S.)

- Thales Group (France)

- BIO-key International (U.S.)

- Precise Biometrics AB (Sweden)

- secunet Security Networks AG (Germany)

- Siemens (Germany)

- Facebanx (U.K.)

- ValidSoft (U.K.)

- IDEX ASA (Norway)

- LAFORGE OPTICAL (Germany)

- neuromore co (Austria)

- ZKTECO CO., LTD. (China)

- HYPR Corp (U.S.)

- B-Secur (U.K.)

- Auraya Inc (U.S.)

What are the Recent Developments in Global Next Generation Biometrics Market?

- In January 2025, Mitsubishi Electric Automotive America, Inc. unveiled its FLEXConnect system at CES, featuring cloud-connected capabilities powered by QNX software and Amazon Web Services (AWS). The platform integrates real-time biometric monitoring, including facial recognition, driver distraction detection, and fatigue tracking, to improve safety and personalize the in-cabin experience. This launch reinforces the growing adoption of advanced in-vehicle biometric systems

- In October 2024, Infineon Technologies and Rheinmetall AG introduced cutting-edge biometric identification and authentication solutions for driver monitoring systems (DMS). Infineon launched automotive-qualified fingerprint sensor ICs to enable secure driver authentication, personalized vehicle settings, and payment authorization while meeting stringent automotive reliability standards. This development highlights the increasing focus on road safety and secure vehicle personalization

- In July 2024, authID Inc. partnered with FinClusive Capital, Inc. to integrate its biometric identity verification services into FinClusive’s Compliance-as-a-Service (CaaS) platform. The collaboration enhances detection and prevention of financial crimes, identity fraud, and AI-driven deepfakes by providing fast, accurate, and seamless biometric identity assurance throughout onboarding and ongoing interactions. This partnership underscores the rising use of biometrics in financial security and fraud prevention

- In June 2022, Vision-Box presented its Seamless Kiosk solution, leveraging next-generation biometric innovation to transform the traveling experience. This solution demonstrates the growing application of biometrics in travel and public spaces for enhanced convenience and security

- In May 2022, IDEMIA introduced two new MorphoWave contactless fingerprint terminals: MorphoWave XP X-tended Performance and MorphoWave SP Simplified Profile. Both models offer plug-and-play capabilities, software integration with 20 full-access controlling systems, and physical compatibility with leading gate and turnstile manufacturers, enabling easier and more affordable deployments. This launch highlights the trend toward scalable and user-friendly biometric solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Next Generation Biometrics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Next Generation Biometrics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Next Generation Biometrics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.